What are assets and liabilities

Assets are what generate income. Buildings, apartments, cars, money in accounts, etc., if they work and make a profit. On the contrary, liabilities are expenses that ensure the operation of the enterprise. The relationship between expenses and income is reflected in the balance sheet. This is perhaps the most difficult and important subject in accounting to understand.

Difference between liabilities and assets

A simple and ingenious example is shown in the cartoon “Three from Prostokvashino”. Remember?

The cow was rented. She gives milk - this is an asset. She also calved. The rent for it is a liability. We bought a cow and a calf and reduced our liabilities. There was one animal, now there are two. Both will be profitable. By the way, a ready-made version of the business model! But this is so, schematically. Let me look at the problem deeper.

Are own shares an asset or a liability?

There is an opinion that if a company can sell its securities and get money for them, then these are assets. Not certainly in that way. The result of the sale will indeed be the proceeds. They can be used for different purposes. And the shares themselves are a liability. They act as a mechanism for obtaining funds.

Interaction of assets and liabilities

Here is an everyday example: a citizen bought a car to go to work and to his dacha. Here he acquired a liability. The car immediately lost value because... It became used and requires expenses for refueling, repairs, storage, etc. Then this man decided to work on his car, receiving a fee for it. Then the car becomes a core asset. With its help, a person makes a profit. At enterprises the situation looks similar.

Assets and liabilities in financial statements

These are the main indicators that allow you to almost completely evaluate the activities of the enterprise. They are correlated with each other and are reflected in the form of a table. Simply put, these are items in the general balance sheet – the enterprise’s report for a certain period of time.

Assets and liabilities according to Kiyosaki

This gentleman has published 26 books on financial topics. His brilliant work “Rich Dad Poor Dad”, along with other works, is sold all over the world.

The writer’s main thesis can be formulated as follows: “Assets bring you money, whether you work or not. Liabilities take your money, whether you work or not.”

Of course, these are the basics of economics “for dummies.” This approach is too simplistic and controversial. However, in everyday life this is quite acceptable. It's more difficult with companies. Judge for yourself.

Interpretations of the passive

In the modern understanding, the use of liabilities is generally successful, but its interpretation is very changeable and its forms also take on such forms, for example, when assets are completely equal to liabilities, taking into account capital. It is under the influence of Western accountants that this interpretation of capital takes on the form of an organization’s debt to its direct owner. As a result, the most well-known formulation arises: liabilities are considered as a list of legal entities and individuals who primarily own the assets. This leads to the following three conclusions :

- a liability is a consequence of an asset; if there is no asset, there will be no liability;

- the liability can rightfully be called a plan for the distribution by the owners of the property specified in the asset;

- It is necessary to collect liabilities according to the principle of withdrawal, so the best way is to start with what is subject to withdrawal in the very last place.

The most important takeaway is that liabilities equal assets. Of course, then it remains unclear how to understand such an item as the profit of future developments? In theory, and then in practice, there are three explanations of the passive from a purely informative side. The income items of such upcoming periods are a completely traditional understanding of the definition of a liability, which defines it as property at the disposal of the owner himself. There are basically two approaches to this. The first is a passive, it is understood as a purely legal category. And the second is like a plan for the distribution of certain assets, while loan debt is already formed by emerging obligations, and personal funds, at the same time, are normalized in accordance with the established, as well as a given limitation. The first option we are considering can be safely considered traditional for modern domestic accounting. This theory was confirmed by all the classics of domestic accounting. Namely: Lunsky, Rudanovsky, Kiparisov, Pomazkov and many others. The second option was more supported by accountants who wanted to vigorously link accounting with Marxist political economy. In both options there are no problems understanding the income of subsequent periods. They are taken into account as sources of personal funds. The accounting option was compared with Marxist political economy.

A new interpretation of the passive appeared relatively recently and serves as quite significant evidence of the priority of the content itself (economic relations) over the form (legal relations).

The whole essence of this approach is expressed as follows: liability is the future outflow of assets.

