When registering a business entity, regardless of its organizational and legal form, the types of activities according to OKVED that are planned to be carried out in the future must be indicated. In practice, there are often situations when an enterprise, in the process of work, comes to the need to start a new type of activity, and in this regard the question arises: is it possible to carry out activities without OKVED? This question is typical both for a one-time operation and for a complete transition to a new line of work.

Is OKVED mandatory?

A clear answer to this question is given by clause 5 of Art. 5 of Federal Law No. 129-FZ of 08.08.2001 “On State Registration of Legal Entities and Individual Entrepreneurs”, which specifies the obligation of legal entities and individual entrepreneurs to notify the tax authorities of changes in activities within three days. Note that the law does not specify whether the main type changes or an additional one appears, therefore any change in the OKVED codes must be registered in the prescribed manner and entered into the Unified State Register of Legal Entities. Consequently, the answer to the question whether it is possible to carry out activities without OKVED is unambiguous - the implementation of activities, the code of which is not included in the information about the organization or entrepreneur in the state register, is not permitted by current legislation.

Read also: Changing OKVED codes: step-by-step instructions

At the same time, it is not prohibited to indicate several types of activities during registration and not actually carry them out. But it should be taken into account that some OKVEDs provide for the use of only a general taxation system or require licenses for their implementation.

Read also: List of licensed activities 2020 according to OKVED

Work rules not according to OKVED code

It is permitted by law for companies or individual entrepreneurs to conduct activities that do not comply with the previously selected OKVED code, as indicated in the Federal Tax Service letter No. ED-19-2/, published in open sources on September 3, 2018.

The main information contained in this letter includes:

- according to tax inspectors, entrepreneurs can independently choose what type of activity they will engage in;

- OKVED codes selected for these areas of business are entered into a special register called the Unified State Register of Individual Entrepreneurs;

- the Federal Tax Service does not have the rights and capabilities to verify whether the individual entrepreneur is actually engaged in activities that correspond to the selected codes;

- in practice, the selected codes that are entered by the entrepreneur when filling out an application for registration do not in any way affect the amount and features of paying taxes under the chosen tax regime;

- in its letter, the tax service refers to the fact that in judicial practice, incorrectly selected OKVED codes in no way created obstacles to paying taxes, recording income received or carrying out activities;

- it is impossible to prove that the work of an entrepreneur in an area that does not correspond to the selected code is evidence of receiving any tax benefit.

How to choose an OKVED code? Watch the video:

Therefore, in its letter, the Federal Tax Service indicates that even if an entrepreneur works under a different code that is not registered in the Unified State Register of Individual Entrepreneurs, this is not a basis for holding him accountable or using different penalties.

Initially, such information is required only as statistical data. But it is still advisable for entrepreneurs to notify the tax service about working in another type of activity, otherwise they may be held accountable and pay a fine of 5 thousand rubles.

Why is information entered into the Unified State Register of Individual Entrepreneurs?

This register contains information about all registered Russian entrepreneurs. All changes in the specifics of the individual entrepreneur’s work must be recorded in the Unified State Register of Individual Entrepreneurs.

If false information is entered into this register, businessmen face serious consequences, represented not only by fines, but even by a ban or suspension of activities.

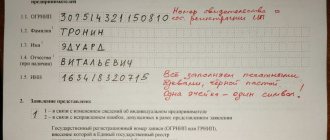

At the time of registration of an individual entrepreneur, a citizen must draw up a correct application. It can list many OKVED codes, which takes into account the field of activity in which the businessman will work.

What is the OKVED 2 classifier and why is it needed? Find out here.

Information from this application is transferred to the Unified State Register of Individual Entrepreneurs. Using this data, control over the activities of entrepreneurs is ensured. Supervision of compliance with legal requirements is guaranteed.

Decoding OKVED.

Responsibility for carrying out activities without OKVED

If tax authorities identify the fact of carrying out activities not included in the Unified State Register of Legal Entities, they may be subject to administrative liability under Art. 14.25 of the Code of Administrative Offenses of the Russian Federation:

- under Part 3 – in case of violation of the notification period, i.e. when it is submitted later than three days. For this violation, a warning or a fine for an official or individual entrepreneur in the amount of 5,000 rubles is provided;

- under Part 4 - if the notification of the new OKVED was not submitted at all. The fine for such a violation ranges from 5,000 to 10,000 rubles.

The practice of bringing to administrative responsibility for carrying out a type of activity not specified in the Unified State Register of Legal Entities shows that when several unregistered types are identified, a protocol for each of them is drawn up separately, i.e. a fine is imposed for each type of activity not specified. But punishment is possible only if such activity was carried out for more than two months and the tax authorities were able to prove this fact (Article 4.5 of the Code of Administrative Offenses of the Russian Federation).

In addition, the tax service may refuse a VAT refund for an unregistered type of business, as well as oblige you to provide reporting that corresponds to this activity. In this case, the courts take the side of the taxpayer, since assigning an organization a specific OKVED code does not deprive it of the right to carry out other types of activities, and the tax benefit received from their conduct meets the criterion of being justified (for example, Resolution of the Federal Antimonopoly Service of the Volga Region dated April 26, 2012 in case No. A49-1563/2011).

