Do I need an individual entrepreneur charter, procedure for registering an entrepreneur

Modern Russian legislation does not require this document to register a citizen as an entrepreneur. However, a charter may be needed if you plan to expand your activities or if you want to specify the nuances of team management. Let's look at how to compose it correctly.

Why is the charter created?

The charter is a document that does not have a mandatory form.

Do you need a charter for an individual entrepreneur? No. A private person wishing to register as an entrepreneur is not required to draw up a document, since he does not have an authorized capital. An individual entrepreneur, when opening his own business, is a full manager of his funds, conducts activities at the risk of personal property and has the right to exercise power in the team without creating a charter.

If you want to establish internal rules of conduct, there are other types of documentation. The staff of employees recruited by the business manager is usually small, so it is more convenient to specify relations with the team in an employment agreement or, in addition to it, a collective agreement can be drawn up.

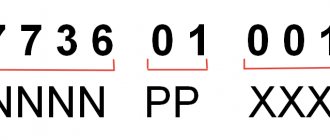

Do you need a charter when registering an individual entrepreneur? No, from the state’s point of view, an entrepreneur is the same taxpayer as individuals. A citizen who wants to start a business just needs to have identification documents, write an application (form P21001) and pay the state fee.

Do you need a charter for individual entrepreneurs in neighboring countries? Kazakhstan and the Republic of Belarus also do not require this document from the entrepreneur during registration.

Mandatory document details

The only case when a charter is necessary for an individual entrepreneur is a change in the form of ownership. Expansion of activities may include a transition to a different type of business and association with other businessmen. In this case, we are talking about a merger of capitals, so it is necessary to register the share of each in the constituent document.

The creation of a charter will also be relevant when recruiting a large staff. The existence of a document for an individual entrepreneur does not contradict the law and, if desired, can be drawn up by a business executive, the main thing is that the rights of employees are not infringed.

How to properly draw up a charter? What are its mandatory details? There is a standard form of the document, but you can develop it yourself.

However, the document must display the following data:

The provisions of the document should be as detailed as possible. The more detailed they are, the fewer conflicts there will be with hired personnel.

Additionally, you can specify the following points:

A well-drafted charter can improve the microclimate in the team. It also allows you to summarize all the rules of behavior and the main provisions of local acts in a single document. In addition, it saves time and helps to avoid difficulties when switching to another type of business. Every entrepreneur is capable of developing his own ideal charter. A sample document can be found on the Internet.

Do farms need a charter?

Peasant farms are a special field of activity. Do you need a charter for an individual entrepreneur who intends to engage in farming? The answer to this question depends on the number of founders. An individual entrepreneur has the right to independently establish a farm. In this case, the rules are similar to the usual registration of individual entrepreneurs. A charter is not required in case of registration of a KHF by one citizen.

It should include the following information:

The agreement is signed by all participants in the farm. It may also include additional information (if necessary).

From the site: https://biznes-prost.ru/nuzhen-li-ip-ustav.html

Does the individual entrepreneur have a charter?

Let us turn to the rules of the Russian language and find concepts that are rooted in the word “charter” and directly relate to the functioning of enterprises. The first thing that comes to mind is “Authorized capital” and this is correct.

The company's charter must contain information about its authorized capital at the time of registration. Otherwise, the organization simply will not be registered.

As you know, all legal entities have authorized capital; individual entrepreneurs do not have authorized capital. And this is one of the main reasons for the lack of need to formulate a charter for individual entrepreneurs.

In addition, there are many other reasons why the charter for an individual entrepreneur is not a mandatory document:

- Lack of start-up capital for individual entrepreneurs (and this is one of the main points in the formation of a regulatory document);

- The individual entrepreneur has a single founder, which makes it impossible for disagreements to arise regarding invested funds;

- Full responsibility of a private entrepreneur for his property and, accordingly, personal management of the organization;

- As a rule, individual entrepreneurs have a small staff, which eliminates the need to create a general set of rules in the form of a charter;

- Registration of an individual entrepreneur takes place under the name of the individual founder;

- Taxes are paid by an individual, that is, the founder’s data is saved.

