If you suddenly need money urgently, and going to the bank for a loan is too troublesome, then you can borrow it from friends or acquaintances. This practice is common and does not cause any serious legal consequences, since such a transaction is usually concluded by mutual consent and as a result of a strong relationship of trust. However, there are situations when disagreements arise even between close people. Therefore, in the case of a large debt amount, it is better to document everything, and not only at the time of lending money, but also at the time of their return. A receipt for the return of money is a document that can save the borrower from unpleasant consequences and misunderstandings.

Recommendations for drafting the document

The content of the article

According to Article No. 161 of the Civil Code of the Russian Federation, the use of a receipt when purchasing a car refers to transactions, the fact of which is confirmed by a simple written form. Conditions – the amount must exceed 10,000 rubles, entering data on all parties to the agreement.

When selling a car, there are two types of financial relations - a deposit (advance) or payment of the full amount. This must be stated in the document. Also, when analyzing a sample receipt for receiving cash for a car, you need to pay attention to the following:

- Confirmation of the sale of the car is written by the seller, in duplicate, by hand.

- The date of preparation is indicated at the top, and the date of receipt at the bottom. They may vary.

- Complete details of the seller and buyer.

- The phrase “Money received in full” is required. It is attributed upon acquisition.

- Provide information about the car - make and VIN number.

- Duplicating a numerical amount in words.

- The signatures of the parties are decrypted.

Preliminary familiarization with a sample receipt for receipt of funds for a car will help you avoid mistakes. This is not an official form - the document is drawn up in free form.

Notarization is not necessary if all formalities have been completed. Additionally, it is recommended to involve witnesses. Their details and signatures must appear in the document.

Purpose of the document

A receipt is drawn up if an agreement is concluded between the parties to transfer more than one thousand rubles. This norm is prescribed in the Civil Code of the Russian Federation.

In accordance with legal norms, a receipt can be considered evidence in court. This is provided if one party sues the other to collect a debt.

The document contains a promise from one person to return money to another.

For example, you can confirm the fact of transfer of funds for:

- product;

- vehicle;

- previously received debt.

Legal features

Sometimes a sold car becomes the subject of controversy. Declaring a transaction illegal does not eliminate the need to return funds. Example - a vehicle was sold, but it later turned out that it was joint property; the document was signed without the consent of the other party.

You also need to take into account the following features of the transaction in simple written form:

- the limitation period is 3 years;

- in case of disputes, the claim is filed in the district court;

- You can receive interest for the illegal use of money by the defendant.

Important: a copy of the receipt is not accepted as evidence in court. For this you will need the original.

The video describes the details and nuances of drawing up the document:

Debt repayment receipt: what is it and when is it needed?

A receipt should be understood as an official document that is drawn up when transferring money or valuables. The Civil Code of Russia specifies the need for written registration of transactions whose value exceeds 10,000 rubles.

If the transferred amount of money is more than 10 times the minimum wage, then a loan agreement must be signed. The return of funds is also documented by receipt. In this case, it is drawn up by the lender.

Disputes between the lender and the debtor often arise, especially if one of the parties to the transaction is dishonest. Having a receipt allows you to achieve justice when disagreements arise. It confirms the fact of transfer of funds. It can be presented in court as evidence.

A receipt should be drawn up not only when transferring money from hand to hand, but also in the case of a bank transfer.

Official receipt for receiving the car

Official receipt for receiving a car Buying a car is a purchase for which a person prepares responsibly over a certain amount of time. The car costs a lot, so no one would want to risk their own savings during the transaction.

But how can you protect yourself from the actions of criminals and not be left without money or a vehicle? In such cases, it is customary to write receipts.

An official receipt for receiving a car from the buyer is a paper that can certify that the seller has received money from the buyer in the specified amount for the vehicle that was being sold.

Types and features of car receipts

When buying a car, making a transaction with the seller, it is important to protect yourself from possible claims or the risk of fraud. It is for this purpose that it is recommended to write a receipt for receiving money for the car. It is this document that will play a decisive role if one of the parties to the purchase and sale agreement decides to terminate the transaction.

When you purchase a used vehicle, you are spending your money knowing that you are responsible for it. A receipt for a car is a document that acquires legal force from the moment the date and signatures of the parties are applied to it. This is enough for the paper to acquire the status of an official document, but there are cases when the seller does not inspire confidence, then you can have it certified by a notary.

Main types of receipts:

- Written by hand, certified by the personal signatures of the seller and buyer;

- Certified by a notary.

The main features of the prepared receipts when purchasing a car include:

- The paper is written by the seller in several copies by hand.

- The date of its preparation should be indicated at the top of the document, and the date of receipt at the bottom. Note: Dates vary.

- Provide complete information about the seller and buyer.

- Upon receipt of money from the buyer, the seller must indicate on the document the phrase “Received the money in full.”

- Provide comprehensive information about the car being sold.

- The numerical amount must be duplicated in words.

- The signatures of the parties must be deciphered.

If all formalities are met, there is no need to have the document certified by a notary.

Receipt for compensation for damage in case of an accident

By virtue of the provisions of Art.

15, 1064 of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation), the harm caused to the victim must be compensated by the culprit in full. In the event of a traffic accident (hereinafter referred to as an accident), compensation is most often paid by the insurance company. You can learn more about this from the article Procedure for compensation for damage in case of an accident under compulsory motor liability insurance. You will probably also be interested in the ConsultantPlus material about options for compensation for damage in case of an accident. If you do not yet have access to the ConsultantPlus system, obtain it for free.

