What is a tax register?

Registers are elements of tax accounting. They are conducted by companies that pay income tax. Personal income tax agents are also required to create registers.

All information necessary to establish the amount of income tax is entered into the registers (Article 314 of the Tax Code of the Russian Federation). Then this information is systematized. On their basis, the tax base is determined.

Registers are consolidated forms for systematizing information, which are grouped on the basis of Chapter 25 of the Tax Code of the Russian Federation. However, they are not placed on the accounting accounts. The corresponding definition is given in Article 314 of the Tax Code of the Russian Federation.

Register data must answer, inter alia, these questions:

- On the basis of what documents is the tax base determined?

- What is the method of forming this base?

Article 314 of the Tax Code of the Russian Federation indicates that registers are formed on the basis of the primary register. When filling them out, you need to eliminate these shortcomings:

- Errors and typos.

- Erratic entry of information.

- Availability of passes.

NRs are filled out exclusively in chronological order.

There are rules regarding the storage of HP. They must be protected from unauthorized attempts to correct them. If errors need to be corrected, the procedure requires documentary support. Corrections must be certified.

IMPORTANT! Information from registers constitutes a tax secret: information cannot be disclosed. Otherwise, liability is imposed.

List of tax accounting registers (what are tax accounting registers)

Here is a list of the most commonly used tax accounting registers (perhaps some registers are not mentioned in this list, but should be used at a specific enterprise - they must be developed and executed independently):

- Register-calculation “Formation of the cost of an accounting object.”

- Register of accounting of earmarked funds used for purposes other than their intended purpose.

- Register-calculation of depreciation of intangible assets.

- Register of accounting for the use of target proceeds.

- Register-calculation of the cost of written-off raw materials using the FIFO method.

- Register of accounting for the use of target funds.

- Register-calculation of the cost of written-off goods using the FIFO method.

- Register-calculation “Financial result from the activities of service industries and farms.”

- Register-calculation of the cost of raw materials/materials written off in the reporting period.

- Register of losses of service industries and farms.

- Register of doubtful and bad receivables based on inventory results as of the reporting date.

- Register of income accounting for the current period.

- Register of accounting for doubtful and bad debts based on inventory results as of the reporting date.

- Register-calculation of the financial result from the assignment of claims (expenses for the sale of rights, except for situations of sale of previously acquired rights).

- Calculation of the reserve for doubtful debts of the current reporting (tax) period.

- Register-calculation of the financial result from the sale of rights that were previously acquired as part of a transaction for the provision of financial services.

- Accounts payable inventory report as of the reporting date.

- Register of accounting for non-operating expenses of the current period.

- Register of contracts for voluntary insurance of employees.

- Register-calculation of the balance of transportation costs.

- Register of cost accounting for voluntary insurance of employees.

- Register for recording the cost of sold other property.

- Register-calculation of accounting expenses for employee insurance of the current period.

- Register-calculation “Financial result from the sale of depreciable property.”

- Register-calculation of expenses for repairs of the current reporting period (maintained by organizations that are not companies specified in paragraph 1, clause 1, article 260 of the Tax Code of the Russian Federation).

- Register of accounting for other expenses of the current period.

- Register-calculation of repair costs taken into account in the current and future periods (maintained by companies that are not enterprises listed in the text of paragraph 1, clause 1, article 260 of the Tax Code of the Russian Federation).

- Register for recording the cost of goods written off in the reporting period.

- Register of accounting for non-operating expenses on transactions of assignment of claims relating to future periods.

- Register-calculation of depreciation of fixed assets.

- Register-calculation of reserve costs for warranty repairs.

- Register of accrual of taxes and fees included in expenses.

- Register-calculation of the coefficient for recalculating the reserve for warranty repairs.

- Register of labor costs accounting.

- Register of information about a fixed asset object.

- Register-calculation of the amounts of accrued penalties for the reporting period.

- Register of information about the object of intangible assets.

- Cash expense register.

- Register of information on purchased consignments of goods accounted for using the FIFO method.

- Cash receipts register.

