Criteria for applying the simplified tax system

According to the legislative act, payers of the simplified tax system are legal entities that have transferred and are applying the special regime in the manner established by Chapter. 26.2 Tax Code of the Russian Federation.

Entrepreneurs and companies voluntarily switch to using a special regime:

| The tax base | Bid, % |

| Income | 6 |

| Income minus Expenses | 15 |

Regional regulations may adopt differentiated tax rates according to the simplified tax system in the first case 0-6% , in the second 5-15% . The reduced tariff applies either to all legal entities or to certain categories.

Not everyone can voluntarily switch to a special regime; there are clear restrictions on the transition and use of this special regime. These norms are regulated by Articles 346.12 and 346.13 of the Tax Code of the Russian Federation.

How taxes are paid according to the simplified tax system

Tax payments under the simplified system, as before, include:

- Advance payments. They are carried out based on the results of the quarter, they are paid before the 25th day of the month following the reporting period. Funds are transferred for the 1st, 2nd and 3rd quarters.

- Final payment. Carried out based on the results of the year.

Organizations pay tax under the simplified tax system until March 31 of the year following the reporting year.

For individual entrepreneurs, the period during which the tax contribution must be transferred is slightly longer - until April 30.

Payment details can always be found on the official tax website - www.nalog.ru.

It is worth considering that organizations need to transfer tax payments according to the details of the branch at the location of the company.

Individual entrepreneurs contact the inspectorate at their place of residence.

back to menu ↑

Income limit for switching to simplified tax system

One of the main requirements for the transition and application of the simplified tax system for legal entities is the limitation on the maximum amount of income . An organization has the right to switch to a simplified regime only if, based on the results of its activities for nine months of the year in which it notifies the fiscal authorities of the transition to the special regime, revenue does not exceed 112.5 million rubles .

Every year until December 31 of the current year, the revenue limit is subject to indexation. For this purpose, the deflator coefficient established for the next year is determined. Let us recall that for three years 2017–2019 the revenue limit was not indexed to the deflator coefficient in accordance with Federal Law No. 243-FZ of July 3, 2020.

Thus, the maximum income of an enterprise for the transition to the simplified tax system from 2020 cannot exceed 112.5 million rubles.

Simplification limit for 2020

Next year, it will become easier for many to stay on the simplified tax system - the income limit under the simplified tax system in 2020 will increase for all taxpayers from 60 to 120 million rubles. As in the case of the “transitional” limit, no coefficients will be applied to this amount until 2020, that is, in fact, the amount of allowable “simplified” income compared to 2020 will not double, but only by 40.260 million rubles ( 120,000,000 – 79,740,000).

You can focus on the new threshold of 120 million rubles, starting from January 1, 2020; in 2020, the income limit of the simplified tax system remains the same - 60 million rubles, multiplied by the deflator coefficient.

Example

The simplified organization Aktiv LLC provides transport services. In 2020, she received income in the amount of 79,500,000 rubles.

The maximum amount of revenue that can be earned from simplified taxation in 2020 is 79,740,000 rubles (60,000,000 rubles multiplied by a deflator coefficient of 1.329). In our case, Aktiv LLC fits into the limit and can continue to operate under a simplified regime in 2020.

Let’s assume that income from the “simplified” activities of “Aktiva” will increase next year and amount to 125,000,000 rubles. The “income” limit of the simplified tax system for 2020 is set at 120,000,000 rubles. No coefficients or indices are applied to this amount. This means that Aktiv LLC will exceed the maximum permissible level of revenue for further application of the simplified tax system and will have to switch to the general taxation system.

The procedure for switching to the simplified tax system

To switch to a simplified taxation system, enterprises must be guided by Articles 346.12 and 248 of the Tax Code of the Russian Federation.

The Tax Code clearly regulates the procedure for determining an enterprise's revenue for nine months of the current year for the transition to a special regime. Consequently, in order to switch to simplified taxation, merchants take into account the following types of income:

| Types of income | Article |

| From the sale of goods, works, services | Article 249 of the Tax Code of the Russian Federation |

| From the implementation of property rights | |

| Non-operating | Article 250 of the Tax Code of the Russian Federation |

When determining the maximum amount of revenue, it is necessary to exclude taxes that are imposed on the purchaser of works, property rights, services and goods. These rules for accounting for income for the purpose of switching to the simplified tax system are general.

