Interesting to know

Yandex.Checkout is a fairly young project, launched in the fall of 2013 under the management of Yandex.Money. It is available to organizations registered in the Russian Federation and abroad.

In 2020, the service became the most popular domestic payment solution, and in the winter of 2020, more than 30% of Russian Internet websites, websites of government services of the Russian Federation and large online retailers in Russia accepted payments through Yandex.Checkout.

At the beginning of 2020, Yandex.Checkout became the winner of the international MPE (Merchant Payments Ecosystem) award in the Best PSP (best payment provider) category.

I suggest you figure it out: why has Yandex.Checkout become so popular among business owners? What are its pros and cons? How to work with it?

Who is comfortable working with Yandex.Checkout?

The automated payment system is intended for business owners who conduct their activities via the Internet. It is used by:

- online stores and companies providing various types of goods/services;

- cafes, bars and restaurants, commercial/non-profit organizations;

- financial organizations, exchanges, electronic platforms;

- self-employed (individuals and individual entrepreneurs: without an employment contract and employer, without employees, with an annual income of up to 2.4 million rubles);

- educational, charitable and other types of foundations.

What payment types does Yandex.Checkout support?

Methods for accepting payments are fixed in the agreement with Yandex.Money, which you sign when connecting to the Cashier from Yandex.

- Bank cards – Visa, Mastercard, Maestro, Mir, JCB. The service allows clients to link a card so as not to enter its data every time they make a payment.

- Contactless payment method from smartphones – Apple Pay and Google Pay.

- Electronic wallets – Yandex.Money, WebMoney, Qiwi Wallet and WeChat Pay application.

- Internet banking services - Sberbank Online, Alfa-Click, Promsvyazbank, Tinkoff and ERIP (Settlement system in Belarus). B2B payments for legal entities are made through Sberbank Business Online.

- Phone balance – Beeline, Megafon, Tele2 and MTS.

- Cash – communication shops, terminals and ATMs that accept payments in favor of Cash Desk or Money from Yandex.

Please note that refunds through Yandex.Kassa are possible for all payment methods with the exception of Internet banking from Promsvyazbank, cash payment, ERIP (Belarus).

How to pay via Yandex cash register

Payments can be made through this service in almost any way convenient for the client:

- Electronic payment systems (Webmoney, Qivi, Yandex money).

- Internet banking (Sberbank, Promsvyazbbank and others). In this case, the condition is to connect the service.

- Via smartphone. The service is supported by all Russian mobile operators.

- Bank cards. You can pay for your purchase at a bank, through a personal computer or mobile phone. In addition to regular cards, the system accepts payments using the Mir card.

- Cash payment. In the Euroset offices.

For high-quality operation of the cash register, you should understand what management system the site on which the online store is located operates on. Not all CMS programs are supported for calculations. This is due to the rapid transition of domestic business to comply with the requirements of Federal Law No. 54 on the application of the Code of Conduct. However, the company offers installation of new updates and applications for entrepreneurs to work with such popular modules as WordPress WooCommerce, Virtuemart 1 based on Joomla and others. Through these CRM programs, the OFD sends data for checks and other information.

Important! At the moment, online stores operating using the Amiro.Cms or 1C-Bitrix system have updated versions in the settings specified in the device extension.

Principles and conditions of working with Yandex.Checkout

When connecting to Yandex.Checkout, payment for goods or services occurs according to two scenarios:

- The choice of payment method is made by the buyer on the Yandex.Checkout page.

The website (application, online service) contains a button offering to pay via Yandex. Next, the Cashier offers all methods connected to the business, checks the payment information entered by the user, confirms the payment and shows the result.

- The choice of payment method is made by the user on the website itself.

It involves the independent placement of buttons, using which the buyer selects a payment method convenient for him.

Successful payments are credited to the organization's bank account no later than the next business day after the payment is made, minus the service fee. In turn, Yandex.Kassa provides documents necessary for accounting and tax services - acts for accounting reports and payment registers.

