What is refinancing?

Refinancing (often called refinancing) is a banking service that allows you to pay off your current loan by obtaining a new loan. The loan term for refinancing is the same as for a conventional mortgage - from 1 to 30 years.

Almost all main types of loans can be refinanced (with the exception of microloans in microfinance organizations):

- consumer;

- car loans;

- credit/debit cards with permitted overdraft;

- mortgage

Mortgage refinancing can be done at your bank, or by switching to another one. The last option is more popular. Banks do not want to lose money by reducing their own rates, so they rarely agree to refinance their loans.

If there is no desire to switch to another bank, it is better to first submit an application requesting a reduction in the interest rate

for a mortgage to “your” organization - this is an easier service to apply for, which gives the same effect as refinancing. The response to the petition must be received within 30 days.

Conditions for refinancing in different banks

Each financial institution can set its own conditions for on-lending, guaranteeing the safety of the funds it lends; This is why it is important to explore the programs of several banks, without stopping at the first offer you come across.

Thus, Sberbank is ready to combine the mortgage into a package with other loans, provided that the total amount is no less than one and no more than seven million rubles. The term of the new loan is up to 30 years; interest rate - from 10% per year. The main requirements for the borrower are age up to 75 years at the time of the last payment and official employment with a period of work in the last place of at least 6 months.

Gazprombank offers clients on-lending in the range from 500 thousand to 45 million rubles; however, the amount should not exceed 85% of the collateral price. Debt repayment period is up to 30 years; the minimum interest rate is 9.5% per year.

Similar conditions apply at VTB: the bank is ready to provide an amount not exceeding 80% of the estimated value of the collateral and, in absolute terms, 30 million rubles. Debt repayment period is 30 years; the minimum interest rate is 9.5% per year.

There are many offers, and each of them is tempting in its own way; The more diligence the borrower shows when choosing a refinancing program, the easier it will be for him to pay off the creditor in the future - and finally receive full ownership of the home.

Your rating of the article

What are the benefits of refinancing a mortgage?

- Saving on overpayments.

By refinancing, the borrower reduces the interest rate on the loan - and therefore reduces the overpayment to the bank. - Change of loan terms and payment amount.

Refinancing involves concluding a new loan agreement, in which new conditions can be stipulated - increasing or shortening the mortgage term, monthly payment. This is an additional way to close your mortgage early and reduce your financial burden. - Combining several loans into one.

Along with a mortgage, you can refinance and combine other loans (car loan, consumer loan, cards) - many banks offer this service. Then, instead of several separate payments, there will be one common payment at a reasonable rate.

How long does it take to refinance a mortgage in large Russian banks?

Before contacting this or that institution, it is important to understand one nuance. The lender, in fact, does not care how many times you refinanced. Now you have ONE valid contract in your hands. If you have made all payments on time and have a reliable source of funds, refinancing should not be a problem.

As for the interest rate, at the moment it is in the range of 9-11%. Of the top five large creditors, the most favorable percentage is with Rosselkhozbank (9.05%), the highest is with Sberbank (10.9%). At the same time, for all lenders the final rate depends on:

- loyalty to customers (“our own” discount is higher);

- loan term;

- assessment of a collateral apartment or house;

- willingness to take out insurance;

- the nature of the property being purchased (a house with a plot of land is more expensive; an apartment on the secondary market is cheaper).

Important nuance! For all institutions, the percentage increases when they refuse insurance and for the period until the housing is officially the property of the bank.

Rosselkhozbank

The institution is ready to refinance the borrower in an amount from 100 thousand to 20 million rubles. True, the last figure is relevant for residents of Moscow and St. Petersburg. For other Russians, the upper limit is limited to 5 million rubles.

Current rates:

- 9.05% (for bank clients);

- 9.10% (for state employees);

- 9.2% (for other categories).

Important! If you refuse insurance, the percentage increases by 1%.

