Charitable foundation and the basics of its functioning.

Non-profit entities that accumulate financial capital for subsequent transfer to those in need are called charitable foundations. Such a mechanism is extremely important for the existence of society, since the country’s budget does not always cover problematic areas of public life.

And the best thing about charity is that every caring person can make a feasible monetary contribution to a common cause (for example, supporting sports, medicine or science). Double control on the part of supervisory authorities and active citizens guarantees that all funds are spent exclusively for their intended purpose.

The functioning of the charitable foundation consists of the accumulation of monetary donations and their distribution among those in need. The work of the fund is impossible without a staff of employees who receive wages. Thus, part of the funds inevitably goes to pay off debts to staff.

Along with its main activities, the foundation can open an entrepreneurial direction, but only with an emphasis on charity.

This material will cover in detail all the nuances of how to establish a charitable foundation.

The executive management body of the fund, its functions and competence

Organizational support for the current activities of the fund falls on the executive body. The legislator does not impose any requirements on the composition of executive bodies, and also does not establish its name.

Based on the provisions of the Civil Code and law enforcement practice, the following can be stated:

- The executive body of the fund can be collegial or sole.

- It is possible to combine: general director/chairman + board. Then significant issues are under the jurisdiction of the collegial body, and minor issues are under the jurisdiction of the sole executive body.

- Branches and sectors can function within the collegial executive body of large funds.

The executive body of the fund is, as a general rule, elected by its highest collegial body. However, according to relevant legislation on certain types of funds, as well as the fund’s charter, this power can be attributed to the prerogatives of the founders.

The competence of the executive body/bodies of the fund includes the resolution of all issues of its functioning and activities, except those referred to the exclusive competence of the general meeting or other supreme collegial body.

Within the limits of clause 3 of Art. 123.19 of the Civil Code, the legislator refers to the possibility of imposing an obligation on a member of the executive body to compensate for losses caused to the fund by his unlawful actions/inaction, improper performance of official duties, etc. The grounds and procedure for holding officials of the executive bodies of legal entities liable are stipulated in Article 53.1 of the Civil Code.

Step-by-step instructions on opening a charitable foundation.

How to independently create a charitable foundation from scratch in Russia? To do this, just follow the step-by-step guide that will make your dream come true.

a) Clear formulation of the direction of activity.

You need to understand that profit is not the priority goal of an NPO. The main task is to support those in need. To do this, you need to know how to open a charity fund to help children, disabled people, orphans and people in difficult life circumstances. Specificity is important here, because “fuzzy” ideas about the future can stymie the idea in the early stages. You should also create a charter and choose a location for the future project.

b) Search for investors and philanthropists.

It’s great if the founder’s initial capital allows him to implement the project on his own. But when funds are limited, you have to ask investors for help. A successful start gives hope for a bright future. But the question is that the investor must be confident in the reliability of his investments, and after the first month of work he may require a report on the results. Therefore, this aspect should be approached thoroughly.

Finding an investor will be much easier if the organizer has a wide circle of acquaintances and a large number of contacts.

c) The appearance of BF. Directly, the legal stage of creation. Registration of a charitable foundation takes place at the Ministry of Justice of the Russian Federation. A detailed overview of how to register a charity will be provided later.

d) Recruitment of staff. Many employees join voluntarily and are volunteers. You should hire several paid specialists (technical personnel, accountant). When selecting candidates, it is important to pay close attention to personality qualities, so that over time you do not become disappointed in the hired employee who systematically violates the organization’s charter.

Completing these steps precedes the start of work in the chosen direction.

Found documents on the topic “charter fund charter”

- Charter of the charitable foundation Constituent agreements, charters → The charter of the charitable foundation

was approved by protocol No. 1 of the constituent meeting of "" 20. Charter of the charitable fund for the social protection of citizens 1. general provisions 1.1. charitable foundation social... - Typical charter charitable fund

Founding agreements, charters → Model charter of a charitable foundation... the sample was approved by the decision * of the meeting of the founder of the fund No. dated "" model charter of the charitable foundation for helping homeless animals "tramp"** Veliky Novgorod 2012 ...

