Reasons for refusing the simplified tax system

Why they refuse:

- Termination of activities. In this case, the liquidation procedure is practically no different from the general system and includes the implementation of all the necessary stages, including the preparation of an interim liquidation balance sheet.

- Transition to another tax regime. A change in the tax regime occurs on the basis of a voluntary decision of the taxpayer or due to forced circumstances.

Reasons for voluntary refusal:

- buyers (customers) who provide the largest turnover of the company are VAT payers. Cooperation with a simplified counterparty becomes unprofitable for them due to the impossibility of refunding tax amounts;

- next year it is planned to open branches or increase staff;

- Individual entrepreneurs switch to the regime for the self-employed (used in some regions of Russia).

Forced refusal occurs due to exceeding the maximum amount of revenue or other criteria, compliance with which is mandatory under the simplified tax system. In all cases, it is necessary to notify the tax authorities of the change in regime.

Termination of application of the general simplified tax system at the initiative of the taxpayer

According to paragraph 6 of Art. 346.13 of the Tax Code of the Russian Federation, a taxpayer applying a simplified taxation system has the right to switch to a different taxation regime from the beginning of the calendar year, notifying the tax authority no later than January 15 of the year in which he intends to switch to a different taxation regime. Sending by the taxpayer a notification about the transition from the simplified tax system to another taxation regime at a later date than those specified in Art. 346.13 of the Tax Code of the Russian Federation, is a violation of the established procedure for transition from the simplified tax system to another taxation regime, and therefore such a taxpayer does not have the right to make this transition, but is obliged to apply the simplified tax system until the end of the tax period (see Letter of the Federal Tax Service of Russia dated July 19, 2011 No. ED -4-3/11587 “On compliance by taxpayers with the provisions of Article 346.13 of Chapter 26.2 of the Tax Code of the Russian Federation”).

If the taxpayer submits a notification of refusal to apply the simplified taxation system erroneously, for example, without the knowledge of the director of the company, and then withdraws this notification. This circumstance will be regarded as the absence of the company’s intention to switch to a different taxation regime (see Resolution of the Federal Antimonopoly Service of the Moscow District dated May 14, 2008 No. KA-A41/3941-08 in case No. A41-K2-20963/07). Thus, the taxpayer independently decides to switch from using the simplified tax system to another taxation regime. In this case (clause 6 of Article 346.13 of the Tax Code of the Russian Federation), the taxpayer, for example, applies the simplified tax system until December 31, 2011 inclusive, notifies the tax authority about the transition to a different taxation regime until January 15, 2012, and from January 1, 2012 applies a different taxation regime. In this case, for a taxpayer switching to the general taxation regime, the tax period will be the period from the first day of the quarter in which he lost the right to use the simplified tax system until the end of the given year.

At the same time, the application is of a notification nature; the tax authorities, in accordance with the provisions of Chapter. 26.2 of the Tax Code of the Russian Federation does not provide the right to prohibit or allow a taxpayer to use a particular taxation system. And if the taxpayer independently stops using the simplified tax system without filing an application or submits an application to the tax authority later than January 15 of the year in which he intends to switch to a different taxation regime, such a taxpayer risks that the tax authority will make claims regarding the legality of the change in the taxation regime.

In practice, there may be a situation when the taxpayer mistakenly believes that he has circumstances that preclude further application of the simplified tax system, for example, on August 16, 2005, an entrepreneur will inform the inspectorate about the loss of the right to use the simplified taxation system and the transition from August 1, 2005 to the general taxation regime. This situation was the subject of consideration by the Presidium of the Supreme Arbitration Court of the Russian Federation, which, in Resolution No. 4157/10 of September 14, 2010 in case No. A03-6228/2008-34, indicated that the taxpayer does not have the right to switch to the general taxation system from August 1 to December 31 2005. At the same time, the taxpayer had the right not to apply the simplified tax system from January 1, 2006, since the application, although submitted on August 16, 2005, was submitted no later than January 15, 2006.

A taxpayer who has stopped using the simplified tax system has the right to reapply this system subject to compliance with the requirements established by the norms of Chapter. 26.2 of the Tax Code of the Russian Federation (beginning of application of the simplified tax system), but not earlier than one year after he lost the right to use the simplified taxation system (clause 7 of Article 346.13 of the Tax Code of the Russian Federation).

How to notify the tax office

In case of a voluntary transition, a notification to the tax service must be submitted no later than January 15 of the year in which the transition is planned. If you decide to change the regime later than this period, then the transition is possible only next year. The recommended form of notification is 26.2-3. Submission of a tax return payable in connection with the application of the simplified system and payment of the tax is carried out within the usual deadlines:

- for organizations - no later than March 31 of the year following the expired tax period;

- for individual entrepreneurs - no later than April 30 of the year following the expired tax period.

In case of termination of an activity in respect of which the simplification was applied, it is necessary to submit a notification within 15 working days after the relevant decision is made.

