What are constituent documents

These are documents certifying the legality of the entrepreneur’s actions; this phrase can be roughly described in this way, since its clear definition is not specified in legislative acts.

According to the Civil Code, constituent documents are the fact of creating an organization, but not an individual entrepreneur; among the entrepreneur’s documents there are no charter, founders’ agreement or minutes of the general meeting, which relate to constituent documents according to the law.

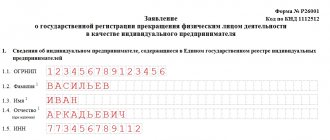

There is no reason for an entrepreneur to complete all the steps that are carried out when forming an LLC; he only needs to submit an application in form P21001 and obtain permission to operate. The TIN remains the same as that of an individual, and the organization is a separate entity from its founder.

It follows that the constituent documents of an individual entrepreneur permit its activities, and they are necessary for conducting a legal business.

What documents are needed to open an individual entrepreneur and how to open an individual entrepreneur - watch this video:

List of documentation

Unlike an LLC, an entrepreneur has much fewer documents, and collecting them is not difficult.

TIN code

TIN is a unique code consisting of a set of 12 digits. It is necessary for every citizen who pays taxes, regardless of what income - business, official work, etc.

Important: if at the time of registration the individual entrepreneur has a code, then it remains unchanged. How to find out statistics codes by TIN - find out here.

It is part of the person’s details and is necessary for indication in various documentation, as well as for establishing control over the taxpayer by the relevant authority.

OGRNIP

This number is also individual and is intended to officially confirm the fact of registration of the entrepreneur and whether he has the appropriate opportunity to conduct business. During the registration process, each individual entrepreneur is entered into the state register, where OGRNIP is its individual number.

USRIP

This is the Unified State Register for entrepreneurs who, after registration, receive an extract from it, which states:

- Passport details;

- Registration address;

- OKVED code – types of activities performed. Here you will find out what OKVED 2 is and what its features are.

This statement must have a certain period of time, for example, in a bank to open an account you need a document valid for up to a month.

Certificate of state registration of individual entrepreneurs

It is a confirmation of the entry of data about the entrepreneur into the Unified State Register of Individual Entrepreneurs, OGRN, and in 2020, a Sheet of Entry into the Register will be issued instead.

Identification

An entrepreneur, unlike an LLC, does not need to present an order or power of attorney to confirm his authority; he acts on the basis of a passport.

In addition to the listed and mandatory documents, the entrepreneur’s folder can be supplemented with:

- Certificate of registration with the Pension Fund, which has been issued since 2010, when the Compulsory Medical Insurance Fund transferred its powers to register individual entrepreneurs;

- Certificate from Rosstat on assignment of codes;

- Licenses for activities, if they are subject to licensing;

- If available, individual entrepreneur's current account number;

- If there are hired employees, confirmation of registration with the Social Insurance Fund.

Certificate of registration of individual entrepreneur.

Additional papers

The constituent documents of an individual entrepreneur can be supplemented with papers from statistics and the pension fund.

A business representative registers in statistics a list of activities that he plans to engage in. Confirmation of the fact of assignment of statistical codes for types of activities is a certificate issued by the statistical authorities. The document may be requested by the counterparty, who is most often a legal entity, in order to verify the declared right to engage in the type of activity for which a fee is charged.

To be able to pay insurance contributions to the Pension Fund, you must register with the authorized body located at the place of residence of the individual. Confirmation of the registration is the corresponding notification of assignment of the status of an insurance premium payer to the Pension Fund of the Russian Federation. This document is usually sent by mail in the form of a valuable letter. A business representative engaged in business activities without hiring employees may not have it.

When planning to hire employees, an entrepreneur must register with the Social Insurance Fund as an employer. The procedure is implemented within a month after the first episode of hiring an employee. To obtain the appropriate status, it is enough to submit an application to the organization. After the registration steps have been completed, the entrepreneur will receive:

- notification of assignment of the status of an insurer entitled to cover insurance risks caused by employee illnesses, accidents, pregnancy and childbirth;

- notification of the amount of insurance tariffs, which indicates the registration number of the entrepreneur, as well as the procedures for depositing funds into a designated account, drawing up and submitting reports.

