Hello! In today's article we will talk about the investment activities of enterprises.

Today you will learn:

- The concept of ID and how it differs from financial activities;

- What types of investment activities exist;

- What are the characteristic features of ID?

Enterprises are elements in the structure of the state's economy. How efficient the economy as a whole depends on what they produce and what costs are required for it.

The foundation for the development of enterprises is healthy competition between them. Largely thanks to competition, enterprises reduce production costs, look for new technologies and methods for producing goods, and develop new products.

These manipulations cannot be carried out without investment. Therefore, investment activity becomes the most important for the development of an enterprise; without it, their work itself will raise questions.

Content

- The concept of investment activity

- Legislation on ID

- Purpose of investment activity

- Classification of targets

- Types of investment activities

- Subjects of ID

- Objects of investment activity

- Characteristics of the principles of investment activity

- Forms of investment activity

- Methods of investment activity

- Sources of investment activity

- Stages of ID implementation

- How is ID managed in an enterprise?

- What risks exist in enterprise ID

Registration of a tax deduction

Occurs according to the standard scheme, taking into account the broker’s status as a tax agent.

By type of deduction:

- Type A. I will provide a list of documents required from the VTB broker. It is standard. Source - VTB broker website.

- Type B. Provide VTB with a certificate from the tax office stating that the taxpayer - an individual - did not use a deduction for contributions (type A). Based on this certificate, the broker makes the calculation himself. If there was no deduction for contributions, then the amount of personal income tax payable = 0.

Purpose of investment activity

The goals of investment activities of enterprises include a set of various tasks and activities that need to be implemented in order to achieve success in business.

To clearly formulate goals, you need to solve the following tasks:

- Set goals so that they help realize each other;

- All goals must be interpreted unambiguously so that they are clearly understood by participants in investment activities;

- All goals are formulated so that they can be adjusted at the right time;

- Each goal should serve as an incentive for the enterprise to achieve planned results;

- All goals set by the enterprise must be realistic; this is why not only the potential of the enterprise is assessed, but also the external environment for investment;

- The goals of investment activity must be related to the main goal of any enterprise, namely making a profit.

What does a company's investment portfolio include?

An enterprise's investment portfolio may include various objects with different investment durations (short-, medium- and long-term).

It is short-term investment objects that have the highest profitability, but they carry the greatest risks and therefore require more detailed study and research.

Objects of the investment portfolio should differ in terms of liquidity, that is, the ability to quickly turn into free cash.

This indicator is especially important when the company is in dire need of working capital.

However, the portfolio should also include objects with low liquidity to ensure the company's sustainability in the future.

When forming an enterprise's investment portfolio, it must be based on certain principles, which in most cases include:

- Subordination to the enterprise strategy developed for the purpose of carrying out investment activities;

- Optimization in terms of profitability and riskiness of all objects of the investment portfolio;

- Optimization in terms of profitability and liquidity of investment portfolio objects;

- Creation of an investment portfolio management mechanism.

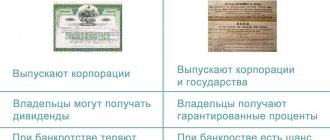

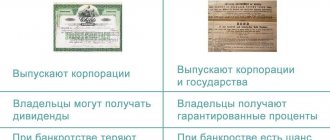

An investment portfolio involves distinguishing between two main types – real and financial investments.

Classification of targets

First of all, let us clarify that any goals can be aimed at:

- Achieving an economic effect (increasing profits and so on);

- For the formation and raising of the company’s reputation, that is, for moments that have nothing to do with the economy.

In addition, we present the following classification of the objectives of the investment activity of the enterprise:

| No. | Target name | Characteristic |

| 1 | primary goal | Increasing the profit and welfare of the enterprise and its owners |

| 2 | External goals | Formulated to evaluate the results that will be obtained from investments |

| 3 | Internal goals | Set to solve problems within the enterprise |

| 4 | Strategic Goals | Those that contribute to the development of the enterprise |

| 5 | Related goals | Aimed at achieving the main goal of ID |

| 6 | Reconstruction goals | Aimed at replacing or repairing production facilities that have reached the end of their service life |

| 7 | Secondary goals | A set of economic and non-economic goals |

The goals discussed in the table can be adjusted depending on the field of activity of a particular enterprise.

