Hello! In this article we will talk about investment funds.

Today you will learn:

- What are investment funds, their types and types;

- How to choose the right IF;

- How to start investing in an investment fund.

Many people have heard what an investment fund is more than once. But whether it is profitable to invest money in them is a very relevant question that interests many potential investors. Today we will try to give a reasoned answer to this question.

Content

- What is an investment fund in simple words

- Why do we need IFs?

- How do IFs work?

- Types of investment funds

- Mutual funds

- IF of Russia

- Mutual IF

- Hedge

- Check

- Exchange traded

- Choosing an investment fund: How not to make a mistake

- Tips for choosing an investment fund

- Who may be interested in investing in an investment fund

- What to do to become an investor

- TOP 10 investment funds in Russia

- Signs of fraud

- Pros of IF

- Cons of IF

Types of investment funds by investment objects

When classifying investment funds by investment objects, the following should be highlighted:

- bond funds;

- equity funds;

- mixed.

Note that the concept of industry funds is established by law. They specialize in investments in manufacturing and industrial activities.

Index funds are mutual funds that have a stock index corresponding to the investment portfolio. This index consists of securities of companies that occupy leading positions in the market. Thus, the risk of such investments is quite low.

Real estate investment funds are created in a closed form. This is due to the fact that the implementation of construction projects takes much longer than the sale of financial instruments.

Modern legislation also distinguishes a separate group, which includes funds for qualified investors. They have legal freedom in the process of choosing objects for investment. In developed countries, venture funds are popular, which support promising projects at the stage of their implementation and companies at the initial stage of development.

How do IFs work?

Any investment fund is engaged in attracting and pooling investor money in order to invest it in various assets: real estate, antiques or shares. An investment fund also increases the value of assets, and therefore the value of the investments made by each of the investors.

To increase value, fund assets are bought, sold and transferred. This is done by fund specialists who are professional investors. There are funds in which asset management is carried out automatically, but for now these are special cases.

Each client is entitled to a portion of the profit received. And the investment fund itself will receive a profit from payment for the services provided.

A fundamentally important point for the investor: how is the reward received? From the profit that was received or the commission - the value is constant (even if there is no profit). No one wants to pay for work that was done poorly, so you need to carefully read the contract being concluded.

By the way, statistics say that more than half of citizens who are investors do not even read contracts to the end. This can be fraught with unpleasant consequences.

A person who is an investor does not take part in the management itself, but has the opportunity to get acquainted with the fund’s reports, and therefore can assess how effective the investment fund’s work is.

All that has been said can be summarized in just a few points:

- Each participant contributes a certain amount to the general fund;

- These funds are invested in various financial projects;

- The amount of profit will be distributed among the members of the fund according to the contributed shares.

Types of investment funds

There are several types of IF:

- Share;

- IF of Russia;

- Mutual;

- Hedge;

- Check;

- Traded on an exchange.

Let's talk about each of them in more detail.

Mutual funds

In such a fund, property that is common is distributed among investors in the form of shares. Shares are securities that confirm that the investor has ownership rights to a certain part of the funds. The essence of a mutual fund is that the team invests funds in a specific project.

Investments can be made in the following areas:

- Carrying out transactions with securities (stocks, bonds, etc.);

- Loan services;

- Operations for opening deposits;

- Real estate transactions and more.

Mutual funds are especially attractive because the initial investment amount can be small. In addition, risks are distributed among all investors, and this reduces the likelihood of possible loss of funds.

The activities of such funds in our country are regulated by Federal Law.

A mutual fund is not a legal entity, it is a complex formed from the property of its investors.

Another fundamentally important point: a mutual fund cannot accept property pledged as a deposit.

Mutual investment funds are divided into several:

- Exchange - with access to trading on the exchange;

- Open-ended investment funds – the investor has the right to demand redemption of all shares on any working day;

- Closed – until the end of the contract, the investor cannot terminate it;

- Venture capital – investing in the development of innovative technologies;

- Interval – the investor can withdraw his funds only at the time established by the rules of trust management.

Mutual Fund Management

The mutual fund and its shareholders interact with the management company. This happens under a trust agreement. The maximum period during which such an agreement is valid is 15 years. Under this agreement, the management company acquires securities and other assets.

