In simple terms, assets are any property owned by a particular enterprise: buildings, equipment, intellectual property, inventories, etc. In economics, these are funds that are received externally or as a result of the activities of an enterprise and are aimed at generating income. In other words, these are all the resources that the company can manage.

The assets of the enterprise are characterized by the main parameters:

- They always generate income;

- Over time, their value increases;

- The enterprise can exercise control over the use of resources;

- Officially, that is, legally owned by the enterprise.

What are intangible assets

An intangible asset is property that does not have a physical form, but it costs money, brings income to the owner and its existence is documented. Source code of programs, patents for inventions, works of science and art, technological secrets, brand and business reputation of an enterprise are intangible assets.

The defining feature of an intangible asset is the exclusive rights of the owner. If you bought a licensed 1C, this is not an intangible asset; you only have the right to use the program. And if you yourself wrote an accounting program and sell it, this is an intangible asset.

In addition to exclusive rights, intangible assets include ownership of a secret formula or process, information about industrial, commercial or scientific experience.

The creation and accounting of intangible assets are prescribed in the Accounting Regulation 14/2007.

According to PBU, an asset is recognized as intangible if the following conditions are met:

- this is not a thing and its actual value is documented. To do this, all costs of creating an asset are reflected in the documents;

- the asset is used in production or for management needs;

- the company does not intend to sell the asset and plans to use it for more than a year;

- the company has confirmation of exclusive rights to the asset: patents, certificates, agreement on the transfer of rights or other security documents.

Which is definitely not NMA

Research, development and technological work that did not produce a positive result. They are written off for R&D.

Intellectual and business qualities of employees, costs of their training. Qualifications and skills are considered inalienable from the bearer, but people are not things and are taken into account in a different way.

Subjects in which the results of intellectual activity are expressed. A flash drive with a program, a paper with the text of the methodology are not intangible materials. If you are engaged in genetic engineering and have developed a breed of long-haired horses, the animal is also not HMA, just like its DNA molecule. The intangible asset will be the combination of genes that determines the characteristics of the breed.

Various financial investments and expenses associated with the formation of a legal entity. These are just organizational expenses.

Self-test question. The medieval castle is haunted by the ghost of a sad knight. It is creepy and attracts tourists. Can it be classified as an intangible asset?

The answer is at the end of the article.

What is an intangible asset - a concept in simple words

The definition of intangible assets is regulated by PBU-14/2007 and certain provisions of the Tax Code.

Intangible assets are accounting objects that simultaneously meet the following mandatory requirements:

- They do not have a specific physical expression.

- Each such intangible asset can be clearly and unambiguously identified, that is, separated from other assets on the organization’s balance sheet.

- Bring specific economic benefits to the copyright holder company.

- They have been used by the company for quite a long time. The useful life period exceeds 12 (twelve) months. Alternatively, they can be used during one standard operating cycle, the temporary duration of which also exceeds 12 (twelve) months.

- The copyright holder organization does not plan to sell this object over a twelve-month period or a typical operating cycle exceeding twelve (12) months in duration.

- The organization has all legal rights to this object, formalized and registered in accordance with current rules. Proper documentation (certification) of the relevant rights will allow their owner to legally prevent unauthorized access of other entities to intangible assets.

- Objects can be freely and lawfully transferred to other (third-party) parties.

- It is possible to reliably estimate the current primary value of an object classified as intangible assets.

Where do they come from

Intangible assets are purchased, created on their own, received as a gift or as a share in the authorized capital. The options differ in the way the initial cost is calculated.

When purchasing, the initial cost includes all actual expenses for acquiring the asset:

- the cost of exclusive rights under an agreement with the copyright holder;

- the cost of consultations required to purchase the asset;

- non-refundable taxes, government and patent fees;

- customs duties and fees;

- remuneration to the intermediary through whom the asset was purchased.

VAT is not included in the price. But if you are on the simplified tax system, input VAT is included in the cost of the purchased property*.

When created, the initial cost is the sum of all costs for its development and registration: costs of materials, labor, insurance premiums, electricity, third-party services, patent fees.

The rest is quite simple.

If the intangible asset was donated , the initial cost is taken at the market value or determined by an expert. The services of an appraiser in this case are not intangible assets, but management expenses.