Freedom Finance

- Service fees

- Mobile application for Android and IOS

The investment company was founded in 2008. What sets her apart from others in this ranking is her work not only on the Moscow Stock Exchange, but since 2013 on the Kazakhstan Stock Exchange. Freedom Finance offices are open in Moscow, St. Petersburg, Almaty and other 26 cities.

There are 46 thousand clients registered on the Moscow Exchange through this company (approximately 4 thousand active per month) and 2.1 thousand IIS.

Advantages:

- Trust management, ready-made strategies.

- Distance courses, webinars, stock exchange university, free seminars for learning trading.

- Access to exchanges in the CIS, Europe, and the USA (but, according to the company’s website, it is focused on the American market).

Types of investment activities

In this part we will look at the most common types of ID:

- Investing through the investment of cash or securities. The main purpose of such investment is to earn profit, either in the form of interest or dividends. This type of investment is available to everyone if they have savings. To do this, you need to make a wise investment of money.

- Investment in the form of investment in production, provision of services, or performance of work (real investment). Its main nuance is that the investor simultaneously participates in the activities of the enterprise.

- Investing in the development of new technologies and various inventions. Very often, such investments involve a high level of risk, so such investments are usually made not by enterprises, but by individual investors.

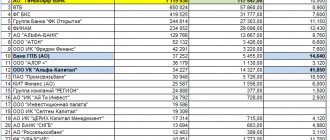

The best brokers for investing in the stock market

When choosing a broker, you need to pay attention to commissions, service costs, additional payments, but you cannot ignore the status of the organization.

Reputation, experience and stability are criteria that influence an investor’s willingness to entrust money. There are hundreds of brokers working in Russia, but most of them are small, sometimes occupying a specific niche. In the review, we presented the 10 largest companies, based on official data from the Moscow Stock Exchange on the number of clients. These are the best brokers on the market that are suitable for investing in Russian or foreign securities.

Subjects of ID

Let's talk about who the subjects of investment activity are and briefly characterize them.

So, the subjects:

- Investors (both individuals and legal entities);

- Customers;

- Contractors;

- Persons using ID objects.

Investors are the main subjects of ID. Investors can be either individuals. persons, legal entities, as well as foreign companies, etc.

Customers include both investors themselves and others.

As for contractors , these are those persons who perform any type of work specified in the contract. Contractors must have a license, which meets legal requirements.

Persons using ID objects are those individuals. and legal entity, state authorities and foreign enterprises, in general, all those for whom these objects were created.

Characteristics of subjects and objects of ID

The components of ID are its subjects (ID) and objects (OID). So, LEDs include:

- investors;

- customers;

- contractors;

- persons using OID.

Let us dwell on the characteristics of LEDs in more detail. In most cases, they are investors. Both individuals and legal entities can become self-employed persons. There are no restrictions in this direction for foreign enterprises registered outside the Russian Federation.

The customers can be the same investors or other persons.

A contractor is a person who performs a number of works specified in a contract. According to the norms of current legislation, the contractor’s activities are subject to licensing, that is, in order to carry out work, the latter must first obtain the appropriate permit.

The category of persons using OID includes those OID for whom, in fact, the presented objects were created.

The OID category usually includes:

- objects that have a certain value and have a material expression. OID includes movable and immovable property;

- money;

- intangible values, rights. Thus, the OID of an enterprise can be either a license or certificate, or copyright.

Characteristics of the principles of investment activity

Any type of investment is based on certain principles, thanks to which the most positive results are achieved.

Let us characterize them in more detail:

- Investment activity is voluntary. Each enterprise makes an independent decision whether to carry out such activities or not.

- Investment activities are protected by law.

- All subjects of ID have equal rights.

- Investment activity is a free activity. All its participants can choose any number of investment criteria.

- If the ID is conducted in full compliance with the law and does not violate it in any way, then the state. organs and other structures should not interfere with it.

