Tax period codes

Tax period codes for declarations can consist of a wide variety of digital combinations: 01, 31, 34, 24, etc. They encrypt information about the tax period established by tax legislation for each tax.

IMPORTANT! A tax period is a calendar year or another period of time, after the end of which tax is calculated and paid (Clause 1, Article 55 of the Tax Code of the Russian Federation).

Next, using examples, we will decipher the period codes for individual taxes.

Types of quarterly tax reporting

Limited liability companies (hereinafter referred to as LLC) on the general taxation system (hereinafter referred to as OSNO) are required to submit quarterly tax reports to the Federal Tax Service at the place of registration of the company.

Let us remind you that the tax reporting quarters are as follows:

- 1st quarter (January, February, March);

- 2nd quarter – also called half-year (April, May, June);

- 3rd quarter – also called 9 months (July, August, September);

- 4th quarter – also called the year (October, November, December).

| Preparation and submission of reports for individual entrepreneurs and LLCs Cost of reporting

|

The VAT declaration is submitted by the 25th day of the month following the reporting month (reporting period quarter). The declaration is prepared quarterly. Compiled on the basis of books of purchases and sales, a journal of issued and received invoices.

The Profit Declaration is submitted by the 28th day of the month following the reporting month (reporting period quarter). The declaration is drawn up on an accrual basis for the quarter. Those. When preparing a declaration for the quarter, it is necessary to take into account the indicators of the previous quarter. Compiled on the basis of the balance sheet.

Payments for insurance premiums are due by the 30th day of the month following the reporting month (reporting period quarter). Such a declaration is drawn up on an accrual basis for the quarter. Those. When preparing a declaration for the quarter, it is necessary to take into account the indicators of the previous quarter. Compiled on the basis of accrued insurance premiums from the payroll.

VAT return tax period codes: 21, 22, 23, 24

The tax period in the VAT return is most often indicated by the numbers 21, 22, 23 and 24. They are entered in accordance with Appendix 3 to the order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3 / [email protected] , which is for tax periods 2019 -2020 applies as amended on November 20, 2019.

The numbers in the tax period code in the VAT return mean the following: the first digit of the code is a number that is always equal to 2, and the second digit varies depending on the quarter number. For example, 24 is the VAT return for the 4th quarter.

Similar codes are used in tax returns, the reporting periods for which are quarterly. In addition to VAT, such taxes, for example, include water (Article 333.11 of the Tax Code of the Russian Federation) or UTII (Article 346.30 of the Tax Code of the Russian Federation).

You will find a completed VAT return in ConsultantPlus. Try the system for free and proceed to the practical example and sample.

List of VAT codes

According to Order of the Ministry of Finance No. 104 of 2009, not only quarters, but also months are encrypted with the tax period code in the VAT return. January – 01, … December – 12.

When liquidating an enterprise, the quarters are indicated as follows:

- I – 51.

- II – 54.

- III – 55.

- IV – 56.

Codes by month during liquidation:

- First quarter: 71, 72 and 73 respectively.

- Second: April - 74, May - 75, June - 76.

- Third: 77, 78 and 79.

- Latest: 80, 81, 82 for October, November and December.

Art. 55 clause 1 of the Tax Code of the Russian Federation implies several reporting periods in one tax segment. Regarding VAT, these indicators are the same - each reporting period is equal to one taxable period. The declaration is not filled out on an incremental basis - it reflects information only for a specific period of time.

“Profitable” report with codes 21, 31, 33, 34

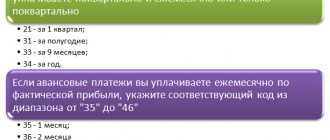

Reflecting the tax reporting period, code 21 in the income tax return is similar to the quarterly tax coding discussed in the previous section and means the report for the 1st quarter. The number 31 is entered in the semi-annual declaration. Code 33 denoting the tax period in the income tax return indicates that the information reflected in this document relates to the reporting period from January 1 to September 30 (for 9 months), and tax period 34 is entered in the annual “profitable” declaration.