However, there are situations when it is the culprit who is obliged to pay for the damage caused:

- in paragraph 2 of Art. 6 of the Law “On Compulsory Civil Liability Insurance of Vehicle Owners” dated April 25, 2002 No. 40-FZ (hereinafter referred to as Law No. 40) lists circumstances the consequences of which are not covered by the MTPL policy (for example, compensation for moral damage);

- in paragraph 1 of Art. 14 of Law No. 40 indicates cases when, when the insurer pays compensation, the right of recourse against the person who caused the harm is transferred to it (for example, the culprit at the time of the accident was intoxicated or did not have the right to drive a vehicle);

- if the insurance company has provided compensation in the maximum possible amount (the limits are set in Article 7 of Law No. 40), but it is not enough to cover the damage in full (the amount above the limit is paid by the culprit).

In order to avoid lengthy proceedings involving insurance companies, meeting deadlines, paperwork, etc., participants in an accident have the right to agree to resolve the consequences of the accident peacefully. A corresponding receipt will help to confirm the decision made on the amount of compensation and the procedure for its payment.

In what cases is a receipt used?

If the buyer purchases a vehicle from its owner under a car sale agreement and feels trust, then there is no urgent need for a receipt. But not in every case, a car purchase and sale agreement guarantees the buyer that the money will be received in full without problems.

So, in what cases is a receipt required:

- If you bought a car during a sale from a private person, but did not immediately pay the full amount, you made an advance payment for the purchase of the vehicle;

- If the transaction is carried out by a third party, an intermediary, and direct contact with the owner is not possible, then in such cases a receipt is required;

- If the car has not yet been deregistered and the seller is considered the owner at the time of the transaction, it is worth writing a paper and protecting yourself from fraud;

- When selling a car, the seller asks that the price indicated in the contract be less than the cost of the vehicle itself. Thus, the seller tries to reduce tax costs. If you feel trustworthy, then arrange for the full amount to be transferred to the seller, indicating a different amount in the purchase and sale agreement. In any case, having an official document will help if a risk of fraud is detected;

- In the event that the owner of the vehicle being sold offers you, as the buyer, only a power of attorney, instead of the full required package of documents.

Of course, when buying a vehicle at a car dealership, you will not be required to provide any such papers. But if you decide to buy a used car, then you should not neglect precautions to save your money. If the receipt is written according to all the rules, if fraud is detected, you can always file a lawsuit with it, proving the case.

IOU for a car. Sample

I, Ekaterina Vasilievna Somkina, passport series 0000 No. 00000, issued by the Basmanny district police department of the Central Administrative District of Moscow on June 12, 2004, received from Yaroslav Vitalievich Filatov, passport series 0000 No. 000000, issued by the Fili-Davydkovo police department of Moscow on March 11, 2003, monetary the amount of 300,000 (three hundred thousand) Russian rubles for a Chevrolet Niva vehicle, vehicle identification number X9L0000000000. According to the car purchase and sale agreement concluded by the parties on November 5, 2011.

Payment has been made in full.

05.11.2011 _______ Somkina E. V.

A promissory note with interest can also be drawn up in a similar way. A consulting company can also provide a sample of all documents, whose specialists have the ability to objectively assess situations from different angles. They can also advise you on this issue in order to avoid going to court or other unpleasant situations in the future.

Competent preparation of receipts

If the situation or circumstances so require, it is advisable to record the fact of transferring funds for the purchased car with a receipt for the car. However, registration of a car from the point of view of the legally correct party must be carried out in accordance with existing laws. Despite the fact that everyone can draw up such a paper, it is not written on a standard form.

Such a document can be written in any form, but writing a receipt correctly means indicating the following:

- Name.

- Last name, first name, patronymic of both parties.

- Passport details of both parties.

- Specify registration by address.

- TIN of both parties.

- Amount in numbers and words.

- The number of a car that passes from one owner to another during a purchase and sale transaction.

- The amount of the deposit for the car (if we are talking about incomplete payment of the entire amount).

- Signatures and transcripts of both parties.

- Date signed and decrypted when the transaction was completed.

Only when the receipt lists all the above data can it become an official document and gain legal force. At the same time, whether to write it or trust the seller - the choice remains with the buyer.

Special cases

When buying or selling a car, every person would like to be sure that he will find a responsible, conscientious partner. Of course, you can’t trust the first person you come across, especially if it’s a big deal. In such cases, to protect themselves, the parties must make a decision and write a receipt.

Let's look at a particular example of when it is worth writing such a document. Let's say you are selling a car, and it seems like there is already a buyer for it. But suddenly it turns out that the buyer is not ready to pay the entire amount at once and offers you to buy the car in installments, making an advance payment. What to do in this case?

If you still want to sell your car to this buyer, ask him to draw up a receipt.

At the same time, do not forget that the purchase and sale agreement must contain the following necessary clauses:

- Between whom an agreement is concluded with the obligatory indication of passport data;

Subject of the contract, indicating the details of the car being sold;

- Payment details. The total expected amount, the amount of the buyer's contribution, the amount of unpaid funds, and the installment period are indicated. In some special cases, an installment payment schedule clause is also added.