Here we note that the relations between the participants of the ID are prescribed in an agreement or contract.

HYIP partisans - promising highly profitable investment projects

- Vellius Solutions - Start: 09/03/2020. Tariffs: 1) 1.3% daily for 3 days, deposit at the end of the term ($10-300); 2) 160% after 30 days, one payment at the end of the term ($10-300). Payouts: from 0.1$ on PerfectMoney and Bitcoin.

- LiveCandle - Start: 09/30/2020. Tariffs: 2.1% every day for 20 days, deposit at the end of the term ($10-100). Payouts: from 0.1$ on PerfectMoney.

- iStorm - Start: 06/15/2020. Tariffs: 1) 1.1% per day for 3 days ($10-300); 2) 1.2% per day for 7 days (from $301). The body of the deposit is returned at the end of the term. Payouts: from 0.1$ on PerfectMoney.

- Libre Trade - Start: 09/30/2019. Tariffs: 1% per day for 365 days (+265%), deposit included (from $50). Payouts: from 0.1$ on PerfectMoney, Bitcoin, Ethereum, Litecoin.

- Crystal Coin Online - Start: 05/04/2020. Tariffs: 1) 1.1% daily for 15 days ($10-250); 2) 1.2% daily for 20 days ($200-350); 3) 1.3% daily for 25 days ($300-450); 4) 1.4% daily for 30 days (400-650 days). Refund of deposit at the end of the term. Payouts: from 0.1$ on PerfectMoney.

- Dantex - Start: 09/13/2020. Tariffs: 1.1% per day for 5 days, deposit at the end of the term ($5-350). Payouts: from 0.1$ on PerfectMoney.

- Ramuz - Start: 07/16/2020. Tariffs: 1) 1.1% daily for 3 days ($10-300); 2) 1.2% daily for 5 days ($10-500). Refund of deposit at the end of the term. Payouts: from 0.1$ on PerfectMoney.

- CoinGeneration - Start: 03/28/2020. Tariffs: 1) 1.0% per day for 20 days (from $10); 2) 1.2% per day for 40 days (from $1001); 3) 1.4% per day for 60 days (from $5001). Refund of deposit at the end of the term. Payouts: from $0.5 to PerfectMoney, Bitcoin, Litecoin, Dash, Ethereum, Bitcoin Cash, Dogecoin.

Forms of investment activity

The form of investment activity is directly dependent on the organizational and legal form of the enterprise, as well as the form of its ownership. So, in enterprises investments are made through financial and real investments.

Real investments can be made in the following forms:

- In the form of acquisition or takeover of other enterprises;

- Through the construction of a new enterprise;

- Through the reconstruction of an existing enterprise;

- Through modernization of production.

If we talk in more detail about the first point, it is more typical for large enterprises that can afford to absorb an existing enterprise rather than build a new one.

Modernization of production is the most common form of investment.

As for financial investment, they are more typical for those enterprises that have significant funds or can attract large funds from outside. They make such investments in order to receive additional income.

The management of the enterprise decides which form of investment to choose, taking into account the level of inflation, interest rates on loans and other factors.

Portfolio of financial investments of the enterprise

The acquisition of financial investment objects involves investing free funds in various financial instruments, for example, government securities or legal entities in order to obtain a certain income.

This is an independent area of investment activity that is not related to operational activities, since its main goal is to generate additional income without physically using investments.

Financial investments of an enterprise have different durations, that is, they can be both short-term and long-term.

Investments in securities or other financial instruments are a rather risky undertaking, especially in conditions of instability in the global economy, but in many cases they bring a tangible positive effect in the form of high returns.

Methods of investment activity

The ID method is, first of all, those actions by which investment resources are attracted for the implementation of a specific project.

The most common methods are:

- Investment at the expense of the enterprise;

- Issue of shares or equity financing;

- Financing from budgets of various levels;

- Mixed type financing, that is, a combination of several methods at the same time.

Each of the listed methods has its own advantages and disadvantages; each enterprise chooses a technique within the framework of its developed ID strategy.