In addition to the Federal Tax Service, claims under unregistered OKVED may arise from the Social Insurance Fund, because The rate of contributions for “injuries” depends on the type of main activity. Therefore, its change cannot take place without appropriate notification of social insurance. There is no fine for such a violation, but the calculation of insurance premiums by the Social Insurance Fund will be carried out at an increased rate if, according to the OKVED code registered in the state register, a higher tariff for contributions is provided than for the type of activity actually carried out, but not included in the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs.

Risks and liability

Federal Law No. 129 (Article 5, Clause 5) provides for mandatory notification of the government agency about changing/adding a type of activity no later than 3 days from the beginning of its implementation.

When wondering whether it is possible to carry out activities without OKVED, you need to clearly understand the main risks associated with the absence or non-compliance of codes:

- an organization engaged in activities that are not properly registered is recognized by the Federal Tax Service as unreliable;

- the tax service may challenge expenses associated with such an organization (IP) and even refuse to deduct VAT;

- if the Unified State Register of Legal Entities does not contain the necessary codes, the counterparty company may terminate the profitable cooperation.

You must be extremely careful when choosing codes, because if among those listed in the Unified State Register of Legal Entities some fall under the general taxation system, you will have to submit additional reporting. In this case, the tax service will require you to submit a quarterly income tax and VAT return.

Penalties

The Federal Tax Service may oblige an enterprise/entrepreneur to submit additional reports and even issue a fine for failure to provide them.

You can also earn a fine for activities without OKVED or for non-compliance of the type of work/service with the special tax regime chosen by the entrepreneur (for example, UTII).

According to Art. 14.25 Code of Administrative Offenses, Part 3, liability for carrying out activities without OKVED, if changes were not made to the state register in a timely manner, is commensurate with a fine of 5,000 rubles.

What could the new OKVED affect?

It is in the interests of the entrepreneur to submit information about changes in a timely manner also because the selected new code may fall under a preferential rate of insurance premiums.

Extra-budgetary funds must also be notified of the change or addition of new areas of services, work or production. The amount of the injury rate will depend directly on the main type of activity. When submitting the 4-FSS calculation for the 1st quarter, you should confirm the main type of work performed for the enterprise or indicate a new one.

If this is not done on time, the Fund’s employees have the right to set the maximum tariff for the current year. This will entail additional costs for the organization and recalculation of already accrued and paid contributions from the beginning of the year.

However, if a new type of activity falls under the application of reduced tariffs for insurance payments to the Pension Fund and the Social Insurance Fund, the organization will save money (Federal Law No. 212 of July 24, 2009). However, it does not have to be the main one: it is important that during the specified period the volume of services provided or goods sold accounted for at least 70% of the total income.

The right to use these benefits should be confirmed quarterly using RSV-1 and 4-FSS reporting.

Other consequences

Negative consequences may also arise in relations with counterparties. Most large companies will not enter into an agreement if they do not find the corresponding OKVED in the extract from the state register of a potential business partner. This is also relevant for participants in public procurement, where in some cases the customer may reject a participant’s application without the required type of activity.

The policy of many banks also provides for the analysis of information in the Unified State Register of Legal Entities of clients and the activities actually carried out by them. Often, receipt of funds for goods and services not provided for by the OKVED code of a company or entrepreneur can lead to demands to provide explanations for the transaction, or to blocking of transactions.

Thus, the answer to the question: is it possible to carry out activities without OKVED will be negative. The exception is a one-time transaction, the profit from which does not differ significantly from the usual account turnover. In all other cases, before starting a new line of work, it is necessary to make changes to the Unified State Register of Legal Entities.

Conducting the activities of individual entrepreneurs without OKVED

The first of these codes acts as the main form, in relation to which the others will be used as additional forms.

Data on the main code is traditionally indicated: We describe typical ways to resolve legal issues, but each case is unique and requires individual legal assistance.

To quickly resolve your problem, we recommend contacting qualified lawyers on our website. Codes specified in the register that do not correspond to reality and requirements may arise: There are types of activities in which the selection of codes must be approached with particular care, for which it is necessary to make timely adjustments. The correspondence of indexes between documents and actual activities is important in some cases, which requires a careful approach: Attention!

There are situations in which tax inspectors study the OKVED forms assigned to individual entrepreneurs.

During the verification process, the following is analyzed:

- Documents involved in determining the taxable base and VAT deduction.

- Counterparties involved in the supply and acquisition of goods and materials.

- Data about partners specified in contracts.

- Information about suppliers listed in the state register.

An entrepreneur, using special areas of business that require careful selection of codes, must adjust the data to avoid losses.

In paragraph 5 of Art. 5 of Law No. 129-FZ states that a legal entity or individual entrepreneurs must notify the registration authority within 3 days.

IMHO “Registration of enterprises” (ed.

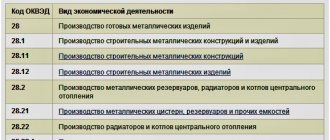

A.V. Kasyanova) (GrossMedia, ROSBUKH, 2008) Chapter 5. TYPES OF ECONOMIC ACTIVITY - production of products (rendering services). There are main, secondary (secondary) and auxiliary types of economic activities.