The trustee does not transfer ownership of the money or property of the shareholders, he only manages them. And for this activity he is paid a commission.

Trust management is of 2 types:

- Collective – when all client funds are combined in one “portfolio” and the company manages it;

- Individual – the funds of each investor are managed separately.

You don’t need to immediately count on a huge profit, but you shouldn’t discount the possibility of multiplying your capital through investments either. The main thing is to decide what type of fund to invest in.

If you choose a venture fund, then you will need significant funds for investment, and the payback period will take a long time: 5-10 years. Such an investment, of course, has a high level of risk, but at the same time there is the opportunity to receive a large income, since technology does not stand still and will be in more and more demand every year.

IF of Russia

This is a state-owned company that carries out co-financing operations for various projects.

Mutual IF

Distributes its shares among fund participants. Shares are usually inexpensive, which means the number of investors is steadily increasing. You can safely invest small amounts of money in such funds, since the risk of losing them is reduced due to the large number of investors.

Hedge

They are not widely used in Russia, but are very popular in the USA. They are aimed at obtaining the maximum return on investment. Their main feature is large amounts of deposits. The main disadvantage: they are practically not regulated by regulations.

Check

They are especially typical only for the Russian Federation. They appeared during the transition period, when the state economy began to move from a planned to a market type. They were created to transfer property from state ownership to private ownership. At the moment, most funds of this type have been liquidated.

Exchange traded

Shares of such funds are traded on the stock exchange. And the price for them will change along with the activity of traders.

Let's summarize: The types of investment funds in Russia may differ from those that operate in other countries. For example, hedges are not common in our country, but checks are available (a small number).

Open investment companies

There are open-ended and closed-end investment funds. The open type involves the free purchase and sale of shares.

Features of open-end funds

Having the necessary resources, at any time the investor can become a participant in an open-ended investment fund. Neither the amount of capital, nor the duration of the project, nor the number of shareholders is limited.

Closed-end funds issue a limited number of investment certificates. They can be sold. A distinctive feature of open ones is the liquidity of their shares. That is, they can be sold and reacquired, which cannot be done in closed ones. However, this difference more often leads open-ended funds to bankruptcy. Such a disastrous result is influenced by economic crises or political upheavals.

Choosing an investment fund: How not to make a mistake

Profit and capital preservation directly depend on how correctly the investment fund is chosen. First of all, decide what is the purpose of your investment? This is the goal you should start from when choosing an investment fund. Also keep in mind that there will not be a fixed profit: it consists of several factors and may vary.

Now let’s look at each step that needs to be taken on the path to choosing a reliable investment fund.

Step 1. Decide on the amount and investment period .

This stage can be called the most important. The following principle applies: the smaller the investment amount, the narrower the range of options. The larger the amount, the more extensive the choice. As for the timing, the situation here is this: in different types of investment funds, the turnover periods are different.

If you want to invest in real estate, this is a long-term investment; if in stocks and bonds, then the funds turn over faster, but the risks are significantly higher.

Step 2. Select the appropriate type of IF .

If you have no investment experience, then it is better to choose an open mutual fund where the liquidity of the shares is high. That is, the participant can withdraw his investments from circulation.

If you are an experienced investor and know how to balance risk and return, then use other tools. For example, real estate funds, venture funds or mixed ones.

Step 3. Selecting a company to manage .

Direct deception of investors is a risky business for a management company. They are most often afraid of breaking the law and usually do not make unreasonable promises.

You can control your investments yourself if you choose an active deposit. In this case, you can deposit and withdraw funds at any time and perform any actions to achieve maximum profitability. This is available in open type IF.

If you plan to forget about the invested capital for a while, choose a closed-end or interval fund.

Step 4. Comparison of IF ratings .

The publication of ratings is openly posted on various resources. Use several and compare their data. The most authoritative pages belong to financial departments and government agencies.

Step 5. Final selection .

Having analyzed all the information received earlier, we focus on a specific fund and management company. To dispel all doubts, consult with people who already have investment experience or visit investor forums on the Internet.

If you are a beginner, then choose a stable and popular fund. But this does not mean that the majority opinion is absolutely correct.

