Classification of production costs

All costs that arise in a manufacturing company can be divided into two groups: direct and indirect (overhead).

A specific list of types of expenses that belong to a particular group is determined by the organization itself and enshrined in its accounting policies. But, as a rule, direct costs include:

- Raw materials and materials.

- Equipment depreciation.

- Workers' wages and insurance premiums accrued on them.

Overhead costs can also be divided into two groups:

- General production.

- General economic (managerial).

The first group relates to the costs of managing the production process, and the second - to the management of the enterprise as a whole.

For example, the salary of a shop manager or foreman is general production costs, and the remuneration of a director or chief accountant is general economic costs.

We solve organizational issues

In addition to the implementation of the production and technological process at the enterprise, it is necessary to take care of organizing complete and reliable accounting of all technological stages. So, when organizing accounting in production, where should an accountant start in this case:

- Study in detail the production processes of the enterprise, raw material processing technology, features and characteristics of products at each technological stage.

- Determine the methods, norms and methods of accounting for raw materials, semi-finished products, and finished products. This choice should be fixed in the company's accounting policy.

- Establish a procedure for remuneration for workers and other personnel involved in production processes. Such norms should be formalized by a separate order or regulation on remuneration.

- Regulate the list of auxiliary production costs (raw materials, wages, equipment). Determine the procedure for assigning this category of costs to main production (OP).

Having dealt with regulatory issues, we move directly to accounting. In accordance with section 3 of Order of the Ministry of Finance No. 94n dated October 31, 2000 (as amended on November 8, 2010), transactions on the OP should be reflected in special accounts.

Costing methods

The basis of production accounting is the calculation (calculation) of the cost of finished products. But the products can be very diverse - from needles to complex machines and ocean liners. Therefore, the calculation methods will differ.

The custom method is used for:

- Production of technically complex products with a long production cycle (mechanical engineering, shipbuilding).

- Construction.

- Work under a contract.

- Small-scale production.

In this case, a separate cost estimate or estimate is drawn up for each order.

The cross-cutting method is used if the finished product is obtained from the original raw material after several stages of processing. A typical example of such production is the food or oil refining industry. In this case, the cost is determined at each intermediate stage (redistribution).

The evaluated result of each stage (semi-finished product) is the raw material for the next cycle. At the last stage, the cost of the final product is calculated.

The boiler method is that all production costs are taken into account together (in one “boiler”). There is no analytical accounting. The cost per unit of production is determined by dividing all costs by the volume of output. Therefore, this accounting option is used by small enterprises or those companies that produce one type of product.

What is reflected in production accounting

To record the dynamics of the production process, the accountant should take into account:

- expenses arising in the process of manufacturing the finished product;

- funds spent on finished products and on those goods whose production has not yet been completed;

- the sum of all resources for creating products;

- fluctuations in cost, factors of its growth and reduction possibilities.

Forms of production costs

Production costs are those costs incurred by an enterprise during the transformation of raw materials into products. All manifestations of these costs are taken into account:

- material;

- financial;

- resource.

In fact, these costs represent one or both options for the movement of monetary (sometimes non-monetary) funds:

- payment to third parties;

- increase in obligations to counterparties.

Classification of production costs

The division of costs is due to a different approach to their accounting:

- Fixed (overhead) and variable costs - characterize the relationship of costs to the production process. The first ones are related to the organization of the production process; they do not change, even if the volume of goods grows. The second group ensures the production process itself - the purchase of raw materials and payment of labor, so this part of the costs is subject to dynamics.

- Direct and indirect costs are associated with the attribution of expenses to cost. The former are included directly in it, reflecting the connection with the production of each individual unit (for example, the cost of materials). The latter are distributed across several types of products at once; they must be included in the cost within the framework of the methodology adopted by the enterprise.

What is included in production costs

We list the main items of the enterprise’s expenses for creating products, which must be reflected in accounting:

- wages for personnel – workers, maintenance, management;

- the cost of objects of labor that were spent on production and household needs;

- depreciation of equipment, as well as premises, household equipment, etc.