Thus, at the legislative level, the charter is not a mandatory document when registering an individual entrepreneur.

But, if you want to transfer the individual entrepreneur to an LLC in the future, then the charter will need to be drawn up in any case. In addition, if you, as an individual entrepreneur, have a certain staff of employees, that is, you are a small organization, then a constituent document in the form of a charter will not be superfluous for you, but is also not a prerequisite for existence.

Thus, the answer to the question: “Can an individual entrepreneur act on the basis of the charter” is yes. But at the same time, the answer to the question: “Should an individual entrepreneur have a charter” is no, since a charter is not a prerequisite for the existence of an individual entrepreneur.

Does an individual entrepreneur have a charter?

Conducting a special assessment of jobs remains mandatory..03/31/2015 Recently, State Duma deputies rejected a draft law that provided for the possibility of...

- Is the delay in filing a notice of exemption...31.03.2015 In the month in which the entrepreneur received grounds for non-payment of VAT taxes, o..

- Who is responsible for all actions performed..03/31/2015 The full extent of responsibility for maintaining work records, as well as any actions related..

- New penalties await those who violate 03/31/2015 The Rosstat Agency has prepared another draft legislative act.

So, now they .. - Changes in the procedure for extending contracts with pregnant women..03/31/2015 Not long ago, further changes in labor legislation were subject to approval.

Main...

What does the charter of a sole proprietor consist of?

The creation of a charter for an individual entrepreneur is an optional condition. The document itself is a set of rules that outline the activities of the organization and the procedure for performing work. If an entrepreneur works independently, without additional personnel, a charter is not required.

At this stage, a completely normal question arises for a person who has not previously been involved in business: whether it is necessary to formulate a charter.

We fill out work books for individual entrepreneurs

Registration of labor relations with an employer - an individual entrepreneur who hires personnel to conduct production activities - has its own characteristics.

Registration number in the Pension Fund according to TIN

How to find it if you lose an official letter, you will find out below.

Basic concepts Policyholders under compulsory pension insurance (OPI) include: Persons who make payments of insurance premiums for individuals (enterprises, individual entrepreneurs).

Lawyers and notaries operating privately. Voluntary persons who have entered into legal relations with the Pension Fund.

Their obligation to register as payers of compulsory insurance contributions to the Pension Fund of the Russian Federation is enshrined in the Federal Law

Purpose of the registration number The registration number in the Pension Fund is required for the following actions: payment of various fees; referral to the tax reporting service. In addition, it is also needed for the Pension Fund itself; based on the registration number, it recognizes the policyholder and makes any accruals on it. The procedure for registering with the Pension Fund of Russia for organizations The registration number of an LLC in the Pension Fund of Russia is received within a period of five days after the tax service transfers information about the new business entity to the Pension Fund of Russia.

What is the difference between individual entrepreneurs and companies?

The question of the charter of an individual entrepreneur does not arise very rarely among citizens who would like to try themselves in entrepreneurship or formalize their private activities, which in fact is entrepreneurship. Knowing that when registering a company, they must submit the company’s charter to the tax office, they are also trying to find an answer to the question: what should be the charter of the individual entrepreneur. The question may sound naive for a professional registrar who helps register LLCs and individual entrepreneurs, but as Socrates said: “It’s not a shame not to know, but it’s a shame not to want to know.”

Therefore, the question of why individual entrepreneurs do not have charters deserves a detailed answer.

An individual entrepreneur is a kind of hybrid of an ordinary citizen and a company. He is a person with all his rights and responsibilities, he can be subject to criminal prosecution and even die, but at the same time he participates on equal terms in transactions and other relations with organizations: joint-stock companies, limited liability companies, cooperatives, etc.

