For some tax systems operating in Russia, the transition period is set at the beginning of the new year. So, if you did not switch to a simplified taxation system immediately after registering your business, then this opportunity will appear only from January 1.

The patent tax system is simpler in this sense. You can apply for a patent for a permitted type of activity at any time of the year. Moreover, a patent for 2020 can be obtained for either one or several months.

What is an IP patent

If you want to apply for a patent for individual entrepreneurs for 2020, we recommend that you read the brief information about this tax regime.

A patent is issued only to individual entrepreneurs who operate within the framework of the patent tax system. There are no complex reports or declarations on the PSN, because the actual income received is not taken into account for tax calculations. Instead, the concept of “potential annual income” is used, which is established by municipal authorities.

For example, the Legislative Assembly of the Omsk Region established that the potential income of an individual entrepreneur without employees engaged in the repair and sewing of clothing, fur and leather products is 160,000 rubles per year. In reality, an entrepreneur can earn several times more, but will only pay tax on this established income.

The tax rate on PSN is 6%, so an Omsk seamstress will pay only 800 rubles per month for her patent. The patent taxation system exempts you from paying other taxes, with some exceptions (for example, VAT when importing goods into the territory of the Russian Federation).

It is the low tax burden that is the main advantage of the patent system, but not in all cities a patent is so cheap. Therefore, you need to apply for a patent for an individual entrepreneur for 2020 only when you have found out its cost from the tax office or from the Federal Tax Service calculator.

The procedure for paying for a patent depends on the period of its validity. If the patent is issued for a period of up to six months, then the entire amount must be paid before its expiration. For a patent with a term of six to twelve months, you must first pay 1/3 of the amount (no later than 90 days), and 2/3 of the cost before the termination date.

There are a number of restrictions on PSN:

- the maximum number of employees of an individual entrepreneur should not exceed 15 people;

- allowable income cannot exceed 60 million rubles per year (although real income is not used when calculating tax, but is reflected in the Individual Entrepreneur Income Book on PSN);

- the issued permit is valid only in the territory of one municipality, except for the patent for road transport and distribution/distribution retail trade (here the territory is the entire subject of the Russian Federation);

- if an individual entrepreneur plans to engage in several types of patent activities, then a separate document is drawn up for each of them;

- now employers on PSN pay insurance premiums for employees at general rates, the right to apply reduced rates for them has been canceled;

- insurance premiums that an individual entrepreneur pays for himself and for his employees do not affect the calculation of tax, i.e. do not reduce the cost of the patent.

Given the above, the decision to switch to a patent system should be made only after you have compared the expected tax burden under different regimes. If you find it difficult to do this on your own, we recommend that you seek a free tax consultation.

Get a free consultation

How much does a patent cost?

The price is calculated based on local legislation. There is an online calculator on the website patent.nalog.ru, which is quite easy to use. The service will issue the amount that must be paid during the period of application of the PSN. When filling out the form on the website, you must select a municipality and type of activity. For example, a patent is being issued for the rental of non-residential premises (as of 2019) in Moscow. When the patent validity period is from 1 to 5 months, payment must be made before the end of its validity; if from 6 to 12, a third is paid within 90 days from the start of this system. The rest is paid until the end of the document's validity period.

Loko-Bank - open a current account for individual entrepreneurs, how much does it cost?

For example, for Moscow, a patent for retail trade in a stationary store for the Yuzhnoye Butovo district (a residential area) with a sales area of up to 50 meters will cost 113,400 rubles per year. For a patent for distribution and distribution trade in the same area - already 162 thousand a year. For the Krasnoselsky district (city center) for delivery trade, the price of a patent is the same - 162,000 rubles. And for retail with a hall of up to 50 square meters, the price of a patent trade for this area will be a completely different amount - 240 thousand rubles.

Additional Information! Each region, city, district, tax office has its own coefficients and figures.