Legislative framework and changes therein

Explains in detail the issue regarding the constituent documentation of Art. 52 of the Civil Code of the Russian Federation.

Article 52. Constituent documents of legal entities

1. Legal entities, with the exception of business partnerships and state corporations, act on the basis of charters that are approved by their founders (participants), except for the case provided for in paragraph 2 of this article. A business partnership operates on the basis of a constituent agreement, which is concluded by its founders (participants) and to which the rules of this Code on the charter of a legal entity apply. A state corporation operates on the basis of the federal law on such a state corporation. 2. Legal entities may act on the basis of a standard charter approved by the authorized state body. Information that a legal entity operates on the basis of a standard charter approved by an authorized state body is indicated in the unified state register of legal entities. The standard charter, approved by the authorized state body, does not contain information about the name, company name, location and amount of the authorized capital of the legal entity. Such information is indicated in the unified state register of legal entities. 3. In cases provided for by law, an institution may act on the basis of a single standard charter approved by its founder or an authorized body for institutions created to carry out activities in certain areas. 4. The charter of a legal entity, approved by the founders (participants) of the legal entity, must contain information about the name of the legal entity, its organizational and legal form, its location, the procedure for managing the activities of the legal entity, as well as other information provided by law for legal entities of the corresponding organizational -legal form and type. The charters of non-profit organizations, charters of unitary enterprises and, in cases provided for by law, the charters of other commercial organizations must define the subject and goals of the activities of legal entities. The subject and certain goals of the activities of a commercial organization may also be provided for by the charter in cases where this is not mandatory by law. 5. The founders (participants) of a legal entity have the right to approve regulating corporate relations (clause 1 of Article 2) and internal regulations and other internal documents of the legal entity that are not constituent documents. The internal regulations and other internal documents of a legal entity may contain provisions that do not contradict the constituent document of the legal entity. 6. Changes made to the constituent documents of legal entities become effective for third parties from the moment of state registration of the constituent documents, and in cases established by law, from the moment the body carrying out state registration is notified of such changes. However, legal entities and their founders (participants) do not have the right to refer to the lack of registration of such changes in relations with third parties who acted in accordance with such changes.

Federal Law No. 125 specifies a list of individual entrepreneur documents and the period for their storage, while the entrepreneur must provide all conditions for the safety of documentation.

Clause 8 art. 23 of the Tax Code of the Russian Federation indicates the need to store accounting and tax records.

There have been changes in the execution of some documents that an entrepreneur must have:

- Until 2020, a Certificate of State Registration was issued in the form P21001, and after that the Unified State Register of Entrepreneurs (USRIP) Entry Sheet on registration of an entrepreneur was issued.

- In this case, the certificate issued earlier is considered valid.

- In addition, after successful registration, the entrepreneur is given a notification in the form 2-3-Accounting.

conclusions

So, let us repeat once again what documents the individual entrepreneur receives after successful registration:

- USRIP record sheet in electronic form (if desired, you can also request a paper document);

- certificate of assignment of TIN, if it has not been received previously;

- a document confirming the transition to a preferential tax system, if the individual entrepreneur has made such a choice;

- notification of registration with the Pension Fund of the Russian Federation, as well as with the Social Insurance Fund (only employers are required to register with the Social Insurance Fund);

- statistics codes.

Well, if registration of an individual entrepreneur is refused, then the applicant will receive a decision on refusal from the tax authority indicating the reasons. If they are eliminated, you can contact the Federal Tax Service again. An exception is a ban on engaging in entrepreneurial activity or the bankruptcy of an individual entrepreneur that has already taken place. In this case, resubmission of registration documents is not possible.

How to obtain individual entrepreneur documents

Before going to the tax office you must:

- Fill out application form P21001;

- Prepare your passport;

- Make sure that the tax office where you need to apply accepts such documents;

- Serve them up;

- Receive the entrepreneur’s documentation in your hands within 3–5 days.

Features of the set of documents

The list of documentation for an entrepreneur is expanded if the registered person belongs to a special category.

