Work in progress: reflected in reporting

The cost of production costs not written off to the cost of finished products (work performed, services) is recognized as the cost of work in progress.

Work in progress is reflected in the balance sheet asset in the 2nd section “Current assets” in the line “Inventories”, being part of the amount of all inventories available at the reporting date. Read more about the structure of the balance sheet in the article “Balance sheet (assets and liabilities, sections, types)” .

You will find information on the procedure for filling out a balance sheet in the material “Compiling a balance sheet .

You will learn how to fill out a balance sheet for “simplified” people by reading the material “How to fill out a balance sheet under the simplified tax system?” .

Work in progress: accounting account

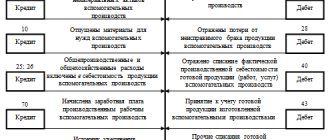

Costs in work in progress are taken into account in production cost accounts: 20 “Main production”, 23 “Auxiliary production”, 29 “Service production and facilities”. But the answer to the question whether the costs of work in progress in accounting will be formed taking into account the costs accumulated in accounts 25 “General production expenses” and account 26 “General expenses” depends on what the organization has written down in its accounting policy.

Costs collected on account 25 for the month can be fully attributed to the main production cost account (20), or can be distributed either to 2 accounts (20 and 23) or to all 3 direct cost accounts (20, 23, 29) . The expenses accumulated on account 25, together with direct costs, form the production cost of products, works or services.

Account 26 can be distributed similarly to account 25 (then the full cost will be collected on the corresponding accounts), or you can write off the entire amount collected on it every month to the financial result (to the debit of account 90). In the latter case, the cost of a specific product (work, service) will not include its data.

Read more about account 20 in the material “Account 20 in accounting nuances).”

Debit account 20

The following transactions are reflected in the debit of synthetic account 20.

| Dt accounts | CT account | Contents of operation |

| 20 | 10, 15, 11 | Materials written off as main production |

| 20 | 02, 05 | Depreciation was accrued for fixed assets and intangible assets used for main production |

| 20 | 23, 26, 25, 29 | The costs of auxiliary production, experimental work, operational maintenance, and irreparable defects were written off to the OP |

| 20 | 70, 69 | The salaries of employees were accrued, deductions were made from the amount to the relevant funds |

| 20 | 96 | A reserve has been created for OS modernization |

| 20 | 97 | Part of the (estimated) expenses of future periods is written off |

Turnover for the reporting period is summed up and transferred to the cost of manufactured products. After this, account 20 is closed.

Composition of main production costs

Account 20 is used to account for direct and indirect expenses incurred in connection with:

- with the production of products of any kind;

- provision of all types of services;

- performing construction and contracting, design, survey and geological exploration work;

- carrying out repair work;

- carrying out design and research work, etc.

Direct expenses are written off to the debit of the “Main production” account from the credit of the accounts:

- 02 and 05 - regarding depreciation of property used for main production

- 10, 15, 16, 21 - for used inventories and costs associated with their acquisition;

- 60 and 76 - for production services directly related to the main production;

- 69 and 70 - regarding the salaries of the main production personnel and charges for it.

Defects subject to correction are also written off for the main production (Dt 20 Kt 28). Every month, from the credit of account 23 to account 20, part of the costs of auxiliary production is received, from the credit of account 25 - indirect costs (or part thereof) to ensure production, from the credit of account 26 - part of general business expenses (if the organization does not use the direct costing method and does not write off these expenses are debited to account 90).

Accounting scheme

Each account is schematically depicted in the format of a small plate:

| Debit (Dt) | Credit (Kt) |

a debit is an increase, and a credit is a decrease.

A simple example: an accountant withdrew money from a bank account (account 51) for the needs of the enterprise and put it in the cash register (account 50). Therefore, he will write down that the funds have passed this way: Kt 51 → Dt 50.

This posting should be interpreted as follows: the source of money was a bank account, and the recipient of money was the cash desk of the enterprise. This is an example of double entry , which is used in accounting. You can read more about debit and credit at the link above.

Debit and credit in active and passive accounts have opposite interpretations :

- an active account assumes that debit is the receipt of assets, and credit is their expenditure. The balance of active accounts is always formed by the debit of the account. We looked at an example of posting active accounts in the previous paragraph of the article;

- passive account: debit is the expenditure of funds (for example, for salaries), and credit is the receipt of funds. The balance of passive accounts is formed only for the loan.

