Engaging in entrepreneurial activity without registering as an individual entrepreneur is doing business without registering with the Federal Tax Service as an individual entrepreneur or without obtaining a license, if required. It is a violation of the law and is punishable by administrative and tax fines. They may also be subject to criminal liability.

If a citizen runs a business, even a small one, without registering as an individual entrepreneur or legal entity, he faces a fine for illegal business activities; in 2020, it is applied on the basis of articles of the Code of Administrative Offenses of the Russian Federation, the Criminal Code of the Russian Federation, and the Tax Code of the Russian Federation (calculation of additional taxes).

Legislative norms

In accordance with Art. 23 of the Civil Code of the Russian Federation, a citizen has the right to engage in entrepreneurial activity without forming a legal entity, but only after registering with the Federal Tax Service in the appropriate capacity - an individual entrepreneur (IP). In accordance with Art. 2 of the Civil Code of the Russian Federation, entrepreneurship is an activity that is carried out at one’s own peril and risk in order to make a profit. An entrepreneur is liable for his debts with all the property belonging to him (with the exception of things that are not foreclosed on under the Code of Civil Procedure of the Russian Federation).

Prosecution is carried out on the basis of the norms of the relevant codes. Thus, punishment for illegal business activities in 2020 is carried out under the following articles:

- tax - art. 116 Tax Code of the Russian Federation;

- criminal - art. 171 of the Criminal Code of the Russian Federation;

- administrative - 14.1 Code of Administrative Offenses of the Russian Federation.

How the tax authorities recognize entrepreneurship as illegal

The key points of judicial practice in cases of illegal entrepreneurship are discussed in the Letter of the Federal Tax Service dated 05/07/2019 No. SA-4-7/8614. It also contains the position of the Federal Tax Service on certain controversial issues.

What is important to know:

- The tax office must prove that the person is engaged in entrepreneurial activity. You cannot fine without proof.

- Signs of entrepreneurial activity are duration, systematicity and mass scale of transactions. Also characteristic:

- accounting of transactions, even if in a “notebook”;

- stable communication with clients and counterparties, for example, concluding contracts;

- purchasing property to make a profit, for example, if an apartment is filled with pipes for sale.

- The goal of systematically making a profit is proven by the testimony of counterparties, documents, account statements, advertising, display of samples and offers to buy. Typically, a person actively strives for systematic profit rather than receiving passive income.

- Lack of profit does not turn entrepreneurial activity into “non-entrepreneurial.”

What does the term "illegal" mean?

According to the law, carrying out business activities without registering an individual entrepreneur is illegal and is subject to prosecution. What does "illegal" mean? The answer to this question has already been given in the list of norms regulating entrepreneurship: without registration in this capacity with the Federal Tax Service of the Russian Federation. In addition, it is illegal to conduct business in a group of occupations for which the law requires obtaining a special permit - a license.

To identify facts of illegal business, Federal Tax Service specialists examine the following signs that indirectly indicate it (Resolution of the Plenum of the Armed Forces of the Russian Federation No. 18 of October 24, 2006):

- testimony of counterparties or clients who paid for goods or services;

- advertising, including in the form of samples and advertisements in the media;

- carrying out wholesale purchases;

- establishing connections and contacts with counterparties and clients to conduct business;

- availability of receipts or other documents on the sale of goods and provision of services;

- keeping records of transactions;

- concluding contracts for business purposes.

What is entrepreneurial activity

But first, what is entrepreneurship anyway? How does it differ from employment? And why is illegal business prosecuted by law?