Transition to the simplified tax system when combining several tax regimes

If a company that combines several taxation systems, for example, OSNO and UTII, intends to switch to a special regime, then for certain types of activities the maximum amount of revenue that determines the possibility of switching to a special regime must exclude income received under UTII and determine only revenue from activities related to BASIC.

Transition to the simplified tax system when applying UTII

Note that the Tax Code of the Russian Federation does not regulate the procedure for determining the maximum amount of income for the transition to simplified taxation for enterprises operating exclusively in the UTII regime. It follows that in such cases there is no need to calculate the revenue limit . This conclusion can be made on the basis of Article 346.12 of the Tax Code of the Russian Federation and the explanations of the Ministry of Finance of Russia contained in Letter No. 03-11-11/255 dated October 5, 2010.

Pros and cons of simplified tax system

The main advantages of the simplified tax system are:

- Simplified tax accounting.

- There is no need to submit financial statements to the tax office.

- Possibility to choose an acceptable object of taxation (6% - “income” or 15% - “income minus expenses”). Since 2020, local legislatures have the right to reduce tax rates for their regions at their discretion. In some regions, the simplified tax system provides for tax holidays for two years.

- Tax returns are submitted once a year (in accordance with the Tax Code of the Russian Federation, the tax period for the simplified tax system is a calendar year).

- Exemption from personal income tax (regarding income received from business activities).

The disadvantages of the simplified tax system are the following:

1. Not all types of business activities fall under the simplified taxation system. Individual entrepreneurs (as well as organizations) that:

- carry out banking or insurance activities;

- notaries and lawyers (private practice);

- investment funds;

- organizations involved in the production of excisable goods;

- non-state pension funds.

A complete list of activities for which the simplified tax system for individual entrepreneurs cannot be applied in 2020 is contained in paragraph 3 of Article 346.12 of the Tax Code of the Russian Federation.

2. Using the simplified tax system, individual entrepreneurs do not have the right to open branches (representative offices).

3. Limitation of the list of expenses that reduce the tax base (subject to the choice of the object “income minus expenses”).

4. In the event of a loss, an individual entrepreneur using the simplified tax system is not exempt from paying the minimum tax.

5. The likelihood of losing the right to use the simplified tax system (if the number of employees increases or if income is received in excess of the norm).

Notification to fiscal authorities about the transition to a special regime

The income limit is not the only requirement that organizations must meet when switching to a simplified taxation regime.

If companies and entrepreneurs meet all the requirements for switching to the simplified tax system from the next calendar year, they are required to notify the tax office no later than December 31 of the current year. In this case, the notification must be sent to:

- organizations - to the fiscal authorities at the place of registration of the company

- for entrepreneurs - to the tax office at the place of residence

In other words: after making a decision to switch to a special regime, you must send a notification to the tax office by December 31 of the current year about choosing a simplified taxation system and apply the simplified tax system starting next year.

The recommended form of notification (form N 26.2-1) was approved by Order of the Federal Tax Service of Russia dated November 2, 2012 N ММВ-7-3/ [email protected] In addition to the paper form, notification to tax authorities can also be submitted electronically. The format for submitting the notification in electronic form was approved by Order of the Federal Tax Service of Russia dated November 16, 2012 N ММВ-7-6/ [email protected]

The notification must provide reliable information:

- object of taxation

- residual value of fixed assets as of October 1 of the current year

- the amount of income determined as of October 1 of the current year

Please note that a company that has not notified the fiscal authorities within the required time frame does not have the right to apply the special regime.

Attention! For companies that used the UTII regime and decided to switch to the simplified tax system, the procedure for submitting tax notifications is somewhat different. They must notify the fiscal authorities no later than 30 calendar days from the date of termination of the obligation to pay UTII.

Limit on residual value of fixed assets

In 2020, a company can use the simplified tax system if the residual value of its fixed assets does not exceed 100 million rubles. This value must be determined according to the accounting rules (clause 16, clause 3, article 346.12 of the Tax Code of the Russian Federation). Also see “Accounting on the simplified tax system”.

