Help report from cashier-operator and online cash register

The primary unified forms for recording trade operations, including Form No. 6-KM, were approved by State Statistics Committee Resolution No. 132. The cashier's certificate report contains readings from check-total counters, the amount of revenue received per day or shift, and the amount of cash refunds to customers. Since the unified forms of Goskomstat are no longer mandatory for use, the cashier-operator’s report can be filled out on a form of his own design in compliance with the mandatory details. The cashier's report and a sample of how to fill it out can be found at the end of this article.

Companies and individual entrepreneurs using online cash registers may not fill out the unified forms KM-1 - KM-9, approved by Resolution No. 132, which includes the “Cashier’s Certificate Report” in form KM-6. The Ministry of Finance of the Russian Federation gave such an explanation in its letters dated 09/16/2016 No. 03-01-15/54413, dated 06/16/2017 No. 03-01-15/37692 and dated 07/04/2017 No. 03-01-15/42314. The department explains this approach as follows: Resolution of the State Statistics Committee No. 132 does not apply to the legislation on the application of cash register systems, consisting of Law No. 54-FZ dated May 22, 2003 and regulations adopted in accordance with this law; therefore, the resolution does not apply to online cash registers Necessarily.

The need to fill out a cashier-operator report with the introduction of an online cash register also disappears due to technical reasons: all the required information and indicators are stored in the cash register’s fiscal storage device, from which it is not difficult to generate reports. Tax officials even receive information about cash transactions made through online cash register systems in real time.

What information is contained in the help report?

If the organization’s work involves receiving and issuing cash, they must comply with all rules of cash discipline. When using cash registers, special documents are required to be filled out, one of which is the cashier’s report.

This report should contain the following information: information about the readings of cash register counters, thanks to which you can find out the amount of revenue received per working day. The money that the organization had to return to customers at their request is not taken into account.

You can read more about the purpose of the cashier-operator report in the article.

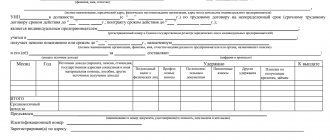

The procedure for filling out the “Cashier-operator’s certificate-report”

The certificate-report is drawn up in a single copy, for each operating cash desk of the company separately. At the end of the shift, or at the end of the day, the cashier transfers the received proceeds to the bank, or according to the receipt order, to the senior cashier (or to the manager, if there is no senior cashier in the organization), attaching the cashier’s report, completed in form No. KM-6. The report form can be found in the album of unified forms approved by Decree of the State Statistics Committee of the Russian Federation No. 132.

The cashier fills out the form in the following order:

- The name of the organization is entered in the very top line of the form, and the address and telephone number of the company are also indicated there. If necessary, enter the name of the structural unit of the organization. In the tabular part on the right, the company’s tax identification number and the type of activity code according to OKVED are indicated.

- The line “Cash register” indicates the model of the cash register used - its class, type, brand. The KKM registration number and manufacturer's serial number must be entered in the corresponding cells of the table on the right. You can specify the software you are using in the Application Program line.

- The surname and initials of the cashier are entered in the “Cashier” cell, and the number of the corresponding shift is indicated in the “Shift” cell.

Next, you should fill in the serial number, the date of compilation, the beginning and end of the working hours - these are the details of the cashier’s report (the form can be downloaded below):

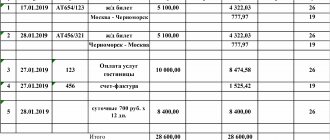

The main part of the “Cashier-Operator Certificate Report” is a table of ten columns.

- Column 1 “Sequential number of the fiscal memory report at the end of the shift/day” must contain the serial number of the Z-report.

- Columns 2 and 3 – indicate the number of the department and section (if any).

- Column 4 does not need to be filled out.

- Column 5 contains the readings of the summing cash counter at the beginning of work (beginning of the day or shift) and must coincide with the data in column 6 of the KM-4 “Cashier-Operator Journal” for that day or shift.

- Column 6 – readings of the same meter at the end of the working day/shift, which correspond to column 9 of the KM-4 log.

- Column 7 – the amount of revenue received per working day/shift, according to the counter. This indicator is calculated as the difference between columns 6 and 5 and must correspond in amount to column 10 of the “Cashier-Operator Journal” for that day/shift.

- Column 8 – the amount of refunds to customers for unused cash receipts. Here you need to indicate the total amount of all money returned to customers and checks punched by mistake. In the “Cashier-Operator Log” this column corresponds to column 15 for the same shift. If there are no returns, this column is crossed out.

