Transactions can be concluded not directly, but through agents. The role of such specialists is an individual or legal entity. The basis of cooperation is the agency agreement. According to it, the customer (principal) pays for the work of the agent and bills associated with the transaction. When an agency agreement is concluded, accounting must take into account a number of nuances:

- on whose behalf the agent acts - his own or on behalf of the customer (this factor determines who will have ownership of the acquired assets);

- mandatory reflection in accounting of the accrual and payment of agency fees (agent's income for intermediary services provided), which can be fixed or calculated as a percentage of the transaction amount);

- how often the agent must report;

- whether the goods will be stored in the agent's warehouses or will be directly delivered to the customer.

The legal basis for cooperation within the framework of agency agreements is disclosed in Chapter 52 of the Civil Code of the Russian Federation.

Mediation agreements - general principles

When concluding an agency agreement, the principal (principal) instructs the agent (commission agent) to purchase or sell goods, works and services in his interests for a fee. The procedure for concluding and carrying out actions within the framework of such an agreement is regulated by the provisions of Chapter 52 of the Civil Code of the Russian Federation. Its essence lies in instructing the intermediary to perform legal and other actions in the interests of the organization:

- on your own behalf, but at the expense of the principal;

- on behalf and at the expense of the principal.

Based on the results of the execution of the order, an agent’s report is drawn up, which describes the essence of the completed order, the amount of expenses incurred during execution, with the provision of supporting documents.

One of the main provisions is that such an agreement can only be for compensation. That is, a fee is paid for the services of the commission agent. The procedure for calculating it and the terms of payment should be specified in the concluded agreement.

When agency agreements are concluded, accounting often raises many questions. For both parties, it is advisable to keep records of settlements under intermediary agreements on account 76 “Settlements with other debtors and creditors”. Let's consider the features of reflecting transactions in the accounting of both parties to the transaction.

Contents of the contract

An agency agreement refers to contracts of a civil law nature. There are a number of points that must be spelled out in such a document:

- the subject of the contract, that is, what exactly the agent must perform, regardless of whether we are talking about the sale of any goods or the provision of all kinds of services;

- names of the parties, details;

- determination of the powers of the performer, that is, an indication on whose behalf the intermediary will carry out the agreed activities;

- validity period (for a certain period or indefinitely);

- reporting procedure;

- the payment procedure together with the amount of the fee due;

- the procedure for limiting the rights of both parties or one of the parties to the contract;

- procedure for terminating the agreement;

- force majeure;

- procedure for considering controversial issues;

- liability of the parties;

- signatures.

Such a document is considered to come into force after it is mutually signed by the parties.

Accounting under an agency agreement with an agent

The intermediary is not the owner of the goods and services purchased or purchased in the interests of the principal. That is, goods and services received cannot be recognized as expenses, and those transferred cannot be recognized as company income. Income will only reflect the amount of the agency fee issued under the agreement. It will also be necessary to calculate and pay VAT to the budget if you work for OSNO. The receipt of material assets in accounting is reflected in off-balance sheet accounts:

- 002 - if assets acquired on behalf of an order were received;

- 004 - if assets have been received that the agent is instructed to sell.

Agency agreement: accounting entries for the commission agent.

| Contents of operation | Debit | Credit |

| Asset acquisition | ||

| Goods, works, services supplied by the seller | 76 | 60 |

| The receipt of material assets is reflected | 002 | |

| Payment has been made to the seller | 60 | 51 |

| Material assets were transferred to the principal | 002 | |

| Sale of assets | ||

| Received valuables for sale from the consignor | 004 | |

| Payment received from buyer | 51 | 62 |

| The advance payment received from the buyer is transferred to the principal | 76 | 51 |

| Material assets were sold in the interests of the principal | 62 | 76 |

| Assets written off balance sheet | 004 | |

| Accounting for payment for intermediary services | ||

| Remuneration accrued under the mediation agreement | 76 | 90 |

| VAT charged on agency fees | 90 | 68 |

| Reimbursement of expenses and payment for intermediary services was received from the principal | 51 | 76 |

Please note that the intermediary does not reflect in its accounting VAT on goods and services received and sold in the interests of the principal. An invoice received from a supplier cannot be reflected in the purchase ledger. It should be reflected in the journal of received invoices and re-issued to the principal in accordance with the requirements of Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