The specified codes are not used by all taxpayers filing a “profitable” declaration. Firms that pay monthly advance payments on actually received profits use a different coding: 35, 36, 37, etc.

Such encryption of the tax period of the “profitable” declaration is provided for in Appendix 1 to the procedure for filling out the declaration, approved by Order of the Federal Tax Service dated September 23, 2019 No. ММВ-7-3 / [email protected] , applied from the reporting for 2020. A similar encoding existed before.

You can see and download a practical example and a sample of filling out an income tax return in ConsultantPlus, having received free trial access to the system.

To learn about the deadlines for submitting a profit tax return, read the article “What are the deadlines for submitting an income tax return?” .

Income tax period codes (21, 31, 33, 34, etc.) for the declaration

The tax or reporting period for income tax must be indicated in the “profitable” declaration - on the title page. The periods are coded, their codes are given in Appendix 1 to the Procedure for filling out the declaration (approved order of the Federal Tax Service of Russia dated October 19, 2016 No. ММВ-7-3 / [email protected] ).

| Codes | Name |

| 13, 14, 15, 16 | Used in declarations for a consolidated group of taxpayers (CGT) and indicate the first quarter, half-year, 9 months and year according to CTG |

| 21, 31, 33, 34 | Designate quarterly reporting periods: I quarter, half year, 9 months and year, respectively |

| 35–46 | Monthly reporting periods: 1 month, 2 months, 3 months and so on - until the end of the year |

| 50 | The code indicates the last tax period during the reorganization (liquidation) of the organization |

| 57–68 | Indicated by responsible CTG participants paying monthly advances based on actual profits |

ConsultantPlus will help you choose the correct tax or reporting period code for any declaration. Get trial access to the system for free and go to the Ready-made solution.

Tax period code in the payment slip: field 107

The tax period code is indicated not only in declarations, but also in payment orders for transferring tax payments to the budget. Field 107 is intended for this.

Find out how to fill out field 107 correctly in the material “Indicating the tax period in the payment order.”

Unlike the 2-digit codes indicating the tax period in declarations, the “payment” code for the tax period consists of 10 characters. Its composition:

- the first 2 characters indicate the frequency of tax payment in accordance with tax legislation (MS - month, CV - quarter, etc.);

- the next 2 characters are the number of the month (for monthly payments from 01 to 12), quarter (for quarterly payments from 01 to 04), half-year (for semi-annual payments 01 or 02);

- in 7–10 digits - indication of the year for which the tax is paid.

For example, in field 107, the tax period may look like this: “Qtr.03.2020” - this means payment of tax for the 3rd quarter of 2020.

In addition to the tax period code, payment orders for the payment of taxes also use other codes, for example the budget classification code KBK. To find out in which field of the payment order you need to indicate it, where to get information about the correct BCC and what the consequences of indicating it incorrectly, read the materials:

- “Deciphering the KBK in 2020 - 18210102010011000110, etc.”;

- “Fill in field 104 in the payment order (nuances).”

Application of codes in practice

VAT reports are submitted to the tax office on forms approved by the Ministry of Finance. The importance of correct completion is due to the fact that errors lead to resubmission of the report. Their untimely identification is fraught with the risk of violation of the Tax Code and corresponding administrative measures.

To fill out the declaration, information is taken from the following databases:

- List of invoices from counterparties;

- Database for control of invoice forms;

- Book of sales and purchases;

- Information from tax and accounting reports.

The form consists of 12 pages, including the front page. It contains the following information:

- TIN/KPP;

- Document version. If it is submitted for the first time during the reporting period, then 0 is entered; if this is a clarification, then 1, 2 or another corresponding figure;

- Tax period code according to the above rules;

- Information about the company.

