To reduce the tax burden, small businesses are allowed to switch from the general regime to the simplified regime (STS). To do this, the enterprise should not be subject to restrictions prescribed by law. To switch to the simplified tax system, you must submit an application to the tax authority before the end of the year.

Let us recall the restrictions for application and the order of transition. Everything written below is also relevant for individual entrepreneurs, with the exception of certain points that we will explain throughout the article.

Basics of the simplified tax system

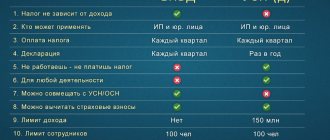

The use of the simplified tax system makes it possible to facilitate the preparation of reporting, and also reduces the number and amount of taxes paid. The transition to a simplified system exempts an enterprise from paying taxes such as VAT on profits and property, although there are a number of exceptions. Regional authorities have the right to independently reduce tax rates on the simplified tax system.

When submitting an application, an enterprise can choose an object of taxation

- "Income". Taxes are paid on all proceeds. The standard rate is 6% (at the regional level it can be reduced to 1%).

- "Income minus expenses." The tax rate is set at 15% , but regional authorities can set it at a rate from 5 to 15%. The difference between revenue and expenses is taken into account as the tax base. This means that the more expenses a company has, the less tax it will have to pay. The base is reduced only by the amount of expenses that are prescribed in Article 346.16 of the Tax Code of the Russian Federation. At the end of the year, it may turn out that the tax amount is less than 1% of the amount of income. In this case, you must pay the difference.

You can change the object of taxation starting next year.

In a simplified system, tax accounting must be kept in a ledger for accounting expenses and income , the form of which is approved by Order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n. The book does not need to be certified by the Federal Tax Service.

At the end of the reporting year, you must submit a tax return according to the simplified tax system : organizations - before March 31, individual entrepreneurs - until April 30 inclusive.

Accounting for losses during reorganization and regime change

An important point when carrying forward a loss to a future period is the transition from one tax regime to another. For example, an organization decided to switch to a general taxation system from a simplified one, or vice versa. In this case, it is impossible to transfer a loss from one tax system to another, that is, losses received under the simplified tax system do not transfer to the general regime and vice versa. The same applies to simplifiers who decided to switch from the “income minus expenses” mode to “income”. They do not have the right to carry forward losses to the next year under the new tax regime. Since under the simplified tax system “income” losses cannot arise and the tax base cannot be reduced on them. When the organization's activities are terminated due to its reorganization, it is also impossible to carry forward losses. An organization acting as a legal successor does not have the right to take into account the losses of the acquired company during the reorganization.

Who is allowed to switch to the simplified tax system?

The Tax Code specifies restrictions for the use of the simplified tax system , namely:

- number of employees - no more than 100 people ;

- You cannot switch to a simplified system if over the previous 9 months your income exceeded 112.5 million rubles . The amount of income is determined on the basis of documents - primary tax records. Sales revenue and non-operating income are taken into account. The amounts of taxes presented to the buyer are deducted from the income;

- the residual value of fixed assets, which are recognized by law as depreciable property, at the beginning of 2020 should not exceed 150 million rubles . This is considered property whose useful life is more than 1 year, and its original price was more than 100 thousand rubles . Article 256 of the Tax Code of the Russian Federation states that it does not include land, securities, natural resources, unfinished construction projects, etc.;

- the enterprise must not have branches;

- the share of other organizations in the authorized capital does not exceed 25%.

The last two points do not apply to individual entrepreneurs, since they do not have founders or branches.

Insurance companies, banks, microfinance organizations and some other companies whose activities are related to finance cannot switch to the simplified system. The simplified tax system is not available to those individual entrepreneurs and organizations that produce excisable goods, extract and sell minerals. The full list of restrictions is given in paragraph 3 of Art. 346.12 Tax Code of the Russian Federation.

Carrying forward losses under the simplified tax system

Absolutely any organization in the course of its business activities is not insured against losses. According to Art. 346.18 of the Tax Code of the Russian Federation, a loss is an excess of expenses over income. Accordingly, it is logical to assume that a tax loss can arise only for those organizations that apply the simplified tax system “income-expenses”.