From a comparison of the words “individual” and “society” it follows that an entrepreneur is always one person, and firms - JSC, CJSC, LLC - are organizations with more than one participant (with rare exceptions, when an LLC has only one participant, which is not prevents him from accepting new members into society).

What should the charter of an individual entrepreneur contain?

Any citizen who wishes to engage in any activity for the purpose of generating income can become an individual entrepreneur subject to certain conditions.

As you know, all legal entities have authorized capital; individual entrepreneurs do not have authorized capital. And this is one of the main reasons for the lack of need to formulate a charter for individual entrepreneurs.

Such a document is useless at the first stage of registration. It is up to the business owner to decide whether to have it or not; no sanctions are imposed for the absence.

Additional IP documents

Throughout the course of its activities, the accounting of an individual entrepreneur is replenished with various certificates, contracts, acts, invoices and other documents. This means that the counterparty’s request to provide him with individual entrepreneur’s papers will not be limited to just a list of “constituent” documents. Some documentation may be requested during the audit by the tax office and other regulatory authorities.

In addition to the basic documents, an entrepreneur must have the following papers at his enterprise:

- Tax reporting (any documents proving timely payment in full of taxes, fees, penalties and fines).

- Documents required in connection with the use of a cash register (agreement with the fiscal data operator, journal of cash transactions, etc.).

- Personnel nomenclature (employment contracts, employee statements, etc.) - only required by individual entrepreneurs who employ hired personnel.

- Safety and labor protection instructions (if the individual entrepreneur hired employees).

- Agreement on opening a current account in a banking institution (if there is an account).

- Agreement on the use of the Bank-Client system (if any).

- Originals of reports based on the results of inspection by regulatory authorities.

- Copies of agreements on ownership or lease of property (premises, equipment, transport) that is used in the course of business activities.

- Control log.

- Documents on participation in domestic and foreign organizations (if the individual entrepreneur participates in organizations as a founder).

Other documents may be required, depending on the chosen area of activity and tax regime.

Download the Charter of an individual private enterprise

- Foundation agreements: samples (Full list of documents)

- Search for the phrase “Memorandum of Association” throughout the site

- “Charter of an individual private enterprise”.pdf

- Documents downloaded

Entered into the database

Corrections have been made to

- Treaties

- All documents

- Holidays and weekends calendar for 2019

- Small business registration is useful

- How to draw up a contract yourself

- OKVED code table

On our website, everyone can find a contract or a sample document of interest for free; the database of contracts is updated regularly. Our database contains more than 5,000 contracts and documents of various types. If you notice an inaccuracy in any agreement, or the impossibility of the “download” function of any agreement, please contact us using the contact information. Have a good time!

This is interesting: Personal income tax payment from dividends 2020 sample filling

Today and forever

— download the document in a convenient format! A unique opportunity to download any document in DOC and PDF absolutely free of charge. Only we have many documents in such formats. After downloading the file, click Thank you,” this helps us form a rating of all documents in the database.

Types of constituent documents, do individual entrepreneurs need them?

The constituent documents of an organization determine its legal status and are the basis of its activities. The mandatory package of documents of the Civil Code (Article 52) includes:

- charter (including standard) - as a general rule for all legal entities;

- constituent agreement - for business partnerships;

- Federal law on state corporations - accordingly, for a state corporation.

The charter is needed to regulate the relationship between the founders, employees and partners of the company. The law does not oblige individual entrepreneurs to prepare constituent documents for the following reasons:

- The individual entrepreneur invests only his own funds in the business and independently determines the order of spending;

- the entrepreneur is solely responsible for the transactions he makes - he cannot have disputes with the co-founders;

- the businessman has no start-up capital.

If desired, an individual entrepreneur can draw up a charter, but the document is not subject to registration with the tax authorities and will have the status of an internal document of the company.

