VAT

This tax is considered indirect. VAT is a form of withdrawal to the state budget of part of the price of a product, service or work. It is created at all stages of the production process and is paid as it is sold. When applying VAT, the final buyer pays the seller tax on the entire price of the purchased good.

But it starts coming into the budget earlier. This is due to the fact that the amount from its part of the price added to the cost of purchased raw materials, services/work required for production is paid to the state by each participant in production at different stages. The VAT rate in the Russian Federation is 18%. It is used by default if the transaction is not classified as taxable at 10% or 0%. In the Russian Federation, VAT was introduced on January 1, 1992. The rules for its calculation and payment were first determined by the relevant Federal Law “On Value Added Tax”. Since 2001, the procedure has been regulated by Ch. 21 NK. For certain categories of payers and transactions, VAT is not established. For example, enterprises may not pay tax if the amount of their revenue for the previous three consecutive months did not exceed a certain limit (2 million rubles according to paragraph 1 of Article 145 of the Tax Code).

VAT deduction

The Tax Code provides for a certain number of conditions for deducting VAT. These conditions are general:

- The purchased goods must be used in the production operations of the enterprise, which are subject to VAT.

- The purchase of goods or services must be recorded on the balance sheet of the enterprise.

- The organization must be provided with an invoice from the supplier of the goods, where VAT is highlighted as a separate line.

- When crossing the state border, VAT must be paid at customs.

In some cases, in order to accept VAT for deduction, additional conditions must be met or some general conditions must not be met. The Tax Code does not provide for an article specifying the exact period in which VAT should be deducted. The dates between shipment and direct purchase of goods may vary, since this condition may be provided for by a concluded agreement between organizations. Accordingly, the company has the right to make a VAT deduction based on the invoice before the goods become its property.

The amount of value added tax is deductible if:

- The supplier issues the amount for the goods purchased from him.

- The company paid the tax when crossing the border at customs.

- A tax was paid to the budget for goods that were refused by the buyer.

- The prepayment amount was received before the goods were shipped.

- Contracting enterprises carried out capital construction of fixed assets or their liquidation.

- VAT was paid to the budget when construction work was performed in the interests of the enterprise.

- Payment was made by tax agents.

- Payment was made for entertainment expenses or business trips.

- The tax amount was paid during export transactions.

- The amount of tax as a contribution to the authorized capital from the shareholder of the enterprise.

- Cost, which has a difference in the amount of tax before and after shipment of the goods.

In the Tax Code there are a single number of cases when value added tax is not deductible, but includes the initial cost of products, works and services:

- If the purchased products are used in the production of other goods, where the enterprise is exempt from paying VAT;

- If the organization that purchases the goods is not a VAT payer;

- If goods that are not subject to value added tax are specifically purchased for transactions;

- If the purchased goods are used for a transaction abroad.

Subaccounts 19 accounts

The article can be accessed by:

- Subaccount 19.1. It reflects VAT when purchasing OS. This takes into account the amounts of tax due or paid related to the purchase and construction of fixed assets, including individual land use facilities, etc.

- Subaccount 19.2. This article applies to VAT on purchased intangible assets.

- Subaccount 19.3. It shows VAT on purchased inventories. This article covers tax amounts assigned for payment or paid by an enterprise relating to the acquisition of materials, raw materials, semi-finished products and other types of inventories and goods.

Common VAT entries for purchased assets

VAT on purchased assets is reflected in the balance sheet using special entries. Frequent are Dt 19 Kt 60 - this is how the input fee for acquired fixed assets, intangible assets, etc. is reflected.

If the lines on the balance sheet indicate the entry Dt 20 Kt 19, this means writing off tax on assets and services used in transactions that are not subject to tax. Posting Dt 91 Kt 19 means writing off the fee for other expenses if there is no invoice or the document was filled out incorrectly.

Score 46

The invoice reflects the completed stages of work in progress. It is designed to display information about completed stages of work. It is used by companies that perform long-term work, with the beginning and end of the work occurring in different reporting periods.

