How is account 63 used in accounting?

Using an account is relevant when interacting with unreliable counterparties: the main task of an accountant in this case is to create a financial “safety cushion” that allows the company to continue operating as usual.

Unreliable counterparties include companies whose transactions are not secured by certain guarantees and are accompanied by a high probability of lack of final settlement.

Only the director or an authorized person has the right to recognize a debt as doubtful. This is done on the basis of information documenting the following situations:

- bankruptcy of the debtor company;

- delay in payment;

- inability to produce ordered products, despite the previously transferred advance payment.

Opening an account 63 is mandatory for any commercial organization.

How is the provision for doubtful debts formed?

Doubtful debt in accounting is any unsecured debt to a company that, with a high degree of probability, will not be repaid in the future.

The criteria for classifying receivables as doubtful are determined by the enterprise independently. Typically this is:

- expiration of the payment period;

- information about the debtor's insolvency;

- information about the debtor’s inability to manufacture products in the event of an advance payment;

- the presence of enforcement proceedings and bankruptcy proceedings.

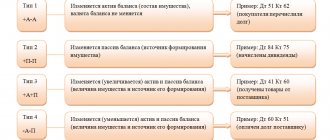

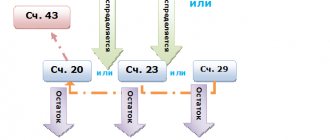

Unlike tax accounting, in accounting, any debt accounted for in the debit of accounts: 60, 62, 76, 58-3 is considered doubtful.

Postings to account 63 are created on the basis of an inventory of accounts receivable and a value judgment about the possibility of repaying the debt:

A reserve for doubtful debts can be created monthly or quarterly for part or all of the debt including VAT. In any case, this procedure must be fixed in the accounting policy. For example, you can focus on the timing of creating a reserve for doubtful debts in tax accounting, but it is important to remember that the procedure for creating reserves in tax accounting and accounting is very different.

Features of working with count 63

Account 63 is passive. The debit of the account is used to pay off debts, and the credit is used to create a reserve.

Resources for account 63 can be created every month or once a quarter (both for the entire amount and for part of it). However, there are unspoken recommendations on the amount reserved for compensation of doubtful debts:

- if the debt period is from 45 to 90 days, then an amount equal to 50% of the debt should be pledged;

- if the period is more than 90 days, the amount is 100%.

This information is for advisory purposes only - the final decision is always made by the company's management.

In cases where reserve funds were not used before the end of the year, in accounting documents they are classified as an item of income of the enterprise for the period following the one in which the reserves were formed.

If there are several questionable organizations, a reserve is created for each of them.

Adjustment of the reserve on account 63 during the year

1. Let’s assume that on October 15, 2014 you transferred 50,000 rubles. in repayment of debt. Then the amount of the created reserve will be reduced:

| date | Dt | CT | Sum | Contents of operation | Document |

| 31.10.2014 | 63/ | 91-1 | 50 000,00 | The amount of the reserve was reduced by the amount of repaid debt | Accounting certificate-calculation |

Thus, the amount of the reserve at the end of the year is 68,000 rubles. Accordingly, in the balance sheet for 2014 it will be necessary to reduce the amount of “receivables” by this amount.

2. Assume that “B” was liquidated in June 2020. Thus, the debt owed to this debtor will be considered uncollectible and subject to write-off. Due to the fact that the previous debt

“B” was involved in the formation of the reserve, its write-off in the entries will be carried out at the expense of the reserve:

| date | Dt | CT | Sum | Contents of operation | Document |

| 30.06.2015 | 63/ | 62/ | 68 000,00 | Bad receivables written off against reserve | Extract from the Unified State Register of Legal Entities |

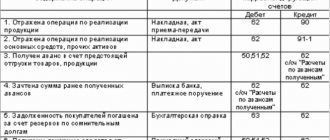

Typical accounting entries for account 63

Account 63 corresponds with the following accounting accounts:

- 91 - by posting from the debit of this particular account, a reserve is formed, and the positive balance is transferred to its credit;

- , , 76 - amounts are written off from these accounts to compensate for the debt, depending on the subject of the agreement, the obligations under which were not met.

The company does not have the right to create a reserve if it is associated with an unreliable counterparty with mutual obligations for the same amounts. If the counterparty’s debt exceeds its financial obligations, the amount of the reserve is determined by the difference in the cost of services, work, and goods.

Opening and maintaining an account 63 protects the organization from failure to fulfill obligations under contracts concluded between firms, which helps stabilize the economic situation in unforeseen situations.

Postings in accounting

On August 10, 2014, goods were shipped to the buyer in the amount of 118,000 rubles. The payment period under the contract is 15 days from the date of shipment. However, the buyer did not make payment for the shipped goods on time. The accounting policy determines that the reserve for doubtful debts is formed monthly, separately for each debt. As of 08/31/2014, the overdue debt “B” was recognized as doubtful, and therefore a decision was made to include the entire amount in the reserve.

The operation is reflected by the following accounting entry in the account:

| date | Dt | CT | Sum | Contents of operation | Document |

| 31.08.2014 | 91-2 | 118 000,00 | A reserve for doubtful debts has been formed | Accounting policy "A" |

Chart of accounts. Account 94 “Shortages and losses from damage to valuables”

Accounting ~ chart of accounts >>

Account 94 “Shortages and losses from damage to valuables” is intended to summarize information on the amounts of shortages and losses from damage to material and other assets (including money) identified in the process of their procurement, storage and sale, regardless of whether they are subject to inclusion in accounts accounting for production costs (selling costs) or those responsible. In this case, losses of valuables resulting from natural disasters are charged to account 99 “Profits and losses” as losses of the reporting year (uncompensated losses from natural disasters).

