Let's consider the tax consequences of value added tax when selling receivables for an organization selling the debt.

Until January 1, 2001, that is, before the entry into force of part two of the Tax Code of the Russian Federation, when determining the taxable bases for transactions for the sale of debtors' debts, one should proceed from the norms of part one of the Tax Code of the Russian Federation. According to paragraph 3 of Article 38 of the Tax Code of the Russian Federation, goods for tax purposes are property that is sold or intended for sale.

According to Article 39 of the Tax Code of the Russian Federation, the sale of goods is the transfer of ownership of goods.

The right of ownership as a combination of the rights to own, use and dispose of property is a real right that can only arise in relation to things - material property. The assignment of a claim is an operation governed by the law of obligations. An obligation is a type of property that is not related to things, and, therefore, the assignment of the right of claim is not a fact of transfer of ownership and therefore, in accordance with Article 39 of the Tax Code of the Russian Federation, is not a sale of property and is not subject to sales taxes, in particular, in accordance with Article 3 of the Law of the Russian Federation dated December 6, 1991 No. 1992-1 “On Value Added Tax”, before the entry into force of part two of the Tax Code of the Russian Federation, the assignment of the right of claim was not subject to VAT.

Part two of the Tax Code of the Russian Federation has changed the interpretation of transactions for the sale of receivables for tax purposes in terms of payment of value added tax on these transactions. According to Article 155 of the Tax Code of the Russian Federation, which is specifically devoted to this issue, the procedure for determining sales turnover depends on whether the organization sells the buyer’s receivables arising as a result of the sale of goods (works, services) to him, or the receivables previously acquired under an agreement for the assignment of the right of claim.

According to paragraph 1 of Article 155 of the Tax Code of the Russian Federation, when assigning a claim arising from a contract for the sale of goods (works, services), transactions for the sale of which are subject to taxation, the tax base for transactions of these goods is determined based on the price of their (goods, works, services) sale and no additional turnover subject to VAT arises in this case.

Paragraph 2 of Article 155 of the Tax Code of the Russian Federation literally reads: “the tax base for the sale by a new creditor who has received a claim of financial services related to the assignment of a claim arising from an agreement for the sale of goods (works, services), transactions for the sale of which are subject to taxation, is determined as the amount of excess the amount of income received by the new creditor upon the subsequent assignment of the claim or termination of the corresponding obligation, over the amount of expenses for the acquisition of the said claim.”

From the text of paragraph 2 of Article 155 of the Tax Code of the Russian Federation it follows that the Tax Code classifies transactions for the purchase of receivables with the purpose of receiving funds from them or subsequent resale as the sale of services. In this case, sales turnover is determined in the first case as the difference between the acquisition cost of receivables and the amount received on it*; in the second - as the difference between the acquisition cost of receivables and the amount of proceeds received from their resale.

______________

* Here the Tax Code refers to the amount “received by the new creditor upon termination of the relevant obligation,” and not the amount of debt. Consequently, if, when purchasing a debt, its acquirer received from the debtor an amount less than the amount of the debt, when determining the tax base, only the amount of funds actually received should be taken into account.

____________

It is important to take into account that these regulations of the Tax Code of the Russian Federation relate only to transactions of purchase and sale of receivables “arising from a contract for the sale of goods (works, services).” Consequently, when selling other debts at a profit, for example, those arising from a loan agreement, no VAT base arises. This has quite important consequences.

Example

The seller organization has receivables from the buyer organization, which arose as a result of the sale of goods (works, services). At the same time, a third organization is ready to buy this debt.

Based on the requirements of Article 818 of the Civil Code of the Russian Federation, according to which, by agreement of the parties, a debt arising from the purchase and sale, lease of property or other basis can be replaced by a borrowed obligation, organizations - the seller and the buyer - agree to transform existing receivables into a loan agreement. After this, when this debt is sold, a third organization acquires it as a debt arising from a loan agreement. Consequently, when receiving money for this receivable or subsequent resale of it at a profit, the organization that purchased the debt will not have a VAT tax base.

