The Civil Code of the Russian Federation establishes the procedure for closing an individual entrepreneur. Therefore, the closure of individual entrepreneurs in 2020, in accordance with the current legislation of the Russian Federation, has a clear sequence.

The most common reason for closing an individual entrepreneur is his desire, but there are other reasons for closing - out of necessity. These include:

- bankruptcy of individual entrepreneurs;

- completion of registration of residence in the Russian Federation;

- court decision banning business;

- death of an entrepreneur.

The first point refers to the voluntary closure of individual entrepreneurs, the rest to forced closure.

In this material we will look at how to close an individual entrepreneur in 2020 on a voluntary basis.

Before closing an individual entrepreneur, it is necessary to carry out preliminary preparations. First of all, an individual entrepreneur must:

- Find out which tax service he needs to submit documents to in order to terminate his activities as an individual entrepreneur.

- Find out whose details should be used to pay the state fee for closing an individual entrepreneur. To do this, you can contact the Federal Tax Service at your place of residence or find out the details on the official website of the Federal Tax Service.

After the address of the tax office and the details for paying the state duty for closing an individual entrepreneur have been clarified, you should:

- fill out an application in form P26001, which can be taken to the Federal Tax Service or downloaded on our website along with a sample form;

- pay the state fee for closing an individual entrepreneur. The state duty in 2020 is 160 rubles. You can fill out a receipt for payment of the duty on the official website of the Federal Tax Service using this link or take the payment details from the Federal Tax Service.

From January 1, 2020, when closing an individual entrepreneur through the Federal Tax Service website using an electronic digital signature, there is no need to pay a fee. Of course, a digital signature is not cheap, ranging from 1,500 to 3,500 rubles, but it is likely that you had one for submitting reports electronically.

The procedure for filling out an application for closing an individual entrepreneur

The application can be filled out by hand or typed on a computer. If you fill out by hand, use a pen with black ink.

When filling out using a computer, use Courier New font, height 18 points; when filling out by hand, all letters must be capitalized.

Information required to be included in the application for deregistration of an individual entrepreneur:

- OGRNIP - your registration number indicated in the certificate of state registration of individual entrepreneurs;

- Full name and INN IP.

Next, you need to indicate how you will submit the application to the Federal Tax Service:

1 - in person. 2 - to a representative by proxy. 3 - by mail.

Then you need to provide contact information - mobile phone and, if available, landline phone number and e-mail.

If you plan to submit the application in person, you do not need to sign in advance; it must be signed in the presence of the tax inspector at the time of submitting the application.

If your representative will submit the application or you plan to send it by mail, you must sign when filling out the application.

The applicant fills out the details for paying the state fee for closing an individual entrepreneur independently.

Submitting reports for closing individual entrepreneurs in 2020

First, let’s clarify which date is the closing date of the individual entrepreneur

The date from which a person is not an individual entrepreneur is indicated in the Certificate of state registration of termination by an individual of activities as an individual entrepreneur (Form N P26001).

Until you receive the above certificate from the INFS, you cannot be considered to be an entrepreneur.

There is a possibility that your application to close an individual entrepreneur will be lost by the tax office, or for some other reason you will not be deregistered as an individual entrepreneur. Therefore, after 5 working days after filing an application to deregister an individual entrepreneur, contact the tax authority to obtain a Certificate of state registration of the individual’s termination of activities as an individual entrepreneur.

Regardless of whether business activity was carried out or not, it is necessary to submit a tax return (including for an incomplete period).

Deadlines for filing returns depending on tax regimes

Under the simplified tax system, the declaration must be submitted no later than the 25th (the month following the month in which the individual entrepreneur was closed).

For example:

The Certificate of State Registration of Termination by an Individual of Activities as an Individual Entrepreneur contains the date January 20, 2020; the simplified tax system declaration must be submitted by February 25, 2020. But using the simplified tax system, you have the right to submit a declaration simultaneously with submitting an application for deregistration of an individual entrepreneur.

An individual entrepreneur using the simplified tax system has the right to submit reports both before submitting an application to close the individual entrepreneur and after.

In the case of UTII , the UTII declaration must be submitted no later than the 20th day of the month following the quarter in which an entry was made in the Unified State Register of Individual Entrepreneurs about the termination of the individual entrepreneur’s activities.