Best Mutual Funds 2020

| Name: | Rating by net assets |

| Mutual Fund "Sberbank - Global Debt Market". Here, funds are placed in corporate and government bonds EM and DM, whose nominal value is US dollars. Bonds are also purchased in other national currencies (all except rubles). The fund's management strategy involves the active transfer of funds from one debt security to another, depending on market conditions, as well as a constant search for new types of securities with the most favorable risk/return ratio. | 16 |

| Mutual Fund "Sberbank - Eurobonds". The object of investment is the state. and corporate debt bonds of issuers registered in Russia and the CIS countries. The denomination of the securities is US dollars. Other currencies are also possible, if there is a well-functioning mechanism for hedging the risks of their devaluation. The portfolio is diversified across industry sectors and issuers. | 5 |

| Mutual Fund "Sberbank - Emerging Markets". The investment object here is the Vanguard FTSE EM ETF, which is linked to the FTSE EM index. | 19 |

| Mutual Fund "Sberbank - America". The investment object is the SPDR S&P500 index ETF, linked to the American S&P500 index. | 18 |

| Mutual Fund "Sberbank - Global Engineering". Investments here are directed into shares of the largest engineering companies (both domestic and foreign in relation to the Russian Federation):

Papers in one way or another dedicated to mechanical engineering account for about 41% of the total funds of the mutual fund; for aircraft engineering – 25%; for other transport engineering – about 15%. | 22 |

| Mutual Fund "Sberbank - Global Internet". The mutual fund's investments are made both in shares and depositary receipts (ADRs/GDRs) of large companies operating in the field of Internet development. In addition, the portfolio also includes shares of index ETFs of the profile sector. | 3 |

| Mutual Fund "Sberbank - Europe". Investment object – ETF Ishares Eurostoxx 50 (linked to the EURO STOXX 50 index). | 21 |

| Mutual Fund "Sberbank - Consumer Sector". If you are interested in investing in the real sector, where there is increased liquidity, then you should pay attention to the shares of this mutual fund. Here, investments are made in shares of enterprises from the current consumption sector, moreover, operating in the Russian market:

| 9 |

| Mutual Fund "Sberbank - Natural Resources". Within the framework of the fund, securities (shares) of purely domestic mining enterprises are purchased (this means both hydrocarbons and companies mining and processing ferrous and non-ferrous metals, as well as precious stones). | 10 |

| Mutual Fund "Sberbank - Telecommunications and Technologies". The fund aggregates shares of Russian cellular companies and enterprises from the IT technology sector. | 15 |

| Mutual Fund "Sberbank - Financial Sector". Shares of domestic commercial banks of category A (first and second echelon of liquidity) are purchased. | 11 |

| Mutual Fund "Sberbank - Active Management Fund". Investments are made in Russian securities. companies of the first echelon of liquidity (“blue chips”). | 13 |

| Mutual Fund "Sberbank - Dobrynya Nikitich Share Fund". Most of the fund's assets are blue chips, but at the same time they are “diluted” by shares of the second tier of liquidity. | 4 |

| Mutual Fund "Sberbank - Small Capitalization Company Share Fund". Shares of issuing companies of the second echelon of liquidity are purchased. At the same time, only those shares that have a high, significant potential for increasing their value are purchased. (Above general market values). | 17 |

| Mutual Fund “Sberbank – Bond Fund Ilya Muromets”. The object of investment is growing. government and corporate bonds with medium and high duration. | 2 |

| Mutual Fund "Sberbank - Perspective Bond Fund". The object of investment is domestic debt securities (bonds), but only 2 and 3 echelons of liquidity. | 1 |

| Mutual Fund "Sberbank - Risky Bond Fund". Investments are made in bonds of the 2nd and 3rd echelons of liquidity. Only among them are selected those with the maximum potential for capitalization growth in the medium term. | 6 |

| Mutual Fund "Sberbank - Balanced Fund". Here the ratio of securities of various classes and categories changes depending on market conditions. This is the basis of a market-based fund management strategy. | 7 |

| Mutual Fund "Sberbank - Electric Power Industry". Shares of Russian generating, network and sales enterprises are purchased. | 14 |

