What it is

This type of material support refers to the gratuitous receipt of financial resources and other instruments that must be used in accordance with the purpose pursued by the person who provided it.

That is, it turns out that the expenditure of this type of funds is limited by certain conditions. If they are carried out correctly, the received instruments will go to the section of your own; if this is not done, you will have to return them and “get into” accounts payable. The list of these material resources includes the following elements and areas:

- assistance from the state;

- subsidies from legal entities and individuals;

- non-repayable loans;

- sponsoring events.

These are direct economic actions aimed at increasing the benefits of the organization. They are presented in the form of subsidies, subventions, assistance and support in all directions. There are several goals that targeted funding can be used to achieve:

- expense or coverage of unprofitable areas;

- maintaining an optimal financial position;

- replenishment of balance funds;

- acquisition of assets.

Funding for the following plan cannot be reflected:

- receiving assistance in the form of benefits, including tax breaks, exemptions and holidays;

- credit funds or other repayable obligations;

- state capital and participation.

There are two key conditions under which detailed reflection of target financing occurs:

- the need for a sufficient level of confidence and probability in achieving the target distribution of funds;

- confidence that help will be 100% received.

Regulatory regulation

Accounting activities for targeted financing are carried out in accordance with the following legislative norms, features and documents:

- instructions on the procedure for determining the amount by which payments exceed the norm;

- instructions that include the procedure for transferring and reflecting money that was allocated from the federal fund;

- clarification related to the intricacies of accounting for assistance provided by individual entrepreneurs and legal entities;

- instructions describing the procedure for accounting measures during construction work;

- other documents providing regulation of the use of CS of innovation and other funds.

Maintaining analytical accounting for this account in accordance with the norms of current legislation is carried out according to the purpose of resources and according to the sources of their formation.

Accounting: account 86 “Targeted financing”

Account 86 “Targeted financing” is used by legal entities to summarize information and subsequent analysis of the use of funds attracted from both the state and individuals and organizations for special purposes.

Account 86 in accounting is used by commercial and non-profit organizations to obtain information about incoming funding from third-party organizations and the state and the directions for spending these funds.

Targeted financing is property (cash, land) received by the company for use only for predetermined and specified purposes (in some cases, a period during which the financing must be spent may be specified).

Count 86 is passive. The loan displays the funds that the company should receive in correspondence with account 76 (the actual receipt of investments should be reflected in correspondence with the accounts for accounting for forms of subsidies). Account debit - spending on certain, pre-agreed activities in correspondence with the accounts of these areas (20,26,83,98, etc.)

Targeted funding can be raised in the form of:

- government assistance;

- investments of individuals and third-party organizations.

Note from the author! To account for sources of financing, subaccounts can be opened separately to account 86:

- accounting of budgetary funds;

- accounting for investments from other sources.

The Tax Code of the Russian Federation has approved a list of revenues related to targeted financing, some of them:

- grants for activities in the fields of education, medicine, culture, sports, etc.;

- funds received by developers under equity participation agreements and from investors;

- budget investments that will be used for equity participation in the capital repairs of apartment buildings;

- investments in scientific, scientific-technical and innovative activities, etc.

Note from the author! Each enterprise must maintain separate accounting for targeted financing. Taxpayers who do not maintain separate accounting are required to report investments received as taxable income.

State targeted funding

In accordance with PBU, the accounting records of commercial companies display information about budget funds presented in the following forms:

- subvention – provision of public funds to local authorities for certain purposes with a specified period of use. If the terms of the agreement are not met, the investments received are subject to return;

- subsidies – benefits to local authorities, as well as individuals and legal entities, for example, for the reconstruction of real estate. As a rule, it is not subject to return if the terms of provision are violated;

- budget loans (exception – deferment of tax obligations);

- other forms (gratuitous loans, consultations, guarantees, etc.).

Note from the author! Information about the budget funds provided is recorded regardless of the form (money, land, property, etc.).

Targeted funding from the state in the form of subventions and subsidies is divided into:

- investments provided for capital expenditures (for example, purchase of equipment);

- investments provided for current expenses (purchase of inventories, payment of employees and similar activities).

When preparing financial statements, it should be borne in mind that the following data must be disclosed:

- the amount and form of government assistance provided;

- amount of budget lending, direction of spending;

- other types of assistance from the state, the use of which leads to economic benefits for the company;

- balances of government lending funds not repaid in the reporting period.