Recognizing the sale of receivables as the sale of financial services, the Tax Code thereby extends the effect of Article 167 “Determining the date of sale (transfer) of goods (work, services)” to these transactions. Consequently, if, according to the accounting policy of an organization reselling receivables, the moment of sale of “payment” is established, the obligation to the budget for VAT on the difference between the purchase and sale prices of the debt arises only after receiving funds from the buyer of the debt in payment.

Comprehensive analysis of accounts receivable

Without this point, buying remote control means pointing your finger at the sky and ultimately paying for a pig in a poke. This, as a rule, leads to the loss, at best, of the deposit for the lot, and in the worst case, the amount that you allocated for the lot. With the help of my website debtorki.rf, carry out a professional analysis of remote control and distribute liquid lots to a database of persons participating in the purchase of remote control over the past three years.

I know the need to conduct a preliminary study of liquidity, in other words, the future 100% possibility of debt collection.

Over the 4 years of its activity, it has developed liquidity criteria for the subsidiary, which allow us to hope for the future successful collection of the debt of a third-party LLC . I'm posting them for you.

Video – the whole truth about collection of receivables

As a result, out of 10 receivables, you will find 1-2 that are realistically recoverable, and of these, collect one, but you will earn at least half of the nominal value.

Hundreds of percent on just one simple transaction!

The first step is to gain knowledge and experience in this matter.

The author of our guide, Vadim Kuklin, used to be a simple doctor in Smolensk and in 1 year was able to earn 22 million rubles from debt collection.

Watch a special video by Vadim Kuklin about his experience in collecting receivables:

Liquidity criteria for a legal entity's debt

A legal entity's financial assets must have the following liquidity parameters:

- Preferably a valid telephone number, postal address and company website;

- Information about the Debtor appears in search engines;

- The debtor is a going concern;

- The LLC must not be bankrupt;

- The LLC should not be in the process of liquidation or reorganization;

- Participation in existing government contracts is encouraged;

- The LLC must not have any debts to the tax office;

- The debtor must not have a legal address of mass registration;

- Its director is not in the “mass” category;

- The claim against the debtor must be categorized as “settled”;

How to determine whether a given receivable is worth buying

What you should pay attention to when purchasing accounts receivable, so as not to purchase a “dummy”.

Analysis of the debtor-legal entity:

- Has the debtor company been liquidated? Is it going to stop operating in the near future?

- Does this company have any legal cases? Do bailiffs have enforcement proceedings?

- When did the debt arise? The shelf life of accounts receivable is 3 years (if there have been no court decisions, after filing a claim, the period is suspended).

- How is the debt verified? What documents are there?

Analysis of the debtor-individual:

- Isn't it bankrupt?

- Is there any property that can be sold to pay off the debt? What is its approximate cost? Is there an official source of income?

- Do you owe it to anyone else? Does he have a lot of debt?

- When did the debt arise? The shelf life of accounts receivable is 3 years (if there have been no court decisions, after filing a claim, the period is suspended).

- Are there documents confirming the debt?

How to check:

- First of all, visit the website https://bankrot.fedresurs.ru

- Website for bailiffs to check the availability of enforcement proceedings https://fssprus.ru/iss/ip/

- Checking by TIN, ORGN on the tax website https://egrul.nalog.ru, as well as in various paid and free services.

- Service https://kad.arbitr.ru

An example of confirmation of debt liquidity as a result of a comprehensive analysis of a real lot

Open auction

Accounts receivable from GarantStroyExpert LLC—RUB 49,709.03. Region: Altai Territory

Claims against the debtor: RUB 39,539. 52 kopecks amount of unjust enrichment and 10,169 rubles. 51 kopecks interest for use.