- Sample. Charter non-profit organization - charitable fund

Founding agreements, charters → Sample. Charter of a non-profit organization - a charitable foundationapproved by the meeting of founders, protocol no. dated "" 20, charter of the charitable foundation "" 20 1. general provisions 1.1. n...

- Minutes of the founding meeting on the creation charitable fund

Founding agreements, charters → Minutes of the constituent meeting on the creation of a charitable foundation... of the special general meeting. on the establishment of a charitable foundation for the support of motherhood and childhood. on approval of the charter of the charitable foundation for the support of motherhood and childhood. on state registration of a charitable foundation under...

- Sample. Exemplary charter fund

Founding agreements, charters → Sample. Model charter of the fundsample charter of the fund "" (name) i. general provisions 1. the foundation is a non-profit organization established by the mentioned...

- Charter Fonda

Founding agreements, charters → Charter of the Fundcharter of a non-profit organization fund for assistance in the development of the Internet 1. general provisions 1.1. non-profit org...

- Charter Public fund

Founding agreements, charters → Charter of the Public FundMinutes No. 1 of the charter of the regional public fund “development” were approved by the constituent assembly 1. general provisions 1.1. regional society...

- Sample. Charter non-profit humanitarian fund

Founding agreements, charters → Sample. Charter of a non-profit humanitarian foundationThe charter of the non-profit humanitarian fund was “registered” by the Moscow Department of Justice reg.no. "" 20...

- Sample. Exemplary charter stock exchanges

Founding agreements, charters → Sample. Sample charter of a stock exchangesample charter of stock exchange i. general provisions 1.1. The stock exchange (hereinafter referred to as the exchange) is a non-profit organization...

- Minutes of the founding meeting charitable society (example)

Founding agreements, charters → Minutes of the founding meeting of a charitable society (example)... and children" and admission to its membership. about the program of activities of the charitable society “Land and Children”. 2. discussion of the draft charter of the charitable society “land and children”. 3. elections of the company’s board, president and audit commission. 1. listening...

- Agreement about charitable donation

Agreement on donation of real estate and other valuables → Agreement on charitable donation...physical activity, and the beneficiary accepts charitable donation to use the latter in accordance with the statutory goals of the beneficiary’s activities, namely: organizing events aimed at (it is necessary to write what...

- Agreement on targeted donation in charitable purposes

Agreement on donation of real estate and other valuables → Agreement on targeted donation for charitable purposes...the charitable foundation , hereinafter referred to as the “beneficiary”, represented by the director of the foundation , acting on the basis of the charter , on the other hand, collectively referred to as the “parties”, and separately as the “party”, have entered into this agreement...

- Sample. Agreement on deferment of debt repayment of insurance contributions to the Pension fund Russian Federation (letter from the Pension fund RF dated October 27, 1995 No. yul-03-11-6374-in)

Insurance, reinsurance contract → Sample. Agreement on deferment of repayment of debt on insurance contributions to the Pension Fund of the Russian Federation (letter of the Pension Fund of the Russian Federation dated October 27, 1995 No. yul-03-11-6374-in)...acting on the basis of the regulations, on the one hand, and, hereinafter referred to as the debtor, in the person acting on the basis of the charter , hereinafter referred to as the guarantor, in the person of the director, acting on the basis of the charter , on the other hand, concluded a contract...

- Monthly summary report on the transferred amounts of insurance premiums, payments, financial sanctions to the territorial fund and insurance premiums, financial sanctions to the federal fund compulsory health insurance. Form No. eso (order FFOM

Accounting statements, accounting → Monthly summary report on the listed amounts of insurance premiums, payments, financial sanctions to the territorial fund and insurance premiums, financial sanctions to the federal compulsory health insurance fund. Form No. eso (order FFOMAppendix 5 to the order of the Federal Fund dated March 29, 1996 no. 23 approved by order of the Federal Compulsory Health Insurance Fund

- Sample. Exemplary charter union

Founding agreements, charters → Sample. Sample charter of the unionsample charter of the union "" this charter was developed on the basis of Art. 121 - 123 Civil Code of the Russian Federation, other legislative acts, and...