Let's look at what the movement of funds in an active account looks like in the diagram:

| debit | credit |

| Balance at the beginning of the period (Сн) | |

| An increase in the amount of funds as a result of a business transaction | Decrease in the amount of funds as a result of a business transaction |

| The sum of the results of all business transactions (debit turnover - AUD) | The sum of the results of all business operations (loan turnover - OK) |

| Balance at the end of the period (Sk): Sk = Sn + Od – Ok |

Note: it is customary to keep account turnover in accounting by month, i.e. Recalculate every month.

Now let's calculate the account using a specific example. Let's analyze account No. 50 (cash register) of a fictitious company:

| debit | credit |

| CH = 20000 | |

| Od: 100000 20000 2000 | Ok: 10000 90000 |

| Sk = 20000 + 122000 – 100000 = 42000 |

The final balance turned out to be positive (debit) , therefore, in the next period it is recorded as a debit. If the balance were negative, then in the next period it should be recorded as a credit.

The diagram below shows the movement of funds through a passive account:

| debit | credit |

| Balance at the beginning of the period (Sk) | |

| Decrease in the amount of funds as a result of a business transaction | Increase in the amount of funds as a result of a business transaction |

| The sum of the results of all business transactions (debit turnover - AUD) | The sum of the results of all business operations (loan turnover - OK) |

| Balance at the end of the period (Sk): Sk = Sn + Ok – Od |

Formation of the balance of work in progress

The actual cost of manufactured products (works, services) is written off from the credit of the “Main production” account. In this case, account 20, depending on the adopted accounting policy, corresponds with accounts 40, 43, 90.

The balance of account 20 remaining at the end of the month reflects the value of the main work in progress (WIP).

Balances on accounts 23 “Auxiliary production” and 29 “Service farms” are formed in a similar way. Accordingly, the balance on account 23 shows the cost of auxiliary work in progress, and the balance on account 29 shows the cost of work in progress at service farms.

The balance of work in progress in accounts 20, 23, 29 is the balance of work in progress in accounting for the organization as a whole. Work in progress - account 20 + account 23 + account 29, not closed at the end of the reporting period - the balances on them are summed up with other data entered in the “Inventories” line in the balance sheet.

The procedure for filling out a balance sheet with a breakdown of accounts is discussed in detail in the ready-made solution ConsultantPlus. Get free trial access to the system and study the material.

Does not apply to work in progress:

- raw materials, supplies, purchased finished products transferred to workshops (sites), but not processed;

- rejected semi-finished products that cannot be corrected.

Read about the entries that arise when accounting for irreparable defects in the article “Accounting for defects in production - accounting entries.”

Direct and indirect costs

Features of accounting for costs related to work in progress are determined by industry guidelines, since they quite strongly depend on the specifics of the type of specific production.

There is no clear list of costs that should be classified as direct in the law on accounting and other regulatory materials. There is only a mention in the Instructions for using the chart of accounts, approved by Order of the Ministry of Finance dated October 31, 2000 No. 94n, that direct costs should include the cost of inventory and the cost of paying workers involved in the production process.

Such uncertainty in regulations indicates that the enterprise, in accordance with the characteristics of its production, should reflect in its own accounting policies which costs for accounting purposes will be classified as direct and which as indirect.

Direct costs include:

- material costs for production (raw materials, materials, semi-finished products and components);

- expenses for remuneration of personnel involved in production and maintenance of the production process;

- expenses for compulsory pension, social and medical insurance accrued for the remuneration of the above-mentioned personnel;

- depreciation charges for fixed assets used in the production process.

For methods for valuing inventories written off for production, read the material “Methods for valuing inventories .

Then all other expenses will be indirect.

To learn how to divide production costs into direct and indirect for income tax purposes, read the article “How to divide income tax expenses into direct and indirect?” .

Brief description of account 20

Accounting costs in account 20 depend on the main activity of the company.

These may be expenses for the production of industrial or agricultural products, for construction and installation work, or for the provision of transport services. The purpose of accounting on this account is to form the full or reduced cost of the main production (hereinafter - OS). Account 20 - Main production - is regulated by the Chart of Accounts, Instructions for its application (Order of the Ministry of Finance dated October 31, 2000 No. 94n), PBU 10/99 “Organization Expenses” and other accounting standards (methodological instructions, recommendations, guidelines) for accounting for production expenses and their reflection in reporting in the context of specific economic sectors (clause 10 of PBU 10/99, letter of the Ministry of Finance of Russia dated April 29, 2002 No. 16-00-13/03).

