Why check the counterparty?

Checking a counterparty means protecting your own company from possible risks and allowing yourself to consistently plan future activities.

At the same time, the verification process is not a one-time activity, but a comprehensive and systematic work. In most cases, verified counterparties comply with all agreements, and the company’s management does not expect any surprises. The main negative consequences of poor verification of the counterparty and cooperation with an unreliable partner are, for example, delays in delivery of certain cargoes, delivery of low-quality goods. To prevent such undesirable consequences, a company representative must be required to review the following documents:

- A copy of the legal entity registration document.

- A copy of the company's charter.

- A copy of the document confirming registration with the Federal Tax Service of Russia.

- Accounting statements for the last year ended.

- A copy of the identity document of the head of the company.

FREE check – “Open services”

Almost all the main parameters for verifying a counterparty can be found in open sources of information. The only disadvantage of such a check is that collecting and analyzing information will take quite a long time.

Checking a partner on the official portal of the Federal Tax Service of Russia

Checking the counterparty by TIN

The official website of the Tax Service of the Russian Federation provides several useful services that work online and allow you to obtain certain information about a potential partner. You can check the TIN, the fact of registration of a legal entity, the region of its activity, the scope of work and a number of other information. The data is grouped into sections, all of which are available at nalog.ru. Users of the portal also have access to information about the prohibition of activities for a particular organization. To obtain such information, simply enter the organization’s TIN. A new service is currently being tested that will help identify companies created for fraudulent purposes.

Of course, the lion's share of tax and other information relating to the company's activities is not publicly available. However, the list of data available for review is constantly expanding. Recently, a lot of new information about the activities of any organization has become available on the official website of the tax service. It became possible to evaluate the company’s financial balance over the past year. The average number of employees of the organization also became available. You can clarify information about tax payments made and existing overdue debts. All information can be obtained for free online.

Register of unreliable suppliers

The Federal Antimonopoly Service has compiled a Unified Federal Register of Unreliable Suppliers. This information is available online 24 hours a day at any time.

Card index of arbitration decisions

File of arbitration cases

At the moment, there are over 15 million arbitration cases in the file cabinet. A simple search form allows you to obtain all the information available for a company from this file in record time. At the same time, the information card that appears after processing the search request contains information about the subjects of the case, the process itself and its results.

Bank of Enforcement Proceedings

Information about debts

The interactive service of the Federal Bailiff Service allows you to obtain information about the existing debts of the counterparty, which were confirmed in court. The amount of debt, its reason and the extent of repayment are available.

The Unified Federal Register allows you to familiarize yourself with important facts about the company’s activities, including its relationships with other market participants. To search for the counterparty you are checking, you need to fill out a fairly simple search form. You can search by contact information, individual taxpayer number, etc.

Register of current licenses

If the prospective partner is engaged in a licensed type of work, then it would be useful to check the validity of the company’s license to carry out the core type of activity. This can also be done online.

The Department of Natural Resources has information on licensing activities related to the management of hazardous waste. The communications supervisory organization licenses organizations involved in the transmission and dissemination of information. Other areas are also dealt with by the relevant departments. You can make a request on their official portals.

Checking your passport for validity

Russian passport verification

The database of the Russian Ministry of Internal Affairs is always up to date, as it is constantly updated. This information resource allows you to check the passport of a manager, potential counterparty or individual entrepreneur with whom you intend to cooperate.

The invalidity of an identity document may indicate a high risk of fraudulent activity on the part of the counterparty. It is better not to have any business contacts with such a partner.

Government contracts

Government contracts

If a potential partner regularly enters into contracts with government agencies for the supply of goods or services, then such a counterparty can be considered reliable. – You can cooperate with him.

Register of inspections

On the official portal of the Prosecutor General's Office of Russia proverki.gov.ru you can always find up-to-date information about already completed and planned official inspections of any organization. A simple search form allows you to quickly get the information you need.

Website of the prospective partner

You should definitely look at the company’s official website and its pages on social networks, if any. The appearance of the site and its accessibility can say a lot about the organization. Pay attention to the counterparty's portfolio; many companies post information on cooperation with well-known brands on their websites. This information is also worth checking. Real reviews are of great importance. If there are too many negative reviews, then it is better to refuse cooperation with such an organization.

Control questions

The Russian Federal Tax Service recommends asking yourself a few simple questions that will help you assess the feasibility of cooperation with a particular organization. These are the questions:

- What kind of relationship unites you and the head of the company?

- Do you know the employees of the organization?

- Do you have any experience of business interaction with this counterparty?

- What has been done to verify the reliability of the counterparty?

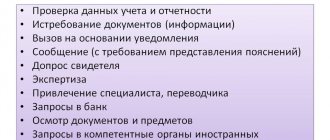

Methods of checking an organization for reliability

Today, there are several verification mechanisms available. The easiest way is to use paid services that aggregate all publicly available data. Comprehensive information about a potential counterparty will be provided quickly, in an accessible and visual form. At the same time, some of these services will also conduct an initial analysis of the collected information; They will tell you what points you need to pay attention to and give a preliminary assessment of the safety of the transaction.

