After registering an individual as an individual entrepreneur with the tax office, he needs to perform a number of other actions that are prescribed by law.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

One of the mandatory measures is to contact RosStat to obtain statistics codes for the types of activities that the businessman plans to engage in.

For violation of the deadlines established by law for applying to government agencies, penalties may be applied to individual entrepreneurs.

Registering an entrepreneur with funds

After an individual submits documents for registration of an individual entrepreneur to the Tax Inspectorate and his application is approved, Federal Tax Service employees independently report information about the emergence of a new entrepreneur to the Pension Fund and RosStat.

After this, the Pension Fund of the Russian Federation sends the entrepreneur a notice of registration, which includes all the necessary information.

In the case of State Statistics, this happens very rarely.

As a rule, an individual must wait until the information on the website is updated and in this case he will be able to find his data or receive it by personally contacting this government agency.

Legal regulation

Registration of an individual entrepreneur with the State Statistics Service is carried out in accordance with Federal Law No. 129 “On State Registration of Legal Entities and Individual Entrepreneurs”.

Required documents

The founders of a limited liability company can be both individuals and legal entities. The minimum amount of authorized capital established by law is 10,000 rubles. Half of it in the form of property or cash must be contributed immediately upon founding the company.

Registration with the statistical authorities of an LLC in 2020 requires:

- the size and form of the authorized capital specified in the charter;

- a unique Russian-language name for the region;

- certain types of activities (main and additional);

- tax payment form (in accordance with OKVED codes);

- documents of the founders proving their identity;

- individual tax numbers of the founders (if any);

- passport and tax identification number of the general director of the LLC;

- permission letter from the owner of the property located at the stated registration address.

Changes in the initial registration of an LLC in 2020 concern mainly changes in the sequence of actions, as well as issues regarding the authorized capital of the enterprise.

How an LLC is registered by power of attorney in 2020 can be read in the article at the link.

There is also a difference between the packages of documents for foreign and domestic companies establishing a limited liability company:

| For foreign companies | For domestic companies |

| 1. Certificate of registration of a legal entity (notarized copy) | 1. An extract from the trade register or a certificate of company registration in a standard form (issued in the country where the company was registered). |

| 2. A copy of the document confirming tax registration | 2. A document confirming the availability of an individual tax number (also in the form approved in the country of registration). |

| 3. Extract from the Unified State Register of Legal Entities | 3. Documentation that regulates the composition of the founders, the distribution of shares between them and the management of the founding company |

| 4. Copy of the general director’s passport | — |

| 5. Copy of individual taxpayer number (if available) | — |

Before submitting a package of documents, you must consult with an expert - a lawyer or someone who has worked in the tax service. Despite the common set of laws for all regions and branches of the Federal Tax Service, they work differently and one small nuance can cost you a wasted fee, a lawyer’s services and a week of wasted time.

The data specified in the documents must be checked and double-checked for consistency with the real ones and for coincidences with each other. Even accidental mistakes are fraught with failure - the Federal Tax Service does not allow you to correct information in already submitted papers.

If the type of activity of the company provides for a simplified taxation system, then it is necessary to submit all documents within 5 working days , and if the founders were unable to do this on time, then the income tax rate will be standard, and the transition to a simplified system in this case will be possible only with the beginning of the new tax year

Registration of individual entrepreneurs in statistics

Registration of an individual entrepreneur with the Federal State Statistics Service takes place automatically after the transfer of information from the tax office.

Receiving a notification is currently not a mandatory procedure, but it is better to do it immediately after registration in order to avoid various problems in the future.

What is it for?

Most often, the notification from RosStat for individual entrepreneurs lies in the general mass of documents and is not used, so many mistakenly consider this document to be unnecessary.

But in reality this is not the case at all:

- Statistics codes can be useful for obtaining various work licenses. Without notification from RosStat, the entrepreneur will, in principle, not be able to take these documents. As a result, if the individual entrepreneur did not contact the state statistics service immediately after registering with the Tax Inspectorate, then later he will have to do this in a hurry and waste time and nerves on those actions that should have been taken at the very beginning of his activity.