Foreign citizen

- Permission to stay on the territory of the Russian Federation is required - temporary residence permit or residence permit;

- Passport translated into Russian by a Russian notary;

- In addition, it is possible to issue an internal passport with temporary registration.

Minors

In addition to the standard list of documentation, you must submit 1 of 3 documents:

- Parental permission;

- Court decision on full legal capacity;

- A copy of the marriage certificate.

Important: in any case, you must pay a state fee of 800 rubles.

List of documents for individual entrepreneur registration.

How to confirm the income of an individual entrepreneur on UTII

Unlike other types of taxation, individual entrepreneurs located on UTII, if it is necessary to confirm income, find themselves in a slightly more difficult situation.

The thing is that to calculate taxation, it is not income that is used here, but types of activity. At the same time, the tax amount for each type of activity has a fixed value, based on their level of expected profitability, physical indicator and adjusting federal and regional coefficients. That is, the actual income that an individual entrepreneur receives on UTII actually, in any case, differs from what is assumed when calculating this tax. Moreover, the state does not in any way oblige entrepreneurs working on UTII to monitor and record their income.

What to do in this case?

Option two:

- regardless of the will of legislators, still keep records of income in a simplified form;

- prove profitability by presenting primary documents.

Here the first option requires some explanation. Almost all individual entrepreneurs who are “imputed” still control the level of their income in one way or another. Which, in general, is logical: every individual entrepreneur wants to be sure that his business is profitable and profitable, and also to clearly understand exactly how much income he has. However, the main question here arises not in the fact of accounting itself, but in what form it is carried out. For example, if these are ordinary magazines or notebooks filled out by hand, then of course they will not have any evidentiary value. It is important that income records are kept in documentary form, with official status assigned to internal accounting documents. This is possible if each such document has the appropriate details.

The law clearly defines the information that must be contained in the details confirming income on the “imputation”:

- Name;

- date and place of compilation;

- Full name IP;

- IP INN;

- individual entrepreneur registration number;

- signature and seal (if any) of the individual entrepreneur.

In addition, this document must include:

- the name of the business transaction performed;

- a specific amount of income or expense, if accounting is also carried out for expenses.

All accounting documents must be kept in chronological order, including all information about costs and profits without exception.

Attention! Since, according to UTII, the reporting tax period is one quarter, it is necessary to summarize the internal accounting of expenses and income once every three months. Based on the results of the year, it is necessary to display separate annual results.

Actions after registration

Founding documents are proof of the legality of the entrepreneur’s activities:

- Based on them, it is possible to confirm information about entering data into the Unified State Register of Individual Entrepreneurs about an individual;

- In addition, information is included in the database of funds, the Federal Tax Service, and Rosstat.

After registration you need:

- Choose a tax system;

- Comply with deadlines for submitting reports and paying tax and social fees;

- Obtain a license if necessary and open a cash register;

- Form the staff in accordance with legal requirements;

- Submit notice of commencement of activity.

Documentation for concluding an agreement with an individual entrepreneur

An entrepreneur has the right not to engage in business on his own, but to hire a third party for this - a director, who will become a representative of the individual entrepreneur.

You can hire yourself as a director, but this will only add extra costs for paying fees.

It is permissible to hire a director:

- Under an employment contract;

- For partial transfer of powers.

In this case, responsibility for the activities of the director falls on the individual entrepreneur who issued him the power of attorney, with the exception of criminal offenses.

The validity of the agreement with the individual entrepreneur is confirmed by the presence of his details - TIN, passport details.

The basis for drawing up the agreement is the Certificate, and now the Registration Sheet - all the details of the document are indicated, and a copy of it is also attached.

Additional Documentation

The accounting of an individual entrepreneur is constantly updated with certificates, invoices, contracts, and acts. Therefore, the constituent documents for an individual entrepreneur are not all the documents that a counterparty may request.

The list of secondary documentation that an individual entrepreneur needs depends on the type and specifics of the activity being carried out. Among the most common are:

- Personnel nomenclature (employment agreements, contracts, statements). Needed only for those entities that use hired labor.

- Instructions for Occupational Health and Safety (Occupational Health and Safety). Such papers are required when hiring hired labor.