You can find out how much taxes the counterparty paid and check its financial condition in the “Kontur.Focus” service. Connect to the service

An alternative option involves independently collecting information using free databases of government agencies and other open sources. In particular, information about the counterparty can be found on the websites of the Federal Tax Service, Rosreestr, arbitration courts, bailiffs, etc. It would also be a good idea to use regular search engines to assess the business activity of your future partner.

Finally, there is another way to check. It involves obtaining all the necessary information directly from the counterparty or persons related to him. This option is usually used in addition to the first or second. From the company with which you plan to cooperate, you can request a copy of the charter, information about the manager’s passport details, information from tax returns, as well as real reviews (recommendations) of people who have dealt with it.

Interpretation of the information received

Experts advise dividing the information received about the counterparty into several groups. Firstly, this is the volume of activity of the organization at the moment. Secondly, these are existing controversial issues. Finally, a thorough risk analysis must be carried out. It is worth noting that the financial vector of the organization indicates what is happening - growth or stagnation.

Analyzing the above, it becomes clear that checking the trustworthiness of a potential partner is a labor-intensive and quite complicated matter, especially for a novice entrepreneur.

Therefore, it is advisable to use the services of the specialized service “Contour Focus”. This service will instantly check your counterparty.

Benefits of the service

Information about a particular company is searched based on the contact details of the manager, tax identification number or any other parameter. The service allows you to obtain all the above information in the shortest possible time in a clearly presented form.

The organization card issued by the service, in addition to the described data, provides information about the nature of the counterparty’s mentions on the global network. In addition, the user becomes aware of the nature of reviews about the organization’s activities from the World Wide Web.

Any user of the service can monitor the activities of several hundred companies simultaneously. At the same time, any significant changes will not go unnoticed; they will immediately become known. The user will instantly receive appropriate notifications. The service has flexible user settings. You can regulate the criteria by which the organization's activities will be monitored.

A few additional points to note. In addition to the main online check, it is worth visiting the organization’s office in person to assess the company’s status with your own eyes. You need to make sure that the organization is located at the stated address. Talk to a manager or representative from the organization. During the conversation, you can not only resolve any business issues, but also evaluate the personal qualities of the manager. An inspection of an organization’s office to some extent allows one to draw conclusions about the financial condition of a legal entity. This fact is important when deciding on the possibility of cooperation.

How to check a counterparty: step-by-step instructions

If a special paid service is used for verification, then to obtain an analytical certificate for the counterparty, it is enough to enter its data into the appropriate program. In other cases, to find out information about the counterparty, you should follow a certain algorithm.

Step one: checking the counterparty on the Federal Tax Service website

Self-checking should begin by visiting the official website of the Federal Tax Service, where the electronic service “Business risks: check yourself and your counterparty” is posted. With its help, you can generate an extract from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs. To do this, you need to enter the TIN or OGRN (OGRNIP) of the taxpayer being audited. Or indicate the name of the organization (full name of the individual) and select the region. The extract you receive will ensure that your business partner is a current taxpayer and that liquidation, exclusion from the register, or bankruptcy proceedings have not been initiated against him.

Additionally, from the extract you can find out information about the head of the organization and its address. This information should be compared with that provided by the counterparty itself. In addition, you need to pay attention to the OKVED codes indicated in the extract. Such information will make it possible to verify that the business partner indicated during registration a code corresponding to the type of activity that he undertakes to carry out under the terms of the agreement.

IMPORTANT

If an extract from the Unified State Register of Legal Entities displays information about the unreliability of information about the address, manager or participants of the counterparty, then it is better to refrain from concluding an agreement with him.

Check the counterparty for the accuracy of information in the Unified State Register of Legal Entities and signs of a shell company

Next, on the Federal Tax Service website, you need to check whether your partner has tax debts. To do this, you need to enter his TIN into the service “Information on legal entities that have arrears in paying taxes and/or have not submitted tax reports for more than a year.” The amount of debt itself can be viewed in the “Open Data” section on the Federal Tax Service website. But it is impossible to obtain information from this section by simply indicating the TIN or OGRN of the counterparty. To find out information about tax debt, you need to find and download the corresponding file on the page https://www.nalog.ru/opendata/7707329152-debtam/.

ATTENTION

It is quite difficult to find information about a specific counterparty in Open Data. The Federal Tax Service website contains hyperlinks to archives containing files with data for all taxpayers at once. Accordingly, in order to find the organization being checked, you will have to open dozens, if not hundreds of files one by one, and study their contents. It is much more convenient to obtain information from registers, including about the tax debt of the counterparty, using special services. Thus, Kontur.Focus users just need to enter the name or TIN of the counterparty in the search bar. The service will collect important information from the Federal Tax Service databases and other sources in one window and generate an express report (for more details, see “Information on tax regimes applied by taxpayers has been published” and “Information on the average number of employees for 2019 has been published”).