- The second reason that determines the need to receive a notification from RosStat is the fact that this organization has the right to receive data from all entrepreneurs of the Russian Federation. The selection is carried out by computers, so the verification can affect any legal entity or individual entrepreneur.

In order to transfer information, entrepreneurs will have to fill out a special form, one of the items of which is the statistics codes assigned to it by RosStat.

Penalties are applied to individual entrepreneurs and legal entities for evading this obligation.

In addition, at present, many banking institutions and extra-budgetary funds request statistical information when creating an account and registering, although the RosStat notification is not a mandatory document for the implementation of these procedures.

But in order not to receive a document at the last moment or not to wait several days for entering data, it is best to take care of it in advance, that is, in the first days after registering with the Tax Inspectorate.

To register an individual entrepreneur with the Federal Tax Service, you need to write an application and collect a package of documents. How to check the registration of an individual entrepreneur with the Tax Office using the TIN? See here.

Receiving codes

Registration of individual entrepreneurs in statistics 2020 is carried out to obtain OKVED codes, which determine the list of activities that an entrepreneur can engage in.

The codes themselves represent a six-digit number, but for notification it is better to write only the first four digits so as not to greatly narrow the scope of the work.

In this case, the individual entrepreneur will be able not only to provide the services he is interested in, but also related ones that relate to the same area.

This choice will allow you to avoid frequent additions of statistics codes and replacement of documents.

Is it possible online?

The development of modern technologies has not gone unnoticed by government agencies, including the state statistics service.

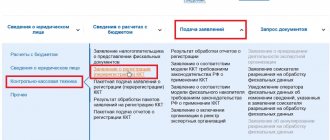

That is why entrepreneurs currently have the opportunity to find their data via the Internet on the official website of the FSGS.

You can print the notice there yourself. Since it is simply informational in nature, no seals or signatures of RosStat employees are required.

In addition, this situation is convenient in that if it is necessary to re-receive a notification with statistics codes, individual entrepreneurs do not need to contact the statistics service, but simply go back to the institution’s website.

Obtaining statistics codes from the Federal State Statistics Service

After registering a citizen as an individual entrepreneur, the territorial body of the Federal State Statistics Service generates a letter with statistics codes, which indicates all the codes assigned to the entrepreneur during the state registration process. These codes are associated with the types of activities declared by the entrepreneur during registration. An entrepreneur has the right to receive this letter by appearing at the branch of the territorial authority. You can find out the address of your territorial authority on the Internet: https://www.gks.ru/. In addition, you also don’t have to receive the letter itself, since it is purely informational in nature, and all information about statistics codes is available in electronic form on the same website of the State Statistics Committee.

An extract from the Unified State Register of Individual Entrepreneurs is required when individual entrepreneurs enter into various contracts, participate in auctions and tenders. You can read where to get an extract from the Unified State Register of Individual Entrepreneurs in the materials of the new publication.

The current tax calendar 2015-2016 for individual entrepreneurs using a simplified tax system is here.

Procedure

In order to obtain statistics codes, individual entrepreneurs need to contact the FSRS with:

- statement;

- a package of documents necessary for this procedure.

After five days, you can receive a notification when you contact a government agency again if it is needed urgently.

If there is no urgent need, you can simply wait for the information to be updated on the website and add your document there by printing it in the office or at home.

Currently, there are several ways to receive notification from the FSRS:

- when independently applying to this government agency;

- when choosing intermediary services;

- The organization itself sends a notification to the individual entrepreneur’s email.

But this option happens very rarely, so it’s better not to count on it.

Required documents

In order to receive statistics codes, an individual entrepreneur must submit the following documents:

- passport;

- extract from the state register of individual entrepreneurs;

- certificate of registration with the tax office;

- certificate of creation of an individual entrepreneur with an individual registration number.

A sample certificate of registration of individual entrepreneurs is here.

Fines for violating the terms of registration in extra-budgetary funds

For violation of the terms of registration with extra-budgetary funds, significant penalties are provided:

- for the Pension Fund of Russia from 5,000 to 10,000 rubles (depending on the delay);

- for the Social Insurance Fund 10% of the tax base for the period of delay, but not less than 20,000 rubles.