Score 19

The invoice reflects VAT on purchased assets. It is needed to summarize information about the collection amounts contributed by the company for valuables, works, and services. The account includes sub-accounts 19-1, 19-2, 19-3.

Decor

When selling work, goods, or services, in addition to their actual cost, the buyer must pay VAT to the seller at the established rate. The latter must issue an invoice to the purchaser for its amount within five days. The calculation of the period begins from the date of shipment of products or provision of services/performance of work. In the settlement documentation and invoices of the supplier, VAT must be highlighted as a separate line. If transactions involving the sale of any services, products, or works are not subject to taxation or the seller is exempt from the obligation to pay tax, paperwork is completed without allocating it.

In this case, the payment documents must contain a corresponding entry “excluding VAT”. In the process of selling work, products or services to the public for cash, the requirements for drawing up documents and issuing invoices will be considered fulfilled if the seller has handed over a cash receipt to the buyer. He may submit other supporting paper in the prescribed form.

Why is there a balance left on account 19?

Every accountant knows how to close account 19: by posting Dt 68 Kt 19 in the amount of VAT, the deduction of which meets the conditions of Art. 171 and 172 of the Tax Code of the Russian Federation:

- if goods (work, services) are purchased for VAT-taxable transactions;

- if the invoice presented by the seller is issued in accordance with the requirements of Art. 168 and 169 of the Tax Code of the Russian Federation;

- if purchased goods (works, services), VAT on which is included in the account. 19, accepted for accounting.

If an organization meets all of the above conditions at the end of the month, then how does the 19th account close when closing the month? Posting Dt 68 Kt 19. And the balance will be equal to 0.

However, there are exceptions:

- When separately accounting for “incoming” VAT, posting Dt 68 Kt 19 writes off part of the tax presented on the invoice in the proportion calculated in accordance with clause 4 of Art. 170 Tax Code of the Russian Federation. The remaining part cannot be claimed as a deduction from the budget; it must be included in the cost of goods (work, services).

- If the primary documents from the seller were received by the accounting department, but the seller forgot to submit the invoices or wrote them out with errors, VAT on their value will be on the balance of the account. 19 before the seller presents an invoice drawn up in accordance with the Tax Code of the Russian Federation.

IMPORTANT! Debit balance of the account. 19 can be registered for three years from the moment when all the conditions listed in the Tax Code of the Russian Federation for deducting VAT from the budget are met. In addition, tax can be claimed for deduction on an invoice in installments during this three-year period.

Invoice

This is a document that serves as the basis for accepting tax amounts for reimbursement or deduction. Mandatory invoice details are established in paragraph 5 of Art. 169 NK. The document must be signed by the chief accountant and director of the enterprise or other persons authorized by them. The invoice is certified by a seal. The seller must have a journal for recording these documents and a sales book. The acquirer, accordingly, must also record received invoices in the appropriate catalogue. A purchase book is also required. The procedure in accordance with which these journals are maintained is approved by government decree.

VAT payers

The circle of persons paying VAT is quite wide. These include organizations, individual entrepreneurs on the general taxation system, and entities involved in the import of goods into the territory of the Russian Federation.

In addition to these persons, other entities are also recognized as tax payers:

- Representatives of foreign companies, if they operate within the Russian Federation.

- Non-profit organizations, budgetary, trade union institutions, if implementation occurs in the process of their activities.

- Authorities and local self-government.

- Tax agents, that is, persons purchasing goods from foreign entities, receiving municipal property for rent and other entities acting in accordance with the adopted provisions of Article 161 of the Tax Code of the Russian Federation. The obligation to accrue and further pay tax arises even in situations where they themselves are not recognized as VAT payers.

However, not all organizations and individual entrepreneurs must have the status of tax payers. These do not include the following categories of legal entities. and physical persons:

- applying preferential tax regimes, such as UTII, simplified tax system, unified agricultural tax, patent system;

- engaged in the sale of goods exempt from VAT (this list includes medical goods, social services, as well as in the field of education, medicine, culture, sales of coins made of precious metals, sales of religious products, banking operations and others);

- entities that have received exemption from VAT payer status if the total sales amount for the previous 3 months is less than 2,000,000 rubles;

- participants of the Skolkovo project.