Moreover, it is necessary to make a reservation that monitoring the residual value limit is required for companies both planning to apply the simplified tax system from the beginning of the new year, and those already using this special regime.

Tracking the limit on fixed assets

| The organization applies the simplified tax system | If, at the end of a reporting period (for example, a quarter or half a year), the residual value limit is exceeded, the organization will switch to OSN from the beginning of the quarter in which the excess occurred. |

| The organization plans to switch to the simplified tax system | To switch to the simplified tax system from the beginning of the new year, it is necessary that the limit on the residual value of fixed assets not be exceeded as of December 31 of the year preceding the start of application of the simplified tax system. |

Individual entrepreneurs do not have the obligation to control the residual value of their assets when switching to the simplified tax system. But if an individual entrepreneur is already running a business using a “simplified” system, then they are obliged to monitor these indicators in the same way as organizations (letter of the Ministry of Finance of Russia dated January 20, 2016 No. 03-11-11/1656).

From 2020, the maximum asset value will increase from 100 to 150 million rubles. Accordingly, from January 1, 2017, companies and individual entrepreneurs will have the right to rely on the new maximum limit on the residual value of their fixed assets.

Limitations on the use of the simplified tax system

The Tax Code has another limitation on the maximum amount of revenue, which applies to all payers of the simplified tax system. We are talking about exceeding the income limit , which entails the loss of the right to use the special regime. If, based on the results of the tax or reporting period, the income of a legal entity exceeded the threshold of 150 million rubles , the merchant loses the right to apply the simplified tax system. Moreover, he needs to switch to a different taxation regime from the beginning of the quarter in which the excess was allowed.

In Art. 346.19 of the Tax Code of the Russian Federation clearly defines the concepts for applying the simplified tax system:

- tax period is a calendar year

- reporting period is 1st, 2nd and 3rd quarters

The income limit of 150 million rubles, which affects the use of the special regime, has not changed for three years. Accordingly, in order not to go beyond the limits provided for by legislative acts, merchants using the simplified tax system must regularly monitor their income not only at the end of the calendar year, but also every reporting period.

Briefly about the conditions of the simplified tax system-2017

A simplified tax regime in 2020 can be applied by individual entrepreneurs and organizations, for which a number of the following conditions will apply:

- annual income not exceeding 120 million rubles;

- fixed assets valued at no more than 150 million rubles;

- staff of no more than 100 people;

- participation in other companies should not exceed one fourth of the capital;

- maximum profit for switching to the simplified tax system – 90 million rubles;

- the activities of an individual entrepreneur or organization are not included in the list of restrictions provided for in Part 3 of Art. 346.12 of the Tax Code of the Russian Federation.

FOR YOUR INFORMATION! The given figures are valid without taking into account the deflator coefficient for 2020.

Two forms of the simplified tax system are still valid, differing in tax base:

- 15% (income minus expenses);

- 6% (income).

NOTE! A bill has been prepared for consideration that proposes to reduce the rates on these forms of taxation: to 3-8% instead of 15 and to 1-3% instead of 6.

For reporting purposes, it is necessary to maintain an Income and Expense Accounting Book (KUDiR), which does not need to be submitted, but at the end of the year, submit a reporting declaration to the tax authorities (no later than March 30 of the next year for organizations and April 30 for individual entrepreneurs).

There are 3 advance quarterly tax payments and one final payment based on the results of annual reporting.

The simplified tax system can be combined with the patent system and UTII.

What income is included in the limit?

Legal entities must remember that the limit of 150 million rubles includes the following income:

- from sales

- non-operating

- income that the organization received when switching to a special regime with OSNO, provided that they were not taken into account as part of the revenue for OSNO. This norm is enshrined in paragraph 4 of Art. 346.13

The Russian Ministry of Finance clarified that when monitoring revenue, one should take into account the income of a legal entity received during the tax period and, accordingly, during the reporting period (Letter of the Ministry of Finance of the Russian Federation No. 03-11-06/2/24984 dated July 1, 2013).