How Yandex.Checkout differs from the standard Yandex.Money service

In simple terms, Yandex.Money is an independent payment system. In this case, the user is the owner of his virtual wallet with a unique number. He can independently manage his finances and make the necessary payments and other monetary transactions. Yandex.Money is primarily used by individuals.

Yandex.Checkout is a payment intermediary. The user does not have a virtual wallet. Instead, he links his bank card (or account) to the account. Payments are made only from it and funds are also credited only to it. This service is used mainly by private entrepreneurs. Yandex.Checkout really has very convenient tools for running your business and for preparing documents for tax reporting.

Tariffing in Yandex.Checkout

Tariffs are indicated on the official website of the service in the form of reference information. Payment is charged in the form of a commission for payments - from 2.8%. But there is a note that the specific rate is specified in the contract.

Tariffs for accepting payments are divided into several categories:

- By level - basic (with a monthly turnover of up to 1 million rubles) and premium (over 1 million rubles per month). With a turnover of more than 5 million rubles, the terms of cooperation are considered individually.

- By type of business - goods with delivery, services and digital content, gaming content, charity.

Payment in accordance with 54-FZ

First of all, it is worth saying that from January 1, 2020, fiscal documents will have to be submitted in a new format. First of all, two new parameters will appear that appear on the receipt. Now the seller must indicate the so-called sign of the subject of payment. In this case, you need to determine the category into which the product being sold belongs. You will also need to indicate the method of calculation. In this case, we are talking about the method of depositing funds.

Important! Does the Yandex.Cash service send checks to the tax office? No, in this case Yandex.Checkout acts as an agent who helps make payments. Checks, or rather copies of electronic checks, must be sent to the tax service by the entrepreneur himself.

Based on this, it is worth figuring out which service cash desk is more suitable. In this case, there are several options.

Renting a cloud cash register

In this case, we are not talking about the usual “physical” cash register, but about a specific service. The service will automatically generate checks for the seller in electronic form. At the same time, from his personal account, the entrepreneur will be able to send them to the tax office, using the services of fiscal data operators. There are several OFDs of this type:

- Athol Online. In this case, you will need to pay for the fiscal accumulator. 15 months will cost 6,200 rubles, but you can save and pay for 3 years at once for only 9,200. You will also need to pay monthly rent for a virtual cash register (3,000 rubles each). However, if we are talking about Yandex.Checkout clients, then you can pay only 900 rubles per month.

- Orange Data. You will also have to pay for a fiscal accumulator. Renting a cash register will cost 2,000 rubles per month. But, account holders on Yandex.Checkout can take advantage of a 10 percent discount.

This option is considered optimal for those who conduct business only via the Internet. This means that in this case you can only accept online payments.

Buying or renting a physical online cash register

In this case, we are talking about a virtual service with the ability to print a receipt using a printer. Such a service is necessary for those who offer customers to pay for their purchase upon receipt at a pickup point or upon delivery of the goods. For this, a special fiscal drive is used, which is a memory card and a special identifier. Data on all operations is stored on this media.

However, in this case, you need to understand that the business owner is fully responsible for such a drive. However, his memory is limited. This means that it must be replaced every 3 years. If this is not done on time, checks will no longer be automatically sent to the tax service.

Healthy! The cost of a fiscal drive is about 12,000 rubles.

At the same time, you can choose from many options for modern cash registers. Some connect directly to the store's website, can send receipts and much more.

You can connect Yandex.Checkout to an existing online cash register

Some already have a cash register. In this case, it all depends on the specific model. Yandex.Checkout is capable of transmitting the necessary information to more than 70 different models of units. Data transfer is carried out through the “Business.Ru Online-Checks” service. This is a kind of intermediary between a stationary cash register and an online store.

If an entrepreneur is already a Yandex.Checkout client, then such service will cost him 300 rubles every month.

Connecting Yandex.Checkout

- Open the official website of Yandex.Checkout and click “Connect Cashier”.

- Next, you need to fill out and submit a connection application. After reviewing it, you will have a Personal Account.

- After gaining access to your Personal Account, you need to fill out a questionnaire about the company, as well as upload copies of the requested documents (a scan of the director’s passport is required for all organizations).

