Individual entrepreneurs and organizations that are employers are required to transfer insurance contributions (from employee payments under employment contracts). Monthly insurance premiums of individual entrepreneurs are transferred to:

- to the Federal Tax Service (for compulsory pension insurance);

- to the Federal Tax Service (for compulsory health insurance);

- to the Federal Tax Service (for insurance for temporary disability and in connection with maternity);

- in the Social Insurance Fund (for compulsory social insurance against accidents at work and against occupational diseases, in short, insurance against injuries).

In our today's publication, we will find out the amount of individual entrepreneur contributions for employees in 2020 for transfer to the funds, as well as what kind of reporting individual entrepreneurs submit to these funds.

Note that from payments to individuals. to persons (on the basis of civil contracts), entrepreneurs must transfer contributions only to the Pension Fund and the Federal Compulsory Compulsory Medical Insurance Fund. Contributions are transferred to the Social Insurance Fund provided that this clause is provided for in the individual entrepreneur’s agreement with the employee.

Please note that in accordance with current legislation, some payments to employees are exempt from paying insurance premiums (Article 217 of the Tax Code of the Russian Federation).

Mandatory for all individual entrepreneurs is:

- registration with the Social Insurance Fund as an employer;

- In addition to contributions for employees, pay insurance premiums “for yourself.”

Contributions paid by individual entrepreneurs for employees in 2020

Tariffs for paying insurance premiums to funds in 2020 are as follows:

- Pension insurance - 22%. From the amount exceeding the established limit value of the base - 10%;

- Insurance in connection with temporary disability and maternity - 2.9% (excluding contributions from accidents), and 1.8% from payments to temporarily staying foreigners;

- Health insurance - 5.1%.

Some individual entrepreneurs have the right to pay insurance premiums at reduced (preferential) rates. Data on these individual entrepreneurs are presented in tables at the end of the article.

The basis for calculating insurance premiums is all payments and rewards received by an individual and subject to contributions for medical pension insurance, injury insurance, temporary disability insurance and maternity insurance. As soon as the annual income of an individual reaches the limit approved by the Government of the Russian Federation, a regressive scale comes into effect. Such income will be taxed at a reduced tariff rate or even exempt from taxation.

From January 1, 2020, the maximum values of the base for calculating insurance premiums are set in the following amounts:

- for contributions to pension insurance - 1,150,000 rubles (if exceeded, contributions are calculated at a rate of 10%);

- for insurance premiums in connection with temporary disability and maternity – 865,000 rubles;

- There is no limit for health insurance contributions.

For 2020, the maximum values of the base for calculating insurance premiums are set in the following amounts:

- for contributions to pension insurance - 1,292,000 rubles (if exceeded, contributions are calculated at a rate of 10%);

- for insurance premiums in connection with temporary disability and maternity – 912,000 rubles;

- There is no limit for health insurance contributions.

Individual entrepreneurs' insurance premiums for employees in 2020 for all types of compulsory insurance (pension, medical, injury, disability, maternity) must be paid by individual entrepreneurs no later than the 15th (next month). Do not forget that if the last day for payment of contributions falls on a weekend (holiday), then the final due date for payment of contributions is postponed to the nearest working day.

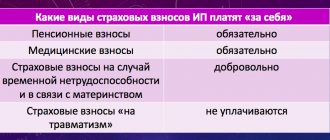

Taxes and contributions of individual entrepreneurs “for themselves”

As was clear from the examples, when applying the special regime, an individual entrepreneur is exempt from paying personal income tax on income from his business. However, he annually pays fixed contributions “for himself” to the Federal Tax Service.

They are called so because they are equal for all individual entrepreneurs. Please note that when calculating the amount of insurance premiums from 2020, the Government refused to link them to the minimum wage! They began to have a fixed size.

Social insurance of individual entrepreneurs is carried out on a voluntary basis. Pension and health insurance are mandatory.

Their amount in 2020 is 36,238 rubles, including:

- pension contributions – 29,354 rubles;

- medical insurance – 6,884 rubles.

It is important to pay everything before the end of the current year. An individual entrepreneur using the simplified tax system and UTII can split the payment into four parts in order to submit it for deduction.

If an individual entrepreneur earned more than three hundred thousand in a year, the individual entrepreneur pays an additional 1% of income on the excess amount.

Individual entrepreneurs do not need to submit reports “for themselves.” Contributions are paid via Internet banking or at a Sberbank branch.

Payment of fees and submission of reports

From January 1, 2014, there is no longer a need to distribute pension insurance contributions between the funded and insurance parts of an employee’s pension. Workers now independently choose an insurance tariff to pay contributions that go towards the funded part of their pension.

An individual entrepreneur who is an employer transfers contributions only to the insurance part. The Pension Fund itself distributes the contributions of the insurance and savings parts (at the employee’s choice).

In 2020, individual entrepreneurs making payments to individuals pay insurance premiums for pension insurance to the Federal Tax Service with a payment order indicating the BCC: 182 1 0210 160.