When calculating the maximum amount of revenue that affects the application of the simplified tax system, expenses do not need to be taken into account, even if the simplified tax is paid on the difference between income and expenses:

- if an organization applies both the simplified tax system and the special tax system, then when calculating the income limit, revenue under two special modes should be taken into account

- if an organization applies both the simplified tax system and UTII, then the revenue received from “imputed” activities does not need to be taken into account

Income limit for applying the simplified tax system in 2020

In 2020, a new limit will be in force, giving the right to remain on a simplified basis.

Its size is 120 million rubles, and it will not be indexed until the end of 2020. Let us remind you that “current” simplifiers must track their income and, if the limit is exceeded, change the tax regime to OSNO. 07/13/2016

What income should be considered?

In 2020, simplified taxation system income received from January 1, 2020 is taken into account. According to Article 346.15, this is revenue from sales (Article 249 of the Tax Code) and non-operating expenses (Article 250 of the Tax Code) without VAT and excise taxes. Their values are taken from column 4 of section I KUDiR.

A simplifier may have income that does not need to be counted for the limit. Namely:

- income under Article 251 of the Tax Code - loans, credits, pledges, deposits, deposits of founders, subsidies, etc.;

- interest on government securities and dividends from which income tax is calculated;

- income from parallel activities carried out on UTII;

- income that is accounted for on the accrual basis for income tax before the transition to the simplified tax system;

- subsidies for the implementation of government tasks received by autonomous institutions.

Example

Fakel LLC sells bicycles wholesale. Tax regime – simplified tax system. Revenues for the 1st quarter of 2020 were:

- 28 million rub. – trading revenue;

- 1.5 million rubles. – income from subletting part of the premises;

- 3 million rubles - bank loan.

The calculation of the income limit for applying the simplified tax system based on the results of the 1st quarter of 2017 will include trading revenue and income from sublease, a total of 29.5 million rubles. (28 million rubles + 1.5 million rubles). There is no need to add credit.

Since the recorded income of Fakel LLC is much lower than the threshold value (120 million rubles), the company can safely apply the preferential special regime in the 2nd quarter. At the end of the six months, you should check the limit again.

Entrepreneurs who combine a patent and a simplified tax regime, in order to find out whether they fit into the limit of 120 million rubles, can add up the proceeds under both special regimes (letter of the Ministry of Finance dated May 15, 2013 No. 03-11-10/16830).

What to do if you exceed the limit

If in any month of 2020 the income level of 120 million rubles is reached, you will have to say goodbye to the simplification.

The algorithm of actions is as follows:

1. We set up accounting for calculating general taxes (profit, VAT, property) from the beginning of the quarter in which the limit was exceeded. We begin to issue invoices, create a purchase book, a sales book.

But, most likely, some part of the goods and services will already be sold without VAT, and therefore you will have to pay tax on top of the price at your own expense. There is no need to issue invoices if five days have passed from the date of sale (letter of the Federal Tax Service dated 02/08/07 No. MM-6-03 / [email protected] ).

Entrepreneurs begin to keep a book of accounts for calculating personal income tax.

2. At the same time, roll up KUDiR. All income and expenses in the current quarter are now included in OSNO. If the book is electronic, unnecessary records of the excess quarter can be deleted. If KUDiR was kept on paper, you can leave extra entries, but not transfer them to the final declaration.

3. Before the 15th day of the month following the quarter when the right to the simplified tax system is lost, we notify the Federal Tax Service (form 26.2-2). Despite the fact that inspectors, having received VAT and profit reports, will already learn about the change in regime, it is better to send a message in any convenient way (electronically, by mail, in person). Ignoring this obligation will cost the company 5,000 rubles. (fine under Article 129.1 of the Tax Code), and for the manager (entrepreneur) from 300 to 500 rubles. (fine under Article 15.6 of the Code of Administrative Offenses).

4. By the 25th day of the month following the quarter, we pay the total amount of tax (simplified or minimum) and submit a tax return according to the simplified tax system.

5. By the 25th day following the quarter, we submit and pay VAT, and by the 28th – income tax. Monthly advance payments for profits during the quarter in which the right to the simplified tax system is violated are not transferred. Former simplified companies pay the first advance on the same basis as newly created companies no later than the 28th day of the month following such quarter. And if it’s the 4th quarter, then until March 28th.