- Register of information on purchased batches of raw materials/materials accounted for using the FIFO method.

- Register of accounting for disposal operations of property, works, services, rights.

- Register of information on the movement of purchased goods accounted for using the average cost method.

- Register of accounting for transactions of acquisition of property, works, services, rights.

- Register of information on the movement of purchased raw materials/materials accounted for using the average cost method.

- Register of accounting for settlements of penalties.

- Register of accounting for deferred expenses.

- Register for accounting expenses for warranty repairs.

- Register of accounting transactions for the movement of receivables.

- Register of movement of reserve for doubtful debts.

- Register of accounting transactions for the movement of accounts payable.

- Register of accounting of settlements with the budget.

What should the register look like?

The Tax Code of the Russian Federation contains practically no information regarding the type of register. The Code contains general information only. That is, the task of preparing documents is assigned to organizations.

But Article 313 of the Tax Code of the Russian Federation specifies mandatory information that must be included in the register. In particular, these are the following points:

- Name.

- Period.

- The name of the operation performed.

- Results of the operation in rubles.

The document is certified by the signature of the responsible employee. The signature is accompanied by a transcript.

If this is a personal income tax register, it includes this information:

- Type of income.

- Personal income tax benefits that reduce the tax base.

- Payment amounts.

- Payment dates.

- Amount of calculated tax.

- Tax withholding date.

- Information about payment slips that confirm tax payment.

The rules relating to tax registers are almost identical to the rules relating to primary accounting. Therefore, some experts have a question about the possibility of replacing registers with accounting documentation. There are no prohibitions regarding this in the Tax Code of the Russian Federation. Moreover, Article 313 of the Tax Code of the Russian Federation provides indirect permission for this. But the same article states that if accounting data is insufficient, it needs to be supplemented. Based on the results of the additions, the register is formed.

ATTENTION! Registers are maintained in both paper and electronic form. Electronic documentation is simply printed if there is a need for this (for example, a tax requirement).

How to Design a Form

It does not matter which form of register a particular company uses. There are no strict requirements for the structure of documentation. Therefore, every economic entity has the right:

- Develop a form from scratch. For example, come up with a special table that is suitable for recording tax accounting information.

- Finalize journals and accounting orders. For example, convert a payslip into a personal income tax register by adding certain data to the form.

Moreover, the format of maintaining such documentation does not matter. That is, fiscal accounting data can be recorded in documentation by hand. For example, on paper, and a specialist systematically enters information into it.

Or cash. records are kept in Excel spreadsheets. This approach is more convenient and allows you to automate calculations. Another option is to use specialized accounting programs. For example, the accounting journal is converted to RNU. The program automatically generates the requested information for the required period. This format of managing NU is recognized as the most optimal and effective.

IMPORTANT!

Regardless of the option for developing documentation forms, tax accounting registers, their list and forms must be approved at the local level. For example, approve the structure of documents in a separate management order. Or attach it in the appendices to the accounting policy regarding the organization and maintenance of NU.

How to create registers

As already mentioned, the law does not prescribe a form for registers. It is determined by the organization independently. The developed form is fixed in the accounting policy. To do this, an order must be issued.

Registers can vary dramatically in appearance depending on the company. There are no restrictions in law regarding form. But the taxpayer must comply with the general rule - all information required for tax accounting is indicated in the registers. From the data provided it should be clear how the tax base was formed.

Data can be grouped in different ways. The use of tables and lists is allowed. However, the grouping tool used must be included in the accounting policy.

Despite certain freedom, the taxpayer must be aware of a number of restrictions. In particular, the register must contain mandatory details. If these details are not present, the register will be considered invalid.

Required details

Tax accounting registers developed by an organization must contain a number of mandatory details:

- register name;

- period (date) of compilation;

- meters of transactions in kind (if possible) and in monetary terms;

- name of business transactions;

- signature (deciphering the signature) of the employee responsible for compiling these registers.

These are the requirements of Article 313 of the Tax Code of the Russian Federation.