One of the types of government assistance currently is support for small businesses. Read more about the development of state assistance to small businesses and individual entrepreneurs in 2020

Analytical monitoring

Monitoring of information displayed on account 86 is carried out by the purposes for which this subsidy was received, as well as by sources of income.

Normative base

The use of account 86 to summarize information about incoming targeted financing of commercial organizations is regulated by the Chart of Accounts, approved by Order of the Ministry of Finance dated October 31, 2000 No. 94 and other legally approved documentation (for example, PBU 13/2000, Article 251 of the Tax Code of the Russian Federation).

You can view the current chart of accounts using the link (source: Consultant Plus)

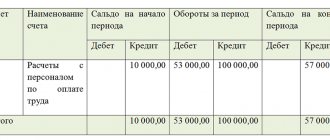

Accounting entries for main business transactions from account 86

Operation Posting

Source: https://moneymakerfactory.ru/articles/86-schet-tselevoe-finansirovanie/

When to use this account

Account 86 in accounting is intended to summarize information related to the movement of funds.

It is needed to carry out targeted activities based on amounts received from other organizations, individuals, and the federal budget. Monetary resources of a targeted nature, which were acquired in the form of sources of financing, are reflected in Kt 86. Correspondence to this direction is Dt 76, which reflects settlement transactions with creditors and debtors.

After carrying out analytical activities, you can notice that in practice this line can correspond by debit with the following accounts:

- 20 - main production part;

- 26 — expenditure areas of general economic importance;

- 83 - additional capital;

- 98 - future income receipts.

For a loan, this account can be used in conjunction with the following areas:

- 07 - materials with equipment for installation;

- 08 - deposits in non-circulating funds;

- 10 - materials;

- 11 - fattening animals;

- 20 - main production;

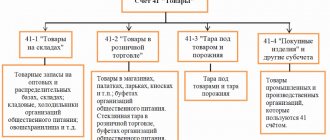

- 41 — commodity items;

- 50 - cash register;

- 51 - accounts of calculated value;

- 55 - special accounts in banking structures;

- 76 - settlements for receivables and payables.

Account 86 in balance

The answer to the question whether account 86 is active or passive depends on the pre-agreed conditions of the subject of financing. The chart of accounts considers account 86 as active-passive. Although most often the balance of the record is of a credit nature. If the allocated funds are overspent, the account may also have a debit balance.

Unspent funds 86 account in the balance sheet will be reflected in the passive part on lines 1450 and 1550. In case of overexpenditure of allocated target funds, asset line 1190 is used, which includes other non-current assets.

Records of the movement of received amounts depend on the nature of the activity of the economic entity.

Account 86 “Targeted financing” posting (example of records of a commercial organization):

- Dt 76 - Kt 86 - an agreement arose on the need to use targeted assets;

- Dt 10, 50, 51 - Kt 76 - materials, cash resources and other assets were capitalized as target accounting;

- Kt 20, 26 - Kt 10 - received materials are taken into account as part of other expenses.

Funds received from the budget can be immediately recorded in accounts with the appearance of appropriate entries, for example:

- Dt 50, 51 - Kt 86 - monetary assistance credited.

What are the subaccounts?

An important role is played by the main sub-accounts of the account in question, which are also taken into account in the process of compiling certain transactions. In total, there are two key subaccounts on this line:

- 86-1 – targeted financing of funds from the organization’s budget fund;

- 86-2 – other areas of financing and revenue.

Both of these accounts are relevant and widely used in practice, so accountants often use them to display a large number of activities.

Postings to account 86 using an example

Let’s say that Stromex LLC received subventions in March 2020 in the amount of:

- 1,200,000 rub. — for the purchase of production equipment;

- 2,000,000 rub. — for current expenses (targeted work according to the approved estimate).

Until the end of 2020, funds from the state budget went to:

- equipment, RUB 1,500,000, useful life 10 years;

- purchase of materials, 250,000 rubles;

- remuneration for employees involved in targeted activities, RUB 150,000;

- social insurance, 39,000 rubles;

- materials released into production (in fact), 170,000 rubles.