What are the types of investment funds - TOP 5 main types

Now about what types of mutual funds there are. There are several criteria for classifying stock organizations.

According to the type of availability for deposits, they are divided into:

- open;

- closed;

- interval.

Open ones, as the name implies, practice free sale and purchase of shares. That is, you can become a co-owner of a company at any time, provided, of course, there are sufficient resources to purchase a share.

The total amount of capital, as well as the number of participants in open funds, is not limited. Such structures usually invest in highly liquid and reliable financial instruments.

Closed-end funds sell members' shares immediately after the organization is formed, after which sales of shares cease. Closed-type mutual funds are limited in terms of their work, which are agreed upon in advance.

Often such funds specialize in a particular industry. For example, they work only with the real estate market or invest assets in innovation.

A characteristic feature of interval mutual funds is that the sale of shares and their redemption occur at certain intervals. Typically, interval funds work with stocks - they are engaged in professional exchange trading.

Another classification criterion is by area of investment. We will consider in detail the species that differ in this characteristic.

Type 1. Equity funds

The most popular type of mutual funds. The purpose of such a fund is to make a profit from investing in shares of various companies.

Since manufacturing (and any other) companies differ in the amount of working capital, mutual funds are also divided into those that operate:

- with small enterprises (turnover - less than $500 million);

- medium (from 500 million to 5 billion dollars);

- large (turnover – more than $5 billion).

The last type of investment is the most reliable, but is designed for a long period (3-5 years). High-income companies that are leaders in their industries are called “blue chips” by investors. The net profit from deposits in shares of large corporations is 10-15% annually.

Obviously, when choosing a fund, you should take into account both the size of your own investments and the operating principles of the mutual fund. Some institutions prefer to work with stocks that are characterized by rapid (and not always predictable) growth, while others choose more stable partners.

Another piece of advice from experienced investors is that you shouldn’t put all your eggs in one basket, that is, don’t limit yourself to one fund. If finances allow, it is better to create a “portfolio of funds”, which will include shares in several organizations, different in their structure and focus.

Type 2. Bond funds

Bonds are investment instruments with a fixed income (this is their difference from shares, the value of which is constantly changing).

Funds that invest exclusively in bonds are called bond funds or bond funds.

Investments of this type bring regular dividends to investors - interest on deposits and profit from the difference in prices are summed up. The net profit of bond funds is low (from 6-8%), but the risks are minimal.

Depending on who issues the securities, bond funds are divided into:

- state (federal);

- municipal;

- corporate.

Government bond funds are considered the most reliable. Papers issued by regional governments are also popular.

Corporate bonds are a risky, but in case of a successful combination of circumstances, a very highly profitable investment instrument.

Type 3. Real estate funds

Such organizations receive income from contributions to the construction and operation of real estate. Institutions have different specializations - some funds sell houses and apartments, others rent them out, and others specialize in operations with land plots.

Typically these are closed-end funds: this feature is due to the fact that housing (especially acquired at the construction stage) takes longer to be sold than, say, liquid shares.

Considering the high cost of housing, the minimum initial share contribution of a participant to such funds is quite impressive - approximately $10,000.

A type of real estate fund can be called mortgage funds - closed organizations that make money on mortgage securities.

Type 4: Money Market Funds

These are the most conservative mutual funds in the world. Their essence lies in the fact that managers keep 50% of the participants’ assets on deposits, and only the second half of the money is involved in current investment operations.

Finance is invested in the most reliable instruments - bonds, currency. Experts consider money market funds to be an alternative to short-term bank deposits. The risk of losing deposits in such institutions is minimal, as is the profit of depositors.

Type 5. Balanced (mixed) funds

It is easy to guess that such funds work with various instruments. Typically these are bonds and stocks: the most liquid types of securities.

Mixed fund management tactics require experience and special knowledge from the management company. Market experts must constantly analyze the situation, buying and selling securities at the moment of their most profitable value for shareholders.