The exception is the import of goods into the customs territory of the Russian Federation. In such cases, VAT is paid by all persons, regardless of their status and the applicable tax regime.

Account 19: postings

After accepting the purchased goods, the buyer pays VAT to account 19. In accounting, this item also includes tax amounts paid on business trip expenses. The calculation is carried out at a rate of 16.67% of the specified expenses (excluding sales tax). For the amount entered into account 19, the buyer, in accordance with the information from the invoices issued by the sellers, as well as documents confirming the payment of tax, has the right to reduce the mandatory deduction to the budget. This opportunity is available to those acquirers who use the received values for production purposes. In this case, it is necessary to make an entry: “Db 68 CD 19.”

What is account 19 used for in accounting?

In accordance with the Tax Code of the Russian Federation, business entities in the general regime must include VAT in the cost of products produced, services provided and work performed. It is called output tax.

On the other hand, a business entity is a consumer of products, works and services, in the cost of which their suppliers also included these amounts of mandatory collection. This tax is called input VAT.

Input VAT is subject to exclusion from the cost of purchased material assets, works and services. An organization or individual entrepreneur has the right, when paying its outgoing VAT to the budget, to offset the incoming VAT on received goods, works, and services.

Therefore, incoming VAT is subject to separate reflection in accordance with the Chart of Accounts on account 19. The information collected on this account is of great importance in determining the VAT payable, therefore the indicators reflected on the account are under close attention when carrying out tax audits.

The amounts reflected in account 19 must be included in the tax register, which is called the purchase book. Information is entered into it based on invoices received from suppliers.

This account is also used by entities under the simplified tax system. This is due to the fact that they can also purchase goods, works, and services, the price of which includes input VAT. Since these entities cannot offset the output VAT due to its absence, the accumulated amounts are written off as a separate item in the company’s expenses.

Attention! Business entities in special regimes have the right not to use account 19. However, it must be remembered that there is a possibility for them of violating the conditions for using the special regime and losing the right to use it.

After such an event, it is necessary to recalculate all taxes, including VAT. Failure to use account 19 in such a situation will lead to the re-posting of all received documents with the allocation of tax.

When determining what is reflected in the debit and credit of this account, you need to remember that VAT may be reflected here on advance amounts listed to suppliers.

If an organization or individual entrepreneur simultaneously applies several taxation systems, for example OSNO and UTII, then it must organize separate accounting of VAT amounts on purchased goods, works and services that belong to different regimes on account 19.

Attention! Thus, activities that fall under VAT and without VAT can be carried out at the same time. Tax on non-taxable transactions cannot be claimed as a deduction, but must be included in the cost of the acquired assets.

Inclusion of VAT in buyer's expenses

The tax amounts that are presented to the purchaser are included in his costs when using products, works, services:

- In the manufacture/sale of objects, operations for the sale of which are not subject to taxation (exempt) under paragraphs 1-3 of Art. 149 NK.

- The production/transfer of products, services, works, operations for which for one’s own needs are considered subject to taxation under Ch. 21, but are not subject to tax accounting under paragraphs 2, 3 of Art. 149 NK.

- Sales outside the territory of the Russian Federation.

For the VAT amounts presented to the buyer, the following entry is made: “Db 20 (44, 23, 26, 25, etc.) Kd 19.”

General rules

Count 19 should be maintained while observing a number of requirements:

- The debit reflects the amounts that are payable to contractors and suppliers for acquired material assets, as well as accepted services/work.

- The item balance should not contain VAT charged to counterparties.

- The paid amounts are presented to the budget in accordance with the rules established in the Tax Code.

- VAT allocated to contractors/suppliers, but not presented to the budget according to the Tax Code, must be reflected in the accounts of valuables, costs or other expenses.