There are types of activities for which tax holidays have been declared; you will not need to pay for a patent at all. In each region, local authorities themselves decide which areas will fall under the holidays. Vacations do not apply to previously formed individual entrepreneurs. They only apply to those who have just registered.

Submitting documents to the tax office

What types of activities are covered by a patent in 2020?

The types of activities permitted for the patent taxation system are given in Article 346.43 of the Tax Code of the Russian Federation. Basically, these are services to the population, and they are specified very specifically. For example, repairing, cleaning, painting and sewing shoes. This PSN differs from UTII, where the general concept of the permitted line of business “household services” is used.

If an entrepreneur provides several different types of household services, then he will have to buy a separate patent for each of them. This must be taken into account in advance; perhaps in this case it will be more profitable to work on UTII and pay one tax on different types of services.

In 2020, agriculture will also be added to the permitted types of patent activities. Moreover, it will be possible to issue one patent for animal husbandry and crop production. For retail trade and catering, area restrictions remain the same - no more than 50 square meters.

In addition, constituent entities of the Russian Federation can independently add types of activities for PSN on their territory, so the full list of areas must be found out from the relevant regional law. The Tax Code does not limit the number of patents and place of business in different regions of the Russian Federation.

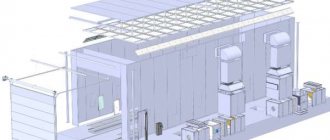

First stage: registration

The start will begin with business registration. Registration documents will be the first to open a car wash.

Organizational and legal form

Car washes are traditionally classified as micro-enterprises. The optimal organizational and legal form is individual entrepreneur and LLC.

We recommend choosing an individual entrepreneur. Why? Registration as an individual entrepreneur is much faster and easier. It requires less financial costs. Individual entrepreneurs have simplified reporting. In short, this is the best choice for those who have little experience in running a business.

But make a choice in favor of an LLC if you open a car wash together with a business partner. It is the LLC that provides the opportunity for co-founding.

Car wash: what is the taxation?

The choice of taxation system is yours:

- General taxation system - does not provide any privileges or preferences

- Simplified taxation system - consists of two possible rates, one of which you have to choose yourself: 6% of total income or 15% of income reduced by the number of expenses. As practice shows, the second option is more profitable

- Patent for conducting business activities - this system is available only to those who are registered as individual entrepreneurs. The advantages of a patent are that it exempts from payment of VAT, personal income tax, personal property tax and trade tax.

Washing: OKVED

There is no need to experiment and choose when choosing a classifier code. There is one code available for the car wash - 74. 70. 2. “Cleaning and cleaning of vehicles.”

How to obtain a patent for a certain type of activity

To apply for a patent for 2020, you must contact the tax office at the place of patent activity. If an entrepreneur provides services via the Internet, then he must contact the Federal Tax Service at his place of registration, even if his clients are in another city.

The application is submitted on an official form approved by the Federal Tax Service (form 26.5-1). The form has five pages, but you do not need to fill out everything. Depending on the type of activity for which a patent is received, different pages are drawn up.

The first two pages of Form 26.5-1 are completed in all cases. And the fields where information about retail and catering facilities or information about a vehicle are indicated - only when selecting the appropriate line of business.

You can find out how to fill out an application for PSN in this article. There you will also find a completed sample and the actual form 26.5-1.

The Federal Tax Service may refuse to issue a patent; the reasons for the refusal are listed in the Tax Code:

- non-compliance of the specified type of activity with the list established by Article 346.43 of the Tax Code of the Russian Federation or the law of the subject of the Russian Federation;

- the condition regarding the calendar year during which the patent is valid is not met (for example, the stated period is from November 1, 2020 to May 31, 2020);

- the right to work on PSN has already been lost by the entrepreneur in the year in which the application was submitted (the number of employees or the amount of income received has been exceeded);

- there is arrears on an already issued patent, i.e. its cost is not paid on time;

- the required fields of form 26.5-1 are not filled in.

How and where to purchase a patent for an individual entrepreneur

Online cash register for individual entrepreneurs - how much does it cost and how does it work?

