A certificate in form 182n is included in the package of mandatory documents that the employer is obliged to issue to the resigning employee. This unified form was approved in 2013 - it replaced the previously valid template 4n, in the sections of which it was impossible to indicate the reasons for the employee’s disability (the updated version of the certificate will contain more detailed information on this part).

ATTENTION! The Ministry of Labor, by order of January 9, 2020 No. 1n, made changes to certificate 182n. Points 3 and 4 of the reference and footnote “3” have been corrected. A distinction has been made between making insurance contributions in the period until December 31, 2020 and from January 1, 2020. The changes were made in connection with the transition of social services. payments under the control of the Federal Tax Service.

Certificate issuance period

The employer can issue a certificate to the employee either on the last day of his work at the enterprise (without a preliminary application from the subordinate), or, if there is an application, no later than three days from the moment the employee’s written request is registered in the company’s internal documents.

At the same time, exactly when the person left the organization does not matter - the employer is obliged to issue a certificate, even if more than one year has passed since the dismissal.

When is it necessary to compile it?

The law provides two options for providing a certificate to the 182nd employee:

- within 3 working days from the date of registration of a written request from a former employee whose employment contract was terminated in previous years.

- on the last day of work, upon his dismissal without his application;

Termination of the employment relationship between the employee and the employer obliges the latter to issue a certificate 182-to the worker on the day of dismissal. This procedure is specified in paragraph.

2 tbsp. 4.1 No. 255-FZ dated December 29, 2006. This is official information, guidelines for calculating wages at the employee’s new place of work.

Certificate 2 of personal income tax is filled out by the tax agent, which reflects complete information about the employer, details, signed and stamped. Also, the declaration indicates exact information about the employee, TIN, registration address and place of residence.

Why do you need certificate 182n

The certificate provides information about the income that the employee received over the last two years of work (or less if he worked for the company for a shorter period). This data is needed for the further accrual of various social benefits and benefits guaranteed by the state to a person, such as:

- compensation for persons on sick leave;

- pregnant and postpartum women;

- those citizens who care for children until they reach the age of one and a half years.

Actions of the employer in the absence of a certificate

The Social Insurance Fund recommends that employers, in the absence of information about the earnings of an employee at his previous places of employment, accrue social benefits based on available data. For the monthly amount of earnings in the billing period, a minimum level is legally stipulated - the minimum wage at the time of illness. If, in fact, in one of the months (or throughout the entire two-year calculation interval) the employee had a salary below the minimum wage, the minimum wage must be taken as a basis.

In situations where certificate 182n was provided by the employee to the accounting department after the benefit was assigned, accrued and paid, a recalculation is made. To recalculate the amount of benefits for days of temporary disability, time restrictions must be observed - changing the amount of the calculation base is possible if the time gap between the date of payment of sick leave and the day of presentation of the certificate does not exceed three years.

Here is a sample of filling out certificate 182n in 2020:

If the former employer has ceased to operate, then the certificate of salary amount 182n can be replaced by an extract from the Pension Fund database. To do this, the employee applies in writing to his current employer with a request to request information about income from the Pension Fund. The management of the enterprise is obliged to respond to such an appeal from an official. The Pension Fund of Russia has two working days to complete the request.

A request to the pension authority must be made in writing signed by the head of the company. It can be sent by the enterprise by registered mail or via TKS. In the latter case, the company sends not a copy of the document, but an electronic original, endorsed with an electronic digital signature. This algorithm of actions is provided for in Art. 13 of Law No. 255-FZ and the Order of the Ministry of Health and Social Development dated January 24, 2011 under No. 21n.

After receiving a response from the Pension Fund with an extract of the employee’s income for the period of interest, the employer includes these amounts in the calculation. At the next stage, the benefits due on sick leave are recalculated. Based on the updated data, the difference is calculated and is subject to additional payment to the official. The rule applies both to unpaid benefits and to amounts that were actually received by the insured person.

Who issues certificate 182n

This document is usually prepared by a specialist from the accounting department of the employing enterprise, i.e. the employee who has access to the resigning employee’s salary information. The form is generated on the basis of accounting data and reporting of the policyholder.

After drawing up the certificate, the director of the organization and the chief accountant must sign it.

Their signatures will indicate that all data entered into the document is current and reliable.