Under the simplified tax system, in contrast to the general taxation system, only the difference between the income and expenses of the organization can be attributed to losses. For example, you cannot take into account a number of costs that do not directly lead to profit, but do not go beyond the scope of income-generating activities. Such expenses will not reduce the tax base. Under the general taxation system, according to Art. 265 of the Tax Code of the Russian Federation, losses received in the reporting (tax) period would be equal to non-operating expenses, namely: losses of previous tax periods identified in the current reporting (tax) period; amounts of bad debts (not covered by the reserve, if one is created); losses from downtime due to internal production reasons; losses from downtime due to external reasons not compensated by the culprits; expenses in the form of shortages of material assets in production and in warehouses, at trading enterprises in the absence of perpetrators, as well as losses from theft, the perpetrators of which have not been identified; losses from natural disasters, fires, accidents and other emergencies, including costs associated with preventing or eliminating the consequences of natural disasters or emergencies; losses on the transaction of assignment of the right of claim in the manner established by Art. 279 Tax Code of the Russian Federation. The list of expenses recognized under the simplified tax system does not include these non-operating expenses. Also, organizations using the simplified tax system do not separately determine the tax base for individual transactions (assignment of a claim, sale of depreciable property, land plots).

IMPORTANT IN WORK

The organization is obliged to keep documents confirming the amount of losses incurred for the entire period when it reduces the tax base of the current tax period by the amounts of previously received losses.

Carrying forward losses

The use of the simplified tax system by organizations does not exclude them from the possibility of transferring losses to future tax periods. This can be done within 10 years following the tax period in which the loss occurred. If a taxpayer receives losses not in one, but in several tax periods, they should be transferred to future periods in the order of their direct receipt (clause 3 of Article 283 of the Tax Code of the Russian Federation). This means that losses incurred in the earliest period are carried forward first, and then later ones.

For example, by the amount of loss incurred in 2020, the organization has the right to reduce the tax base until 2026. But if by 2026 the loss has not been completely written off, that is, the organization will not receive sufficient profit for this, it should be left outstanding. Writing it off after 10 years is not correct and carries a risk.

Writing off losses from previous years does not require the end of the current tax period. Write-offs can begin even from the first quarter of the current tax period, if there was a profit (Article 283 of the Tax Code of the Russian Federation).

There is another important point that must be taken into account when writing off losses from previous years. You cannot write off an amount of loss greater than the tax base calculated in this period. That is, if an organization using the simplified tax system “income-expenses” has a loss for past tax periods in the amount of 1,000,000 rubles, and in the current period a profit of 300,000 rubles was made, then write off the losses of previous years in this period possible for the amount of 300,000 rubles.

Do not forget about the minimum one percent tax, which must be paid if the tax calculated according to the general procedure turns out to be less than the minimum (clause 6 of Article 346.18 of the Tax Code of the Russian Federation). The fairness of this action lies in the fact that when receiving a tax calculated in a general way, in an amount less than 1% of income (minimum tax), the organization forms a loss at the end of the tax period. It will be possible to take into account as expenses of the next tax period the difference between the amount of the minimum tax paid and the tax calculated according to the general rules in this tax period. If after this the organization again gets a negative result, then the tax amount will be equal to zero. The financial result of the next tax period does not affect this in any way.

GOOD TO KNOW

If an organization decides to change its tax system, whether from the simplified tax system to the special tax system or vice versa, losses received under one system do not transfer to another taxation system, and vice versa: losses from other taxation systems are not transferred to the simplified tax system.

Transfer of losses in the event of termination of the taxpayer’s activities in connection with the reorganization of companies (clause 5 of Article 283 of the Tax Code of the Russian Federation) is not possible for organizations using the simplified tax system. The successor organization has no further right to reduce its tax base by the amount of losses of the organization affiliated to it received before the moment of reorganization. According to paragraphs. 4–9 tbsp. 50 of the Tax Code of the Russian Federation determines the successor organization (letter of the Ministry of Finance dated September 25, 2009 No. 03-03-06/1/617). Since when calculating the tax base for income tax, you can only take into account the loss that is formed according to the rules of Chapter. 25 of the Tax Code of the Russian Federation, the merging legal entity cannot take into account the loss of the merging organization that used the simplified tax system before the merger. According to para. 8 clause 7 art. 346.18 of the Tax Code of the Russian Federation, a loss received by a taxpayer when applying a simplified taxation system is not accepted when switching to other taxation regimes. The Ministry of Finance also included the case of reorganization in the form of merger or accession under this norm. When one or more legal entities are separated from the organization, the latter do not have legal succession in relation to the reorganized legal entity in terms of fulfilling its obligations to pay taxes (clause 8 of Article 50 of the Tax Code of the Russian Federation), therefore the right to transfer losses remains with the reorganized company.