Registration of a charitable foundation with the Ministry of Justice.

How to open a charitable foundation in Russia? That's right, only through the local branch of the Ministry of Justice.

How do you start creating a charitable foundation? From collecting the necessary certificates and papers. The application must be submitted within a 3-month period from the date of the decision to engage in activity.

The registration procedure includes several stages:

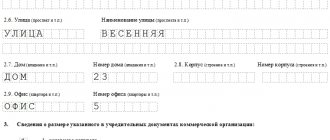

- Submitting an application for registration (form RN0001). The form is drawn up in 2 copies, one of which is certified by a notary office.

- Preparation of a package of documents for the institution. This includes: the organization's charter (3 copies) and information about the co-founders (2 copies).

- Receive a receipt for payment of the state duty, which is about 4 thousand rubles.

- Collect information about the actual and legal addresses of the fund.

- Provide documents confirming the fact of ownership of the premises for the organization.

According to the law, it is prohibited to use the rented space for the activities of the charitable foundation. That is why it is necessary to prove the fact of ownership of property.

The current package of documents is specified in clause 4 of Art. 13.1 Federal Law No. 7. Controlling authorities do not have the right to require other additional documents. The review process takes 14 business days from the date of application. After this, within 5 working days, an entry about the organization is made in the general register. Denial of the right to registration is grounds for appealing the decision in court.

It will take approximately 7 days to collect all the necessary documents. The most time-consuming stage is drawing up the internal charter. The content of the document is regulated by Art. 14 Federal Law No. 7. It must contain the following information:

- Name of the database.

- Legal address.

- Information about branches.

- Sources of income.

- Operating principles of the organization.

Legal aspects of charitable activities.

The legal interpretation of the concept of a charitable foundation implies any non-profit entity that does not pursue the goal of self-enrichment. On the contrary, the main task of such an organization is to provide social assistance of a certain type.

Article 118 of the Civil Code of the Russian Federation states that the founder of an NPO may be an individual. face. In addition, legal entities also have a similar right. The law is loyal to foreign investors - even a foreign citizen is allowed to open a fund.

It is noteworthy that the law allows for the conduct of business activities for charitable organizations on their own behalf or through the creation of a new joint-stock company.

This type of activity is subject to certain restrictions:

- At least 4/5 of the proceeds must be reinvested in the charitable foundation.

- The specifics and scope of the fund’s activities must be fully reflected in all reporting documents.

- Entrepreneurship cannot contradict the organization's charter.

The legal basis for the functioning of the CF is stated in:

- Constitution of the Russian Federation.

- Civil Code of the Russian Federation.

- Federal Law No. 135.

- Federal Law No. 7.

The Constitution and the Civil Code prescribe the most important rights and freedoms. According to the regulations, an NPO is a full-fledged independent subject of legal relations. This offers some benefits:

- Ownership of freehold property.

- Possibility to open representative offices and branches.

- Protect interests through the courts.

Federal Law No. 135 (“On Volunteering”) regulates the rules and regulations within the framework of the functioning of NPOs:

- Probable directions of the fund's activities.

- List of possible participants.

- Description of the legal entity.

- The management team and the founding process of the Charitable Foundation.

- Possible branches.

- Controlling structures.

Federal Law No. 7 (“On NPOs”) stipulates the regulations for the creation and operation of a non-profit organization:

- Detailed registration process.

- Rules for preparing accompanying documentation.

- Legal description of the organization's status.

- The procedure for resolving conflict situations.

- Fund management process.

Each of the regulatory documents contains important information that guides all NPOs in Russia.

Types and features

In practice, there are several types of funds. It is worth considering their features and characteristics separately.

Charitable

A charitable foundation is an NPO. It was established by combining several contributions of a property nature. The purpose of its creation and existence is to conduct charitable activities.

The charter acts as a regulation on the procedure for registration and conduct of activities . There are two options for obtaining funds for the activities of the organization:

- searching for a sponsor in the person of a philanthropist (state or organization);

- independent income.

Government structures, local governments, and enterprises of state and municipal importance cannot participate in charitable foundations.

