When money accumulates in the cash register, it is transferred to the bank’s current account. Sometimes this is done by a cashier or an entrepreneur. But if you don’t want to take risks and waste time, order a collection service. In the article we will tell you how to conclude an agreement with a bank, how to meet collectors, so as not to pay for idle

What is collection

- What is it for?

- Advantages and disadvantages

How to prepare for collection

How does the procedure work?

How much does collection cost and how to make it cheaper?

- Classic collection

- Safe for receiving money

- Electronic cash collector

- Self-collection via ATM

What is collection

Collection is a service for transporting money or other valuables under guard: in simple words, you hand over money and accompanying documents to the guards so that they deposit the funds into your current account.

This service is provided by the bank where you have an account, or an organization with a special license (Law “On Banks and Banking Activities”). Most often, collectors take cash to the bank, but other directions are also possible: from the bank, between company offices, to another organization or to an individual.

What is it for?

Usually the service is ordered in order to comply with the cash register limit. By law, most organizations approve a cash balance limit - the maximum amount that can be kept in the cash register. All money above this amount must be sent to a bank account. But only medium and large businesses are required to set a limit, while individual entrepreneurs and small businesses can work without this indicator: keep as much money as they want in the cash register and transfer it to their current account whenever they want.

Collection is also needed for the safe transportation of proceeds and saving time. You can either yourself or with the help of a cashier credit cash to your account through the operator at the branch. But the bag of money still needs to be taken to the bank and time spent on the trip. Armed guards in an armored car are a more reliable delivery option, if only because they will return the entire amount to you if something happens to it along the way.

Advantages and disadvantages

The advantages of cash collection are obvious: you don’t take risks and are almost never distracted from your work.

- Safety. Armed people guard your cash and ensure that the money gets into your account. You enter into a liability agreement with them and do not worry about your funds. If you take the proceeds to the bank yourself, then you are responsible for it yourself. And you don’t have a machine gun or an armored car.

- No downtime. With cash collectors, you won’t have to waste time delivering money and queuing at the bank. If you or the cashier are engaged in this task, the business suffers: during such intervals you do not earn money.

- Speed of crediting to the account. During collection, money arrives in your current account faster than with a classic transfer to an operator; your turnover does not drop.

The downside is also simple - bureaucracy. To periodically call a car for money, you will have to collect documents and sign an agreement with a bank or licensed company. Then each time you fill out a stack of documents and pack the money in a bag.

You need to prepare money and papers strictly on time: collectors work according to a schedule and cannot stay with you even for 10 minutes. If you forgot to fill out the paperwork or count the money, you will have to write a refusal and pay for a single departure.

What services do collection services provide?

Regardless of who exactly will provide collection services (the bank service or a third-party organization), the following actions can be performed with its help:

- delivery of the company's cash proceeds to the bank;

- transportation of proceeds from the company’s retail outlets to the main office for the purpose of subsequent delivery to the bank;

- transportation of funds to the place of purchase of material assets;

- collecting funds from the company’s structural divisions and transporting them to the bank;

- escort to ensure the safety of company representatives transporting funds or securities to the storage location;

- delivery of funds from the bank to an office or a separate division of the company for the purpose of using them (for salaries, for cash payments with counterparties);

- delivery by order of companies of small change.

How to prepare for collection

You can’t just call the bank and say, “Come get my money.” You will have to prepare for the first collection for a long time: draw up an agreement, show the premises for transferring money, approve the schedule and cost of the service. Preparation may take several weeks.

- Make sure you have provisions for collection. You need free access to the premises and the ability to park near the entrance. You will also need a room in which only you and the collectors can lock themselves while the money is being transferred.

- Leave a preliminary application for drawing up an agreement using the form on the website of the bank or collection service. If you can't do this on the website, call.

- Agree on the cost of service. Tariffs can be found on the website or found out in a conversation with the manager. Below we will tell you what the cost of the service consists of.

- Before signing, study each clause of the contract and clarify the details: how long cash collectors can stay in your store, what will happen if there are errors in the documents, who buys the bags for packing money.

- Sign the contract. If you order a service from the bank that maintains your current account, the agreement will be bilateral. If the collection service has a tripartite one (you, your bank and the service).

- Agree on the schedule of visits if collection is carried out according to a schedule, or agree on trips by calling in advance. Usually the second option is more convenient for small businesses.

- The bank will issue instructions for the cashier on collection, teach how to prepare funds for transfer and fill out paperwork in the office or store.

Find your bank to maintain your account

Select bank

Find your bank to maintain your account

Select bank

Order of conduct

Since the collection of funds, bills, payment and settlement documents, as well as other banking procedures, is a cash transaction, some paperwork must first be completed. To begin with, an agreement is concluded between the organization providing collection services and the company that needs them. However, you should not limit yourself only to legal entities, since there are situations in which collection of funds for individuals is also in demand.