Main provisions

According to Art. 346.13 of the Tax Code, upon completion of work under the simplified tax system, companies and individual entrepreneurs are required to report this to the inspectorate at the location of the legal entity. person or individual entrepreneur registration address.

Article 346.13. Procedure and conditions for the beginning and termination of the application of the simplified taxation system

Aspects of the law

In accordance with the letter of the Ministry of Finance No. 03-09-11/35436 dated July 18, 2014, loss of the status of a legal entity or individual entrepreneur on a simplified basis leads to a parallel termination of the special regime. Such business entities do not have to submit a corresponding notification to the tax office.

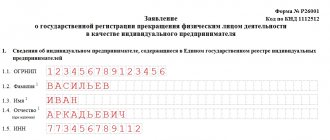

Since the beginning of 2013, based on the provisions of Art. 346.13 Tax Code and clause 11 of Art. 2 of the Law on Amendments to Tax Legislation No. 94-FZ dated June 25, 2012, upon completion of activities under the simplified tax system, the entity is obliged to submit a notification about this to the tax office. It has form No. 26.2-8 and was approved by tax order No. ММВ-7-3/829 dated 11/02/12.

Form 26.2-6. Notification of changes in the object of taxation

Form N 26.2-8. Notice of termination of business activity

The paper indicates the completion date of the work, which the organization or individual entrepreneur determines independently. The document is submitted to the Federal Tax Service within 15 days from the date of its closure. Counting is carried out in working days.

By the 25th day of the month following the submission of the notification, the organization (IP) must submit a simplified declaration. This is stated in Art. 346.23 Tax Code.

Section 346.23. Tax return

The Ministry of Finance in document No. 03-11-06/2/123 dated September 12, 2012 explains that termination of work on the simplified tax system means the end of all types of business for which this special regime was applied. There are several positions regarding what this ending is.

According to one version, if a company does not have and does not plan any income or expenses before the end of the year and is going to file for tax zero, then there is no simplified business activity. In this regard, she needs to prepare notification No. 26.2-8 and switch to OSNO (general tax regime).

Failure to submit a notice will result in a fine of RUR 200. (Article 126 of the Tax Code). The Federal Tax Service has the right to force an organization to submit quarterly reports on OSNO.

Article 126. Failure to provide the tax authority with information necessary to carry out tax control

Another point of view: if a company does not have simplified income, this does not mean that it does not operate under the simplified tax system. For example, a firm might have long-term contracts for which payment was expected the following year. Accordingly, an organization can pass zero and not transfer to OSNO.

Conditions of the message

When terminating business under a simplified procedure, the taxpayer must notify the Federal Tax Service about this. On the paper, he indicates a self-selected date for completing work according to the simplified tax system. It is submitted to the tax office at the place of registration of the legal entity or the residence address of the individual entrepreneur. The inspectorate does not have the authority to dictate to an entrepreneur what date to put in the notice.

The notification period is 15 days from the date of completion of work under the simplified tax system. A notice of termination of activities under the simplified tax system is drawn up on approved form No. 26.2-8. It was adopted by the Federal Tax Service in order No. ММВ-7-3/ [email protected]

Based on Art. 346.23 of the Tax Code, a subject refusing the simplified tax system must submit a declaration to the tax authorities. This must be done before the 25th day of the month following the month in which the simplification work was stopped.

The taxpayer indicates the date of completion of activities under the simplified tax system himself, without the participation of tax officials in this matter.

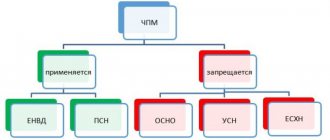

You should know that if a business entity wishes to switch from the simplified tax system to the patent system or imputation, then it will not lose the right to use the simplified system. The absence of profit from transactions not subject to UTII and tax for PSN does not oblige him to inform the Federal Tax Service about the completion of work under the simplified tax system in the manner prescribed by the Tax Code of the Russian Federation.

The loss of status by legal entities or individual entrepreneurs who worked under the simplified system also indicates the termination of the simplified tax system. These entities do not submit a notification to the tax office. Detailed interpretations are reflected in the letter of the Ministry of Finance No. 03-11-09/35436 dated 07/18/14.

Form for notification of termination of activities under the simplified tax system

Resignation or loss of status

If a taxpayer decides to switch from a simplified tax regime for all types of activities to another special regime (UTII, PSN), according to the opinion of the Ministry of Finance stated in the letter, he is not deprived of the right to use the simplified tax system. In this case, he does not have to submit a notice of completion of the simplification work.

In Art. 346.13 of the Tax Code states that a legal entity (IP) has the right to switch to a different special regime from the beginning of the year. He is obliged to notify the Federal Tax Service before January 15 of the year in which he plans to apply it.

For example, a simplified enterprise decided to pay taxes under OSNO in 2020. To the Federal Tax Service, it is obliged to send the inspectors a paper on termination of work under the simplified tax system by January 15, 2020. The organization must draw up a document according to form No. 26.2-3, adopted by the Federal Tax Service in order No. MMV-7-3/829 dated 02.11.12.