- Signing an agreement with Yandex.Money, which is prepared by service specialists. The document is downloaded, signed and sent to Yandex via email or electronic document management.

- Filling out a technical questionnaire: organizations registered in Russia do this procedure in their Personal Account, foreign organizations - with the involvement of a Yandex manager.

- Integration – embedding payment forms and setting up Yandex.Checkout. The developer offers several methods, each of which determines how you will receive notifications about successful payments and what service functions will be available to you. Read the detailed manual in the section The developer offers several methods of “Integration”.

Registration in the system for individuals

Let's look at how to connect Yandex Cashier for individuals:

- Open the Yandex Money main page.

- Click on “Create wallet”.

- You can register it through your profile on one of the social networks or choose the option of creating a login and password.

- After registration, all you need to do is confirm your email address by clicking on the email with the link.

- Log into your personal account in the Yandex Money system, click on “Accept payments”.

- Select one of the options for what you want to see on your site. The simplest is the standard “Form”. You can also choose “Button” or “Custom” (if you are strong in web development).

- The designer will ask you to enter information into the form, which will be reflected on your website. Attach a bank card to your cash register to withdraw funds from clients.

- Copy the code provided to you by the system.

- The code can later be inserted into your own web resource. This is enough for it to work properly.

Note that the created wallet has the status “Anonymous”! This means that you can only store up to 15 thousand rubles on it. Users note that it is not uncommon for the system to delete anonymous wallets along with the funds stored on them.

Therefore, to secure your income, upgrade your status to “Name”. To do this, just send a scan of your own passport, following the system prompts. With “Name”, the volume of the wallet grows to 60 thousand rubles. In addition, such a profile is not deleted due to prolonged inactivity.

Further expansion of the capabilities of the Yandex electronic wallet is already paid. This is the “Identified” status, which allows you to save up to 500 thousand rubles on your account.

How to accept payments without connecting to Yandex.Checkout?

Among the service products, Yandex.Payment is offered, which allows you to receive money to an organization’s account from Yandex cards and electronic wallets. To do this, you need to embed a payment form on the site, the cost of which is 3 thousand rubles. Having paid for it, you receive the right to money transfers in favor of your company - 100 payments in the amount of 100 thousand rubles (no commission is charged).

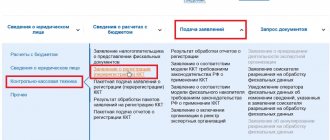

The form is created in the “Payment” section:

Important information: sending fiscal receipts to the tax office

According to Russian Federation Law 54-FZ, which came into force on July 1, 2020, after receiving payment for goods/services, the organization is obliged to send a fiscal receipt to the tax office via an online cash register. Otherwise, the organization will be subject to a fine for each unsent check.

Your actions should be as follows:

- Purchase/rental of cash register equipment (online cash register).

- Conclusion of an agreement with OFD (fiscal data operator).

- Obtaining a qualified electronic signature (electronic signature) to register an online cash register with the tax service.

- Registration of an online cash register on the website of the Federal Tax Service.

- Sending fiscal receipts using the online cash register after each payment is made.

Yandex.Checkout offers its solution for interacting with the online cash register, which is optional for users of the service. To do this, you need to connect the online cash register of a Yandex partner, and in the payment form indicate the data for generating a receipt. After this, the service will automatically send the data to the online cash register.

Read more about how “Sending checks to the tax office” and “Addition to FFD 1.05” occurs.

Advantages of the Yandex solution

When installing the specified cash register device for an online store, users become owners of the following preferences:

- Auto payment. With frequent and systematic purchases, clients, in order not to waste time filling out payment fields, can set up automatic debiting of funds from a bank card. It goes like this. When paying for a child’s school tuition for September, the client (parent) then checks the “Automatic payment” checkbox. Now every 1st day of the month a certain amount is debited from the parent’s bank card. There is no need to worry that money will not be paid due to forgetfulness.

- Linking a bank card. If a client repeatedly uses certain services, but there is no system in the payment schedule, it is possible for the system to “remember” the card information of Sberbank or another institution. The buyer enters the card details (number, expiration date, three-digit code) and links it to an email address. The next time you purchase a product or service, enter the e-mail to which your bank card is linked and click “Pay.” Payment has been made.