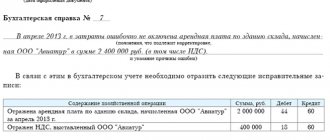

Help 182n sample page 3

Thus, the document in question is an important element of personnel document flow, without which the calculation of benefits will be carried out in minimal amounts, based on the minimum wage. Accordingly, if an insured event occurs - the employee gets sick - and the length of service in the organization is not enough, the accountant uses information from certificate 182n from the employee’s previous place of work.

How compensation payments are made based on a certificate

To calculate the above-mentioned types of compensation, the employee’s average earnings for one day are taken, which makes it possible to correctly calculate temporary disability benefits (if there is, of course, a good reason for it, since any absence from the workplace must be confirmed by the necessary documents).

The formula for calculating the average daily salary since 2013 is as follows:

SDZ = OZ: CODE – DIP

where: SDZ – average daily salary, OZ – total salary (for two years); CODE – number of days worked according to the calendar (for two years); DIP – days of maternity leave, child care leave and sick leave.

Small explanations to the formula:

- OZ. This includes all funds that were issued to the employee, provided that contributions to the Pension Fund and the Social Insurance Fund were paid from them. Calculation period: two years before dismissal or maternity leave.

- CODE. This parameter takes into account all days actually worked over a two-year period, but it is also possible to fill in additional lines for other periods of time if they include, for example, maternity leave.

- DIP. According to the law, during the time that an employee spends on sick leave, on maternity leave or caring for young children, he retains his average monthly salary. However, these days are not included in the calculation period, since no deductions were made from these payments to extra-budgetary funds.

What documents are needed to calculate temporary disability benefits?

The procedure for calculating sick leave is given in the Regulations approved by the Government of Russia No. 375 of June 15, 2007. The benefit is determined by multiplying the average daily earnings by a coefficient that depends on the insurance period and the duration of the period of release from work. Average income is calculated using a special formula.

First, all payments related to the wage system and received by the employee over the last couple of years are summed up. The result is then divided by 730.

The average daily salary is multiplied by 0.6 or 0.8, depending on the employee’s length of service. Sick leave issued due to a subordinate being injured at work is paid in full (100%). It is important for management and employees to know what documents are needed to calculate sick leave.

This will make it easier for employers to determine the amount of benefits, and will give subordinates the opportunity to understand what papers need to be brought to the enterprise and where to get them in order to receive fair monetary compensation.

Based on the features and procedure for calculating temporary disability benefits, it becomes clear that to determine the amount of cash payment, the following documents will be required:

- employment history . This is the employee's main document. It records the periods of official work activity during which contributions were paid. Accordingly, it makes it possible to determine the total insurance length of a subordinate. But we must not forget that periods of work are not always displayed in the work book. A citizen could be employed unofficially by a company for some time, but at the same time personally pay contributions to the Social Insurance Fund;

- salary sheet . It contains information about the subordinate's income. Using such a document, you can find out the total salary for the reporting period;

- time log . It shows how many days the employee worked, and how long and for what reason he was absent from the company;

- sick leave . This document provides information about the cause of temporary disability. Based on this, it is possible to determine what percentage of the average salary is due to a subordinate for days of absence from the workplace. For example, if the code is “07”, then this means an occupational disease. Even if the employee’s work experience is less than 5 years, he is still given a benefit in the amount of one hundred percent of his earnings. The bulletin also indicates the subordinate’s compliance with the hospital regime, the start and end dates of outpatient or inpatient treatment. All this is taken into account when determining the amount of benefits.

It is important that the amount of monetary compensation is determined correctly. For payment of benefits to an employee not in full, regulatory authorities may hold the legal entity and official liable.

How to draw up a document

Despite the presence of a standard unified form, the design of form 182n is left to the compiler. Information can be entered into it by hand (with a ballpoint pen of any dark color, but not in pencil) or filled out on a computer, on letterhead (conveniently, the document contains all the necessary details of the employing company) or on an ordinary A4 piece of paper.

It is not necessary to stamp the certificate using a seal, since since 2020, legal entities, as previously and individual entrepreneurs, are exempt from the requirement of the law to certify their documentation using stamps (unless this norm is specified in the internal local acts of the company).

The only condition that must be strictly observed: the presence of “live” autographs of the head of the enterprise (or a person authorized to act on his behalf), as well as the chief accountant (the use of facsimile signatures, i.e. printed in any way, is excluded).

The certificate is usually made in one copy , but if necessary, the employer can issue certified copies of it in the required quantity.