A patent for retail trade or other type of activity is applied for at the location of the enterprise. If the entrepreneur will work at his place of residence, the application for a patent and for registration of an individual entrepreneur is submitted on the same day to the tax office. If the work will be carried out in an area that is subordinate to another inspection, an application is submitted there, but after registering the individual entrepreneur.

For example, a businessman is registered in the Moscow region; he goes to the Federal Tax Service at his place of residence to obtain a registration certificate. If the business will be conducted, for example, in the Tver region, then there he will apply for a patent after receiving a registration document from his inspectorate. A sample patent for individual entrepreneurs is given below:

Sample of filling out the form

Note! The law does not prohibit the combination of several taxation systems. When choosing, it is necessary to take into account how many employees are involved in the entire enterprise. When combining systems, the total staff should not exceed 15 people, and revenue from the beginning of the year should not exceed 60 million.

When to apply for a patent?

The deadline for filing an application is established by paragraph 2 of Article 346.45 of the Tax Code of the Russian Federation - no later than 10 working days before the start of action. That is, in order to obtain a patent for an individual entrepreneur for 2020 from January 1, an application for it had to be submitted no later than December 17, 2020.

What happens if an entrepreneur is late and submits an application after the deadline? After all, this reason is not included in the list of reasons for refusal. In letter dated July 14, 2020 N 03-11-12/45160, the Ministry of Finance responds that the tax authority has the right to consider such an application and issue a patent. However, a right is not an obligation, so it is better not to violate this deadline.

Choosing a taxation system: which is better: a patent or simplified tax system for cargo transportation?

You won’t get a definite answer here; before choosing which special regime to switch to, you need to calculate the tax burden that will fall on you from both regimes. Moreover, if potential income is used to calculate tax under the PTS and the value of the patent will be easy to determine, under the simplified tax system, especially at a 15% tax rate (Income-Expense), it is necessary to carefully plan all upcoming cost and income items. The fundamental differences between these two modes are as follows:

| Sign | simplified tax system | Patent |

| Territorial restrictions | No | There is |

| Mandatory insurance and other contributions | Pension Fund, Compulsory Medical Insurance Fund, Social Insurance Fund at the rates established in the Tax Code | Fixed rate 20% |

| Accounting for the cost of contributions when calculating the tax base | Yes | No |

Practical recommendations:

- Is it possible to acquire a patent for cargo transportation if the transport is not personally owned, but used under a rental agreement (leasing, etc.)? The legislation does not prohibit the provision of cargo transportation services using a rented car. It’s another matter if the individual is a lessor, in this case, no later than April 30 of the year following the reporting period, submit a 3-NDFL declaration to the tax authorities and pay 13% personal income tax.

- When opening an individual entrepreneur to provide cargo transportation services, the entrepreneur himself performs the functions of dispatching and searching for new clients. Not having his own car, he plans to acquire a patent for his activities. A relative acts as a driver in a personal car. Is it beneficial for me to draw up an employment contract along with a lease agreement? Having an employment contract and employees implies the payment of personal income tax contributions, regardless of the tax regime. In this case, it is more rational to enter into a lease agreement with the crew, which will eliminate the driver’s employment and the 13% tax on his income and contributions to the Pension Fund. In turn, the driver with the car under the vehicle rental agreement, after the end of the calendar year, but no later than April 30, must report on the income received and pay personal income tax on it. The second option, if the driver sells his services on a simplified basis, then, depending on the selected rate (6 or 15%), only rental income will be taxed.

- When submitting an application to purchase a patent, the tax authorities requested an additional vehicle lease agreement and other documents indicating the validity of the provision of transport services by the individual entrepreneur. Are these actions legal and will failure to provide the appropriate documentation become a reason for refusal to obtain a patent? This requirement is illegal. Your next action should be a request to the tax authority for an official refusal to obtain a certificate for cargo transportation with a mandatory interpretation of the reason for the refusal, referring to the law. For your information, a closed list of reasons for refusal of a patent is contained in clause 4 of Article 346.45 of the Tax Code of the Russian Federation.