The conditions for obtaining a new loan are quite flexible:

- no commissions;

- the consent of the original creditor is not required;

- the possibility of prolongation of the contract and early repayment is provided;

- independent choice of repayment scheme (annuity or differentiated);

- compulsory insurance of collateral (life and health - voluntary).

It is possible to attract one, two or three co-borrowers - not necessarily those specified in the current agreement. In addition, the bank does not necessarily require your spouse to be involved as a co-borrower. The application review period is up to 5 working days.

Attention! Before submitting an application for refinancing to Rosselkhozbank, make sure that 6 months have passed since the date of conclusion of the original agreement (relevant for bona fide borrowers) or 12 months (for borrowers who have made minor delays).

Alfa Bank

The organization lends to bona fide borrowers at a rate of 9.99% for amounts from 600 thousand to 50 million rubles. These are the conditions for salary clients. For third-party borrowers, the loan will cost 0.3% more. On the website you will see an online calculator that will help you calculate your planned financial burden.

The financial institution will definitely require that the collateral property be insured, and this must be done in an accredited company. Offers refinancing with the TOP UP service (at the client’s request). This means that the borrower will be able to receive additional money along with the required amount.

Mortgage refinancing at Alfa-Bank - conditions and documents

Sberbank

Sberbank is ready to provide a loan from 300 thousand to 7 million rubles (relevant for residents of Moscow and the region) or up to 5 million rubles (for residents of other regions). The bank puts forward standard conditions for security, registration, documentation, and length of service. Lends only to careful borrowers who strictly adhere to the payment schedule. The loan can be taken either at the place of residence or at the legal location of the employer. The application is considered within 8 working days.

Attention! To see the real benefits, it is convenient to use the online calculator on the DomClick website. You can also make a preliminary application here.

Conditions for refinancing a mortgage at Sberbank

VTB

Compared to Sberbank, which uses very strict assessment methods, VTB has more favorable conditions. People come here to renegotiate the contract without unnecessary paperwork and red tape (albeit at an increased rate). The minimum percentage is 10.1%, the maximum amount is 30 million rubles. There are reduced rates and bonuses for preferential categories.

Conditions for refinancing a mortgage at VTB

Gazprombank

The financial institution offers on-lending from 10.5%. This is a preferential rate and is subject to insurance. If you refuse insurance, the percentage increases by 1 point - to 11.5%. According to information on the official website, a Russian citizen can borrow up to 45 million rubles for a period of up to 30 years.

Attention! The organization has a minimum loan term requirement. It is 3.5 years. That is, you cannot enter into a loan agreement for 2 or 3 years. But you can increase the mortgage term compared to the original one. The main thing is that the total time interval does not exceed 30 years. Gazprombank also offers an increased loan amount (current mortgage + consumer loan for personal needs).

How to calculate savings from refinancing?

The benefits of refinancing a mortgage can be calculated using an online calculator. To do this you need to do the following:

- Find out the balance of debt for the month of registration of the service. It is reflected in the payment schedule - in the loan agreement (if there was no early repayment of the mortgage) or in the banking application.

- Calculate the loan at the current rate and write down the amount of overpayment on interest. The term you need to indicate is the one planned for refinancing.

- Repeat the calculation with the same period, but at the refinancing rate. The difference in overpayment on interest will be savings.

Example.

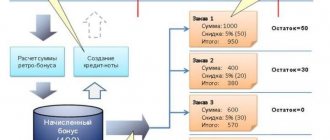

In January 2020, the Petrov family took out a mortgage in the amount of 5 million rubles. for 15 years at 10.5% per annum. After 2 years, the Petrovs wanted to refinance their loan for the remaining 13 years at 7.9%.