Section 1 contains the following points:

- OKTMO/KBK codes;

- The final tax amount is reflected in clauses 030, 040 and 050;

If in the current reporting period there were transactions for which VAT must be charged, then you should fill out paragraph 3. The following should be indicated here:

- The amount of tax according to the established rates;

- Amount of restored VAT;

- Deductions.

The value of the 1st point is formed as the sum of lines 200 and 210.

Sections 8 and 9 are filled out in accordance with data from the book of sales, purchases and other accounting documents.

Sections 4 and 6 are intended for companies engaged in exporting. All documents confirming the right to export and types of exported goods are taken into account here.

The finished report is submitted in electronic format. The title page and the first section must be completed. The remaining blocks are filled in depending on the type of transactions performed in the reporting period.

If an error is found in a document, a correction on the same form is unacceptable. To correctly display the information, a new report is drawn up - a corrective declaration.

VAT returns are completed manually. The option to fill out online has not yet been implemented. On the Federal Tax Service website there is only the possibility of sending. Before it, the entire document should be checked using the control ratios declared in the Letter of the Federal Tax Service of 20015.

Similar articles

- VAT return for the 4th quarter of 2017

- Instructions for filling out a VAT return (example)

- VAT return for the 4th quarter of 2017

- How to fill out sections of a VAT return without errors?

- Filling out the VAT return for the 3rd quarter

Results

The code reflecting the tax period is entered in declarations and payment orders for the transfer of tax payments. A 2-digit code is used for declarations, and a 10-digit code is used for payments. Both encodings allow you to identify the tax period for which a return is filed or tax is paid.

Both in tax returns and in payments, another code is used - OKTMO. Read about its reflection in the payment order in the article “OKTMO in the payment order (nuances)”.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated September 23, 2019 No. ММВ-7-3/ [email protected]

- Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

What to pay in October 2020

Regular payments that do not depend on coronavirus delays, taking into account postponements from weekends:

The obligation and deadlines for paying advances on property, transport and land taxes are established by local authorities. Check this information with your tax office or using the Federal Tax Service service.

If you are one of the affected industries for which tax payment deadlines have been postponed, please note that the deferrals under Resolution 409 of 04/02/2020 are ending. The time has come to pay deferred taxes.

- Personal income tax for individual entrepreneurs on OSNO. The tax payment deadline for 2019 has been pushed back from July 15 by three months. The deferment ends on October 15. The advance for the first quarter was shifted from April 25 to 6 months. The deferment ends on October 25.

- Income tax. The advance for the first quarter was shifted from April 28 to 6 months. The deferment ends on October 28.

- USN. The tax payment deadline for 2020 for individual entrepreneurs has been moved from April 30 to 6 months. The deferment ends on October 30. The advance payment for the first quarter for individual entrepreneurs and LLCs was shifted from April 25 to 6 months. The deferment ends on October 25.

- UTII. Tax payment for the first quarter was delayed from April 25 by 6 months. The deferment ends on October 25.

- Taxes on property, land and transport. Payment of the advance for the first quarter was postponed until October 30.

- Insurance premiums for employees. Payment of dues for March was postponed for 6 months. The deferment ends on October 15.

If you used a deferment and did not pay taxes and contributions, you need to pay starting from the next month after the month in which the deferment ends. But not all at once, but 1/12 of it throughout the year. The deadline is the last day of this month.

For example, an individual entrepreneur using the simplified tax system works in the affected industry and is entitled to a tax deferment for 2020. The tax amounted to 120 thousand rubles. The normal due date for tax payment is April 30th. The six-month deferment is valid until October 30. Individual entrepreneurs must start paying 10 thousand per month in November. The deadline for the first payment is November 30th.

For what periods do you pay income tax?

Income tax is paid based on the results of the tax period, and based on the results of reporting periods, advance payments are calculated and transferred.

The tax period for income tax is a calendar year from January 1 to December 31. Tax must be paid and reported after the end of the year, when the actual taxable profit of the company becomes known.