Account 20 in accounting is an active calculation account that does not have a negative balance.

The following types of production costs are distinguished:

- acquisition of raw materials and materials for production, work, services;

- workers' compensation;

- depreciation and repair of fixed assets;

- modernization and introduction of new technologies;

- losses from marriage, etc.

If there is a positive balance at the end of the month, the account contains work in progress (work in progress, hereinafter referred to as WIP) - material assets that are in production or being processed, as well as finished products, but not yet shipped to storage warehouses.

Analytical accounting on the account is carried out in the context of types of products, cost items and divisions of the organization.

Work in progress in accounting

In accordance with paragraph 63 of the PBU on accounting and accounting, approved by Order of the Ministry of Finance dated July 29, 1998 No. 34n, products or services (work) that have not completed all phases of the production cycle should be classified as work in progress (work in progress). This also includes products that are understaffed and/or have not passed testing and technical acceptance.

As stated in paragraph 64 of the PBU on accounting and accounting, for reflection in the balance sheet, the assessment of work in progress can be carried out according to:

- actual production cost;

- standard (planned) production cost;

- cost of material costs (raw materials, materials and semi-finished products);

- the amount of direct costs.

Those enterprises that have established serial or mass production can choose one of the indicated methods for assessing work in progress. And those manufacturers who produce products in single copies should show work in progress only based on actual costs incurred.

The chosen method of assessing work in progress must be fixed in the accounting policy. When choosing a method for estimating work in progress using direct cost items, it is recommended that the accounting policy reflect how the organization will distribute current expenses and work in progress balances at the beginning of the month between the release of finished goods and work in progress at the end of the month.

From 2021, the procedure for assessing work in progress will be determined by the new FSBU 5/2019 “Inventories”. What needs to be changed in accounting in this regard, you can find out from the Review from ConsultantPlus, having received free access.

Guidelines for cost accounting

Since cost accounting in different industries is characterized by its own characteristics due to the conditions and specifics of a particular industry, industry ministries have developed industry-specific guidelines for cost accounting. These recommendations detail and clarify the provisions of federal and industry accounting regulations in relation to the production of products in a particular industry.

In the recommendations for cost accounting in a certain production industry, an economic entity will find a classification of methods and techniques for cost accounting, forms of primary documents for their accounting, cost distribution schemes, a nomenclature of cost items and principles for calculating the cost of various types of products.

Methodological recommendations for cost accounting have been developed, for example, for agricultural organizations, crop production organizations, enterprises engaged in breeding and growing fish, dairy and beef cattle breeding.

Results

The balance on the accounts “Main production”, “Auxiliary production”, “Service production and farms” at the end of the reporting period indicates that there is unfinished production. The cost characterizing work in progress at the end of the reporting period is taken into account in the data that forms the indicator of line 1210 of the “Inventories” balance sheet.

Account 20 takes into account direct production costs; Every month, at the end of the month, part of the indirect expenses is included there, taking into account the peculiarities of their distribution established by the accounting policy. In addition, the accounting policy establishes the rules for dividing expenses into direct and indirect, the procedure for closing accounts for indirect expenses and assessing work in progress.

Sources: Order of the Ministry of Finance dated April 19, 2019 No. 61n

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

* * *

So, the balances accumulated on account 20 by the end of the reporting period should be entered into balance sheet line 1210 called “Inventories.” When a certain balance is formed in the “Main Production” account at the end of the reporting period, this indicates a balance of work in progress at the enterprise.

Direct production costs should be recorded on account 20. In addition, at the end of each month, a certain share of expenses from accounts 23, 25, 26 should be attributed to this account.

The accounting policy should be formulated so that this document provides a criterion for distinguishing direct costs from indirect ones, principles for assessing oil refineries, and methods for closing the account of indirect costs.

Care must be taken to ensure that work in progress is recorded correctly, since such data is entered into the balance sheet and, if incorrectly calculated, can significantly distort the financial performance of the organization.

Similar articles

- Finished products are reflected in the balance sheet...

- Production costs

- Direct and indirect production costs

- Accounting for costs of auxiliary production

- Direct material costs