Information on the average number of employees (AHR) is one of the first reports of a newly created LLC. The reporting form looks simple, however, submitting the SSR raises a lot of questions, which we will answer in this article.

Who must submit information about the number of employees

Judging by the name, only employers must submit information about the average number of employees. But the Ministry of Finance believes that all companies must report, including newly organized ones that do not yet have employees .

From the letter of the Ministry of Finance of the Russian Federation dated February 4, 2014 No. 03-02-07/1/4390: “... there is no provision for exemption of organizations that do not have employees from submitting information on the average number of employees to the tax authorities within the prescribed period.”

Let's list who is required to submit a report on the average headcount:

- newly registered legal entities, regardless of the availability of personnel;

- individual entrepreneurs-employers;

- organizations that have entered into employment contracts;

- organizations that do not have employees on staff.

Thus, only individual entrepreneurs without employees have the right not to submit this information; all other businessmen are required to report.

Free accounting services from 1C

Individual entrepreneur without employees

Currently, the position of the legislative bodies regarding individual entrepreneurs without employees is becoming unambiguous and boils down to the fact that an individual entrepreneur, being an employer, does not have the right to perform this function in relation to himself. This point of view is reflected in the letter of Rostrud dated February 27, 2009 No. 358-6-1 and in the letter of the Ministry of Finance of the Russian Federation dated January 16, 2015 No. 03-11-11/665. Thus, an individual entrepreneur does not have the right to regard himself as a staff member when submitting reports. This is explained by the fact that the legislation does not provide for the conclusion of a bilateral agreement, which is an employment contract (Article 56 of the Labor Code of the Russian Federation), with oneself. Accordingly, the law does not allow an individual entrepreneur to assign himself the payment of wages. At the same time, there are no requirements in the Tax Code for an individual entrepreneur to submit a form of information about the zero average number of employees.

Who to include in the headcount for the report

The calculation of the average headcount in 2020 is carried out in accordance with the Instructions approved by Rosstat Order No. 711 dated November 27, 2019. The Instructions list the categories of workers who are included in the number for the report, and those who are not taken into account in the calculation.

A lot of controversy arises regarding the inclusion in the SCR of information about the only founder who works without an employment contract and does not receive a salary. Should he be taken into account in the number of employees, since he performs administrative functions for the management of the LLC? No, it’s not necessary, there is a clear answer to this question in paragraph 78 (7) of the Directives.

The average headcount is calculated only for personnel hired under an employment contract. This is the main difference between this indicator and reports to funds, which also take into account employees registered under a civil law contract. In this case, the duration of work under the employment contract does not matter; everyone who performs permanent, temporary or seasonal work is included in the information of the SCH. Separately, those who are employed full-time and those who work part-time are taken into account.

Read more: How to calculate the average number of employees

In general, the average payroll number is determined by adding the number of employees on the payroll for each month of the reporting year and dividing the resulting amount by 12. The final result is indicated in whole units, because it means the number of working people in the state.

Calculation: is individual entrepreneur included in the average headcount?

As a rule, the report is compiled on the basis of a time sheet: the number of employees present for each working day is summed up and the result is divided by the number of calendar days of the month. Then the data for each month is divided by 12.

When calculating the indicator, we recommend that you follow the requirements of Rosstat (Appendix No. 1 to Order No. 580 of 2014).

Note:

- Only personnel under an employment contract need to be taken into account;

- The individual entrepreneur himself does not need to be included in the average headcount.

When drawing up a report on the average number of employees, individual entrepreneurs do not take into account personnel who:

- carries out labor activities outside the Russian Federation;

- transferred to another organization;

- works under a student contract;

- are on maternity leave, etc.

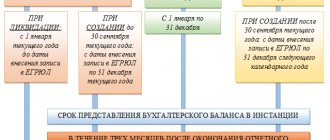

The deadline for the completion of the SSR is 2020

The deadline for submitting information on the average number of employees is established by Article 80 of the Tax Code of the Russian Federation. According to it, this form must be submitted no later than January 20 of the current year for the previous calendar year. But the deadline for submitting a report on the average number of new organizations (legal entities that have just been created or reorganized) is no later than the 20th day of the month following the one in which the organization was registered or reorganized.

For example, the creation of an LLC occurred on January 10, 2020, therefore, information on the average headcount of the newly created organization must be submitted no later than February 20, 2020, then the company reports in the general manner.

If the delivery deadline is violated, the LLC will be fined under Article 126 of the Tax Code of the Russian Federation in the amount of 200 rubles. In addition, an administrative punishment of an official (chief accountant or director) in the amount of 300 to 500 rubles is possible under Article 15.6 of the Code of Administrative Offenses of the Russian Federation.

Important: information about the average number of employees of a new organization, although submitted to the Federal Tax Service, is not a tax return, therefore tax authorities do not have the right to block the LLC’s current account due to late submission deadlines.

When there is no staff: do individual entrepreneurs pass the average payroll?

Often, businessmen independently conduct their business affairs, without hiring people or attracting family members (friends) without concluding an employment contract. In this case, you do not need to submit the report in question. A similar rule applies when concluding contracts only of a civil nature.

