In our country, the state focuses on the development of small businesses and regularly introduces various preferences for small enterprises, including micro-enterprises.

The purpose of today's publication is to consider the concept of a microenterprise from all economically significant points of view, evaluate its advantages and disadvantages, determine the criteria for classifying business entities as microenterprises and review other related applied issues.

Microenterprise concept

A microenterprise is one of the actively developing forms of small business.

It is understood as a business company (JSC, LLC), cooperative, peasant farm (peasant farm) or individual entrepreneur (IP), which meet certain criteria prescribed in the federal law on small business.

Based on these criteria, on August 1 of each year, existing businesses are entered into a special register.

There is no need to confirm this status with any documents; this happens automatically based on the submitted tax and statistical reports.

In 2020, Rosstat registered over 2.5 million such organizations.

You can find out whether any company is on this list on the Federal Tax Service website by searching by TIN, OGRN or initials of an individual entrepreneur.

Microenterprise criteria

To be included in the microenterprise register in 2020, the enterprise must meet the following criteria:

- the share of the state, regions or municipalities in the authorized capital should not exceed 25%, and the share of foreign and large Russian companies should not exceed 49%;

- number of employees up to 15 people;

- financial income from business activities should not “exceed” the bar of 120 million rubles.

Income now includes not only sales revenue, but also income from other types of activities.

The amount of income is determined from income tax returns or special tax regimes, if any.

If one or more indicators are not achieved within three calendar years, the company will be excluded from the list of microenterprises, but not earlier than 08/10/2019.

Who are SMEs?

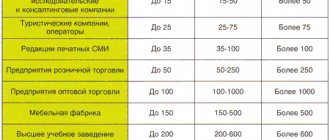

The criteria for classification as small businesses in 2020 are established by the state. The main requirements, subject to which it is possible to classify a businessman as a small and medium-sized enterprise (SME), relate to the number of employees and the amount of income received.

Who is the SME, i.e. refers to small businesses, defined by law dated July 24, 2007 N 209-FZ in Article 4. We indicate these criteria in the table.

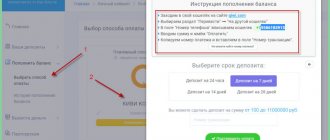

Free tax consultation

| Category of SME subject | Income for the year | Average number of employees |

| Microenterprise | 120 million rubles | no more than 15 people |

| Small business | 800 million rubles | no more than 100 people |

| Medium enterprise | 2 billion rubles | no more than 250 people |

For individual entrepreneurs, the same criteria for dividing into business categories apply: according to annual revenue and number of employees. If an individual entrepreneur does not have employees, then its SME category is determined only by the amount of revenue. And all entrepreneurs working only on the patent taxation system are classified as micro-enterprises.

Accounting statements of micro-enterprises

The management of a micro-enterprise has a lot of legal opportunities to optimize accounting. Its features depend on the chosen form of accounting.

There are several types of simplified accounting for small businesses.

[A]. In the full form, an organization uses many registers and accounts to maintain records. Records of liabilities and assets are kept in accordance with recommended forms.

This type of accounting makes sense to use if the organization carries out many different transactions.

To determine the tax base, it is advisable to use the accrual method.

[B]. Short form . If the company's operations are of a uniform nature, then there is no need to use a large number of accounts, and some homogeneous accounts can be combined into one.

For example, you can take into account on the twentieth account expenses not only for the main, but also for auxiliary production and general business expenses, and so on.

All transactions are recorded in one journal in chronological order by double entry.

It is recommended to use the K-1MP book for recording the facts of economic life as this journal.

It will also be useful to use the payroll slip (8MP).

To calculate the tax base, it is better to use the cash method.

[IN]. Simple form . Double entry does not apply.

Transactions are entered in chronological order into a single journal - “K-2MP” or “KUDiR” (book of income and expenses), if this is an individual entrepreneur or a simplified enterprise.

The chosen accounting method is fixed in the accounting policy, as well as the forms of the corresponding registers with the required details (name, name of the organization, dates, persons responsible for maintaining, etc.).