Depending on the type of activity, legal entities and individual entrepreneurs are required to notify other State Supervision bodies of the start of their work, in particular, Rospotrebnadzor, Rostransnadzor, etc. In Government Decree No. 584 of July 16. 2009, you can find out more about what types of activities fall under this provision.

What to do when changing the type of activity?

If you decide to change your main type of activity or additional ones, then to do this you need to contact the Tax Inspectorate with application P24001, which will indicate the new codes and exclude the old ones.

To enter new types of individual entrepreneur activities, you must use the first page of sheet E, and to remove unnecessary ones, including the main one, you should enter them on the second page of sheet E.

After transferring this information to the government agency, the entrepreneur will need to re-receive an extract from the Unified State Register of Individual Entrepreneurs and also print out the RosStat notification.

Self-registration of an individual entrepreneur requires payment of a state fee. What to do if an individual entrepreneur changes his registered address? Read here.

Is it possible to open an individual entrepreneur through the MFC? Detailed information in this article.

Update information

Information on the FSRS website is not updated as often as some users would like.

On average, this is done once every couple of months, so if the notification needs to be received urgently, then it is better for an individual entrepreneur to contact RosStat independently.

In this case, registering an individual entrepreneur in statistics will take five days and you will have all the necessary documents on hand.

The role of codification

At the moment, cooperation between the Federal Tax Service and statistical accounting authorities has been established in most regions and the codification process (accounting in the Statregister) begins to be carried out automatically. Code documents are issued upon request. Without registration with Rosstat, a company will not have the opportunity to register with the Pension Fund and Social Insurance Fund.

An information letter is also necessary in situations:

- generation of payment orders (for taxation, as well as payment of state duties);

- concluding transactions with counterparty companies;

- when participating in government procurement and tenders;

- for cooperation with the bank, including creating a current account;

- for certification of manufactured products.

The types of codes and their meanings are presented in the table below:

| Code name | Explanation and designation |

| OKVED | All-Russian Classifier of Types of Economic Activities |

| OKATO | All-Russian classifier of objects of administrative-territorial division |

| OKOGU | All-Russian Classifier of State Authorities and Management Bodies |

| OKPO | All-Russian Classifier of Enterprises and Organizations |

| OKFS | All-Russian classifier of forms of ownership |

| OKOPF | All-Russian classifier of organizational and legal forms |

Statistics codes for LLCs - where to get them: tips for businessmen

- Numbers of the Pension Fund, Compulsory Medical Insurance Fund, Social Insurance Fund and OKPO. After registration, the Pension Fund and Social Insurance Fund numbers are sent to the legal address of the LLC within 30 days. The FFOMS and TFOMS identifiers were canceled three years ago. OKPO is recorded in a letter from information content statistics.

- OKTMO is an identifier obtained by entrepreneurs or founders of a legal entity using one of the following options:

- statistical information data, which is issued in the form of a letter during the registration procedures;

- information from the Ministry of Finance (consolidated), where the compliance of OKATO with OKTMO identifiers is recorded, and according to OKATO, an entrepreneur has the opportunity to find the OKTMO code corresponding to his enterprise;

- Federal Tax Service data (information content) here you can download statistics codes for LLC - they are located on the Tax Service website .

- OKATO: starting this year, when paying taxes it is necessary to enter OKTMO codes . But OKATO is still required to generate various documents for LLC. In particular, the OKATO code in the details is needed for its use in several cases:

3a. Tax authority - when selecting a municipal level district, the OKATO column is filled in automatically. You can also see it in data from Rosstat or find out on the official website of the Tax Inspectorate by selecting the region of activity.

3b. PF - almost always OKATO is similar to OKATO of the Tax Inspectorate. However, it is necessary to clarify this identifier with the Pension Fund (at the place of registration of the company).

This determines where the insurance premiums will go .

3c. FSS - OKATO identifiers for paying mandatory contributions can be found on the official resource.

Simplified method

To avoid having to wait long, all data on OK TEI codes assigned in statistics can be obtained on the Rosstat Internet portal. You just need to indicate one of the codes (OGRN, OGRN IP or INN) and print the document directly from the site. This procedure has been in effect recently. This is due to the April changes by the Federal Tax Service to the format for providing information from unified state registers to statistical authorities.