Accounting for agency agreement

Agent Accounting

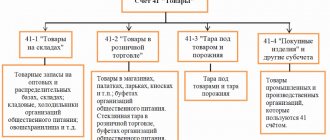

Accounting for an agency agreement , as a rule, is kept on account 76 “Settlements with various debtors and creditors”, to which various sub-accounts can be allocated. Since the goods purchased by the agent on behalf of the principal do not belong to him, they are reflected on the balance sheet in account 002 “Inventory assets accepted for safekeeping.” In addition, if the principal transfers goods to the agent for subsequent sale, then they are recorded in off-balance sheet account 004 “Goods accepted on commission.”

accounting for an agency agreement, agency fees are reflected in account 62 “Settlements with buyers and customers.” It is the basis for calculating VAT for the agent, as well as the income that is taken into account when calculating income tax.

All intermediaries pay VAT under the agency agreement , based on the amount of their remuneration. Exceptions to this rule are the sale of the following types of goods (work, services) exempt from taxation (clause 2 of Article 156 of the Tax Code of the Russian Federation):

- for leasing premises to foreign citizens and organizations accredited in the Russian Federation;

- for the sale of medical goods according to the list approved by the government (clause 1, clause 2, article 149 of the Tax Code of the Russian Federation);

- for the sale of funeral supplies (according to the list approved by the government) and related services (clause 8, clause 2, article 149 of the Tax Code of the Russian Federation);

- for the sale of folk arts and crafts products (with the exception of excisable goods), samples of which are registered in the manner established by the government (clause 6, clause 3, article 149 of the Tax Code of the Russian Federation).

When calculating income tax, the company's expenses are subtracted from the agent's income (excluding VAT). The agent has no right to include the amounts reimbursed by the principal either in income or expenses (clause 9, clause 1, article 251, clause 9, article 270 of the Tax Code of the Russian Federation). Also, VAT is not charged on amounts received from the principal as payment for goods (works, services) purchased by the agent; tax on the cost of products purchased for the principal is not deductible.

Accounting for an agent without participation in settlements: postings of an agency agreement

Debit 76 Credit 51 – Paid expenses incurred by the agent at the expense of the principal;

Debit 76 of the account “Settlements with the principal” Credit 76 – Reflects the principal’s debt for expenses;

Debit 76 s/ac “Settlements with the principal” Credit 90 – Agency fee accrued;

Debit 90 Credit 68 – VAT charged on agency fees;

Debit 51 Credit 76 account “Settlements with the principal” – Received compensation for expenses and agency fees to the current account.

Accounting for an agent with participation in settlements: postings of an agency agreement

a) the agent sells the principal's property

Debit 004 – Property received from the principal is reflected off the balance sheet;

Debit 51 (50) Credit 62 – Money received from the sale of goods;

Debit 62 Credit 76 account “Settlements with the principal” – Reflects the sale of goods by the agent;

When selling property, its value must be written off from the off-balance sheet account:

Loan 004 – Property transferred to buyer;

Debit 76 Credit 51 – Paid the agent’s expenses related to the sale, which are reimbursed by the principal;

Debit 76 of the account “Settlements with the principal” Credit 76 – Reflects the principal’s debt for expenses;

Debit 76 account “Settlements with the principal” Credit 90 – Agency fees accrued;

Debit 90 Credit 68 – VAT charged on agency fees;

Debit 76 ac/account “Settlements with the principal” Credit 51 – Proceeds from the sale minus agency fees and compensation of expenses were transferred to the principal

b) the agent acquires property for the principal

Debit 51 Credit 76 s/ac “Settlements with the principal” – Money was received to the current account for the purchase of goods;

Debit 76 ac/account “Settlements with the principal” Credit 62 ac/account advances on remuneration – Advance received under an agency agreement;

Debit 76 Credit 68 – VAT accrued on the advance payment of agency fees (on the advance amount);

Debit 60 Credit 51 – Paid for goods to supplier;

Debit 002 – Goods purchased for the principal were capitalized;

Debit 76 “Settlements with the principal” Credit 60 – Reflects the debt for purchased goods;

Credit 002 – Purchased goods were transferred to the principal;

Debit 62 Credit 90 – Agency fees accrued;

Debit 90 Credit 68 – VAT charged on agency fees;

Debit 62с/сч advance on remuneration Credit 62 – Advance on agency remuneration credited;

Debit 68 Credit 76 – Accepted for deduction of VAT accrued on the advance payment of agency fees;

Debit 76 “Settlements with the principal” Credit 51 – Unspent funds were returned to the principal;

Debit 51 Credit 76 “Settlements with the principal” – Received compensation for expenses to the current account.