Charitable foundations do not have the right to participate in business companies along with other legal entities. The structure of a charitable foundation does not provide for membership, therefore legislation allows participation in them directly or through business entities.

The regulation regarding the activities of this organization is Federal Law No. 135 of August 11, 1995. It is mandatory to form a board of trustees represented by a controlling structure .

The purpose of its formation is to oversee the activities of the organization and the use of its funds. The board of trustees created within the framework of the fund has the right to appeal to the courts, declaring the need to liquidate the enterprise.

How is a typical charitable foundation structured? The answer to the question is in the video below.

Public

This is one of the types of non-membership NPOs. The purpose of creation is to form property and its subsequent application for public purposes.

- Providing social support for citizens and their protection, as well as improving the existing financial situation of low-income segments of the population.

- Carrying out social rehabilitation of unemployed persons and citizens with disabilities who, due to circumstances, are not able to act independently.

- Preparing citizens to overcome the results of natural disasters, environmental and industrial disasters.

- Providing comprehensive assistance and support to persons affected by repression, terrorist attacks, and natural factors.

- Promoting the improvement of peace and friendship between different nationalities.

- Interpretation of the concept of the institution of family and its strengthening in society.

- Assistance in obtaining education and enlightening citizens in the scientific, cultural, and social spheres.

- Maintaining health standards and principles, promoting a healthy lifestyle.

- Propaganda of sports.

- Protection of the environment and historical sites.

The Foundation has the right to conduct business activities that correspond to these goals.

Non-profit organization

This is an NPO, and it does not require membership and is established by individuals and legal entities on the basis of contributions made voluntarily. The creation can be carried out for the purpose of providing comprehensive services related to education, culture, healthcare, science, and sports.

The regulation in this direction is Federal Law No. 7 of January 12, 1996. In accordance with it, a non-profit organization can carry out entrepreneurial activities and achieve the goals for which it was formed. However, there is no distribution of profits between the founders .

The founders do not retain the right to property, nor do they retain responsibility for obligations. The organizers do not have any privileges compared to the participants of the NPO and can use its services on an equal basis with other persons under similar conditions.

Supervision and control of activities is carried out in the manner prescribed in the constituent documentation. The general founding meeting, council or board acts as the highest collegial management body.

Establishment

An institution is usually understood as an NPO that was formed by its owners in order to solve managerial and social problems. It may be sponsored by the organizer in whole or in part .

The owner can be a legal or natural person, as well as a municipal entity or government agency. There is a possibility of participation of several owners. The basic constituent document is the charter, which is approved by the owner .

The institution bears direct and immediate responsibility for the obligations that are at its disposal. If there are not enough funds available to solve problems, and it is impossible to pay off debts with them, they are collected with the participation of the owner of the organization.

Along with this, the founder has the right to grant the institution the right to carry out commercial activities. The income received from it is subject to mandatory accounting on the balance sheet and is a means of economic activity.

Non-residential

The non-residential fund represents a complex of premises that are in state or municipal ownership. This concept is given in Art. 7.24 Code of Administrative Offenses of the Russian Federation.

The law states that the non-residential stock includes buildings, structures, structures and individual premises, including built-in and attached areas, which are not recognized as residential and do not meet the requirements for the residential stock.

It is customary to include primary technical inventory , which is carried out by the technical accounting body and the BTI.

Planning tips.

How to open a fund to help those in need? The first step towards creating a project will be choosing a direction. For example, you can concentrate your efforts on supporting orphans. Accordingly, all funds received on the balance should be transferred to orphanages and shelters - institutions where unfortunate children are located.

In order not to get confused among the many roads and find your niche, you need to answer a couple of questions. To which funds do people donate as often and as much as possible? What attracts them more than others? This formulation of the problem will help determine the appropriate area.

It is important to indicate the distinctive feature of a particular fund - how it will compare favorably with others.

The founding of foundations by media personalities is becoming a modern fashion trend. Of course, a recognizable face coupled with a serious image of the hero plays into the hands of the project. People trust such images and are always ready to help.

Therefore, competent marketing is not a selfish method, but a forced necessity.

Marketing events.

