In our country, businessmen at the legislative level are given the opportunity to choose a taxation system suitable for running their business. In some cases, when making transactions, it is necessary to know which of the existing types is used by the counterparty. Let's consider this issue in more detail, and also try to figure out what a certificate of the general taxation system is. We will provide a sample of it in the article.

Why do you need a certificate?

In most cases, business partners require confirmation of the chosen taxation system in order to correctly calculate and pay fiscal VAT payments. Let us remind you that for violation of the rules, significant fines and liability are provided, including the seizure of accounts and the freezing of activities for up to 90 calendar days.

If the company has received documents from a partner that contain o, then it should request appropriate confirmation that the entity has the right not to allocate value added tax. Your company may receive a similar request. In this case, you will have to prepare a response sample: a certificate about the taxation system.

Letter IP is not a VAT payer

Contents: VAT collection has a significant impact on budget formation in the Russian Federation.

And the total amount of the tax itself is actually determined by three factors: This article is designed to help you figure out which individuals and organizations are VAT payers, whether a supplier is considered such, and whether it is true that an individual entrepreneur is not a VAT payer. So, let's find out who is a VAT payer in the Russian Federation and who is not recognized as such. The most important component of the VAT collection infrastructure are those who actually make this tax - VAT subjects.

This is important to know: Guidelines for filling out a VAT return: rules and procedure for filling out

According to the modern interpretation of the Tax Code of the Russian Federation, the following are recognized as VAT payers: Companies and organizations representing all forms of ownership permitted by law and engaged in any type of commercial or production activity (except for those mentioned in the relevant articles of the Tax Code).

How to prepare

Taxpayers who have switched to simplified tax regimes confirm their status with an official notification from the Federal Tax Service or provide a special form No. 26.2-7. Consequently, it is enough for “simplified” clients to send a copy of the Federal Tax Service’s notification about the transition to a preferential regime to the business partner. Or request a special information letter from the inspection.

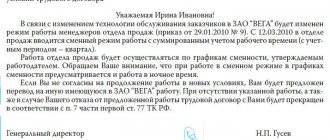

For subjects using the general regime (OSNO), a similar form is not provided. To confirm the selected mode, you will have to notify your partner by letter, drawn up in any form.

Help for OSNO

To compose a letter in any form, use A4 letterhead. Follow the general rules of business correspondence. Do not forget to indicate the required details of the written notification of the chosen taxation system:

- Information about your organization, individual entrepreneur. Enter the full name in accordance with the registration documents. Please indicate your actual and legal addresses. Enter the TIN, KPP, OGRN and other information if necessary.

- Date of registration. Separately indicate the date of registration with the tax authority. It is acceptable to attach a copy of the document.

- Data that the company is a payer of VAT or other fiscal obligation, depending on the request of the business partner.

How to confirm the OSNO tax system?

Tax for the year is due by December 1 of the year following the reporting year.

Taxes and payments for employees

Individual entrepreneurs and organizations on OSNO are required to withhold personal income tax on all income paid to their employees (including those working on a civil basis), as well as transfer insurance contributions to extra-budgetary funds.

Fixed contributions for individual entrepreneurs

All individual entrepreneurs, regardless of the chosen taxation system and the presence of employees, are required to pay fixed insurance premiums “for themselves” every year. In 2020, their amount is 40,874 rubles.

Reporting to OSNO in 2020

Below is all the main reporting that must be submitted by individual entrepreneurs and LLCs under the general taxation system:

VAT declaration

Quarterly, due date - no later than 25 days from the end of the quarter. The format for submitting the declaration from 2020 is electronic. Submitting a declaration in paper form is equivalent to failure to submit reports and entails prosecution under Art. 119 of the Tax Code of the Russian Federation. VAT payers are also required to maintain tax accounting registers

: books of purchases and sales, journal of received and issued invoices.

