What is investment in agriculture

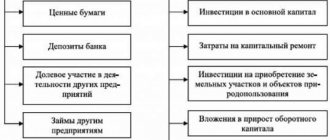

Investments in the agricultural industry have three main areas of investment:

- agricultural production;

- updating the material base;

- social sphere (infrastructure, construction of housing, cultural facilities, education and healthcare).

This can be lending to both large agro-industrial complexes and peasant farms. Private investment in agricultural projects, government grants for production development and other investment instruments are possible.

Agro-industrial complex of the Russian Federation and its features

People have always strived to purchase high-quality agricultural products, so there are guarantees that this type of activity promises its investors a stable income.

As for the development of the agro-industrial complex, it actively continues regardless of economic changes in the country; crisis situations have practically no effect on this process. Due to the growth in the value indicators of natural products on a global scale, there is a guarantee of receiving a stable profit after investing in this area. This has a positive impact on the economy because it helps to establish trade relations with any foreign country.

We should also not forget about the lack of investment; this is precisely the situation observed in the Russian agro-industrial complex today. As for the main sources of funds that ensure the development of agro-industrial complexes, attention should be paid to:

- Government investments;

- Private investment;

- Foreign investments.

The agricultural sector of the Russian Federation is experiencing a shortage of funds at this stage of its existence, because the available finances are not enough. This has a negative impact on the profitability of investing in the agricultural sector.

However, it is possible to correct the current situation if more people start investing in this direction. This will be a profitable decision because it will result in confidence and a high return on investment.

However, before investing in agriculture, it is very important to first familiarize yourself with all the nuances that have a direct impact on the efficiency of investing in this area.

The revival of agriculture in Russia - fundamentals, reality and myths:

Cons of investing

When considering the negative features of this type of investment, special attention should be paid to:

- Inability to make quick profits. To do this, it is worth remembering the situation within your own dacha. For a good harvest, it is very important to dig up all the beds in the spring; in the fall you will be able to harvest. As for investments, the same rule applies to them. You should not count on receiving quick funds after 6 months; sometimes even a year of waiting will not bring anything.

- Seasonality. A distinctive feature of our country is its rather harsh climate. This is a huge disadvantage due to the inability to obtain a harvest throughout the year.

- A large number of farms and lands in Russia, which lead to losses. This is explained by low levels of investment in the agricultural sector, a long period of time from initial financial investments to generate income, lack of money to update outdated equipment, and the lack of highly qualified workers in the agricultural sector.

Before investing your own finances in any enterprise, it is very important to first analyze its financial documentation and the state of the economy in general.

Advantages of investing finances

Next, we should consider the positive aspects of investing in agro-industrial complexes. Accounting is important here:

- Tax benefits. A producer of agricultural products can replenish the state budget by only 12%. Also, enterprises of this kind do not need to pay transport tax, VAT and property tax.

- When deciding to invest money in such an area, additional government support is possible. The authorities very often offer special conditions for attracting loans; all this is possible with this type of investment. Such benefits mean that the state undertakes to pay part of the amount of loans that were taken for the development of agro-industrial complexes.

- The state will support exports and prevent the import of imported products. The state strives to establish gentle duties on the export of Russian goods abroad. For example, if an entrepreneur is going to sell meat products to other countries, then he will pay only 15% of the established customs standards. If the same products are imported into Russia, the duty will rise by 60%. This moment is characterized by the support of domestic producers of agricultural goods.

- The relevance of real estate will most likely never be lost; objects will only increase in value. A good investment is the purchase of land and its subsequent resale, so you can get a good income. If you receive a loan, the land can become your collateral.

- The purchase of agricultural products is carried out by the state. This is necessary in order to ensure state control of the cost of social products and the formation of special funds.

Thus, the state provides guaranteed sales to manufacturers of these products.

Advantages and disadvantages of investments

Agriculture is one of the most promising areas in the economy.

The Russian government is interested in the development of agriculture and has approved a number of benefits to support it:

- reduced tax rates. Agricultural enterprises pay 12% tax to the budget;

- exemption from VAT, property tax and transport tax;

- special lending conditions. Part of the loan is compensated by the state in the form of benefits;

- state support for the Russian manufacturer. The customs rate for export is 15%, and for import – 60%. Which significantly stimulates agriculture in general;

- increase in the price of land suitable for agricultural activities. Farmland can be rented out, resold, or used as collateral when obtaining a loan.

But despite the support, investment in agriculture is insufficient. Russian farmers need more financial resources, and this shortage significantly affects the efficiency of investments.

Risks

Heterogeneity of climatic conditions creates serious problems for the successful promotion of investment projects in agriculture.