Important point

According to a number of experts, in DB account 19 the accrued VAT should be included in the budget for adopted fixed assets, completed capital construction, and implemented in an economic way. But other authors recognize this proposal as unfounded. Account 19 reflects the amounts of VAT that must be paid to contractors and suppliers, that is, legal entities (organizations). When an enterprise has budgetary tax obligations, it is necessary to take into account the circumstances under which they arose. In the process of construction, a taxable object is created using an economic method. In the absence of the possibility of presenting this tax to the budget, the accrued VAT amounts would have to increase the initial cost of the fixed assets. But according to tax legislation, enterprises show tax. It follows from this that these VAT amounts represent a certain amount of budget obligations to the payer. The latter, if the requirements are met, will present them to the budget subsequently. Thus, these amounts should be reflected in settlement accounts, in particular in accounts. 76.

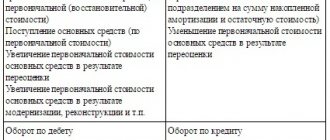

Account characteristics

To answer the question which account 19 is active or passive, you need to know where it is reflected in the balance sheet.

Since the account reflects the amount of VAT paid upon acquisition, it is reflected in the balance sheet as part of inventories and costs, which are reflected in the active part of the above report. Therefore, according to the Chart of Accounts, account 19 is active, which has a balance reflected in the debit of the account.

Let's take a closer look at what is accounted for in this account. The debit of the account reflects the amount of VAT paid on purchased goods, works, and services. For the credit of account 19, it is necessary to take into account the write-off of previously recorded VAT either on account of the output tax, or in special modes its inclusion in expenses.

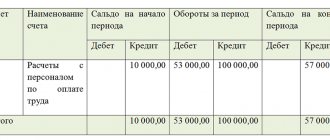

The balance at the end of the month is determined based on the following rule. The turnover on the debit of the account should be added to the initial balance and the amount of VAT passed on the credit of account 19 should be subtracted.

Attention! As a rule, account 19 is closed at the time of writing off material assets in production, transferring them into operation, etc.

The account balance at the end of the year is to be reflected in the balance sheet. For this, line 1220 is used. If the requirements of tax legislation are met, this amount can be included in the VAT deduction in the next period.

Example

Let's consider a situation where, throughout March 2014, an enterprise bought certain products from a supplier and subsequently resold them to its own customers. The batch of goods was purchased and sold in full. Purchase costs - 12 thousand rubles. Of this amount, 1830.51 is VAT. The amount of tax was separated from the cost of production and charged to account 19. This operation is reflected in two entries:

- Db 41 Kd 60 – the cost of purchased products is taken into account: 10,169.49 rubles.

- Db 19 Kd 60 – shows the input VAT on the purchase of goods RUB 1,830.51.

At the end of the reporting year, the company writes off the VAT amount to the account. 68. Thus, the organization uses its right to reduce debt to the budget. The following entry is made: “Db 68 Kd 19 – the amount to reduce the amount of accrued tax of 1830.51 rubles is transferred to the debit of the account for settlements with the budget.”

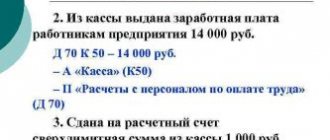

In the same March, the company sells products to its own customers at a cost 1.5 times higher than the purchase price (18 thousand rubles). This operation is reflected by the entries:

- Db 90.2 Kd 41 – the cost of goods sold is shown as RUR 10,169.49.

- Db 62 Kd 90.1 – accounting for the buyer’s debt to the enterprise 18 thousand rubles. (with VAT 2745.76 rubles).

- Db 90.3 Kd 68 - the amount of VAT allocated for deduction to the budget is 2745.76 rubles.

Next, the financial result of the transaction is determined by establishing the difference between the turnover in the debit and credit of the “Sales” account: 10,169.49 rubles. + 2745.76 rub. — 18,000 rub. = - 5,084.75 rub.

Minus here means profit. The received amount is transferred to the account. 99: Db 90.9 Kd 99 – income from March sales 2014 5,084.75 rub.