When working for OSNO, declarations are provided when closing an individual entrepreneur on time:

- for personal income tax – no later than 5 working days after the termination of the activities of the individual entrepreneur (clause 3 of Article 227 of the Tax Code of the Russian Federation);

- for VAT - no later than the 25th day of the month following the quarter in which the activities of the individual entrepreneur were terminated.

The forms of declarations when closing an individual entrepreneur and when carrying out entrepreneurial activities are no different.

If an individual entrepreneur was registered with the Pension Fund of the Russian Federation and the Social Insurance Fund as an employer, then it is necessary to deregister with these funds, having previously fired the employees, calculate the contributions and pay them.

If employees are dismissed not of their own free will, but due to the liquidation of the organization, then it is necessary to provide the employment service authorities with a notice of liquidation of the organization. Moreover, the period for providing notification is different for individual entrepreneurs and LLCs. An LLC must provide notice two months before the start of measures to terminate employment contracts; an individual entrepreneur provides such notice two weeks before the start of dismissal of employees.

You can download the notification form from the link at the bottom of this article.

Official resources for closing an individual entrepreneur

You can submit an application to deregister an entrepreneur through two official resources - the Federal Tax Service website and the government services portal. But you shouldn’t believe the advertising offers of law firms; you will simply spend extra money, but will not speed up the procedure.

In addition, you can submit an application to close an individual entrepreneur remotely through a notary who provides such services, but you will have to pay at least 1,000 rubles for this. There is no particular need for this. If you want to close an individual entrepreneur online through the tax office during the period of self-isolation, then this can be done even if you do not have your electronic signature.

How to close an individual entrepreneur through the Federal Tax Service website

To carry out registration actions, the Federal Tax Service has developed a special service called “State registration of legal entities and individual entrepreneurs.” It allows you not only to open an individual entrepreneur and make changes to the register, but also to stop business activities.

In normal times, it was possible to close an individual entrepreneur online through the tax service only with an enhanced digital signature. But during the period of restrictions due to coronavirus, the Federal Tax Service allowed the applicant’s identity to be confirmed using a selfie in front of the passport. Let's talk about this in more detail.

To begin the procedure, click on the “Cease activity as an individual entrepreneur” tab, after which you must confirm your consent to the processing of personal data.

From the proposed types of applications, select the last one - form P26001.

At the next stage, indicate the option for submitting the application - with or without an electronic signature. If you have an electronic signature, then you will save 160 rubles, because in this case no duty is charged. In our example, we select the “Without digital signature” option.

Let us remind you that it is possible to close an individual entrepreneur online without an electronic signature only for the period of restrictions due to coronavirus. After the tax inspectorates return to normal operation, this option will only allow you to send application P26001 to the Federal Tax Service. And to complete the procedure, you will need to appear in person at the inspection.

But while the restrictions are in effect, the applicant can confirm his identity not using an electronic digital signature, but by taking a selfie along with an open passport.

Next, the service will offer you to fill in the required fields step by step and pay the fee online. Photos are attached to the application and sent to the Federal Tax Service.

How to submit an application through the public services portal

The application P26001 is submitted in the same way through the government services portal. To use the functionality, you must have a verified account on the portal.

In the “Registration of legal entities and entrepreneurs” section, click on the “Fill out a new application” button.

Next, you need to confirm your consent to data processing and select an application in form P26001.

Is it possible to close an individual entrepreneur remotely through the government services portal if the applicant does not have his own digital signature? Just like on the Federal Tax Service website, this opportunity became available only during the pandemic.

Using the service prompts, fill out the application, pay a fee of 160 rubles and submit the documents online.

Deregistration from the Pension Fund and the Social Insurance Fund

Starting from 2020, after the acceptance of reports and the transfer of insurance premiums was transferred from the Pension Fund to the Federal Tax Service, there is no need to deregister with the Pension Fund when closing an individual entrepreneur or LLC. Federal Tax Service in accordance with Art. 11 Federal Law No. 167 independently transmits information about closure to the Pension Fund.

In 2020, the Social Insurance Fund will continue to accept reports and contributions for injuries. Therefore, the need to deregister with social security authorities upon closure remains in 2020.

Moreover, many FSS deregister an employer only through the government services website, refusing to accept an application for deregistration submitted to the FSS personally by an individual entrepreneur or by the director of an LLC.