Entrepreneurs, regardless of the quarter in which they failed the simplified tax system, report on personal income tax only annually - until April 30 (May 2, 2017), and transfer the tax until July 15 (July 16, 2017).

Example

Rassvet LLC worked on a simplified basis with the “income” object (the rate in the region is 3%). On September 20, 2020, the LLC’s income exceeded 120 million rubles. Thus, starting from the 3rd quarter, the company was forced to join the general system, which it notified the Federal Tax Service by October 15, 2017 by sending a message in form 26.2-2 about the loss of the right to the simplified tax system.

Indicators of Rassvet LLC for the first half of 2020:

1st quarter income – 46 million rubles, advance payment – 1.38 million rubles. (RUB 46 million × 3%);

Income for the half year - 105 million rubles, advance payment - 1.77 million rubles. ((105 million rubles × 3%) – 1.38 million rubles).

It was these indicators that the company included in the final declaration under the simplified tax system, filling out sections 1.1 and 2.1.1, and submitting it by October 25, 2017.

Based on the data from the 3rd quarter of 2020, reports on the general system were compiled.

You can say goodbye to simplification not only by exceeding the revenue limit. There are also threshold values for the simplified tax system that cannot be crossed. For convenience, they are collected in a table.

Table. Limits for the use of the simplified tax system in 2017

| Index | Limit value | How to count |

| Relevant for individual entrepreneurs and legal entities | ||

| The amount of income received for the reporting (tax) period | 120 million rubles. | Calculate this indicator based on all income from business in “simplified terms”. At the same time, take into account sales revenue and non-operating income. Do not include in the calculation income that is not taken into account under the simplified tax system (clause 4.1 of article 346.13 of the Tax Code of the Russian Federation) |

| Average number of employees for the reporting (tax) period | 100 people | Determine the value by adding the average number of employees, the average number of external part-time workers, the average number of employees performing work under civil contracts (subclause 15, clause 3, article 346.12 of the Tax Code of the Russian Federation, clause 77 of the Instructions, approved by order of Rosstat dated October 28, 2013 No. 428). When calculating, do not take into account citizens working on the basis of copyright agreements (letter of the Ministry of Finance of Russia dated August 16, 2007 No. 03-11-04/2/199) |

| Residual value of fixed assets** | 150 million rubles. | Consider the cost according to accounting data as the difference between the original price of fixed assets and the amount of accrued depreciation. Take into account objects with a useful life of more than 12 months and an initial cost of more than 100,000 rubles. (Subclause 16, Clause 3, Article 346.12 of the Tax Code of the Russian Federation) |

| Relevant only for organizations | ||

| Share of participation of other organizations in the authorized capital of the company on the simplified tax system | 25% | Determine the share based on an extract from the Unified State Register of Legal Entities (clause 8, article 11 and article 31.1 of the Federal Law of 02/08/98 No. 14-FZ). Please note that this restriction does not apply to companies listed in subparagraph 14 of paragraph 3 of Article 346.12 of the Tax Code of the Russian Federation. For example, for non-profit organizations, including consumer cooperation organizations and economic societies, the only founders of which are consumer societies and their unions |

| Availability of branches | 0 | Find out information about the presence of branches from the company's charter (subclause 1, clause 3, article 346.12 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated June 29, 2009 No. 03-11-06/3/173). You can have representative offices |

* If these conditions are not met, then from the beginning of the quarter in which the excess occurred, the “simplified” person must switch to the general tax regime (clause 4 of Article 346.13 of the Tax Code of the Russian Federation).

** The limitation on the residual value of fixed assets upon transition to the simplified tax system is established only for organizations. At the same time, if an entrepreneur exceeds the limit of the residual value of fixed assets, he will lose the right to use the “simplified tax” (clause 4 of Article 346.13 of the Tax Code of the Russian Federation and letter of the Ministry of Finance of Russia dated January 18, 2013 No. 03-11-11/9).