Features of filling out a salary certificate

The document form was developed by the Ministry of Labor, but employers are given the opportunity to choose how to fill it out on their own. The certificate can be drawn up in both handwritten and printed format. It is better to use a pen in standard colors: black, blue or purple. Many companies prefer to draw up documents on company letterhead, which is not prohibited by the Ministry. As for the use of a seal imprint on a certificate, it all depends on whether the company uses a seal in its activities. After all, for the second year now, not only entrepreneurs, but also companies have the right not to use the stamp. The document must be signed by the employee responsible for preparing personnel documents, appointed by the manager.

What information should be reflected in certificate 182n? In the most general form, this information can be grouped:

- information about the employer company, which is the insured (registration number and subordination code, tax identification number and checkpoint, address, telephone);

- information about the insured person, that is, the employee (full name, passport details, place of registration);

- period of employment in the organization;

- amount of income broken down by year;

- number of days on sick leave;

- position, signature and transcript of the manager and chief accountant.

In most cases, the certificate is issued directly on the day the employee is dismissed. However, in practice, situations may arise when an employee cannot independently pick up a document from the HR department. In this case, the employer can send the document using postal services, but with a certain condition - permission to send must be obtained from the employee. It is prohibited to send a certificate without consent.

Certificate 182n - sample filling:

Document structure

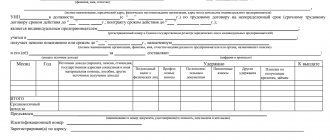

Form 182n consists of several sections.

- The first includes information about the organization that issued the certificate,

- in the second - information about the employee for whom it is intended,

- the third section of the certificate reflects data on wages for the last two years, from which insurance contributions were made to the Pension Fund and the Social Insurance Fund,

- in the fourth - about those periods for which payments to extra-budgetary funds were not made (for example, while on sick leave).

Sample of a certificate in form 182n

Filling in information about the policyholder

At the very beginning of the document, the date of issue of the certificate is indicated, as well as its number according to the employer’s internal document flow. Next, write the full name of the enterprise (with a deciphered organizational and legal form), as well as the name of the local territorial social insurance fund in which it is served. Then in the form you should indicate the organization’s subordination code (it can be found in the notification sent by the FSS or on the website of this structure), its tax identification number and checkpoint, address and current telephone number for contact.

Filling out information about the insured person

After all the necessary information about the company has been indicated, information about the employee must be entered into the form: his full name, data from the passport (series, number, where and when it was issued), registration address at the place of residence (here in the “subject” column you need indicate the territory, region or republic of the Russian Federation) and the number of the pension insurance certificate (SNILS).

Filling out salary data

In the third part of the form, in order (starting from the year when the employee joined the organization), the periods and amounts (in numbers and in words) of the paid wages are entered. As mentioned above, only the amount of income of an enterprise employee for which accruals were made to the Social Insurance Fund and the Pension Fund of the Russian Federation is taken into account here.

It should be noted that there is a certain limit for each year.

For example, for 2016 , the amount entered here should not exceed 796 thousand rubles. – contributions to the Pension Fund, 718 thousand rubles. – contributions to the Social Insurance Fund. For 2020 : 876 thousand rubles. – contributions to the Pension Fund, 755 thousand rubles. – contributions to the Social Insurance Fund.

If an employee has not worked for a full calendar year, the certificate must include information only for those months that he was employed by the enterprise.

Filling out data on days of temporary disability

The fourth section should also indicate in order the time periods when the employee was disabled (indicating specific dates (in numbers and words) of the beginning and end of each period and their duration). Here you must enter the name of the period (i.e., the officially confirmed reason why he was absent from the workplace). Finally, the document is signed by the director and chief accountant of the company.

Any employee is interested in the question: why is certificate 182n needed for a resigning specialist? Benefits are calculated based on actual average income for each day.

Form 182n: employer doubts

Income certificate (182n) can be verified.

The employer has the right to contact the territorial body of the Social Insurance Fund for confirmation of the information specified in the provided document. To do this, a request must be sent to the Social Insurance Fund office at the location of the employer who issued the certificate.

It can be submitted in person, by mail or via communications using an electronic signature. If the employer who issued the certificate provided incorrect information, then he is obliged to reimburse the amount of overpaid benefits. If the employee provided a false certificate, then the amounts paid on sick leave are withheld from him.

What is it, why is it needed?

The information reflected in this certificate is used when crediting money to provide guaranteed benefits to a specialist (for childbirth, pregnancy, sick leave, child care up to 1.5 years).