NOTE! In these expenses, part is included in the cost directly (direct costs), and part is distributed indirectly.

Accounting and distribution of costs in production

Direct costs are reflected on account 20 “Main production” in correspondence with accounts for materials, payments, wages, etc.

DT 20 - CT 10 (60, 69, 70, 76, etc.)

General production expenses (account 25) and general business expenses (account 26) during the month are taken into account in the same way as direct ones:

DT 25 (26) - CT 10 (60, 69, 70, 76)

General production expenses at the end of the month are also transferred to account 20:

DT 20 – CT 25

The distribution of overhead costs between products is carried out according to the selected base. This could be, for example, the cost of materials consumed or workers' wages.

For general business expenses, the following options are possible:

- The distribution is similar to general production.

DT 20 –KT 26

- Attribution directly to cost.

DT 90 – KT 26

The selected base and method of distribution of general production and general business expenses must be reflected in the accounting policy.

Examples of using account 20 in accounting

Let's look at the procedure for using account 20 “Main production”, as well as its closure using examples.

Example 1. Direct closing method

The Trigolki enterprise produces evening dresses. The accounting policy stipulates that product output is accounted for on account 43 “Finished products”, without taking into account account 40 “Product output”. During the month, 20 pieces of products were produced and 10 of them were sold at a price of 5,000.00 rubles. The planned cost was RUB 3,000.00. per piece

The amount of production costs is 70,000.00 rubles. of them:

- Material costs – RUB 55,000.00;

- The amount of depreciation is RUB 1,980.00;

- Remuneration and contributions – RUB 13,020.00.

Postings to account 20 in the form of a table according to the example:

| date | Account Dt | Kt account | Amount, rub. | Wiring Description | A document base |

| Production costs | |||||

| 10.10.2016 | 20 | 10 | 55 000,00 | Raw materials written off for production process | Requirement invoice |

| Output | |||||

| 16.10.2016 | 43 | 20 | 60 000,00 | Production of evening dresses (at planned cost) | Production report, receipt order (when moving to a warehouse) |

| Sales of finished products | |||||

| 20.10.2016 | 62 | 90.01 | 59 900,00 | Sales proceeds | TORG-12 |

| 20.10.2016 | 90.03 | 68 | 9 900,00 | VAT charged | |

| 20.10.2016 | 90.02 | 43 | 30 000,00 | Write-off of planned cost of goods sold | |

| Payroll for production workers | |||||

| 31.10.2016 | 20 | 70 | 10 000,00 | Salary accrued | Time sheet, payslip |

| 31.10.2016 | 70 | 68 | 1 300,00 | Personal income tax withheld | |

| 31.10.2016 | 20 | 69 | 3 020,00 | Insurance premiums accrued | |

| Closing the month | |||||

| 31.10.2016 | 20 | 02 | 1 473,41 | Depreciation of production machines has been calculated | |

| 31.10.2016 | 43 | 20 | 10 000,00 | Adjustment of production output | |

| 31.10.2016 | 90.02 | 43 | 5 000,00 | Adjustment of cost of goods sold | |

Example 2. Intermediate closing method

The Trigolki enterprise produces evening dresses. The accounting policy stipulates the use of account 40 “Product Output”. During the month, 10 pieces of products were produced and 7 of them were sold at a price of 4,500.00 rubles, VAT in total. The planned cost was RUB 2,700.00. per piece

The amount of production costs is 30,393.41 rubles. of them:

- Material expenses - 15,900.00 rubles;

- The amount of depreciation is RUB 1,473.41;

- Remuneration and contributions – RUB 13,020.00.