- Documentation related to the use of cash register systems (journal of cash transactions, service agreement).

- Tax papers (declarations, reports and other forms that the tax office may require).

- Licenses for the legality of certain types of business activities, for example, for the transportation of passengers, the provision of medical or legal services.

A businessman must keep all checks, receipts, acts, contracts that are drawn up in the process of entrepreneurship.

Documentation recovery

If the entrepreneur’s documents were lost due to circumstances, steps must be followed to restore them in compliance with procedural norms.

In this case, depending on the type of loss of documents, you need to take a certificate from the police, housing office or Ministry of Emergency Situations, which will act as supporting documents.

If you lose documents, you can act in 2 ways:

- Close the enterprise - after submitting the relevant documents and settlements with all creditors, as well as funds, closure will occur within 10 days;

- To restore documents and work further, for this you need to write an application, attach a confirmation certificate to it, and pay the state fee for each restored form.

Confirmation of income of an individual entrepreneur: when necessary

There are plenty of situations when an individual entrepreneur is obliged to provide information about his income. These may be the following cases:

- An individual entrepreneur applies for a loan from a bank;

- An individual entrepreneur needs to receive an allowance, subsidy, benefit, etc.;

- in some cases when traveling abroad.

Moreover, if people who work for hire can apply for a certificate confirming their income to their employer, where the issue is resolved quickly and competently, then individual entrepreneurs in this case have a problem - quite often entrepreneurs do not know how to correctly confirm their level of income for all kinds of authorities

Does the bank have the right to write off increased interest if it suspended the issuance of the loan before increasing it? If at the time of concluding the loan agreement the bank’s tariffs did not provide for a commission for early repayment, does the bank have the right to write it off after changing the tariffs? What circumstances do courts evaluate when considering cases of writing off fees for early loan repayment? View answers

What income will need to be verified?

Depending on the chosen taxation system, slightly different funds are legally recognized as income. If necessary, you need to confirm various forms of income:

- actual - to entrepreneurs working on the general taxation system, as well as the simplified taxation system and the unified agricultural tax (Chapter 23 of the Tax Code of the Russian Federation, clause 1 and clause 2 of Article 248 of the Tax Code of the Russian Federation);

- imputed - individual entrepreneur working on UTII (Article 346.29 of the Tax Code of the Russian Federation);

- possible – for patent entrepreneurs (Article 346.48 of the Tax Code of the Russian Federation).

NOTE! If an individual entrepreneur combines his taxation system with UTII or PSN, that is, combines forms of income, then the imputed or possible income will be included in the total actual amount.

Each type of income has its own characteristics in reflection and documentary evidence.

What is the procedure for assessing personal income tax on the income of an individual entrepreneur when renting out premises ?

How to purchase goods from an individual entrepreneur: necessary documents

Citizens should also know what documents the individual entrepreneur provides to the buyer when making payments. One of the main types of papers is an agreement, which specifies the rights and obligations of each party to the transaction. It is drawn up in two copies, which must be certified by seals and signatures. The agreement can be oral and come into effect as soon as one of the types of payment documents is issued.

This is one of the income items that forms the total profit of a businessman. But you must report on sales by entering invoices, receipts, and checks into a special ledger of income and expenses. Tax inspectors have the right to check this documentation when a declaration and other types of papers are submitted at the end of the fiscal period.

A document confirming that the individual entrepreneur works without a seal

However, there are times when an organization's seal is necessary. For example, when strict reporting forms are filled out. If an individual entrepreneur tries to issue some documents that require a blue stamp without using this attribute, they may not be accepted, despite the law allowing not to have an individual entrepreneur seal. When using strict reporting forms, for example, in a cash register, a seal must be attached, since there is a designated space for a stamp in the document fields.

- notarization is not required (FAS Far Eastern District in Resolution dated 06/07/2011 No. F03-1980/2011 in case No. A73-8365/2010);

- the power of attorney of the individual entrepreneur is certified by a notary (FAS of the Volga Region in the Resolution of July 12, 2011 in case No. A21-7618/2010), the conclusion was made on the basis of the definition of individual entrepreneur given in Article 11 of the Civil Code.