Income tax return

Submitted at the end of the reporting period (1st quarter, half year and 9 months) no later than 28 days from the end date of the period. The annual declaration is submitted by March 28. If an organization makes advance payments on actually received profits, it must submit reports every month by the 28th.

Personal income tax declaration

Form 3-NDFL is submitted once a year until April 30. Form 4-NDFL has been canceled since 2020. More details about 3-NDFL.

Declaration on property tax of organizations

The declaration is submitted at the end of the year - by March 30 of the year following the reporting year. From 2020, settlements for advance payments have been cancelled.

Declaration of property tax for individuals

Individual entrepreneurs do not submit a property tax return.

Single simplified declaration

If during the tax period an organization or individual entrepreneur does not have objects of taxation and operations that result in the movement of funds through accounts and cash desks, they have the right, for certain taxes, to submit a single simplified declaration. It should be noted that the EUD for the OSN can only be submitted for corporate income tax and VAT (provided that there are no VAT transactions). In relation to personal income tax, the submission of EUD is not allowed.

KUDIR

The book of income and expenses is kept by individual entrepreneurs on OSNO and is necessary to determine the tax base for personal income tax. It can be filled out in paper and electronic form, but, unlike, for example, KUDiR on the simplified tax system, it is subject to certification by the tax authority. More details about KUDiR

For small organizations

Organizations that are small businesses (the average number of employees is no more than 100 people and the total amount of income, both sales and non-sales, is not more than 800 million rubles per year) can conduct simplified accounting, as well as submit simplified reporting, which consists of balance sheet and income statement.

For large companies

Large organizations on OSNO (commercial) are required to maintain full accounting records and prepare financial statements, which consist of:

- Balance sheet.

- Statement of financial results (formerly called “Profit and Loss Statement”).

- Statement of changes in capital.

- Cash flow statement.

- Explanations for the balance sheet and these reports.

Starting with reporting for 2020, it must be submitted only electronically.

For non-profit organizations

For non-profit organizations, financial statements consist of a balance sheet, a report on the intended use of funds and appendices to them. Starting with reporting for 2020, it must be submitted only in electronic form.

For individual entrepreneurs

Individual entrepreneurs on OSNO may not keep accounting records if they record income, expenses and business operations (KUDIR).

Reporting for employees

All employers are required to submit reports for their employees.

Combining SST with other taxation systems

OSNO can be combined with only two taxation systems: UTII and PSN. Combining OSNO with the simplified tax system and unified agricultural tax is not allowed. When combining OSNO with UTII and PSN, the taxpayer must keep separate records of income and expenses separately for each type of activity.

Sample certificate of general taxation system

A letter about the general taxation system submitted by the counterparty, drawn up according to the sample below, is a simple way to make sure that he pays value added tax (VAT). Taxpayer under OSNO (some details about this regime can be found in the article at the link: Taxation under OSNO - types of taxes) to obtain a VAT deduction, an invoice is required (Article 169 of the Tax Code of the Russian Federation). This document can be exhibited:

- The counterparty who pays VAT using OSNO. In this situation, sometimes they resort to a confirmation method such as receiving a certificate (letter, notification) from the counterparty stating that he actually uses OSNO.

- A person who applies a special taxation regime (unified tax on imputed income (UTI), simplified taxation system (STS), etc.) and is not a VAT payer. Such taxpayers in some cases are obliged, and as a general rule are not limited in the ability to charge VAT, subject to compliance with the obligation to pay tax (clause 3 of Article 175 of the Tax Code of the Russian Federation). In this case, in addition to clearly highlighting VAT in the contract, acts, invoices, it is desirable to obtain written confirmation that the counterparty has actually accrued and paid VAT on the required transactions.

So, upon receiving a request, the counterparty can submit on its own behalf a certificate-letter about the OSNO taxation system according to the sample, which can be downloaded in completed form via the link: Sample of filling out an information letter-notification on the application of OSNO.