- The buyer's responsibility if the terms of the contract are violated, up to the possibility of returning the car to the previous owner.

If you are dealing with a responsible buyer and not a scammer, such conditions will not frighten you.

Useful tips

So, when selling or buying a used car, it is important for every person to remain confident that they are not dealing with a scammer, but with a conscientious partner. And in order to complete the transaction in full, in order to protect yourself from unpleasant situations, it is important to approach each stage of the transaction with full responsibility.

Never, feeling a lack of trust in your transaction partner, neglect the opportunity to once again play it safe by offering to draw up a receipt. Thanks to such an official document, adhering to all existing drafting rules, if questions arise, you will be able to prove your case in court.

Yes, there is no official receipt form, but anyone can give a paper written by a person legal force, following the existing rules of drafting and writing. And, if such an opportunity or need arises, you can have the receipt for the car certified by a notary.

Before buying a used car, take the time to check whether the car is deregistered or not, whether the documentary part of the transaction is in order, whether the owner is selling the car personally or whether a third party is involved, and so on. There are many cases when unscrupulous partners in concluding a transaction turn out to be scammers. But a person himself is personally able to avoid the negative consequences of such actions on the part of scammers by writing a receipt.

How to write a receipt for a refund for a car

IOU - the secret of proper drafting

Thus, the mentioned part of the money, according to the agreement, can be paid in absolutely any order, but if the terms are not agreed upon, then the payment must occur monthly. If, according to the agreement, a loan is provided in a foreign currency, then the borrower, subject to an interest-free loan, must repay not only his debt in rubles, but also the difference that may arise due to the fall of the national currency.

- Last name, first name and patronymic of the borrower and lender. Such a document cannot be anonymous. In addition, here you need to indicate the names of the witnesses present when drawing up the receipt, if any.

- Passport details of the person accepting the funds and the person giving them. If the borrower is married, the passport details of the spouse are also indicated, and a record is made that he/she is aware of the loan and has no objections.

- Loan amount (in numbers and words).

- Refund deadlines.

- Signatures of the parties.

- It is also necessary to indicate where and when the receipt was made.

It is very important that such a document contains all the relevant details: who, to whom, when and how much money was borrowed. If there is interest on the use of the amount, it must also be reflected in the receipt. It is good if the document is written by the borrower himself, in his own hand and supported by his signature.

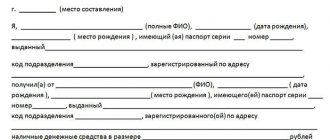

The receipt can be drawn up in front of witnesses or certified by a notary, but even without this, this document has legal force. I, ________________________________________________, passport: series ______, No. ___________, issued ______________________________________________________________________________, registered______ at the address: __________________________________________________________, ____________________________________________________________________________________, received from __ ___________________________________________________, passport: series ______, No. ___________, issued _________________________________________________________________________, registered ____ at the address: _________________________________________________________________________, _________________________________________________________________________________________, cash in the amount of __________ (amount in words) rubles and undertake to repay the debt by ________________________ 20____.

Correct sample receipt for refund

- The borrower's information may not be complete. For example, receipts are often drawn up by friends and relatives. If passport data is missing, the document may be considered invalid.

- A receipt that is printed on a computer is considered to be incorrectly drawn up. It will not be possible to prove that the paper was issued by a specific person. You also need to put not a signature, but completely decipher the last name, first name, and patronymic.

- It is not permissible for the amount of debt to be written down only in numbers. After all, sometimes they are difficult to decipher. It is important to duplicate the information in words.

- The document must indicate that “the money on the receipt was received.” Unscrupulous citizens may note that the money was never received.

- The return period must be noted. If there is none, then the loan is considered unlimited. It will be more difficult to obtain.

- The number of the agreement on the basis of which funds are transferred is indicated. If the loan was provided in accordance with a previously issued receipt, this fact must be reflected.

- The amount previously received on credit is recorded. The size to be returned is also noted. They must be indicated in numbers and in words.

- Both parties should note that they have no claims against each other.

- If interest is charged on top of the amount, this is reflected in the document. It should be noted which rate applies. In the absence of this mention, involuntary creditors demand fictitious premiums through the courts. But this will be easy to refute.

I, Anna Sergeevna Konstantinova, born in 1985, living at the following address: Moscow, st. Lomonosova, 63, apt. 12, passport data: series 0714 number 639943, issued by the Federal Migration Service of Russia for the city of Moscow on February 12, 2014, I give a receipt to citizen Anton Stepanovich Prikhodko, born in 1984, that I, Anna Sergeevna Konstantinova, received funds from Anton Stepanovich Prikhodko in the amount of 26 thousand rubles. The loan is transferred on an interest-free basis.

I undertake to return the funds by October 14, 2020.

- The procedure for pre-trial dispute resolution must be followed. Before going to court, you should try to resolve everything peacefully. To do this, a request for the return of funds is submitted to the debtor within two weeks. If the money is not received after the deadline, you can go to court.

- The receipt is prepared in three copies. One of them is transferred to the judicial authority. When signing, you need to make a copy of the debtor's passport.

- The court must be addressed at the place of registration of the plaintiff.

- It is important to pay the state fee in advance, attaching the appropriate receipt. It is also necessary to have basic documents available.