In 2020, individual entrepreneurs making payments to individuals pay insurance premiums for health insurance to the Federal Tax Service with a payment order indicating the BCC: 182 1 02 02101 08 2013 160.

In 2020, the amount of fixed insurance pension contributions is 26,545 rubles per year , the amount of fixed contributions for health insurance is 5,840 rubles .

The amounts of fixed contributions for 2020 and 2020 have been determined . Just as in 2020, they will not depend on the minimum wage, but are established by the Government of the Russian Federation in specific values:

- in 2020 – for pension insurance – 29,354 rubles; for medical insurance – 6884 rubles;

- in 2020 - for pension insurance - 32,448 rubles; for medical insurance – 8426 rubles.

Starting from 2020, fixed contributions are no longer calculated based on the minimum wage. The government will set a specific annual contribution amount for the purpose of paying fixed contributions for individual entrepreneurs.

Also in 2020, an additional contribution to the Pension Fund of 1% will remain if the annual income exceeds 300,000 rubles. This contribution cannot be more than 212,360 rubles in 2020 and cannot be more than 234,832 rubles in 2020 . In 2020, the pension insurance contribution will not be higher than 259,584 rubles. Moreover, this amount includes not only 1% of the excess income of 300,000 rubles, but also the amount of fixed insurance premiums paid.

KBC for payment of insurance premiums in a fixed amount for compulsory pension insurance for payment in 2020:

182 1 0210 160

KBK for payment of insurance premiums for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of insurance pensions (calculated from the amount of the payer’s income received in excess of the income limit - 1%):

182 1 0210 160

Please note that the BCCs of the two fees listed above are the same.

KBC for payment of insurance premiums for compulsory health insurance in a fixed amount in 2020:

182 1 0213 160

Starting from January 1, 2020 (this rule is also true for the periods 2019 and 2020 ), when transferring insurance premiums to the Federal Tax Service, the amount payable in rubles and kopecks is indicated.

In 2020, an individual entrepreneur submits reports on accrued and paid contributions:

- quarterly to the Federal Tax Service in the form of a Calculation of accrued and paid insurance premiums for pension and health insurance, as well as for temporary disability and maternity insurance (RSV form);

- monthly report to the Pension Fund Information about insured persons (form SZV-M);

- quarterly to the Social Insurance Fund Calculation of accrued and paid insurance premiums for injuries (form 4-FSS);

- starting from 2020, the Pension Fund of Russia will provide a new form (SZV-STAZH). Information about the length of service of employees must be submitted to the Pension Fund once annually. The first report of the new form had to be submitted by 03/01/2018 for 2020. For 2020, the SZV-M experience report must be submitted to the Federal Tax Service no later than 03/01/2020 .

In 2020, electronic reporting is submitted to the Federal Tax Service no later than the 20th day of the second month of the next quarter, on paper - no later than the 15th day of the second month of the next quarter. If there are more than 25 employees, the report must be submitted only electronically. From 2020, a report in the DAM form with 10 or more people will be accepted only in electronic form.

We pay insurance premiums for ourselves and our employees: instructions for individual entrepreneurs, incl. using "simplified"

Insurance premiums of an individual entrepreneur for himself consist of two parts:

Fixed. In 2020 - 27,990 rubles. Every year the amount increases: compared to 2020, it increased by almost 5,000 rubles. Most of the money—23,400 rubles—is taken by the Pension Fund (PFR), and the remaining 4,590 rubles go to the Compulsory Medical Insurance Fund (FFOMS).

Additional. The Pension Fund also requires 1% on annual income over 300,000 rubles (non-taxable amount), but not more than 187,200 rubles. So, if in 2020 an individual entrepreneur receives an income of 1 million rubles, the additional part of the insurance premiums will be 7 thousand rubles. (1 million rubles - 300 thousand rubles): 100). When calculating the additional part, all income of the entrepreneur is taken into account, regardless of the taxation system applied. The amount of the fixed and additional parts of insurance premiums cannot exceed 191,790 rubles.

The fixed part of the contributions is paid by December 31 of the current year, the additional part by April 1 of the next year. It is often more profitable to pay insurance premiums in installments, once every three months, before transferring taxes (they are paid quarterly) - in order to apply a tax deduction, that is, to legally reduce the tax on the amount of insurance payments. We have instructions on how to do everything.

Entrepreneurs pay insurance premiums “for themselves” according to the details of the Federal Treasury department of the corresponding constituent entity of the Russian Federation, indicating their tax office, with the exception of contributions for accident insurance, when the FSS branch is indicated. Contributions to funds are distributed automatically. You can pay from an individual entrepreneur’s current account through an online bank or through the tax service - from an individual’s bank card or in cash at the bank’s cash desk.