In order to comply with the FSS requirement, you must register on the website at https://www.gosuslugi.ru/. Obtain a login and password from the MFC, fill out an application for deregistration as an employer and send it via electronic document management. However, often such requirements of regional branches of the FSS cannot be implemented due to incorrect operation of the website.

Therefore, if you are unable to submit an application through the website, take the application in person to the FSS and explain the reason for the impossibility of sending it electronically. You can download the application form for deregistration from the FSS from the link at the bottom of the article.

If an individual entrepreneur has a cash register, you need to remove it from the cash register register.

In addition, it is necessary to close the individual entrepreneur’s bank account.

Application form

All registration forms, including application P26001, were approved by Order of the Federal Tax Service of Russia dated January 25, 2012 No. ММВ-7-6 / [email protected] , which continues to be in effect in 2020. The application form for deregistration of an individual entrepreneur is very simple, it only has one page.

You can find the current application P26001 to fill out on the website of the Federal Tax Service, in reference and legal systems, on specialized sites for preparing documents, such as our portal.

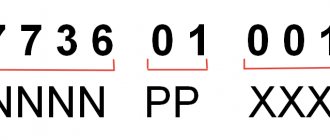

If you download an application form for closing an individual entrepreneur from an unverified resource, make sure that the form contains the correct barcode (7170 1011) and KND code 1112512.

To fill out the application quickly and without errors, use the online service. Enter your INN or OGRNIP and the service will automatically fill out all the required role forms.

Fill out an application to close an individual entrepreneur

Closing an individual entrepreneur in 2020 at the tax office

The next step to close an individual entrepreneur in 2020 is to submit the prepared documents to the tax office (with a receipt for payment of the state duty).

There are two ways to submit documents for closing an individual entrepreneur in 2020:

- personally;

- by mail (by a valuable letter with an inventory of the contents and a receipt).

When sending documents to close an individual entrepreneur by mail, they must be certified by a notary, with the exception of a receipt for payment of state fees.

The filing date will be considered the day on which the tax office receives the letter.

After 5 days, the applicant comes with a passport and an extract (received from the inspector on the day of submitting documents for closing the individual entrepreneur) for the following documents:

- An extract from the Unified State Register of Individual Entrepreneurs (USRIP);

- Certificate of state registration of termination by an individual of activities as an individual entrepreneur (Form P65001).

If the individual entrepreneur did not have the opportunity to pick up these documents on his own, the tax service will send them by mail to the address specified when registering the individual entrepreneur. In this case, do not forget to indicate in the application in clause 2, clause 3 “ send by mail ”.

Providing reports to the Federal Tax Service when closing an individual entrepreneur

The following reporting deadlines are established for different taxation regimes:

- STS - until the 25th day of the month following the entry into the Unified State Register of Entrepreneurs of the deregistration of the individual entrepreneur;

- UTII - until the 20th day of the month after the end of the quarter in which the individual entrepreneur was deregistered;

- Patent – no need to provide a report;

- OSNO - no later than five days after deregistration of the individual entrepreneur.

Submitting an application to close an individual entrepreneur online

Today, the procedure for closing an individual entrepreneur has been significantly simplified, and entrepreneurs no longer have to personally submit an application to the MFC or a tax application to close an individual entrepreneur, and also waste their time visiting various authorities.

Submitting an application to close an individual entrepreneur online on the tax office website in 2020

In order to fill out an application for closing an individual entrepreneur in 2020 online, an entrepreneur must have an ECES (enhanced electronic qualified signature).

Closing an individual entrepreneur in this way is suitable for those who have a “Taxpayer Personal Account” registered on the Federal Tax Service website:

- You should log on to the Federal Tax Service website and go to ]]>state registration service]]>.

- Next, you need to select the item “Cease activities as an individual entrepreneur” and log in to the system; this can also be done through the State Services portal.

- After this, the entrepreneur must select one of the proposed options for sending form 26001 (application to close an individual entrepreneur) to the registration authority and click on the “Next” button. In our case, it will be “In electronic form with the electronic signature of the applicant.”

- Then the system will prompt the entrepreneur to enter the following information: OGRNIP, contact information (phone number and email address), method of obtaining documents. The system will generate an application, and the entrepreneur must carefully check all the data. If an error is found, appropriate adjustments must be made.