- After this, you need to wait for the court's decision to accept or refuse the application. If the decision is positive, a meeting is scheduled in a month.

Useful video: how to make a receipt

The creditor, as a result of incorrectly written documentation, has the right to file a claim for the return of debts and even write a statement of claim to the judicial authorities. Such an unfavorable situation can only be avoided if all the requirements of the debt agreement are fully met and there is real confirmation of the return of the debt amount in addition to a receipt for the return of funds. You should be on the safe side and always keep in reserve additional documents and evidence that can indirectly confirm the stated facts.

Receipt for refund: Sample

“I, Petrov Semyon Semenovich, __.__._______ year of birth, passport series ____ number_______, issued by __.__._______ Department of the Department of Internal Affairs of Russia in the city. Moscow, department code ___-___, registered and live at st. Kosmicheskaya 111 kv. 22, when signing this Receipt I received from Ivanova Lyubov Petrovna, __.__._______ year of birth, passport series ____ number_______, issued by __.__._______ Department of the Department of Internal Affairs of Russia of the city.

Moscow, subdivision code ___-___, registered and residing at st. Ivanova 333 kv. 33, previously transferred to her funds in the amount of 11,000 (eleven thousand) rubles, which were issued against a receipt dated __.__._______.

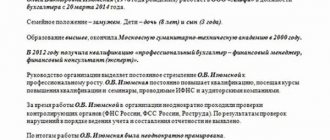

- full details of the borrower: full name, date of birth, full passport details, place of registration and actual place of residence;

- full details of the creditor: full name, date of birth, full passport details, registration;

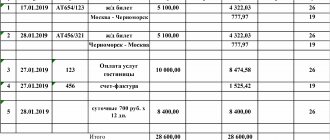

- debt amount in words and figures;

- date of actual receipt of money according to receipt;

- the term or date by which the borrower undertakes to repay the debt;

- purpose of debt money;

- signature of the debtor - full name and abbreviated signature.

As we have already said, any debt obligations should be drawn up in writing. True, if the amount of debt is less than 10 minimum wages, then the law provides for an oral conclusion of the transaction. The logic of legislators in this case is as follows: the amount of debt is small and if it is not repaid, the lender will not suffer serious financial losses, and the solution to such problems lies in the integrity of the parties. To repay money borrowed against a receipt, a simple physical act of transfer is also not enough.

If you owed money and decided to return it, then you need to draw up an appropriate document that confirms that the borrower has returned the funds to the lender. The rules for writing such a receipt generally overlap with the rules for debt, however, there are several important nuances: The receipt may contain information regarding the place and time of repayment of the debt. As a general rule, if the document does not indicate the place of its execution, then this is considered to be the address where the creditor lives or is located. But the parties to the loan agreement can change it at will and indicate any other place at their discretion.

In addition, they may even indicate not the lender, but another person to whom the borrower must give the money. As a rule, a receipt for receiving funds from a creditor is written by hand , but a printed version is also allowed. However, if disputes arise, a handwritten document is more provable. The receipt is not certified by a notary in most cases, but if the parties mutually agree, it can be notarized.

When lending money to a person you do not completely trust, you can invite several witnesses to confirm the fact of the transaction. They must indicate their data under the signature of the author of the receipt: Full name, residential address and signature (in full and abbreviated).

How to correctly write a receipt for an individual to repay a debt

Post Views: 622

Receipt for the return of funds - debt. Even with absolute trust in the borrower, you need to understand that sometimes situations arise that do not depend on the will of the parties. A verbal agreement may turn out to be just a sound that will dissolve in time.

Only written proof of receipt of the loan will help the creditor recover the debt from the debtor's heirs. Or the creditor's heirs can receive money from the debtor. A legally correct promissory note guarantees the protection of the interests of not only the creditor, but also the borrower. What to do if the return period is not specified. Is it possible to register online?

Sample receipt for refund

Receipt for refund, what the law says

If the lender is an individual, the agreement is considered to come into force from the moment the loan amount is received.

It is almost impossible to confirm the fact of a transaction when there are no documents confirming that the borrower has received funds. Witnesses can confirm the legality of the creditor's claims only through an oral transaction.

Prove that the debtor has received an amount in excess of 10,000 rubles. It is possible only by a receipt or an act of transfer recorded in a written agreement.

When borrowing more than 10,000 rubles, a written form of the transaction is required. According to Art. 812 of the Civil Code of the Russian Federation, a party cannot refer to witness testimony if the requirements for completing a transaction are not met. Therefore, in the absence of written confirmation of the transfer of money, the lender cannot attract witnesses in the event of a dispute.

A case from a law firm:

Galina N. asked her sister Irina P. for 300,000 rubles to buy a dacha, promising to repay the debt after receiving a bank loan. Irina transferred the required amount to Galina, who lives in another city. After 3 months, Irina asked to repay the debt, but her sister could not. As it turned out, the dacha was purchased, but the loan was not received.

The sisters quarreled, Irina turned to lawyers for help. Galina did not dispute receiving the money, but claimed that the money was given to her by her sister. Apart from the bank receipt, Irina had no other evidence of the loan. The court decided to recover money from Galina, since the defendant received unjust enrichment (Art.

1102 of the Civil Code of the Russian Federation).

The clients of lawyers and law firms are often creditors who cannot recover their money from the debtor due to improper execution of contractual relations . Unscrupulous debtors claim that after signing the agreement they did not receive money and refuse to pay.