It is very important to indicate the correct BCC - budget classification code, otherwise your money will be credited to other payments for which you have an overpayment, and for the required payment - a debt, and you will be charged fines and penalties. The error can be corrected, but it takes a lot of time. The code must be entered in the “KBK” field or, if it is not there, in the “Recipient” column.

- 182 1 0210 160 — insurance contributions to the Pension Fund (both fixed 23,400 rubles for 2020, and additional +1% on income above 300,000 rubles),

182 1 0213 160 - insurance contributions to the Federal Compulsory Medical Insurance Fund (in 2020 - 4,590 rubles).

Nuances

If you opened this year, then you will pay not 27,990 rubles, but less - according to the number of calendar days from the date of registration of the individual entrepreneur until December 31. So, if you became an entrepreneur on March 6, 2020, the fixed part of insurance premiums will be 22,948 rubles 79 kopecks: 19,185 rubles 48 kopecks in the Pension Fund and 3,763 rubles 31 kopecks in the FFOMS.

The insurance portion of the premiums must be paid, even if there is no income. Entrepreneurs are exempt from contributions to the Social Insurance Fund “for themselves” in the event of temporary disability or due to maternity. Entrepreneurs are exempt from contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund “for themselves”:

- undergoing military service by conscription,

- caring for a child under 1.5 years old, a disabled child or a person over 80 years old;

- spouses of military personnel living together in a remote area,

- spouses of diplomatic workers living together abroad.

You must report such circumstances in writing to the regional offices of the Pension Fund, Social Insurance Fund and Federal Compulsory Medical Insurance Fund, where you are registered as an entrepreneur, and attach supporting documents. You will be exempt from paying fees. Being an individual entrepreneur “in reserve” is unprofitable. When the business does not bring in money, it is better to submit an application to terminate the activity to the tax office (fee - 160 rubles). You can open an individual entrepreneur again at any time, the cost of the issue is three days of waiting and 800 rubles in fees.

Insurance premiums for employees

There are no fixed contributions - payments are tied to the income of each employee. Individual entrepreneur, incl. those using the “simplified system” pay at the general tariff: to the Pension Fund of the Russian Federation - 22% of the employee’s salary, bonuses and other remunerations, to the Federal Compulsory Medical Insurance Fund - 5.1%, to the Social Insurance Fund (FSS) - 2.9% and there - contributions for injuries: 0.2% or more, maximum 8.5% (depending on the main type of activity).

There are exceptions. If an entrepreneur uses the simplified code, his income is no more than 79 million rubles. per year, is engaged in any type of activity from the wide list of subclause 5 of clause 1 of Article 427 of the Tax Code and the share of income from these types of activities is at least 70%, then he deducts 20% to the Pension Fund instead of 22%, to the Social Insurance Fund - only for injuries , and in the FFOMS - nothing.

Contributions to the Social Insurance Fund stop accruing from the moment your employee’s income during the year exceeds 755,000 rubles. If the income has reached 876,000 rubles, from the fact that in excess of this amount, the Pension Fund asks for less - 10%.

Employees must be paid at the end of each month - before the 15th of the next month. For example, contributions for November will have to be transferred before December 15. Those who do not comply with these deadlines are charged penalties for each day of delay in the amount of 1/300 of the refinancing rate of the Central Bank of the Russian Federation per day (from March 27, 2017 - 9.75% per annum). If an entrepreneur mistakenly underestimates the amount of insurance premiums, he is fined in the amount of 20% of the unpaid amount, and if intentionally, then in the amount of 40%.

Contributions for injuries (from 0.2 to 8.5%) must be sent to the details of the Social Insurance Fund branch to which you are attached as an employer.

- KBK - 393 1 0200 160.

Entrepreneurs pay all other contributions for employees according to the details of their tax office, just as “for themselves”: from an online bank from an individual entrepreneur’s current account or through the tax service - from an individual’s bank card or in cash at the bank’s cash desk.

Bookmaker codes:

- 182 1 0210 160 - to the Pension Fund for pension insurance,

- 182 1 0210 160 - to the Social Insurance Fund for social insurance, in case of temporary disability and in connection with maternity,

- 182 1 0213 160 - to the Federal Compulsory Medical Insurance Fund for compulsory health insurance.

Yes, employees are expensive. But we have found ways to reduce these costs.

Payment of insurance premiums for individual entrepreneurs for employees in 2020

Let us remind you that from January 1, 2020, the functions of tax administration of insurance premiums are assigned to the Federal Tax Service. At the same time, the procedure for monitoring the payment of insurance premiums for temporary disability and in connection with maternity changed.

Since 2020, the tax inspectorate has been charged with the following duties:

- control the payment of insurance premiums in accordance with the provisions of the Tax Code of the Russian Federation;

- collect debt on insurance premiums, including those incurred before January 1, 2020;

- accept calculations of insurance premiums for the reporting period from the 1st quarter of 2020.

In 2020, the Social Insurance Fund remains responsible for contributions for temporary disability and in connection with maternity:

- accept calculations for insurance premiums for 2010-2016.