How an entrepreneur can use standard options

Businessmen are in no hurry to abandon the developments of legal entities. In practice, documents drawn up for business companies are widely used. Thus, the 2020 samples published on the tax service website act as a kind of basis. Templates are guidelines for choosing control systems and methods for achieving goals. In the regulations, entrepreneurs prescribe the following points:

- start-up capital for individual entrepreneurs;

- directions of economic activity;

- features of contract work;

- goals and objectives;

- principles of attracting investments;

- document flow and accounting system;

- pricing rules;

- control methods;

- terms of doing business;

- relationships with hired employees.

An improvised charter of an entrepreneur can replace a whole complex of internal documents. It is advisable to approve such an act with impressive turnover and expansion of the structure. There is no need to register the authorized capital of an individual entrepreneur and register regulations with the tax authorities.

Charter structure

The Charter consists of the following structural elements:

- Header of the constituent document. Here you must indicate the founder of the company, the date of registration with the Registration Chamber, as well as the legal address of the company. In the case of an individual entrepreneur, the charter will be with one founder; when moving to an LLC, it will be necessary to enter the remaining shareholders.

- The first chapter: “The subject and goals of the enterprise.” At this stage, it is necessary to duplicate the header of the document, indicate the main goals of the existence of the enterprise (satisfying the needs of society for products produced by the enterprise, providing jobs for citizens, etc.), as well as the types of activities that the entrepreneur will engage in (production and provision of services in any area , production and others).

- Chapter two: “Property of the enterprise.” In this chapter, you need to indicate the amount of fixed assets and current assets of the enterprise, the sources of formation of the company’s property, and also state the right of individuals to dispose of the property of the enterprise and the economic responsibility of the enterprise to society and the state.

- Third chapter: “Production and economic activities of the enterprise.” Indicate here the basis for the emergence of relations with the enterprise of third parties (contractual), the right to acquire property and other actions necessary for the implementation of the company’s activities, the basis for setting prices or tariffs (independently, on a contractual basis, as prescribed by the state), methods of making payments with third-party organizations and persons (cash and non-cash).

Chapter four: “Education and use of enterprise funds.” Here, be sure to indicate the sources of financial resources. This could be profit, income from sales of company property and securities, depreciation, loans. Also in this chapter it is necessary to indicate the main areas of expenditure of the funds received.

Fifth chapter: “Enterprise management.” In this chapter, indicate the person managing the organization, the method of his appointment and dismissal. The rest of the management positions, as well as the positions of ordinary specialists, and the methods of their appointment and dismissal are also indicated here. The procedure and consequences of the entry and exit of the founders from the constituent assembly are prescribed here.

Chapter six: “The enterprise’s workforce, organization, remuneration and labor discipline.” Here you will have to indicate the maximum number of employees of the enterprise, documents regulating controversial situations, the procedure for determining the form and amount of remuneration for workers and other income, sanctions for violating the rules of labor discipline, safety regulations and other regulatory documents.

Chapter seven: “Social insurance.” We will not dwell on this stage for long; all you need to indicate is that your company will make all the necessary contributions and implement activities to improve the working and living conditions of employees. Chapter Eight: “Acceptance and registration of the Charter of the enterprise.” We indicate the place of registration of the charter and note that the enterprise has acquired the status of a legal entity (remember that we are drawing up the charter for an individual entrepreneur, that is, for an individual, but taking into account the possibility of transferring it to the LLC format), and also indicate the place where the original of this document will be stored.

Ninth chapter: “Reorganization and liquidation of the enterprise.” This chapter describes the procedure for reorganization and liquidation of a company: who makes the decision on liquidation, in which cases the company is subject to mandatory reorganization and liquidation, from what moment the enterprise will be considered liquidated or reorganized, who carries out the liquidation, who disposes of free property after the closure of the company.

What does the structure include?

A sample charter of an individual entrepreneur includes a head and chapters, with a detailed description of the rights and obligations of the parties.