But there are types of risks that are typical for all regions:

- long production cycle. It is impossible to get quick income;

- most of the country’s territory is a zone of risky agriculture (low temperatures in winter, insufficiently fertile soils, etc.);

- dependence on the change of seasons, seasonality;

- shortage of qualified personnel in agriculture;

- a large percentage of outdated technology.

What does investing in the Russian agro-industrial complex give - 5 main advantages

The main advantage of investing in the agricultural industry is that agricultural products tend to constantly increase in value. There are seasonal fluctuations, but in general the price of food increases every year. The demand for products grown in environmentally friendly areas without the use of growth accelerators and chemicals is also increasing.

The demand for agricultural goods is also not decreasing. The population is growing, and therefore more and more food is needed.

Now about other advantages of agricultural investments.

Advantage 1. Tax benefits

The tax rate set by the state for agricultural producers is 12%. Representatives of other industries pay 24%. In fact, the agro-industrial sector is the only one in the Russian Federation for which such significant tax benefits are provided.

Agricultural enterprises are exempt from transport tax and some other fees. And on top of that, companies in this sector have the right to expect partial compensation from the regional or state budget for the costs of seeds, fertilizer and fuel.

Advantage 2. Creating conditions for attracting borrowed funds

Favorable conditions have been created for investors in agriculture to attract loans. Federal and regional structures subsidize the costs of servicing loans associated with investments in the agricultural industry.

Example

took out a loan from Sberbank with an annual rate of 13%. The state undertakes to pay the bank the main part of the commission - 9.5%, the rest is paid by the borrower himself.

This policy gives investors more freedom in finding financial sources for their projects.

Benefit 3: Import regulation

In the Russian Federation, favorable quotas have been introduced for producers of agricultural products. The state duty levied, for example, on the export of meat is equal to 15% of the customs value. At the same time, the import duty on similar products reaches 30-60%.

Advantage 4. Prospect for investing in land

The price of land tends to constantly increase. Investing in farmland for the purpose of subsequent resale of the territory is another way to get a guaranteed profit. The land is also used as collateral when obtaining profitable loans.

Advantage 5. Benefits of investment in agricultural production

Investments in agriculture give companies the right to subsidies and preferential conditions from the state.

For example, in order to regulate the price of grain on the domestic market, the Ministry of Agriculture of the Russian Federation established a special grain fund, the reserves of which are replenished through government purchases in harvest years. Thus, companies are not left without profit, and the country always has a supply of grain in case of shortage.

In recent years, there has been a steady increase in grain prices on the world market. This means that Russian farmers have a good chance of earning income from exporting their products.

In the table, the advantages and disadvantages of investing in the agro-industrial complex are presented in visual form:

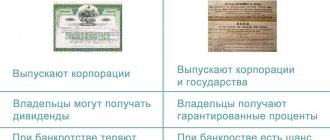

| № | Pros (+) | Minuses (-) |

| 1 | Tax benefits and partial reimbursement of materials costs | Long payback period |

| 2 | Favorable loan conditions | Ineffective insurance mechanisms |

| 3 | Prices for agricultural products are constantly rising | Low productivity growth |

| 4 | The value of land is constantly growing | Profits depend on climatic and seasonal factors |

See also the article “Investments in fixed capital”.

How to invest in agriculture: step-by-step instructions

It is impossible to create specific step-by-step instructions for investing. Each case is individual. But it is quite possible to set a general direction, a “road map”.

- Potential assessment. Agriculture is a resource-intensive business, so large investments will bring decent profits. If your own funds are not enough, you should think about borrowed funds. In this case, it is necessary to take into account the creation of a financial reserve.

- Determining the goal. What do you want to get out of your investment?

- Selecting an investment object. We carefully study the financial and technical characteristics of production. And it would be best to see everything personally, with your own eyes. Having 100 pieces of equipment does not mean they are suitable for work. The wear and tear of the technical park in some agricultural enterprises reaches 90%.

- Risk identification.

- Preliminary calculations. You know the total volume of investment, you have decided on the investment object and conducted its audit; now, taking into account the information received and the planned risks, preliminary calculations are necessary. And based on this, the final decision is made.

- Conclusion of an agreement.

Where to invest in the Russian agro-industrial complex - review of the TOP 3 investment options

To make it easier for future investors to choose objects, our magazine’s experts analyzed the market and identified the three most promising companies in terms of investment in the agricultural sector.

Study, compare, make decisions.

1) Peasant farms and Partners

Maslennikova’s peasant farm was created in 2016, but despite its youth, it has already achieved very specific results. The peasant farm successfully raises sheep, pigs and poultry.