In this case, it does not matter at all who owns the real rights to the funds: however, it is important to know the exact or possible schedule for making payments. This type of distribution of funds should mean both repayment of loan debt and writing off reserved funds. (In addition, here it is necessary to take into account the possible possible withdrawal of funds by the owners themselves.) It is from here that the well-known revolutionary interpretation of loan debt follows, by which, as a result of all of the above, it is necessary to understand not only obligations, that is, debts to legal entities and individuals, but also reserves, which also require the release of funds within a predetermined time frame.

Repayment of debt on a loan in comparison with the options of the first interpretation gives rise to an understanding of completely different relationships between liabilities and personal funds, since inventories are personal funds - they are understood as non-own funds, however, profits of subsequent periods are understood in the same way as in

in the case of the first interpretation. So, for example, the interpretation of liability according to Schmalenbach, who lived in 1873-1955, who was a German accountant, he defined liability as follows: income, which at the moment cannot be called expenses. E. Schmalenbach was a great German accounting theorist in the 20th century. By right, it should be noted that the owners invested a certain capital, that is, the enterprise receives profit from its personal owner (initially, when conducting the business, it was their own, and at the time of the work they were transformed and capitalized into accounts payable and their personal income). The funds received must be invested in some business. And this is precisely what means that it is necessary to obtain the necessary equipment, materials, goods and the like in order for the company to turn such income into its costs. In this case, the entire total liability must be understood as profit of either past or future periods.

Kinds

I will present the balance sheet of the organization in the form of a table.

| Assets | Liabilities |

| Negotiable. Money or goods to be sold within a year. | Equity. It is formed from the money of the founders. It turns out that the company, as it were, borrows money and is obliged to return it to the owner. Conditionally, of course. But since it must, it means a liability. |

| Non-negotiable. What the company is not going to sell: land, buildings, machines, vehicles, long-term investments, etc. | Securing future payments. |

| Future expenses. Expenses carried over to the next period after the reporting period. Example: car insurance for 2 years. Payment for the second year of the insurance policy, in this year’s report, will be reflected in the “Assets” column. | Long term duties. Own shares, bonds, mortgages, leasing, loans, etc. |

| Revenue of the future periods. Something for which money has already been received, but services or supplies will be made next year. | Current expenses (liabilities). |

Industrial use

Modern economists and investors interpret the concepts of asset and liability in two ways. The first interpretation defines traditional economic concepts from the field of accounting. The second is used in connection with the development of the topic of personal capital management. Assets and liabilities are everything that forms a company's balance sheet. Company property in any form is considered an asset; liabilities are debt obligations.

Any intangible and tangible property that an enterprise has, as well as rights to property, are assets of the company. Assets are any property of the enterprise, liabilities are the funds at the expense of which the formation of property is carried out. Liabilities are considered to be the capital of an enterprise:

- joint stock;

- borrowed;

- statutory;

- credit.

The assets of the enterprise are classified according to:

- Form of participation in the production process (current and non-current).

- The nature of the functioning (financial, intangible, material).

- Ownership rights (own, leased).

- Source of formation (net, gross).

- Liquidity.

Assets and liabilities reflect the company's balance sheet, which is prepared for a specific period. Balance sheet equilibrium is considered to be their equality. The first ones are arranged in the balance sheet according to increasing liquidity, and the second ones - according to the urgency of involvement in turnover.

What to do with liabilities and assets

Mr. Kiyosaki speaks out clearly on this matter: get rid of the former and accumulate the latter. By the way, this approach causes criticism against him. According to the guru, I should sell my car because it is not generating income. Dacha - for the same reason. Yes, a lot more.

On the other hand, if I earn less than I pay for the maintenance of my liabilities, then sooner or later I will lose them anyway. Therefore, in my opinion, it can be formulated this way: maximize your income-generating property, reducing expenses to reasonable limits. This is exactly what successful companies do.