- carry out control measures on insurance premiums for 2010-2016.

- make a decision on the return of overpaid (collected) insurance premiums for 2010-2016.

- carry out verification of expenses for sick leave and maternity and reimbursement of social insurance expenses.

Contributions for injuries remain administered by the Social Insurance Fund.

The deadlines for paying insurance premiums in 2020 will remain the same as in previous years - no later than the 15th day of the month following the month for which they were accrued. But contributions in 2020 must be transferred to the tax office, and not to the Pension Fund or Social Insurance Fund.

In 2020, individual entrepreneurs must submit reports on paid contributions to the Federal Tax Service.

Reporting on insurance premiums in 2020

In 2020, a new report to the Federal Tax Service will continue to be in effect - a unified calculation of insurance premiums. Let us remind you that this report replaced the following reports: 4-FSS, RSV-1, RSV-2 and RV-3. The form for calculating insurance premiums was approved by Order of the Federal Tax Service of Russia dated October 10, 2016 N ММВ-7-11/ [email protected]

Entrepreneurs-employers must submit calculations for insurance premiums within the following deadlines:

- for the 1st quarter of 2020 until 05/03/2019.

- for the first half of 2020 until July 30, 2019.

- for 9 months of 2020 until October 30, 2019.

- for 2020 until January 30, 2020

For the periods of 2020, the following reporting deadlines have been established:

- for the 1st quarter of 2020 until 05/03/2020.

- for the first half of 2020 until July 30, 2020.

- for 9 months of 2020 until October 30, 2020.

- for 2020 until January 30, 2021

To date, a new form for calculating insurance premiums has been prepared, which will presumably need to be submitted for the periods of 2020. The new form, as usual, will take into account changes in legislation. The new 2020 DAM form must be submitted from the 1st quarter of 2020. The 2020 DAM form was approved by Order of the Federal Tax Service dated September 18, 2019 No. ММВ-7-11/ [email protected] and officially published on October 8, 2020.

The changes in the new form are minor, in particular:

- the sheet with information about an individual who is not an individual entrepreneur was excluded;

- the line “Amount of insurance premiums payable for the billing (reporting) period” has been removed from section 1; the amounts of contributions will be indicated only for the last three months of the billing (reporting) period;

- A line has been added to Appendix 1 for deducting expenses when calculating contributions from income under copyright contracts and other contracts specified in clause 2 of Article 421 of the Tax Code.

For 2020, the 2019 DAM form, approved, is relevant for submission to the Federal Tax Service. by order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/551.

The SZV-M report continues to be submitted in 2020. SZV-M must be submitted to the Pension Fund by the 15th day of the month following the reporting month.

The report Information on the length of service of insured persons is submitted, starting in 2017, annually before March 1 of the year following the reporting year.

Form 4-FSS in 2020 is submitted to the FSS within the same time frame as in previous years. This form consists of section 2 of the previously valid form 4-FSS. It must also be submitted to the territorial offices of the Social Insurance Fund.

Let us remind you of the deadline for submitting 4-FSS in 2020:

- on paper no later than the 20th day of the month following the reporting period;

- in the form of an electronic document no later than the 25th day of the month following the reporting period.

For individual entrepreneurs who do not employ hired workers, there is no need to submit reports on insurance contributions to the Federal Tax Service, Pension Fund or Social Insurance Fund in 2020.

Does the individual entrepreneur pay taxes for employees?

Yes, in most cases, individual entrepreneurs pay taxes for their employees. After registering as an individual entrepreneur, he is obliged to register with the Pension Fund and the Social Insurance Fund, and thus declare himself as a tax agent for his subordinates.

According to current legislation, an employee is not required to independently fill out a tax return and make contributions to extra-budgetary funds if his work is hired. These functions are assumed by the employer.

Thus, all funds contributed by an individual entrepreneur for his employees consist of two points:

- Income tax – 13%. The entrepreneur takes this amount not from his own pocket, but from the accrued salary of his employee. In fact, the employee pays, the employer only transfers the salary tax to the budget for him. Not all income is subject to personal income tax - the exceptions are pensions, maternity payments, and severance pay. The employer must transfer the withheld tax amount to the treasury on the day of payroll or the next day.

- Insurance contributions – 30% of the employee’s accrued salary . The employer takes this amount from his own funds, thus increasing his personnel costs. Since 2020, reporting on insurance premiums for employees is submitted to the tax service.

Payment of contributions to the Social Insurance Fund

Individual entrepreneurs' insurance premiums for employees in 2020 to the Social Insurance Fund are divided into 2 types:

1. From accidents at work (and from occupational diseases). 2. In case of temporary disability (and in connection with maternity).

The amount of insurance premiums in case of temporary disability is 2.9% of wages. The amount of the contribution may vary depending on the preferential tariff.

The amount of insurance premiums for accidents at work is from 0.2 to 8.5%. It depends on the class of professional risk to which the type of activity of the employee belongs.