The written agreement itself does not confirm that the debtor has received the loan amount, unless this is directly indicated in the text of the document.

A handwritten promissory note from the debtor is a documentary confirmation of the fact that the borrower has received funds, which is guaranteed to protect the interests of the creditor in the event of a dispute.

How to write

Lawyers and forensic lawyers recommend writing the text by hand, even when the document is an appendix to a printed form of the loan agreement.

Important ! When concluding an agreement, at the time of receiving money, receipt No. 1 is written by the debtor. All oral agreements that are significant for the parties must be included in the text.

On the day of final settlement of the loan, the lender:

- issues receipt No. 2 to the debtor stating that he has received the entire amount of the debt;

- returns receipt No. 1 to the debtor.

Often, the creditor simply gives the debtor receipt No. 1, without drawing up a document on his own behalf confirming receipt of the debt . It is not recommended to do this, since judicial practice knows cases of fraud when an attacker destroys the supposed original in front of the debtor, and after a while makes claims in court for the original copy.

Documents on financial calculations must be kept for at least 3 years.

If the money is returned in parts, for each payment the creditor must issue receipts to the debtor (No. 2, No. 3, etc.), and receipt No. 1 is returned to the debtor upon full repayment of the debt.

What information should it contain?

The receipt as a financial document must contain the following details:

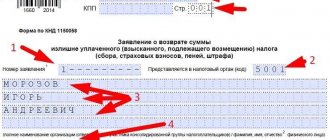

- name (the word “Receipt”);

- date and place of signing;

- full name, passport details, registration (address) of each party;

- contents and terms of the transaction;

- signatures of the parties.

The more detailed the debt document is, the fewer controversial situations there are.

If the receipt is an addition to a written agreement, then its contents only indicate how much of the loan was received by the debtor.

If issued without a written agreement, the contents of the document must include all the essential terms of the transaction. According to paragraph 1 of Art. 423 of the Civil Code of the Russian Federation, the essential conditions include:

- about the subject of the transaction;

- specified in the law as significant (for a loan - the amount of the transaction);

- significant for the parties.

All three points of the conditions must be contained in the text of the receipt (if there is no agreement).

Mandatory

- Indicate that this is a receipt for funds received under the loan agreement.

- Write the exact, full amount of transferred funds with a verbal description (for example, 50,000 (fifty thousand) rubles).

- Specify interest (if established), debt repayment period, and other conditions essential to the parties.

Attention ! If a loan is issued in foreign currency (according to paragraph 2 of Article 807 of the Civil Code), it cannot be indicated that the debt is repaid in rubles. Such a transaction may be regarded as carrying out settlements in violation of currency legislation (Clause 1, Article 9 of the Law on Currency Regulation N 173-FZ dated 10.12.

2003).

Additional

The receipt also indicates important, but not essential, terms and conditions regarding the procedure and timing of payments, the method of calculating interest, liability for delay, the procedure for terminating the transaction, etc.

It is technically difficult to include many additional items in a handwritten receipt. When the need arises, an agreement is drawn up , which details the essential and additional terms of the agreement.

As an addition to the loan agreement

A loan is an agreement between the lender and the borrower (parties to the agreement), executed orally or in writing. Regulated by the norms of the Civil Code of the Russian Federation (Chapter 42, Articles 807-818).

Lender is a person who transfers money, securities or other property to the other party to the transaction (Article 807 of the Civil Code of the Russian Federation). Lawyers also use other terms: creditor, lender, broker .

Borrower is a person who receives money and undertakes to repay it by a certain date. Other designations are debtor, debtor.

A loan is the same loan, but the lender is a bank or other financial organization (Articles 819-821.1 of the Civil Code of the Russian Federation). The subject of the loan can be cash, bonds or other securities, foreign currency, or things. According to the loan agreement, only money is lent. Payment of interest for the use of funds is a mandatory condition of the loan.

If an agreement is concluded between a legal entity and a citizen, then a written agreement is drawn up.

Agreements between individuals may be concluded orally if the loan amount is less than 10,000 rubles. If the amount transferred is more than 10,000 rubles. – written form is required (clause 1 of Article 808 of the Civil Code of the Russian Federation).

The borrower's receipt is equated to a loan agreement, this is evidenced by the content of clause 2 of Art. 808 of the Civil Code of the Russian Federation. If there is a promissory note, the contract may not be drawn up.

How to use the document

A promissory note is a financial document that can be presented to the debtor for payment after the end of the loan repayment period agreed upon by the parties.

Reference . The lender has the right to demand repayment of the debt ahead of schedule if the written agreement (agreement or receipt) contains a condition for paying the debt in installments and the borrower is overdue for the next payment (Clause 2 of Article 811 of the Civil Code of the Russian Federation).

A promissory note in a controversial situation, when the debtor refuses the obligation to return funds, will be important, if not the only evidence of the transaction.

Often, to resolve a conflict between the parties, a forensic examination of documents is ordered to determine the consistency of handwriting, how old it was written, etc.

Therefore, you need to store the receipt and other supporting documents (bank statement, transfer receipt) in places inaccessible to children, away from sources of fire, water and excess sunlight.

If the borrower is late in repaying the debt, it is first recommended to write a written claim with the corresponding requirement , providing a reasonable period for payment (for example, 30 days).