- When the application form for closing an individual entrepreneur is submitted online in the form of an electronic document, there is no need to pay a state fee. But if the applicant has chosen a method of filing an application that involves paying a state fee, he needs to generate a receipt for payment and transfer the funds. If the payment has already been made, you must enter the payment order data in the appropriate window (document index, payment date, bank BIC, bank name).

- After sending the documents, within 5 working days the entrepreneur will receive a corresponding notification letter from the Federal Tax Service in the “Personal Account” or to the email specified in the application.

Closing an individual entrepreneur in 2020 and paying off debts

From 2020, there is no need to notify the Pension Fund about the closure of the individual entrepreneur within 12 days from the date of closure of the individual entrepreneur (with the exception of the individual entrepreneur who had hired employees).

If the individual entrepreneur worked without employees, the tax service will independently send information to the Pension Fund that the individual entrepreneur has been deregistered. Then the pension fund employees will deregister you with the Pension Fund.

A different situation arises when closing an individual entrepreneur with hired employees. The legislation does not clearly answer this question. Previously, before the Pension Fund of Russia was involved in the administration of pension and medical contributions, it was necessary to submit to the Pension Fund an application to deregister an individual entrepreneur as an employer. After transferring the authority to collect contributions to the Federal Tax Service Inspectorate, it would be logical not to do this, since, just as in the case of individual entrepreneurs without employees, the Federal Tax Service Inspectorate has all the necessary data about individual entrepreneurs with employees and has the opportunity to transfer information to the Pension Fund through interdepartmental channels. But in order to avoid conflict situations, we recommend contacting the regional branch of the Pension Fund of Russia and clarifying this issue. The fact is that individual regional branches solve this issue differently.

In accordance with current legislation, deregistration of an individual entrepreneur from the Pension Fund of the Russian Federation must occur within 5 days after the tax authorities submitted the information contained in the Unified State Register of Individual Entrepreneurs to the territorial body of the Pension Fund of the Russian Federation.

In Art. 432 of the Tax Code of the Russian Federation states: “payment of insurance premiums must be made no later than 15 calendar days from the date of making an entry in the Unified State Register of Individual Entrepreneurs about the termination of business activity.”

The Federal Tax Service may require an individual entrepreneur to provide a certificate of absence of debt (even before closing the individual entrepreneur), although according to the law, it is possible to close an individual entrepreneur in 2020 even with debts.

You can check if you have debts:

- in the PFR personal account at https://es.pfrf.ru/

- on the bailiffs website at the link https://fssprus.ru/iss/ip/

- on the Federal Tax Service website in the taxpayer’s personal account https://lkip.nalog.ru/

After the closure of the individual enterprise, the received documents must be stored for four years.

State registration of termination of the activities of individual entrepreneurs

From the moment a businessman submits an application for state registration of the right to terminate activities, its end occurs after 5 working days. You can check whether the document is ready through the website in the Personal Account. Receiving a new sheet of the Unified State Register of Individual Entrepreneurs, indicating the completion of the activity, occurs in the manner that the applicant indicated when filling out the application. From the moment of the new entry into the Unified State Register of Individual Entrepreneurs, all aspects of the individual entrepreneur’s activities cease.

Having received the document, the individual must notify the Pension Fund about this within 12 days. It is necessary to convey this information to the territorial FSS. To exclude, a businessman should take care of paying off tax debts, deregistering a cash register if it was used in business, and closing bank current accounts.

If an individual entrepreneur has hired employees under his command, the employer must formalize the dismissal according to the Labor Code of the Russian Federation, pay them, and only after that submit an application to close the business. Filing a tax return and paying debts on taxes and fees can take place after the individual entrepreneur has been deregistered, but for this you need to strictly adhere to the established deadlines and follow the reporting regulations.

You need to know this: How to find out if an individual entrepreneur is closed

This might also be useful:

- The procedure for deregistering cash registers with the tax authorities

- Step-by-step instructions for closing an individual entrepreneur

- How to close an individual entrepreneur with debts?

- What reporting must an individual entrepreneur submit?

- In which bank should I open a current account?

- What taxes does the individual entrepreneur pay?

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Checking the current status of the individual entrepreneur

As soon as the tax authority registers the termination of activity, this information will become publicly available, and anyone can find out the status of an individual entrepreneur. This opportunity is provided by the Federal Tax Service website, where you can check whether the individual entrepreneur is working by entering one of the types of data into the search engine:

- TIN;

- OGRN;

- Full name of the entrepreneur;

- the region in which he lives.