Documents when opening an individual entrepreneur

The best option is to include as many activities as possible in the document. You should not include in the list of planned species those that are not permitted for individual entrepreneurs, as well as those requiring the acquisition of a special license, except in cases where it is planned to conduct licensed activities.

The main feature of income tax can be called the calculation period, which is a calendar reporting year, and not a month, like most taxes. Read about how to calculate personal income tax in this article.

Document Confirming IP

Additional registration of the powers of the director (general director) with a power of attorney is not required. Civil legislation provides that employees of a legal entity can act in its interests without a power of attorney, only if such actions arise from their job duties.

The General Director may represent the interests of the company directly or authorize another person to represent the interests of the company on the basis of an issued power of attorney. A document confirming the powers of the head of a branch (representative office) acting on behalf of a legal entity is a power of attorney signed

How does an individual entrepreneur confirm his income?

Like ordinary citizens, sometimes individual entrepreneurs are faced with situations where they must, for some reason, confirm their income. However, sometimes one certificate of income is not enough; some additional documents are also required.

Different authorities have different requirements for the validity period of certificates confirming the profitability of individual entrepreneurs. But, as a rule, all documents confirming the income of an entrepreneur are suitable for presentation to various government and other structures during the period following the last tax reporting period. In any case, it is necessary to clarify the maximum limitation period for such documents in the institution where they are required to be presented.

What documents should an individual entrepreneur have? Package of documents for an individual entrepreneur

As you know, to open your own business, you need to register your commercial activity in accordance with current legislation.

One of the most popular forms of business organization is the individual entrepreneur (at this link you can find out what tax regimes are provided for entrepreneurs).

In Russia, any capable individual who has reached the age of 18 and is a citizen of the Russian Federation can become an individual entrepreneur.

To officially register a business, you will need a number of documents that serve as the basis for registering the business activity of an entrepreneur (the information found at this link will help a businessman choose a taxation system). What constituent documents the registrar may require from an individual entrepreneur can be found out directly from the regulatory authorities.

So, the constituent document is information recorded in a certain form and established by law, which serves as a legal basis for the recognition of activities and legal status. Detailed information is indicated in Art. 52 Civil. Code of Russia. Every entrepreneur should know what constituent documents an individual entrepreneur must have in order to avoid problems with regulatory authorities.

Important! According to the law, there are no mandatory requirements for the constituent documentation of an individual entrepreneur, since an individual entrepreneur is not a legal entity. The main document that gives the right to carry out commercial activities is the registration certificate, which entrepreneurs receive from the tax authority at their place of residence.

Registration of business activities takes place with local tax authorities. An individual wishing to undergo the procedure applies to the relevant authorities depending on their place of residence (official registration in the passport).

- List of statutory documents of the individual entrepreneur:

- — issued certificate of registration as an individual entrepreneur; — received from the Unified State Register of Individual Entrepreneurs (stands for the Unified State Register of Individual Entrepreneurs), registration extract; — received notification of registration of physical. persons for registration in the tax system (form No. 2-3-Accounting). The constituent documents of an individual entrepreneur, the list of which is regulated by Russian legislation, are the basis for obtaining the appropriate status, which a person receives upon completion of the registration procedure with state and tax authorities.

The World of Business website team recommends that all readers take the Lazy Investor Course, where you will learn how to put things in order in your personal finances and learn how to earn passive income. No enticements, only high-quality information from a practicing investor (from real estate to cryptocurrency). The first week of training is free! Registration for a free week of training

— during a personal visit of a businessman; — when submitting an application by power of attorney certified by a notary office;

- via Russian Post.

Find out the answers to these questions to avoid problems. Compared to other complexities of entrepreneurial life, registering an individual entrepreneur is a simple and quick procedure. It requires strict adherence to the regulations, after which you acquire the coveted status of an individual entrepreneur in just three days.

It would seem that the main thing is behind you, and now you can conduct business with a clear conscience. But this is just the beginning. Along with the status of an individual entrepreneur, the responsibility for timely and competently compiled reporting, drawn up in accordance with the specifics of your business, falls on your shoulders.