Transferring unused property to conservation

Conservation is the transfer of assets to a state that will allow them to remain serviceable after a specified period of time. Can be preserved:

- objects of unfinished construction - if there are no funds to continue construction or it is not practical to invest them at the moment;

- both technological complexes and parts of the whole;

- ready-made fixed assets – if they are not planned to be used for at least 3 months.

IMPORTANT! This procedure can be performed on the basis of clause 23 of PBU 6/01 “Accounting for fixed assets” and p.

3 tbsp. 256 Tax Code of the Russian Federation.

Preservation procedure

Transfer to conservation is done in accordance with the decision of the management of the enterprise or, if the property is state-owned, by the relevant decree of the ministry.

The procedure for conservation and re-preservation is adopted by an internal decision of the management of a particular organization and is fixed by local regulations. An act on the transfer of a fixed asset object to conservation must be drawn up and signed (there is no standard form, it needs to be approved). The act is signed by a commission that management established by order. The act must necessarily reflect:

- name of the unused asset;

- its inventory number;

- the initial cost at which the fixed assets were accepted onto the balance sheet;

- the amount of depreciation that has already been accrued on it;

- reasons for conservation;

- term of future re-opening;

- signatures of the commission members.

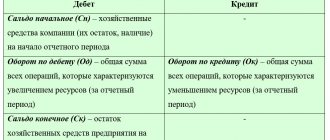

Accounting for mothballed OS

Expenses for the maintenance of unused fixed assets, including those transferred to conservation, are classified as other, they should be reflected in account 91 “Other expenses”.

When depreciation is lost

There is no need to temporarily charge depreciation on unused property if one of the following conditions is met:

- if conservation is for more than 3 months;

- repair (restoration) lasts longer than a year;

- modernization (reconstruction) will take longer than 12 months;

- the property was transferred under a contract for free use (this is no longer conservation).

If the temporary downtime is shorter, is not economically justified, or is not registered as conservation, depreciation is accrued in the usual manner.

During conservation, the useful life of a fixed asset increases for the period until it was used.

NOTE! If not all the fixed assets were mothballed, but only part of it, while the remaining parts continue to take part in the activities of the enterprise, depreciation is not charged on the entire fixed assets, although it is listed on the balance sheet as a single whole. For example, in a building that is in use, one floor is closed for renovation, while the rest continue to function

Tax accounting for conservation

Taxes are paid on the funds used to generate income. On the one hand, fixed assets continue to be on the balance sheet and are the property of the enterprise. On the other hand, due to downtime, they are not directly used to extract economic benefits.

If depreciation continues to accrue on an unused fixed asset, it can be taken into account to reduce the tax base for income tax (clause 1 of Article 252 of the Tax Code of the Russian Federation), since these expenses:

- economically justified;

- documented;

- aimed at future income generation (after all, the asset will later be reactivated).

Once decommissioning has occurred, depreciation should be calculated as it was before, before the outage began.

An act that will justify the company’s expenses for the conservation of fixed assets

To transfer property for conservation, preparatory work is often required: special processing, dismantling, etc. An act on transferring a temporarily unused object to conservation will help justify the costs.

There is no unified form for the act of transfer to conservation, so companies draw it up in any form. His supervisor approves. Drawing up such an act completes the stage of transferring the fixed asset to conservation, which is drawn up with a whole package of documents (see box on the right). A sample act of transfer to conservation is presented on p. 70.

Reference. A package of documents that confirms the conservation of property

There are no specific recommendations on the procedure for transferring OS to conservation. Each company develops it independently, but in practice they usually draw up the following documents:

- application for transfer of objects for conservation;

- order to create a commission to transfer objects to conservation;

- an order to conduct an inventory of objects subject to conservation, and documents documenting its results (inventory list, matching sheet, etc.);

- conclusion of the commission on the conservation of the object;

- order from the manager to transfer the object to conservation;

- cost estimates for the maintenance of mothballed production facilities and facilities;

- act on transferring an object to conservation.