A secondary (secondary) activity is any other (not defined as the main) activity for the production of goods and services, i.e. types of economic activities related to various areas of production.

The products of primary and secondary activities are generally intended for sale on the market to third parties. When determining the main type of activity, activities that are an integral part of a single technological process are also not taken into account, and the entire process is classified according to the final product.

The main type of economic activity in this case corresponds to the OKVED grouping 51.38.21

, since it corresponds to a criterion value of more than 50% (52.5%).

We now know how the main type of activity of a commercial organization is determined; now let’s look at the example of a non-profit organization to determine its main type of activity. For example, a training center carries out the following types of economic activities: Since for no type of activity the value of the criterion exceeds 50%, we determine the value of the criterion for each section by adding the values of the corresponding (related to the section) types of economic activity.

The main type of activity is determined by the following indicators. The procedure for determining the cost of goods produced or services provided (in trade - gross income) is established by the relevant regulatory documents of the State Statistics Committee of Russia.

For financial and insurance organizations, the main type of activity is established in accordance with the statutory documents.

If they perform any other types of activity, the code of the main activity does not change.

The main type of activity is determined as of January 1 of the new reporting year on the basis of statistical data on the results of all types of economic activity of the reporting business entity for the past calendar year. An exception is a change in the charter that excludes the specified type of activity.

Thus, the size of the insurance tariff depends on the class of professional risk of the main type of activity of the legal entity (individual entrepreneur). If the policyholder is engaged in several types of economic activity at once, without confirmation of the main one, then he will be assigned to the type with the highest class of professional risk among the types of economic activity he carries out.

Problems with the Social Insurance Fund

If you engage in activities not specified during registration, problems will also arise with the Social Insurance Fund. The Fund may revise the size of the insurance tariff when calculating mandatory contributions for “injuries”, which remained with the Social Insurance Fund.

The FSS expects the entrepreneur to confirm the main OKVED code every year. If you do not send confirmation to the Fund or the declared code does not correspond to the information from the Unified State Register of Legal Entities (USRLE), the businessman will be set an increased tariff. This tariff is used for business entities with high professional risks. At the same time, the Fund is indifferent to what risks the entrepreneur actually has.

If you do not confirm the main type of activity, the tax burden will increase.

Engagement in activities not specified in the qualifier

Other consequences are much more dangerous - regarding taxes and contributions.

Ideally, OKVED codes in the Unified State Register of Legal Entities should clearly correspond to your transactions. Both missing and unnecessary activities can lead to annoying tax consequences.

Especially if you use a special mode. On imputation, it is safer to remove from the Unified State Register of Legal Entities all types of activities that do not fall under this special regime.

Otherwise, tax authorities may declare that taxes must be paid according to the general system. This position does not find support in the Russian Ministry of Finance. After all, if there is an exemption from taxes, then there is no need to report on them, officials believe (letter dated May 18, 2012.

No. 03-11-06/3/34 ). But it’s still safer to remove unnecessary codes from the registry. It is also dangerous to indicate the OKVED code in the declaration if it does not correspond to the tax for which you are reporting.

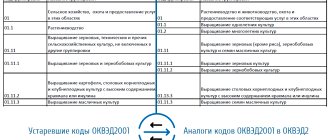

Assigning and changing activity codes

Data on the codes of planned types of activities are entered into the application in the established form when completing the application. An unlimited number of OKVED codes can be entered into the document for registration of individual entrepreneurs, form P21001. An exception is the type of activity that requires licensing or special reporting. To avoid misunderstandings, such indices (in the absence of plans for their use) should not be included in the list.

The first of these codes acts as the main form, in relation to which the others will be used as additional forms.

The choice of type of activity is made according to the OKVED directory. The business direction chosen as the main one with the code indicated on the first line of the application may not have a predominant volume of turnover or revenue. If an individual entrepreneur considers a direction a priority, pays attention to its development and conducts active business in a narrow sector with development prospects, his actions are legal. The determination of the main code is made by the entrepreneur based on a subjective approach.

Data about the main code is traditionally indicated:

- In reporting submitted to the Federal Tax Service and funds.

- When registering the tariff for insurance premiums paid to the Social Insurance Fund. The rate is set or confirmed annually.

- Client card used to inform partners. The document is not an official form, but is often needed to establish contact with new partners.

- When specifying data in contracts in the part containing the details of the entrepreneur. Information is entered at the end of the agreement when describing the counterparty.

- In other situations requiring the provision of information about the basic details of the individual entrepreneur.

In the course of doing business, an entrepreneur can change the direction of activity or introduce new forms. When the emphasis on activity codes changes, it is allowed to indicate a non-main index in documents without making changes to the constituent forms. The legislation does not prohibit the use of any of the codes as the main one.

In the process of business development, the need arises to add activities. You can enter new codes and remove irrelevant ones through the registration authority, for which you need to submit an application P21001 with data adjustments. There is no charge for changing information.