- The individual entrepreneur is registered in one region, and the activities are planned to be carried out in another. A patent is acquired and is valid only where the activity will be carried out. However, the tax authorities refused to accept the application because they did not find information about the individual entrepreneur in the database. The territory for the provision of cargo transportation services is limited only to the entity specified in the patent. Binding to the place of registration of an individual entrepreneur is not prescribed by law. If the tax authority refuses to purchase a patent for this reason, you must request the refusal in writing with reference to the relevant article in the Tax Code.

- The patent was acquired in one subject of the Russian Federation, and the point of departure under the contract for the provision of cargo transportation is in a neighboring subject. Is it necessary to acquire a patent in a second subject? If the contract for the provision of transport services specifies the same subject as in the patent, then the point of departure, as well as the destination, located in another subject, does not imply the acquisition of a second patent.

Patent duration

Despite the fact that the patent tax system is simple for accounting and calculating taxes, there is one inconvenient nuance for entrepreneurs. Each patent is valid for a certain period - from one to twelve months, but only within a calendar year.

Let's assume you filed a patent on March 15, i.e. he begins to act not from the beginning of the month, but from its middle. The maximum period for which a patent can be issued is nine months, until December 15. But the rest of December cannot be completed on PSN, because there is not a full month until the end of the year.

Officials do not see anything strange in this and propose to work on the remaining days of the year using a simplified or general taxation system. In practice, this is difficult to do, because these tax regimes are very different from PSN.

And it’s good if the entrepreneur submitted an application to switch to the simplified tax system in advance, because submitting a declaration under this regime is easy. But if there is no combination with the simplified system, then you will have to report for this period within the framework of OSNO. This means that you need to submit 3-NDFL and a VAT return, which is accepted only in electronic form, as well as fill out the appropriate tax accounting books. It is difficult to prepare such reports without an accountant or specialized service.

What can be done in such a situation if you do not want to spend several days on OSNO or simplified tax system? You can temporarily suspend activities until the new year, but this will negatively affect the entrepreneur’s income. Or you can issue a separate patent in advance for the period from December 1 to December 31. True, in this case, the period from December 1 to December 14 turns out to be paid twice, because the validity of the previous patent continues until the middle of the month.

Formally, the Federal Tax Service cannot refuse to issue a new patent in this case, because there is no such basis in Article 346.45 of the Tax Code of the Russian Federation. And there is more tax revenue from individual entrepreneurs, so in practice the inspectorates go for it. But in order to avoid finding yourself in such situations, it is better to apply for a patent from the 1st day of the month.

IP patent car wash.

You personally will face administrative liability under Article 18.15 of the Code of Administrative Offenses of the Russian Federation

Article 18.15. Illegal recruitment of a foreign citizen or stateless person to work in the Russian Federation

1. Involving a foreign citizen or stateless person in labor activity in the Russian Federation if this foreign citizen or stateless person does not have a work permit or patent, if such a permit or patent is required in accordance with federal law, -

(as amended by Federal Law dated May 19, 2010 N 86-FZ)

entails the imposition of an administrative fine on citizens in the amount of two thousand to five thousand rubles; for officials - from twenty-five thousand to fifty thousand rubles; for legal entities - from two hundred fifty thousand to eight hundred thousand rubles or administrative suspension of activities for a period of fourteen to ninety days.

(as amended by Federal Laws dated June 22, 2007 N 116-FZ, dated July 23, 2013 N 207-FZ)

2. Involvement of a foreign citizen or stateless person in labor activity in the Russian Federation without obtaining, in accordance with the established procedure, permission to attract and use foreign workers, if such permission is required in accordance with federal law, -

entails the imposition of an administrative fine on citizens in the amount of two thousand to five thousand rubles; for officials - from twenty-five thousand to fifty thousand rubles; for legal entities - from two hundred fifty thousand to eight hundred thousand rubles or administrative suspension of activities for a period of fourteen to ninety days.