Types of small and medium-sized businesses

Entrepreneurial activity in Russia is represented by a huge variety. The purpose can be determined according to legally established criteria: field of activity, form of ownership, number of owners, use of hired personnel.

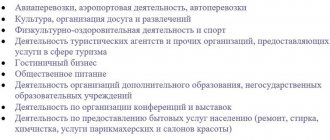

By type of activity

The division by type of activity is ambiguous. One organization can simultaneously combine several areas. The most common example is the combination of trading activities and the provision of services.

According to the form of purpose, entrepreneurship is divided into production, commercial, financial or advisory.

By type of ownership

The official division by type of ownership is as follows:

- private, that is, owned by a private individual or group of individuals;

- municipal. All assets belong to the municipal organization;

- state Activities are completely controlled by the state;

- public.

Important! We should not forget about legal restrictions on private ownership. The total participation of the state in the capital of the organization cannot exceed 25%

By number of owners

Enterprises are divided according to the number of owners into individual and collective. The difference depends on how many people are involved in the business. If the business is owned by one individual, it will be considered individual. Collective property can be shared or joint.

Attention! There is a difference between sole proprietorship and the legal form of ownership described above.

According to the degree of use of hired labor

There are two forms of using hired labor:

- If the entrepreneur carries out his activities himself and does not involve hired employees in the work.

- The staff list includes employees who carry out their activities, for example, under legally established employment contracts.

Features of accounting for micro-enterprises

The accounting regulations (PBU) and other regulations provide for a number of relaxations for small businesses. Thus, a microenterprise has the right:

- recognize income and expenses based on the actual receipt or write-off of funds (cash method);

- to level out the difference between tax and accounting accounting when calculating income tax and not to create deferred tax assets and liabilities;

- do not use estimated liabilities (do not create reserves);

- do not correct errors retrospectively; you can do this in the month in which they were discovered; the resulting profit or loss is reflected in 91 accounts;

- take into account all borrowing costs as part of other expenses (account 91);

- make depreciation payments once a year (for other enterprises once a month);

- do not set a cash limit.

For reporting purposes, it is sufficient to submit a balance sheet and financial statements.

It is allowed to use simplified forms of these documents, in which individual articles are grouped into larger groups.

For example, only 5 indicators remain on the balance sheet assets, instead of 15 in full form: tangible and intangible assets, inventories, monetary and financial assets.

Personnel records for micro-enterprises

From 01/01/2017 you can use simplified personnel document flow.

This means that the company is freed from the obligation to draw up local regulations, such as shift schedules, bonus provisions and others.

These points must be spelled out individually in a standard employment contract with each employee.

Instructions on labor protection at a micro-enterprise can be carried out by its manager.

Certification of workplaces is still required, except for remote and home workers.

If there is a need, employment contracts can be concluded for a period of up to 5 years; in general, such contracts are indefinite.

Video about personnel document flow of micro-enterprises:

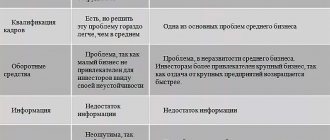

Features of small and medium-sized businesses

According to the experience of more developed countries, the harmonious development of small and medium-sized businesses plays a huge role in shaping the economy. It is also this segment that allows us to solve social issues.

Enterprise support

Competent development and government support allow enterprises to positively influence the economic growth of a particular region, the formation of scientific and technological progress, saturation of the market with goods, and the creation of additional jobs.

Statistical reporting of micro-enterprises

Rosstat can conduct continuous and selective collection of data on companies.

In the first case, standard reporting is usually submitted:

- for individual entrepreneurs falling under the concept of a micro-enterprise, a report on the activities of 1 individual entrepreneur is submitted;

- information on key performance indicators - MP (micro);

- data on manufactured products - MP (micro)-nature;

Since 2020, the TORG (micro) form has been abolished in retail trade, and form 1-alcohol has been abolished for those selling alcohol.

Rosstat may organize random checks and then you will have to submit additional reports.

You can find out whether any microenterprise is in the sample on the website of the State Statistics Service.

For violation of delivery deadlines, a fine of 20 to 70 thousand is provided for organizations, and for managers - from 10 to 20 thousand rubles.