Within the tax period, the company is obliged to transfer advance payments to the budget. They are calculated for each reporting period. Reporting periods for an organization can be:

- I quarter, half year and 9 months;

- month, 2 months, 3 months and so on until the end of the calendar year.

The timing of payment of income tax at the end of reporting periods depends on how the organization calculates advance payments.

A company can only pay quarterly advances if its annual revenue does not exceed 60 million rubles.

If annual revenue exceeds 60 million rubles, then you can pay:

- monthly advance payments calculated based on the data of the previous quarter, with additional payment based on the results of the quarter;

- monthly advance payments based on actual profits.

Paid monthly advances are counted against the quarterly advance, and quarterly advances are counted against the tax for the year (Clause 1, Article 287 of the Tax Code of the Russian Federation).

If a company pays advances monthly based on actual profits, then it transfers them monthly.

Tax period when calculating income tax

When paying quarterly advances, the following coding is used: tax period 21 - first quarter, tax period 31 - first half of the year, 33 - nine months. Codes 35 to 46 indicate the months, starting from January and ending in December.

Tax period 50 is entered by taxpayers when filing reports before cessation of activity or reorganization. It is calculated from January 1 until the moment of actual liquidation, or from the moment of opening until the moment of liquidation, if the company existed for less than a year.

Reporting and tax period

According to the rules established in the Tax Code, each tax period may have one or more reporting periods. When filling out a VAT return and paying this type of tax, they coincide: the tax period is equal to one reporting period. This means that the amount of tax paid is not calculated on an accrual basis: only those transactions that were carried out during the reporting period, that is, within one quarter, are taken into account.

All organizations and individual entrepreneurs are required to pay a VAT return, including enterprises with a small number of employees. Because of this, you have to issue an electronic digital signature, as well as resolve the issue of sending reports. You can submit it through the Federal Tax Service website yourself, but this is a rather complicated procedure. It’s easier and faster to contact a company that deals with electronic document management and provides intermediary services.

For VAT, a single tax period is established - a quarter (Article 163 of the Tax Code of the Russian Federation). This means that, as a general rule, taxpayers, tax agents, persons specified in paragraph 5 of Art. 173 of the Tax Code of the Russian Federation, must calculate and pay the amount of VAT, as well as submit a declaration for this tax based on the results of each quarter (Articles 173, 174 of the Tax Code of the Russian Federation).

Reporting periods for “profitable” declarations and deadlines for filing them

A thorough calculation of income tax is carried out at the end of the year, however, the tax code provides for advance payments:

- Quarterly;

- Monthly, the tax amount is calculated from the actual profit received.

Making advance payments entails the provision of periodic reporting, which is compiled with an accrual total:

- First quarter;

- Half year;

- Nine month;

- Year;

- Monthly (one month, two, three and so on).

When submitting an income tax report, a potential taxpayer is required to indicate the appropriate tax period code, the procedure for application of which is regulated by Order of the Federal Tax Service No. ММВ-7-3/600.

Note! The rules for choosing a reporting period for “net” profit tax depend on the amount of income received.

If the quarterly income of the enterprise does not reach the 15 million mark, then the reporting period will be a quarter. If this limit is exceeded, then the organization is obliged to switch to a “monthly” reporting scheme for this tax, and, accordingly, to a monthly form of payment of advance payments. Such a transition is carried out either from the beginning of the subsequent tax period or at the initiative of the taxpayer.

Regarding the deadlines for filing an income tax return, the taxpayer is required to submit this report form by the 28th day following the reporting period:

Reporting period – quarter:

- Until April 28 - for the first quarter;

- Until July 28 - for the first half of the year;

- Until October 28 - 9 months;

- Until March 28 - one year.

Reporting period – month:

- Until the 28th day of the month following the previous one.

Based on the results of the annual declaration, the taxpayer is also obliged to pay by March 28 of the following year, and the payment deadline is not postponed to another business day.