In what case is the M-11 form used?

A demand invoice is a primary accounting document used to document the movement of materials between responsible persons and between departments of the company. This form differs from a limit-fence card in that it is used to document the movement of several items of materials. It is applied if the inventory items reflected in it do not have consumption (withdrawal) limits established.

A demand invoice must be issued for each fact of movement of materials.

This document is also filled out when recording the return of inventory items unused during production, when accepting defective products and waste into the warehouse, etc.

When is a standard interindustry form M-11 needed?

Using the requirement-invoice form M-11 (a unified document approved by Decree of the State Statistics Committee of the Russian Federation dated October 30, 1997 No. 71a), the internal transfer of inventories is drawn up, i.e. the procedure:

- releases from the warehouse for production needs;

- movement between warehouses or financially responsible persons;

- return of unused inventories to the warehouse;

- delivery of finished products, returnable waste, defects, as well as materials generated during the liquidation of OS to the warehouse.

What distinguishes the requirement-invoice from a similar document, the limit-fence card (form M-8), is the possibility of using:

- for unlimited supply of materials from the warehouse;

- registration of the transfer of several items of inventories in 1 document;

- each fact of movement of goods.

For more information about the documents used for warehouse accounting, read the article “Maintaining document flow for warehouse accounting of materials .

Procedure for using the invoice

A company can develop its own form or use a standardized form that can be filled out by hand or using a computer. The requirement for invoice form M 11 is included in specialized accounting programs.

It is drawn up in two copies by the transferring party, that is, the materially responsible person at whose disposal the goods and materials are located, with each release of materials. Form M-11 is recorded in the log of registration of these invoices. The MOL signs the document and transfers the documents to the receiving party along with the materials.

The new responsible person checks the name and quantity of valuables, then endorses both demand invoices and returns one copy to the deliverer. Next, each party, when preparing material reports, attaches these invoices to them and transfers them to the accounting department.

Form M-11 must be kept, like all accounting documents, for 5 years.

Basic rules for filling out the demand invoice

Today, there is no unified single sample of a demand invoice, and in principle, enterprises and organizations can develop such a document independently. However, many still prefer to use the previously approved and mandatory M-11 form.

Since the demand invoice is used within the company, it can include several different items and names of goods and materials, except in cases where special restrictions are imposed on the consumption of some inventory items in the form of limits. All products covered by this document must be indicated in it with details:

- Name,

- quantity,

- cost, etc.

Filling in pencil, as well as errors, blots, and other corrections are not allowed, so if such an incident does occur, it is better to draw up a new document.

The form can be filled out either manually or on a computer, but in any case it must contain “live” signatures of the one who released the goods and the one who accepted it. There is no need to certify the demand invoice with a seal, since it relates to the internal documentation of the enterprise, but the document is drawn up in two copies, one of which is transferred to the organization’s warehouse and subsequently serves as the basis for receipt, and the second remains with the sender of the inventory and material assets and is the basis for their write-off.

The demand invoice belongs to the category of primary documentation and, like any other similar papers, must be stored for at least five years.

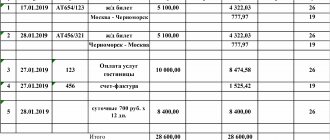

Sample of filling out the requirement for invoice form M-11

[ads-pc-2] [ads-mob-2]

Form M-11 must contain the invoice number, the name of the company, and its code in OKPO statistics.

Then the registration date and transaction type code are filled in (if the company uses its own coding system). Next, you need to make entries in the “Sender” and “Recipient” fields, which have divisions. They indicate the name of the structural units and the types of activities that are carried out at these facilities. For example, “Industrial warehouse”, “Storage”; “Main workshop”, “Production”. The following column reflects the corresponding invoice with its analytics of the place of receipt and must contain a unit of measurement of the final result of the work of the receiving party.

In the “Where” line, fill in the purpose of use, in accordance with which the vacation is carried out, “Allowed”, “Requested” must contain professions, personal data of the persons carrying out shipment and reception, as well as the official who gave permission to carry out this operation.

The tabular part of the invoice request contains information about the corresponding materials accounting accounts with analytics, their names with a breakdown of grade, brand, size and item number of inventory items. Next, fill in the code of the unit of measurement and its name according to OKEI, as well as the amount of material assets requested and released.

The next column contains the price per unit of the product and the amount of the cost of materials excluding VAT, since this document is issued only for the internal movement of goods and materials.