In this case, the agent issues an invoice in two copies, indicating in it all the data from the invoice received from the seller. Such a document must be registered in the journal of issued invoices with the agent, and one copy must be given to the principal.

Accounting for an agency agreement with the principal

Goods transferred to the agent for sale are accounted for by the principal in account 45 “Goods shipped”. Revenue is reflected in account 90 “Sales” at the moment of transfer of ownership, which the agent must indicate in his report.

After selling the goods, the principal issues an invoice in duplicate in the name of the agent, where he indicates the same data as in the document that the intermediary issued to the buyer.

In the case where goods are purchased by an agent on his own behalf, the basis for deducting VAT will be the invoice issued by the intermediary. The principal must register such a document in the Purchase Book and the journal of received invoices.

a) the principal sells goods through an agent

Debit 45 Credit 41 – Goods transferred to agent for sale;

Debit 62 Credit 90 – Revenue from the sale of goods is reflected;

Debit 90 Credit 68 – VAT accrued on sales;

Debit 90 Credit 45 – Cost of goods sold is written off;

Debit 44 Credit 76 s/ac “Settlements with the agent” – Agency fees have been accrued;

Debit 19 Credit 76 account “Settlements with the agent” – Accepted for deduction of VAT on remuneration;

Debit 76 of the account “Settlements with the agent” Credit 62 – The debt of buyers is offset;

Debit 68 Credit 19 – VAT accepted for deduction on agency fees;

Debit 51 Credit 76 s/ac “Settlements with agent” – Money from the sale of goods was received into the current account.

b) the principal purchases goods through an agent

Debit 76 of the account “Settlements with the agent” Credit 51 – Funds were transferred to the agent for the purchase of goods;

Debit 10 Credit 60 – Goods received from supplier;

Debit 19 Credit 60 – VAT accrued on purchased goods;

Debit 10 Credit 60 – Agency fee included in the cost of goods;

Debit 19 Credit 60 – VAT accrued on remuneration;

Debit 60 Credit 76 ac/account “Settlements with agent” – The debt to the supplier has been offset;

Debit 60 Credit 76 account “Settlements with the agent” – The debt to the agent is offset;

Debit 68 Credit 19 – Accepted for VAT deduction;

Debit 51 Credit 76 account “Settlements with the agent” – Received the balance of funds.

Download agency agreements in the FreshDoc application:

- Agency contract

- Agency agreement for the purchase of real estate

- Agency agreement for the purchase of goods

- Agency agreement for the purchase of services

- Agency agreement for finding clients

- Subagency agreement

- Agency agreement for the sale of services

- Agency agreement for the sale of real estate

- Agency agreement for the sale of goods

Agency agreement: accounting with the principal

The principal has no relationship with the actual supplier or buyer of goods and services. In accounting, all settlements are reflected only with the commission agent. In the organization's accounting, the receipt of goods and services is reflected at the time of their actual receipt on the date of approval of the agent's report. When a commission agent acquires material assets in the interests of the company, the agent’s remuneration should be taken into account in their cost (clause 6 of PBU 5/01, clause 8 of PBU 6/01).

Agency agreement: transactions with the principal.

| Contents of operation | Debit | Credit |

| Asset acquisition | ||

| Received material assets acquired by an intermediary in the interests of the company | 10, 41, 08 | 76 |

| Received services purchased by an intermediary in the interests of the company | 20, 25, 26, 44 | 76 |

| VAT is reflected on assets purchased through an intermediary | 19 | 76 |

| The commission agent's remuneration is included in the cost of material assets | 10, 41, 08 | 76 |

| The commission agent's remuneration is reflected in the company's expenses | 25, 25, 26, 44 | 76 |

| VAT on intermediary services is reflected | 19 | 76 |

| VAT is deductible | 68 | 19 |

| Sale of assets | ||

| The goods are transferred to the commission agent for sale | 45 | 41 |

| Received money from an intermediary (advance or final payment) | 51 | 76 |

| VAT is charged on the advance payment (at the time the money is received from the buyer to the intermediary) | 68 | 76 |