The Petrovs' mortgage debt as of January 2020 amounted to 4.7 million rubles. We will find out the savings from refinancing by calculating the loan twice (at the old rate and the refinancing rate) and determining the difference in the overpayment

First, let's calculate a mortgage for 13 years at the old rate of 10.5% per annum

Then we calculate the loan for the same 13 years, but taking into account refinancing at 7.9%

Now all that remains is to compare the overpayment in both cases and calculate how much you ended up saving when refinancing:

| Old loan | Refinancing | |

| Bid | 10,5% | 7,9% |

| How much time is left to repay the loan? | 13 years | 13 years |

| Overpayment | RUB 3,928,282 | RUB 2,829,917 |

| Monthly payment for January 2020 | RUB 55,270 | RUB 48,229 |

By refinancing the mortgage 2 years after registration, the Petrovs saved on overpayments to the bank 3,928,282 - 2,829,917 = 1,098,365 rubles. by reducing the rate. The monthly payment amount decreased by 55,270 - 48,229 = 7,041 rubles.

The essence of refinancing

Refinancing, otherwise called refinancing, is the provision of a new loan to the borrower in order to help him repay the previously issued one.

This loan has two features:

- it is targeted, that is, it is issued for clearly defined needs and cannot be used for another purpose;

- its terms are usually more favorable than the previous ones, which encourages the borrower who finds himself in a difficult situation to still pay the bank.

Refinancing a mortgage, like any other loan, can be carried out:

- at the “original” bank that issued the first amount;

- in third-party financial institutions taking over negotiations with the first lender.

Refinancing (later in the article this term will be taken as identical to refinancing) should not be confused with similar banking procedures:

- registration of a new loan, not aimed at repaying the old one;

- changing the terms of the original contract.

The first option is highly discouraged: the borrower, already entangled in debt, takes on new obligations, taking into account his credit history - on obviously unfavorable terms, which can ultimately lead to loss of housing, prosecution and complete ruin.

The second, due to the complexity of recalculating and rearranging the payment schedule, is very rare in practice: it is easier for a bank to apply for a new loan than to carry out cumbersome calculations.

Example. In 2020, citizen A. took out a mortgage from Sberbank for 15 years at an interest rate of 17% per year. In 2020, as a result of a drop in official income, he asked the bank to refinance; They agreed to him, providing him with a loan for the remaining 10 years at 11% per annum to repay the remaining amount. Thus, the nominal rate has decreased by 6% per year, which increases the likelihood of the client repaying the lender.

And if citizen A. tried to get a new loan instead of refinancing, taking into account the current debt, he would either be refused, or would take on inflated obligations - for example, to pay the amount not for 10, but for 5 years, and not for 11 %, but at 19%, and in the end this would make timely repayment of the first loan impossible.

When is the best time to refinance a loan?

If we talk about savings, then refinancing is important in the early stages of a mortgage. When the loan was issued a long time ago and the principal debt has already been paid by 50% or more, the benefit from refinancing is significantly reduced.

If the difference between the rate on a current loan and refinancing rates in banks reaches 1.5-2% or more, it’s time to think about refinancing.

The ideal time to refinance is when mortgage rates are falling across the country. In order not to miss this moment, you need to monitor the situation on the market through information and analytical resources - for example, read our news section and telegram channel.

When choosing the moment to refinance, monitoring forecasts for the Central Bank key rate will not hurt. When this indicator decreases, mortgages in the country also become cheaper.

Refinancing a military mortgage

To assess the benefits of refinancing a military mortgage, you need to track changes in the interest rate from the moment it was issued. At the time the program was launched (2005), the rate was at 10%. Then it increased by several points.

In September 2020, there was a decrease in the key rate to 8.25%, which entailed a reduction in the military mortgage rate to 9-9.7%. If the military mortgage was issued in 2005, then it makes no sense to refinance it. Rates are currently at the same level.

If a citizen took out a mortgage during a crisis, you can try to improve lending conditions. In 2020 and 2020, the annual savings contribution was not indexed. Therefore, there are fears that some military personnel may remain among the debtors at the end of the contract.

Previously, it was not possible to refinance military mortgage loans. The program was introduced in 2020 (Resolution of the Government of the Russian Federation No. 1345 of November 10, 2020).

Attention

Military mortgage refinancing is carried out both at the creditor bank and at another institution. The procedure is no different from standard refinancing. You need to submit an application to the credit institution, noting the details of the existing agreement. The reason given is the fact that the Central Bank of the Russian Federation has reduced the rate.