In 2020, the budget classification code for transferring insurance contributions to the Social Insurance Fund remained unchanged:

- KBK 393 10200 160 (in case of temporary disability);

- KBK 393 10200 160 (from industrial accidents).

The remaining details can be found in the territorial office of the Social Insurance Fund.

Starting from January 1, 2020 (this rule is true for 2019 and 2020 ), when transferring insurance contributions to the Social Insurance Fund, the amount payable in rubles and kopecks is indicated.

An individual entrepreneur submits reports quarterly to the Social Insurance Fund in the form of “Calculation of accrued and paid insurance premiums (according to Form 4-FSS).”

In 2020, electronic reporting is submitted to the Social Insurance Fund no later than the 25th day of the month following the reporting quarter. On paper - no later than the 20th day of the month following the reporting quarter.

Employers with an average number of employees of more than 25 people in 2020 submit reports only in electronic form (with an enhanced qualified electronic signature of UKEP).

Reporting for individual entrepreneurs with employees

An individual entrepreneur must register with the Social Insurance Fund and report in two cases:

- when hiring the first employee;

- when concluding a civil law or copyright agreement - only if it states that the entrepreneur must transfer contributions to the Social Insurance Fund for accidents.

To register, you must, within 30 days from the date of conclusion of the first employment contract, contact the local branch of the Social Insurance Fund with an application, passport and copies of the employee’s passport and employment contract. The fund will issue you a notice with a registration number and the percentage of contributions for accidents and occupational diseases.

You need to report quarterly in Form 4-FSS. This report is compiled on contributions calculated from employee salaries before withholding income tax (NDFL), as well as, if there is an indication of the payment of contributions, from payments under civil contracts.

Contributions are calculated at the interest rate specified by the fund upon registration (from 0.2 to 1% of the wage fund). The percentage is determined by the risk class of the main activity in accordance with the statistical code OKVED-2. When changing the type of activity and OKVED-2 code, you should contact the FSS office to clarify the rate.

We recommend reading: Individual entrepreneurs’ reporting on the simplified tax system with employees: what needs to be submitted to the Pension Fund, Tax Service and Social Insurance Fund.

Table of tariff rates for insurance premiums in 2020

| Category of insurance premium payers | Pension Fund | FFOMS | FSS | Total |

| General insurance premium rates in 2020 | ||||

| Organizations and individual entrepreneurs on the OSN, simplified tax system, UTII and Unified Agricultural Tax, with the exception of beneficiaries | 22% | 5,1% | 2,9% | 30% |

| Individual entrepreneur on PSN (trade, catering, property rental) | ||||

| With a tax base for each employee of up to 1,150,000 (2019), 1,292,000 (2020) | 22% | 5,1% | 2,9% | 27,1% |

| If the tax base per employee is above 1,150,000 (2019), 1,292,000 (2020) | 10% | 5,1% | — | 15,1% |

| Preferential or reduced rates of insurance premiums in 2020 | ||||

| — | 20% | — | — | 20% |

| NPOs (on the simplified tax system that operate in the field of social services, science, education, healthcare, sports, culture and art) | ||||

| Organizations and individual entrepreneurs (on the simplified tax system with preferential types of activities) | ||||

| Charitable organizations (using simplified tax system) | ||||

| — | ||||

| Participants in the free economic zone (FEZ) in Crimea and Sevastopol | 6% | 0,1% | 1,5% | 7,6% |

| Organizations and individual entrepreneurs engaged in technical innovation and tourism and recreational activities in special economic zones | 8% | 4% | 2% | 14% |

| Organizations in the field of IT (provided that the income from this activity at the end of 9 months is at least 90%, and the number of employees is at least 7 people) | ||||

| Organizations that have received the status of a participant in the Skolkovo project | 14% | — | — | |

| Organizations and individual entrepreneurs that make payments to crew members of ships (registered in the Russian International Register of Ships) | — | — | — | 0% |

| Beneficiaries, if the limits for the Pension Fund of the Russian Federation are exceeded 1,150,000 rubles in 2020 and over 1,292,000 rubles in 2020, do not need to transfer additional contributions to the Pension Fund of the Russian Federation. | ||||

| Additional rates of insurance premiums in 2020 | ||||

| The persons specified in paragraphs. 1 clause 1 art. 27 of Law No. 173-FZ | 9% | — | — | 9% |

| The persons specified in paragraphs. 2-18 clause 1 art. 27 of Law No. 173-FZ | 6% | — | — | 6% |

| Additional contributions are paid regardless of the 1,021,000 and 815,000 limits in 2020. At the same time, companies that have assessed working conditions can be paid additionally. contributions to the Pension Fund at special rates (part 1-2.1 of article 58.3 of Law No. 212-FZ) | ||||

It remains to add that a bill is currently being prepared to maintain the current insurance premium rates for the period up to 2020 inclusive. The bill is aimed at ensuring, in the period from 2020 to 2020, the unchanged conditions for the payment of insurance premiums to state extra-budgetary funds, in accordance with the Message of the President of the Russian Federation and the instructions of the Chairman of the Government of the Russian Federation.