GOOD TO KNOW

If losses are received in more than one tax period, such losses are carried forward to future tax periods in the order in which they were received.

Transfer of a loss in the event that the organization does not have primary documents confirming the amount of the loss

If the organization does not have any primary documents, the tax authorities have the right to tax savings, even if there is confirmation of the loss in the form of annual financial statements and tax returns. The lack of primary documents can become a serious problem when confirming losses of previous years that arose earlier than the established retention periods for documentation. Therefore, we emphasize: if you want to write off a loss in current periods, storing primary documentation for previous periods in which the loss occurred is mandatory. Required:

- Save accounting data and other documents necessary for the calculation and payment of taxes, as well as confirming income, expenses and taxes paid (clause 8, clause 1, article 23 of the Tax Code of the Russian Federation) for 4 years.

- The organization is obliged to store primary accounting documents, accounting registers and financial statements for the periods established by the rules of state archiving, but not less than five years, in accordance with Federal Law dated December 6, 2011 No. 402-FZ “On Accounting”.

According to established judicial practice, in the absence of the full volume of primary documentation, it is still not worth considering the situation as hopeless for writing off the loss. Many courts take the side of taxpayers, citing the fact that the amount of loss can still be confirmed not only by primary documents, but also by a balance sheet, profit and loss statement, balance sheets, general ledgers, explanatory notes, analytical statements, tax registers . In addition, a previously conducted tax audit is taken into account, which confirms the amount of the loss. And do not forget that checking primary documentation for years beyond three years is illegal (resolution of the Federal Antimonopoly Service of the North-Western District dated September 2, 2009 No. A56-28506/2008, resolution of the FAS Volga District dated November 18, 2008 No. A65-3230 /2008-SA2-41, resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated 02.11.2008 No. A11-2175/2007-K2-20/131, while the decision of the Supreme Arbitration Court of the Russian Federation dated 06.06.2008 No. 6899/08 refused to transfer this case to the Presidium VAS for review in the manner of supervision, resolution of the Federal Antimonopoly Service of the Moscow District dated December 8, 2008 No. KA-A40/10513-08, etc.). But, for example, the resolution of the FAS of the Far Eastern District dated 04/06/2009 No. F03-832/2009 (the decision of the Supreme Arbitration Court of the Russian Federation dated 06/19/2009 No. 6822/09 refused to transfer this resolution to the Presidium of the Supreme Arbitration Court) indicates the opposite: here the side of the tax authorities was accepted and the need for primary documentation is indicated, since only it determines the legality of reducing the tax base of the current period by the amount of the previously received loss.

POSITION OF THE MINISTRY OF FINANCE

If at the end of the tax period the taxpayer has incurred a loss and the amount of tax calculated according to the general rules is equal to zero, then the taxpayer has an obligation to pay the minimum tax.

— Letter dated June 20, 2011 No. 03-11-11/157.

Example 1.

Let the organization incur losses in both 2013 and 2014 in the course of its activities. At the end of 2013 - 10,000 rubles, at the end of 2014 - 5,000 rubles. Starting from 2020, the organization’s business went uphill, and in 2020 it was possible to earn 15,000 rubles, and in 2020 – 30,000 rubles. How much loss can be transferred?

The amount of the loss in this example does not exceed the tax base; accordingly, the entire amount of the loss in 2013 - 10,000 rubles - can be transferred to 2020, and to 2020 - the entire remaining amount of 5,000 rubles.

Example 2.

Suppose that during the activity of the organization losses were incurred both in 2013 and in 2014. At the end of 2013 - 20,000 rubles, at the end of 2014 - 15,000 rubles. Starting from 2020, the organization managed to make a profit: in 2020 - 15,000 rubles, and in 2020 - 10,000 rubles. How much loss can be transferred?

The amount of loss cannot exceed the tax base. Accordingly, part of the amount of loss in 2013 can be transferred to 2020 - 15,000 rubles. Then you can leave 5,000 rubles for 2020. from 2013, adding to them part of the loss of 2014 in the amount of 5,000 rubles. In total, a total loss of 10,000 rubles is transferred to 2016. The balance of the 2014 loss in the amount of 10,000 rubles. moves to 2017.

GOOD TO KNOW

Losses received when applying other taxation regimes are not accepted when switching to the simplified tax system.