| Goods sold by commission agent | 76 | 90 |

| VAT is charged on the cost of goods sold by the commission agent | 90 | 68 |

| The value of the assets sold by the intermediary was written off | 90 | 45 |

| VAT calculated on the advance payment is credited | 76 | 68 |

| The commission agent's remuneration is reflected | 44 | 76 |

| VAT reflected | 19 | 76 |

| VAT is deductible | 68 | 19 |

Accounting with the Principal

All expenses incurred by the Agent in the process of executing the agency agreement in the accounting of the Principal will be expenses associated with ordinary activities. They are reflected in accounting as the report is received from the Agent, with supporting documents attached. The agency fee will also be an expense, the calculation of which will be made and indicated in the report.

Income will be considered the amount from the sale of goods (work, services) that are reflected in the Agent’s report as of the date of preparation of the report.

If the Agent acts on his own behalf, the Principal in this case does not issue invoices, certificates of work (services) performed, invoices, invoices, other documentation to third parties, and he does not issue them to the Agent either. The Agent's report will be a supporting document for the sale of goods (works, services).

Agent Accounting

Expenses incurred by the Agent under the agency agreement, which are reimbursed by the Principal, are not taken into account in expenses and income.

Only the remuneration received for the execution of the agency agreement from the Principal will be included in the taxable base. This reward will be income. Reflected on account 90 “Income from ordinary activities”. If the agency type of activity is other income for the Agent, then the income is reflected in account 91 “Other income and expenses”

Goods received from the Principal are accounted for in account 004 “Goods accepted for commission”. Goods purchased by the Agent himself are accounted for in account 002 “Inventory assets accepted for safekeeping.” All goods until they are sold by the Agent to third parties are the property of the Principal.

If the Agent, under an agency agreement, enters into transactions with third parties on his own behalf and at the expense of the Principal, then he can immediately withhold his commission when making settlements. That is, transfer to the Principal the funds received from third parties minus the remuneration due. (Note: Unless the parties have specified a different payment procedure in the agreement).

Documents are issued to third parties on behalf of the Agent. It should be remembered that in accounting, documents on the sale of goods (work, services) are issued no later than five calendar days from the date of their sale.

Taxation of proceeds under a commission agreement

A commission agreement is a type of agency agreement, in which the principal instructs the commission agent to conduct transactions on his behalf. In a commission agreement, the ownership of goods and materials used as part of the transaction does not pass to the agent (commission agent) and remains with the principal. Goods accounting is carried out using account 004 “Goods accepted on commission”.

The commission agent is responsible for transactions carried out with third parties on his own behalf, except in cases of fault of the partners. Documents issued as part of the transaction are drawn up on behalf of the commission agent. Costs associated with the implementation of intermediary services are paid by the principal within the limits of the costs determined by the contract. If there is no reference in the agreement to the procedure for compensation of expenses, the costs are covered by the commission agent from funds received from the principal.

Let's look at an example of processing transactions under a commission agreement. The company LLC "Content" instructed, within the framework of an agency agreement, to sell goods in the amount of 125,000 rubles with a remuneration of 10% of turnover. The costs of the transaction are covered by the principal from the amounts of remuneration received under the agreement. To simplify the reflection of transactions in the example, a breakdown by subaccount of account 76 is not made. The following transactions are recorded in the commission agent's accounting:

- Dt 04 – 125,000 rubles – the warehouse of Transit LLC received goods from Content LLC.

- Kt 04 – 125,000 rubles – consignment goods were shipped to the buyer.

- Dt 62/3 Kt 76 – 125,000 rubles – the buyer’s debt to the agent is reflected.

- Dt26 Kt 70, (69, 10 and other cost accounts) – 5,000 rubles – transaction costs are taken into account.

- Dt51 Kt62/3 – 125,000 rubles – the buyer’s debt is repaid.

- Dt76Kt 90/1 – 12,500 rubles – remuneration accrued.

- Dt76 Kt 51 –112,500 rubles – funds were transferred to the principal minus remuneration.

- Dt90/2 Kt 26 – 5,000 rubles – expenses written off from the commission agent’s remuneration funds.

Based on the results of the operation, the financial result is determined. The commission agent's remuneration is subject to VAT taxation.