Debtor: STROYGARANT LLC (TIN: 2222795753) (at EFRSB) Address: Altaisky, Barnaul, Krupskoy, 143 Region: Altai Territory Date of auction: 04/13/2018 08:00

About the company: Limited Liability Company "GarantStroyExpert"

1. Company details: TIN 2225091811 2. Legal address of the company 3. Actual address of the company: (matches the legal one) yes 4. Types of activity: Construction of residential and non-residential buildings. 5. Company registration date: Registered 01/30/2008, active+ 6. Taxation system used: uses the simplified tax system 7. Director: Director Maxim Aleksandrovich Rudnev 8. Number of employees 9. Telephone 10. Website: garant22.rf. 11. Founders of the company: Rudnev Maxim Aleksandrovich, also director 12. Relations with other companies: no 13. Branches of the company: no 14. Authorized capital (thousand rubles): 12

Financial Analysis: Projected Revenue Growth for 2020: +36%

Performance results for previous years:

Efficiency: high. The owner's income is above average (70 kopecks per invested ruble). The profitability of property (68%) is higher than the industry average (2%) for the Construction industry. Return on sales (292%) is higher than the industry average (6%) for the Construction industry.

Property status: normal. Management of current assets has become more economical: customer debts began to be collected 14% faster. Over the past year, property has grown by 36% (from 867 thousand rubles to 1182 thousand rubles), which increased the potential of the enterprise. No funds have been allocated for long-term development.

Financial situation: good. Solvency is high: current assets (sources of repayment of liabilities) exceed liabilities by 5273%. There is no threat of financial dependence: borrowed funds on the balance sheet (2%) do not exceed equity. The provision of current activities with own funds is good (98%> 30% of the amount of current assets)

Company reliability: above average. Courts (plaintiff, defendant, writs of execution): there are no enforcement proceedings.

Factors for successful recovery:

- Availability of a phone number and a website, which is very good for collection.

- Excellent economic indicators.

- Availability of state contracts.

- LLC reliability is above average.

- The claim against the debtor is ours alone.

Recommendations for purchasing private property: very high probability of collection.

Collection plan:

- Proposal to conclude a settlement agreement after the debt takeover procedure with a discount of 10% to 30%.

- Full recovery.

- Debtor's bankruptcy.

The receivables I selected fully met all of the listed debt liquidity criteria.

For what reasons do accounts receivable arise?

There are a number of main reasons due to which large financial losses occur in enterprises. These include: lack of mandatory payments and unpaid loans.

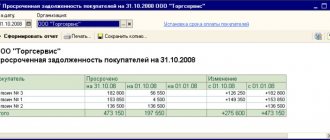

Accounts receivable are also divided into normal (when debts are repaid within the agreed period) and overdue (when agreements on debt repayment are not observed). Another type of legal classification of debtors' debts involves the occurrence of expected, doubtful and hopeless probabilities of debt repayment.

Debt has a steady tendency to constantly increase. When it increases, and the guarantee of return by debtors is not even discussed, such an enterprise is regarded as a source of profit for interested and legally savvy individuals who want to acquire its debts with a view to further collecting them from debtors.

Buying a lot

An important phase of the transaction has arrived. Questions that are important to find answers to at this stage:

- At what price should I buy the lot?

- What is the public offering period?

- How can I prevent the auction organizer from finding out my price?

- And didn’t ruin the purchase?

The experience I acquired over 4 years of activity in this field allowed me to make the right decisions and win the auction. I am posting the auction protocol for you:

However, victory in the auction is considered final only after the debt is collected.

Debt purchase procedure

The acquisition of receivables for the purpose of debt collection is carried out as follows:

- Search for lots on the debt market.

- Pre-check.

- Submitting an application to participate in the auction.

- Checking lot documentation.

- Participation in auctions.

- Drawing up an agreement on the assignment of rights to claim debt.

- Sending a notice to the debtor.

Information about receivables of bankrupt organizations can be viewed on special online platforms for the sale of debts. During the preliminary check, the quality of the debt is analyzed based on information about the debtor and the length of the delay, since the debtor of a bankrupt enterprise may also be on the list of persons against whom a bankruptcy case has been opened.

In the Unified Register you can see at what stage the debtor’s bankruptcy case is, what is the total value of his property and the amount of claims of creditors of each priority. Based on the collected data, it is possible to determine what amount the company selling the debt can expect if the case of its debit debtor enters the stage of bankruptcy proceedings, as well as what are the prospects for restoring the solvency of such a debtor.