If the intangible asset is received as a share in the authorized capital , the initial cost is determined by the board of founders. For example, students started a startup. Some invested in money, some in real estate, and some with their unique streaming video compression algorithm. They determine how much this algorithm costs themselves, based on the amount of contributions from others.

Grouping of assets by liquidity

In the balance sheet, each type of asset is not located randomly, but in a strict order. Thus, less liquid assets are located at the beginning, and more highly liquid ones are located closer to the final part.

According to the degree of liquidity, assets are divided:

- for illiquid ones (when they cannot be sold at their real value or they are not in demand at all);

- low-liquidity (overdue debts, securities that are not quoted on the stock market, etc.);

- medium-liquid (fixed assets that are in demand);

- highly liquid (examples - cash or money in a bank account, government securities, etc.).

How long do they serve?

To write off the cost of an intangible asset, you need to determine its useful life. This is the duration of the exclusive rights or the period during which the company plans to receive income from the asset. For some intangible assets, the service life is determined by the number of products that the company plans to produce with its help.

The company annually inspects assets with an indefinite life. If something has changed and the period can be determined, then depreciation begins to be charged on the asset*.

What are the assets of an organization?

These are all rights to property that the enterprise has (fixed assets, inventories, financial deposits, monetary claims against legal entities and individuals). The concept of tangible assets or assets in general is used to refer to any kind of property. This economic concept includes 4 types:

- material (property, raw materials, buildings, land and others);

- financial;

- long-term;

- intangible.

How are they depreciated?

Amortization is the gradual transfer of the value of an intangible asset to the cost of products or services.

Depreciation is charged for each intangible asset on a monthly basis, starting from the next month after commissioning. We bought the rights to the logo in May, started using it in June, and depreciation will begin in July.

When an asset is completely depreciated or is written off from the balance sheet as unnecessary, depreciation stops on the 1st day of the next month. They were written off in May, June is the last month of depreciation of the asset.

If the useful life of an intangible asset cannot be determined, depreciation is not charged on it.

The method of calculating depreciation is chosen based on the planned income from the use of an intangible asset. There are three methods of depreciation:

Linear is the simplest. Assumes equal accrual over the useful life. This method is also used when it is impossible to calculate the income from the use of an asset or this calculation is unreliable.

Declining balance - a smooth decrease in the original cost along a flat curve. The method was borrowed from IFRS and does not work well in our context. We have no concept of depreciable or salvage value.

Write-off of cost is proportional to the volume of production - when you need to link expenses to a specific activity or product.

The chosen method is fixed in the accounting policy.

Rules for accounting for intangible assets

The unit of measurement of intangible assets is an inventory object. This term refers to the totality of all rights associated with the purchase of one asset. An object may include rights to a collection of objects.

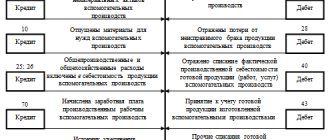

Objects are recorded in account 04 “Intangible assets”. The accounting must indicate their original cost. The situation is somewhat more complicated with depreciation. In relation to some assets, it cannot be reflected on account 05 “Depreciation of assets”. Accruals are indicated in the credit column of account 4 “Intangible assets”. The receipt of objects into the enterprise is reflected in the debit of account 04. The correspondence will be account 08 “Investments in non-current assets”.

Where are they going? Disposal of intangible assets

Intangible assets are sold, donated, written off or made as a contribution to the authorized capital of another company.

In such cases, the use of the retired intangible asset is terminated, its cost and the amount of accrued depreciation are written off from the balance sheet*.

An intangible asset can not be written off, but the rights to use it can be transferred to another company. For example, you invented a pump for liquid oxygen, but are not currently building rocket engines. To ensure that the technology does not lie idle, you enter into an agreement with Elon Musk on the transfer of rights to use the invention. For this, SpaceX will transfer you royalties.

In this case, the intangible asset is not written off from the balance sheet and the exclusive rights to it remain with you. In addition, this intangible asset continues to be amortized.

Act on write-off of intangible assets

The write-off of intangible assets is documented in a write-off act.

If the intangible assets are sold or donated, the recipient is issued an act of acceptance and transfer of intangible assets. The act is drawn up by a commission, the commission is appointed by the director. To do this, he issues an order. The commission includes representatives of the enterprise administration, accounting workers and competent specialists capable of assessing an intangible asset. The commission draws up the act in one copy and submits it to the accounting department. There it is kept in the archives for five years.