In accordance with the law, hired workers are entitled to compensation from the Social Insurance Fund budget for illness and other valid reasons related to children and health. If a problem arises with the payment of a certain amount of benefits, the accountant must make a correct calculation of the amount of compensation for the time when the employee could not begin to perform professional duties.

It reflects the time of actual work and the amount of payments to the specialist that were made at the previous job for the current and last 2 years, when contributions were made to the Pension Fund and the Social Insurance Fund.

Detailed information about this document can be found in the following video:

When, by whom and why is income for 2 years issued?

A certificate in form 182n is required to calculate:

- temporary disability benefits;

- maternity benefits;

- benefits for a child until he reaches the age of 1.5 years.

Issued by the employer upon dismissal of an employee or at his request.

Typically, signing is carried out with the execution of all documents necessary for return after the employee ceases his work duties.

From previous job

A former employee has the right to request documents related to his past employment. This also applies to income certificates.

You must write an application and send it to your previous place of work:

The certificate must be issued no later than 3 days from the date of receipt of the application from the former employee.

Upon dismissal

When an employee is dismissed, a certificate of income for the previous 2 years is usually issued on the last day of employment along with a standard package of documents.

The help contains information:

- about income for each year of work from the previous two;

- about periods of temporary incapacity for work (including maternity leave and child care leave).

All data must be reliable and identical to the financial statements.

Do I need to write an application to receive it?

Writing an application is only necessary when applying to an organization where the citizen previously worked.

This is not required to obtain a certificate upon dismissal.

Is sick leave paid while on vacation with a child? Find out here.

When is it issued?

In accordance with the law, an employee must be issued a certificate on the last day of his employment upon dismissal (without an additional application for its issuance) or within 3 days upon a written request from an employee whose employment contract was terminated earlier. Therefore, the accounting department and the personnel department, upon dismissal, must draw up and sign this document in advance from the manager, so that the employee will be given it with a work book and other documents at the end of the last working day.

If in 2 years a citizen has changed several jobs, then he must submit certificates from all places (based on Article 13, Part 5 of Federal Law No. 255). But when it is impossible to obtain a document, he can contact the Pension Fund by sending a request there in accordance with the approved form (by order of the Ministry of Health and Social Development No. 21n dated January 24, 2011).

Issuance procedure

The legislation provides that the employer issues it independently on the day the employee is dismissed, i.e. together with the work book and the final payment for all days worked, unused vacation pay, etc. Thus, issuing certificate 182n is the responsibility of the organization, and the employee should not remind about this (no application is required to be written).

However, in practice, there are often cases when in fact only a work book is issued, and calculations are also made, and the certificate itself is not issued. In such cases, even a dismissed employee can come to his former employer and write a written statement in free form, after which the organization must provide the document no later than 3 business days from the date the statement was written. The countdown of this period begins on the working day following the day the application is submitted.

NOTE. An employee has the right to notify of his dismissal in advance (more than 14 days required for working off). At the same time, he can also write an application for the issuance of certificate 182n on any day after dismissal. Then the employer acts in accordance with the wishes of the resigned employee.

If on the last working day the employee does not show up for his documents, then the employer’s procedure is as follows:

- First, you should try to contact the employee by phone and offer to come pick them up.

- If this cannot be done, then an official letter is sent to the home address containing a similar request. The letter is also accompanied by a written offer to send all documents by mail.

- If the employee signs it, then the employer sends the originals of all documents by mail (registered mail), keeping receipt of receipt.

- If the employee ignores the letter, responsibility for non-issuance of documents remains with him.

Thus, it is prohibited to simply send them by mail - you need to coordinate your actions with the resigned employee. It is also important to keep in mind that if the company does not use the blue seal to certify documents, then along with certificate 182n it is necessary to issue copies of the following documents:

- order appointing a director or Articles of Association – i.e. written confirmation of the authority of the manager;

- a power of attorney issued to an official who has the right to certify.

It turns out that the simplest option is to simply provide it to the employee on the last day of work along with the work book . Then there is no need to send it later by mail.

Who should fill it out and sign it?

Each organization appoints a person responsible for filling out reports, who draws up this certificate (it is based on information from accounting). But if the preparation of accounting reports and payroll is carried out by another company (outsourced), then its specialists will easily draw up this document.

In accordance with the standards of the Labor Code of the Russian Federation, upon dismissal, the employer must familiarize the employee with the order, issue him a work book, certificates 2-NDFL and 182n.