Post:

Comments

What happens if the income limit for the reporting period is exceeded

If, based on the results of activities for the reporting period, the taxpayer exceeds the maximum permissible revenue threshold, he automatically loses the right to apply the special regime . A legal entity is obliged to switch to the OSN from the period in which, according to accounting data, the income received exceeded the maximum permissible limit.

In this case, an individual entrepreneur or organization is obliged to transfer all taxes to the budget in accordance with OSNO. At the same time, administrative punishment in the form of fines or accrued interest for non-payment of monthly taxes during the reporting quarter in which the merchant switched to OSNO will not be applied.

to notify the fiscal authorities within 15 calendar days after the tax (reporting) period If the payer does not notify his inspectorate in a timely manner, he will be subject to administrative punishment in the form of a fine.

Attention ! If the payer, after losing the right to use the simplified tax system, did not switch to another regime or switched in violation of the deadlines, for untimely transfer of monthly payments to the budget after the expiration of the reporting period in which the legal entity was obliged to switch to another taxation regime, penalties will be imposed on it and accrued penalties according to tax legislation.

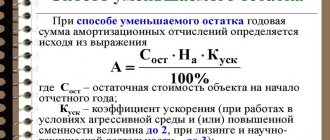

Types of simplified tax system and tax calculation

An individual entrepreneur using the simplified tax system can independently choose the object of taxation:

- “income” - 6%;

- “income minus expenses” - 15%.

The simplified tax system for individual entrepreneurs in 2020 is calculated as follows: Tax rate x Tax base.

Tax is paid by individual entrepreneurs on the amount of income received in the amount of 6% or 15% “income minus expenses”.

For taxpayers who apply “income minus expenses” of 15%, the minimum tax rule applies. The tax amount in this case is 1% of the actual tax received.

It must be paid by:

- for legal entities - until March 31 of the year following the reporting year;

- for entrepreneurs - until April 30 of the year following the reporting year.

To determine the amount of the minimum tax, it is necessary to summarize the data for the year in the Book of Income and Expenses (in the Income section in column 4). Then multiply the resulting amount by 1%. This will be the amount of the minimum tax. Next, calculate the simplified tax system for the year in the standard manner. Compare these two results, and if the minimum tax exceeds the regular tax of the simplified tax system, then it will be necessary to pay exactly the minimum tax.

An example of calculating the minimum tax on the simplified tax system

Initial data:

IP income for 2020 is 37,600,000 rubles.

IP expenses for 2020 are 40,000,000 rubles.

40,000,000 – 37,600,000 = 2,400,000 rubles.

At the end of the year, the individual entrepreneur suffered a loss. The usual tax of the simplified tax system for 2020 in this situation is 0. Therefore, an individual entrepreneur must pay a minimum tax in the amount of:

37,600,000 x 1% = 376,000 rubles

To transfer the minimum tax for 2020, you must indicate KBK - 182 1 0500 110.

Income limit when combining simplified tax system and UTII

If a company combines two special regimes: UTII and simplified tax system, then the legislation provides for the same established threshold for the amount of profit received as with the “simplified” system. The limited amount remains the same - 79 million 740 thousand rubles. At the same time, revenues received from UTII will not be included in the revenue side.

Combining the simplified system and UTII, the income limit is calculated similarly. Only the profit received from activities regulated by the rules of the simplified tax system will be taken into account. Imputed financial and economic activity is not included in the calculation. This rule is enshrined by the Ministry of Finance of the Russian Federation. Companies in this special regime are recommended to maintain separate reporting documentation for the receipt of funds (for each type of activity separately).

You can take into account the costs of an independent assessment

Since 2020, the Federal Law of July 3, 2016 No. 238-FZ “On independent assessment of qualifications” has come into force. See Independent Workforce Assessment: What You Need to Know.

From 2020, organizations and individual entrepreneurs using the simplified tax system with the object “income minus expenses” will be able to take into account the costs of an independent assessment of the qualifications of employees in expenses (clause 33, clause 1, article 346.16 of the Tax Code of the Russian Federation). For these purposes, the rules will be applied according to which the cost of such an independent assessment is taken into account in income tax expenses. That is, in particular, the organization and individual entrepreneur will have to have documents confirming an independent assessment. For more information about this, see “STS: accounting for the costs of an independent assessment of qualifications in 2020.”