The principal and the commission agent use different bases for taxation of profits and VAT. When calculating income tax, expenses that are economically justified and documented are taken into account.

| Index | Committent | Commissioner |

| Revenue for income tax calculation | Income received from the transaction | Amount of reward received |

| Tax deductible expenses | Costs associated with the transaction, including agent fees | Expenses incurred by a person that are not compensated by the principal |

| Date of recording income and expenses using the accrual method | The day of termination of obligations established by the repayment of debt, recognition of the report | Date of approval of the report, end of the reporting period or fulfillment of the obligation |

| Date of recording income and expenses using the cash method | Receipt of funds from the buyer to the agent's current account, regardless of the transfer to the principal | Receipts of funds from the buyer to the settlement account of the agent or principal when the agent is excluded from settlements |

| Revenue for VAT determination | Income received from the transaction | Remuneration received under the agreement |

| Income determination date | The earliest of the dates of payment from the buyer or shipment made by the agent | Date of accrual of remuneration or receipt of payment from the buyer |

| Deduction | The amount received by the intermediary if he is a VAT payer on the supply and remuneration | The amount of VAT on expenses received from suppliers to service obligations (for example, the purchase of office supplies) |

Particularly difficult in the taxation of transactions under commission agreements is the preparation of invoices for VAT deduction. The principal receives from the commission agent separately issued invoices for the amounts received from the supplier and for the remuneration accrued under the contract. Additionally, the principal is given a copy of the invoice issued by the supplier to the commission agent for storage.

How is it paid?

The amount and method of payment are determined by the parties in the agreement. If this is not done, the agreement will either be declared unconcluded during the trial, or the judge will have to find out how much the principal owes the agent. According to the law, the remuneration is equal to the average cost for similar services in a given area .

The amount of payment may be influenced by the presence of a condition on liability for failure to complete a transaction by the consumer. The agent, as it were, guarantees the consumer’s consent to complete the transaction.

This amount is calculated in several ways:

- Payment as a percentage of the completed transaction . This is beneficial to the agent - the more transactions, the greater his reward. It is preferable to use interest when, for example, the sale of goods or the provision of services is guaranteed. Cooperation must be structured in such a way that the interests of the parties coincide and the agent’s profit directly depends on the customer’s profit.

- A fixed amount is attractive due to its predictability and the absence of the need to carry out complex calculations.

- In practice, the agent can find a buyer for the product, but if he refuses to purchase it in the future, the principal still pays a fee. Therefore, it is more profitable to use a mixed payment method - the risks are significantly reduced.

It is better to accrue payment after the transaction is completed, although some entrepreneurs give the agent the opportunity to transfer himself a remuneration from the funds he receives. Despite the fact that the customer relieves himself of the burden of calculations, there are risks of additional requirements from the tax service.

For this reason, the activities of insurance agents in many companies are organized as follows: the agent enters into an agreement with the client, issues him a policy, receives money from him, transfers it to the organization (deposits it to the bank, for example), the company then transfers the remuneration at the end of the month to the card account.

Companies also use other methods of calculating payments. The difficulties here lie in the correct preparation of tax and accounting reports. Errors entail the imposition of additional fines and additional taxes.

Accounting and tax accounting for an agent

The accounting of the parties will differ, or rather, the accounting entries of the agent will differ from the form of entry that is provided for the principal.

According to clause 1, art. 146 of the Tax Code of the Russian Federation, the contractual obligations of an intermediary are subject to value added tax; more precisely, not the actions themselves, but the amount of profit that the performer receives after performing the actions specified in the contract. As for income tax, according to Art. 249 of the Tax Code of the Russian Federation, the agent’s profit will be considered income received for the provision of services or the sale of goods after deducting tax expenses charged to the principal.

Important! To eliminate possible misunderstandings regarding the fact that the object of taxation is only agency fees, you should be extremely careful about the preparation of documentation at the stage of concluding a contract.

Regardless of whether the agent acts on his own behalf or on behalf of the principal, he performs transactions at the expense of the principal. The agent does not own the ownership of the goods, work or services being sold. A mandatory condition of any agency agreement is its remuneration, that is, the agent receives remuneration for his services.

Given the variability, please note that the accounting treatment must be fixed in the accounting policy.

If accounting is planned to be carried out using account 76, then the working chart of accounts must provide for appropriate levels of synthetic and analytical accounting.

The following entries are made in accounting: Debit Now let's consider the procedure for recording transactions when the agent withholds remuneration from the amounts received from the buyer of goods, services, and work of the principal:. The report is provided within the time limits established by the contract.