Decision on conservation of an object

Letter of the Federal Tax Service No. SD-4-3/ [email protected] dated 08/27/2018

The Federal Tax Service reviewed the letter of the Federal Tax Service of Russia (hereinafter referred to as the letter of the Office) on the methodological issue planned to be reflected in the on-site tax audit report, and reports the following.

From the letter of the Department it follows that the taxpayer, in violation of subparagraph 8 of paragraph 1 of Article 265 of the Tax Code of the Russian Federation (hereinafter referred to as the Code), took into account as part of non-operating expenses the cost of costs associated with the creation of an unfinished construction project, which, by decision of the taxpayer (minutes of the meeting on financial economic activity of the company) is subject to partial dismantling with the subsequent construction of a new purpose facility.

Article 252 of the Code provides that the taxpayer reduces income received by the amount of expenses incurred (except for expenses specified in Article 270 of the Code).

Expenses are recognized as justified and documented expenses (and in cases provided for in Article 265 of the Code, losses) incurred (incurred) by the taxpayer.

Justified expenses mean economically justified expenses, the assessment of which is expressed in monetary form.

Documented expenses mean expenses confirmed by documents drawn up in accordance with the legislation of the Russian Federation, or documents drawn up in accordance with business customs applied in the foreign state in whose territory the corresponding expenses were made, and (or) documents indirectly confirming expenses incurred (including customs declaration, business trip order, travel documents, report on work performed in accordance with the contract). Any expenses are recognized as expenses, provided that they are incurred to carry out activities aimed at generating income.

In accordance with subparagraph 8 of paragraph 1 of Article 265 of the Code, non-operating expenses not related to production and sales include reasonable costs for carrying out activities not directly related to production and (or) sales, in particular the costs of liquidating fixed assets being decommissioned , for write-off of intangible assets, including amounts of depreciation underaccrued in accordance with the established useful life, as well as expenses for the liquidation of unfinished construction projects and other property whose installation has not been completed (costs of dismantling, disassembly, removal of disassembled property), subsoil protection and others similar work, unless otherwise established by Article 267.4 of the Code.

Paragraph 5 of Article 270 of the Code establishes that when determining the tax base, expenses for the acquisition and (or) creation of depreciable property, as well as expenses incurred in cases of completion, additional equipment, reconstruction, modernization, technical re-equipment of fixed assets, are not taken into account, with the exception of expenses in in the form of a depreciation bonus provided for in paragraph 9 of Article 258 of the Code.

Thus, on the basis of subparagraph 8 of paragraph 1 of Article 265 of the Code, the taxpayer has the right to take into account as non-operating expenses only the costs of liquidating these unfinished construction projects and other property, the installation of which has not been completed.

The expenses listed in the letter of the Department (construction and installation works, design and estimate documentation, project management services, research, insurance, construction and installation works, electricity supply) are the costs of forming the initial cost of the disputed object, and are not related to the actual liquidation of this object (dismantling, dismantling, removal of disassembled property).

Taking into account the above, if the liquidation (partial liquidation) of an unfinished construction object is carried out in the process of creating a new object of depreciable property, then for profit tax purposes the amount of costs that form the cost of the liquidated object of unfinished construction is subject to inclusion in the initial cost of the created object, in that part in which this unfinished construction facility will be used to create a new facility (this position is confirmed by the Resolution of the Arbitration Court of the East Siberian District dated September 29, 2017 No. F02-5060/2017 in case No. A19-22028/2016).

Acting State Advisor of the Russian Federation, 3rd class D.S. Satin

Expert commentary

Conservation procedure

The conservation procedure, as well as the work associated with this process, is carried out by the developer and the contractor. Other entities also fall into this category, namely investors, subcontractors, and so on.

Developer

If the customer decides that it is necessary to suspend the construction of the structure, he notifies the contractor, as well as the local authorities that issued permission to construct the facility. The Civil Code of the Russian Federation (Article 752) states that the customer who initiates the conservation process is obliged to pay the contractor:

- Based on completed work.

- To reimburse costs associated with the conservation of the construction process.