The data is processed, and then the system produces a table that has a cell for the date of termination of activity. The absence of information in this column means that the individual entrepreneur is carrying out activities at the time of the request.

FAQ

I fell behind on my insurance premiums as an individual entrepreneur. I haven't cried for 3 months now. What will it cost me and how can I close an individual entrepreneur with debts if I now live in another region?

The tax office will establish arrears and calculate all your debts and fines. Then he will ask them to pay, indicating the due date. To close an individual entrepreneur in another city: go to a notary and write an application to terminate the work of an individual entrepreneur using a special form - the notary will give it to you. Verifies your signature. Then to the bank to pay the state fee for closing - 160 rubles. Next, go to the post office and send the application and paid receipt by registered mail with acknowledgment of receipt to the address of the tax office where you opened the individual entrepreneur. Ask a question that interests you - use the online consultant form on the right or call by phone (Moscow). It's fast and free!

Is it possible to gradually pay off the balance of the debt after the closure of the individual entrepreneur?

You can repay the debt in parts, as an individual, but you must be prepared for the fact that you will have to pay off penalties for this delay. Ask a question that interests you - use the online consultant form on the right or call by phone (Moscow). It's fast and free!

Will an individual entrepreneur's current account be seized because of bank debts as an individual?

If an entrepreneur owes the bank on personal loans, and they sue, then the judge can seize all the entrepreneur’s accounts, including the current account, since an individual entrepreneur is an individual and is liable for debts with all his property. Ask a question that interests you - use the online consultant form on the right or call by phone (Moscow). It's fast and free!

Comments

View all Next »

Elena 02/17/2015 at 01:45 pm # Reply

Thank you! Everything is very detailed and accessible.

Alexander 06/21/2015 at 07:53 pm # Reply

Is it possible to close an individual entrepreneur without leaving home via the Internet?

Natalia 06/22/2015 at 00:14 # Reply

Hello, Alexander. IP can be closed via the Internet. This procedure is regulated by the Federal Law “On State. legal registration individuals and individual entrepreneurs." And the electronic version of documents can be sent using the Unified Portal of State Services. In order to close an individual entrepreneur via the Internet, you will need to send the same information as if you applied in person to the territorial department of the tax office. The list includes: •a completed application for registration of termination of activity; •a receipt confirming payment of the state fee for registration of liquidation (one hundred and sixty rubles); •a letter containing information about personalized accounting. To close an individual entrepreneur through the official portal of the Federal Tax Service, you need to go to the website of the Federal Tax Service and place everything listed above. After you do this, you will receive a receipt in your mailbox stating that the application, receipt and letter were successfully received. After registration, you will receive information in the same mailbox confirming changes have been made to the register of individual

Alexander 07/16/2015 at 12:33 # Reply

Hello.., please tell me... how long does it take to close a bank account after receiving documents on closing an individual entrepreneur..? The situation is simply as follows...the individual entrepreneur was closed on July 7, and the last invoice was issued on July 5 and money is expected for it...approximately July 20...The bank account service was paid until November...

Natalia 07/16/2015 at 04:27 pm # Reply

Alexander, good afternoon. The legislation of the Russian Federation does not contain a “direct” answer to the question: “Is it necessary to close a current account in connection with the termination of the activities of an individual entrepreneur”? The deadline for closing a current account is also not clearly established by the legislation of the Russian Federation. Those. this period may be determined in the agreement with the bank. Therefore, wait until you receive the expected money, and then close your account.

Alexander 07/17/2015 at 06:12 # Reply

Hello! The situation is as follows. I closed at the beginning of the 3rd quarter. 15 years IP on the simplified tax system (6%). Taxes on income for the 1st and 2nd quarters have been paid, as well as contributions to the Pension Fund and the Social Insurance Fund. Do I need to submit reports -1. Tax return for this current year 2020, if yes, when? 2. Do I need to write any statements and submit any reports to the Pension Fund of Russia and the Social Insurance Fund and for what period?... Thanks in advance!