If a positive decision is made, the rate may be recalculated. Typically, banks where mortgages are issued meet customers halfway and reduce the rate by 1-2 points.

How to choose a bank for refinancing?

An important condition when choosing a bank is to search for a program with a favorable refinancing rate. The lower the current loan rate, the more you can save - and this is one of the main reasons for refinancing.

In 2020, banks offer the following refinancing rates*:

| Name of the bank | Refinancing rate, from |

| Sberbank | 7,9% |

| VTB | 7,99% |

| RosselkhozBank | 8,5% |

| Alfa Bank | 7,99% |

| Rosbank | 6,19% |

| Bank "Dom.RF" | 7,3% |

| Gazprombank | 8,3% |

| Bank opening" | 7,8% |

| Promsvyazbank | 3,99% |

| Raiffeisenbank | 7,99% |

* Information is current as of 09/02/2020.

Refinancing programs may change depending on the situation on the mortgage market, appear and disappear in certain banks - not only in large ones. You can track them on special resources.

When choosing a bank for refinancing, it would be a good idea to pay attention to the quality and convenience of service - is there an application for loan payment, are there ATMs operating near the house. The comfort of repaying the loan depends on this, because it is issued for a long period.

Banks providing refinancing

Banks that provide refinancing on favorable terms include:

VTB – minimum rate 8.8% per annum;- Promsvyazbank – 8.9%;

- FC Otkritie – 8.95%;

- Rosselkhozbank – 9.15% (only for apartments);

- Revival - 9.2%;

- Gazprombank – 9.2%;

- Raiffeisenbank – 9.2%;

- Uralsib – 9.5%;

- Sberbank – 9.5%;

- DeltaCredit – 9.75%;

- Zenit – 9.8%.

It is also worth highlighting the Tinkoff mortgage lending service. The bank does not issue mortgages directly, but

acts as a credit broker. By submitting an application to Tinkoff, you will instruct the bank’s specialists to independently select the products that suit you and send the application on your behalf.

Bank DOM.RF works in a similar way. It interacts with several banks that are associated with it. By submitting an application for a mortgage at DOM.RF, you will receive a number of refinancing options and will be able to choose the most suitable one.

Thus, refinancing a mortgage with a third-party bank is a very real task. First, you need to make sure that you and your mortgage meet the requirements of the new lender. Then you should collect documents and fill out an application. Once approval is received, an agreement will need to be signed. The banks will pay each other independently, and you will only have to pay for the new loan.

How to refinance your mortgage?

The procedure for refinancing in the current bank and with the transition to a new one is approximately the same. In the first case, it is a little simpler due to less paperwork. When switching to another bank, you must first notify the current lender about this and clarify whether it will be possible to repay the loan ahead of schedule in this way.

Refinancing is processed step by step in four stages:

- Submitting a preliminary application.

It can be issued at the branch or online, the response usually arrives in 2-5 days. An approved application is valid for 2-3 months, during which the rate is fixed. - Collection of documents.

It includes papers for the borrower/co-borrowers/guarantors, for a refinanced loan, and collateral for real estate. - Getting money to pay off an old mortgage.

To do this, a new loan agreement is drawn up - either in the same or in another bank. - Re-registration of mortgage.

At this stage, the borrower closes the old mortgage and enters into a new mortgage agreement for the apartment.

In a nutshell, refinancing goes like this: the borrower chooses another bank (or a program in “his” bank), receives a new loan and pays off his current debt with this money. Then all that remains is to repay the refinanced loan on new terms.

Is it possible to refinance a mortgage with another bank?

Mortgage refinancing can be done either with your bank or with others. And if their own credit institutions often refuse the procedure, third-party institutions often make concessions.

This is due to the fact that it is profitable for banks to receive new clients through refinancing that have left their competitors. Moreover, the number of mortgage applications has been declining in recent years.