Income tax registers

Registers are filled out on the basis of primary records and accounting accounts. They are required to establish the amount of income tax. Register forms are developed taking into account the specifics of the company's work.

As already mentioned, tax registers can be replaced by accounting documents. But sometimes you need to create registers separately. This is relevant for transactions, the results of which are reflected differently in tax and accounting records. If an organization deals with such transactions, it is worth developing registers.

It is necessary to take into account that sometimes accounting and tax accounting standards differ.

Accordingly, the documents for accounting must be different. This is where tax registers come in handy.

If an organization deals only with transactions that are equally documented from the point of view of both tax and accounting, separate registers are not required. They are simply replaced by accounting registers. A single form saves time and makes calculations easier.

To generate an income tax return, you will need at least two tax registers: for income and expenses. Information about income and expenses is needed to determine the amount of profit. It is this that is the tax base, on the basis of which the amount of tax is determined.

Two registers are the bare minimum that will be useful in calculations. Sometimes auxiliary registers are introduced. They are relevant when the organization is engaged in several areas of activity at once. Registers should be created when a company is faced with special transactions that require a special procedure for the formation of the tax base.

Recommended register forms

The Tax Service has developed recommended sample tax register forms. They are given in the Methodological Recommendations of the Ministry of Taxes of Russia dated December 27, 2001. It is not necessary to use these samples, but they can serve as an example for the design of register forms that the organization develops independently.

In any case, in the accounting policy for tax purposes, indicate the composition of tax registers (either in the form of a list, if they are among those recommended by inspectors, or in the form of an appendix (album of forms)). In addition, identify other data sources for tax accounting, if they are used (accounting registers, analytical accounting data, etc.). These are the requirements of Article 314 of the Tax Code of the Russian Federation.

Examples

There are two main forms of register. These are registers that reflect income and expenses. But if necessary, additional forms can be added to them. For example, one organization may have the following registers:

- Proceeds from sales.

- Expenses that reduce sales revenue.

- Non-operating income.

- Non-operating expenses.

There may be more registers. It all depends on the needs of a particular company. For example, you can enter these HP:

- Revenue from the sale of goods of own production.

- Revenue from the sale of goods that were previously purchased in bulk.

- Revenue from the sale of other products.

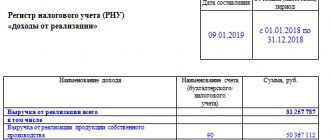

When registering each register, you must adhere to the provisions of the Tax Code of the Russian Federation. For example, when filling out the “Sales Income” register, you need to remember that revenue should be recorded excluding VAT and excise taxes. The corresponding rule is given in paragraph 1 of Article 248 of the Tax Code of the Russian Federation.

To fill out such a register, you need to use information from accounting. In particular, accounts 90 and 91. Accounting data and information in registers should not contradict each other.

Types of registers

Depending on their purpose, registers are divided into:

- Accounting for business transactions, which summarizes data on each fact of the entity’s economic activity that changes the amount of taxes paid in the reporting period.

- Accounting for the state of a tax accounting unit, systematizing data on accounting objects that are used longer than the 1st reporting period, further taking part in the formation of expenses as a component of costs for the described period. The status is taken into account for each change date.

- Interim calculation as a basis for the formation of registers 4 (further), or when calculating the cost of an accounting object, without indicating them in declarations. They give a picture of the formation of declaration data in the form of intermediate calculations, including all material quantities.

- The generation of reporting data summarizes information on available income and expenses, their explanation in the declaration, which is provided under the taxation system with income tax.

Each species has several dozen subspecies, but not all are necessary for use. An organization can select the ones they need and enter them into their accounting policy settings. In the future, tax services do not have the right to demand the completion of register forms that do not comply with it.

For users in 1C 8.3, where to find this part of the reporting can be traced in Fig. 1:

Users can also work with more than three dozen ready-made register forms, a list of which is provided below in Fig. 2:

For those who manually fill out tax accounting registers, a sample is presented in Fig. 3:

On video: “Income tax 2017” March 2017