Solution to the example with transactions in the form of a table:

| date | Account Dt | Kt account | Amount, rub. | Wiring Description | A document base |

| Production costs | |||||

| 10.10.2016 | 20 | 10 | 15 900,00 | Raw materials written off for production process | Requirement invoice |

| Output | |||||

| 16.10.2016 | 43 | 40 | 27 000,00 | Production of evening dresses (at planned cost) | Production report, receipt order (when moving to a warehouse) |

| Sales of finished products | |||||

| 20.10.2016 | 62 | 90.01 | 31 500,00 | Sales proceeds | TORG-12 |

| 20.10.2016 | 90.03 | 68 | 4 805,08 | VAT charged | |

| 20.10.2016 | 90.02 | 43 | 18 900,00 | Write-off of planned cost of goods sold | |

| Payroll for production workers | |||||

| 31.10.2016 | 20 | 70 | 10 000,00 | Salary accrued | Time sheet, payslip |

| 31.10.2016 | 70 | 68 | 1 300,00 | Personal income tax withheld | |

| 31.10.2016 | 20 | 69 | 3 020,00 | Insurance premiums accrued | |

| Closing the month | |||||

| 31.10.2016 | 20 | 02 | 1 473,41 | Depreciation of production machines has been calculated | |

| 31.10.2016 | 40 | 20 | 30 393,41 | Adjustment of production output | |

| 31.10.2016 | 43 | 40 | 3 393,41 | Adjustment of planned cost to actual cost | |

| 31.10.2016 | 90.02 | 43 | 2 375,39 | Adjustment of cost of goods sold | |

Accounting for production costs during production

There are two ways to formulate product costs:

- Accounting "as per fact".

In this case, after the month, actual production costs are transferred to account 43 “Finished products”:

DT 43 - CT 20

After the product is sold, its cost is written off:

DT 90 – KT 43

- Accounting at planned cost.

Using only actual cost is not always convenient. It can be accurately determined only at the end of the month, when salaries are calculated, bills for heat and electricity are received, etc. But what if products are produced quickly and transferred to the warehouse every day? In this case, additional account 40 “Product Output” is used.

During the month, finished products are accounted for at planned cost:

DT 43 - CT 40

The cost of products sold is written off in the same way as the previous option:

DT 90 – KT 43

At the end of the month, the debit of account 40 reflects the actual cost.

DT 40 – CT 20

If the actual cost turns out to be more than planned, then it must be additionally written off to account 43

DT 43 – CT 40

If the cost plan is not fulfilled, then this posting should be reversed

DT 43 – CT 40

Formation of product costs

Enterprises engaged in the production of products are faced with the need to calculate the cost of manufactured products. What does the cost include, how is the cost of finished products formed, what is costing and costing items? We will discuss all these questions below.

There are such concepts as “full cost” and “production cost”.

Any production is accompanied by certain costs: raw materials, semi-finished products, materials, wages, social contributions, depreciation, etc. All these costs form the production cost of the finished product.

The total cost includes, in addition to costs associated with production, also costs associated with the sale of these products that arise at the sales stage.

During the production process, costs are accumulated in the accounts associated with the production process. When finished products are sent for sale, the accumulated costs associated with the production of these products are written off as expenses of the organization. The income from the sale will be the proceeds from the sale.

Expenses and income participate in the formation of the financial result from the sale of products.

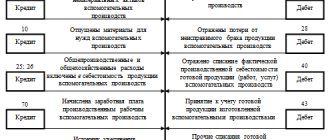

So. The process of forming the cost of finished products begins with the accumulation of costs associated with its production. All costs are collected by debiting the accounts involved in production. What accounts are used for savings?

Accounts for recording production costs:

20 “Main production” - used to form the actual cost of finished products; direct costs of the main production are collected here.

21 “Semi-finished products of own production” - the debit of this account collects all costs incurred in connection with the production of semi-finished products.

23 “Auxiliary production” - costs of auxiliary production, for example, costs associated with equipment repair, transport services, energy provision, etc.

25 “General production expenses” - the debit of this account collects costs associated with servicing the main and auxiliary production.

26 “General business expenses” - the debit of the account collects expenses for administrative and managerial needs

28 “Defects in production” - this account collects all losses from defective products.

Product cost calculation

What does the cost include? Costs associated with the production and sale of finished products.

Costs are formed using the so-called costing method.

All costs are grouped by costing items. Costing is the calculation of costs according to costing items.

The costing object is each individual type of product (product, semi-finished product, work, service), for which its cost can be determined by breaking it down into costing items.