- Payment via QR code. In the age of new technologies, almost everyone uses a smartphone. New requirements for paper (and electronic) checks, established by 54-FZ, provide for the presence of a QR code. All necessary information is already written in the electronic code. After sending it to the buyer, he touches the code with his smartphone and automatically pays for the product or service. This form of calculation is the most progressive. The spread of the QR code means that soon most payments will be processed in the specified order.

In the modern world, many areas of human activity are moving to the World Wide Web. Trade is no exception. Purchasing goods and paying for services through online stores is becoming a given. The legislator takes this trend into account. Therefore, the provisions of Federal Law No. 54 on the application of CCR also apply to payments on the Internet. When carrying out trading operations electronically, an online cash register, checks, and a fiscal data operator are required. And you need to send information about each purchase to the tax office.

Carrying out payments in an online store is a more complex process than similar actions in a regular supermarket. It is necessary to connect the human sphere with the electronic one. You can install some CRM programs on regular cash registers, but their effectiveness will be low.

The most effective solution for payments in online stores is the registration of a Yandex cash register in conjunction with the ATOL cash register model 42f. The advantage of this mechanism is that it simplifies the process for the entrepreneur and the client. When purchasing goods or services, the client has the opportunity to carry out the process in the most convenient form of payment for him and in the shortest possible time. An entrepreneur receives money, transfers goods or provides a service. The program does the rest for him. The information is automatically sent to the fiscal data operator and the tax office. In case of technical difficulties, Yandex LLC specialists always solve the problem.

Additional options and solutions for Cash Desk from Yandex

Issuing an invoice from your personal account

This feature can be used even without a website. You will be required to create an account in your Personal Account with a list of goods, their prices and your contacts. You send the buyer an email, SMS or invoice link. The client chooses a payment option convenient for him and makes it through Yandex.Checkout.

Invoicing in Telegram

For those who are connected to Yandex.Checkout, the developer offers to create their own bot and link it to the service bot. As a result, you will be able to accept payments from clients in the Telegram messenger.

Invoicing via chat

Using this option, you can issue an invoice to the buyer in dialogue mode - in chat on the website, instant messengers and social media. After the client decides to make a purchase, he receives a payment button via SMS chat. The button will take him to the Yandex.Checkout page, where he will select a convenient payment method.

Buyer lending

Using Yandex.Checkout you can sell in installments or on credit. The loan terms that you write down on your website are discussed with the service manager. After this, the option is configured.

Mobile terminal mPOS

Using this solution, you will be able to accept payments in mobile mode, for example, during the delivery of goods or at events. You will need to have a smartphone or tablet with Internet access, install the 2can Terminal application (free) and activate your Yandex.Cash account in it, as well as a reader costing 7,990 rubles, which connects via bluetooth.

Auto payments (Recurring payments)

The option involves automatic debiting of funds from your client’s bank card or Yandex.Money wallet after his permission. There are 2 types of auto payments available in the system:

- By account status - the user sets up automatic payment from a Visa, Mastercard or Mir card, for example, when reaching a zero balance on resources such as a platform for online games, social networks, mobile operators.

- By schedule - the user sets up an automatic payment for a specific date, for example, to transfer money to a charity organization, pay for the services of a provider, etc.

Payment by QR code

The generated QR code allows the buyer to quickly pay for the order using his gadget. Important: a special QR is generated for a specific order. This option works like this:

- a link is previously created to pay for the order via Yandex.Checkout;

- a QR code is generated that will transfer the buyer to this link;

- the buyer scans the code using his smartphone;

- goes to the payment page in Yandex.Checkout and pays for the purchase.

Pre-authorization (deferred payment)

The option involves paying for the order using bank cards in 2 stages and returning the money without charging a commission. For example, a buyer paid for an order, but the money was not debited from his account, but was blocked. At this time, you can check the availability of the product in the warehouse and make its delivery. If everything is in order, then the money is debited from the card at your command. Otherwise, you can “unfreeze” the payment and return it to the buyer without a service fee.