To achieve these goals, an area of 22 hectares has been allocated, located in an environmentally favorable zone - in the Rzhevsky district of the Tver region. The farm's plans include increasing the number of livestock, building additional workshops and a workers' camp, and attracting more workers.

Peasant Farm and Partners invites investors to invest in a successful existing project and receive an income of 34%. The minimum deposit is 30,000 rubles, i.e. the program is available even for novice investors with small capital. Investors are provided with individual conditions regarding payment method and other parameters.

2) MirZemli

The group includes more than 20 operating enterprises operating in all sectors of the Russian economy. The year the holding was founded is 1991. During the formation of the organization, it specialized in trade operations and finance, mainly engaged in real investments in production, industry and agriculture.

The group offers private investors and companies interested in agricultural investments to invest money in farms in various regions of Russia - in particular, in the Yaroslavl and Moscow regions. Investors do not waste time on the construction of objects, but get into their hands a ready-made business with an established structure and a sales market.

3) GeoDevelopment

The main activity of the company is the development and sale of land assets. Investors are offered to buy plots in the Moscow region and are provided with consulting services on the maintenance and development of territories.

The company's activities also include:

- consulting and legal support when purchasing land assets;

- assistance in site management;

- market analytics;

- assistance in investment projects.

Investors have access to land for farming, construction of cottage villages, estates and estates.

Read a new publication on the topic of profitable investments - “Crowdinvesting and crowdfunding.”

Where to invest: review of the best investment options

My opinion is that it is best to invest in enterprises in your region. This brings with it a number of advantages:

- you know the specifics of your region and can correctly calculate and plan risks;

- availability. The possibility of personal control over the expenditure of funds and visual confirmation of their intended use.

You can contact the regional Ministry of Agriculture and, with the support of specialists, choose the most promising direction and enterprise for the project.

Or, alternatively, become a farmer yourself.

What problems may arise when investing?

In addition to the risks already mentioned, there are problems that a potential investor investing in agriculture may encounter:

- lack of insurance. The insurance market is reluctant to deal with uncertain risks;

- sales of products. You should look for partners and conclude supply contracts long before the harvest;

- equipped with modern technology. The cost of modern agricultural machinery is quite high; delivery from the manufacturer to the customer often occurs by rail, which is also expensive.

How to get grants from the state and from private investors

A grant is money that the budget allocates to cover business expenses as part of agricultural development programs.

The state sets a number of requirements for candidates, compliance with which will be the main factor in receiving a grant.

- Professionalism. Having a higher education or running an agribusiness for more than 10 years.

- Availability of 10% of the funds from the cost of the project in personal ownership (this percentage is minimal, each region sets its own, but not less).

- A well-developed business plan.

- Land is personal property and real estate is not.

- Product sales strategy. Ideally, confirmed offer agreements with buyers.

- Number of jobs created.

In addition to the state, private investment funds are involved in the allocation of grants. But their requirements are identical, and sometimes even stricter, than those of the state ones.

Russian private investment funds

Most often, investments are proposed in large projects in various areas of agriculture with an estimated investment volume of 50 to 200 million rubles and a payback period of 3-5 years, but there are also investors operating with amounts from 200 to 600 thousand rubles.

The number of investors varies significantly by industry. Thus, there are practically no funds willing to invest in feed production; 3 private investment funds offer investments in veterinary medicine. Number of investment funds ready to invest by industry:

- Fish farming 12;

- Greenhouse farming 15;

- Plant Science 16;

- Poultry farming 16;

- Livestock 25;

- Processing of agricultural products 26.

Private investors can be found on the Internet: to do this, type in the search bar “investment project”, “investment base”.

Alternatives

In addition to direct investment, obtaining grants and loans, there are other investment instruments for financing agriculture.

Here are two examples of alternative options:

- Since 2020, the state agricultural development program “Far Eastern Hectare” has been in effect. Anyone can take farmland in the territory of Buryatia, Transbaikalia and the Far East;

- acquisition of shares in large agro-industrial complexes. For example: Miratorg is the largest producer of meat and semi-finished meat products. Since 2013, the capitalization of the holding has increased by 86 billion rubles.

Reviews

Real people have left reviews on different types of investments on the Internet.

Having monitored reviews of different types of investments in agriculture, we can conclude: everything is very difficult. Our country is just at the beginning of its journey. And negative results are inevitable.

The main result at the present stage is that the state is interested in the development of agriculture and is ready to meet both investors and agricultural producers.

I hope that my article answered your questions. Write comments and share the link on social networks.