Example 3.

Let’s say that at the end of 2020 I received a loss of 500,000 rubles. In 2020, this company was reorganized through a merger with Energo, as a result of which a new one was formed. How are losses transferred if both companies were on a common tax system?

Reorganization of a legal entity in the form of annexation of another legal entity entails recognition for the successor organization of losses of previous years incurred by the merged legal entities, subject to the availability of documentation confirming these losses, including tax returns in which the affiliated organization declared tax losses (letter from the Federal Tax Service for Moscow dated June 18, 2009 No. 16-15/061705, letter from the Federal Tax Service dated April 27, 2009 No. 16-15/041113, letter from the Federal Tax Service dated January 11, 2009 No. 19-12/000118 and resolution of the Federal Antimonopoly Service of the West Siberian District dated December 18, 2009 No. Ф04-6760/2009).

In this regard, for 2020 she will have a loss of 500,000 rubles, which she will be able to write off over the next 10 years.

Example 4.

Let’s say that at the end of 2020 I received a loss of 500,000 rubles. In 2020, this company was reorganized through a merger with, which also had a loss in the amount of 100,000 rubles in 2014. Based on this connection, a new one was formed. Both Svet and Energo did not exercise the right to carry forward losses until 2020. How are losses transferred if both organizations apply a common tax system?

For tax purposes, Svet-Energo in 2020 has the right to take into account losses totaling RUB 600,000. The successor organization "Svet-energo" in its tax return will have to reflect losses taking into account the losses of the annexed company, reflecting the number of tax periods in which the losses were incurred (letter of the Federal Tax Service of the Russian Federation for Moscow dated July 18, 2009 No. 16-15/06170) .

Example 5.

Let’s say that at the end of 2020 I received a loss of 500,000 rubles. In 2020, this company was reorganized by merging with Energo, as a result of which a new one was formed. How are losses transferred if you were on the simplified tax system?

Transferring Svet's losses to Svet-Energo will be impossible, even if it did not take advantage of such an opportunity before, since it was on the simplified tax system before the reorganization.

GOOD TO KNOW

Documents confirming the amount of loss incurred and the amount by which the tax base was reduced for each tax period should be kept for the entire period of exercising the right to reduce the tax base by the amount of the loss.

Transition deadlines

To switch to the “simplified” system in 2020, you must submit a notification to the Federal Tax Service by the end of this year. The form was approved by Order of the Federal Tax Service of the Russian Federation dated November 2, 2012 No. MMB-7-3/ [email protected] , and the electronic format was approved by Order of the Federal Tax Service of the Russian Federation dated November 16, 2012 No. MMB-7-6/ [email protected]

to submit a notification about a change in tax regime :

- personally;

- through an authorized representative;

- by registered mail.

When submitting a notification personally or through a representative, the filing date will be considered the day the form is received by the Federal Tax Service. If the document is sent by mail, the date indicated on the postal stamp.

The regulations for the transition to the simplified tax system are enshrined in Art. 346.13 of the Tax Code of the Russian Federation. Deadlines for submitting notifications for switching to the simplified tax system:

| New LLC or individual entrepreneur | Operating organizations and individual entrepreneurs | Payers of the single tax on imputed income |

| Simultaneously with the submission of documents for state registration or no later than 30 calendar days from the date of registration with the tax authority | No later than December 31 of the current year | Within 30 calendar days from the date of termination of the obligation to pay UTII |

| clause 2 art. 346.13 Tax Code of the Russian Federation | clause 1 art. 346.13 Tax Code of the Russian Federation | clause 2 art. 346.13 Tax Code of the Russian Federation |

Companies that are ready to switch to the simplified tax system next year will be able to use their right to switch only until the end of 2019 , otherwise the opportunity to switch will only appear from January 1, 2021.

Organizations that already use the simplified tax system can continue to work under it next year without additional notification to the tax office.

Write-off of fixed assets as expenses during “simplified” and OSN: what to pay attention to

There is one more nuance of the procedure under consideration for changing taxation systems. It lies in the fact that depreciation during the transition from OSNO to simplified tax system is applied according to special principles.

The fact is that it is used as a standard mechanism for transferring fixed assets to costs during OSN. However, the simplified tax system uses a different approach. Actually, a method such as depreciation may not be used in principle when simplified. Under the simplified tax system, fixed assets are written off directly.