Individual entrepreneur benefits at the expense of the Social Insurance Fund: how to calculate and receive

From the article you will learn:

1. Why should an entrepreneur voluntarily register with the Social Insurance Fund and pay contributions “for himself?”

2. What benefits can individual entrepreneurs receive at the expense of the Social Insurance Fund?

3. How to calculate the amount of benefits that an individual entrepreneur can receive from the Social Insurance Fund.

Individual entrepreneurs who have employees must register as insurers with the Pension Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund and the Social Insurance Fund and pay the appropriate contributions from the salaries of their employees. As for contributions “for themselves,” entrepreneurs must pay them regardless of whether they have employees or not. At the same time, individual entrepreneurs are required to pay contributions to pension and health insurance, while contributions to social insurance are voluntary. Why should entrepreneurs pay contributions to the Social Insurance Fund on their own initiative if the law allows them not to do so? The answer is simple: to be eligible to receive social benefits, such as temporary disability benefits, maternity benefits, and child care benefits. Read this article to learn how to calculate individual entrepreneur contributions to the Social Insurance Fund, determine the amount of benefits due, and how beneficial it is for entrepreneurs to voluntarily pay contributions to the Social Insurance Fund.

The interaction scheme between an entrepreneur and the Social Insurance Fund is as follows:

- Registration with the Social Insurance Fund as an insurer

- Payment of insurance premiums, submission of reports

- Applying to the Social Insurance Fund for the assignment of benefits in the event of an insured event.

Next we will look at each of these points in detail. Let me remind you once again that this article is about the voluntary entry of entrepreneurs into legal relations under compulsory social insurance in case of temporary disability and in connection with maternity, regardless of the presence of employees. The relationship between individual entrepreneurs and the Social Insurance Fund when paying contributions for employees is not discussed in this article.

Voluntary registration of an individual entrepreneur with the Social Insurance Fund as an insurer

Individual entrepreneurs (as well as lawyers, members of peasant farms, notaries and other persons engaged in private practice) are subject to compulsory social insurance in case of temporary disability and in connection with maternity only if they voluntarily entered into legal relations under this type of insurance and pay insurance premiums for yourself (Part 3, Article 2 of Federal Law No. 255-FZ). In order to enter into voluntary legal relations under social insurance, an individual entrepreneur must register as an insurer. For this purpose, the entrepreneur submits the following documents to the territorial body of the Social Insurance Fund at the place of residence (Articles 4, 6 of the Registration Procedure, approved by Order of the Ministry of Health and Social Development of the Russian Federation dated December 7, 2009 No. 959n):

- Statement

Download Application form for entering into legal relations under compulsory social insurance in case of temporary disability and in connection with maternity

- Copies (with presentation of the originals to the FSS employee): passports;

- certificate of registration with the tax authority (TIN);

- certificates of state registration as an individual entrepreneur.

Within five working days from the date of receipt of the specified documents, the FSS body assigns a registration number and subordination code to the applying entrepreneur, and also generates a registration notice. One copy of the notice is given to the individual entrepreneur in the manner specified in the application (in person or by mail), and the second remains in the fund.

Payment of individual entrepreneur contributions to the Social Insurance Fund “for oneself”

Individual entrepreneurs who voluntarily registered with the Social Insurance Fund as policyholders pay insurance premiums based on the cost of the insurance year. In this case, the annual amount of contributions is calculated according to the following formula (Article 4.5 of Federal Law No. 255-FZ):

Вз = minimum wage x Т x 12 , where:

Вз – the amount of contributions payable for the year (cost of the insurance year);

Minimum wage – the minimum wage established at the beginning of the year for which contributions are paid;

T – insurance premium rate.

Insurance contributions to the Social Insurance Fund must be paid before December 31 of the year for which they are calculated. In this case, the frequency of payment does not matter: in parts throughout the year or in a lump sum in the entire amount, the main thing is that at the end of the year the entire amount of contributions is repaid. Another important point: the amount of contributions payable to the Social Insurance Fund does not depend on the month in which the individual entrepreneur registered as an insurer. That is, an entrepreneur who registered with the Social Insurance Fund in January and an entrepreneur who registered in December must pay the same amount of contributions - for the full year.

An example of calculating individual entrepreneur contributions to the Social Insurance Fund

IP Morozova S.V. registered with the Social Insurance Fund as a person who voluntarily entered into legal relations under compulsory social insurance in case of temporary disability and in connection with maternity, March 15, 2020. Let's calculate the amount of contributions that individual entrepreneur Morozova must pay to the Social Insurance Fund for 2020 (until December 31, 2015):

Vz = 5,965 x 2.9% x 12 = 2,07.82 rubles.