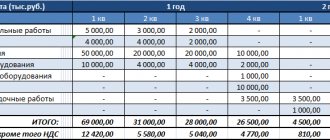

The table shows the main types of funds and their basic indicators:

| № | Types of funds | Profitability | Investment Features |

| 1 | Equity funds | From 10% and above | Relatively high risks |

| 2 | Bond funds | 6-8% | Low risks |

| 3 | Real estate funds | From 7-10% | Designed for long-term investments |

| 4 | Money Market Funds | 7-10% | Reliability and low risk |

| 5 | Mixed | From 12% and above | Requires competent management |

Tips for choosing an investment fund

In principle, an investment fund is a reliable and affordable investment instrument. Their activities are customer-oriented and transparent.

But it still doesn’t hurt to pay attention to some indicators:

- How long has the investment fund been operating;

- What discounts and benefits are available for shareholders;

- What level of profitability has been observed over time;

- What is the minimum amount of funds required for investment?

- What are the conditions for exchanging or selling a share?

People with experience advise making choices using the elimination method. It is also recommended to collect as much information as possible about the funds, this will protect your funds.

What to do to become an investor

To start investing and purchase a share in the selected fund, you need to follow a few simple steps. Visit the management office and leave your application. To register, you need to have with you: a passport and funds to buy a share. If the payment is non-cash, then you only need a passport.

If you plan to invest in a mutual fund of a bank, then you will have to visit the bank itself, or rather, any of its branches.

Experts recommend that you read all the conditions and documents on the company’s official website. You can also call there and discuss all questions with a consultant over the phone.

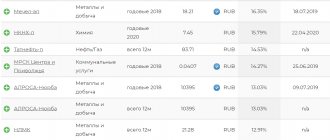

TOP 10 investment funds in Russia

Note: This table is not an investment fund rating, but an overview of the most famous companies.

| No. | IF name | a brief description of |

| 1 | Finam | Offers brokerage and wealth management services. Minimum bet size 18% |

| 2 | Teletrade | A stable and large company that is over 20 years old. Specializes in investing in Forex. Clients have the opportunity to passively invest in trades |

| 3 | BCS Broker | Provided by Prof. assistance in financial management. Each investor has the opportunity to receive advice from a personal advisor. The company is a leader in working capital |

| 4 | FinPro | The company specializes in real estate investment. They advise and train clients for free and for free. A personal investment plan is developed for each investor |

| 5 | Finance-Invest | A company operating since 1995. The company's staff includes professionals from foreign and Russian banks |

| 6 | SotsAgroFinance | Invests in precious metals and minerals. Also carries out retail sale of jewelry. For individuals there is a fixed rate. interest rate on investment agreements |

| 7 | Adfincom | Investments in stocks and bonds of high liquidity. Member of the Swiss-Russian Business Association |

| 8 | VTB Capital | It is an open-ended fund. The minimum amount of funds for investment is 5000 rubles. |

| 9 | Gazprombank Asset Management | Invests in securities and has been active on the market since 2007. The minimum amount for the first purchase is RUB 5,000. |

| 10 | Sberbank Electric power industry | Open type mutual fund. In operation since 2006, the largest % of funds are invested in shares of energy companies. The minimum amount for investment is 15,000 rubles. |

There are several hundred different investment funds operating in the Russian Federation. They have different management structures and profitability. Many of them have the ability to remotely invest and withdraw funds to client accounts.

Index funds

Index share groups look like a separate category. These are enterprises of a similar type, but with a number of their own differences. First of all, binding to the index. An index is an indicator of the aggregate dynamics of a certain group of securities.

The index can be created for any industry, a separate group of companies, or the entire state economy as a whole.

Accordingly, an index investment fund (IIF, TIF, ETF) does not use the services of analysts, since there is nothing to analyze here. Managers buy securities only in strict accordance with the selected index, and only periodically “shuffle” the portfolio, selling securities that have fallen out of the composite indicator, or changing the balance.

For example, the Moscow Exchange index, which includes the largest companies in Russian industry and services. The IIF based on it will contain the same stocks, in the exact percentage of the index. As the Moscow Exchange grows, the fund and the profitability of investors grow. Such instruments allow you to tie your investments to market dynamics, while simultaneously fueling it by moving capital into company shares.

Signs of fraud

Unfortunately, along with offers from large and serious companies in the field of investment, there are offers that come from scammers. Often even experienced investors get caught in these networks, let alone beginners.