In the process of forming the cost price for each costing object, you need to select a costing unit - a unit of production for which the cost will be determined. The calculation unit can be expressed in natural or conditionally natural form. In the first case, the calculation unit can be kilograms, tons, liters, meters; in the second case, the unit is determined by calculation methods using various coefficients.

Costing items:

- Raw materials

- Returnable waste

- Semi-finished products and purchased products

- Fuel and energy

- Depreciation of fixed assets and intangible assets

- Employees' wages

- Insurance contributions from employees' salaries

- Preparation and development of production

- General production expenses

- General running costs

- Losses from marriage

- Other costs associated with production

- Expenses on sales of products

All these costing items form the full cost of production. If we exclude the last point, we get the production cost.

Classification of production costs

What are the costs?

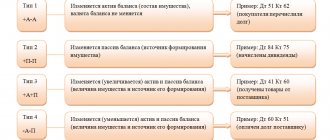

Direct and indirect

All costs, according to the method of inclusion in the cost, are divided into direct and indirect.

Direct – relate to a specific type of product (materials, semi-finished products, depreciation).

Indirect – evenly distributed across all types of products (general economic, general production). Indirect costs accumulate over the course of a month, at the end of which they are written off as cost.

Basic and invoices

According to their economic role in the production process, costs are divided into basic and overhead.

The main ones are directly related to the process of manufacturing products, performing work, services (materials, wages, depreciation).

Invoices - related to the maintenance and administration of the production process (general production and general economic).

Single element and complex

According to their composition, costs are divided into single-element and complex.

Single-element - consist of one element (depreciation, raw materials, semi-finished products).

Complex - consist of more than one element (general plant, workshop).

Variables, conditionally variable and conditionally constant

In relation to production volume, costs are divided into variable, semi-variable and semi-fixed.

Variables - depend proportionally on the volume of products produced (semi-finished products, raw materials).

Conditional variables are not a direct dependence on the volume of products produced (general production).

Conditionally constant - practically do not depend on the volume of production (general economic).

Productive and unproductive

Depending on their effectiveness, costs can be either productive or unproductive.

Productive - for the rational production of products of established quality.

Unproductive - arising due to imperfections in the production process (defects, downtime).

Current and one-time

Based on the frequency of occurrence, costs are divided into current and non-recurring.

Current - occur with a certain frequency (raw materials, supplies).

One-time — one-time costs (launching new equipment).

Industrial and commercial

Based on their participation in the production process, they are divided into industrial and commercial.

Production - related to the production of products.

Commercial - related to the sale of products.

Work in progress accounting

The actual cost is usually calculated monthly. This is convenient because... many costs (for example, wages, utilities, communication services, etc.) can only be determined based on the results of the month. Naturally, the production cycle often does not coincide with the calendar month. In this case, unfinished production is formed.

Its valuation corresponds to the debit balance of account 20 at the end of the month. Depending on the methodology adopted at the enterprise, the “work in progress” can:

- Include only direct and overhead costs.

- Calculate based on full cost, i.e. taking into account general business expenses.

Typical wiring

| Operation | Debit | Credit |

| Raw materials were transferred to the OP, the write-off of raw materials to the OP is reflected | 20 | 10 "Inventories" |

| Salaries accrued to the staff of the OP | 20 | 70 “Payroll calculations” |

| Insurance contributions have been accrued to the payroll fund of the OP personnel | 20 | 69 “Calculations for social insurance and social security” |

| Expenses of auxiliary stages are written off to the OP | 20 | 23 “Auxiliary production” |

| General business and general production costs are written off to the OP account | 20 | 25 "OPR" 26 "ОХР" |

| Losses from manufacturing defects are written off to the OP account | 20 | 28 “Marriage in the OP” |

Accounting for production defects

The production process does not always go perfectly. Often, during product quality control, defects are detected. To account for it, special account 28 “Defects in production” is used.