! Please note: Since registration of individual entrepreneurs in the Social Insurance Fund and payment of contributions “for oneself” occurs on a voluntary basis, in case of non-payment or incomplete payment of contributions, the entrepreneur is automatically deregistered. In this case, fines and penalties are not charged, and the amounts of contributions transferred during the year (in partial amounts) are returned.

Calculation and payment of individual entrepreneur benefits at the expense of the Social Insurance Fund

It should be noted that only those individual entrepreneurs who have paid insurance premiums for the previous year in full and on time (Clause 6, Article 4.5 of Federal Law No. 255-FZ) can count on receiving benefits at the expense of the Social Insurance Fund events that occurred in the current year . For example, for insured events that occurred in 2020, entrepreneurs who paid contributions to the Social Insurance Fund “for themselves” for 2014 will be able to receive benefits.

So, what types of benefits are provided to individual entrepreneurs who voluntarily entered into legal relations under compulsory social insurance in case of temporary disability and in connection with maternity (clause 1 of article 1.4 of Law No. 255-FZ):

- temporary disability benefits;

- maternity benefits;

- monthly child care allowance;

- social benefit for funeral.

! Please note: regardless of whether an individual entrepreneur is registered with the Social Insurance Fund or not, he can count on receiving the following “children’s” benefits: a one-time benefit for women who registered with medical institutions in the early stages of pregnancy and a one-time benefit at the birth of a child. These benefits are paid in a fixed amount, the same for everyone.

Benefits for temporary disability, pregnancy and childbirth, and child care are calculated based on the average earnings of the insured person. For individual entrepreneurs who voluntarily registered with the Social Insurance Fund, these benefits are calculated based on the minimum wage in force in the year in which the insured event occurred. For example, for 2020 the minimum wage is set at 5,965 rubles. The calculation of temporary disability benefits is also affected by the insurance period, which includes years of work under an employment contract, or years for which the individual entrepreneur voluntarily paid contributions to the Social Insurance Fund “for himself.”

An example of calculating an individual entrepreneur's temporary disability benefit

Individual entrepreneur A. I. Alexandrov voluntarily registered with the Social Insurance Fund in 2014 and paid contributions. Before registering as an individual entrepreneur, Alexandrov worked under an employment contract for 9 years. In March 2020, Alexandrov was sick for 15 days. We will calculate the amount of temporary disability benefits.

- Total insurance experience: 10 years (9 years under an employment contract + 1 year as an individual entrepreneur). Therefore, the VNT benefit will be accrued in the amount of 100% of average earnings.

- Average daily earnings: 5,965 / 31 days * 100% = 192.42 rubles.

- VNT allowance: 192.42 * 15 days = 2,886.30 rubles.

If IP Aleksandrov did not have work experience under an employment contract, then his insurance experience would be 1 year. In this case, temporary disability benefits were paid in the amount of 60% of the average daily earnings and amounted to: 192.42 * 60% * 15 days = 1,731.78 rubles.

Read more about the procedure for calculating temporary disability benefits in this article.

Example of calculating maternity benefits

Individual entrepreneur Snegireva voluntarily registered with the Social Insurance Fund in 2014. In 2015, a certificate of incapacity for work was received for pregnancy and childbirth for 140 days from January 18, 2020 to June 6, 2020. Let's calculate the amount of maternity benefits.

The period of incapacity for work covers 14 days of January, 6 days of June and 4 full months (from February to May). The benefit will be: 5,965 / 31 * 14 + 5,965 / 30 * 6 + 5,965 * 4 = 2,693.87 + 1,193 + 23,860 = 27,746.87

Child care benefits are paid in the amount of 40% of average earnings until the child reaches 1.5 years of age. In this case, the amount of the benefit cannot be less than the minimum amount established for the corresponding year. For example, in 2020, the minimum amount of benefits for caring for the first child is 2,718.34 rubles, for the second and subsequent children - 5,436.67 rubles. Thus, an entrepreneur who is voluntarily registered with the Social Insurance Fund will be guaranteed to receive the minimum amount of child care benefits.

The amounts of benefits that an individual entrepreneur can claim are small, since they are calculated from the minimum wage. However, if you compare these amounts with the amount of contributions payable to the Social Insurance Fund, the benefits of voluntary registration in the Social Insurance Fund and paying contributions “for yourself” become obvious.

In order to receive temporary disability, maternity, or child care benefits from the Social Insurance Fund, an individual entrepreneur must contact the Social Insurance Fund body with which he is registered as an insurer with a corresponding application. The application is drawn up in any form, with copies of supporting documents attached (certificate of temporary incapacity for work, certificate of registration in the early stages of pregnancy, birth certificate of the child).

Download a sample application from an individual entrepreneur for payment of benefits at the expense of the Social Insurance Fund

! Please note: You can apply to the Social Insurance Fund to receive benefits within a certain period. The maximum period for applying for temporary disability benefits is six months from the date of restoration of working capacity (establishment of disability), for maternity benefits - six months from the date of expiration of sick leave, for child care benefits - six months from the date the child reaches the age of one and a half years.