However, it may turn out that the company can begin to use the operating system even during the operating system, and through depreciation only part of it will be written off as expenses. How, in this case, will a company, having switched to the simplified tax system, take into account the remaining cost of fixed assets in expenses?

After the transition from OSNO to simplified tax system has been made, fixed assets should first of all be counted and their residual value determined. In this case, it is tax accounting information that should be taken into account, not accounting information. After this, the residual value of the fixed assets can be attributed to costs that reduce the amount of tax paid to the budget under the simplified tax system - in equal shares. Their total number, as well as other nuances of write-off, will be determined by the service life of fixed assets.

For example, for objects that are subject to operation for 3 years, the residual value can be written off during the first year of operation of the company under the simplified tax system. In turn, if the objects are used for 3-15 years, then during the first year of operation under the simplified tax system the residual value can be written off as costs by 50%, in the second - by 30%, in the third - by 20%. If a fixed asset has a service life of 15 years or more, then its residual value is written off as costs over 10 years of the company using the simplified tax system - in equal parts.

Rules for filling out the notification

The form is easy to fill out, it only fits on one page, but you need to know the mandatory requirements:

- Choose object of taxation. In business it is believed that if the company's expenses are more than 60% of her income, it is more profitable to choose “income minus expenses”, if less than 60% is “income”.

The taxpayer has the right to change the object of taxation every year. The tax authority must also be notified of this before December 31 of the previous year. If an organization uses an object that is not specified in the notification, officials may make additional tax assessments.

- Indicate the residual value of fixed assets and the amount of income as of October 1 of the current year.

- If a notification is submitted through a proxy, the application form must indicate a document confirming his authority and attach a copy of it.

- The notification form should be filled out in 2 copies. One is kept by the tax office, the second by the applicant (with a mark of acceptance). Tax inspectors often ask to provide them with both copies; in this case, you can make another copy.

Features of loss accounting

Losses can be taken into account in tax calculations only at the end of the year. This cannot be done when calculating an advance payment based on the results of a quarter, half a year or 9 months. This is one of the features of loss transfer for. Organizations using the general regime can do this without waiting for the end of the tax period. They have the right to do this already based on the results of the first quarter. When calculating the amount of the annual payment, organizations using the simplified tax system have the right to take into account the loss of previous years. A loss can be carried forward for no more than 10 years. Thus, the loss received in 2020 can be taken into account until 2027. But if the loss is not written off in full by 2027, it will no longer be possible to write it off and it will remain outstanding.

One of the conditions for reducing the tax base by the amount of a loss is its documentary confirmation.

You can confirm your loss: (click to expand)

- primary documents (invoice, act, etc.);

- copies of tax returns;

- books of income and expenses.

Such documents must be stored for no less than the period during which they can be used for transfer. That is, even if the period for storing documents according to the law allows them to be destroyed or transferred to the archive, they will have to be preserved for the entire period of transferring the loss. In addition, these documents are additionally stored for another 4 years. The Ministry of Finance clarifies this in letter No. 03-03-06/1/278 dated May 25, 2012. Thus, the total storage period of the document confirming the loss is 14 years.

The loss can be taken into account as a whole amount in the current period, or the balance can be transferred to any permitted year (within 10 years). Moreover, losses received in several periods are taken into account in the order in which they were received. That is, the loss that occurred earlier in time will be taken into account first.

Also read the article: ⇒ “Annual tax under the simplified tax system in 2020.”

Confirmation of transition to simplified tax system

According to the requirements of the Tax Code of the Russian Federation, an organization should not wait for confirmation from the Federal Tax Service about the transition to another tax regime. After providing notification, you can begin working on the new system. But it is better to make sure that the actions are legal. You can go to the official website of the Federal Tax Service and see information about the transition to the special regime in your personal account.

If you still need a supporting document from the Federal Tax Service to conduct business activities, you must send a request. Within 30 calendar days, the tax office is required to provide a response letter indicating that the organization submitted a notification and has the right to apply the “simplified tax treatment.”

About the content of the norm.

According to paragraph 5 of Art. 346.25 of the Tax Code of the Russian Federation, organizations and individual entrepreneurs that previously applied the general taxation regime, VAT, when switching to the simplified tax system, comply with the following rule: the amounts of VAT calculated and paid by the taxpayer VAT on the amounts of payment, partial payment received before the transition to the simplified tax system for upcoming deliveries of goods, performance of work , provision of services or transfer of property rights carried out during the period after the transition to the simplified tax system are subject to deduction in the last tax period preceding the month of the taxpayer's transition to the simplified tax system, if there are documents indicating the return of tax amounts to buyers in connection with the taxpayer's transition to the simplified tax system.