The creation of a charitable foundation is inextricably linked with a marketing campaign. How else can people find out about the existence of NPOs if not through advertising? Therefore, the events need to be given due attention.

For a powerful starting push you will need:

- Own website.

Today it is a key element of successful advertising. Everything is simple: more people know about the company - the amount of donations increases. You can entrust the creation to a team of professional developers for a fee, or you can do the work yourself.

- Social networks and advertising mailings.

A powerful tool for promoting any product is its placement on public platforms. A large traffic of active users carries with it a potentially high percentage of donators.

- Leaflets, business cards and flyers.

Distributing paper “booklets” in busy parts of the city will attract many concerned citizens.

The company logo also plays an important role. You should work thoroughly on its design on the site. The right design will attract people, but an unattractive design will turn many people away. In order for a brand symbol to look its best on the Internet, it is important to pay attention to:

- Color combinations.

- Convenience and friendliness of the interface on the site.

- Fascinating and educational content.

- Publishing authentic photos and motivational videos.

The listed actions will help increase the popularity of any NPO.

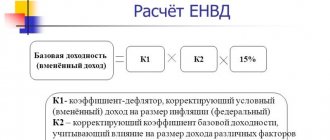

Tax contributions for the charitable foundation.

According to the laws of the Russian Federation, NPOs, along with other legal entities. individuals must pay taxes. True, on preferential terms. The main reason for including the BF in the general inspection database is the constituent documentation. How to register a charitable foundation with the tax authorities?

In order for an organization to be included in the Federal Tax Service register, the head must come to the relevant authority with an application. The procedure for registration directly depends on additional sources of income. In other words, is the BF going to engage in entrepreneurship? If the answer is yes, you will have to choose the appropriate type of taxation from the existing ones.

When submitting an application for registration, indicate on the form the appropriate tax percentage for mandatory payment. The rate may vary:

- For total revenue – 6%.

- For net profit – 15%.

But if the fund does not plan to engage in entrepreneurship, the registration process is greatly simplified. In addition, it is not at all necessary to do all the work yourself - this can be entrusted to experienced professionals. Today, many companies offer their assistance in registering a fund at a very reasonable price.

How long does it take for the IRS to process an application? On average, the processing period occurs within 7 days. Based on the results of consideration of the application, the formed fund receives its own TIN and is also assigned a OGRN (main registration state number). In addition, the manager is given an extract from the state register, which is necessary for the procedure for issuing a general power of attorney.

After completing registration, you must register with the statistics service, as well as pension and insurance funds. Then the founder determines the bank with which he will cooperate in the future, and only now can he begin to carry out the direct activities of the created organization.

As mentioned earlier, the taxation of a charitable foundation has some peculiarities. In particular, voluntary cash transfers occur on a narrowed base. This system exempts any donations to the charitable foundation from taxation.

Financial matters should be handled by an experienced accountant. It keeps constant records of funds and also draws up an annual report, which is available for viewing on the official website of the organization.

Charitable foundations are subject to the general tax payment system, but it is possible to switch to a special regime. There are no concessions for the general activities of the fund; all payments are made on an equal basis with other commercial organizations.

It should be noted here that accounting for donated funds is separated from other financial transactions. Of the total amount of “donations”, the charitable foundation can use no more than 20% for personal needs. The funds are used to support the work of the fund. When the collected amount exceeds the required amount, the difference can be used for organizational needs or other social projects within the framework of the activities being carried out - the law does not prevent such expenditure of funds.

All amounts of money are used within strictly established periods, all transactions of income and expense are reflected in the corresponding separate documentation.

Taxation of charitable activities

Foundations and private philanthropists are entitled to benefits. Their goal is to encourage individuals to give to charity. Let's consider all the tax features when sending funds to help others:

- Legal entities that allocate funds from their own profits to charity do not have tax deductions.

- Benefits of 1-4.5% are offered only to certain individuals. It is calculated from the amount that is sent to the regional budget.

- Deductions can also be received by some organizations that allocate funds to the development of culture and science. These companies must be included in the department's lists.

- If products are given to any person for the purpose of charity, VAT is not paid. However, this rule is only relevant if the transfer of the object is completed correctly. In the opposite situation, the tax inspectorate will have questions.