- In columns 9 and 10, the head of the department/section puts his last name, initials and signature. In the absence of the manager, your full name. and the cashier signs.

- The “Total” line of the table separately summarizes the indicators for columns 7 and 8.

The line “Total revenue in total” should be filled out as follows: rubles in words, kopecks in numbers. This indicator is calculated as the amount of revenue minus returns (the total line of column 7 minus the total of column 8).

Next, indicate the date and number of the cash receipt order (PKO), according to which the proceeds, and the cash report attached to it in the KM-6 form, are transferred to the accounting department of the company, or its head. You must indicate the details of the bank to which the proceeds are subsequently deposited. If the organization is small, with no more than two cash desks, the cashier-operator can immediately hand over money to bank collectors. This is also reflected in the cashier's report indicating the bank that accepted the proceeds, the number and date of the receipt received from the collector.

“The cashier-operator’s certificate-report” is signed by the senior cashier, the cashier-operator and the head of the organization with transcripts of their signatures.

What is a certificate in the KM-6 form?

The job of a cashier is difficult and responsible. In their work, these specialists are guided by Law No. 54-FZ and Directives of the Central Bank of the Russian Federation No. 3210-U dated March 11, 2014. Cashiers are faced with numerous reports that show cash register movements. Every cashier is faced or has encountered the preparation of the KM-6 form. This is an important document for the cashier, his report on the amounts posted at the cash register.

Initially, the report was compiled only on cash revenue, but with the development of technology and the advent of payments using bank cards, such information also began to be displayed in the certificate report.

The form of the certificate - report was approved by Resolution of the State Statistics Committee No. 132 of December 25, 1998. At the same time, the company can use in its work both a unified form and a report form developed at the enterprise. This possibility is enshrined in the Letter of the Federal Tax Service of the Russian Federation No. ED-4-20 / [email protected] dated September 26, 2016. However, it is worth considering that the report form developed at the enterprise must necessarily contain the key details of the unified document.

Functional meaning

The main reporting normative act for a cashier is a certificate of this type.

It confirms the amount of revenue received and is transferred directly to the manager along with the funds. In cases where money is transferred to a bank for safekeeping, a special note is made on the form with the help of collectors. When conducting inspections by supervisory authorities, such certificates play an extremely important role. These acts indicate the completeness of the information provided and compliance with the reporting documentation. Also, using KM-6, a summary report is compiled. This certificate includes important information about the status of cash register meters.

The determination of total revenue is made at the beginning and end of the reporting month. The amount of funds returned by the client via checks is also taken into account, which is deducted from the total amount of revenue. This is checked and certified by responsible officials.

Documents on the receipt and posting of money via cash register must necessarily contain the confirming signatures of the head of the company and the senior cashier.

How long should you keep cash documents?

In accounting and tax legislation, there are different opinions regarding the storage period for cash documents.

In accordance with tax law, cash records must be kept in the company's archives for four years. Accounting legislation states that such papers must be kept for at least five years. The Ministry of Culture has also established a storage period for documents of five years.

Thus, based on the maximum period, cash register papers must be stored in the archive for at least five years. It is worth considering that documents can only be destroyed if an audit has been carried out over these five years. If it was not there, the papers cannot be destroyed even after five years.

The storage periods for cash documents must be observed, since the following fines are provided for their violation:

- For employees responsible for storage – from two to three thousand rubles;

- For citizens - from two hundred to three hundred rubles.

Features of using a certificate in the KM-6 form

| Filling conditions | Decoding |

| Who fills out the certificate | Since the preparation of this report is related to the material side of the company’s activities, its preparation should be carried out by the financially responsible person. The cashier is just such a person |

| How information is filled out | All data is entered into the certificate form using a pen with blue or black ink. |

| Are blots allowed when filling out the form? | Since this document is very important and concerns the financial sector, it must be filled out in legible handwriting, preferably without errors or blots. If regulatory authorities find corrections, a fine may be imposed |

| Certificate preparation period | Such certificates are prepared every day |

| Who is the report sent to? | The completed certificate along with the cash is handed over to the senior cashier, accountant or director of the enterprise. It is also given to the bank |

| Certificate storage period | Certificate – the report must be kept by the company for 5 years |

Are Z-reporting necessary for online cash registers?

A document similar to the cancellation report is also provided in the new model cash registers. The cashier-operator's report on the online cash register is tied to a period of 24 hours. Federal Law No. 54 (clause 2, art. 4.2) on the use of cash register equipment states that such a restriction is associated with the ban on the generation of cash receipts after the expiration of this time period from the moment of drawing up other reporting - on the opening of a shift.