Table of entries for accounting for subventions in account 86:

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| 76 | 86 | 3 200 000 | Subventions are recognized in accounting (as approved in budget expenditures) | Targeted financing agreement |

| 51 | 76 | 3 200 000 | Subventions received are recognized in accounting | Bank statement |

| 08.04 | 60 | 1 500 000 | Equipment (cost) included | Packing list |

| 01 | 08.04 | 1 500 000 | Equipment put into operation | OS commissioning certificate |

| 86 | 98 | 1 000 000 | The amount of the subvention is recognized as part of deferred income (upon commissioning of equipment) | Targeted financing agreement, Consignment note, OS commissioning certificate |

| 20,23,25,26,44 | 02 | 12 500 | Depreciation reflected (monthly deduction) | Depreciation statement |

| 98 | 91.01 | 12 500 | Recognition of other income from the received subvention | |

| 10 | 60 | 250 000 | Materials (cost) included | Receipt order (Form No. M-4)/Act of acceptance of materials (Form No. M-7) |

| 86 | 98 | 250 000 | The amount of the subvention is recognized as part of deferred income | Targeted financing agreement, Consignment note, M-4/M-7 |

| 20,23,25,26,44 | 70 | 150 000 | Payments have been accrued to employees of Stromex LLC | Certificate-calculation/ Salary slip (form No. T-53) |

| 20,23,25,26,44 | 69 | 39 000 | Social insurance contributions (including accidents and occupational diseases) | Payroll (form T-51) |

| 86 | 98 | 189 000,00 | The amount of the subvention is recognized as part of deferred income | Targeted financing agreement, certificate of calculation, T-53 and T-51 |

| 98 | 91.01 | 189 000 | Recognition of a subvention as part of the income of the reporting period of Stromex LLC | Targeted financing agreement, certificate of calculation |

| 20,23,25,26 | 10 | 170 000 | Materials released into production (cost) are taken into account | Packing list |

| 98 | 91.01 | 170 000 | Recognition of a subvention as part of the income of the reporting period of Stromex LLC | Targeted financing agreement, Consignment note |

Add a comment Cancel reply

You must be logged in to post a comment.

What does the remainder show?

The loan of this line displays the remaining part of unused resources previously intended for targeted financing. Under a loan in this area, funds for special purposes are formed, which were received as sources of financing for certain activities. Usually such a transaction is recorded in total with a score of 76.

Most often, if there is a balance on the account, the account correspondence is used with accounts 20, 26, 83, 98. If we talk about the debit direction of this account, it can be noted that it reflects the remaining part of the funds, which will still be used in the following periods .

Typical entries for accounting for designated funds

To summarize information about funds and operations for designated purposes, account 86 is used. We will consider the main operations for accounting for target financing using examples.

Targeted funding for a non-profit organization

Let's say:

NPO "Grace" received office equipment to automate work and simplify document flow. According to the assessment report, the market value of the received office equipment was 174,500 rubles.

In the accounting of NPO "Grace" the following entries were made to account 86:

| Dt | CT | Description | Sum | Document |

| 08 | 86.02 | NPO "Grace" received office equipment | RUB 174,500 | Transfer and Acceptance Certificate |

| 01 | 08 | Office equipment put into operation | RUB 174,500 | OS commissioning act |

| 86.02 | 83 | NPO "Grace" reflects the use of targeted funds | RUB 174,500 | Report on the use of targeted funds |

10/02/2015 Non-profit organization "Blagodat" received construction materials free of charge. The purpose of their use is the renovation of premises in a medical institution. The cost of building materials is 294,800 rubles.

The operation was reflected in the accounting of NPO “Grace” as follows:

| Dt | CT | Description | Sum | Document |

| 10 | 83 | NPO "Blagodat" received construction materials free of charge | RUB 294,800 | Transfer and Acceptance Certificate |

Closing procedure

In the process of receiving and wasting financial assistance, there is a possibility that a situation may arise where the recipient spends less than the amount allocated by the “sponsor.” If, on the basis of the concluded agreement, this amount remains with the recipient, then the following entry must be made in the accounting records: Dt 86 Kt 90-1 (91-1).

The posting reflects savings on the part of the recipient. If the agreement provides for final settlement actions between the investor and the recipient on the basis of actual costs, in this situation the saved amount goes to the investor. In this situation, it is necessary to record the following entry: Dt 86 Kt 51 (50, 52). It means that the money saved was transferred to the investor's account.