What are fixed assets

Fixed assets include any property of an enterprise used to carry out its activities: these can be materials, machinery, instruments, equipment, etc., in other words, everything that is involved in the labor process.

It should be noted that any inventory items acquired by an organization for work must be listed on its balance sheet. Once materials, equipment or machinery become unusable, they must be written off.

Read more about the article: what are fixed assets?

Other Disclaimers

In addition to these features, there are also several other important nuances that need to be taken into account in the process of writing off fixed assets.

Depreciation process

Depreciation is carried out from the moment the production assets were registered with the organization until the full repayment of the cost or in the case of write-off of fixed assets due to their excessive wear and tear. Any entries made for depreciation charges are made to account 02, while the credit for passive and balance sheet accounts fully reflects the total amount of accruals for the specified object.

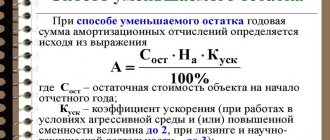

By debit, the depreciation amount is written off only in the case of write-off of non-current assets, and the procedure itself can be carried out using the following methods:

- linear;

- write-off due;

- by reducing balance"

- in proportion to the ratio of the volume of production of commercial products.

The choice of methods remains with the enterprise, and must be reflected in the accounting policies. Taking into account the chosen scheme, which is determined on the basis of information about the fund’s inventory objects, this amount is posted on loan 02.

Such expenses can lead to an increase in the cost of property of certain divisions that operate fixed assets.

Trading companies include all depreciation charges in costs.

Defective statement

When preparing a defective statement, you must indicate the following information:

- justification for why this procedure is advisable from an economic point of view;

- a source of information within the company to analyze the reason for the depreciation of fixed assets;

- a document indicating the expert's decision.

This statement contains information confirming the fact that there is no possibility of further operation of fixed assets, which led to the need to write them off.

Service memo

The preparation of a memo should be carried out in accordance with some recommendations:

- on the right side the full name and position of the addressee are indicated;

- You must indicate the title of the document;

- the date and registration number of the note are indicated;

- the specific subject of this document is reflected;

- description of the situation;

- signature of an authorized person.

An official note when writing off fixed assets is required only if the object has suffered wear and tear or its material and technical base is considered obsolete.

Procedure

In order to write off fixed assets, it is necessary to first establish their unsuitability for further use. For this purpose, the company creates a special commission, the main task of which is to certify the fact of a defect, wear, etc.

The commission must include at least three people, including the financially responsible person.

Most often, only full-time employees of the enterprise are included in the commission, but in some cases, these may also be third-party experts who have the necessary knowledge and skills to determine irreparable failure, for example, of particularly complex equipment.

After the property is declared completely faulty, the commission draws up a special act, on the basis of which the organization writes an order to write off fixed assets. This order, in turn, serves as the basis for drawing up a write-off act.

Legislative regulation of this issue

On the territory of the Russian Federation, Goskomstat has distributed the same type of form for the act of write-off of fixed assets OS-4.

It was approved in his Resolution No. 7 of January 21, 2003. The document is drawn up by a commission

for deregistration of unsuitable operating systems.

At enterprises, this form is recommended for use for writing off any property from the fixed assets category, except for vehicles. For transport

you need to use another unified form OS-4a.

To deregister a group of objects

, use the OS-4b form.

When disposal of property included in the fixed assets of the enterprise, upon sale or transfer to another organization, it must be written off on the basis of the OS-1 drawn up and signed by the parties.

How to draw up an act correctly

Today, the act of writing off fixed assets can be written in any form, however, most enterprise employees, in the old fashioned way, prefer to use previously generally applicable mandatory forms in their work. Their advantage is obvious: there is no need to rack your brains over the structure and content of the document, since all the necessary positions are indicated in it. Such unified forms also include form OS-4. This act can be filled out both when writing off one object or several at once.

Composition of the form

This form consists of a title part and three sections (tables):

- The first table is drawn up on the basis of the OS acceptance and transfer certificate, which is generated when an object is entered into the organization’s records. This table contains general information about the object, the period of its use, as well as the amount of depreciation accrued during operation.

- The second table describes the main features of the OS, as well as the presence of drags in it. metals and precious metals stones.

- The third table is intended to list the costs of decommissioning and dismantling the object. In most cases, during dismantling, some materials remain that can be used in the future. They come as material assets. The cost of these values is also reflected in the table.

The form of the act in form OS-4 is given below.