It is important to remember that organizations providing such services work closely with banks, which, in turn, issue numbered appearance cards on a monthly basis. They indicate in detail: the name, contact details, address and opening hours of the organization, the numbers of the bags assigned to them, as well as the time and frequency of arrival of collectors. Of course, the last of the listed data is determined in accordance with the volume of transported banknotes. Each empty bag involved in the described process is assigned its own number. Then the head of the collection service coordinates with the serviced organization the time of arrival of specialized vehicles.

How does the procedure work?

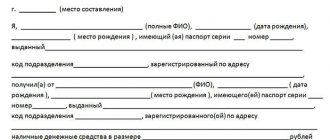

If you have signed a schedule of departures, the car will arrive strictly on schedule. If you call her, prepare for the appointed time. You need to count the money and fill out the accompanying papers. Study the instructions and memos from the bank on filling out documents and packing money. There are also official explanations for filling out in the Appendices to Bank of Russia Directive No. 3352-U.

1. Count the money and fill out three documents that are included in the “Transportation sheet for bag 0402300”

- statement;

- invoice;

- receipt.

It is important that the amount in all three documents matches, otherwise they will not accept your money and you will have to pay for a single departure. You are responsible for documenting collection, as well as for the correct packaging of funds.

2. Hand over the money and documents to the collector. Before leaving, you will be informed of the name of the employee who will accept the amount from you. Upon arrival, he shows his passport and power of attorney for transporting money to prove that he is really the one you are waiting for.

Previously, collectors showed an appearance card, but it was canceled on July 3, 2020. Today, you only need a specialist’s passport and a power of attorney from the bank.

Having established the identity of the collector, lock yourself in the room with him, give him documents to check and put the money in a special bag. Such a closed bag cannot be opened unnoticed - this ensures that no one will gain access to the money along the way. There are two options for bags, check with your bank which ones they work with.

- A canvas bag is a traditional container for money; it is usually brought by collectors. Such a bag is sealed with a special lead seal: the bank will give you an individual seal that leaves the number of the collection location on the lead. The cashier ties the bag with string, puts a lead seal on the ends and compresses it with a sealer: they will show you how to make a seal when concluding a collection agreement. The bags come in large sizes; you can transport really large amounts of money in them.

- Safe bag is a disposable plastic strong bag. Once sealed, it cannot be opened unnoticed. The bank can issue packages, but sometimes you have to buy them yourself. They come in different sizes and cost from 5 to 20 rubles apiece.

Put the money in a bag or bag, put the completed statement there and seal it with a seal or seal it. After this, the collector checks that the bag or package is intact, the seal matches the sample, and the remaining papers: invoice and receipt are also filled out correctly.

If all is well, the collector takes the bag and invoice, stamps the receipt and signs it. The receipt remains with you as proof that the bag with the money went to the collector, and now he is responsible for it.

If something goes wrong, you will have to sign a refusal to collect funds and wait for the next trip for cash.

3. Wait for the money in your current account. The collector will take the bag of money to the bank, employees will count it, check for authenticity and credit it to the account. If everything is in order, you will see the money in your online bank within 1-2 days

If the bank detects irregularities: the amount in the bag is more or less than in the statement and invoice, or a counterfeit banknote was found, it will look into it and contact you.

How much does collection cost and how to make it cheaper?

Classic collection

The cost of the service consists of the fixed departure price (500-800 rubles) and a percentage of the amount you transfer to the bank (0.1-2%). Sometimes the price of the service looks like this: 0.5% of the amount, but not less than 1000 rubles. The final cost depends on several conditions:

- transportation amount: the larger it is, the lower the percentage you will pay;

- complexity of the route and distance of your store or office from the bank;

- frequency of collections: the more often, the cheaper.

The tariff may be lower if you have a current account, acquiring and terminal rental with this bank.

Safe for receiving money

Also, to reduce the cost of collection, banks install an automatic safe in a place where there are many collection points (for example, in a shopping center). Clients independently pack money into bags, fill out accompanying documents and place them in safe deposit boxes. The cost of delivering money to the bank with this system is lower.

Electronic cash collector

Another cost-effective cash collection option for small businesses is installing an electronic cash collection system in your store or office. This device looks like a small ATM that is attached to the floor. You deposit money into it, and it immediately appears in your checking account. After this, the bank is responsible for the collected cash and takes money from the device as it is filled. Banks install such a terminal for free and charge a commission for depositing money of 0.3-0.5% of the amount.

Self-collection via ATM

Also today, most large banks have the possibility of self-collection, when you or your employees deposit money into your current account through bank ATMs using special cards. This can be done at any time of the day, and the commission for depositing funds will be lower than the costs of classical collection (on average, 0.3% of the amount). Money appears in the account instantly or within 3 hours, depending on the bank. The law does not establish a list of employees who can withdraw money through an ATM; this is usually assigned to a cashier or accountant. You can issue several self-collection cards for different employees and create depositor profiles in online banking so that they receive SMS notifications about depositing money.

So, decide whether you need collection, find out its cost from your bank or collection service, look where the account is cheaper, choose a profitable service option. All that remains is to prepare documents for concluding an agreement, learn how to fill out accompanying papers and transfer money.