See also: Nine steps - and all permissions in hand

As noted earlier, the suspension of construction work is not a reason to suspend contractual relations. As soon as the organizational arrangements are completed, the developer begins conservation work on the unfinished facility to preserve existing elements and continue construction in the future.

Contractor

Practice shows that the implementation of conservation measures falls on the shoulders of the contracting organization, which operates at the expense of the customer. This type of activity is not considered in the contract and is not reflected in the estimate, so the necessary calculations are performed separately. As a rule, the work is carried out by a construction company, after which the estimate is agreed upon with the customer.

The documentation provides the following information:

- The price of doing the work.

- Calculations of measures for installation, repair or restoration of a structure.

- Building security.

The construction contract agreement specifies the activities that must be completed first, as well as the actions of the participants in the event of a suspension of construction and installation, in order to avoid disputes in the future.

Inventory

One of the main activities when carrying out conservation work on an unfinished object is inventory. This process is organized taking into account the requirements of methodological guidelines agreed upon and approved by the Ministry of Finance of the Russian Federation (order No. 49). An inventory commission is appointed for the work, which includes participants in the construction process and agreements between the parties.

The commission carries out an inspection and, at the end of the work, makes an inventory of the mothballed structure. It indicates the name of the building, the volume of installation and construction work already completed, the costs of implementing the measures, as well as the reasons for the “freezing” of construction.

The papers are drawn up taking into account the current working schemes and materials, namely work acceptance certificates, drawings (design, working), available estimates, as well as logs of work performed. A summary of the measures taken is carried out taking into account the papers that were drawn up and filled out during the construction process.

The task of the inventory process is to record the real condition of the building, taking into account all the nuances. The work being carried out is also useful in that it helps to identify current inconsistencies with the existing accounting. Prepared and certified papers are sent to the customer for the purpose of storing and ensuring the preservation of the unfinished building, the construction of which is planned to be resumed in the future.

Only fixed assets can be preserved

The concept of conservation in accounting and tax accounting is applicable only to fixed assets. If an object does not meet all the requirements of clause 4 of PBU 6/01, then there is no need to talk about its conservation. For example, objects that cannot be used in the provision of services (are in disrepair, subject to demolition, purchased for reconstruction, etc.) cannot be reflected on account 01. Until they are brought into a condition suitable for use, the cost such property remains on account 08.

This is confirmed by clause 5.2.3 of the Regulations on accounting for long-term investments, approved by Letter of the Ministry of Finance of Russia dated December 30, 1993 N 160, according to which acquired buildings and structures are included in fixed assets upon their receipt by the enterprise and completion of work to bring them to the condition in which they are suitable for use for the intended purposes, on the basis of the acceptance certificate of fixed assets. Financiers came to similar conclusions in Letter dated 09/04/2007 N 03-05-06-01/98: if the acquired building is not in use and requires capital investments, which must be confirmed by administrative documents for the organization, a contract agreement for construction work to bring it to condition , in which the building is suitable for use for the planned purposes, then this real estate object is not subject to taxation until it is transferred to fixed assets, since it does not simultaneously meet the requirements of paragraph 4 of PBU 6/01 (see also Letter of the Ministry of Finance of Russia dated May 29, 2006 N 03-06-01-04/107).

This is exactly the situation that arose in one of the enterprises in the health sector, which in 1998 received property as a contribution to the authorized capital and did not use it until 2006 (the property was subject to reconstruction). The arbitrators decided that if the acquired real estate requires reconstruction or is subject to demolition, then they cannot be taken into account as fixed assets, therefore they recognized the additional assessment of property tax for the entire past period as unlawful (Resolution of the Federal Antimonopoly Service of the Moscow Region dated October 1, 2009 N KA-A41 /10020-09).

It must be taken into account that if the property is in principle ready for operation (even if not for the intended purpose) and was actually operated by the previous owners, then even with the intention to reconstruct the object and change its purpose, the organization is obliged to register such an object as part of fixed assets (Resolutions of the Presidium Supreme Arbitration Court of the Russian Federation dated 04/08/2008 N 16078/07, FAS SKO dated 07/21/2009 N A32-20402/2008-58/368, FAS BBO dated 01/22/2008 N A12-11490/07-C51). Before reconstruction, it is advisable to transfer it to conservation (if the property is not used in the organization’s activities).