When filling out the document, you will need to consider the following elements:

- filling out the header. Here they indicate the personal data of the individual entrepreneur, date of registration, legal address. In the case where one person acts as a founder, then when switching to an LLC you will need to enter the remaining members;

- Chapter 1 Describe the main goals of the enterprise. At the same time, they duplicate the information from the header and indicate their goals. We must not forget about the type of activity, in what area it is carried out and what products are provided to consumers;

- Chapter 2 Includes information about owned property. The size of the reserve fund, current assets, sources of financing are indicated;

- Chapter 3 Production and economic activities. Indicate that relationships with potential clients and suppliers are established on the basis of contracts. And also how the payment is made - in cash or non-cash. Prices are set by government regulations, personally by the owner or on the basis of a concluded agreement;

- Chapter 4 How funds are spent and how they appear. Here you need to indicate the sources from which the funds come. These include income from sales of goods and services, sales of enterprise property, and loan processing. Also, do not forget about the expenses of the funds received;

Chapter 5 Organization management. There is information about the person involved in the activity, how he was hired and the method of removing him from his position. All management positions and positions of other employees are also indicated - the methods of their acceptance and dismissal. The procedure for joining and leaving the founders is also prescribed; Chapter 6 Remuneration of employees, penalties for violations. This indicates the maximum number of personnel, methods for regulating conflicts and disputable situations, the method of determining the amount of wages, payments, options for disciplinary action for violations, safety precautions during work; Chapter 7 Insurance – payments and contributions aimed at improving working conditions; Chapter 8 Registration of the constituent document. Indicate the place where the registration took place and will be kept in the original; Chapter 9 Process of reorganization and liquidation. The entire process of reorganization and liquidation of the organization is described in detail. Namely, in what cases is this possible, when a change occurs, who is involved in it and has the right to dispose of the remaining property.

In order not to do the same work repeatedly, it is better to familiarize yourself with the main elements in advance and write them down in the charter. Question: “Does the individual entrepreneur have a charter?” – common among budding entrepreneurs. The answer to this can be found above.

Who draws up the articles of association? You can get the proper help from a lawyer who specializes in corporate law or from a consultant located at a business development agency.

Each chosen method has pros and cons, for example:

- When drawing up the charter yourself, there is a high probability of making legal mistakes.

- The owner may lose sight of the specifics of the enterprise.

- It's difficult to implement everything yourself.

Regardless of your personal knowledge of the structure that is present in the charter and the available sample documents, it is better to seek help from a qualified specialist. This will significantly save time and avoid some difficulties when switching to an LLC.

Does the individual entrepreneur have a charter or only a decision to accept the individual entrepreneur?

e. a copy of the passport of a citizen of Russia); c) a copy of a document established by federal law or recognized in accordance with an international treaty of the Russian Federation as an identification document of a foreign citizen registered as an individual entrepreneur (in the event that an individual registered as individual entrepreneur is a foreign citizen); d) a copy of a document provided for by federal law or recognized in accordance with an international treaty of the Russian Federation as an identification document of a stateless person registered as an individual entrepreneur (if an individual registered in as an individual entrepreneur, is a stateless person); e) a copy of the birth certificate of an individual registered as an individual entrepreneur, or a copy of another document confirming the date and place of birth of the specified person in accordance with the legislation of the Russian Federation or an international treaty of the Russian Federation (in if the submitted copy of the identity document of an individual registered as an individual entrepreneur does not contain information about the date and place of birth of the specified person); e) a copy of a document confirming the right of an individual registered as an individual entrepreneur to reside temporarily or permanently in the Russian Federation (if an individual registered as an individual entrepreneur is a foreign citizen or a stateless person); g) an original or a copy of a document confirming, in accordance with the procedure established by the legislation of the Russian Federation, the address of residence of an individual registered as an individual entrepreneur, in the Russian Federation (if the submitted copy of the identity document of an individual registered as an individual entrepreneur, or a document confirming the right of an individual registered as an individual entrepreneur to temporarily or permanently reside in the Russian Federation, does not contain information about such address); h) notarized consent of the parents, adoptive parents or trustee to carry out entrepreneurial activities by an individual registered as an individual entrepreneur, or a copy of the marriage certificate of an individual registered as an individual entrepreneur, or a copy of the decision of the guardianship and trusteeship authority or a copy of the court decision declaring an individual registered as an individual entrepreneur fully capable (if the individual registered as an individual entrepreneur is a minor); and) a document confirming payment of the state duty.