As a result, on the account. 68, the amount of VAT to be transferred to the budget is formed. It is defined as the difference between Kd and Db: 2,745.76 rubles. — 1,830.51 rub. = 915.25 rub. – tax for deduction to the budget generated from March sales in 2014.

Why may account 19 not be closed?

Sometimes a situation arises that the accountant does not close account 19 at the end of the period. This can arise for several reasons.

First, you need to see what balance appears on the account - debit or credit. The presence of a credit balance means that during the period the documents received were incorrectly reflected, since this account is active, and there simply cannot be a credit balance on it.

It must be remembered that errors on account 19 will be recognized by the inspection authorities as gross. For this, a business entity may be subject to a fine of up to 10 thousand rubles.

Ideally, there should not be a correct debit balance on the account either. This account should be closed to account 68 VAT subaccount.

However, there may be a debit balance and this is due to the lack of a supporting document from the supplier. Another reason for the presence of a balance is the acquisition of an OS object, but before its actual commissioning.

Attention! When keeping records in the program, sometimes accountants do not understand why account 19 in 1C 8.3 is not closed. This operation is performed using a special form “Creating a purchase book”. Before this operation, you need to make sure that invoices are loaded into the program for all receipt transactions.

If for any purchase in the system there are only receipt documents (deed, invoice), but no invoice, the program cannot use it to receive a deduction.

- Purpose of the article: displaying information about the balance of input VAT on purchased goods, works or services that was not accepted for deduction in the reporting year (or was not written off to cost accounts in some cases).

- Line number in the balance sheet: 1220.

- Account number according to the chart of accounts: Debit balance on account 19.

According to the law, VAT payer organizations can deduct input tax amounts on purchased inventory items, services received and work performed in the amounts included by VAT taxpayer suppliers in the cost of the product (suppliers must pay this tax to the budget of the Russian Federation).

To claim input tax for deduction and reduce the tax accrued for payment, the following basic conditions must be met simultaneously:

- purchased goods and materials, works or services are subsequently intended for the activities of the company, subject to value added tax. For example, the purchase of goods for their further resale, the purchase of raw materials for the production of finished products for the purpose of their subsequent sale, etc.;

- purchased goods and materials, services or work received are accepted for accounting by the company, their cost is displayed to the buyer;

- correct execution of primary documentation (invoices, UPD with the allocation of the tax amount in a separate line).

Note from the author! When filling out a tax return, information from the purchase book and sales book is additionally attached, the Federal Tax Service Inspectorate automatically reconciles the interaction of counterparties, and if discrepancies are detected in the data in the buyer’s purchase book and the supplier’s sales book, the regulatory authorities have the right to request clarification on this issue, a deduction may be made cancelled.

In most cases, account 19 at the end of the reporting period is completely reset and line 1220 of the balance sheet is not filled in. However, situations may arise when a debit balance is accumulated on account 19:

- errors made in the submitted invoice or its absence;

- the deduction can be made within three years after the date of acceptance of the acquired inventory, work or services for accounting, so the enterprise can decide to transfer the deduction to subsequent periods;

- export transactions on raw materials (tax deduction can be claimed only after full confirmation of the fact of the export transaction);

- in cases where the purchased materials are used in a long production process, the tax can be deducted only after the final product has been shipped to the customer.

Note from the author! A debit balance of account 19 can also be formed when paying standardized costs for calculating income tax (these costs cannot be included at a time in calculating the tax base; accordingly, the amount of VAT that can be deducted is reduced). Balances at the end of the reporting year can be included in other expenses, since these tax amounts cannot be deducted in future periods.

Line 1220 – current assets of the company: this displays the balance of input tax on purchased goods and materials, which was not accepted for deduction in the reporting year for certain reasons, but the company’s right to deduction is transferred to subsequent periods.

Note from the author! If there is a large debit balance on account 19, the company must detail line 1220, for example, by adding additional lines.

The final figure in accounting should be reflected as the final debit balance of account 19. The financial statements display information as of the current period, December 31 of the previous year, as of December 31 of the year preceding the previous one. Comparison of indicators from previous years should be carried out comprehensively with an analysis of the reasons for the balance of input VAT.