By the way, these notifications do not impose any obligations or give any rights, and are in no way connected with the regulation of your activities as an entrepreneur and have nothing to do with this. And they are for informational purposes only.

That is why the notification is not even stamped by the territorial body of Rosstat, and the head does not sign it. This is not provided for in the form.

You may also be interested in:

What is a current account and where to open one

A current account is a bank account of a legal entity or individual.

As a rule, it is used as a kind of “wallet” - that is, for intermediate or permanent... Read more→

Do I need a seal for individual entrepreneurs and LLCs?

For individual entrepreneurs who are subject to special taxation regimes, in particular UTII, the use of a seal is not necessary if they use cash register equipment for calculations.

According to the Law, ... Read more→

Strict reporting forms: pros and cons of use

If the company’s activities fall under Article 2 of Federal Law No. 54 of May 22, 2003, individual entrepreneurs and legal entities are allowed not to use cash register systems in their work.

In some situations, ... Read more→

Forms of reporting forms to Rosstat for individual entrepreneurs

Rosstat sends reporting forms to individual entrepreneurs independently. Along with the forms, instructions on how to fill them out correctly are also sent.

You can find out the exact list of reports provided by sending an electronic request through the feedback form on the Rosstat website to the corresponding regional branch of the statistics service. To obtain reporting forms and recommendations for filling them out, it is convenient to use the website What to submit to Rosstat. The portal presents 22 reporting forms for individual entrepreneurs, of which 17 are annual, 2 quarterly and 3 monthly. The most common forms are 1-IP, 1-IP (trade) and 1-IP (services). The forms themselves, their correct names, as well as due dates can be easily found on the website of the statistics service on the Internet.

Table: reporting forms 1-IP to Rosstat in 2020

| Form | Name | Who rents | Due date (year following the reporting year) | OKUD |

| 1-IP | Information about the activities of the individual entrepreneur | All entrepreneurs not engaged in agriculture | until March 2 | 0601018 |

| 1-IP (trade) | Information about the activities of individual entrepreneurs in retail trade | Entrepreneurs engaged in retail trade | until October 17 | 0614019 |

| 1-IP (services) | Information on the volume of paid services provided to the population by individual entrepreneurs | Entrepreneurs engaged in the provision of services to the public | until October 17 | 0609709 |

In addition, there are also more specific forms that provide, for example, information about the protection of atmospheric air (2-tp (air)), information about the activities of a travel company (1-travel agency), various forms for individual entrepreneurs engaged in agriculture (1- farmer, 2-farmer, 3-farmer) and others. For individual entrepreneurs, which also belong to small businesses, a separate form is used called MP (micro) - in kind, which collects information about the production of any product by a micro-enterprise. This form is due by the 4th day of the month following the reporting month.

You can fill out Form 1-IP using the link.

LLC: concept and main characteristics

A limited liability company can be established by a citizen (citizens) or a legal entity. LLC is a commercial organization. The authorized capital of the enterprise is divided into shares of each of the participants, and the latter are not liable for the obligations of the organization, but bear the risk of losses within the limits of their share.

An LLC is created for various types of economic activities: tourism, trade, consumer services, etc. A considerable part of them apply the simplified taxation system (hereinafter referred to as the simplified taxation system), but for this the organization must meet certain parameters determined by annual income and the number of employees.

The possibility of using the simplified tax system must be submitted to the Tax Inspectorate during the initial registration of the LLC. Statistics codes are issued at the same time along with all documentation for the LLC . They are received again from Goskomstat in the following situations:

- change of organization address (legal);

- changing the type and name of the enterprise’s business;

- creation of branches;

- opening of representative offices.

When to update information

Receiving notification of codes is necessary when changes are made to the data that will affect identification codes:

- change of surname, name or patronymic;

- change of registration address.

Please note that information in online databases is usually updated twice a month. If an individual entrepreneur has changed his last name or address and urgently needs to obtain information about new statistics codes, and the online service is still uploading the old data, you can personally contact the territorial body of Rosstat with an extract from the Unified State Register of Individual Entrepreneurs and receive a notification.

Thus, obtaining statistics codes for individual entrepreneurs is a fairly simple undertaking that only requires free time, and if you use the FSGS online service, it will take no more than a few minutes.

Back to contents