Payments to clients via Yandex.Cash

Yandex.Checkout makes it possible to pay money to clients to Russian bank cards and accounts, phone balance and Yandex electronic wallets. Money transfers require the receipt of reporting documents for accounting and tax departments (payment registers and acts of provision of services). That is, everything is happening officially.

The tool will be useful for microfinance organizations (MFOs) for repaying loans, platforms with online games for paying out winnings, marketing agencies and other similar companies.

How to use Yandex Money, settings and capabilities

After filling out all the available fields on the registration page, click on the “Open wallet” button. As a result, you will go to the service page, where in the top right you will see the number zero (this is the balance of your current account), by clicking on which you will find out the number of your money wallet . Previously, by the way, it was displayed in the left column and there was no need to frantically search for it in different menus.

In the center of the main page, you will be described other options for working with this type of money (how to top up, transfer, withdraw, cash out, spend, link a bank card, etc.):

Let's first go over the settings of our Yandex wallet.

Settings for your Yandex wallet

To do this, you will again need to click on the amount of your current balance and go to the “Wallet Management” drop-down menu item, which is shown in the previous screenshot (if you don’t know, it will take quite a long time to search for it, which is not good in terms of usability):

Let's start in order. By default, the Yandex Money system can be considered anonymous, because you are free to indicate any of your data, but now, however, you cannot refuse to display your mobile phone number.

However, this way of working imposes some restrictions on the capabilities of your wallet. There is an alternative option when you click on the “Change status” and get acquainted with the new features and how to connect them. By default, your status will be anonymous, but, for example, to change it to a personal one, you don’t even need to go anywhere:

You will only need to enter your real name and passport details in a special form. But to obtain the status of an “Identified” Yandex Money user, you will have to provide your passport data , and then new opportunities will open up for you, described at the top of the screenshot (extended limits on payments, transfers and withdrawal of funds ).

Let's return to the Yandex wallet settings, which were shown in the second screenshot of this chapter (the “Wallet Management” item in the balance menu of your account). In the “Informing” area, you can activate receiving SMS notifications about account transactions (expense transactions and replenishment) by clicking on the “Pay subscription” link. This service costs 20 rubles per month. Email notifications are, of course, free.

Previously, Yandex Many used a one-time payment password, which was, a priori, more vulnerable than one-time passwords sent to you in SMS messages (free, of course). Now all payment passwords are one-time, but you can still protect yourself, for example, in case you lose your mobile phone, save or print emergency codes that will allow you to confirm any payment or service without SMS.

It’s somewhat unpleasant for me to remember about emergency codes now, because today 9 thousand rubles were stolen from my Yandex wallet using phishing (I myself gave one of these emergency codes to the attackers). But as I write this article, I hope to gather my strength and describe my shameful carelessness.

Installing the mobile application "Yandex.Money: online payments"

If you make payments, transfers and withdrawals from Yandex Money online, then the best option may be to install a mobile application that will generate one-time payment passwords. SMS messages do not always and not always reach everywhere, but the application will always be at hand.

To do this, click on the button with an arrow (sort of a spoiler) in the upper right corner of the “Passwords” area (I would double-check the usability of the new money.yandex.ru interface for professional suitability), and in the window that opens, click on the “Change protection method” link.

On the page that opens, you will need to go to the “Application” tab, where links to installing it in Android, iOS or Windows Phone will be given.

In the case of Android in Google Play, it is called “Yandex.Money: online payments” and is placed in the usual way.

After entering the login and password for your Yandex account, you will also be asked to come up with a password to enter this application in order to protect you from unauthorized access to your wallet while the phone is in the wrong hands. The application itself looks very nice and is easy to use:

How to use the wallet?

That's it, now you can fully use the payment system - deposit funds (replenish your account), transfer the required amount to another wallet, withdraw (cash out or simply withdraw) money from the system. To do this, use the corresponding menu buttons located on the left.