Does an individual entrepreneur need a charter or can he do without it?

The legislation of the Russian Federation does not provide for the existence of a charter as such for individual entrepreneurs.

In order for an individual to register as an individual entrepreneur, he only needs to provide the Federal Tax Service with the necessary application, a photocopy of his passport and a receipt for payment of the state duty. Who needs a charter and why?

If a person decides to open his own business, he must collect the necessary package of documents required by law. As a rule, in this case the question arises: “Does an individual entrepreneur need a charter?” Fortunately, many beginning individual entrepreneurs can breathe easy: they are spared from drawing up this document, since it is not at all necessary to have a charter in place.

If you really want to, you can draw up a certain set of rules only for use within the team, although there is little point in this, since the staff cannot include more than five people, and with such a small number of subordinates, it is better to discuss all the details in person. Moreover, in the event of any disagreements or conflicts within the organization, such a document will not carry any legal force.

Having a charter has a completely different meaning when it comes to legal entities. They are required to write down the charter, since it is an important component of the documentation package required for registration. Accordingly, the Federal Tax Service can familiarize itself with this document at any time.

Why is a charter created?

A small enterprise can be organized only if there is an authorized (start-up) capital, which cannot be less than ten thousand rubles. The charter must state who the founders of the organization are. If there are several of them, it is very important to clarify how the start-up capital is distributed between them and what happens if one of the founders of the company for any reason is unable or refuses to participate in the activities of the enterprise and is forced to leave the founding staff .

An extremely important circumstance is the fact that the charter must spell out not only the rights, but also the direct responsibilities of each of the founders. Thus, various penalties may be provided in the form of fines if the money was not deposited or was not deposited in full within the prescribed period.

In addition, the likelihood of conflicts increases significantly when multiple owners come together. That is why the procedure for resolving problem situations should be set out in the text of the document.

The charter does not have strictly established rules and is written to suit the needs of each specific organization. The law does not regulate who should be the preparer, but since it concerns serious financial issues, it is better to entrust this paperwork to a trusted lawyer who specializes in this area.

Do you need a charter for an individual entrepreneur??

Based on this, we can conclude whether a charter is needed for an individual entrepreneur. It becomes quite obvious that no. Firstly, start-up capital for an individual entrepreneur is not provided for by the legislation of the Russian Federation. Individual entrepreneurs, as a rule, invest their accumulated savings, borrowed funds, or apply for payments from the state. The very word “individual” seems to imply that such a business relates to one person, which means that there were not and cannot be several owners with the same rights in this matter, as a result of which conflicts will not arise. Workers hired by an individual entrepreneur are usually not interested (at least they shouldn’t be) how much money the employer has invested in his business and how he wants to dispose of it in the future.

Mandatory document details

The only case when a charter is necessary for an individual entrepreneur is a change in the form of ownership.

Expansion of activities may include a transition to a different type of business and association with other businessmen. In this case, we are talking about a merger of capitals, so it is necessary to register the share of each in the constituent document. Establishing an LLC requires clean documentation and transparency of the entrepreneur’s activities. Accumulating authorized capital and recruiting staff is not enough. It is necessary to carry out real accounting of the movement of material assets, income and expenses. The existence of a charter from the first days of an individual entrepreneur will help to properly maintain documentation.

The creation of a charter will also be relevant when recruiting a large staff. The existence of a document for an individual entrepreneur does not contradict the law and, if desired, can be drawn up by a business executive, the main thing is that the rights of employees are not infringed.

On video: Law and business. Issue 1. Small business - from idea to implementation

How to properly draw up a charter? What are its mandatory details? There is a standard form of the document, but you can develop it yourself.