Certificate of application of the general taxation system and its sample for the counterparty

In order for a letter or certificate to truly fulfill the function of confirming the application of OSNO and (or) other taxation systems, as practice shows, a number of requirements must be met:

- The ability to accurately determine who the information is coming from. A letterhead with details will help with this, and affixing signatures with a seal, if available (more information about how a company’s letterhead and seal can look can be found in our article at the link: Letterhead and organization seal - samples for LLC).

- An indication of the use of one of the universal modes - general or simplified taxation system. It is advisable to indicate from what time the tax system has been applied (this is especially important if the transition has been made recently), if possible, attach copies of documents that can confirm the specified information (for example, copies of tax returns for VAT, income tax).

- Indication of the use of special modes - when combined with OSNO or simplified tax system.

A certificate is a more formalized document compared to a letter. Often, a certificate is drawn up on a form by filling out the details handwritten or printed. It is advisable to produce a standard form of this kind if there are a large number of counterparties.

Obtaining a certificate about the applied OSNO system from the tax authority

In practice, there are situations when, when making a transaction for a large amount or entering into a long-term relationship, the buyer asks the supplier to present a certificate of application of OSNO from the tax authority. Taxpayer requests for information fall under several types of norms:

- Law “On the Procedure for Considering Appeals...” dated May 2, 2006 No. 59-FZ (hereinafter referred to as Law No. 59-FZ);

Source: https://xn--80apfbbighbel2n.xn--p1ai/dokumenty/kak-podtverdit-sistemu-nalogooblozheniya-osno

Demand or ask?

The current tax legislation does not provide for the obligation of the simplified tax operator to provide his counterparties with any evidence of the application of the simplified tax system. Therefore, it is impossible to demand such documents from a simplifier. However, he can be asked to provide evidence that he uses a special regime. Moreover, some simplifiers themselves, together with a set of documents, for example, an invoice or an agreement, submit a letter on the application of the simplified tax system for the counterparty. After all, it is easier to submit such documents than to spoil relations with your partners.

Is it possible to obtain a certificate from the tax office without going through a counterparty?

It happens that a certificate about the use of OSNO by the counterparty is needed, but a response to the corresponding request is not received from him. At the same time, the need for such a document may be acute, for example, among budgetary organizations that are controlled by higher-level and regulatory authorities. What to do in this case? Is it possible to obtain information from the tax authority? These are the questions taxpayers ask.

Position of the Federal Tax Service of the Russian Federation

There is an option to contact the tax authority to find out whether a third party fulfills the duties of a taxpayer on OSNO. The Federal Tax Service of the Russian Federation does not support it, fearing the mass practice of appeals.

At the same time, the main fiscal authority of the country argues its position with reference to subparagraph. 3 clause 17 of the administrative regulations of the Federal Tax Service of the Russian Federation, approved. by order of the Ministry of Finance of the Russian Federation dated July 2, 2012 No. 99n: tax officials do not have the right to give a legal assessment of any circumstances and events. Thus, the possibility of directly formulating the question of whether the obligations to pay taxes are properly fulfilled is excluded. However, there are variations of requests to which tax authorities are required to respond.

Norms of the Tax Code of the Russian Federation on tax secrecy

The likelihood of receiving an answer to the substance of the questions posed depends on whether the relevant information is a tax secret. This category includes any information, with some exceptions. In Art. 102 of the Tax Code of the Russian Federation, the list of exemptions includes the following data:

- on violations of tax legislation (subclause 3, clause 1, article 102 of the Tax Code of the Russian Federation);

- special regimes applied by the taxpayer (subclause 7, clause 1, article 102 of the Tax Code of the Russian Federation).

Thus, the tax authority is obliged to report these 2 parameters of the counterparty’s activities by force of law. Based on the answer to the question about special regimes, it will be possible to conclude whether the counterparty uses OSNO. It should be taken into account that only the use of the simplified tax system completely excludes the possibility of using the OSNO.