Sample of filling out the OS-4 form

- At the beginning of the document, on its front side, the following is indicated:

- name of company,

- her TIN,

- checkpoint,

- the structural unit to which the written-off fixed asset belongs.

- Next, the basis for the write-off is written - here you need to put a link to some supporting document (usually an order from the manager) and the financially responsible person (only the employee’s full name is written here).

- On the right side of the form enter:

- OKPO code of the company (can be found in the constituent documents),

- date of write-off of fixed assets from accounting,

- number and date of issue of the document that became the basis for write-off,

- personnel number of the financially responsible employee.

- Below is the document number, the date it was compiled, and the reason for the write-off.

- On the right is a place for approval of the act by the director of the enterprise.

The next part is presented in the form of a table and relates directly to the property being written off:

- in the first column,

- in the second and third - inventory and serial numbers, respectively,

- on the fourth or fifth date of release of the product and the date of its acceptance onto the balance sheet of the organization.

- in the sixth column (i.e., the time that the property was actively used in work),

- in the seventh - the cost of the object at the time of its acceptance for accounting,

- in the eighth - the amount of accrued depreciation,

- in the ninth - residual value (the value in the last paragraph is the difference in indicators from the two previous columns).

What is OS-4

This is a unified form for writing off fixed assets, approved by Resolution of the State Statistics Committee of the Russian Federation No. 7 of 2003.

Important: in modern accounting and business management, the use of standardized forms is not necessary, so an enterprise has the right to develop an internal document, focusing on a sample.

This form is applicable for writing off from the balance sheet any property that has fallen into disrepair or outdated unprofitable models, except for vehicles.

The report is filled out after it has been fully established that the equipment is unsuitable and, on its basis, an entry is made in the inventory card about the liquidation process.

Writing off fixed assets means excluding the amount of the cost of an object from the balance sheet.

Liquidation of an object is not only its write-off, but also the cessation of accrual of depreciation amounts. The act is the basis for excluding the liquidated object from the balance sheet.

By the way, it is not necessary to liquidate the property, however, when storing it, it will be taken into account in the balance sheet of the enterprise, then the object will have the status of existing and in operation.

In what order the OS is decommissioned and the necessary documentation is prepared - see here:

Who is required to draw up the document?

Before filling out this act and carrying out the liquidation event, a commission is formed, which should include responsible persons, an accountant, and independent experts.

They must install:

- The cause of equipment wear, especially if it is premature;

- Responsible persons for equipment breakdown, especially if this is an unforeseen situation;

- The feasibility of repairs based on the study of technical documentation and expert conclusions;

- Availability of using some of its parts or individual parts;

- If restoration is impossible, they are required to draw up an inspection report with certain conclusions about the liquidation of the object;

- Based on this document, the same commission draws up a write-off act.

Important: the document is signed by all members of the commission and the accountant, and approved by the manager or authorized person.

What does the unified form contain?

The unified form consists of 3 sections and a title.

The contents of the sheets are as follows:

- The title section is the carrier of:

- Company details and name;

- It indicates the write-off date and document number;

- The department in which the write-off occurred;

- Responsible person;

- Reason for write-off.

- Section 1 contains a complete description of the condition of the object at the time of write-off:

- Technical and individual data;

- Initial cost and at the time of write-off;

- Operating period;

- Monthly depreciation amounts. Here you will read what depreciation of fixed assets is in simple words;

- Replacement cost.

All information is taken from the balance sheet and acceptance certificates.

- In the 2nd section there is a brief description of the object, also on the basis of acceptance documents, the presence of precious metals and other valuable components in it.

The same section indicates the commission’s conclusions on the advisability of its restoration.

- The 3rd section is a carrier of information about the costs required for write-off and the availability of inventory and materials that will remain during the dismantling of the facility and the possibility of their use.

Form OS-4.

Important: if several objects are out of service at once, their write-off can be documented in a single document.

Sample of filling out the OS-4 form.

Differences between forms OS-3 and OS-4

It is already clear that the OS-4 form is used to write off fixed assets in the event of their unsuitability and liquidation.

This document is filled out after a complete inspection of the object and receipt of appropriate expert conclusions that it cannot be restored.

Form OS-3 is filled out as a result of acceptance of equipment after major repairs, reconstruction, restoration, that is, it is an acceptance document of fixed assets when they are received back to the enterprise after repair work.

Also, unlike the OS-4 form, this form has only 2 sections.