Types of assets

Assets in the modern investment interpretation are all investments that generate constant (passive) income or increase in value over time: investments that generate constant income, profits from your own business, land, real estate, etc. There are many different assets, the most famous and popular of which are:

| Assets | Description |

| Bank deposits | Funds held in bank accounts from which interest accrues |

| Bonds | Income is generated through coupon payments, which are accrued after a certain time (once every 3 months, 6 months or 12 months). Purchasing long-term bonds creates a constant source of income for a long time. |

| Stock | These securities provide the opportunity to receive two types of income. Firstly, purchasing shares is buying part of a business that will rise in price over time, which means that the price of shares will also rise. Secondly, by purchasing shares that involve the payment of dividends, the owner has the right to expect to receive the company's annual profit, which is proportional to the number of shares purchased |

| Real estate | It is considered the most reliable way to generate income. Investing in the purchase of real estate guarantees a constant flow of cash from rental income. And the price of real estate gets higher over time |

| Mutual funds and other investments | This method of generating income is suitable for those who do not want to think independently about where to invest their capital. In this case, finances are transferred to the management of a team of professionals who have experience in this field and know how to effectively use financial instruments. This contributes to more efficient use of money |

| Borrow money | This will be considered an asset if the money is lent for a reason, but out of financial interest. Otherwise, the debt will be a liability |

| Acquisitions with future appreciation | This is everything that constantly increases in price over time:

|

What are the net assets of an enterprise (NA)

The company has its own funds, which can be valued in money. There are also debt obligations. The difference between the first and second shows the enterprise's NA.

CA and legislation

Order No. 84n of the Ministry of Finance of the Russian Federation dated August 28, 2014 approves their definition. Net assets are all the assets of the organization (JSC), with the exception of the receivables of the founders in the authorized capital.

Debt obligations (DL) are all debts of an enterprise, excluding income that will be received in a future period. Assistance from the state or property received free of charge is not taken into account.

Calculation formula

NA = AO – DO. Property that is in the temporary use of an enterprise is not taken into account when determining the NA.

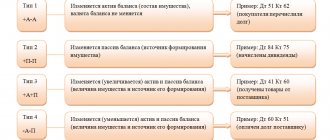

How are the assets and liabilities of the balance sheet formed?

The basic rule for drawing up a company's balance sheet: the indicators must be equal to each other. For example, a company took out a loan for 500 thousand rubles. This money is reflected in the asset column. At the same time, they are entered into liabilities as debt of the enterprise.

Company capital

The “capital” section reflects the company’s financial resources that are not liabilities. That is, these are the funds that the enterprise owns by right of ownership and can dispose of at its own discretion.

Unlike attracted and borrowed funds, the company's capital does not require expenses for payments in future periods.

Authorized capital

The capital is the amount of the founders’ contribution to the formation of a legal entity, which determines the minimum amount of the enterprise’s property. The authorized capital can be formed in various forms:

- in cash

- securities

- material assets

All contributions not made in cash are valued at market value and are reflected in liabilities.

The authorized capital is a guarantee for creditors to fulfill the company's obligations. That is, if an enterprise goes bankrupt, creditors can collect the debt from the funds of the management company.

Reserve capital

The Republic of Kazakhstan is formed during the operation of the enterprise at the expense of its own profits. Reserves are formed for the financial stability of the enterprise - covering losses in future periods, repurchasing own shares from shareholders, covering unforeseen losses, paying dividends to holders of preferred shares in the event of insufficient profits.

The amount of annual contributions to the Republic of Kazakhstan is determined by the organization’s charter. According to Federal Law No. 208, joint-stock companies in the Republic of Kazakhstan must deduct at least 5% of net profit.

Extra capital

These are the company’s own finances, formed through:

- income from the issue of securities

- positive exchange rate difference

- income from revaluation of fixed assets

Additional capital funds can be spent on increasing the capital, covering losses or compensating for negative exchange rate differences.

retained earnings

This is the net profit of the enterprise received in the reporting period, but not yet directed to production and economic needs. This line can reflect both positive and negative financial results.

If the company worked in the negative during the reporting period, then the liability in the “retained earnings” line will be a negative number - an uncovered loss. It can be closed at the expense of the Republic of Kazakhstan or additional contributions from the founders.

Net assets of the enterprise: interpretation

A positive NA indicator of an enterprise indicates the efficiency of its work. This indicator is taken into account by investors when making decisions about purchasing securities, and by banks when making lending decisions.

On the other hand, young enterprises may have a negative NAV but not be unprofitable. Therefore, these figures should be studied over time.

Calculation example

LLC "Mechta Agraria" produces household equipment. The annual balance sheet is as follows: non-current assets (residual value of fixed assets, contributions to construction, long-term investments) - 16,000,00 rubles. Current assets (own funds, debts of third parties, inventories of goods) – 800,000 rubles.