The last section of the table includes the inventory number in order from the warehouse file.

The demand invoice is certified by the persons responsible for issuing and receiving materials, indicating their professions and full names.

Procedure for obtaining form M-11

Form M-11 in 2 copies is drawn up by the person who initiated the receipt of goods at the warehouse or their delivery to the warehouse (transfer to another financially responsible person). With automated warehouse accounting, this document can be generated by the warehouseman in the appropriate program at the time of release from the warehouse or acceptance into it.

Copies of this document serve as the basis for carrying out accounting warehouse operations by departments (materially responsible persons) who are the deliverer and recipient, and after their submission to the accounting department, they are used to reconcile data and make accounting entries for write-offs, transfers or capitalization.

The required details for filling out this document are:

- the name of the organization in which the document was issued and its OKPO code;

- Date of preparation;

- names of departments of the sender and recipient, indicating the types of their activities;

- information (full name) about the person who actually receives (deliveres) the valuables on behalf of the recipient unit (deliverer);

- data (full name) of the person who took the initiative in obtaining the MPZ and the person who authorized this receipt;

- names of materials received or handed over, their units of measurement and the requested (surrendered) quantity;

- signatures of the persons who submitted and received the MPZ.

Data on the item number and the actual quantity issued (received) are entered at the time of release (reception) at the warehouse.

Information about the necessary accounting accounts and the accounting value of inventories is filled out in the accounting department according to accounting records.

The demand invoice form in form M-11, which is a unified document approved by the State Statistics Committee, is not absolutely mandatory for use. Each organization can develop its own form of a primary document of a similar purpose independently, enshrining it in its accounting policies.

Read more about organizing warehouse accounting in the article “Methods of maintaining warehouse accounting of goods (nuances)” .

Form and filling procedure

Public sector enterprises must use the forms of primary documents that are established by Order of the Ministry of Finance of the Russian Federation dated March 30, 2015 No. 52n. Appendix No. 1 to this order in the list of class 05 forms contains form 0504204.

All other organizations that are not subject to Order No. 52n can use the unified form No. M-11 requirement-invoice, which is approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 No. 71a.

Thus, at present, depending on the legal form, one of two invoices can be used:

- according to OKUD 0315006 requirement - invoice form M-11;

- according to OKUD 0504204 requirement-invoice.

Despite some differences between them, the purpose and rules for filling them out are basically the same. The form according to OKUD 0504204 (for public sector employees) is slightly more compact compared to the form according to OKUD 0315006 No. M-11 due to a more rational placement of details.

Any of the specified invoices is drawn up by the financially responsible person of the sending unit. This must be done in two copies, one of which serves as the basis for the transfer of values, and the second for their acceptance.

The demand invoice (either 0504204 or 0315006) is signed by the persons involved in the registration for subsequent transfer, respectively, to the accounting or other responsible service of the sender and recipient in order to timely register the movement of inventory items. After filling out the document, you must put a mark registering the fact of economic life on the relevant accounting accounts.

Why do you need an M-11 consignment note?

The movement of material assets within an organization are operations that are reflected in accounting. To document them, you must use a special primary form - demand invoice M-11

This is what the invoice requirement is for: this is the primary document used to reflect operations on the movement of assets within one business entity. M-11 is filled out:

- when changing the financially responsible person in one structural unit;

- when transferring materials from warehouse to production;

- when shipping goods from a warehouse for the institution’s own needs.

There are quite a few reasons for discharge. We recommend that you specify all possible situations in your accounting policies.

Primary accounting document for the movement of inventory items within the organization

In the list of mandatory primary documentation forms, approved. By Decree of the State Statistics Committee of the Russian Federation dated October 30, 1997 N 71a, the document in question was also included. However, at present, the mandatory use of it has lost its relevance (Information of the Ministry of Finance of the Russian Federation No. PZ-10/2012).

Today, organizations have the right to independently determine which form to use:

- unified;

- or developed and approved independently.

Business entities have the opportunity to independently develop and apply primary documentation that complies with the law related to the internal movement of goods and materials (including the form in question).

The self-approved form must, in particular, contain:

- name and date;

- name of the business entity;

- content of the corresponding operation (fact);

- measurement value;

- names of positions and signatures of persons responsible for registration of the relevant operation (fact).

Let us dwell in more detail on the use of the unified form of demand-invoice.