Which legal acts regulate the filling out of the account balance sheet

Historically, the term “ turnover balance sheet ” was not fixed in the regulatory legal acts of the Russian Federation - in fact, it is used unofficially.

However, the corresponding document is widely used in practice. The use of balance sheets is indirectly predetermined by the provisions of Art. 10 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ. This regulation provides that:

- information reflected in primary documents must be registered and accumulated in accounting registers (Clause 1, Article 10 of Law No. 402-FZ);

- the structure of the accounting register must contain a grouping of accounting objects, as well as the monetary value of the corresponding objects;

- the forms of the corresponding registers for private economic entities are approved by management, for state ones - by budgetary legal acts.

The fact that the balance sheet is used as an accounting register can be associated, first of all, with the legal tradition that was formed in the Soviet Union.

Thus, in the letter of the Ministry of Finance of the USSR and the Central Statistical Office of the USSR dated February 20, 1981 No. 35, it is recommended to use just the same turnover statements as accounting registers - for main, synthetic accounts, as well as sub-accounts.

Another significant factor predetermining the use of turnover by modern enterprises is the publication by the Ministry of Finance of Russia of Order No. 119n dated December 28, 2001, by which the department approved methodological guidelines regarding the accounting of inventories of Russian enterprises. The provisions of this legal regulation use 2 concepts:

- turnover sheet - a source that records the amounts of income and expenses that correlate with the movement of goods or materials in the warehouse, balances at the beginning and end of the reporting month, as well as the corresponding amounts in synthetic accounts and sub-accounts;

- balance sheet - a document that generally corresponds to the turnover sheet, but it does not record the receipt and consumption of goods or materials.

Due to the availability of these legal regulations, as well as in the course of document management practices in the business and accounting community of the Russian Federation, more or less generally accepted formats of balance sheets gradually became widespread, the structure of which we will consider further.

There is another significant factor for the compilation of turnover by Russian enterprises. The Federal Tax Service quite often requests them during inspections - both during traditional interaction with taxpayers, and as part of innovative methods of communication with companies, such as tax monitoring.

In particular, clause 8 of the order of the Federal Tax Service of Russia dated 05/07/2015 No. ММВ-7-15/184 states that the regulations for information interaction between the taxpayer and the Federal Tax Service should fix the obligation of the former to submit balance sheets to the Federal Tax Service as part of tax monitoring .

Is the fine for failure to submit SALT to the tax authorities legal? The answer to this question, supported by arguments from law enforcement practice, can be found in ConsultantPlus:

If you don't already have legal access, a full access trial is available for free.

Turnover sheet for synthetic account 71: formation features

Let’s assume that an employee of an organization, Ivanov, received cash from his employer in the amount of 10,000 rubles. for household needs, and his colleague Petrov - travel allowances in the amount of 20,000 rubles.

A week later, Ivanov reported on the use of funds, providing an advance report with supporting documents in the amount of 9,000 rubles. Petrov brought the employer a similar set worth 19,000 rubles.

Read about the features of preparing an advance report here.

What will the turnover sheet look like for account 71, reflecting these business transactions?

The turnover sheet is a table, the columns of which have the following names:

| Account (sub-account) / Analytical characteristics of a sub-account | Balance at the beginning of the period | Period transactions | balance at the end of period | |||

| Debit | Credit | Debit | Credit | Debit | Credit | |

In the first column of the turnover sheet, the following is recorded:

- synthetic account;

- the subaccount in which transactions are recorded, if it is entered into the applicable chart of accounts (in our case, it is entered and has the designation 71.01);

- analytical characteristics of this subaccount (can be anything; for 71 accounts these are the names of the employees to whom cash is issued).

Filling out the columns of the turnover sheet occurs on the basis of data from primary accounting documents according to the accounting entries corresponding to these documents. If accounting is carried out manually, then each of the transactions recorded in accounting is entered into the turnover sheet in chronological order. In accounting programs, this register is generated automatically.

ConsultantPlus experts explained which accounts should be used in accounting and how to properly conduct analytical accounting:

If you do not have access to the K+ system, get a trial online access for free.

What does a balance sheet look like (structure example)

The Soviet legacy and modern business practices have led to the emergence of 3 main types of balance sheets:

- compiled from a set of values in synthetic accounts;

- compiled according to analytical accounts;

- combined, combining the previous types of whorls.

Statements on a set of synthetic accounts compiled by different enterprises will generally be very similar to each other, since the list of relevant accounts is approved by law.