For your information

It is beneficial for credit institutions to work with clients of other banks. They can be sure that the applicant has a positive credit history. If the borrower is responsible, then the risk of non-payment is minimal. In addition, collateral real estate allows you to protect yourself.

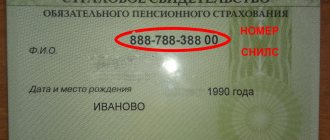

What documents are needed to refinance a mortgage?

| For the borrower/guarantors | - passport – SNILS and INN – military ID for men under 27 years of age – confirmation of employment (certified copy of the work book, employment contract, electronic extract from the Pension Fund of the Russian Federation along with 2-NDFL) |

| For a refinanced loan | – loan agreement – payment schedule – certificate or statement on the refinanced loan – a certificate of the balance of the loan debt on the refinanced loan with accrued interest – certificate of presence/absence of current overdue debt and overdue debt over the last 12 months |

| By property | – purchase and sale agreement (assignment of rights of claim under DDU) – extract from the Unified State Register of Real Estate (USRN) – apartment assessment report – technical passport/floor plan and explication of residential premises from the BTI (for a private house or apartment with unauthorized redevelopment) – confirmation of payment for the apartment (account statement, receipt) |

| Others | – application for refinancing – insurance form – certificate of details (if refinancing in another bank) – marriage contract and notarized consent of the spouse to transfer real estate as collateral – permission from the guardianship and trusteeship authorities (if the property was purchased using maternity capital funds) |

How long does refinancing take?

On average, it takes 1-2 months to refinance a mortgage with another bank. Without switching to a new lender, you can handle it in 1 month or less.

The bank can consider the application for up to 5 days, followed by a long period of collecting documents - this may take 7-14 days depending on what additional documents are requested. It will take another 2-3 days to receive a loan to refinance and pay off the old mortgage. It will take up to 10 days to remove the encumbrance on the property and register the mortgage with Rosreestr.

Refinancing cost

The refinancing process includes some costs. It is worth familiarizing yourself with their size in advance in order to be able to calculate how profitable it will be to conclude a new contract and whether it is worth refinancing the mortgage.

Additional costs may include:

Mortgage decision in 10 minutes with Rosbank Dom Express

Apply now

- Commission for consideration of the application.

- Accrual of an increased rate on the new loan, which will remain until the collateral is re-registered. Often its size exceeds the rate on the existing loan. This is due to the fact that until the collateral is reissued, the loan is considered unsecured, and the bank bears additional risks. At the same time, this practice forces clients to re-register as quickly as possible.

The process of re-registration of collateral usually takes 1-2 months.

- Insurance rates. Banks cooperate with different insurance companies, and accordingly, the cost of the policy also differs. It will not be possible to transfer old insurance with more favorable conditions to a new loan, since it is tied to a specific contract. It is also not always possible to return the money paid. For this reason, it is more profitable to reissue loans with an annual renewal of insurance closer to the end of its validity period.

- Estimation of the cost of the apartment. The service costs 5-10 thousand rubles.

- State duty. The cost of registering a pledge is about 2,000 rubles.

- Intermediary services for collecting documents – from 5 to 10 thousand rubles.

What costs might there be when refinancing?

Refinancing in the vast majority of banks is a free service that does not require payment of commissions. However, the borrower will still have to incur certain costs when refinancing. Most of them relate to payment of insurance, costs for collecting documents, and state fees.

An approximate list of possible costs when refinancing a mortgage looks like this:

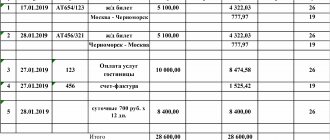

| Expenses | approximate cost |

| Life and health insurance of the borrower and the collateral | 7,000 - 30,000 rub. in a year |

| Increased rate from the moment the loan is issued until the registration of the collateral (1-2 months) | + 1-2% |

| Real estate valuation | 2,000 - 7,500 rub. |

| State duty for registering the rights of the mortgagee to a new creditor in Rosreestr | 2,000 rub. |

| State registration of mortgages in Rosreestr | 1,000 rub. |

| Extract from the Unified State Register of Real Estate | 350 - 870 rub. |

Banks often offer to make a “one-time payment” in the amount of 2-3% of the amount of the refinanced loan. Without it, the interest rate can be increased by 1.5-2%, so most often borrowers agree to such conditions. When refinancing a “fresh” mortgage (in the first 1-3 years), these costs will likely be recouped, but it is still better to weigh the costs against the benefits in advance.

