Where is NPM applied?

A receipt printing machine is used to issue receipts to the buyer after purchasing goods.

However, due to differences from cash register, its use for income accounting is possible only for some entrepreneurs.

The check printing machine is allowed in two tax regimes: UTII and PSN. In these cases, the tax calculation is not affected by the actual sales volume.

Therefore, it is not necessary to use cash register registers to record income and keep records.

Documentary proof of purchase serves several purposes:

- records the receipt of funds;

- is a guarantee for the buyer;

- allows you to control the work of staff.

Although, by law, entrepreneurs working on UTII and PSN do not need to install a cash register, at the client’s request they are required to provide him with a form confirming the transfer of funds.

In this case, a receipt printing machine will be the optimal solution.

Important: NPVs are prohibited when operating in OSNO, USN and ESKHN modes.

How to choose a machine?

Private enterprises are popular among entrepreneurs, as they ensure full-fledged operation of the trading facility. In addition, they have most of the functions of a conventional cash register. The machine prints a document - a check, which contains all the mandatory details established by law.

The advantage of using the CFM is the compactness of the device, which allows it to be used, for example, during the delivery of purchased goods to the client’s address.

The process of issuing a check is much faster than when using a cash register.

Today, manufacturers of these devices have provided the market with a diverse range of these products. The most popular models:

- "Alpha" -400;

- "Kasbi"-02M;

- "Orion" -100;

- "Elwes"-M;

- "Mercury" -115, 130, 180;

- "Middle" - Check.

Reason for using NPM

The use of cash registers is regulated by Law No. 54-FZ of May 2, 2003.

In accordance with it, when making payments in cash or using a bank card, individual entrepreneurs are required to use cash registers.

The same law establishes exceptions that allow the use of alternative methods.

- According to Article 2 of Law No. 54-FZ, individual entrepreneurs engaged in providing services to individuals, regardless of the taxation system applied, have the right not to install a cash register until July 1, 2018. At the same time, they are required to provide clients with strict reporting forms, which include subscriptions, tickets, receipts, vouchers, and so on.

- Paragraph 1 of the same Article 2 establishes the provision that individual entrepreneurs working on UTII and PSN have the right not to purchase a cash register until July 1, 2018. At the buyer's request, he may be issued a receipt or sales receipt.

- According to Article 3, LLCs and individual entrepreneurs are allowed to operate without cash registers under certain operating conditions and operating characteristics. For example, this is the sale of newspapers in special stalls, the sale of ice cream, soft drinks or bottling vegetable oil, and the like.

The very need to use check printing machines arose after the adoption of Law No. 162-FZ of July 17, 2009.

Based on this act, LLCs and individual entrepreneurs on UTII may not use cash registers with ECLZ.

This innovation simplified the work of taxpayers. Now they did not need to spend money on purchasing and maintaining equipment, as well as registering it with the tax service.

Functions of a cash receipt

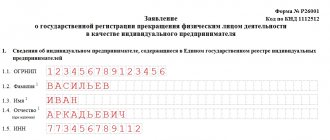

A cash receipt is a fiscal document confirming the fact of purchase and sale of a product or service, registered on a cash register. It may also be required to deduct VAT on goods, services, work performed, for which payments were made in cash, because for this, the taxpayer must document the payment of VAT to the supplier as part of the price of the goods. Many entrepreneurs are interested in the answer to the question of whether they are a taxpayer. The abbreviation stands for the reason for registration. This designation complements the TIN and indicates the basis for registration with the Federal Tax Service.

As a rule, the receipt is printed in the form of a small rectangular strip of paper. In most cases, you can make claims regarding the quality of the product or return it only if you have this document (although according to Article 25, paragraph 1 of the Federal Law “On the Protection of Consumer Rights”, this can also be done if there is one witness). If necessary, a sales receipt may be attached as a supplement to the cash receipt. It is not a primary accounting document, because there is no signature of the responsible person.

What are the main differences between NFM and KKM?

In fact, a receipt printing machine does not replace a cash register.

The legislation imposes a number of requirements on the latter, including registration with the tax authority, conclusion of a service agreement and the presence of an ECLZ.

Cash register is used by all organizations and individual entrepreneurs who make payments in cash or using bank cards.

There are a few exceptions to this rule, as discussed above.

The check printing machine is equipped with a Z-report function, which can be obtained at the end of the working day or shift.

This device resembles a regular cash register. The report contains information about the time of purchase, amount and type of payment, and total income for the day.

Thus, a check printing machine is suitable for two categories of entrepreneurs:

- Those who use UTII, since these businessmen are not required to use cash registers.

- Those using PSN, which are also allowed to accept payments without cash register. However, if the activity is aimed at providing services to individuals, this device alone will not work. You will need to either purchase a cash register or provide clients with strict reporting forms printed in a printing house.

It is worth noting that a receipt from a typewriter does not replace strict reporting forms.

They must be of a printed type; the use of independently printed sheets is not allowed.

Where is the check number on the cash receipt?