S.N. Kozyreva

Journal expert

"Tourist and hotel services:

accounting and taxation"

List of works

Conservation measures include a set of measures in relation to various elements of a finished structure.

Foundation

If the foundation of the building is made using pillars or piles, there is no need to protect it. Such elements are located in the ground, and their safety is ensured by available materials. The strip foundation deserves special attention. The following work is performed in relation to it:

- Structural elements that are located above the ground are covered with inexpensive roofing felt.

- To maintain the integrity of the waterproofing, it must be covered with a special insulation that is not susceptible to moisture.

- To prevent the material from flying off, it is pressed using heavy objects, such as bricks.

In order to avoid problems during further construction, before “freezing” construction work, it is important to allow the concrete to gain grade strength. For this purpose, activities must be carried out after 28 days from the date of pouring.

Basement

If the contractor managed to complete the work on the production of the basement, but did not close it, it will be necessary to make a boardwalk and then cover it with film material. This precaution allows you to protect the basement from snow and subsequent water formation.

See also: Mikhail Men: “We have carried out a whole block of reforms to attract non-state investment in housing and communal services”

It is recommended to cover the floor with crushed stone or use a cement-sand screed. These measures help to avoid groundwater rising during the thaw period. If there is an unfilled pit along the perimeter of the walls, it is worth filling it before the cold weather to prevent the accumulation of water and its pressure on the basement walls during the hardening process. If the structure has holes for communications, it is recommended to cover them with plywood or metal and then press them down.

If the ceiling is installed, it should be insulated with film or roofing felt. The material is pressed using boards around the entire perimeter.

House with walls

The conservation of an individual residential building in which the walls were erected deserves special attention. If a building is built of stone or brick, it will better withstand conservation if there are door and window blocks, as well as a roof covering. If the roof is not finished, ceilings are placed above the wall material. This is done to protect the spaces between the concrete and bricks from moisture.

If the building is made of wood, there is no need to install doors and windows - just cover the openings with plywood or boards. In this case, normal circulation of air masses is ensured. As a result, the log or beam winters without problems.

In general, the conservation process involves the following work:

- Creation of structures that will bear the design loads.

- Installation of equipment that secures unstable building elements.

- Emptying pipelines and containers, welding large openings and hatches

- Transferring equipment to a safe state.

- Disconnection of communications (except for those used for the safety of the building).

- Protecting the facility from access by unauthorized persons.

What a tenant needs to check in a draft real estate lease agreement

Subject of the agreement

Before concluding a contract, you need to check:

1. description of real estate;

2. area of transferred property;

3. legal title of the lessor (whether the leased object belongs to him);

4. purpose of use of the real estate;

5. possible encumbrances of the leased object.

Description of the rental object

state registration of rights to real estate;

technical accounting of real estate (BTI documents).

Documents of state registration of rights to real estate include an extract from the Unified State Register of Real Estate (USRN) and a certificate of state registration of rights. Until July 15, 2020, Rosreestr issued paper certificates. But from this date, Rosreestr stopped issuing certificates of state registration of rights.

Rights and obligations of the parties

2

The tenant should pay attention to four conditions. Method 2: obtain the landlord’s consent for each sublease of property

This method is less convenient for the tenant. But landlords most often agree to this. It is better to stipulate in the agreement the procedure for the landlord to consider the tenant’s request for the possibility of subletting the premises or part of it. In this case, the procedure for giving consent to sublease will not be indefinite in time.

Method 2

: obtain the consent of the lessor for each transfer of property for sublease. This method is less convenient for the tenant. But landlords most often agree to this. It is better to stipulate in the agreement the procedure for the landlord to consider the tenant’s request for the possibility of subletting the premises or part of it. In this case, the procedure for giving consent to sublease will not be indefinite in time.