Connect to the "Contour.Focus" service to choose only reliable counterparties Submit an application

Next, on the Federal Tax Service website you need to use the “Transparent Business” service. The verification is carried out using the INN, OGRN, and the name (full name) of the counterparty. Using the service, you can find out information about the manager and founders of a business partner regarding their participation in various “mass” organizations, possible disqualification or deprivation of the right to hold positions (participate in the management of organizations). It is also possible to check whether the counterparty’s address is a mass registration address. Separately, it should be clarified whether the director stated that he has no relation to the relevant organization (https://service.nalog.ru/svl.do).

Check the counterparty for signs of a shell company, bankruptcy and the presence of disqualified persons

After this, it makes sense to go to the https://bo.nalog.ru section, where you can get data on the organization’s accounting records (by TIN, OGRN, address or name).

Another service on the Federal Tax Service website allows you to find out whether the counterparty’s account is blocked. On the page https://service.nalog.ru/bi.do you need to select the option “Request for current decisions on suspension”, then enter the TIN of the counterparty and the BIC of the bank in which the account being verified is opened. For more information about this service, see “Blocking a tax account in 2020: how to check it on the Federal Tax Service website and what to do.”

In addition, the official website of the Federal Tax Service allows you to check the following data about the counterparty (information is contained in the file archives):

- whether it applies special tax regimes (https://www.nalog.ru/opendata/7707329152-snr/ and https://npd.nalog.ru/check-status/);

- how much taxes I paid (https://www.nalog.ru/opendata/7707329152-paytax/);

- whether he was brought to tax liability (https://www.nalog.ru/opendata/7707329152-taxoffence/);

- what is the number of employees (https://www.nalog.ru/opendata/7707329152-sshr2019/).

IMPORTANT

Information published on the website of the Federal Tax Service is not provided upon request (clause 1.1 of Article 102 of the Tax Code of the Russian Federation, letter of the Federal Tax Service dated March 25, 2020 No. BS-19-11/ [email protected] ). If an organization sends a letter to the inspectorate with a request to provide information about the number of employees of the counterparty, its tax regime, taxes paid, violations committed and other data, it will be refused. You will have to collect this information yourself by studying the Federal Tax Service databases. Or, as mentioned above, it can be obtained in a few clicks in a special service.

Find out about the taxes paid by the counterparty and the violations committed by him

Step two: checking the counterparty by TIN or OGRN

The next stage is to search for data about the counterparty by its TIN, OGRN or name in the databases of government agencies. You can use the following sites for this:

- https://kad.arbitr.ru (data on the counterparty’s litigation);

- https://rosreestr.ru/site/eservices/ (data on real estate owned by the counterparty);

- www.zakupki.gov.ru (data on purchases in which the business partner took part).

Receive notifications about government procurement for small and medium-sized businesses Set up newsletter

IMPORTANT

It would also be a good idea to “punch” the TIN and OGRN of the counterparty through search engines in order to study customer reviews and other information available on the Internet.

Step three: verification of enforcement proceedings

The service on the website of the Bailiff Service (www.fssprus.ru) does not provide information on TIN or OGRN. This data bank works exclusively with the name of an organization or data about an individual. To search, go to the “Services” section and then to the “Bank of Enforcement Proceedings”. Then enter information about the counterparty and region.

ATTENTION

The detected debt data will not indicate the TIN or OGRN. Therefore, this information should be used with caution. The fact is that in one region there may be several organizations with the same name (resolution of the Arbitration Court of the Moscow District dated April 15, 2020 No. F05-4553/2020). Accordingly, it is better to double-check the information about debt found on the bailiffs’ website using other sources. In particular, in the data bank of arbitration cases (https://kad.arbitr.ru) or on the website of the court of general jurisdiction that made the decision

Step four: collecting information on the Internet

The “correspondence” stage of verification ends with the analysis of information from the Internet. First of all, you should study the business partner’s website. The information posted there must be verified with the data obtained in the previous steps. It is also necessary to make sure that it corresponds to the information that the counterparty himself provided about himself.

After this, information about the business partner is requested through search engines by his company name, address, full name of the manager, etc. The information obtained will form an image of the business reputation of the counterparty.

Step five: request information from the counterparty

The next step is the “face-to-face” verification stage. Copies of documents confirming the powers of the officials who will sign the agreement are requested directly from the counterparty. This could be a charter, order, power of attorney, etc. You should also request identification documents of these individuals.

IMPORTANT

This information must be current as of the date of signing the contract, invoice or source document. Therefore, in long-term relationships, you should periodically update information about powers of attorney, orders and passport data.

Exchange UPD and invoices with counterparties via the Internet Inbox free

Also, documents are directly requested from the counterparty for the right to carry out certain types of activities (licenses, SRO approvals, etc.), and information about the availability of resources necessary for the execution of a specific contract (personnel, transport, warehouses, etc.). It would not be amiss to ask for copies of the lease agreement or documents confirming ownership of the premises at the location of the counterparty.

The information received from the partner is verified with the data that was received at the “correspondence” stage. If discrepancies are identified, you need to request clarification from the counterparty.

The verification is completed with measures to ensure that the counterparty's officials are located at its registered address and are available for contact at the specified telephone numbers and email address. Also, at the “face-to-face” stage, you can directly contact other organizations and individual entrepreneurs who have already dealt with the counterparty and ask them for recommendations.