If no response is received or a refusal is received, you need to go to court.

Do not give the original receipt to anyone, including the judge. The original document is submitted only for examination . Prepare several photocopies (for lawyers, the defendant and his representatives, etc.). Upon presentation of the original, the judge attaches a copy to the case with a note about its authenticity, the original remains with the plaintiff.

Claims up to 500,000 rubles. sent to the magistrate, over 500,000 rubles. – district court at the place of registration of the defendant (Articles 23-24, 121-122 of the Code of Civil Procedure of the Russian Federation). When filing a claim, you must pay a fee (Article 333.19 of the Tax Code of the Russian Federation).

Receipt form

There are no printed forms for the return of funds, since the document must be written in one’s own hand . The handwritten text of a receipt is difficult to forge; in controversial situations, when conducting an examination, handwriting specialists need a more voluminous text from the author than just a signature on a document printed on a printer.

Sample for the borrower when receiving the loan amount from the lender

Receipt for receiving a loan

Moscow June 30, 2020

Source: https://autopravo.club/aministrativnoe/oformlenie-dokumentov/raspiska/

Receipt for the return of the car

The son bought a car secondhand, writing a receipt for the return of funds in the amount of 120 rubles, but the seller did not say that the car was deregistered and was allegedly disposed of. The son hoped to sell the car and get the money back. A month later, when transporting the car to a potential new buyer, police officers stopped it, rang through the database and found out that the car was not registered - they put it in a paid parking lot. Now: the seller sued and won, demanding a refund + penalties and legal proceedings. In addition, he managed to pick up that car from a paid parking lot. The son gave this seller another car + 15 tr. The trial took place, the decision was made, they filed an appeal, it was not accepted (allegedly a lawyer should have filed it). The month is running out. The decision came into force (although the borrower-son does not have papers or a writ of execution in his hands). Now the executor shakes the writ of execution, blackmails him (either in cash, he gets 70 thousand rubles, + legal fees), or gives the writ to the bailiffs. What should I do? HELP!4. In 2012 I sold my car in installments. He took a receipt from the person for the repayment of a debt in the amount of 250 thousand rubles. within a year and a half.

For the first six months, he periodically repaid the debt. Then, citing difficulties, he practically stopped paying, and then began to go into hiding. Six months have passed since the expiration of the debt agreement. I decided to sue him. The fact is that I live in a region where I am in debt and quite busy.

Can I register the right to receive and claim a debt to a third party (with his consent). That is, transfer to him the ownership of the rights to debt funds.4.7. Can I register the right to receive and claim a debt to a third party (with his consent).

That is, transfer to him the ownership of the rights to debt funds. -You have such a right. In accordance with Art. 382 of the Civil Code of the Russian Federation The right (claim) belonging to the creditor on the basis of an obligation can be transferred by him to another person under a transaction (assignment of the claim). For the assignment of a debt to another person, the consent of the debtor is not required, except in cases where this is provided for by contract or law. The debtor must be notified in writing that the debt has been assigned to another person.

In accordance with Art.

384 of the Civil Code of the Russian Federation, unless otherwise provided by law or agreement, the right of the original creditor passes to the new creditor to the extent and on the conditions that existed at the time of transfer of the right.4.10. The best option in this case is to first find a representative, collect the amount of the debt, receive a writ of execution with a specific amount of debt, and then sell it under an assignment agreement - assignment of the right of claim, in accordance with Art. 389 of the Civil Code of the Russian Federation.

The debtor's consent is not required, only his notification is required. Then it will be clear what you are selling and for how much, otherwise it turns out that you have paid off part of the debt and owe something. such debts are not bought. The difference in the concepts of assignment and simple assignment is as follows. By assignment, only and exclusively the rights of the assignor are transferred. While under an assignment agreement not only rights can be transferred, but also the responsibilities associated with the implementation of these rights.

Thus, the assignment will not be the assignment of the right to lease office space, because such an agreement is associated not only with the opportunity to occupy the space, but also with the obligation to pay for it at certain periods. And the transfer, for example, of the rights to a preferred share can be called an assignment, since the assignee acquires the right to receive dividends, but at the same time no obligations are imposed on him - ultimately it is his business whether to receive them or not. 4.9. Dear Vladimir. Yes it is possible. The assignment of the right to claim a debt, based on a transaction that is made in simple written or notarial form, must also be made in the appropriate form. According to the Civil Code of the Russian Federation, the debtor’s consent to conclude an assignment agreement is not a prerequisite, except in cases where the identity of the creditor is of significant importance for the debtor. In addition, the law does not oblige the debtor to be notified of the conclusion of an assignment agreement, warning only that if the debtor has not been notified in writing of the transfer of the creditor's rights to another person, the new creditor bears the risk of the adverse consequences caused by this for him. The drafting of the contract must be entrusted to a lawyer; there are certain features.

Sample receipt for refund

The security of financial relationships, starting with your roommate, work, and ending with financial relationships with banking and other legal organizations, depends only on you.

If the amount of monetary relations is more than one thousand rubles, it is necessary to draw up a cash receipt. The state does not provide a mandatory form for drawing up and filling out a receipt.

However, there are mandatory items to fill out:

- Place and date of drawing up the receipt.

- FULL NAME. and passport details of the person transferring the funds.