Balance sheet liabilities: loans – 400,000 rubles, current expenses – 700,000 rubles.

NA = 1,600,000 + 800,000 – 400,000 – 700,000 = 1,200,000 rub.

Balance sheet codes and lines

The balance sheet is compiled according to a certain algorithm. There is a separate line for each indicator. Lines are assigned individual codes for ease of statistical accounting and control.

Each line expresses a cost indicator showing the operation of the enterprise. Modern codes are displayed as a four-digit number, with each digit containing specific information.

So, for example, line 1150 (fixed assets) is deciphered as follows: 1 – type of document (in this case, balance sheet); 1 – non-current assets; 5 – type of asset; 0 – line-by-line detailing of indicators.

Non-core assets are also displayed by the accounting department in the balance sheet of the enterprise.

Diagnostics of business efficiency using the net asset method

One of the main conditions for the prosperity of an enterprise is the constant search for opportunities to increase the number of assets. A negative value of this indicator may indicate that the company is unprofitable, insolvent, and exists on the money of creditors. In this case, the company may be liquidated through court proceedings.

PASSIVE

(from Latin passivus - inactive)

1) the totality of debts and obligations of an enterprise (as opposed to an asset); 2) part of the balance sheet, usually the right side, indicating the sources of the enterprise’s funds and its financing, grouped according to their ownership and purpose (own reserves, loans from other institutions); 3) excess of expenses over revenues.

Source: Dictionary of economic terms on Gufo.me

Meanings in other dictionaries

- passive - Passive/. Morphemic-spelling dictionary

- passive - Put in passive Abramov's Dictionary of Synonyms

- liability - 1. part of the balance sheet, reflecting the sources of funds of an enterprise or institution and their purpose (own reserves, loans from other institutions);... Large accounting dictionary

- passive - See passion Dahl's Explanatory Dictionary

- liability - Borrowed funds, the totality of debts and obligations of an organization (the opposite is an asset). Large legal dictionary

- passive - noun, number of synonyms... Dictionary of synonyms of the Russian language

- Passive - (Italian passive, from Latin passivus - passive, inactive) one of the two sides of the balance sheet, characterizing the sources of funds of socialist enterprises and organizations according to their composition, intended purpose and placement. Great Soviet Encyclopedia

- liability - -a, m. 1. The totality of debts and obligations of an enterprise; opposite asset (accounting). Bank liability. Calculate liabilities. || trans. Negative aspects, shortcomings of someone, something. Small academic dictionary

- passive - ACTIVE - PASSIVE Active - passive (see) activity - passivity (see) active - passive Active participant - passive participant. Active role - passive role. Dictionary of antonyms of the Russian language

- liability - liability I m. 1. The totality of debts and obligations of an enterprise. || opposite asset 2. transfer. That which constitutes the negative side of any phenomenon or matter. II m. Passive voice (in linguistics). Explanatory Dictionary by Efremova

- passive - PASSIVE, a, m. (special). Part of the balance sheet of an enterprise that reflects the sources of its funds and their purpose. | adj. passive, oh, oh. P. account. Ozhegov's Explanatory Dictionary

- passive - PASSIVE -a; m. [from lat. passivus - passive, inactive] 1. Accounting. The totality of debts and obligations of an enterprise (opposite: asset). P. bank. Count p. // Negative aspects, shortcomings of someone, something. Envy should be put in his paragraph. Kuznetsov's Explanatory Dictionary

- passive - PASSIVE, -a, PASSIVE, -ogo, m. Passive homosexual. Explanatory dictionary of Russian argot

- passive - spelling passive, -a Lopatin's Spelling Dictionary

- PASSIVE - PASSIVE (from Latin passivus - inactive) - one of the two sides of the balance sheet; shows the sources of farm funds according to their composition, intended purpose and affiliation. Large encyclopedic dictionary

- passive - Passive, passives, passives, passives, passives, passives, passives, passives, passives, passives, passives, passives Zaliznyak’s Grammar Dictionary

- passive - PASS'IV, passive, pl. no, husband (from Lat. passivus - Passive, inactive). 1. The totality of all debts and obligations of the enterprise; ant. asset (accounting). Bank liability. 2. transfer Ushakov's Explanatory Dictionary