An example of the terms of a lease agreement on the procedure for the lessor to give consent to the transfer of property for sublease

“When the Tenant requests to sublease the Premises or part thereof, the Landlord is obliged to notify the Tenant of his decision within 5 (five) working days.”

Landlords often indicate in the agreement that the tenant does not have the right to reimburse the cost of inseparable improvements: “Upon termination of the Agreement, the Tenant undertakes to transfer the premises to the Landlord along with all inseparable improvements made in the premises without reimbursement of their cost.” Such conditions are contrary to the interests of the tenant. Therefore, they must be excluded from the text of the draft agreement.

the tenant properly fulfilled his obligations under the contract;

otherwise is not provided by law or contract.

Thus, the tenant needs to ensure that in the contract:

there was no clause stating that the tenant does not have a pre-emptive right to enter into an agreement for a new term, and

a period was specified during which the tenant could exercise his pre-emptive right to conclude a new contract (for example, no later than 30 calendar days before the end of the lease term).

Alexander Sorokin answers,

Deputy Head of the Operational Control Department of the Federal Tax Service of Russia

Sample

and sample

- Form

- Sample

Typical mistakes when filling out a document

Of course, errors can be different. But practice shows that the most popular of them include:

- indicating information using a simple pencil;

- adding information in a different font or handwriting;

- numbers indicated in words do not correspond to figures;

- different inks are used;

- the date of execution of the act is not indicated;

- the name of the organization is incorrect;

- the document is signed by an employee who does not have the authority to do so;

- different sheets differ in paper quality;

- pronounced mechanical damage that leads to deliberate aging of the act;

- basic spelling errors.

It cannot be said unequivocally that a document with such errors will always be invalid. But you need to understand that usually inspection inspectors pay special attention to these errors. For example, it is possible that changes have been made to the act that the responsible persons are not aware of. And with the help of artificial aging you can “disguise” some important information. If the inspector concludes that the act is filled out incorrectly, the tax service will refuse to reduce taxes.

If some mistake was made in the document, you can start filling out a new document. You are also allowed to use the standard correction procedure. However, this fact must be confirmed by the signatures of all commission members.

Article Rating

Single inventory object

As representatives of the Ministry of Finance of Russia indicated in Letter No. 03-03-06/1/8 dated January 16, 2008, if in accounting a building is accounted for as a single object of fixed assets, then in tax accounting it is an object of depreciable property as a whole. And in this situation, from the moment the order is issued to begin partial reconstruction of the building, depreciation on it is not accrued as a whole until the completion of the relevant work. Consequently, we can conclude that similar consequences occur when part of such a building is conserved.

According to clause 6 of PBU 6/01, the accounting unit of fixed assets is an inventory item. This is recognized as:

- object with all fixtures and fittings;

- a separate structurally isolated object designed to perform certain independent functions;

- a separate complex of structurally articulated objects, representing a single whole, which is intended to perform a specific job. A complex of structurally articulated objects is understood as one or more objects of the same or different purposes, which have common devices and accessories, common control and are mounted on the same foundation. As a result, each item included in the complex is capable of performing its functions only as part of this complex, and not independently.

Moreover, only if one object has several parts, the useful lives of which differ significantly, each such part is taken into account as an independent inventory object.

Based on this, the Ministry of Finance, in its explanations regarding real estate objects, to which the building belongs, indicates that their components can be taken into account as independent inventory objects if:

- such property does not require installation;

- it can be used separately from the property complex;

- its purpose does not coincide with the functional purpose of the entire complex;

- its dismantling will not affect their purpose.

These criteria, in particular, include elevators, built-in ventilation systems, local networks, and other building communications (Letters of the Ministry of Finance of Russia dated October 23, 2009 N 03-03-06/2/203, dated September 23, 2008 N 03- 05-05-01/57).