However, the document must display the following data:

- details of the founder and information about the registration of the entrepreneur;

- location of the enterprise;

- type of economic activity;

- rights and obligations of the workforce and the founder;

- description of the enterprise’s property – fixed and current assets;

- sanctions applied to employees for failure to fulfill duties;

- responsibility of the founder to the state;

- profit generation;

- employee insurance and the procedure for deductions to funds;

- the procedure for organizing cooperation with counterparties;

- internal document flow rules;

- the procedure for changing the form of ownership in the event of a transition to an LLC;

- grounds for termination of activity.

The provisions of the document should be as detailed as possible. The more detailed they are, the fewer conflicts there will be with hired personnel.

Additionally, you can specify the following points:

- period of creation of a business entity;

- the procedure for selecting the person managing the enterprise;

- the procedure for changing capital and depositing funds on the balance sheet of an enterprise by a businessman;

- operations with profit, the share of income that is deposited into the company’s account;

- the procedure for making decisions by the work collective;

- other issues of internal activities.

A well-drafted charter can improve the microclimate in the team. It also allows you to summarize all the rules of behavior and the main provisions of local acts in a single document. In addition, it saves time and helps to avoid difficulties when switching to another type of business. Every entrepreneur is capable of developing his own ideal charter. A sample document can be found on the Internet.

On video: Taxes and reporting for peasant farms and why I registered it

https://youtube.com/watch?v=qKw_O8636cQ

| Home » Articles » Legal consultant documentation |

What is a charter

The charter is a constituent document, therefore it is necessary only for the founders who create the enterprise. When registering a legal entity, a separate structure is formed, which acts in civil relations on its own behalf and has separate property. The founder who has invested personal savings in his enterprise no longer has the right to them; they become the property of the company.

The charter precisely provides for all the rules of interaction between the founder and his company, as well as between the participants themselves. The charter can be individually developed or standard, but it must comply with the mandatory requirements established by law.

Here is the list of information:

- Name of the legal entity in Russian (full and abbreviated);

- Year of establishment of the organization;

- Location or full legal address;

- Powers of the company's management bodies;

- The amount of contributed authorized capital;

- The procedure for the withdrawal of a participant and the transfer of his share;

- Powers and rights of company participants, as well as their responsibilities;

- The procedure for storing mandatory documents and providing information to external users.

It is no longer necessary to indicate the persons included in the company in the charter. You can find out information about the participants from a free extract from the Unified State Register of Legal Entities or from the constituent agreement.

A standard charter that meets the requirements of the Federal Tax Service can be prepared in the same free 1C-Start service, in which we, in most cases, prepare all our sample registration documents for individual entrepreneurs.

Additionally, the charter includes other conditions that the company's participants must follow:

- The period for which the legal entity is created;

- The procedure for increasing and decreasing the authorized capital;

- Transactions with shares (sale, donation, inheritance, pledge);

- The company’s ability to acquire the share of an exiting participant on a preferential basis;

- The procedure for making decisions at general meetings, as well as changing the proportions of votes when discussing certain issues;

- Prohibition on contributing shares in the authorized capital of certain types of property, etc.

You can clearly see what is prescribed in the organization’s charter in samples that are freely available on the Internet.

The charter of an individual entrepreneur is a myth or a real document of an individual entrepreneur

- Is it possible to reflect production in an employment contract?

- Plot up to 20 sq.m. to place a retail outlet..03.27.2015 The Ministry of Industry and Trade created amendments to the current version of the law..

- The updated 4-FSS reporting form has become official..03/26/2015 Every entrepreneur for whose benefit hired workers work is obliged quarterly..

- For review by the Prosecutor General's Office and other prosecutorial bodies..03.26.2015 One of the priority areas of activity at all levels of prosecutor's offices is the creation..

- New powers are expected by the bodies of the constituent entities of the Russian Federation already in..03/26/2015 Recently, the State Duma has been considering a draft law, according to which the...