In turn, filling out SALT for analytical accounts in each organization may differ in very specific nuances. Let's consider what a typical structure of a balance sheet for analytical accounts might look like.

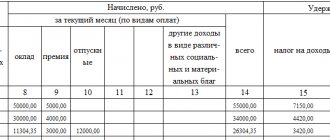

A typical balance sheet for an active or passive account consists of 7 columns:

- name of a specific account (sub-account);

- debit and credit balance at the beginning of the reporting period;

- turnover within the reporting period by debit and credit;

- debit and credit balance at the end of the reporting period.

Depending on which account the balance sheet reflects - active or passive, an increase in assets is recorded in the “Debit” columns and a decrease in them in the “Credit” columns (for active accounts) or, conversely, a decrease in liabilities in the “Debit” and an increase in those in the “Credit” columns (for passive accounts).

You can check whether you are filling out your accounting registers correctly using the Typical Situation from ConsultantPlus. Study the material by getting trial access to the K+ system for free.

How to check SALT and calculate its balance

OSV clearly shows the movement on each account. Methodological negligence is manifested in the inconsistency of balances with the type of account and the economic nature of the transaction. For example, when there is a loan balance on the active account.

Modern accounting programs allow you to generate a balance sheet automatically

How to understand the “turnaround” and find the error

Errors when posting transactions are immediately visible: if you fill out the “turnover” incorrectly, the debit and credit balances will not converge, this is what makes the incorrect statement different from the correct one. Correct preparation of the SALT requires compliance with a number of requirements.

- The balance on the active account is found according to the algorithm: you need to add income to the initial balance and subtract expenses for the month. Calculate the final result and enter it in debit.

- The balance on the passive account is credit. It is calculated according to the algorithm: the initial credit balance is added to the credit turnover and minus the debit turnover.

- In analytical accounting there should not be negative values for some positions and positive for others, so that the result is 0. All accountants need to understand this rule.

- The company's revenue, as well as the final result of its activities (profit or loss), will be formed after the closure of direct and indirect costs.

- Profit is reflected in the credit of account 99 “Profits and losses” and accumulates throughout the year.

- The debit of account 99 shows a loss. On the last day of the year, you need to look at the resulting financial result and close account 99.

- Profit is transferred to the credit of account 84 “Retained earnings”. The loss is debited to account 84 “Uncovered loss”.

The picture of the business is created by the numbers presented by SALT.

The final “turnovers” should show the manager a picture of the life of the enterprise: cash balances in the cash register and in the current account, the amount of profit, the amount of VAT and other taxes payable, etc. Further management decisions should be based on the figures and indicators of SALT. Using the SALT data, the entrepreneur receives a tool for financial control and adjustment of plans and tasks. Generalized and detailed OCB indicators are a reliable way to check the state of the enterprise and see the picture of the business.

Where are the SALT fills?

You can download a sample of filling out a balance sheet on our website. Our experts have prepared for you an example of filling out a statement in Word format, reflecting transactions on account 60 (“Settlements with suppliers and contractors”).

This turnover sheet reflects the following sequence of business transactions:

1. The company transferred to its counterparty an advance payment for goods under a contract in the amount of 100,000 rubles. and reflected this operation as an increase in assets in the debit of active subaccount 60.1. Posting: Dt 60.1 Kt 51 for 100,000 rubles.

2. The counterparty delivered goods to the company under a contract in the amount of 150,000 rubles, and this operation is reflected as an increase in liability in the credit of passive subaccount 60.2. Wiring: Dt 41 Kt 60.2 for RUB 150,000.

3. The company partially pays the counterparty for the goods, and we reflect this transaction as a decrease in liabilities by 100,000 rubles. in the debit of the passive subaccount 60.2 and as a decrease in assets in the credit of subaccount 60.1. Posting: Dt 60.2 Kt 60.1 for 100,000 rubles.

4. As a result, the company owes the counterparty 50,000 rubles, and we record this in the credit of the passive subaccount 60.2, in the credit of the active-passive account 60 as a whole, and also in the final line - as of the end of the reporting period.

Similar statements can be compiled for any accounting account.

Analysis of OCB indicators

In order to correctly read the data reflected in the balance sheet, it is necessary to understand the structure of accounting accounts.

- In accounting, all accounts are divided into three categories:

- active;

- passive;

- active-passive.

Important! Each account has certain rules for filling in when displaying business transactions. Thus, active accounts cannot have a credit balance at the beginning and end of the period.OSV in this case allows you to check the wiring, see possible errors and make corrections.