The concept of entrepreneurship is established in Article 2 of the Civil Code. This is an independent, risky activity aimed at systematically generating profit. At the same time, the entrepreneur receives income not from the performance of labor duties, but from the sale of goods, performance of work, provision of services, and use of property. If you compare an entrepreneur with an employee, you can identify a number of differences.

| Entrepreneur | Employee |

| Independently establishes relationships with the consumer, performing the entire cycle from finding an order for a product or service to receiving payment for it. | Works under the control of the employer, often performing only one function in the customer service cycle. Receives payment from the employer. |

| He risks not receiving payment for his goods and services, but if successful, he disposes of business income at his own discretion. | Protected by labor legislation, receives a salary, regardless of personal results. In this case, the employer pays the employee only part of the profit he earned. |

| He independently provides his pension and health insurance, pays taxes on income received from business. | The employer pays for the employee’s pension, social and health insurance, and he also withholds and transfers personal income tax from the salary. |

If a business is conducted without registration, then the state does not receive anything from such a commercial entity. But at the same time, an illegal entrepreneur enjoys all the rights of a citizen, plus he can count on free medical care and a social pension. And this happens at the expense of law-abiding businesses and their employees, who pay taxes and fees.

The state is trying to return shadow business to the legal field in various ways, including by establishing administrative, tax and criminal sanctions.

Types of punishment

According to the current law, liability for illegal business activities in 2020 can be administrative, criminal and tax.

Administrative

According to Art. 14.1 of the Code of Administrative Offenses of the Russian Federation, a fine is imposed in the following amounts depending on the type of violation and its subject.

| Compound | Subject | Fine in rubles |

| Entrepreneurship without registration as an individual entrepreneur or legal entity | Individual | From 500 to 2000 |

| Without a license, if obtaining one is mandatory | Individual | From 2000 to 2500 |

| —//— | Officials | From 4000 to 5000 |

| —//— | Legal entity | From 40,000 to 50,000 |

Tax penalties for illegal business

According to Art. 116 of the Tax Code of the Russian Federation, running a business without registering is subject to a fine of 10% of income received in the course of business activities, but not less than 40,000 rubles.

Criminal

According to Art. 171 of the Criminal Code of the Russian Federation, a fine for illegal business activity, if the conduct of illegal business caused large-scale damage to citizens, organizations or the state (or income was received in such an amount), is assigned in the following amounts:

| Violation, composition | Amount of fine in rubles |

| Doing business without registration is not accounting | Up to 300,000 or income for 2 years |

| Doing business without a license | Up to 300,000 or income for 2 years |

In addition to a fine, the court has the right to impose compulsory labor or arrest. The maximum fine increases to 500,000 rubles or income for 3 years if the damage is particularly large or the crime is committed by an organized group.

Illegal entrepreneurship in administrative law

The Code of Administrative Offenses provides for penalties for carrying out illegal commercial activities.

1) A fine of 500 to 2000 rubles is imposed on a citizen who has not registered his activities as an individual entrepreneur or legal entity.

2) Carrying out licensed types of activities without obtaining the appropriate permit entails:

- for individuals - a fine of 2,000 to 2,500 rubles with the possibility of confiscation of means of production and products;

- for officials - a fine of 4,000 to 5,000 rubles with possible confiscation;

- for legal entities - a fine of 40,000 - 50,000 rubles with or without confiscation.

3) Violation of the requirements and conditions of the license is punishable by an administrative fine:

- for citizens - 1500 - 2500 rubles;

- for officials - 3000 - 4000 rubles;

- for organizations - 30,000 - 40,000 rubles.

4) Gross violation of licensing conditions is punishable by suspension of illegal business for up to 90 days or a fine:

- individuals - 4000 - 5000 rubles;

- officials - 4000 - 5000 rubles;

- legal entities - 40,000 - 50,000 rubles.

Establishing the fact of illegal business is the responsibility of the police, tax inspectorate, antimonopoly committee, consumer market supervisory authorities, and the prosecutor's office. They draw up a protocol on the offense during verification activities: conducting a test purchase, inspecting the premises and other necessary actions. The reason for the inspection may be a complaint from a dissatisfied client or any signal received indicating that a citizen is illegally engaged in business without registration or is committing irregularities in work.