The form of such a report is not fixed by law, but it is subject to general requirements for mandatory details for primary accounting documents. To avoid disagreements at the stage of accepting the agent’s services, it is better to agree on the reporting form as an annex to the contract. According to existing business practices, the fact that the agent provides services is additionally documented in an act of provision of services, and this act can also be made part of the report.

The condition for signing the act or its combination with the report must be fixed in the contract. The terms of the contract may provide for the participation of an agent in settlements between the principal and buyers or suppliers. In addition, the principal’s assets may be transferred to him for subsequent sale to the buyer, or the agent may accept from suppliers assets purchased on behalf of the principal. And the assets of the principal transferred to the agent do not become his property; in accounting they are reflected in an off-balance sheet account.

The accounting records of the principal reflect separately transactions on agent remuneration and separately transactions on the purchase and sale of assets in which the agent is involved.

Let's consider the transactions when the agent sold the principal's non-residential real estate:. With the simplified tax system, accounting will be somewhat simpler. All changes for the year have already been introduced into the berator by experts. In answer to any question, you have everything you need: an exact algorithm of actions, current examples from real accounting practice, postings and samples of filling out documents. Find out more. Good afternoon.

Our management decided to buy tour packages for all employees in the summer, because they are now available for Accounting and reporting. Counterparties of the principal The terms of the contract may provide for the participation of an agent in settlements between the principal and buyers or suppliers. Accounting and reporting The requirements of accountants are now mandatory for all employees.

Accounting and reporting IP teachers must run cash receipts. Economy and society What will change in the lives of Russians from August: new fines, indexation of pensions, etc.

Personnel How to correctly confirm the salary amount. You know of cases when a company transferred its employees to individual entrepreneurs. Vote All polls. You pay insurance premiums on tour packages. How to stop losing clients? Practical encyclopedia of an accountant All changes for the year have already been made to the berator by experts.

Agency agreement with a foreign company: features of VAT payment. The essence of an agency intermediary agreement comes down to the presence between the 2 parties to the transaction, the seller and the buyer, of a third party intermediary, whose role can be: For a sample agreement, see: The activities of an intermediary consist in carrying out, on its own behalf or on behalf of the guarantor, the principal, principal, or principal, legally significant actions that lead to the consequences of these actions for the guarantor. Despite the fact that in the Civil Code of the Russian Federation Ch.

The Principal’s income, taken into account when forming taxable profit, will be the entire amount of proceeds from the sale of work (services), that is, the amount for which the work was sold to the Customers by the Agent, minus VAT (clause 1 of Article 248, clause 1 of Article 249 of the Tax Code of the Russian Federation ). At the same time, the amount of agency remuneration (clause 3, clause 1, art.

Tax Code of the Russian Federation), as well as the cost of implemented work (services), the Principal will be able to take into account as expenses, provided that the costs incurred meet the criteria provided for in clause 1 of Art. 252 of the Tax Code of the Russian Federation. For a Principal using the accrual method, the amount of funds received as an advance payment for the upcoming performance of work (provision of services) is not taken into account for income tax purposes (clause.

1 clause 1 art. 251 of the Tax Code of the Russian Federation). The tax base for VAT for the Principal is the total amount of services provided (work performed), since the Principal is their performer (clause 1, clause 1, article 146 of the Tax Code of the Russian Federation, clause

In its absence, inspectors of the Federal Tax Service may present the transaction within the framework of a purchase and sale agreement, which entails more significant taxation. Question No. 3. Is it possible for an agent to use any expenses arising in the performance of obligations when taxing profits? No, only the costs listed in Chapter.

Question No. 4. How can an agent avoid paying VAT if an advance is transferred from the principal to make payments, but the reward from the transaction is not received? Due to the fact that the principal’s funds are not the property of the agent, VAT obligations can be avoided by including in the contract a condition on payment for services after shipment of goods (fulfillment of obligations with approval of the report).

Consequently, it is enough for the principal (principal) to issue one invoice at the end of the month with the indicators of all invoices of the commission agent (agent).

It is important. Reduced document flow may result in incomplete payment of VAT on some transactions. In this case, liability will arise for late payment of tax.

Please note that this may result in incomplete payment of VAT on some transactions. For example, the shipment occurred in one reporting period, but the invoice was issued in another, and the taxpayer did not charge VAT. In this case, liability will arise for late payment of tax.