Who uses accounts receivable and payable and when?

Accounts for settlements with debtors and creditors are an integral set of accounts for any company, since its functioning is impossible without:

- accrual and payment of wages and other payments to their employees (the appearance of debit and credit turnover on account 70);

- fulfillment of tax obligations (the emergence of a debit and credit balance on accounts 68 and 69);

- carrying out settlements with their counterparties (turnovers and balances on settlement accounts: 60,62,76);

It is impossible to organize full-fledged accounting without these accounts. Accounting for them must be maintained continuously in chronological order throughout the entire period of the company’s activities.

Which accounting accounts are used by budgetary organizations for settlements with debtors and creditors, see the material “Creating a chart of accounts for budgetary accounting - sample 2016”.

Accounting receivables posting

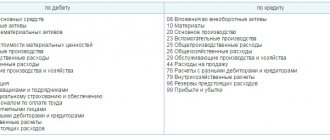

Let's consider the main transactions for settlements with debtors and creditors, in which receivables arise:

| Business transaction | Wiring | |

| D | TO | |

| The supplier has received an advance payment | 60 | 51 (51) |

| Products have been shipped to the buyer | 62 | 90 (sub-account “Revenue”) |

| Sickness benefits accrued at the expense of the Social Insurance Fund | 69 | 70 |

| Employees were paid an advance | 70 | 50 (51) |

| The employee was given a sum of money to report | 71 | 50 (51) |

| A loan was issued to an employee | 73 | 50 (51) |

| The founder's debt to pay into the authorized capital | 75 | 80 |

| Interest accrued on the loan issued | 76 | 91 (sub-account “Other income”) |

Postings for writing off receivables must be distinguished from postings for repayment. Upon repayment, the debtor fulfills his obligation to repay the debt. And when the debt is written off, it is included in the financial result of the company. Thus, repayment by the counterparty of the debt on shipped products is reflected in the following posting:

D 51 (52) K62.

And, for example, writing off a debt on a loan issued to an employee (debt forgiveness):

D91 (subaccount “Other expenses”) K73.

When a doubtful debt for which a reserve was created is written off, the posting will be as follows:

D63 K62 (60).

In which section of the balance sheet are accounts receivable reflected?

Accounts receivable in the balance sheet are reflected in section II “Current assets” on line 1230 “Accounts receivable”.

To complete this balance sheet line, you need to collect information from different accounting accounts and apply the following formula:

p. 1230 = DS (count 60 + count 62 + count 68 + count 69 + count 70 + count 71 + count 73 + count 75 + count 76) − KS count. 63,

where DS and KS are the debit and credit balances of the accounts on which receivables are reflected.

How international standards require accounting for receivables, see the material “Accounting for receivables under IFRS”.

Certain types of debtors' debts may be reflected in the balance sheet in other lines - more on this later.

Accounts receivable in the financial management system

The amount of debt of debtors is characterized as a component of the current assets of the enterprise. Work related to the control of debtors' debts is an important aspect of organizing an enterprise management system.

Economists recommend adhering to the following algorithm:

- Plan the total amount of the maximum possible debt of debtors.

- Set a credit limit for buyers.

- Control the formation of accounts receivable.

- Involve employees in the active participation in the development of new scenarios and solutions to problems related to accounts receivable.

Regardless of what control policy is developed and adopted at the enterprise, it is necessary to carefully monitor the results of the financial analysis of debts of debtors.

Short-term and long-term accounts receivable: how to divide and why to do it

The division of assets by maturity is of great importance for the financial analysis of the company's performance.

How to analyze the balance sheet, see the material “Methodology for analyzing the balance sheet of an enterprise.”

The procedure for such division is simple (clause 19 of PBU 4/99 “Accounting statements of an organization”, approved by order of the Ministry of Finance of Russia dated July 6, 1999 No. 43n):

- assets are short-term if their circulation (repayment) period does not exceed 12 months. after the reporting date or the duration of the operating cycle (if it is more than 12 months);

- all other assets are classified as long-term.

Long-term and short-term receivables are not distinguished in the balance sheet; their breakdown by timing is provided in the notes to the balance sheet.

In the general case, all receivables are considered a highly liquid (highly circulating) asset, and therefore a single place is assigned to it in Section II “Current assets”. In fact, not all debtors' debts are equal in liquidity. For example, prepayments (advances issued) made by a company in connection with capital construction have low liquidity and, according to the recommendations of the Ministry of Finance of the Russian Federation (letter dated April 11, 2011 No. 07-02-06/42), they must be reflected in the balance sheet as part of non-current assets in the line "Construction in progress".