There is no standard form for an act for writing off intangible assets. Take the form for the act of writing off fixed assets - form No. OS-4.

Answer to self-test question. No, the ghost of the knight is inalienable from the castle and it is impossible to estimate the value of the castle without the ghost. And there will be problems with the agreement to obtain exclusive rights to the ghost.

conclusions

Intangible assets are a special category of property that is subject to balance sheet accounting in the accounting department of any enterprise.

They are a separate type of non-current assets, do not have a tangible embodiment, they are objects of intellectual property, products of mental labor, objects of creative activity.

Recognition of intangible assets is carried out at the enterprise upon the fact that the objects taken into account comply with the mandatory requirements (criteria) provided for by law.

Of particular importance for correct accounting and further application of intangible assets is their correct documentation, without which it is not possible to establish/certify the relevant rights.

Asset value

The standard allows for the convenience of accounting to use the standard method of determining the cost of inventories and the method of retail prices, when when using them, deviations from the actual cost values are small and one can say that the cost value is approximately correct. The standard cost must be regularly checked and revised if necessary.

The retail price method is used in retail trade by adding a certain margin to the purchase price of goods, which is called a trade margin in Russian conditions.

Factors influencing the size of the mat. assets

The size of an enterprise’s tangible assets can be influenced by the following groups of factors:

- External factors:

- Tax law;

- Inflation rate and economic situation in the country;

- Regulatory system;

- Amount of interest on loans.

- Internal factors:

- Turnover of goods - the more a company wants to sell goods, the more working capital it needs;

- Organization of commercial activities - thanks to market research, you can purchase only those materials that are quickly used;

- Conditions of contractual supplies and guarantees for them - frequent purchases in small quantities will reduce the size of current assets.

Similar articles

- Permanent asset index: balance sheet formula

- Tangible and intangible non-current assets

- Long-term assets on the balance sheet

- What do non-current assets include?

- Accounting for non-current assets

Accounting for tangible assets

The objectives of accounting for tangible assets are as follows:

- Timely and accurate documentation of all operations performed for the acquisition and issuance of materials.

- Reflection of expenses for the procurement of materials.

- Carrying out constant supervision over the safety of materials. values at all stages of their movement.

- Timely settlements with suppliers.

To accomplish these tasks, the company must ensure:

- Proper organization of technological supply;

- Proper condition of warehouse facilities.

Asset Capabilities

Possible net selling price is the estimated selling price under normal market conditions, excluding the costs of execution and probable selling expenses that are associated with the sale.

The cost of inventories includes the costs of processing, acquisition and other costs that are associated with delivering the inventory to its current location and bringing it to the condition in which it currently finds itself.

Acquisition costs (procurement transportation costs) include import duties, purchase price and other non-refundable taxes, costs of consultants and intermediaries, forwarding, transportation, and other costs that are directly attributable to the acquisition of services, goods, and materials. Trade discounts, chargebacks and other similar amounts are deducted from these costs.

Processing costs, including direct labor and other similar direct costs and systematically allocated variable and fixed and overhead manufacturing costs.

Fixed manufacturing overhead costs per unit of output are allocated based on the plant's production capacity under normal operating conditions. The amount of these costs, included in the cost of a unit of production, remains unchanged when production volume decreases and even when it stops. But variable and fixed overhead costs are allocated entirely to manufactured products in this reporting period.

Other costs are included in the cost of current tangible assets only when they are directly associated with the processing of this asset.

The cost of inventories should not include:

- administrative expenses that are not associated with bringing inventories to their condition and location and sales (commercial) expenses.

- storage costs beyond those required in the production process;

- excess losses of materials and raw materials, labor and other production costs;

All these costs are included in the expenses of this reporting period.

Composition of tangible assets

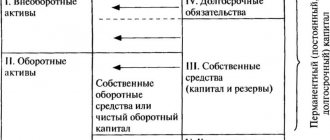

The company's tangible assets are divided into two groups - current and non-current.

Current assets are:

- MPZ – fuels and lubricants, materials, semi-finished products, finished goods;

- Other assets.

Non-current tangible assets of an enterprise include:

- OS objects – structures, special equipment, transport, land;

- Mat. search objects - special equipment and vehicles that are used in the development and search of natural resources;

- Investments in mat. projects – resources that are provided to third-party companies for temporary use for a fee;

- Other assets.