The cash receipt number is a mandatory detail. This data is needed for proper accounting and control over document flow. The higher the amounts indicated on the receipts, the higher will be (the difference between the cost of the goods and the final sales amount, the profitability ratio). To assess the success of an enterprise, you can use the profit received from sales to be divided by costs.

The cash receipt contains the following details:

- name of the document, enterprise, indication of its organizational and legal form;

- serial number for the shift;

- date, time, address of the transaction, list of goods and amount to be paid, as well as signs of the fiscal regime (indicate certain letters), cryptographic verification code;

- taxpayer identification number;

- type of taxation system;

- payment attribute (arrival, return);

- name of goods, services;

- the amount and form of calculation, including VAT (you can find out on specialized websites, in specialized literature, by seeking advice from an experienced accountant);

- position and surname of the person who issued the payment.

By the way, a six-digit number is also required; it is assigned within the series by the printing house. If an entrepreneur orders forms from several places, he must independently ensure that the sets of numbers are unique. Also, a cash receipt may contain other details (greeting, number of bonuses, discount amount) depending on the specifics of the enterprise. They must be clearly printed and easy to read.

Advice

: Both sellers and buyers should remember that for failure to issue a document confirming the purchase, according to the Code of Administrative Offenses, a system of fines is provided. For companies - 30-40 thousand rubles, its employee or individual entrepreneur - 3-4 thousand rubles. However, the possibility of legal challenge must be taken into account, and the fact of non-issuance or demand of the document by the buyer is very difficult to prove.

The cash receipt number is usually indicated opposite the cash register number. Its location is not clearly regulated; it can be in different positions on checks from different companies. But it is always preceded by the symbol “No”, “#” or the indication “Receipt Number”.

Opening and subsequent development of your own business involves not only generating income, but also maintaining records.

An important document that is required by the tax office to calculate mandatory fees are checks issued by cash registers or check printing machines. For many, the unresolved question is: when to use and when to use a machine that prints checks?

Useful functions of the CFM

The check printing machine is designed to automate the issuance of checks. The capabilities of this equipment allow:

- program a list of information that will be reflected in the printed document;

- enter data on products and prices into the database;

- correct the specified information;

- establish a ban or permission to change the value of goods.

As already noted, unlike a cash register, a check printing machine does not have an ECLZ.

However, these devices also allow you to store information and create reports. The function of fiscal memory is performed by a non-correctable memory block.

A receipt printing machine allows you to print not only receipts, but also tickets and reports.

The data stored on the device is the property of the entrepreneur and should not be controlled by tax authorities. Receipts and other documents are printed for the benefit of clients and to simplify record keeping.

You can connect additional devices to the machine that allow you to:

- Make non-cash payments (acquiring).

- Scan barcodes.

- Weigh the goods.

- Manage work using a computer.

- Protect data on income received from distortion.

The check printing machine can be portable thanks to the built-in battery.

Information about the results of work is stored in the device’s memory, regardless of connection to a power source.

Even if the machine is disconnected from the network or the battery runs out, the data will not be erased.

Where is the check number on a cash register receipt?

According to Art. 14 of the Law on the Payment System No. 161-FZ, the cash receipt must contain all the details, including the number. The basic requirements for them, as well as payment terminal receipts, are as follows:

- clear printing of information;

- storage of the document for 6 months.

The legislation does not regulate the form of the document in question and the location of the details. Each company and individual entrepreneur has the right to form it at their own discretion. Here, a lot depends on the manufacturer, model, year of manufacture of the cash register and other parameters.

As a result, find the cash receipt number

you can use inscriptions like “No,” “#” or “Receipt number.” There are examples below:

What parameters to focus on when choosing

Receipt printing machines are in considerable demand. They have almost the same functionality as cash registers, but are smaller in size and easier to use.

Printing a receipt on such a device does not take much time.

There are many models of receipt printing machines on the market. When choosing equipment, you should focus on the following parameters.

- Reliability. This indicator should be considered along with operating conditions.

- Price. On average, the cost of different models can range from 5 to 28 thousand rubles, depending on the functionality.

- Ease of use. Some models have such a simple interface that you don’t have to refer to the instructions to learn how to use them.

- Availability of built-in battery. Particularly important for field sales and other activities that require a portable device.

- Design. The modern design will please the eyes of the staff.

- Availability of connection to a computer. Such a machine can be connected with accounting services.

It is worth buying a cash box for the machine. It is not supplied with the devices.

Important: any model of receipt printing machines is programmed for a specific entrepreneur or organization. It is preferable to invite a specialist to set it up.

To save money, some people purchase cars that have already been in use.

Review of the Mercury machine

From the variety of equipment presented, it can be difficult to choose. Good reviews can be found about the Mercury brand.

The machines are known for their stability and speed, modern design and long service life.

They can be used under unfavorable conditions, in particular at low temperatures (down to -20 degrees).

The average cost of a Mercury machine is 6-8 thousand rubles. The following operations are available:

- accounting and control;

- printing checks;

- electronic journal printing;

- preparation of reporting documents.

These models are equipped with a battery, so they can work independently of the network. They are distinguished by their compact size and modern design.