When accounts receivable are reflected in line 1170 “Financial investments” of the balance sheet, you can find out by reading our material to the end.

What is included in accounts receivable

The composition of accounts receivable in a condensed form can be presented as follows:

- debts to the company from counterparties, borrowers, employees, etc.;

- overpaid taxes, fees, insurance premiums;

- debts of the founders on contributions to the authorized capital;

- advances issued;

- fines, penalties and penalties recognized by debtors (or by court decision).

In expanded form, each enlarged group can be detailed by element. For example:

- accounts receivable from counterparties include debts of suppliers and contractors (for unpaid advances), buyers and customers (for goods and products supplied);

- employees may owe their company for amounts owed, for loans issued, for unearned but received wages, etc.

The volumes and types of receivables in a particular company depend on the specifics and scale of its activities, financial policies, schemes for working with debtors and other factors.

Types of accounts receivable

Types of receivables are distinguished based on their classification criteria:

| Criterion | Types of accounts receivable |

| In order of occurrence | Normal (arising within the framework of credit policy) Unjustified (arising from violation of requirements) |

| By timing of payment | Scheduled (repayment dates have not yet arrived) Overdue (repayment period has already arrived, but the debt has not been paid) |

| By length of delay | Overdue less than 45 days Overdue from 45 to 90 days etc. |

| According to the reality of collection | Real for collection Doubtful Hopeless |

Which account should accounts receivable not be reflected in?

Accounts receivable cannot be reflected in accounting accounts (for example):

- fixed assets and intangible assets - 01, 04;

- depreciation - 02, 05;

- inventory assets (inventory, goods, products) - 10, 15, 16, 41, 43, 45;

- cash - 50, 51, 52, 55;

- costs, income and expenses (for production, for sale, other income and expenses) - 20, 23, 25, 26, 44, 91.

In order not to make mistakes in using accounts to account for accounts receivable, it is necessary to correctly formulate a working chart of accounts and thoroughly have information about the purpose of each account used.

Find out more about the chart of accounts for 2020 - see the material.

Creation of a reserve for doubtful debts

Accounting for receivables that have become doubtful or bad requires the creation of a reserve for doubtful debts. It is worth remembering that this action is primarily regulated by accounting policies. Only accounts receivable from customers can be written off to the reserve. The transaction is reflected by the posting: D 63 Kt 62.

The amount is included in operating expenses, thereby reducing the enterprise’s profit in advance. At the same time, the debt itself does not disappear, but is listed on the off-balance sheet account 007 for 5 years. How does the company leave a chance to collect the debt if the financial situation of the debtor changes.

When the debtor repays the debt, the amount will be written off from the reserve account to the enterprise’s income: Dt 91.1 Kt 63 (Dt 91.1 Kt 007).

Debtors are one of the counterparties in the system of market relations between buyers and customers. By paying due attention to the enterprise's credit policy, it is possible to avoid the formation of bad debt, which hinders the economic development of the company.

What can you learn from the balance sheet about accounts payable?

Line 1520 “Accounts payable” is located in section V “Short-term liabilities” of the balance sheet. Large companies add lines to the balance sheet to decipher accounts payable by type. For example:

- line 1521 - debts to counterparties;

- line 1522 - debt on taxes and fees;

- line 1523 - underpaid insurance premiums;

- line 1524 - accrued but not paid wages, etc.

Separate details of the company's accounts payable are given outside the balance sheet lines, in explanations and transcripts to the balance sheet.

For detailed information on the composition and accounting nuances of accounts payable, see the material “How are accounts payable reflected in the accounts?”

Purchase of receivables: conditions and postings (to which account to attribute)

Accounts receivable may appear on the company's accounts as a result of assignment - transfer of the right to claim the debt.

Any business entity has the right to acquire the debt of a third party. The main purpose of such a purchase is to benefit from the transaction (buy cheaper and collect (or offset) the face value of the debt).

The purchase process occurs under the following conditions:

- an assignment agreement is concluded between the parties to the agreement;

- the contract requires notarization if the debt arose from a transaction completed in notarial form;

- the transfer of rights to property subject to mandatory state registration to a new creditor is subject to state registration;

- the debtor must be informed about the transfer of the right to claim the debt - this responsibility lies with the original creditor;

- After completing a debt purchase transaction, it is better to receive all documents confirming the debt from the original creditor using the transfer and acceptance certificate.

For situations that require the execution of a transfer and acceptance certificate, please use the materials posted on our website:

- “Act of acceptance and transfer of documents upon change of director”;

- “Act of acceptance and transfer of affairs of the chief accountant - sample”.