- FULL NAME. and passport details of the person receiving the money.

- Amount - in numbers and words.

- Date and signatures of the parties.

Important! If you do not intend to have the receipt notarized, it is better to put it in writing. This will give you additional guarantees in case of appeal to the judicial authorities.

Receipt for receipt of money for construction work

It is compiled in random order. The Law of the Russian Federation does not provide for special forms for filling it out. Please take into account the main points that are required for mandatory completion and see the sample we have provided:

Sample receipt for receiving money for services performed

When filling out the document, be as specific as possible about the work performed, as well as how to perform it. At the end of the document, do not forget to indicate full (or partial) payment and no claims against the contractor. If there were complaints, they must be indicated. This way you will protect yourself during the warranty period for the work performed.

Receipt for receipt of funds for repairs performed - sample

The instructions for drawing up and approving this type of document are the same as all of the above. Carefully study the form - a form to fill out, enter your data and the data of the person with whom you are starting a financial relationship.

Sample promissory note for borrowing funds

It is not necessary to draw up an act of transfer/acceptance of money received for a product/service or as a loan. True, if the debtor does not return what he promised, you will have to say goodbye to your finances, since you will not go to court with your bare hands. But there would be a receipt issued between individuals and/or legal entities.

The matter would have turned out differently: the statement of claim was accepted, the handwriting was checked, witnesses were invited, non-payment was established, but... The signature did not match: there is one on the debt paper, and another on the passport. What will be the outcome of the case?

This was one of the options when the friend borrowing the money already knows that he does not want to return it. Besides forging a signature, there are many ways to legally evade obligations, but none of them will work if you follow the recommendations.

At interest

The interest rate must be stated in the text of the document. The contract verbally does not guarantee you anything. Below is a sample of such a receipt, however, if a large amount is borrowed, it is better to use a full-fledged loan agreement (its legitimacy when used by the authorities will not raise doubts). This document gives more rights to both (!) parties.

No interest

An interest-free loan will be obtained automatically if the amount borrowed is not higher than the minimum wage established at the time of signing the document, and there is no indication of interest in the promissory note.

However, if the total amount of money borrowed is higher than the minimum wage (in fact, we are usually talking about significant amounts - above 100 thousand rubles.

), and the document does not indicate the absence of interest, then it will be calculated automatically (at the state bank rate).

It's not a big deal if the debtor pays you off himself. And in court there will be confusion, which will complicate the matter a little. Therefore, it is necessary to clearly state in the text whether there is a percentage or not.

With monthly payment

For such a calculation, it is desirable to have a loan agreement. Why?

- it has greater legal weight;

- it has more opportunities (an extensive system of fines and penalties for late payment, for example);

- it is easier to prove that the debtor did not make payment in a given month.

If you wish, you can create a schedule of monthly payments in a promissory note, but in fact this will not be a schedule, but an indication of the systematic nature of the payment on such and such dates. The ideal solution is the synthesis of a loan and a receipt for receipt of funds for this loan.

You can verify the debtor’s honesty with the help of an insurance company (cost-effective if the loan amounts are large) - you need to conclude an agreement with it: if the payer does not return the money, the insurance company will do it for him. The disadvantage of this method is that you need to spend money.

This method insures the lender against the payer’s dishonesty: even if the money is not paid, the item left as collateral can be sold, thereby returning part or the full amount of the borrowed amount.

Sample form of receipt for borrowing money

There is no universal template for drawing up this document, since each case of transfer of money is individual and has features that will not be inherent in other agreements. The basic rule when drawing up a promissory note is to reflect in the text everything that you need to receive in life (interest, fines, etc.). You can have the receipt certified by a notary, this will give you additional guarantees.

There are often times in life when you have to deal with the return of goods. The reasons for this can be very different, be it dissatisfaction with the size and color (if we are talking about things) or identification of expired goods (when talking about food products). Of course, this procedure has long been strictly regulated, and the mechanisms are regulated by law.

The Law “On Protection of Consumer Rights” is the main one. It allows you to exchange a product for an analogue or even get 100% money for it. But this cannot always be done.

You must follow the procedure and thoroughly go through each of its stages. In particular, one of them is drawing up a receipt for the return of money. This is what will be discussed further.

List of products that can be returned to the store

Before starting a conversation about a receipt, you should mention the list of returnable goods, because not everything can be returned. Returnable goods include clothing, shoes, accessories, swimwear, etc.

Please note that non-returnable goods can still be returned, but only if this was stipulated in the purchase and sale agreement (hereinafter referred to as the SPA). For example, non-returnable goods include complex equipment, but it can be returned for the reasons specified in the policy (if any).

How to correctly write a receipt for the return of funds (sample)

The receipt is written in simple written form. It is possible to fill out the document on a computer, but from a reliability point of view, it is better to write it by hand, so that if problems arise, a handwriting examination can be carried out. If you think that a handwritten signature will be enough for examination, then this is not so.

Experts cannot always identify a person’s handwriting just by their signature. If funds are transferred by receipt in connection with the execution of any agreement, then this should be mentioned in the text itself. That is, the following type must be indicated: “In payment of the principal amount under the purchase and sale agreement dated____ No.____.” If we are talking about a contract for the provision of services, then the receipt should, for example, say: “In payment for the repair of an apartment located at ______.”