- VAT is not charged only for products that are directly transferred to beneficiaries. Otherwise, VAT is paid. For example, the company donated 100 T-shirts to an orphanage free of charge. In this case, VAT will not be calculated. However, if a company decides to set up a charity under which T-shirts are sold, VAT will be charged.

- The organization has the right to include expenses for charity in the list of expenses, which will reduce the tax burden. However, in this case you will have to give up tax benefits. The organization needs to draw up an application waiving preferential conditions and submit it to the Federal Tax Service. This measure is relevant if the company regularly engages in charity work and spends a lot of money on it.

IMPORTANT! To receive tax benefits, you must submit a tax return to the Federal Tax Service on time. The corresponding expenses are reflected in section 7. The transfer of products or provision of services for charitable purposes is assigned code 1010288. It is placed in the first column, line 010.

ATTENTION! According to subparagraphs 16 and 34 of Art. 270 of the Tax Code of the Russian Federation, expenses for charity will not be taken into account when calculating income tax.

Drawing up an optimal business plan.

Many aspiring businessmen ask themselves the question: how, after opening a charitable foundation, can they make its work successful? First of all, it is important to have a suitable business plan that will correspond to the activities of the charitable foundation. Clearly, the approximate amount of starting capital is calculated based on the obligatory expenses for the development of the project.

- BF registration.

The economy option will cost the founder 4,000 rubles if you perform the procedure yourself. The help of specialists will be 2.5 times more expensive - you will have to pay 10,000 rubles.

- Furniture and office equipment.

Equipping a work space will cost the owner a pretty penny – 250,000 rubles. You can be smart and ask your friends about unnecessary furniture that will be given away for free. But the likelihood of such an outcome is extremely low.

- Salary expenses.

A qualified specialist will not work for nothing - he must pay monthly for his work. The amount accumulates is decent - 200,000 “wooden”. Another way is to search for volunteers who are ready to do good deeds for free. This will significantly save costs on the item.

- Marketing company (website development, promotion on social networks and printing of booklets).

Independent work on the advertising front will require 5,000 rubles. Help from outsiders multiplies the amount to 51,000 rubles.

The result is:

- 511,000 rubles – for the “advanced” method.

- 9,000 rub. - for the economy option.

Which way to go is up to the owner to decide. Those who value time should pay much more than those who rely on themselves.

How a successful charity works

The fund will provide real help only if it employs professional employees.

Charitable Foundation staff:

- Director. His responsibilities are to develop the strategy and mission of the enterprise. The director is also responsible for budget formation and controls the activities of the fund as a whole.

- Project Manager. This person must look for philanthropists and sponsors. He also develops the concepts of this or that charitable event, negotiates its implementation, and implements everything. The project manager is responsible for estimates, selection of contractors and props.

- Chief Accountant. Expense reports, accounting for collected money, monitoring the targeted distribution of funds are his responsibilities.

- Social worker. Obliged to accept applications for assistance and verify their accuracy.

- Marketer. Invents and distributes advertising about the work of the fund, checks the performance of activities, and cooperates with contractors.

- Lawyer. Valuable employee for a charitable foundation. Draws up and checks all documents on the collection and investment of funds from the fund.

Accountants, copywriters, website administrators, and lawyers can work for the fund on an outsourcing basis. When starting an organization, you can officially include only a few specialists on the staff, the rest can be hired under a contract, and over time, a stable team can be formed.

To make the fund’s work successful, it is necessary to invite as many sponsors as possible to cooperate. You should look for them first of all among your friends. Think about who might be interested in your initiative.

The format of assistance to the fund can be not only monetary - it can be materials, things, furniture, vouchers, etc. This could be volunteer help - personal participation in work.

The charitable foundation must also be promoted through a marketing campaign. First of all, you need to create a website for the organization. The more people know about you, the easier it is to find information about the fund, the more funds you can receive. In order to make a website, you don’t have to pay a specialist. You can create it yourself using the designer.

Be sure to register on social networks. A huge number of people will know about you and your work, and there may also be sponsors among them.