When Z-reporting (about the closure of the session) is generated, at this time the processes associated with the following no longer occur in the online cash register:

- With information reset.

- With recording of the final result in fiscal memory.

Reporting to the tax authorities will be sent automatically. If there is no confirmation from her, KKT will send her again.

Z-reporting has a number of features:

- Each document has a serial number. There should be no gaps in the cashier-operator's journal.

- Re-generation or cancellation is impossible: the check is already recorded in the fiscal memory of the equipment and on the control tape.

- If there were no transactions on the cash register during the day, zero reporting is taken.

- During the working day, it is allowed to generate any number of Zet reports. Each check is withdrawn separately.

- Once a cash document is printed, it cannot be removed again until the current cash transaction is completed.

Important! The very first check generated by the tax service when registering a cash register remains there. This will not affect the correct formatting of the cashier-operator's journal.

Filling out the help table section

Here is a breakdown of the columns in the table.

| Help column | How to fill it out |

| Column 4 | As mentioned above, this column is filled out quite rarely, only when using very old cash registers. If the cash register used in the organization was released no earlier than 2004, then the data is not entered in the column |

| Column 5 | Here you need to enter the amount of cash at the beginning of the shift. This data can be taken from the cashier's journal or in the report that was compiled in the morning. We will be interested in the line GROSS - TOTAL |

| Column 6 | In this column we enter data from the Z-report, along the line GROSS - TOTAL |

| Column 7 | This column indicates the total amount from the Z-report, taking into account the refunds made |

| Column 8 | We fill in if there are returns (we take them from Z-reports). We will not fill out this column if there have been no returns. |

| Column 9 | In this field you need to indicate the name of the cashier who is preparing the report |

| Column 10 | The cashier - the preparer of the report puts his signature, thereby certifying that the information contained in it is correct |

| Total line | In this column we reflect the total amount that was obtained based on the results of columns 7 and 8 |

Sample report

The cashier records the following information in the reporting form for closing the session:

The best offers in price and quality

- All data on the movement of money in cash register equipment is online throughout the day (cash and non-cash financial transactions).

- Incoming transactions (direct revenue).

- Canceled checks. They occur when the cashier-operator has entered a position, but the purchase did not take place for some reason.

- Operations for refund. The buyer returned the goods to the store and the money is returned to him in cash or on a plastic card.

- Cumulative total amounts per working day.

The reporting must contain the following information:

- TIN and name of the legal entity using the cash register.

- Date and time of reporting generation.

- Cashier's last name and TIN, if available.

- Registration number of cash register equipment.

- Number of checks generated per shift.

- The number of fiscal documentation that has not been transferred to the fiscal data operator (FDO).

- Start time of fiscal data transfer.

- Total for the working day (monetary amounts for checks for each calculation attribute: return of expenses for correction checks, receipts, expenses).

Important! Based on the data from the Z-report for the online cash register, the operator generates a certificate and fills out a log.

Filling out km 6 when returning electronic money

If modern devices have been installed in the organization over the past 12 years, then this section should be left blank. Recommendations for filling out form No. KM-6 “Cashier-operator certificate-report” (form N KM-6) Example of filling out KM-6 1) Name of individual entrepreneur or organization 2) KKM model 3) Taxpayer Identification Number 4) Serial number (manufacturer) KKM 5 ) Registration number (indicated on the KKM registration card issued at the tax office) 6) Last name, initials of the cashier (if the report is made for several departments with different cashiers for them, you don’t have to fill it out) - the “Shift” column.

Indicate the number of the current Z-report - document number - which one. Usually coincides with the Z-report number - the date and time of compilation - we also take from the current Z-report COUNT 1 “Ordinary number of the control counter (fiscal memory report) at the end of the working day (shift)” Indicate the serial number of the Z-report.

To do this, the readings of the fifth column are subtracted from the readings of the sixth column. Column 8 – takes into account refunds to customers for unused checks. If this has not happened, a dash is placed. Columns 9 and 10 - the last name, first name and patronymic, as well as the signature of the section manager are entered. At the end of the table, the actual revenue for the work shift is recorded. It is calculated by subtracting the indicators in columns 7 and 8 and is indicated in words. This certificate-report, together with the revenue, is given by the cashier to the authorized accountant or manager according to the cash receipt order, the number and date of which are indicated under the amount of revenue in the KM-6 form. Also, filling out the KM-6 form (sample) requires indicating the details of the bank to which the proceeds are then deposited, as well as the date and number of the receipt, which the bank cashier then issues after receiving the money.

- Filling out the km-6 form (sample)

- How to fill km 6 correctly

Form km-6.