| Mutual Fund "Sberbank - Biotechnologies". The investment object is the iShares Nasdaq Biotechnology ETF, which follows the Nasdaq Biotechnology Index. In addition to the shares of this ETF, the mutual fund portfolio includes ordinary and preferred shares of specialized foreign companies. | 8 |

| Mutual Fund "Sberbank - Gold". Investment object – ETF PowerShares DB Gold Fund. The price of ETF shares follows the trend of gold prices on the world market. | 12 |

| Mutual Fund "Sberbank - Denezhny". The investment goal is to earn money from placing funds in deposits of the most reliable domestic banks. Investments are also made in short-term bonds (both government and corporate). The priority is to maintain high liquidity of the fund's assets. | 20 |

Sources of investment activity

Sources of investment in an enterprise can be both enterprise funds and borrowed funds.

The amount of own funds includes:

- Authorized capital of the enterprise;

- Extra capital;

- Reserve funds, which include a certain amount of retained earnings from previous years.

Authorized capital cannot be considered a source of large-scale investments, since it must always be available to the enterprise.

Own capital can be called the most profitable option for investment, since in this case all the profit received remains in the enterprise, and there is no need to share it with anyone. The downside is that usually its volume is not enough for investment and borrowed funds will still have to be raised.

In this case, the company will be able to obtain a bank loan only if the credit institution is confident that the investment project will be truly successful and bring profit. If the loan is received, it will itself be considered an investment.

Enterprises that are considered the largest often issue shares. This is done in order to obtain the required amount of investment. Although it is worth noting that this is not only labor-intensive, but also costly, and not always successful. In order to resort to this procedure, you need to carefully analyze not only the market, but also have confidence that the shares will be bought at all.

Foreign investment is attracted to develop enterprises, especially in the form of new technologies or equipment. This task is carried out not only by the enterprises themselves, but also by the state. Creating a favorable investment climate is not an easy task; it is currently complicated by the economic situation in Russia.

Gazprombank

- Service fees

JSC Bank GPB rose to the top ten of Russian brokers in December 2020, gaining 37 thousand clients, beating Alor and Alfa Capital. In April 2020, Gazprombank's position strengthened. Now he has 42.5 thousand clients, 4.7 thousand active and 19 thousand IIS. At the same time, in terms of the total volume of transactions in April, the company was in 6th place - 1.38 trillion rubles.

Stages of ID implementation

The implementation of ID consists of several stages.

Let's look at them in detail:

Stage No. 1. Making a decision on the allocation of funds for investment

First, the goals are determined, and then the direction in which the investment will be made. To receive the necessary support from the state, it is worth conducting an examination and analysis of the chosen direction. At this stage, a business plan is not just formed, but relationships with partners are established that will last for a long period of time.

Stage No. 2. An investment project is developed and approved

Such a project includes:

- Package of design and estimate documentation;

- Developed business plan;

- Justification of investments at the economic level.

Both initial stages are the organizational part of the entire procedure. It will end with the signing of an investment agreement.

Stage No. 3. Procedure for creating an object for an ID

At this stage, the developed business plan acquires practical significance. An example of this stage is drawing up a work schedule.

Stage No. 4. The onset of the payback period

Typically, the payback period for a project is 2-5 years. This period begins to count from the moment when financing was started until the moment when the profit began to compensate for the amount of funds invested in the project.

Stage No. 5. Receiving and accumulating profit

After the payback period occurs, the process of accumulating the received profit begins. In the future, it can be invested in other projects, in the development of production, and so on. At this stage, they analyze what the difference is between the planned period of profit and the actual one.

Types of IF

The classification of investment funds in the Russian Federation and the world is different depending on their structure, goals and objectives.

mutual fund

A mutual investment fund is a mutual investment fund. In it, everything that the fund has is divided among investors in the form of shares. The management company of such an organization is obliged to invest savings in any project.