There are a number of signs that will help distinguish fraudulent offers from real ones:

- Fixed level of profitability. Investments are still a risky business and it is difficult to predict the level of profitability. Even professionals prefer not to express firm confidence in the behavior of the market. This means it is simply impossible to promise a specific percentage of income. And such proposals should cause caution.

- Attempts to convince that this opportunity is unique. Often a person is influenced through his subconscious. It's simple: after all, everyone wants to get the opportunity that comes once in a lifetime. Real investing is not unique; it is a public opportunity.

- The company is not responsible for possible losses. In reality, in any type of investment there are periods of losses. But this is stipulated at the stage of concluding the contract, or even earlier. If this is not the case, they are trying to convince you of a fixed level of profitability (as already mentioned, this fact should cause caution). Please note that the company’s responsibility must be stated in the contract with it.

- Haste. If an investment is offered urgently, this is almost 100% a fraudulent scheme. This is a psychological method, one of the types of influence on the subconscious. Phrases like “This is your last chance”, “This opportunity will not happen again” will encourage anyone to give away money. Refrain from investing in such a situation, you definitely won’t regret it.

- Investment terms are not clearly stated. Try to avoid this kind of language. The more specific, the better and safer. This, of course, is not a direct sign of fraud; real managers also sin like this. But it is important to remember that “money loves counting”, that is, again, specifics.

- The use of schemes surrounded by rumors and scandals. As popular wisdom says, “there is no need to reinvent the wheel.” Most often, deception schemes that have already been tested by time are used. If you see something similar, do not contact such offers.

- They offer to invest money in something that no one has seen before. Stories about super technologies are often used by scammers. They convince the potential investor of the highest level of profitability, but it is important to be aware of the risk of such investments. If they try to convince you that this is real success, you are faced with scammers.

- The manager flaunts his wealth. This is explained simply: invest money and you will live just as richly. But think about it, if a person can afford such a life, why does he need your 5-10 thousand rubles?

- The so-called “brokerage scheme”. Its essence is this: you enter into an agreement with the management company for the provision of brokerage services. It turns out that you transferred the funds to the manager, and according to all documents you manage your accounts, which means you also bear all responsibility. Even if you go to court, the chances of proving the truth are negligible.

We hope that this information will help many people avoid encounters with scammers. Communicate with representatives of different companies, but you should not take everything they say as a guide to action.

Who was counted?

In this material, a private foundation is understood as a fund that was created and continues to operate primarily with the funds of an individual or family (including through controlled companies). At the same time, the founder of such a fund actively participates in its activities; is positioned in conjunction with its founder - as a founder, in the name of the fund, in public materials.

There are a large number of foundations in Russia that were established by one person and work primarily with his personal funds. In the list of private ones, I included only large funds with annual expenses of more than 10 million rubles.

Cons of IF

- High level of expenses for payment of remuneration to the manager;

- There are various payments that reduce the shareholder's profit;

- You cannot buy assets not provided for by the charter of the investment fund;

- The manager cannot sell all the shares if the market suddenly collapses;

- Risk of losing investments.

So, let's summarize. In this material, we answered questions regarding investment funds as fully as possible. For some, the information received will help preserve and increase their accumulated funds, while others will simply take note of it. But it’s worth knowing that an investment fund is far from the only investment instrument. There are others that are no less attractive to investors.

Risks of working with investment funds

An investor's skill needs to be developed like any other. First, it is a long-term process that includes both right and wrong steps. And the average investor often has neither the knowledge nor the time for competent financial management .

Secondly, finding a good idea for an investment project is not so easy. It is necessary not only to be aware of current trends in the market, but also to navigate the profitability and prospects of a financial instrument.

To free yourself from this complex and painstaking work, you can entrust your capital to those who are professional financial managers.

This will help reduce investment risks to a minimum . Financial risks in this case are also reduced due to investments in different investment instruments (diversification).

Professional management and portfolio diversification help reduce financial risks

However, even professionals are not immune from losses. No investment fund guarantees a 100% guaranteed return for its participants.

The risk of losing funds associated with unsuccessful investments, market declines and other objective factors is always present .

But the more reputable and larger the investment company, the less likely it is that managers will make the wrong decisions. The correct choice of investment fund directly affects the amount of profit and safety of capital.