If the citizen has not received these documents, then the employer must send a letter by mail asking him to come and pick them up or send consent to receive them by mail. Documentation cannot be sent by mail without the employee’s approval of such actions.

Read about how sick leave should be paid here.

Rules and instructions for filling out

The order of the Ministry of Labor approved form 182n and provided instructions for drawing up the document. It contains the following blocks:

- information about the company;

- information about the employee;

- the amount of annual payments;

- duration of temporary incapacity, maternity leave.

The sequence here is as follows:

- At the top of the document is the registration number and date of issue.

- The first section contains information about the details of the company paying contributions to the Social Insurance Fund,

- The second contains personal information about the insured employee for 2 calendar years.

- The next section reflects the salary amounts from which contributions to the Social Insurance Fund were made for each calendar year separately.

- The last paragraph should contain information about the time when the employee was absent from the workplace due to disability.

All information should be taken from the company's accounting records. Information can be entered with a blue or black ballpoint pen, using typewritten text or a computer. There should be no adjustments in the document; all financial indicators should be reflected in numerical characteristics and written next to them in words in brackets.

Attention should be paid to filling out section 3. It reflects only the income from which contributions were made to the Social Insurance Fund. There are restrictions on the amount of wages for making insurance contributions, so the document should not indicate indicators that exceed the limits.

In the last part of the form, the excluded period of incapacity for work is entered in each line, its start and end date, the number of calendar days are entered in numbers and in capital text. A name should be given to each such period (maternity leave, child care leave, etc.). The total number of days of incapacity for work for the current year and the past 24 months is entered in the appropriate columns.

Common design questions

Several questions may arise while filling out. Answers to the most common ones are given below.

If the employee does not bring the document

In this case, the entire calculation is made based on the minimum wage (today this amount is 7,800 rubles). Possible recalculation is made only at the initiative of the employee and only at his request.

If the certificate was brought after payment

In accounting practice, situations often arise when an employee actually provided a completed form 182n after payment was made for maternity leave or sick leave. Then, when calculating the average salary, you need to proceed from the minimum wage.

However, an employee can take the initiative and ask to recalculate the benefit in accordance with his official “white” salary and not the minimum wage, and the employer does not have the right to refuse him this. Then a recalculation is made, but it is important to understand that only those payments that were made over the last three years are taken into account (in relation to the day the certificate was issued).

Legal force of original and copy

The document has full legal force, regardless of the form in which it was provided. However, if we are talking about a copy, then it must be certified in one of two ways:

- at a notary (state fee and amount for notary services are paid);

- from the employer (original seal and signature on the copy) - free of charge.

NOTE. If you accrue benefits based on a copy of an uncertified certificate, this creates serious risks, since the inspection authorities will consider this a violation.

How else can you get salary information?

Along with the documents described above, information on the amount of wages for the last 2 calendar years or for another period can be obtained by direct request to the local branch of the Pension Fund. The request can be made either by physical mail or by email. The corresponding application is signed with an electronic digital signature. Thus, there is no need to contact previous employers - you can get all the necessary information in one source.

Common Mistakes

When writing a certificate, you should indicate the total amount of income and add to it the earnings for the period when the specialist combined part-time work with caring for a child under 1.5 years of age. The form is filled out at the time of partial employment on the basis that these days are care leave and are reflected in section 4 with non-working days.

Payments not subject to insurance premiums are excluded from total earnings (state benefits, compensation, financial assistance over 4 thousand). The entire list of insurance payments can be found in Art. 9 212-FZ dated July 24, 2009

On the day of dismissal, it is necessary to pay the employee all wages for the last day of work, all required compensation and severance pay, and also issue the following documents:

- work book;

- a certificate in form 2-NDFL about income for the current year;

- a certificate of income for the last year of work, as well as two calendar years preceding the dismissal, in which insurance premiums were calculated;

- form SZV-M;

- form SZV-STAZH.

Let us consider in more detail the purpose and procedure for filling out the certificate specified in paragraph 3.

Composition of earnings in form 182n

Salary certificate 182n contains the total income for each year (calendar) of work at a given enterprise in chronological order. The document indicates only the accruals included in the base for paying contributions to the Social Insurance Fund.

Based on this rule, the certificate does not indicate:

- one-time benefits for the birth of a child;

- financial assistance for the birth of a child;

- some other payments.