Otherwise, the party to the agreement who received the money under the receipt can say in court (if the case comes to him) that the money was simply transferred - not as payment under the agreement, but, for example, to pay off a debt. Be sure to indicate in the text of the promissory note the date by which the money must be returned. This is due to the fact that it is from this date that the statute of limitations associated with going to court will be calculated.

It is 3 years. If you “forgot to indicate the repayment period, then your loan will be considered unlimited; and before going to court, you will have to present a demand to the debtor (defendant) for repayment of the debt. I, Petr Mikhailovich Ivanov, born on September 2, 1964, passport data 7305 No. 333333, issued on January 1, 2013 by the Department of Internal Affairs of Russia for the Ulyanovsk region, registered and residing at the address: Ulyanovsk, st.

Iron Division, 15 apt. 89, received from Tatyana Andreevna Vasilyeva, born on September 28, 1989, passport data 7304 No. 222222, issued on January 1, 2012 by the Federal Federal Migration Service department for the Zavolzhsky district of the city of Ulyanovsk, registered and residing at the address: Ulyanovsk, st. Dimitrova, 8 apt. 14, funds previously transferred to her in the amount of 50,000 (fifty thousand) rubles in accordance with the receipt dated _____ 2014.

I, Vasilyeva Tatyana Andreevna, born on September 28, 1989, passport data 7304 No. 222222, issued on January 1, 2012 by the Federal Federal Migration Service department for the Zavolzhsky district of the city of Ulyanovsk, registered and residing at the address: Ulyanovsk, st. Dimitrova, 8 apt. 14, I pass on to Pyotr Mikhailovich Ivanov, born 09/02/1964, passport data 7305 No. 333333, issued on 01/01/2013 by the Department of Internal Affairs of Russia for the Ulyanovsk region, registered and residing at the address: Ulyanovsk, st. Iron Division, 15 apt.

89, to repay the debt, funds in the amount of 50,000 (fifty thousand) rubles. Thus, the legislation does not establish clear requirements for issuing a receipt for the receipt of a debt. The main points that are worth paying attention to: the receipt for the repayment of the debt must be drawn up in writing, it must clearly identify both the one who returns the money and the one who is the recipient of the money; The amount of the repaid debt must be clearly stated.

Legal advice

Lawyers give some advice on the most common issues. Taking into account all the points will allow you to correctly draw up a receipt and receive funds with a high probability.

Errors when issuing a receipt

The most common mistakes when drawing up a receipt without the help of a lawyer:

- the exact purpose of providing funds, if any, is not indicated;

- the terms for returning the money are not specified;

- the currency in which the borrower received funds is not indicated;

- incomplete data about loan participants;

- there is no entry “Received money by receipt”;

- the signature has no decryption;

- the signature does not correspond to the real autograph;

- the receipt is completely printed on a computer;

- The amount is indicated in numbers only.

How to return funds before trial?

Despite the fact that this method imposes on the debtor the need to repay the costs of the process, this measure often has a positive effect on the speed of repayment of funds. To do this, you need to contact the defendant and provide evidence of your appeal to the court. The official way to try to collect funds without using the court is a registered letter demanding the return of the money, but if this request is not fulfilled, the creditor will be ready to appeal to higher authorities. If the money is returned, then the creditor can no longer have material claims.

How to return funds through court?

Recovering funds through the courts is a long and expensive process. To do this, you will need a passport and an application submitted to the court.

To resolve the dispute in this way and return the money, it is recommended to consider the following recommendations:

- you need to draw up a letter and send it to the debtor at the place of registration or residence, it should contain information about the earliest possible filing of a claim with the court;

- if the letter does not produce any results, then file an application with the court;

- pay the state fee and keep the receipt or receipt;

- collect the necessary documents to go to court;

- wait for a summons to consider the case;

- making a court decision and transferring a writ of execution to bailiffs, who must recover funds from the defendant.

All financial claims are considered satisfied when the money is transferred in full. The statute of limitations is three years, which means that after their expiration, the court decision loses its legal force. This may be the case if the bailiffs were unable to locate the citizen and collect the required amount from him.

How to file a claim for the return of funds against a receipt

A claim is required when going to court to recover funds from a creditor. The claim must include:

- Cap (name of the court, details of the defendant and plaintiff, including place of residence).

- Description of the situation, arguing your point of view using the existing receipt and other evidence of transfer of funds.

- Statement of requirements. This includes repayment of existing debt, imposing on the defendant the obligation to pay state fees and other expenses associated with the need to conduct a trial.

When the funds are transferred to the creditor, the promissory note must be returned and then destroyed.

What you should pay attention to?

When filling out a receipt, you must ensure that the information entered is real. If the creditor enters incorrect information about himself, then he will not receive the funds at all, but if the debtor is a debtor, there will be no one to collect the money from. Last name, first name, patronymic, passport number and series, place of residence, and so on. This is how the signature is verified with the signature in another document.

What is a “loan episode”?

The “episode of receiving a loan” means the moment of transfer of money, which differs from the date and place of drawing up the receipt. If the preparation of the paper and the transfer of funds occur at different times, then in the second case it is necessary to create a separate document that will record the fact of receiving the money.

The receipt for the return of funds varies depending on special conditions, but it will have clauses that must be included in the document. If problems arise, it is better to contact a lawyer, since paper is the main evidence of the transfer of money.