Sample of filling out the reverse side of the OS-4 form

The reverse side of the act also contains two tables. The first contains individual parameters that serve as part of the characteristics of the object, including information about the content of precious metals.

Below the table there are several lines in which the commission taking part in the write-off of fixed assets makes its conclusion (in this case, on the write-off).

If necessary, a list of additional documents accompanying this act is indicated.

Then the commission puts its signatures next to the indicated positions with their full names.

The last table includes information about:

- expenses incurred for write-off of fixed assets,

- remaining inventory items suitable for further use,

- funds proceeds from the sale of written-off property.

Finally, the act is certified by the signature of the organization’s chief accountant.

An example of filling out the protocol of the commission for writing off fixed assets

As a visual illustration, let’s fill out the protocol step by step.

Step 1. Fill in the details of the institution. It is advisable to indicate not only the full name without abbreviations, but also INN, KPP, OKPO.

Step 2. Fill in the name and number of the document, for example, “Minutes No. 1 of the meeting of the commission on writing off fixed assets,” and also indicate the date of preparation.

Step 3. Fill in the place of origin (address of the commission’s location).

Step 4. Fill in the list of participants in the “Attending the meeting” section. It is required to indicate your full name and position in the organization, as well as your role in the commission.

Step 5. We indicate the agenda of the meeting, for example, “Consideration of the issue of writing off fixed assets of the institution.”

Step 6. Fill out the “Listen” section. It is required to indicate the details of the speakers (name and position) and the topics of the reports with a list of objects for disposal.

Step 7. Fill out the “Resolved” section. It is necessary to provide a description of the objects that have been decided to be written off, including the inventory number and book value. For example, “CDK device” manufactured in 2000, inv. No. 0001, manager No. D 000/1, book value RUB 117,000.00.”

Step 8. We fill out the section with information about the voting results and the section with the signatures of the participants (each person signs in the space provided for this).

The completed document will look like this.

How to correctly draw up an act of write-off of fixed assets in the OS-4 form

The act can be filled out manually or on a computer.

There is only one important condition: it must contain the original signatures of the head of the enterprise, as well as members of the write-off commission.

There is no strict need to certify the form with a seal - as of 2020, legal entities are exempted by law from the obligation to use various types of cliches and stamps in their work.

The act is drawn up in at least two copies :

- one of which is transferred to the accounting department of the enterprise, so that in the future, on its basis, the accountant can reflect the write-off of the property specified in the act,

- the second remains with the financially responsible person, who then gives it to the warehouse in order to either dispose of the fixed asset or sell it.

If necessary, additional copies of the act can be created.

Rules for drawing up an OS write-off act

The write-off report is filled out by the employee responsible for the operating system.

An act is drawn up in 2 copies:

- The first is necessary for accounting in order to reflect the disposal of property from circulation;

- The second is kept by the financially responsible person and is the basis for transferring property to the warehouse.

Sections of the form are arranged in the form of tables on 2 sheets:

- The document header or title section contains all the necessary details and information about the persons drawing up the document, as well as the approval of the manager;

- Section 1 consists of 9 columns of the table, column 7 in this section is filled out only in the case of previously carried out restoration work;

- Section 2 is filled out only if the object contains precious metals and precious stones;

- Section 3 is a carrier of information about the costs of dismantling equipment - the “Total” line contains the full cost of costs minus the cost of parts that can be used in the future, and the total cost of the decommissioned object is displayed.

Important: the act is filled out only in case of liquidation of the object, if it was transferred to free use by another enterprise or was sold; other forms of disposal of fixed assets are filled out.

An example of filling out an OS write-off act.

How to avoid mistakes

The entire process of writing off fixed assets must be carried out according to well-established stages that fully comply with legal requirements.

To avoid errors when filling out documentation, you must:

- Assemble an authorized commission based on the order of the head. How to compose - read the link.

- Draw up an act in 2 copies and hand them over to the appropriate persons.

- In this case, the document must be formatted correctly:

- First, fill out the header, indicating all the required details, dates, numbers;

- You should not forget to indicate the person responsible, the date and reason for decommissioning the object.

- To fill out the tables you need to prepare:

- Technical documentation;

- Inventory card;

- Next, you should indicate all the data from the object’s passport - year of manufacture, name, brand, etc. You will learn how to correctly draw up an act for writing off materials that have become unusable.

- To fill out columns 6 and 7, you must use accounts 01 and 02 SALT.

- After which the manager will study the documentation and approve it.