Amount and details of the state duty for legal entity registration

The amount of state duty for creating a legal entity varies depending on the purpose of payment:

Legal Entity Registration

- The registration amount depends on the type of entity being created: organization of disabled people - 1,400 rubles, political party - 3,500 rubles, other person - 4,000 rubles

- Changing the data of an already registered person costs 800 rubles

- Liquidation of a legal entity is paid in the amount of 800 rubles

- Use of country names – 80,000 rubles

Details for payment for the creation of a legal entity are provided depending on the following parameters:

- Subject of registration

- Places for submitting documents – tax office or MFC

Important! Please check the details you need individually on the Federal Tax Service website.

To do this, you will need to click on the section on payment of state duties and select the tab for registering a legal entity.

Details will be slightly different. The reason is different places for submitting documents:

- The Tax Service provides code 18210807010011000110

- MFC – 18210807010018000110

Now let’s talk about a fast payment method that provides comfort to residents of the Russian Federation.

Urgent extract from the Unified State Register of Legal Entities - state duty in 2020 (cost)

Not everyone knows, but an extract from the unified register of legal entities can be obtained as soon as possible - no later than the day following the submission of the application to the Federal Tax Service or the MFC. However, not everything is so simple, since in order to receive the document as quickly as possible you will have to pay an additional amount.

The cost of obtaining an extract from the Unified State Register of Legal Entities urgently is 400 rubles.

How to pay state duty via the Internet in the Russian Federation

People living in the Russian Federation have the opportunity to pay the full amount of state duty for a legal entity in two ways:

- Through Sberbank online service

- On the tax service website

Which method is better to choose is everyone’s business. They don't have much difference. Let's take a closer look at both options.

We pay for legal entity registration through Sberbank online

Sberbank Online

The procedure does not involve any difficulties or confusion. All it needs is an active Sberbank card or an open account with this institution. Payment is made through the Sberbank online service. Let's look at the procedure:

- Registration (for this you will need to enter your active card number and mobile phone number).

- Selecting the “Transactions and Payments” tab.

- Opening the “Payments to the Budget” tab.

- Enter the corresponding amount and details in the active tab.

- Payment of state duty.

- Printout of the receipt.

Warning! The online service will provide an opportunity to verify the correctness of the entered data.

Even if you do not print out the receipt, it will be saved in the archive on the service. In very rare cases, online payments fail. Therefore, do not delete the electronic version of the receipt. It may be needed to confirm payment in disputed situations.

How to pay state duty on the tax website

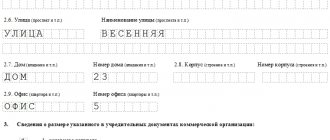

It’s easier than ever to make payments through the tax service. To do this, you need to go to their official website. The procedure is as follows:

- Login to the online service.

- Specifying the type of payment.

- Filling out the menu (full name, identification code, region, registration, etc.).

- Enter the details of the card (or electronic wallet) from which the payment is made.

- Confirmation of action.

Thus, payment for registration of a legal entity will be made quickly and efficiently. Let's move on to the issue of reducing the state duty.

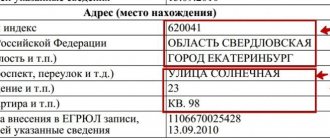

Payment details

- KBK - 182 11300 130 (fee for providing information and documents contained in the Unified State Register of Legal Entities and in the Unified State Register of Individual Entrepreneurs).

- The recipient's account number is 40101810045250010041.

- Recipient bank - Main Directorate of the Bank of Russia for the Central Federal District of Moscow (abbreviated name - Main Directorate of the Bank of Russia for the Central Federal District).

- BIC of the recipient's bank - 044525000.

- Recipient of the Federal Tax Code for Moscow (MIFTS of Russia No. 46 for Moscow).

- INN and KPP of the recipient - 7733506810/773301001 (MIFTS of Russia No. 46 for Moscow).

- OKTMO code - 45373000.

Please note that the KBK is of particular importance when paying the state fee for obtaining an extract from the Unified State Register of Legal Entities. It is its numbers that are responsible for the implementation of which procedure the payment is directed to. And if the procedure code does not coincide with its purpose, this leads to an official refusal.

How to reduce the state duty by 30%

On January 1, 2020, the government approved a decision to provide a 30% discount. This saving opportunity is still relevant today.

Saving money extends not only to paying state fees when registering a legal entity. It also applies to other services:

30% discount

- If you need to change your driver's license, you will pay 1,400 rubles from 2,000

- If you need to register a car, from the total amount of 800 rubles you will pay 595

- To issue an old passport – 1,400 from 2,000 rubles

- If the sample international passport is new, then the amount will be 2,450 rubles from 3,500

- If you need to get a driving license, the payment will be 1,400 rubles (instead of 2,000)

- In the process of registering a new family, a 30% discount from 350 rubles will be 245

- If the marriage needs to be dissolved, you need to pay 455 rubles out of the total amount of 650

Warning! You can pay the state fee for any service with a 30% discount exclusively by electronic payment.

This discount is not available for cash payments in banks. Non-cash payments are presented in several types:

- Using a cell phone

- Sending finances from a card

- Using online money

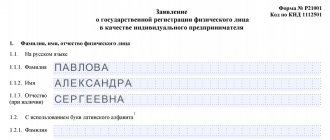

30% savings are available to absolutely everyone. All you need to do is follow a series of simple steps. To get a discount you need:

- Complete the application electronically (in order to receive a discount, you must receive special approval).