- funeral benefits;

- financial assistance for funeral;

- severance pay, if its amount does not exceed three times (for workers in the Far North - six times) average monthly earnings;

- accruals for sick leave: at the expense of the Social Insurance Fund and three days at the expense of the employer;

- financial assistance up to four thousand rubles per calendar year;

- child care benefits up to 1.5 and 3 years old;

- payment for maternity leave;

- benefits for those registered in the early stages of pregnancy;

- payment for services under GPC agreements and copyright agreements;

The base for calculating benefits for insured events is determined in accordance with Article 422 of the Tax Code of the Russian Federation (from 2020), Article 9 of the Federal Law of July 24, 2009 No. 212-FZ (until January 1, 2020). Attention: all accruals for which contributions to the Social Insurance Fund are calculated are taken into account, even if they are not specified in the Regulations on remuneration at the enterprise.

Certificate for calculating sick leave - form 182n

The document form was approved by Order of the Ministry of Labor dated April 30, 2013 No. 182n. It is necessary so that the new employer has information about your income. This information is used to calculate average earnings when assigning benefits:

- due to illness;

- maternity leave;

- for child care.

Certificate for sick leave 182n (form)

Certificate 182n - why is it needed, how to fill it out?

Calculation of sick leave benefits is a procedure that needs to be performed from time to time in any enterprise. In order to get the correct numbers, the accountant must obtain information about the earnings of the employee who fell ill over the previous two years. Certificate 182N was created so that the relevant information could be quickly collected.

And so that there are no problems when organizing document flow. Contents Data from this type of document is needed when determining the amounts of payments of the following types:

- Calculations based on certificates of incapacity for work. Including due to pregnancy and childbirth.

- Payment for parental leave for a child up to one and a half years old.

Any person who has entered into an official employment contract has the right to receive compensation during illness.

Filling rules

When filling out the document form, you must provide information about:

- employer (section 1): name, TIN, data of the territorial body of the Social Insurance Fund to which the organization belongs, and its registration number, contact details of the company;

- employee (section 2): full name, passport data, information about the period of his work in the organization;

- employee income (section 3);

- periods of incapacity for work during work, periods of absence, if the employee during this time accrued income that was not subject to insurance contributions.

Section 3 provides data on the amount of accruals to the employee for the year of dismissal, as well as for the two previous calendar years. Only the amounts of income from which the company calculated insurance premiums are indicated.

The question often arises: why is the amount of earnings in form 182n not equal to the amounts indicated in the 2-NDFL certificate? This is due to the fact that the Government of the Russian Federation annually sets the maximum amount of earnings from which insurance premiums are calculated. If an employee’s income from the beginning of the year exceeds the limit, then insurance contributions to the Social Insurance Fund are not calculated from the excess amount, and they are not taken into account when calculating benefits.

Limit base for calculating insurance premiums:

Thus, if the employee’s earnings exceed this amount, then the maximum base will be indicated in form 182n. Certificate 2-NDFL indicates the full amount of income subject to personal income tax, including payments that are not subject to insurance premiums. This is what explains the discrepancy.

Example of filling out form 182n

An employee of Kompaniya LLC, Irina Eduardovna Vasilkova, is resigning on 05/08/2019.

She worked in the organization from 02/14/2010. Remunerations accrued for 2017-2019 amounted to:

- 2018 - 423,000 rub.

- 2018 - 820,000 (taxable with contributions of 815,000) rubles;

- 2017 - 525,000 rubles;

Over the past three years, the employee has been on sick leave twice:

- from 25.10 to 05.11.2018.

- from 03.06 to 12.06.2017;

Details of LLC "Company": INN 7803111111, KPP 780301001, registration number 7812345678, subordination code 78122, location address:

St. Petersburg, st. Lenina, d.

42, tel.. Employee details: Vasilkova Irina Eduardovna, passport 1111 No. 111111 issued by the Department of Internal Affairs of the city.

St. Petersburg 11.11.2011, SNILS 111-111-111 11, place of residence: 197101,

St. Petersburg, st. Mira, 24, apt. 11. Fill out form 182n step by step. Step 1. The issued document must be assigned a serial number, as well as the date of creation.

Step 2. Fill in the organization's data in section 1. Step 3. Fill in the employee's data in section 2.

Step 4. In section 2 we also indicate the terms of work in the organization.

Step 5. In section 3 we provide information on earnings for 2017-2019.

Please note that only income that was subject to insurance premiums is indicated.

Step 6. Periods of incapacity for work are reflected in section 4. Step 7. Finally, the form must be signed by the responsible persons and affixed (if any) with the seal of the organization.