The cost of defective products is transferred to account 28 from account 20:

DT 28 – CT 20

If the materials that went into the production of a defective product can be partially used, then they are taken into account as inventories:

DT 10 – CT 28

If the guilty person is identified, then the cost of the marriage can be recovered from him.

DT 73 - CT 28 - the amount of recovery is allocated to settlements with the employee who committed the defect.

DT 70 – CT 73 – the amount is withheld from the culprit’s salary.

If the cost of the defect could not be fully compensated, then the remaining amount is applied to the cost of production:

DT 20 – CT 28

Write-off of materials

Most often, materials in 1C 8.3 are written off to production either by an invoice requirement or by a production report for a shift:

- TN is usually used in cases where there is no connection to a specific finished product. For example, we write off consumables, general business expenses, etc.

- The production report for a shift writes off materials for a specific product.

Request-invoice

This document is located in the “Production” section.

Fill in the organization and division in the header of the document. Next, add all write-off items and their quantities to the materials table.

The cost account will be entered automatically when posting the document. If you need to change it, for example, instead of the main production, specify general business expenses, set the flag in the item “Cost accounts on the “Materials” tab.” In the column of the table of materials that appears, make all the necessary changes.

In our example, we will write down only three of our own materials. We will not use customer materials.

When carried out, this invoice requirement will generate three movements to write off materials for production.

For a detailed article on this operation, read the article How to write off materials from the 10th account or watch the video using the example of stationery:

Release of finished products using the Shift Production Report

Now let's look at how to make a similar write-off, but with reference to a specific product. This is usually done using the “Shift Production Report” document. It is also located in the “Production” section.

In the header, select the organization, division and cost division. The default cost account is 01/20.

On the first “Products” tab, add a line and select our “Carved Chair”. Immediately after this, the main specification and accounting account will be automatically entered. If necessary, the values in these columns can be changed.

Next, we enter the quantity of finished products produced and the planned price. It needs to be marked because the cost of the chair is not yet known to us.

We will not fill out anything on the services and return waste tab. Let's move on to filling out the materials.

On the last tab “Materials”, click on the “Fill” button and all data will appear here automatically from the specified specification. In our case, three materials were added: board, nails and varnish.

This document generated four entries: one for the production of “Carved Chair” products and three for the write-off of materials (boards, nails, varnish) into production.

What is included in the account

Account 20 reflects all costs associated with the main activity of the company.

Therefore, the following expenses should be taken into account on the account:

- Material costs are the cost of raw materials, materials, semi-finished products, fuel and others spent on production, that is, what forms the basis of the finished product.

- Costs of services and work of third-party companies involved in the creation of the finished product.

- Remuneration of key personnel with mandatory contributions to extra-budgetary funds.

- Depreciation charges for fixed assets involved in the creation of the finished product.

- Indirect costs that are superimposed on the cost of the finished product - costs of auxiliary production, non-production, factory overhead, sales costs, etc. - they should be reflected on account 20 in the case when the accounts for their accounting are closed at the end of the reporting period.

- Other costs for the production of finished products (taxes, duties, etc.)

The first items relate to direct costs - those that are directly related to production. The cost of the above expenses accumulates while the production process is taking place, and upon its completion they are all written off from account 20 to the cost of the finished product, work, service.

Attention! If the product did not pass technical control and was recognized as a manufacturing defect, the costs of its production previously recorded on account 20 should be written off to the production defect account (usually 28).

Characteristics of account 20 “main production”

Account 20 according to the current Chart of Accounts is active, since the company's assets are reflected on it. It has a debit balance reflecting the cost of work in progress, that is, costs that have not yet formed the cost of a product or service.

Debit turnover reflects the expenses incurred by a business entity for the production of finished products, provision of services or performance of work. The credit of the account records the cost of production written off for finished products.

The balance at the end of the reporting period is determined by summing the balance at the beginning and the turnover on the debit side of the account and subtracting from it the turnover on the credit side of the account.

Attention! Many business entities, especially those who provide services and work, have a balance of 0 at the end of the reporting period for account 20.

However, this rule does not apply to organizations engaged in production activities. For them, this indicator reflects the products launched into production.