On the debit of account 94 “Shortages and losses from damage to valuables” the following are given:

for missing or completely damaged inventory items - their actual cost;

for missing or completely damaged fixed assets - their residual value (original cost minus the amount of accrued depreciation);

for partially damaged material assets - the amount of determined losses, etc.

For shortages and damage to valuables, entries are made in the debit of account 94 “Shortages and losses from damage to valuables” from the credit of the accounts accounting for these valuables.

When the buyer, upon acceptance of valuables received from suppliers, identifies a shortage or damage, then the amount of the shortage within the limits stipulated in the contract, the buyer assigns when posting the valuables to the debit of account 94 “Shortages and losses from damage to valuables” from the credit of account 60 “Settlements with suppliers and contractors", and the amount of losses in excess of the amounts stipulated in the contract, presented to suppliers or a transport organization - to the debit of account 76 "Settlements with various debtors and creditors" (sub-account "Settlements for claims") from the credit of account 60 "Settlements with suppliers and contractors" . If the court refuses to collect losses from suppliers or transport organizations, the amount previously debited to account 76 “Settlements with various debtors and creditors” (sub-account “Settlements for claims”) is written off to account 94 “Shortages and losses from damage to valuables.”

When the court makes a decision to recover from the supplier amounts of shortages and losses of valuables in excess of the amounts stipulated in the contract in the supplier’s accounting, the amount of the sale previously reflected in the debit of accounts 62 “Settlements with buyers and customers” or “Settlement accounts”, “Currency accounts” and credit account 90 “Sales” is reversed for the amount of shortages and losses collected by the buyer. At the same time, the specified amount is reflected by a regular entry in the debit of accounts 62 “Settlements with buyers and customers” or “Settlements accounts”, “Currency accounts” and the credit of account 76 “Settlements with various debtors and creditors”. When transferring amounts to the buyer, account 76 “Settlements with various debtors and creditors” is debited in correspondence with account 51 “Settlement accounts”. The supplier must also reverse the turnover on the debit of account 90 “Sales” and the credit of account 43 “Finished products”. The amount restored in this way on account 43 “Finished products” is then written off to the debit of account 94 “Shortages and losses from damage to valuables.”

In the credit of account 94 “Shortages and losses from damage to valuables” the write-off is reflected:

shortages and damage to valuables within the limits stipulated in the contract - to the accounts of material assets (when they are identified during procurement) or within the limits of natural loss - production costs and sales costs (when they are identified during storage or sale);

shortage of valuables in excess of the values (norms) of loss, losses from damage - to the debit of account 73 “Settlements with personnel for other operations” (sub-account “Settlements for compensation of material damage”);

shortages of valuables in excess of the values (norms) of loss and losses from damage to valuables in the absence of specific culprits, as well as shortages of inventory items, the recovery of which was refused by the court due to the unfoundedness of the claims - to account 91 “Other income and expenses”.

In the credit of account 94 “Shortages and losses from damage to valuables” amounts are reflected in the amounts and values accepted for accounting in the debit of the specified account. At the same time, missing or damaged material assets are written off to the production cost (sales expense) accounts at their actual cost.

When recovering from the guilty persons the cost of missing valuables, the difference between the cost of missing valuables credited to account 73 “Settlements with personnel for other operations” and their value reflected on account 94 “Shortages and losses from damage to valuables” is credited to account 98 “ Revenue of the future periods". As the amount due is collected from the guilty person, the specified difference is written off from account 98 “Deferred income” in correspondence with account 91 “Other income and expenses”.

Shortages of valuables identified in the reporting year, but relating to previous reporting periods, recognized by financially responsible persons or for which there are court decisions to recover from the guilty parties, are reflected in the debit of account 94 “Shortages and losses from damage to valuables” and the credit of account 98 “Income future periods." At the same time, account 73 “Settlements with personnel for other operations” (sub-account “Settlements for compensation of material damage”) is debited with these amounts and account 94 “Shortages and losses from damage to valuables” is credited. As the debt is repaid, account 91 “Other income and expenses” is credited and account 98 “Deferred income” is debited.

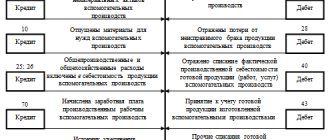

Account 94 “Shortages and losses from damage to valuables” corresponds with the accounts

| by debit | on loan |

| 01 Fixed assets 03 Profitable investments in material assets 07 Equipment for installation 08 Investments in non-current assets 10 Materials 11 Animals for growing and fattening 16 Deviation in the value of material assets 19 Value added tax on acquired assets 20 Main production 21 Semi-finished products of own production 23 Auxiliary production 29 Servicing 41 Goods 42 Trade margin 43 Finished products 44 Selling expenses 45 Goods shipped 50 Cash register 60 Settlements with suppliers and 71 Settlements with accountables 73 Settlements with personnel 76 Settlements with miscellaneous 98 Deferred income 99 Profit and loss | 08 Investments in non-current assets 20 Main production 23 Auxiliary production 25 General production expenses 26 General business expenses 29 Servicing production and facilities 44 Selling expenses 70 Settlements with personnel for wages 73 Settlements with personnel for other operations 86 Targeted financing 91 Other income and expenses 99 Profit and production and economic losses by contractors and other transactions by debtors and creditors |

Accounting ~ chart of accounts >>