In such an investment fund, the common property is distributed among investors in the form of shares. The share confirms that the investor has ownership rights to a certain part of the funds. The essence of a mutual fund is that the team invests funds in a specific project. For example, shares, bonds, depository, loans, real estate rental. The operation of the mutual fund is enshrined in the laws of the Russian Federation.

The investor enters into an agreement with the management company for trust management, for which the management company receives a commission from transactions.

Management can be collective and individual. In a collective investment fund, the management bodies of the investment fund combine the savings of shareholders into one portfolio, then distribute them according to the share. With individual funds, each investor's funds are accumulated separately.

IF of Russia

The Investment Fund of the Russian Federation was created so that our state could invest in various projects.

The budget of the Investment Fund of the Russian Federation is formed from the funds of the external debt and Stabilization funds, a quarter of the budget consists of contributions from private investors.

Investment projects are selected according to the following scheme:

- Part of the ownership of the invested project is registered in favor of the state.

- Funds are sent from the investment fund to the authorized capital of the organization selected for investment.

- Commercial investors enter into an agreement with the Russian Investment Fund for a period of no more than 5 years and pay for participation in the project.

- Projects must be economically and socially beneficial to the state, meet its requirements and, if they cannot be implemented without state support.

- The cost of the project is more than 5,000,000,000 rubles.

- Other indicators are also determined.

The project is selected on a competitive basis by a commission under the Ministry of Economic Development of the Russian Federation.

Mutual IF

A mutual fund attracts a huge number of investors through cheap stocks, which allows for small deposits. And at the same time losses are reduced.

Hedge

There are very few of these in the Russian Federation, since they attract only professional investors with large investments. They try to get the maximum benefit for their deposits and in a short period of time, thereby exposing themselves to unjustified risks. Investment funds buy securities very quickly and sell them just as quickly. Mostly distributed in North America.

Check

Check investment funds were actively created in the Russian Federation in the early 90s of the 20th century and have now been abolished.

Their goal was the transition from state ownership to private ownership. They collected vouchers that were in circulation in the Russian Federation, and then used them to purchase shares of enterprises from the state.

Exchange traded

Such an investment fund has its own shares, which also participate in transactions on the stock markets of the Russian Federation. Their quotes change from the opening to the closing of the exchange. The shares are calculated daily after the end of trading.

What is the difference between a venture fund and direct investment?

PEFs usually try to get quick results by investing in companies that have been on the market for a long time and where the risk is minimal. Moreover, investments are made for a short period, but large amounts at once.

The venture fund is invested in various enterprises in the Russian Federation, including numerous startups, which may not develop, and therefore the money will be lost.

Such investment organizations must have a large income; the venture fund receives it from less risky projects.

What is the difference between a private foundation and a non-private one?

| Properties | Private | Not private |

| Owners | Private investors and legal entities within a limited group of persons | Investors, both individuals and legal entities, without restrictions |

| Tasks | Manages deposits for the benefit of individuals and companies, for example for one family or close friends | Entering the securities market, attracting investors and multiplying their profits |

| View | Closed | Open |

| Registration | Not approved by government agencies of the Russian Federation | In the Central Bank of the Russian Federation and the tax office, as a legal entity |

| Asset control | Produced by the founder, who is represented by a single person | Managed by a management company |

| Anonymity | Information about the investment fund is not publicly available. The owner's name may not appear on documents | The documents contain the details of the legal entity; information about shareholders is not indicated anywhere. |

| Asset Allocation | Not all funds can be used for investment; some can be used for your personal needs | The assets are entirely located in the investment fund and cannot be used otherwise than for activities within the framework of projects |

| Business continuity | With the death of the founder, the organization continues its work. | Does not depend on the death of one of the members of the management company, works until the license expires |

| Inheritance scheme | The owner himself determines the rules for the distribution of assets and the heir | Only shares of the investment fund are inherited; each investor determines the rules of inheritance. If there is no will, the action takes place within the framework of the legislation of the Russian Federation. |

| Composition of the investment fund | May be: founder, board of directors, guarantor, shareholders | Management company, shareholders |

Features of foreign funds

Foreign investment funds help invest funds in international projects and the economies of other countries.

Are divided into:

- Investment funds of one country. Investing only within one state.