As a rule, the sale of receivables is carried out at a price comparable to or higher than the expected amount guaranteed to the claimant as a result of bankruptcy proceedings, so it makes sense to buy debt if there are prospects for rehabilitating the financial condition of the bankrupt debtor during rehabilitation or external administration. Such prospects can be assessed by analyzing the features of the debtor’s company’s business activities and its financial condition.

After submitting an application and registration, the auction participant has the opportunity to familiarize himself with the documentation for the auctioned lots.

Debt collection

No collection - no income from the entire transaction. At this stage, the hopes and dreams of 97% of participants in the purchase of other people's debts perish. Somehow, on the Internet, I read a letter from two cooks. They bought the debt of the LLC for a total amount of 12 million. They spent 500 thousand of the total money.

The LLC went bankrupt a month later. And the cooks naively asked the bankruptcy trustee to return them 500 thousand hard-earned money they had earned by the sweat of their brow. But these unfortunate half a million have already gone into the bankruptcy estate of the debtor. And there are countless such examples at bankruptcy auctions.

Conclusion: invest only with bankruptcy auction professionals.

Let's return to my story.

How to earn

A receivable in itself is a bad thing for an organization, but for those who want to purchase it at a low price and later collect the full amount, this is an opportunity to make good money.

A person buying a debt can make money both from the difference between the purchase price and the further amount to be collected, and from the opportunity to collect penalties, penalties and fines from the debtor.

Earning opportunities vary greatly depending on the company that sells its debt. Usually, for hopeless legal entities that are ready to go bankrupt, the debtors can be completely different - both trustworthy clients and not so reliable ones.

There is a greater likelihood of buying “good” debt from quite successful companies that, for some reason, have counterparties with obligations.

For example, such an organization could be a cellular operator that has accumulated debt from subscribers (mainly legal entities) due to their making advance payments to their balance sheet.

Waiting for subscribers to “talk” the appropriate amount takes a long time, and is simply unprofitable - after all, the cellular operator needs working capital. This is how a debt that is actually recoverable is put up for auction.

So, the main ways to make money on accounts receivable:

- purchase for the purpose of further resale through public auction;

- debt collection through legal proceedings;

- collection of fines, penalties and penalties from the debtor;

- repayment of its obligations by the purchased debtor through offset of claims with another counterparty.

Each of these methods has its own characteristics. They have one thing in common: implementation is quite lengthy, and often not always profitable.

So, purchasing receivables is a way to make money for some companies, while for others it is an opportunity to exercise their property rights in the event of bankruptcy or liquidation.

The purchase can be made on electronic trading platforms or by finding a corresponding announcement about the upcoming auction in the media.

Before purchasing, it is important to evaluate the debt - if a risk is identified based on many factors, it is better to refuse the dubious transaction.

The sale of receivables at auction is described in the article: sale of receivables. Read here which insurance companies insure accounts receivable.

How to conduct an inventory of accounts receivable is described in this article.

Types of receivables

[ads-pc-4][ads-mob-4]

The main characteristic of accounts receivable, in addition to its size, is the timing of its repayment. According to the terms of the receivable, there are:

- normal (which is expected to mature within the expected time frame);

- overdue (not repaid within the contractual terms).

According to the degree of probability of repayment, receivables can be:

- expected – the repayment terms of which are within the contractual limits;

- doubtful - the repayment of which is prevented by any circumstances, for example, the absence of an agreement or other document confirming the existence of a debt;

- hopeless - the repayment period of which has exceeded the statute of limitations or the debts belong to an enterprise under bankruptcy proceedings.

Important: The statute of limitations is 3 years, and all decisions regarding repayment of receivables must be made before its expiration.

As you can see, all varieties are interconnected and smoothly flow from one type to another - from better to worse.

How to reduce accounts receivable

Methods for reducing accounts receivable begin to be applied at the stage of concluding contracts with a potential debtor. These methods are as follows:

- correctly assess the financial condition of the counterparty;

- correctly draw up all the necessary documents confirming the relationship between enterprises.

If a debt does arise, the company’s accounting department must systematically work to pay it off, not excluding the preparation of documents for filing claims.