Prepare a short but detailed appeal on leaflets indicating the direction of your activity and your contacts. Leave them at the reception at sports schools, cinemas, institutions of further education, etc.

The main thing when looking for like-minded people is to be honest: in conversation, in video messages, in the media. Sincere interest and desire to help will resonate in the hearts of your interlocutors.

All funds received into the fund’s account must be spent in two directions - providing assistance for which it was created (80%) and own needs: salaries to employees, renovation of premises, etc. (20%).

Minimum staff.

After successful registration of the project and registration of the fund, a list of required specialists should be determined. It is best to choose experienced professionals in their field for the position, so as not to one day encounter the incompetence of employees. Sometimes this has a negative impact on the functioning of the enterprise. The minimum composition is as follows:

- Manager.

Responsible for making key decisions and for the organization's policies. Performs budget management.

- Manager (Deputy Director).

Searches for new patrons and philanthropists, carries out activities to attract new people, and is responsible for solving business problems.

- Accountant.

Maintains financial records and controls all movements of financial flows both within the company and outside it. It is important to note that all NPO materials are available for review by anyone.

- Social Worker.

Collects complaints from victims and verifies the accuracy of the information received.

- Advertising specialist.

Develops a marketing concept, analyzes its effectiveness, and negotiates with potential business partners.

- Lawyer.

A very valuable specialist who checks the authenticity of all documents and controls the legal side of the correctness of transactions and negotiations.

At first, a lawyer, accountant and marketer can be “incoming” employees brought in from outside. Over time, as the fund gains confidence and scale, it is recommended that the fund be fully staffed.

To create a charitable foundation, you need a business plan - a mandatory and integral stage of preparation.

Ways to make a profit from the activities of a charitable foundation.

How to create a charitable foundation from scratch and receive income from its work? Several methods are allowed here.

In the first case, the founder is the head of the company, which means payroll. Being a manager, the amount of payments is limited only by personal views.

Another way is associated with shadow money fraud. This method is much more profitable than all others, but is illegal. If such operations are detected, the manager faces punishment up to imprisonment. For a decent, respected organization, this behavior is unacceptable. This will greatly damage the brand’s image and tarnish its glorious name.

In addition to those who want to help with small contributions, there are large philanthropists who spend substantial sums. You can take part of the amount from savings and use it to solve the company’s economic issues. But the law limits the amount of such funds - no more than 1/5 of all finances.

Charitable foundations do not initially pursue the goal of enrichment, but subject to strong support from the state, it is possible to earn money from donations.

The largest charitable foundations in the Russian Federation

According to 2020 data, the amount of funds received by non-profit organizations in the Russian Federation amounted to 15 billion 813 million rubles. 53% of these funds were collected by the TOP 10 largest charitable foundations. The TOP 3 largest funds collected 33% of the total amount.

- “Give Life” The volume of funds raised in 2018 was more than 2 billion rubles. The foundation has been operating since 2006, its founders are actresses Ch. Khamatova and D. Korzun. Volunteers and doctors cooperate with the foundation. The main direction is the fight against oncohematological diseases.

- "Rusfond"

In 1996, the foundation created the Kommersant Publishing House. In 2020, he collected over 1.8 billion rubles. Collecting money for the needs of the fund is carried out on the pages of the Kommersant newspaper, in partner media and on Channel One. - WorldVita

has been operating since 2009. In 2020, more than 1 billion rubles were collected. The main focus is the treatment of children with cancer.

The largest charitable foundations in Russia.

Among the most famous and large charitable foundations in Russia it is worth mentioning:

- Foundation named after V. Potanin (financial assistance to talented students).

- “Dynasty” (support for the development of science in the country).

- “Link of Times” (assistance in the preservation of historical cultural heritage sites).

- "Rusfond" (helping seriously ill children).

- “Give Life” and “WorldVita” (support in the treatment of cancer in children).

Charitable organizations perform an important function in the modern world. Thousands of people need support and are being given a helping hand. Charity is not just a business. This is a state of soul and heart. If the desire to make the world a better place arises within you, do not delay the moment. Setting up a charitable foundation is actually not that difficult. People need help. Exactly today. Right now.