Natalia 07/17/2015 at 10:25 am # Reply

Alexander, good morning. 1. The deadline for submitting a declaration under the simplified tax system when closing an individual entrepreneur is no later than the 25th day of the month following the month in which business activity was terminated (clause 2 of article 346.23 of the Tax Code, hereinafter referred to as the Tax Code of the Russian Federation). In addition to the declaration to the tax office for The place of registration must additionally submit a notice of termination of business activity indicating the date of its termination - no later than 15 days from the date of termination of the individual entrepreneur’s activities. This is provided for in paragraph 8 of Art. 346.13 Tax Code of the Russian Federation. This notification is not a form of application to close an individual entrepreneur (which you initially submitted), but represents additional reporting when closing business entities that used the simplified tax system. 3. If you did not have employees, then you do not report to the funds and do not submit any applications. If you were hired, then after the dismissal of the last employee, you submit applications to the Social Insurance Fund and the Pension Fund for deregistration of you as an employer. The deadline for filing such applications has not been established, but you will be deregistered only within 14 days after submitting the applications.

Nadezhda 07/27/2015 at 12:59 # Reply

My individual entrepreneur was closed in May 2020, but the tax office said that I can submit the declaration before the end of the year, the main thing is not to forget, and taxes and contributions (pension and insurance) have not been paid. At the moment, the documents for opening an LLC are ready; can they refuse to open me?

Natalia 07/27/2015 at 01:14 pm # Reply

Nadezhda, they cannot refuse you to open an LLC in your situation.

Ekaterina 07/28/2015 at 15:39 # Reply

Good afternoon. I opened an individual entrepreneur on July 13, 2020 and due to certain situations I closed it on July 28, 2020, there were no employees, and the company did not have time to open. Do I need to go to the Pension Fund or the Social Insurance Fund?

Natalia 07/28/2015 at 05:09 pm # Reply

Ekaterina, you don’t have any relationship with the FSS at all, since there were no employees. To the Pension Fund of the Russian Federation and the Federal Compulsory Compulsory Medical Insurance Fund you must pay the amount of fixed contributions within 15 days. There is no need to submit reports to the Pension Fund and the Federal Compulsory Medical Insurance Fund.

Albina 07/28/2015 at 11:27 pm # Reply

Good afternoon ! Please tell me if the IP was not closed in a timely manner, fines and penalties were accrued, now we want to close it but we live in another city, we found out that we can send it by mail... the question is, do we need to submit any reports? And if necessary, what kind and can we send them by mail? .Thank you !

Natalia 07/29/2015 at 09:42 # Reply

Albina, if you did not have employees, then you do not need to submit reports to the Pension Fund and the Social Insurance Fund. If you had hired employees, then you had to submit quarterly reports to the Pension Fund - RSV-1; in FSS-3-FSS; in the annual tax form - personal income tax. Also, reports are provided to the tax office depending on the taxation system you choose. If you worked on a patent, you do not need to submit reports to the tax office, if on the simplified tax system - an annual declaration of the simplified tax system4, if on a UTII - a quarterly UTII declaration. Reports can be submitted by sending them by certified registered mail with notification. There is information about this on our website.

Albina 07/29/2015 at 10:54 am # Reply

Natalia, there were no employees, did I understand correctly that we only need to pass the USN4? (it was a simpleton) and I have another question, if possible, do we need to provide a declaration for all years or only for 2015? Thank you!

Natalia 07/29/2015 at 11:09 am # Reply

Albina, submit your simplified taxation system declarations for all years. Starting from 2014, failure to submit reports may result in a requirement from the Pension Fund to pay a fixed individual entrepreneur contribution in the amount of RUB 138,627.84.

Albina 07/29/2015 at 07:43 pm # Reply

Natalia, please tell me about one more question, can we send the report by letter along with documents on closing the individual entrepreneur? Thank you

Natalia 07/30/2015 at 09:36 pm # Reply

Albina, the report can be sent by certified registered mail with notification.

Elena 08/03/2015 at 16:36 # Reply

Good afternoon My situation is this: I was registered as an individual entrepreneur (USN) on March 12, 2020, and as a result, no activity was carried out. I was registered in one city, but now I live in another, so I want to send everything by mail. The Federal Tax Service website describes a package of documents: an application and a receipt for payment of the duty, but as I understand from the comments above, I still need to send an annual declaration to the simplified tax system4? Please tell me what else I need to do? And is there anything else I need to pay?

View all Next »