The above notification should not be submitted to the Federal Tax Service upon termination of the operation of a company or individual entrepreneur. In cases of liquidation, reorganization and others established by the legislation of the Russian Federation. A business entity will be deregistered with the tax office based on data from state registers: Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs (Article 84 of the Tax Code).

Article 84. Procedure for registering and deregistering organizations and individuals. Taxpayer identification number

The loss of the status of an enterprise or individual entrepreneur on the simplified tax system indicates a parallel termination of this special regime. The reason for this may be the excess of the amount of income for the reporting period established by law.

When using the simplified and patent taxation systems, income under both regimes is taken into account when calculating sales revenue, and when using the simplified tax system and UTII in parallel, only under the simplified one.

For example, an organization lost the right to apply the simplified procedure in March 2020; it is required to conduct accounting according to OSNO from the beginning of the year. Penalties for non-payment of taxes for the 1st quarter will not be applied to the company. The company must submit a notice of transition to OSNO by April 15, 2020.

Procedure for termination of activities

The procedure for terminating activities under the simplified tax system is divided into several stages:

- Decision-making.

- Submission of notification in the appropriate form. It must be completed manually or in a machine-readable manner. The document is provided in person, transmitted via telecommunications channels or sent by registered mail.

- Filing reports and paying taxes.

Risks of refusing the simplified tax system

It is necessary to analyze current turnover, sources of replenishment of working capital and the reliability of counterparties. It is advisable to request the following documents from existing and potential buyers (customers):

- copies of tax returns and financial statements for the last reporting period;

- a certificate of the status of settlements with the budget;

- certificate of turnover on the current account.

In addition, it should be clarified whether the main suppliers are VAT payers. If you work with companies that use special regimes, VAT refunds are impossible, which means that the point of refusing simplification is lost.

In what cases is the notification not completed?

The notice is not filled out:

- upon liquidation;

- during the planned transition to OSNO or another special regime for those types of activities that are subject to a single tax under the simplified tax system;

- if the established criteria for simplification are exceeded (forced refusal).

The procedure for terminating a business on a voluntary basis

If the basis for closing a business is the will of a business entity, this places an obligation on the individual entrepreneur to carry out all procedures independently, including visiting the tax office and funds, employment center and bank to close the account. Let's figure out how to close the activities of an individual entrepreneur on your own, and in what order this happens, as well as what is needed to close an individual entrepreneur.

Stage 1 – collection of necessary documents: application and receipt for payment of state duty; these are the main and main documents established by the legislator, on the basis of which the termination of entrepreneurship takes place;

Stage 2 - do not forget that if there are hired employees, they should also be notified that they will be fired for the specified reason (termination of business); since the employment center must be warned that an individual entrepreneur is dismissing its employees due to liquidation at least two weeks in advance, then the employees themselves must be warned, under a personal signature, about the impending termination of employment contracts within the same period;

Stage 3 – dismissal of employees, the procedure for this procedure is regulated by the Labor Code of the Russian Federation, and does not impose obligations on the entrepreneur for further employment or payment of additional compensation payments, other than those specified in the employment contract and the law;

Stage 4 – deregistration from funds and the employment center as an employer; This stage occurs after the dismissal of the last employee; the entrepreneur receives a certificate stating that he is no longer listed as an employer in the Social Insurance Fund, the Pension Fund of the Russian Federation and the employment center;

Stage 5 – pay all debts to the budget and extra-budgetary funds; for this purpose, it is recommended to request from the funds acts of reconciliation of mutual settlements, and a receipt for payment of debt; and, although the legislator allows an entrepreneur to liquidate if there is a debt, sooner or later it will have to be paid;

Stage 6 – an individual entrepreneur ceases activities upon making an entry in the Unified Register about the registration of the fact of closure of an individual entrepreneur; the tax authority issues the applicant a document confirming the fact of such registration and after that, the individual is no longer an entrepreneur;

Stage 7 – closing the account and notifying the tax office and the Pension Fund about this, and at the same time, providing the specified services with receipts for payment of arrears of taxes and mandatory insurance payments.

What happens after the closure of an individual enterprise

After all the documents have been collected, submitted to the authorized tax authority at the place of registration, all due checks have been carried out, receipts for payment of state duties and debts to the budget have been submitted, the entrepreneur, on the sixth working day, receives a document stating that the termination of business activity has occurred. However, we should not forget that the mere presence of such a document does not relieve the former individual entrepreneur, already as an individual, from liability for all his unfulfilled obligations. This means that any counterparty or creditor has the right at any time to go to court with a citizen with claims for repayment of debt or fulfillment of an obligation in kind.

After the liquidation of an individual entrepreneur, he must also be issued a certificate of deregistration with the Pension Fund. All other documents that the business entity had while conducting its business remain in its hands. There is no need to hand them over anywhere. It is recommended to store these documents for at least four years. After all, the tax office can check all payments and transactions of an individual entrepreneur after he ceases to be an entrepreneur.

Become an author

Become an expert