In addition, for tax accounting purposes, financiers appeal to the Classification of fixed assets, approved by Decree of the Government of the Russian Federation of January 1, 2002 N 1. The presence in it of different useful life periods of parts of the operating system, such as, for example, an elevator and a building, they indicate, may indicate about the possibility of independent accounting of these objects. It is this approach that the judges support (Resolutions of the FAS Moscow District dated September 16, 2011 in case No. A40-130812/10-127-755, dated January 21, 2011 N KA-A40/16849-10, FAS Ural District dated February 17 2010 N Ф09-564/10-С3; FAS Volga District dated January 26, 2010 in case N A65-8600/2009; FAS Central District dated September 10, 2009 in case N A08-8752/2008-16) . However, such parts of the OS as individual premises of the building (levels, floors) are not named in the Classification.

In this sense, the building for which a single certificate of ownership has been issued (is being issued), which is a single object according to technical documentation, with a single cadastral number, by and large, should be taken into account as a single object in both accounting and tax accounting. And the company has no right to divide it only on the basis of conservation of its individual premises. This means that in this case, depreciation should be suspended for the building as a whole.

On the other hand, nothing prevents the organization from dividing the building, including in accounting, by re-registering the ownership rights to it as separate premises.

O. Kutko

Why is conservation needed?

Preservation of an object is necessary in order to prevent damage, destruction, and deterioration of the technical characteristics of equipment, communications and the construction site itself as a whole.

In addition, conservation of the site is necessary to ensure the safety of the population and the environment. That is, the construction site and the construction site must be in a condition that ensures the strength, stability and safety of structures, equipment and materials. This is stated in paragraph 3 of the Rules, approved by Decree of the Government of the Russian Federation of September 30, 2011 No. 802.

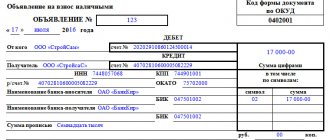

Accompanying documents

In addition to the inventory, to formalize the conservation of a building, an act of suspension of construction is required, which is drawn up according to form No. KS-17, approved by Resolution of the State Statistics Committee of the Russian Federation dated November 11, 1999 No. 100 “On approval of unified forms of primary accounting documentation for accounting of work in capital construction and repair- construction work." It reflects:

- Name and purpose of the building/structure whose construction is suspended;

- Construction start date;

- Estimated cost of work under the contract;

- The actual cost of work at the time of closure of the facility;

- Customer expenses;

- Expenses for conservation and security measures.

Based on the act, an estimate of the upcoming work is drawn up.

Based on the results of the calculations, the customer’s accounting department makes payments to the contractor. Specialists work with company accounts and submit reports to supervisory authorities.

What is unused property

Unused property is considered to be property that is temporarily not involved in the main activities of the organization. The reasons why this may be the case are various:

- change in production volumes;

- transition of the organization to another type of activity;

- property being repaired;

- seasonal activities of the organization;

- obsolescence of fixed assets (obsolescence), etc.

REFERENCE! Such fixed assets can be equipment or (more often) real estate.

If it is planned to use this asset again after a certain time, this means that from an accounting point of view it is “mothballed”. You can rent out an unused OS or sell it - that is, one way or another, bring it back into economic circulation.

How to preserve a frame house at different stages

Dmitry Suprun, a specialist in frame houses, tells how to preserve unfinished frame houses.

Dmitry Suprun

The main rule for preserving frames is to protect them from moisture and ensure good ventilation. If there is a water supply, it must be drained and turned off. Moist materials “for drying”, construction liquids and mixtures should not be stored inside the house. It is advisable to install at least temporary flashings at the junction of the frame and the foundation to prevent water from accumulating.

The process of preserving a bare frame and a frame with insulation, but without external decoration, is somewhat different.

Bare frame

The external walls are covered with insulating material, all possible leaks from the roof are eliminated. Window and door openings are covered with material that does not allow water to pass through.

Insulated frame

In addition to the fact that the walls must be protected with waterproofing and water must not collect and stagnate anywhere, constant air circulation is necessary. It is advisable to install windows so that the sun warms up during the day and you can put it in for ventilation. If this is not possible, tighten the openings with a vapor-permeable wind barrier. There should be no sources of moisture left in the house.