This provision clearly states that an organization (IP) that has switched to the simplified tax system can deduct VAT paid to the budget upon receipt of an advance only if the tax amount is returned to the buyer. The period for applying the deduction is the fourth quarter of the year preceding the transition to the simplified tax system.

We believe that this rule is formulated taking into account the fact that before the transition to the “simplified” system, the organization enters into transactions at a price including VAT. After the transition to the simplified tax system, the legislator considers it appropriate to review the price of such transactions, which will be executed already during the period of application of the special tax regime. In this case, the amount of prepayments received is subject to adjustment for the amount of VAT (by returning the tax amount to the buyer).

On the application of the norm.

VAT accrued for payment to the budget in connection with the receipt of an advance payment can legally be accepted for deduction in the fourth quarter, provided that the organization simultaneously performs the following actions:

- signing additional agreements to contracts with customers on changes in the cost of services from 01/01/2018. This can happen in two scenarios. First, the cost of services can be reduced by the amount of VAT (for example, the initially agreed price of 590 rubles, including VAT - 90 rubles, will change to 500 rubles excluding VAT). Second, the cost of services in absolute terms remains unchanged, but it is renegotiated without VAT (for example, the initially agreed price of 590 rubles, including VAT - 90 rubles, will change to 590 rubles without VAT);

- refund of the tax amount to the buyer. Without refunding VAT to buyers, the supplier does not have the right to deduct VAT amounts calculated and paid from advance payments (Letter of the Federal Tax Service of Russia dated February 10, 2010 No. 3‑1‑11/ [email protected] ).

Thus, in the Resolution of the AS SZO dated December 12, 2014 in case No. A56-75087/2013, the judges considered it sufficient to accept the deduction of “advance” VAT by agreeing on the contract price in a version reduced by the amount of VAT and returning this amount of tax to the buyer’s current account. In the case under consideration, the VAT amount was returned to customers in December of the year preceding the organization’s transition to the simplified tax system. In our opinion, in the case of a VAT refund after the transition to the simplified tax system, but before the deadline for submitting the VAT return for the fourth quarter of the year preceding such a transition, the deduction is also legal. So, clause 1.1 of Art. 172 of the Tax Code of the Russian Federation, when switching from the basis to the usn, allows you to declare a VAT deduction on purchased and capitalized goods (work, services), for which invoices were received late (after the end of the tax period in which the delivery occurred, but before the deadline for submitting a tax return ), precisely during the period of their acceptance for accounting. Applying this rule by analogy, we can assume that by returning VAT amounts to customers before January 25, 2018, the organization has the right to claim a tax deduction in the fourth quarter of 2017.

The buyer’s tax actions related to changes in the supplier’s taxation system will depend on whether he used his right to deduct “advance” VAT at the time of transfer of the prepayment (provided for in clause 12 of Article 171, clause 9 of Article 172 of the Tax Code of the Russian Federation) or No. If the buyer has not applied the deduction of “advance” VAT, then he simply receives goods (work, services) upon receipt (fulfillment, provision) at cost excluding VAT. If a deduction was applied, then the tax must be restored on the date the seller returns the VAT amount to him (based on clause 3, clause 3, article 170 of the Tax Code of the Russian Federation).

In this case, no special invoices in pursuance of the provisions of paragraph 5 of Art. 346.25 of the Tax Code of the Russian Federation should not be drawn up.

* * *

There will be no problems with the tax inspectorate if the newly minted “simplified” interprets clause 5 of Art. 346.25 of the Tax Code of the Russian Federation literally, namely, it will qualify for the deduction of “advance” VAT only if it is returned to the buyer. To justify the return, the value of contracts concluded before the transition to the simplified tax system should be reviewed. To justify the deduction, you must have documents confirming the return. The organization has the right to pay the amount of VAT for the last quarter preceding the transition to the simplified tax system in accordance with the general procedure. That is, VAT for the fourth quarter of 2020 can be paid in three installments of 1/3 of the total amount of calculated tax: 01/25/2018, 02/26/2018 and 03/26/2018 (taking into account the rule for calculating the period in accordance with clause 7 of article 6.1 Tax Code of the Russian Federation).

VAT: problems and solutions, No. 2, 2020