Cases of bringing illegal entrepreneurs to administrative responsibility are dealt with by the magistrate at the place of activity of the individual or at his place of residence. The case of an administrative offense must be considered within two months after drawing up the protocol. Otherwise, the judge is obliged to make a decision to terminate the proceedings. An incorrectly drawn up protocol, the presence of inaccuracies or contradictions in it, often allows the violator to avoid punishment. While the protocol is being reissued by the body that compiled it, the period allotted by law for bringing a citizen to administrative responsibility may expire.

How to avoid punishment

To avoid liability for business activities without registering an individual entrepreneur, register with the tax authorities in a timely manner. In accordance with paragraph 70 of Art. 217 of the Tax Code of the Russian Federation, it is allowed to conduct the following classes without registering an individual entrepreneur (and paying personal income tax, but with filing a notification):

- tutoring;

- provide nanny services;

- apartment cleaning;

- aged care;

- help with household chores.

It is allowed to provide services under civil contracts, but without advertising, and for partners engaging performers under a civil law agreement. There is a risk that government agencies will consider such a partnership illegal and recognize that an employment contract has been concluded. Also, leasing property or a single sale of it is not a business activity, but tax must be paid.

There is another financially profitable way to “come out of the shadows” for those who conduct entrepreneurial activities: since 2020, in 4 regions, and since 2020 in another 9 regions, a new tax regime has been operating - the tax on professional income, or the so-called self-employed regime. Read more about registering as self-employed and the principles of applying such a tax regime in the article “How to become self-employed.”

Content

- What is entrepreneurial activity

- Types of illegal entrepreneurship

- Situation 1. Carrying out business activities without proper registration

- Situation 2. The type of activity does not match the one declared during registration

- Situation 3. Lack of necessary permits (licenses)

- Situation 4. Violation of licensing conditions

- Complaints about illegal business activities

- Responsibility for illegal business

- Criminal liability (CC)

- Administrative responsibility

- Tax code

- Civil liability

- Appeal

Types of illegal entrepreneurship

Illegal business activity is a business that does not meet legal requirements.

What law must a business violate to become illegal? In fact, the correct answer is either. There are many types of illegal businesses, but let's look at the most common ones.

Situation 1. Carrying out business activities without proper registration

Simply put, doing business without registering an individual entrepreneur or legal entity. The moment of registration is the date of entry into the appropriate state register.

It will be considered a violation not only to conduct a business without filing an application with the registration authority, but also to start such activities before receiving a positive response. State registration can only be confirmed by a certificate of the established form; until it is received, it is illegal to conduct business activities.

Recommended reading:

Business activities without registration and licenses: amounts of fines.

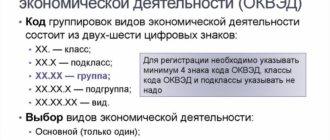

Situation 2. The type of activity does not match the one declared during registration

For example, an entrepreneur registered as an individual entrepreneur planning to open a car service center, but during the construction stage he decided to change direction to a roadside cafe, which he did not inform the registration authority about. Since the entrepreneur was not issued a permit to work in the catering industry, such activity will be considered illegal.

Situation 3. Lack of necessary permits (licenses)

For example, the sale of illegal alcohol or other unlicensed products. The full list of activities subject to compulsory licensing is specified in Article 17 of Federal Law No. 128.

Violations are considered to be situations in which:

- The entrepreneur did not apply to the relevant authority for permission when it was required by law;

- An application for a license has been submitted, but a positive response has not yet been received, and the activity is already underway;

- Commercial activity continues after the suspension or cancellation of the license or its expiration.

Situation 4. Violation of licensing conditions

Many violations fall under this category. For example:

- Violation of the conditions imposed on the product (the date of manufacture is not indicated);

- Violation of technical requirements for licensed activities (sanitary and hygienic conditions in food production);

- Activities outside the territory specified in the license.