- You need to know the rules for closing months in accounting when preparing quarterly and annual reports:

- At the end of each month, accounts for accounting expenses for farming and production (with the exception of work in progress) must be closed.

- Accounts 90 “Sales” and 91 “Other income and expenses” are not closed according to subaccounts, but in general should not have a balance. 1c automatically closes the month, and SALT, in turn, makes it possible to identify unclosed accounts, which leads to distortion of information about the real financial position of the enterprise.

- When preparing annual reports, summary data on the company's work is entered into the balance sheet. The balance sheet displays the final balance of all accounts, which saves time on preparing a balance sheet.

- Drawing up the SALT allows you to compare data with a certificate of calculations from the tax inspectorate and timely determine existing debts on basic taxes (VAT, profit, etc.).

- SALT allows you to calculate the profit of an enterprise: account 90 contains data on sales revenue, cost and VAT; all other income and expenses are reflected here, which in 1C can be automatically sorted by accounting and tax accounting and allocated amounts not subject to income tax. In addition, SALT contains totals for retained earnings.

- SALT serves as an additional check for VAT deductions. When goods and services are received with VAT, suppliers issue invoices and when they are entered into 1C, the turnover on account 19 is closed. However, there are situations when an invoice has not been entered or delivery documents have not been submitted. The unclosed balance at the end of the VAT period makes it possible to see shortcomings.

Where can I download a blank balance sheet form for free?

The balance sheet form is also available to you on our website. You can download it in Excel format, which allows you to make calculations and apply mathematical formulas.

You can get acquainted with the features of compiling turnover for some common accounts in the articles:

- “Features of the balance sheet for account 60”;

- “Features of the balance sheet for account 01.”

Analytical and synthetic accounting: filling out the “chessboard”

Some accountants prefer the so-called checkerboard sheet to the turnover sheet. This is a type of OSV, which differs in the form of filling. All credit accounts are drawn vertically, and debit accounts horizontally. Transaction amounts are indicated at the intersection of rows and columns .

The goal of "chess" is the same as that of a regular OSV. This structure allows you to analyze the income and expense parts of the balance sheet and determine the tax base for any period of time. An example of determining the corresponding account for any of the transactions is given below.

The chess sheet allows you to present information about account balances in a visual form

Sometimes drawing up a balance sheet is preceded by filling out an account card (the so-called drawing of airplanes). For each account, debits and credits are calculated. It looks like the wings of an airplane: debit on the left, credit on the right. In theory, such a drawing makes it easier to fill out the OSV and find errors. In practice, you do not need to fill out account cards to perform the transaction. Experienced accountants always skip the “airplane” stage.

Results

The balance sheet is an accounting register, which is an element of the system for collecting and processing information. As a rule, the form is filled out automatically in accounting systems. Using the statement for tax calculation purposes is possible only in special cases. When carrying out transactions that entail different accounting procedures, there is a need to adjust or prepare a new register for tax purposes.

Sources: Order of the Ministry of Finance of Russia dated December 28, 2001 N 119n

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

How to understand the basics of accounting

To work, all types of possible income, expenses and transactions are coded into accounts. Types of accounting accounts:

- synthetic;

- analytical (sub-accounts).

The difference between them is the degree of detail. The process of encoding accounts began back in 1968, when the first “Regulations...” was approved by letter No. 130 of the USSR Central Statistical Office. Since then, the recommendations have changed several times.

As an example, we can give an analytical accounting of office property: table, chair, wardrobe, etc. These items can be combined into the concept of furniture and passed through the corresponding subaccount in one line. A calculator, a computer - go through the analytical account, and in the sub-account they will be reflected in the “Technical means” column. Everything together will be assigned to the synthetic account “Fixed Assets”. This is article 01 according to the accounting code. The example contains very different estimated value categories, but it gives an idea of the accounting structure.

What does the account number show?

The account code can contain up to seven digits. The first two digits from 01 to 99 include all possible accounting transactions. And the concept of “others” and the availability of free codes make this system universal. The first two digits make up the list of synthetic accounts as amended by Orders of the Ministry of Finance of the Russian Federation No. 38-n dated 05/07/2003, No. 115n dated September 18, 2006 and No. 142n dated 11/08/2010.

The same letter offers a number of subaccounts, which are coded by the third and fourth digits of the code. Sub-accounts can be detailed, and analytical accounts are completely left to the management of the company. In practice - the experience of the chief accountant. The process of forming a range of codes for an enterprise according to the conditions of its activity is a common task for accounting students.

To learn how to prepare a balance sheet, you should analyze the model of active and passive accounting accounts