Accounting entry for accounting for receivables purchased from the original creditor (clause 3 of PBU 19/02 “Accounting for financial investments”, approved by order of the Ministry of Finance of the Russian Federation dated December 10, 2002 No. 126n):

Dt 58 “Financial investments” Kt 76 “Settlements with various debtors and creditors”

When reflecting acquired debt as part of financial investments, a number of conditions must be met - learn about this in the next section.

Account 62 “Settlements with buyers and customers”

Account 62 “Settlements with buyers and customers” reflects information on settlements with buyers and customers.

Account 62 “Settlements with buyers and customers” is debited in correspondence with accounts: 90 “Sales”, 91 “Other income and expenses” for the amounts for which settlement documents were presented.

Account 62 “Settlements with buyers and customers” is credited in correspondence with the accounts for recording cash, settlements for the amount of payments received, including the amount of advances received, etc. Amounts of receivables for which the statute of limitations has expired are written off for each obligation based on inventory data, written justification and an order (instruction) from the head of the organization on the financial results of the organization on the credit of account 62 “Settlements with buyers and customers” and the debit of subaccount 91-02 "Other expenses". Amounts of debts that are unrealistic for collection are credited to the reserve for doubtful debts in account 62 “Settlements with buyers and customers” and in the debit of account 63 “Provisions for doubtful debts”. If during the period preceding the reporting period, the amounts of these debts were not reserved in the prescribed manner, they are included in the financial results of the organization as a credit to account 62 “Settlements with buyers and customers” and a debit to subaccount 91-02 “Other expenses”.

The following subaccounts can be opened to account 62 “Settlements with buyers and customers”:

62-01 “Settlements with buyers and customers”;

62-02 “Calculations for advances received”; 62-

03 “Settlements on bills received”; 62-

04 “Settlements with subsidiaries”; 62-

05 “Settlements with dependent companies”.

Subaccount 62-01 “Settlements with buyers and customers” reflects revenue from the performance of work, provision of services by type of activity in correspondence with the credit of account 90 “Sales”, subaccount 01 “Revenue”. The debit of subaccount 62-01 “Settlements with buyers and customers” also reflects revenue from the sale of fixed assets, materials and other assets in correspondence with the credit of account 91 “Other income and expenses”, subaccount 01 “Other income”.

The debit of subaccount 62-01 “Settlements with buyers and customers” reflects revenue from: -

performance of work, provision of services to the population and third-party organizations in the field of housing and communal services in correspondence with the credit of account 90 “Sales”, subaccount 01 “Revenue”; —

sales of products, performance of work, provision of services by service industries and farms in correspondence with the credit of account 90 “Sales”, subaccount 01 “Revenue”; —

sales of goods (materials purchased for resale) by logistics departments in correspondence with the credit of account 90 “Sales”, subaccount 01 “Revenue”.

The accrual of fines, penalties, penalties for violation by buyers of the terms of contracts is reflected in the debit of subaccount 62-01 “Settlements with buyers and customers” in correspondence with the credit of account 91 “Other income and expenses” subaccount 01 “Other income”.

Receipts of funds from buyers and customers to pay off their debts are reflected in the credit of subaccount 62-01 “Settlements with buyers and customers” in correspondence with cash accounts. In addition, the credit of subaccount 62-01 “Settlements with buyers and customers” reflects the offset of the advance payment for goods, works, and services sold.

Subaccount 62-02 “Settlements on advances received” takes into account calculations on advances received for the supply of material assets or for the performance of work (services). The same sub-account records payments for materials, structures and parts received from customers or paid for by customers.

The amounts of advances received are reflected in the credit of subaccount 62-02 “Calculations for advances received” in correspondence with cash accounts.

At the same time, the debit of account 62-02 “Calculations for advances received” and the credit of account 68 “Calculations for taxes and fees” (subaccount 04 “Calculations for value added tax”) reflects the amount of VAT calculated at the established rate on the basis of documents on advances received .

When shipping products, performing work (services) for the amount of previously taken into account tax, a reverse entry is made to the debit of account 68 “Calculations for taxes and fees” (subaccount 04 “Calculations for value added tax”) and the credit of subaccount 62-02 “Calculations for advances” received”, and the amount of the advance received is taken from the credit of subaccount 62-02 “Calculations for advances received” to the debit of the accounts (subaccounts):

62 “Settlements with buyers and customers”;

73 “Settlements with personnel for other operations”;

76 “Settlements with various debtors and creditors” (subaccount 08 “Settlements with individuals”);

76 “Settlements with various debtors and creditors” (subaccount 80 “Settlements with other debtors and creditors”); depending on which account (sub-account) accounts for settlements with counterparties from whom advances were received.