The average cost of a borrower when refinancing a mortgage is 40-50 thousand rubles. It is difficult to accurately calculate costs - they depend on the terms of the loan, the area of the apartment, the required package of documents and other variable factors.

Why do banks that issued loans agree to refinance?

Lending programs are structured in such a way that bank interest is paid unevenly throughout the entire term. The peak of their payments occurs in the first years. Then the borrower gradually repays the loan amount.

Important! Be sure to check whether early repayment is allowed under the terms of your loan agreement.

When can you apply for mortgage refinancing: profitable 50/50 formula

It is unlikely that the lender will agree to refinance if less than six months have passed since the loan was issued. In this case, he will not have time to assess your reliability as a payer. It is also almost impossible to achieve agreement if there are less than 180 days left before the end of payments (only in Sberbank this period is 90 days). The most beneficial formula for both parties is: 50/50. That is, it is profitable to apply for refinancing after half the term has passed.

Recommended article: How to Apply Online for Mortgage Refinance

When is mortgage refinancing beneficial?

How often can you refinance your mortgage?

There are no restrictions in the law. The borrower can refinance the mortgage as many times as he sees fit. But it’s not worth terrorizing banks at the slightest change in the rate - there is a high risk of receiving an indefinite refusal, and besides, the service often takes more than 30 days and entails expenses for the borrower of about 40-50 thousand rubles.

Completed applications for refinancing are not reflected in the credit history, but requests from each bank where they were sent will appear there - this should be kept in mind.

How many times can you refinance a mortgage on one property?

According to the laws of the Russian Federation, there are no strict restrictions on on-lending. Limits can only be set by banking institutions. As a rule, they are happy to accept conscientious payers with an ideal credit history. If there are debts and arrears, they will refuse. Thus, the main condition is not the number of issued loans, but the quality of their servicing (conscientiousness, solvency).

There is no limit to how many times you can apply for mortgage refinancing. Theoretically, you can refinance 10 times. If you are ready to spend your time collecting papers and closely communicating with two creditors (new and old).

What requirements does the bank impose when refinancing?

Banks take into account the same nuances as when applying for a new mortgage. To obtain approval for refinancing, the borrower must be in good faith and meet the internal criteria of the organization.

The main requirements of banks for borrowers when refinancing:

- citizenship of the Russian Federation;

- positive credit history (no current debt or arrears over the last 180 days);

- the age of the applicant (21 years when receiving the loan and not older than 65-75 years at the time of closing the agreement);

- work experience (at least 6 months in the current job and at least 1 year of total work experience over the last 5 years).

Banks may have special requirements for real estate pledged as collateral. For example, set requirements for the location, year of construction and type of building - even for the internal layout. It is better to check information about this on the bank’s website or when visiting a branch.

Separate requirements are set for the loan that needs to be refinanced. Usually, strict limits are set on the size of the loan (the minimum amount is from 0.3-1 million rubles, the maximum is no more than 80-85% of the value of the collateral real estate).

Requirements for the borrower and mortgage

To apply for such a mortgage refinancing program for a room or any real estate, a number of requirements are put forward to the potential borrower, and in addition, certain restrictions apply to the current loan:

- the individual must meet age restrictions (usually from 21 years to the maximum available at the time of repayment - 65, 75 or 86 years, depending on the terms of the lender);

- Mortgage refinancing is available to citizens of the Russian Federation with official earnings, the necessary documents and a positive credit history;

- a loan is issued only when the new refinancing parameters are more favorable than for the existing loan;

- registration is available at any stage of the current mortgage, if there are no debts on it, and at the time of application the payment has been made for at least 3 months, with more than six months remaining until the end of debt repayment.