- passive - Passive, pl. no, m. [from lat. passivus – passive, inactive]. 1. The totality of all debts and obligations of the enterprise; opposite asset (accounting). Bank liability. 2. transfer Something that constitutes the negative side of something. phenomena, deeds (book). Large dictionary of foreign words

- liability - The totality of LIABILITIES, short-term and long-term debts of the company. Financial dictionary of terms

- passive - (lat. passivus inactive) Passive voice (in grammar), for example, “filled in column”; semantic transitivity. A type of syntactic voice when the original subject is reduced in rank, and the original object can be increased in rank. Dictionary of linguistic terms Zherebilo

- passive - PASSIVE a, m. passif, -ve adj. < passivus passive, inactive. 1. The totality of debts and obligations of the enterprise; opposite sex : active BAS-1. [Vetvischeva:] Is it really possible to stop our ruin? [Peregonov:] There’s nothing to think about it. Dictionary of Gallicisms of the Russian language

- Blog

- Jerzy Lec

- Contacts

- Terms of use

© 2005—2020 Gufo.me

Valuation of assets on the balance sheet

This approach uses company reports. This is necessary to determine the value of property, both tangible and intangible, as well as existing liabilities. Along with market valuation and revenue assessment, it helps create a holistic picture of the company's performance.

Cost and average value of total assets

The sum of current and non-current assets shows the value of the company's total assets. In simple words: if we add up these indicators at the beginning and end of the year and divide by 2, we get the average total assets of the organization for the year. This data is needed to assess the dynamics of enterprise development.

Real assets ratio

Characterizes the potential of the company's activities. It is calculated from the sum of the residual value of fixed assets, raw materials, materials, intangible assets, and work in progress. The result obtained must be divided by the value of the organization’s property.

It looks like this: Kr.a = page 100 + page 120 + page 211 + page 213 / page 300 balance. For an enterprise engaged in production, this coefficient must exceed 0.5. A decrease in the coefficient shows a negative trend in the subject’s activity, an increase – a positive one.

Asset immobilization ratio

Share of non-current assets in the balance sheet. Characterizes the degree of liquidity of the enterprise’s property and the ability to meet its obligations.

Permanent Balance Index Ratio

Shows how financially stable and solvent the company is, regardless of the funds raised. It is calculated by the ratio of non-current assets (line 1100) to the equity capital indicator (line 1300).

These, and a number of other ratios that reflect the company’s performance, are very carefully assessed by professional investors. Making a decision to purchase securities should not be based solely on intuition or the opinions of third-party experts. You need to carefully study all the indicators.

I hope this article was helpful to you. Subscribe to our news, share them with friends on social networks. All the best.

Concept and classification of assets

Assets are the property of an enterprise that should bring profit in the future. In other words, these are financial investments that create constant passive income for the asset holder and increase their value over time. Assets are classified:

- By form of functioning: material: land, structures, finished products, equipment;

- intangible: licenses, copyrights, patents, trademark;

- financial: cash deposits, accounts, debts from individuals and legal entities.

- current assets are property assets used in the current activities of the organization and involved in daily production costs. This group includes cash (in cash, on current and foreign currency accounts), investments in securities (short-term), inventories (raw materials, supplies, inventory, finished products), accounts receivable (if the maturity date is no more than a year), VAT according to acquired values;

- gross - property assets acquired with both own and borrowed capital;

In addition to the main types, there are “hidden” and “imaginary” assets. “Hidden” assets are not reflected when preparing the balance sheet. These may be organizational expenses when creating an enterprise, costs for acquiring a license, training and certification of personnel, improvement of equipment, underestimated residual value of fixed assets and intangible assets due to the use of various methods of depreciation.

“Imaginary” assets, although reflected on the organization’s balance sheet, are in fact absent. It is impossible to obtain significant financial benefits from owning “imaginary” assets, either in the present or in the future. Usually these are funds that have already been written off for a certain time, but for some reason remain not written off. For example, unwritten-off unusable and damaged materials or expired accounts payable.

According to the classification of IFRS (international financial reporting standards), there is another type of assets - excess. These include funds that are not currently needed for the main activities of the organization, for example, an excess amount of equipment in a construction company.