Sequence of operations

The conservation procedure occurs in a certain sequence.

First of all, a decision is made to carry out this procedure by the body of the enterprise that has all the necessary powers for this. After a decision is made, an order is issued that it is necessary to create a commission that deals with conservation issues. The head of this commission should be the head of the enterprise. After the order is issued, it is necessary to create a report stating that the use of fixed assets is impossible. The creation of a report must be approached from a technical and economic perspective.

At the end, an act is created indicating that fixed assets are temporarily removed from the circulation and it is advisable to mothball them. The creation of a commission and the preparation of all documents are optional procedures. In this case, it will be sufficient to provide a decision on conservation.

Fixed assets that have undergone conservation cannot be used by the enterprise. Compliance with this rule is mandatory. It is not recommended to violate it, because the funds that have been preserved are not ready for use. If you ignore this rule, then there is a risk of causing damage to these products by subjecting them to breakage.

If an enterprise has decided to sell or transfer objects that have been mothballed, then in this case it is not necessary to re-mothball them. That is, they can be sold or transferred in the form in which they are located.

Features of the event

Conservation is a mandatory procedure for those enterprises that have a strategic purpose, influence the economic situation of the state, and are also responsible for its safety.

This operation is also carried out in institutions that are the property of the state. It is worth noting that in this case there is no need to clarify the share of state ownership in the capital of the enterprise. The procedure for performing conservation is specified in the regulations. They must be taken into account when carrying out this operation, especially if state funds are involved. And also if the procedure is carried out at the expense of other sources. Thus, it does not matter what form of ownership the enterprise has.

In this matter, only the source of financing is important. It is necessary to focus on how conservation issues are resolved and what this procedure is all about.

The exact definition of what conservation is is indicated in one of the provisions. In your own words, this concept can be stated as follows: conservation of OS objects is a whole complex of measures that are aimed at storing OS for a long period with the possibility of resuming functioning if production activities are stopped.

That is, in the case when fixed assets are temporarily impossible to use, they can be mothballed. Preservation is possible for up to three years. When the conservation period ends, it is necessary to carry out the reverse procedure - re-preservation, and also decide how to continue to use the fixed assets or completely liquidate them. Enterprises that are not affected by the provisions can mothball the OS for a longer period.

It is worth noting that this procedure is performed on the basis of the documents specified in the regulations. If the company does not fall under the criteria, which are also specified in the regulations, then this operation is carried out according to their personal decision.

This decision must be formalized as an order from the manager; it is adopted at the general meeting of shareholders. It all depends on the rules to which the entire enterprise is subject. Before performing this procedure, it is necessary to draw up a project. Such a project may be based on recommendations made by a special commission.

How to preserve an object

What should be done? Here are step-by-step instructions.

Step 1. Make a decision on conservation of the object. It is accepted by the developer or technical customer. The decision is formalized by order or directive of the head of the organization. It states:

- a list of works on conservation of the object and the timing of their implementation;

- timing for the development of technical documentation necessary for the conservation of the facility (its preparation is provided by the developer or technical customer);

- who is responsible for the safety and security of the facility and construction site (official or organization);

- the amount of funds required. It is determined on the basis of an act prepared by the contractor and approved by the developer or technical customer.

Conservation of stone houses at different stages

Gleb Tikhonov

The process of conservation of a stone house depends on the stage at which construction stopped. If a box is removed, but there is no roof, or several rows are folded, the walls must be covered with insulating material - reinforced film. It is better to support individual partitions.

As for preserving the covered box, Gleb recommends protecting all openings from rain and snow, for example, with geotextiles or roofing felt. Be sure to leave gaps for ventilation. Water supply - drain and shut off.

Members of the forum also agree with the professional; vrupasov from Cherepovets calmly leaves the box to spend the winter.

vrupasovFORUMHOUSE Member

It is necessary to cover the top edge of the masonry, and to prevent it from being blown away by the wind, press it down. If the first row is lower than half a meter from the ground, it is advisable to make aprons. I have already overwintered five rows, now ten will overwinter.