If the previously issued mortgage had a rate of 8 percent, and the new offer provides the same percentage, then most likely the loan will be refused. If necessary, the bank may additionally require a guarantee or joint registration with another borrower.

Important! The main point that financial institutions pay special attention to is solvency, which is assessed by official and additional (if any) earnings.

Can a bank refuse to refinance? What to do in this case?

Banks have the right to refuse refinancing at any stage before signing the agreement - when submitting a preliminary application, collecting documents. The reasons are usually indicated in the official response to the borrower.

The reason for refusing a service may be a dark stain on the borrower’s reputation; the lender may not like some document; even the location of the house and the value of the property matters. Sometimes a loan does not meet the bank’s internal requirements.

Most often, banks refuse to refinance if:

- the loan was previously restructured;

- there is a current debt (or it has arisen in the last 180 days);

- the loan amount does not meet the requirements of the creditor organization;

- the first loan was issued less than 6 months ago;

- When submitting an application or in the documents, errors or typos were discovered.

The validity period of a negative decision of the bank depends on the internal regulations - on average up to 2-3 months. After this, you can try to refinance again, having first eliminated the reasons that led to the refusal last time. If the borrower does not meet the conditions at all, refinancing may be refused indefinitely.

Pitfalls of refinancing a mortgage loan

Refinancing a mortgage with the right approach is quite beneficial not only for clients, but also for lenders. However, it should be borne in mind that this process has certain difficulties and a number of nuances.

❗The primary risk for a borrower when refinancing a mortgage is the possibility of a negative decision on submitted applications at any stage of registration.

Sometimes a refusal occurs after initial training:

- warning the lender who issued the primary mortgage about the intention to refinance;

- ordering a report on the assessment of a property (which, by the way, is not cheap);

- preparation of a complete package of documents.

At the same time, the bank is not obliged to inform the potential borrower what the reasons for the refusal are.

❗The second difficulty of refinancing a mortgage is that its registration is not available to everyone.

There are a number of circumstances in which submitting an application makes no sense:

- Damaged credit history. Even if you make all your mortgage payments on time, you can still experience a lot of delays, for example, on microloans. As a result, your refinancing application will almost certainly be rejected.

- Small remaining amount and term on the existing mortgage. Most banks set a minimum size for these characteristics.

- The presence of arrears on an existing mortgage loan.

- The mortgage was recently issued. Most often, the bank’s requirements include a minimum period for successful payments on a housing loan. In most cases, the restriction is for at least six months.

- The mortgage loan previously underwent a restructuring procedure.

❗The next feature concerns primarily property deductions for mortgage loans. The fact is that when refinancing, banks often offer to combine several multi-purpose loans or receive an additional amount of money in cash. As a result, the tax office may consider the new loan agreement to be inappropriate and refuse to pay the deducted funds.

❗Another nuance in relations with the tax office arises in case of registration of repeated refinancing. The fact is that the law provides for receiving a deduction on a mortgage, as well as when refinancing. However, the Tax Code says nothing about repeated refinancing. Theoretically, this could lead to a denial of the deduction.

It is important to carefully study all the nuances of mortgage refinancing. This will help avoid a number of problems in the future.

Are there any specific features of refinancing a mortgage under DDU?

Yes, since when refinancing banks require borrowers to provide documents on real estate ownership. When purchasing housing under construction under 214-FZ, this right has not yet accrued for the shareholder, so the creditor is given the right to claim under an equity participation agreement (DPA) - this is the main feature of refinancing with equity participation.

When refinancing a mortgage with equity participation, you will need to register the deposit twice

. First, a pledge of the right of claim under the DDU will be required, and after the delivery of the object and registration of the property, it will be re-registered as a real estate pledge.

To refinance, the property must be accredited by the bank

on a mortgage. If the new home is not on the lender's books, getting approval for a mortgage refinance will be difficult.