Subaccount 62-03 “Settlements on bills received” takes into account the debt for settlements with buyers and customers, secured by bills received. The debt is reflected in the amount specified in the bill. Receipt from the client of his own bill of exchange in payment for goods (work, services) is reflected in the debit of subaccount 62-03 “Settlements on bills received” in correspondence with the credit of other subaccounts of account 62 “Settlements with buyers and customers” or account 76 “Settlements with various debtors and creditors." The difference between the face value of the bill and the amount of debt for goods, works and services according to the terms of the agreement is reflected in the debit of subaccount 62-03 “Settlements on bills received” in correspondence with account 90 “Sales”, subaccount 01 “Revenue”.

Receipt of funds in payment of a bill of exchange is reflected in the credit of subaccount 62-03 “Settlements on bills received” and the debit of cash accounting accounts. If interest is provided on a bill received, then as this debt is repaid, an entry is made in the debit of cash accounting accounts and the credit of subaccount 62-03 “Settlements with buyers and customers on bills received” for the amount of debt repayment and the debit of subaccount 91-01 “Other income » by the amount of the percentage.

In case of non-payment of the bill by the drawer on time, the debt listed in sub-account 62-03 “Settlements with buyers and customers on bills received” is written off from the credit of this sub-account to the debit of sub-account 76-09 “Settlements on claims”.

To control and streamline the processing of data on business transactions, consolidated accounting documents are compiled on the basis of primary accounting documents. To record the movement of bills of exchange, the organization draws up a Book (Journal) for accounting for bills received and issued, the construction of which should ensure the receipt of the necessary data on the amounts of bills received and issued and separately interest on them for: -

bills issued, the payment term of which has not yet arrived; —

bills received, the payment term of which has not yet arrived; —

bills issued with overdue payment terms; —

bills received that are overdue for payment.

Subaccount 62-04 “Settlements with subsidiaries” and subaccount 62-05 “Settlements with dependent companies” the organization reflects information on settlements with buyers and customers who are subsidiaries or dependent companies in relation to the organization.

Analytical accounting for account 62 “Settlements with buyers and customers” is maintained for each invoice presented to buyers (customers). At the same time, the construction of analytical accounting should provide the ability to obtain the necessary data on: buyers and customers on payment documents for which the payment period has not yet arrived; buyers and customers for documents not paid on time; advances received; bills for which the due date for receipt of funds has not yet arrived; bills discounted (discounted) in banks; bills for which funds were not received on time.

Acquiring debt: accounting nuances

When reflecting the acquisition in accounting, the buyer of debt must:

- check whether the acquired right to claim the debt meets the criteria for a financial investment;

- correctly form its initial amount.

To recognize a financial investment, the acquired receivables must be:

- potentially beneficial to its buyer - it can generate income;

- documented.

In addition, all financial risks (insolvency of the debtor, changes in the value of the debt, etc.) must be transferred to the buyer of the debt.

In order to reflect the purchased debt in accounting in a reliable estimate, it is necessary to correctly formulate its initial cost, calculated according to the formula (clauses 8–9 of PBU 19/02):

PSfv = FZ + KS + PS + PZ,

Where:

PSFv - the initial cost of the financial investment;

FZ - actual costs under the assignment agreement;

KS and PS - the cost of consulting, information and intermediary services related to the acquisition of receivables;

PP - other (other) costs associated with the acquisition of debt.

Find out the scheme for calculating the initial cost of various assets from the materials prepared by specialists on our website:

- “The initial cost of intangible assets is...”;

- “Accounting for fixed assets worth up to 100,000 rubles”.

Results

To account for settlements with debtors and creditors, various accounts are used: account 60 or 62 - if the company’s counterparties owe it for goods supplied or have not worked out the advance payment, account 71 - if employees have not reported on accountable amounts or the company has not reimbursed their personal expenses spent on its needs funds, account 68 - if there are overpayments or tax debts, etc.

If receivables were acquired under an assignment agreement, they are reflected on account 58 if, according to the criteria, they correspond to the concept of a financial investment.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Doubtful accounts receivable

Debt that has a high probability of not being repaid on time and is not secured by any guarantees is considered a doubtful debtor. If such debt is identified, it is necessary to create a reserve in accounting. It is necessary to ensure that the company’s reporting shows the actual financial result, as well as the obligations of counterparties.

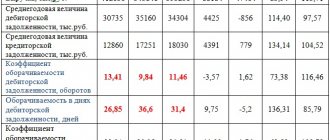

As for tax accounting, reserves for doubtful debts are created at will and taxable profit can be reduced by this amount. A reserve is created only if the delay exceeds 45 days.