- Regional. They can capture one continent, for example, Europe or Asia.

- International. Investment in several countries.

- Developed countries. Savings are accumulated in specific countries with stable economies.

- Global. They invest not only in other states, but also in Russian enterprises.

How is ID managed in an enterprise?

Enterprise ID is a complex process. It is diverse, it involves all the resources that are available in the enterprise. The outcome of such activities will directly depend on how correctly it is managed. Management is usually carried out by senior managers.

If we consider the investment activity management system as a whole, then all management structures must interact in it: financial, technical, etc. The result of the work of these structures is a clearly developed and justified strategy for the enterprise’s investment activity.

The strategy is developed as follows:

- Marketing research is being carried out. Market trends, the number of competitors, and whether specific products are in demand are determined;

- The technical capabilities of the enterprise itself are assessed. The technical service determines what is required in order to switch to the production of a new type of product, gives recommendations for improving existing equipment;

- The financial sector determines what funds are needed, what financial risks exist, and from what sources additional funds can be obtained.

As a result of joint work, an investment budget is formed, which records all income and expenses that will occur in the future.

How to evaluate the effectiveness of an enterprise's investments?

An assessment of an enterprise and its investment strategy makes it possible to determine whether the business entity is attractive to potential investors, including other legal entities, the state, credit institutions or individuals.

High investment attractiveness, based on the construction of a competent investment strategy, allows the enterprise to obtain additional sources of financing, which will be aimed at expanding production and strengthening the material and technical base.

In connection with this formulation of the problem, the assessment of the investment strategy should be carried out comprehensively across the entire enterprise and at its individual sections or hubs, so that it can show the most complete picture of what is happening at the enterprise.

Based on the data obtained, it is possible to draw conclusions about which areas of the enterprise’s investment strategy are most effective, and which of them should be carefully worked on to improve their effectiveness.

The assessment allows you to identify weaknesses in the investment strategy that should be abandoned in order to avoid negative results in the future.

How and why is an investment analysis of an enterprise carried out?

Investment activity is unthinkable without assessing the financial position of the company, the profitability of investment and the degree of risk. That is, without investment analysis.

Investment analysis functions:

- create a structure that collects data and coordinates activities;

- regulate the decision-making process;

- identify social, environmental, technological, financial and organizational problems that arise during the formation of the project;

- assist in making decisions about the feasibility of investing.

Investment analysis consists of 5 successive stages.

Stage 1. Setting objectives and defining goals

The purpose of investment analysis is to determine how profitable the investment will be and whether it is worth starting the project at all. Tasks will arise during the research process: their implementation together will lead to the achievement of the main goal.

Hypotheses are also put forward here . After completing the investment analysis, they are either confirmed or refuted.

Stage 2. Development of a research plan

The plan describes all actions and their sequence.

At this stage, the enterprise strategy is built and the most profitable areas of investment are determined. This is how the general policy of the company is formed.

In addition, the funds spent on the research itself are estimated and calculated. They are divided into monetary and temporary .

Stage 3. Collection of information

The essence of any research is the collection of information, which is carried out in different ways.

This:

- field research (collection of primary information);

- desk research (the study of secondary data on the basis of which conclusions are drawn).

As a rule, serious research involves the use of both methods of collecting information. The method used is also indicated in the plan.

Stage 4. Information analysis

To analyze all the collected information, it needs to be systematized and presented in an appropriate form. For this, tables, graphs, diagrams and other auxiliary tools are used.

An equally important point is checking the data for relevance. Some studies take quite a long time. Before making final conclusions, you need to check whether the information presented is relevant at the moment.

Stage 5. Summing up

The final stage involves obtaining answers to the main questions - will the investment be profitable, how high is the degree of risk and what problems will have to be solved during the formation of the project.

Based on the research conducted and the conclusions drawn, the necessary adjustments are made to the original plan and decisions are made. Of course, investment analysis does not provide a 100% guarantee of success, but it largely helps to assess the situation before launching a project.

Watch this useful video about the specifics of assessing intellectual capital and other issues of investment activity.