Most likely, the bank will require not one, but two reports confirming the market value of the collateral (housing)

: first, the rights to claim at the construction stage, and after putting the facility into operation - ready-made housing.

Registration procedure

In order to qualify for a loan under the mortgage refinancing program, you must go through the appropriate application procedure. The following procedure is provided for such financial proposals:

- selecting a suitable offer and then submitting an application for a mortgage loan to close an existing loan;

- collecting the necessary documentation, submitting an application for early closure of the current mortgage and re-applying to the bank with preliminary approval;

- after the final positive decision, a loan agreement is drawn up, and in addition insurance, if necessary;

- Subsequently, existing loans are repaid and a portion of the funds may be received;

- The next step is to submit a report to the new creditor on the closure of a loan account in another bank in the form of a corresponding certificate.

If necessary, before contacting the bank again, you may need to prepare an assessment of the market value of the property if the available information is out of date by the time the application is submitted. Subsequently, the borrower can only fulfill his obligations under the new loan agreement in a timely manner.

Important! Each borrower has the right to repay the loan in any way convenient for him, including in full or partially ahead of schedule, or through repeated refinancing.

Is it possible to refinance a mortgage with maternity capital?

Yes, but in practice, when applying for refinancing with maternity capital, difficulties may arise - we wrote about them in the “Question and Answer” section. In particular, to refinance, you need to obtain consent to change the mortgagee of the real estate from the guardianship and trusteeship authorities.

Also controversial is the requirement of the Pension Fund to allocate a child a share in an apartment purchased at the expense of maternal capital. This must be done within 6 months from the date of closing the mortgage.

Since refinancing involves paying off the original loan, this will require allocating a share to the child. The bank may refuse to take such real estate as collateral, so as not to contact the guardianship authorities in case of non-payment.

Reminder - what you need to know about mortgage refinancing

- refinancing allows you to reduce the interest rate, change the terms of the mortgage and combine several loans (including car loans and consumer loans);

- You can apply for the service in “your” bank, but if you switch to another bank, you have a greater chance of approval;

- It is better to refinance a mortgage in the early stages (in the first 2-3 years) so that savings on overpayments on interest are noticeable;

- the optimal moment for refinancing is when the difference in rates is 1.5-2%;

- the refinancing application is not reflected in the credit history, but bank requests will be visible there;

- You can refinance the loan an unlimited number of times;

- Registration of the service takes on average up to 1 month in “your” bank and 1-2 months in another;

- the bank may refuse to refinance without giving reasons;

- You can re-apply for refinancing in an average of 2-3 months;

- when refinancing a mortgage under a DDU, the new building must be accredited by this bank;

- refinancing a mortgage with maternal capital will require obtaining consent to change the mortgagee from the guardianship and trusteeship authorities and allocating a share to the child upon closing the first loan.

The meaning of mortgage refinancing: pros and cons

The main point of such a program is re-accreditation of the mortgage (shortening or increasing the term, reducing the rate, reducing overpayments and the possibility of obtaining a more favorable offer). The main advantages of refinancing in the same bank or in different financial institutions are as follows:

- A large sum of money is issued without a down payment for a long period of time, which completely covers the current debt.

- A loan program is provided with an additional amount of funds at a lower interest rate compared to the current loan.

- Ultimately, the amount of overpayment on the loan is significantly reduced if the borrower repays funds evenly until the end of the term.

- Such a loan is provided without collateral, which, according to the main current program, can be additional property.

- When refinancing, you can combine into one loan, mortgage, and also other existing loans from third-party banks.

The procedure itself can be performed several times, provided that the borrower regularly pays his debts, and in addition, his solvency corresponds to the requested loan. However, despite a number of advantages of such a program, there are some disadvantages. It is not always possible to find a better offer. If there are current arrears on loans, the loan will be denied. This program extends loan obligations. The main property purchased earlier with a mortgage continues to remain encumbered, but under a different financial product.

Important! A serious disadvantage is that after the application is approved and the loan is processed, certain transactions cannot be made with the property, as during the term of a regular mortgage.