Individual entrepreneur reporting to the Social Insurance Fund

Individual entrepreneurs voluntarily registered with the Social Insurance Fund must report annually to the fund. The report on accrued and paid insurance premiums is drawn up in Form 4a-FSS and consists of two sections: the first reflects information about insurance premiums paid, and the second – the amount of benefits received from the FSS. The report is submitted to the Social Insurance Fund at the place of registration by January 15 of the year following the reporting year.

Download Form-4a FSS

If you find the article useful and interesting, share it with your colleagues on social networks!

If you have any questions, ask them in the comments to the article!

Normative base

- Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”

- Order of the Ministry of Health and Social Development of the Russian Federation dated December 7, 2009 No. 959n “On the procedure for registration and deregistration of policyholders and persons equated to policyholders”

- Decree of the Government of the Russian Federation dated October 2, 2009 No. 790 “On the procedure for paying insurance premiums by persons who voluntarily entered into legal relations for compulsory social insurance in case of temporary disability and in connection with maternity”

Find out how to read the official texts of these documents in the Useful sites section

CHANGES IN THE APPLICATION OF PREFERENTIAL INSURANCE RATES

Unfortunately, the promise of the Russian Government to maintain preferential tariffs for the simplified tax system until 2020 will not be realized. According to Federal Law No. 303-FZ dated August 3, 2018, only for socially oriented non-profit and charitable organizations that use the simplified tax system, the tariff rate remains at 20%.

For individual entrepreneurs and organizations using the simplified tax system, the tariff rate will be 30%. The tariff increase will occur within the following limits:

- instead of 20%, pension insurance will need to be charged 22%;

- for health insurance the tariff will be 5.1%, instead of 0%;

- for insurance for temporary disability and maternity, the tariff will increase from 0% to 2.9%.

Penalties on insurance premiums in 2020

In 2020, fines for violations of payment of contributions will be calculated, according to the Tax Code of the Russian Federation, according to the following rules:

- for violation of the deadline for submitting calculations for insurance premiums, the fine will be 5% of the unpaid amount for each month, but not more than 30% of this amount;

- the minimum fine will be 1,000 rubles (Article 119 of the Tax Code of the Russian Federation);

- for each document on contributions not submitted, the fine will be 200 rubles (Article 126 of the Tax Code of the Russian Federation);

- for deliberate underestimation of the contribution base, the fine will be 40% of the underpaid contribution amount.

The material has been edited in accordance with changes in the legislation of the Russian Federation, relevant as of 10/11/2019

This might also be useful:

- Fixed payments for individual entrepreneurs in 2020 for themselves

- Changes in individual entrepreneur taxation in 2020

- What taxes does the individual entrepreneur pay?

- What reporting must an individual entrepreneur submit?

- How much taxes does an individual entrepreneur pay in 2020?

- The amount of insurance premiums for compulsory health insurance and compulsory medical insurance for individual entrepreneurs in 2020

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Comments

Max 01/14/2016 at 11:14 pm # Reply

They didn’t introduce different BCCs for contributions to the Pension Fund within and above the limit, the code remained the same as in 1915.

Natalia 01/15/2016 at 07:21 pm # Reply

Max, good evening. The BCC for the Pension Fund of the Russian Federation within and above the limit in 2016 is different, such as those indicated in the article.

Max 01/15/2016 at 08:54 pm # Reply

Natalia, they wanted to do this, but at the last moment they canceled it by order of the Ministry of Finance dated December 1, 2015 No. 190n. Look at the KBK on the Pension Fund website.

Natalia 01/16/2016 at 14:13 # Reply

Max, good afternoon. We checked - you are right, we corrected it. Thanks a lot!

Anna 03/25/2016 at 09:03 # Reply

Error?

KBK for payment of insurance premiums for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of insurance pensions (calculated from the amount of the payer’s income received in excess of the income limit - 1%): KBK 392 102 02010 061200 160

Natalia 03/25/2016 at 01:59 pm # Reply

Anna, good afternoon. From 2020, KBK for payment of insurance premiums for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of insurance pensions (calculated from the amount of the payer’s income received in excess of the income limit - 1%): 392 10200 160.

Zarina 04/09/2016 at 15:11 # Reply

I'm clarifying

On the PFR website, the table “Tariffs for compulsory pension insurance”, in the line “Organizations and individual entrepreneurs applying the simplified taxation system” - 20%, does not indicate the use of preferential rates, as if everyone on the simplified tax system can pay only 20% to the PFR and everything.https://www.pfrf.ru/strahovatelyam/samozaniatoe/porjadok_upl_ip/ They are misleading.

Nikolay 11/15/2019 at 10:03 pm # Reply

IN THE "TABLE OF TARIFF RATES FOR INSURANCE PREMIUMS IN 2019-2020" the second line is not correct

Natasha 04/03/2020 at 10:18 pm # Reply

kbk

check kbk for employees