Exemption from taking the average salary for individual entrepreneurs without employees is possible on the basis of clause 3 of Art. 80 Tax Code of the Russian Federation. This norm establishes the circle of persons who are required to submit a report to the Federal Tax Service on the average number of personnel per year: legal entities and individual entrepreneurs using hired labor.

Thus, only merchants who entered into an employment contract face a fine for failure to submit a report or violation of a deadline. Individual entrepreneurs without employees do not submit the average number of employees for 2020. Therefore, if you receive a notification with such a requirement, you need to inform the tax authorities about the error.

Read also

11.12.2017 27.10.2017 01.02.2018 08.02.2018 28.03.2018 18.04.2018

Report form

The SChR report is submitted in form KND 1110018 on the form approved by order of the Federal Tax Service of Russia dated March 29, 2007 No. MM-3-25/ [email protected] Recommendations for filling out the form are given in the letter of the Federal Tax Service of Russia dated April 26, 2007 No. CHD 6-25/ [email protected]

The report on the average headcount for newly created organizations consists of one sheet and has a fairly simple appearance.

In the top lines of the form (the fields to fill out are highlighted in color) indicate the TIN and KPP of the legal entity. The name of the Federal Tax Service is entered in full, indicating the number and code of the tax authority. The name of the company is given in full, for example, not “Alfa LLC”, but “Alpha Limited Liability Company”.

The only significant indicator of the CHR report is the average headcount, calculated in accordance with Instructions No. 711. If information is submitted for the past calendar year, then January 1 of the current year is indicated in the date fields. The information is signed by the head of the legal entity, but this can also be done by an authorized representative. When submitting a report by proxy, you must enter the details of this document and attach a copy.

The report on the average headcount for newly created organizations differs from the usual annual report only in the date. Please note the footnote marked with (*) - the number of personnel is indicated not as of January 1 of the current year, but as of the 1st of the month following the month in which the LLC was registered. For example, if a company was registered on January 10, 2020, then the headcount is indicated as of February 1, 2020.

We provide a sample of filling out a report on the average number of employees of a newly created LLC, in which the employment contract is concluded only with the general director.

Submission methods

The number of employees under an employment contract is important not only when calculating taxes, but also when choosing the method of submitting the CHR report: paper or electronic. Typically, information about the average headcount of a newly created organization is submitted in paper form, because the number of employees hired in the first month rarely exceeds 100 people.

The rule of Article 80 (3) of the Tax Code of the Russian Federation states that only taxpayers with no more than 100 people have the right to submit tax returns and calculations in paper form. If we take it literally, then this article should not apply to the report on the average headcount, because it is not taxable. However, tax officials insist that if the number of employees exceeds 100 people, information about their number should also be submitted in electronic format.

In fact, this requirement does not cause any particular difficulties, given that since 2020, insurance premium payers are required to submit reports on insurance premiums in electronic form, starting from 25 people. That is, if the number of employees in your enterprise exceeds 25 people, you will still have to issue an electronic digital signature, which can be used to sign all reports.

A report on the number of employees is submitted to the tax office at the place of registration: at the registration of an individual entrepreneur or the legal address of an LLC. If the document is drawn up on paper, then you can submit the report in person to the Federal Tax Service or by mail with a list of the attachments.

How to calculate MSS

An individual entrepreneur is not included in the number of his employees - he cannot conclude an employment contract with himself and set his own salary. If you do not have employees, then you do not need to report in 2020. Such amendments were made to paragraph 3 of Art. 80 Tax Code of the Russian Federation. If you are on UTII, then when calculating the average headcount you are required to include yourself as a unit in the physical indicator. This is stated in Art. 346.29 Tax Code of the Russian Federation. Otherwise, the principle of calculating the MSS is no different.

An individual entrepreneur is not included in the number of his employees - he cannot conclude an employment contract with himself and set his own salary.

So, we fill out the form according to form No. P-4. It is necessary to calculate the average number of employees for the reporting year in several stages:

- The average number of full-time employees is determined. It is necessary to establish how many days each person worked in a month. Weekends and holidays should also be taken into account. The number of calculated days of all employees is summed up and divided by the number of days of the month for which the calculation is being made. The resulting value cannot be rounded.

- We calculate the average number of employees who work part-time. To do this, you need to calculate the number of hours they worked for the entire month, divide this value by the length of the working day, and then distribute the resulting value among the days of the month. That is, in this case, the average number of employees will be proportional to the time they worked. The resulting value cannot be rounded.

- The final step is to calculate the annual value. All data received for each month for full-time and part-time employees must be summed up and divided by 12. Now the resulting value must be rounded and entered into the reporting form.

If an individual entrepreneur deems it necessary, he has the right to calculate the SCH as if part-time employees are full-time.

Make sure that the data reaches the Federal Tax Service on time. Otherwise, you will be fined 200 rubles. By the way, a fine will not relieve you of the obligation to submit a report. The average headcount is necessary to calculate a number of taxes. It is an indicator for the use of UTII or simplified tax system - if the number of employees exceeds 100 people, then the entrepreneur will not be able to use these modes.

A certificate of the average number of individual entrepreneurs is needed to determine the tax base. The amount of payments to the tax office will depend on it. If you work without employees, you can forget about the certificate, but if you have at least one person on staff, you won’t be able to evade responsibility.