(as amended by Federal Laws dated June 22, 2007 N 116-FZ, dated July 23, 2013 N 207-FZ)

3. Failure to notify or violation of the established procedure and (or) form of notification to a territorial body of a federal executive body authorized to exercise control and supervision functions in the field of migration, an executive body of a constituent entity of the Russian Federation exercising powers in the field of promoting employment, or a tax authority on the involvement of a foreign citizen or stateless person in labor activities in the Russian Federation, or failure to notify the relevant authority of the termination of an employment contract or a civil contract for the performance of work (rendering services) with a foreign employee or of granting him leave without pay for a duration of more than one calendar day month during the year, if such notification is required in accordance with federal law -

(as amended by Federal Laws dated July 2, 2013 N 162-FZ, dated July 23, 2013 N 207-FZ)

entails the imposition of an administrative fine on citizens in the amount of two thousand to five thousand rubles; for officials - from thirty-five thousand to fifty thousand rubles; for legal entities - from four hundred thousand to eight hundred thousand rubles or administrative suspension of activities for a period of fourteen to ninety days.

(as amended by Federal Laws dated June 22, 2007 N 116-FZ, dated July 23, 2013 N 207-FZ)

4. Violations provided for in parts 1 - 3 of this article, committed in the federal city of Moscow or St. Petersburg or in the Moscow or Leningrad region -

entail the imposition of an administrative fine on citizens in the amount of five thousand to seven thousand rubles; for officials - from thirty-five thousand to seventy thousand rubles; for legal entities - from four hundred thousand to one million rubles or administrative suspension of activities for a period of fourteen to ninety days.

(Part 4 introduced by Federal Law dated July 23, 2013 N 207-FZ)

5. Failure to notify or violation of the established procedure and (or) form of notification by the employer or customer of work (services) involving highly qualified specialists, the federal executive body authorized to exercise control and supervision functions in the field of migration, or its authorized territorial body in accordance with the list established by the specified federal executive body on the fulfillment of obligations to pay wages (remuneration) to highly qualified specialists, or on the termination of an employment contract or civil contract for the performance of work (provision of services) with a highly qualified specialist, or on granting him leave without pay wages lasting more than one calendar month during the year, or failure to provide or untimely provision of information on the registration of a highly qualified specialist with the tax authority, if such notification or provision of such information is required in accordance with federal law -

shall entail the imposition of an administrative fine on officials in the amount of thirty-five thousand to seventy thousand rubles; for legal entities - from four hundred thousand to one million rubles.

(Part 5 introduced by Federal Law dated July 23, 2013 N 207-FZ)

Notes:

1. For the purposes of this article, the involvement of a foreign citizen or stateless person in labor activity in the Russian Federation means admission in any form to the performance of work or provision of services or other use of the labor of a foreign citizen or stateless person.

2. In case of illegal attraction to work in the Russian Federation of two or more foreign citizens and (or) stateless persons, administrative liability established by this article occurs for violation of the rules for attracting foreign citizens and stateless persons to work in the Russian Federation (in including foreign workers) in relation to each foreign citizen or stateless person separately.

How to renew a patent

As we have already said, a patent is a document that allows you to engage in one type of activity for several months in a row. Sometimes entrepreneurs decide to try this taxation option, so a patent is issued for a short period, assuming that it can be extended later.

This would be convenient, but, unfortunately, the Tax Code does not provide for the extension of an individual entrepreneur’s patent for the next tax period. If you work for PSN and are satisfied with this regime, then you need to submit a new patent application for individual entrepreneurs for 2020 on time. Moreover, it is better to choose the maximum possible period, i.e. 12 months.

If you applied for a shorter period, do not forget to apply for a new patent in time, otherwise activities on the PSN will have to be suspended. The deadline for filing an application for renewal of a patent is the same as for the initial receipt - no later than 10 working days before the start of validity.