- Submit your application.

- Wait online for review.

- Wait until you receive a special invoice for payment.

- Make an electronic payment of state duty.

- Print a receipt confirming your online payment.

To make it clearer, detailed instructions for obtaining a discount using a specific example are provided below.

Instructions for obtaining a discount on state fees

In general, the entire procedure does not take much time. It takes a few minutes. So, we need to register a legal entity and we want to pay for this government service at a good discount. This procedure consists of the following steps:

- Login or register. Everyone who has ever used electronic payments has their own personal account. In other words - a personal account. Log in or do a quick registration.

- Filling out the form. For economy payment, the sample is made in a special format. A sample can be found on the department's website. In accordance with it, you need to fill out a form for 30% savings.

- Submitting an application online. The completed application is sent to the department’s website. After this, its consideration begins. This will take a few minutes.

- Waiting for the application to be reviewed. Information about this stage is in the feed of your personal account. When the application is reviewed and approved, the department's website will personally notify you. A notification will be sent. An invoice will be provided with this notice.

- Choice of payment.

Open the notification sent to you and review it. Look there for a link to pay for legal entity registration. There you can familiarize yourself in detail with all the information about the payment being made. You will need to decide on the payment method and enter it in the appropriate box. Receiving a discount - Entering bank details. Having decided on the non-cash payment method, enter the details of the account from which the payment will be made (mobile phone, bank card number, e-wallet account). After this, you need to click on the “Next” button.

- Proof of payment. At this stage, you need to double-check all entered data to make sure it is correct. The bank will request a special code, which will be sent via SMS to your mobile phone. The code will need to be entered into the appropriate window and payment confirmed.

- Receive a receipt. Once payment is confirmed online, a receipt will be provided. It can be printed on a printer. Some users keep their receipt by email.

Be sure to check the correct details in your region.

Top

Write your question in the form below

State fee for registration of NPOs

Privacy Policy

The Privacy Policy is an official document of mosnko.ru (hereinafter referred to as the Administrator), which determines the procedure for the use by visitors of the site / (hereinafter referred to as the Site) Service (feedback web service integrated into the Site) and the processing of information about individuals (hereinafter referred to as the Site Visitor) received from Site Visitors using Service forms.

Completing the Service forms is understood as using the Service. By filling out the Service forms, the Site Visitor expresses his full and unconditional agreement with these Privacy Policy Terms, which are defined by the Administrator as a public offer in accordance with Article 437 of the Civil Code of the Russian Federation.

The Site visitor must read these Terms of Use of the Service before using the Service and submitting the data entered in the forms.

The text of this document, as well as any terms of use of the Service, can be changed by mosnko.ru at any time unilaterally without prior notice to Site Visitors.

1. Copyright

mosnko.ru has copyright and other rights to the program code, design of the Service and Website, including graphic elements, colors, audiovisual content, grouping and systematization of data, arrangement of various elements. Any copying, distribution, translation or other actions related to copyright infringement are prohibited. Visitors to the Site are granted a simple non-exclusive license to use the Service.

2. Consent to the processing of personal data

If, when using the Service, the Visitor provides any information relating to a directly or indirectly identified or identifiable individual (subject of personal data) (hereinafter referred to as personal data), the processing of such data will be carried out exclusively in accordance with the current legislation of the Russian Federation in the field of processing personal data. With regard to all reported personal data, the Site Visitor provides the Administrator with consent to their processing. The Administrator processes the Visitor’s personal data solely in the interests of the Site Visitor and strictly for the purpose of providing the user with the functionality of the Service and the Site. The Administrator undertakes to provide all necessary measures to protect the personal data of the Site Visitor. All operations related to the processing of personal data are carried out by the Administrator in strict accordance with the requirements of Federal Law dated June 27, 2006 No. 152-FZ “On Personal Data,” as well as the current legislation of the Russian Federation. Under no circumstances does mosnko.ru transfer the user’s personal information to third parties, except in cases expressly provided for by the current legislation of the Russian Federation.

3. Responsibilities of the Site Visitor

The Site visitor, by accepting these Terms, undertakes to strictly comply with the provisions of these Terms, as well as the provisions of the current legislation of the Russian Federation, when using the Service.

As part of this obligation, the User also undertakes to provide only reliable and up-to-date information, not to provide any information, in whole or in part related to state, commercial and/or bank secrets, personal data of third parties, information that could lead to a violation of the legislation of the Russian Federation. Federation, and/or violate the rights and interests of third parties. If the Site Visitor has doubts regarding the legality of communicating any information to the Administrator through the Service and the Site, the Site Visitor is obliged to refrain from performing this action.

4. Responsibility of the Administrator

4.1. The provisions of the legislation of the Russian Federation on the protection of consumer rights do not apply to the relationship arising between mosnko.ru and the Visitor. The Service is free for Site Visitors.

4.2. The service is provided on an “as is” basis. mosnko.ru does not guarantee that the Service will meet all the Visitor’s requirements; services will be provided continuously, reliably and quickly, without any errors, failures or interruptions. The Visitor’s wishes for improving the Service are accepted by mosnko.ru, however mosnko.ru does not have an obligation to implement the stated wishes and suggestions.

4.3. mosnko.ru is not responsible for damage caused to the Visitor as a result of the latter’s use of the Service or Site.