For example, in order to transfer money to another Yandex wallet , you will need to click on the “Transfer” button and simply go to the page located “here”. In the window that opens, you can specify either the recipient's wallet number, or his email address, or his mobile phone number (the data is checked on the fly against the database and you will be given a message if no such user is found in the system):

Although you are free to transfer funds by indicating in the “To” field the mobile phone number of a user who does not have a Yandex wallet at all. He will have to go through the registration procedure in the system described above and indicate his cell phone number. Upon completion of registration, he will need to go to history from the left menu (section “Top-ups”) and click the “Receive” button.

In the “Payment” field, you can enter the amount that will need to be withdrawn from your Yandex wallet, or in the “How much” field, enter the amount that will need to be deposited into the recipient’s account (you cannot withdraw, deposit or transfer money just like that, but only by paying for This is a system commission of 0.5 percent of the amount, which is why there are two fields for entering the transfer amount).

A transfer to Yandex Money can and even should be protected by protection - a digital code, without which the recipient will not receive this transfer. You should also set the lifetime of the protection code. This time is given to the recipient for this and that. If he does not enter the correct protection code within the specified period, the money will be safely returned to your wallet. In any case, protection will allow you to insure yourself in the event of incorrect entry of the recipient's data.

Then click the “Transfer” button and on the page that opens, after making sure that the amount you want to transfer is correct, enter your one-time payment password for Yandex money, which came as an SMS to your mobile phone (or was generated by the mobile application you installed - read about this above).

All goods and services for which you can pay with Yandex Money can be found on this page - https://money.yandex.ru/shops.xml (you can get to it from the left menu by clicking on the item of the same name). The range of services and goods that you can pay for is quite wide.

When paying, for example, for mobile communications, you can set up automatic payment. Then the account on your mobile will be replenished automatically from Yandex wallet as soon as your balance falls below a specified threshold. For the forgetful, it seems to me, this is just the thing.

To confirm payment, each time you will have to enter a one-time payment password received via SMS or taken from your mobile application (if your phone is currently unavailable, you can use one of the emergency codes, which you, hopefully, have already printed and saved).

In the same way, you can pay invoices issued by various services. For example, when paying or renewing hosting, you select the Yandex.Money option (if provided) and you will be transferred to your wallet to confirm this payment.

Yandex.Checkout: pros and cons

The first and weighty argument in favor of connecting to Yandex.Checkout is reliability, and not only for business owners. Almost every online store client uses Yandex services, so the ability to pay for a product or service through the Cashier will inspire confidence in your business.

Advantages of Yandex.Checkout

- Quite simple functionality and ease of use for clients and businesses, good technical support, an impressive list of payment methods.

- Business protection thanks to the implementation of an Antifraud system based on machine learning, which verifies all payments. Provided to service clients free of charge.

- Fast receipt of successful payments to the company’s account – on the next business day.

- The service not only accepts payments, but also makes it possible to make mass payments to clients.

- There are integrations with third-party services to expand the capabilities of the payment aggregator.

- The service operates in accordance with the legislation of the Russian Federation, including Law 54-FZ.

- Obtaining analytics by period displayed in your Personal Account - total revenue, number of sales, average bill, returns. Statistics can be used for management accounting and analysis of the effectiveness of advertising campaigns.

- Payment security – Yandex.Checkout operates using the HTTPS protocol, which encrypts payment data. Every year the service undergoes a security check according to the Visa and Mastercard standard (PCI DSS).

Pros and cons of the solution

This payment service looks quite convenient for different types of businesses. Among its analogues, Yandex.Cash highlights several advantages:

- Yandex.Checkout provides many acquiring options, including mobile terminals for online stores. Buyers have access to all convenient payment methods, and the seller has tools for setting them up

- It is very easy to connect the Cashier - you can do it without leaving your home or office. Payment modules are easy to configure and integrate into the website

- The system operates on the basis of one of the largest Russian companies in the field of information technology. It is reliable enough to be trusted with online payments, and is constantly introducing new features and functions.

But the system has several rather significant drawbacks:

- The service does not send fiscal data to the tax office and OFD itself - it must be connected to a cash register. Other popular acquiring systems, for example, Robokassa, themselves interact with all services.

- The commission for payments made through the system is higher than that of analogues. There are banks and payment systems in our market that offer more favorable conditions for popular payment methods - primarily bank cards