The request must be made according to the same rules as indicated above, clearly stating the questions in it. In addition, when drafting it, one should take into account the position of the Ministry of Finance of the Russian Federation, which is a superior body in relation to the Federal Tax Service of the Russian Federation.

Position of the Ministry of Finance of the Russian Federation

The Ministry of Finance of the Russian Federation, in its letter dated August 20, 2013 No. 03-02-08/33970, with reference to the decision of the Supreme Arbitration Court of the Russian Federation dated December 1, 2010 No. VAS-16124/10, indicated that information about the fulfillment by taxpayers of their obligations to pay taxes is not a tax secret, therefore, a request to apply OSNO should also not be left unanswered by the tax authority. At the same time, it was especially noted that such requests deserve attention if they are dictated by prudence in determining the counterparty.

Thus, according to the Supreme Arbitration Court of the Russian Federation and the Ministry of Finance of the Russian Federation, a request to the tax authority can be sent according to all 3 parameters:

- on the counterparty’s use of OSNO;

- bringing the counterparty to tax liability;

- application of special regimes.

There is judicial practice and the position of the Ministry of Finance of the Russian Federation confirming the legality of such a request and the obligation of the tax authorities to respond to the substance of the requests.

So, the letter or certificate has been received. Regardless of who submitted the certificate - the counterparty or the tax authority, the question inevitably arises: is such a document sufficient to completely protect oneself from claims from inspectors?

What document confirms the use of the simplified tax system?

Let us remind you that when switching to the simplified tax system, an organization or individual entrepreneur must submit to its tax office a Notification of the transition to a simplified taxation system (form No. 26.2-1, approved by Order of the Federal Tax Service dated November 2, 2012 No. ММВ-7-3 / [email protected] ) . In general, this must be done no later than December 31 of the previous year (clause 1 of Article 346.13 of the Tax Code of the Russian Federation) in order to become a payer of the simplified tax system from January 1 of the new year.

However, the tax inspectorate does not have the obligation to confirm that the organization (IP) has switched to the simplified tax system; the Federal Tax Service does not send in response either a permit or a notification about the application of the simplified tax system.

However, by order of the Federal Tax Service of Russia dated November 2, 2012 No. ММВ-7-3/ [email protected] Form No. 26.2-7 – Information Letter was approved. With this letter, the inspectorate can confirm that the organization or individual entrepreneur has submitted a Notification of the transition to the simplified tax system (in the form it is called an application), and also submitted declarations under the simplified tax system. Information about submitted declarations may not be available if the deadline for their submission has not yet arrived at the time of preparation of the information letter.

Confirmation of transition from special regime to OSNO

Taxpayers applying special tax regimes do not calculate or pay VAT, with the exception of some cases specifically specified in the Tax Code of the Russian Federation (import of goods into the Russian Federation, etc.). At the same time, it must be taken into account that in all areas of work, only organizations on the simplified tax system do not use OSNO, and users of UTII, Unified Agricultural Tax (unified agricultural tax), PSN (patent tax system) have the right to combine their activities with OSNO.

If the counterparty that applied the special regime switched to OSNO, then the cancellation of the special regime is completed as follows:

- By sending a notification or message to the tax authority - under the simplified tax system (clauses 5, 6 of article 346.13 of the Tax Code of the Russian Federation), unified agricultural tax (clauses 5, 6 of article 346.3 of the Tax Code of the Russian Federation). In this case, the tax authority does not issue a document confirming the transition.

- By deregistration - with PSN, UTII. Moreover, upon termination of the patent in accordance with clause 4 of Art. 346.45 of the Tax Code of the Russian Federation, a notification is not issued by the tax authority. If you refuse UTII, the tax authority in accordance with clause 3 of Art. 346.28 of the Tax Code of the Russian Federation is required to issue a notice of deregistration. The form of such a document, numbered 1-5-Accounting, was approved by order of the Federal Tax Service of the Russian Federation dated August 11, 2011 No. YAK-7-6/ [email protected]