A few words about the essence of financial statements

As any manager of an organization knows, financial statements are documentation that represents a complete and reliable picture of the economic, business and property status of the enterprise. The reports reflect:

- products manufactured at the enterprise, or work performed, or services provided - depending on the activities of the enterprise;

- income received from the sale of property;

- income received as a result of repayment of loans or interest on deposits;

- funds received from the shareholders of the enterprise;

- expenses for the purchase of raw materials and equipment necessary for production;

- loan repayment expenses;

- taxes paid and tax benefits received.

- and another hundred or so different items for which the company received any amounts during the reporting period or parted with some amounts.

Back to contents

Results

The tax period for income tax is one year. The duration of the first and last tax period in the life of an organization is determined according to the rules of Art. 55 Tax Code of the Russian Federation. In the income tax return, the reporting and tax periods are indicated in accordance with the codes specified in Appendix 1 to the Procedure for filling out the declaration.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Why is the reporting period and period code necessary in financial statements?

Some of the main requirements for financial statements, and, in principle, for any other accounting document of an enterprise, are completeness of the facts provided, reliability of information, measurability and comparability of information. That is why any report, not just accounting, cannot be “in general”, but must contain information for a certain period of time. Only in this way can one trace the dynamics of development (or, conversely, decline) of production and draw some conclusions or predict a certain result.

For example, by looking at the column “income from sold products of type A” in weekly reports, you can understand whether this product is in demand, whether it makes sense to continue producing it in the form in which it is now, or perhaps it is necessary to think about modernization, or, maybe discontinue it altogether - and all this can be understood only from a few numbers in the accounting document.

Coding of reporting periods is necessary to speed up the perception of information, as well as to reduce the time for filling out a document - after all, it is much faster to put a couple of numbers than to print eight to ten printed letters.

At the same time, for example, interim reporting, which is compiled exclusively for internal use and is not subject to transfer to the tax service, may not contain coding for the reporting period, but it is still better to get used to filling out any document as if it were “for parade” - this will avoid unpleasant moments, if an audit ever comes unexpectedly.

Back to contents

Reporting period

Each type of tax has its own reporting period with a code according to the general rule and for a consolidated group of taxpayers.

Income tax

Tax reporting periods are the 1st quarter, half a year and 9 months. Based on the results of the OP, declarations are provided, as well as on the results of the NP, with numerical values of the periods:

| Code as a general rule | Code for a consolidated group of taxpayers | Decoding |

| 21 | 13 | 1st quarter |

| 31 | 14 | half year |

| 33 | 15 | 9 months |

If the taxpayer expresses a desire to calculate the amount of the advance payment based on the monthly actual profit, then for him the OP will be the first month, two months, three months, and so on, on a cumulative basis until the end of the year:

| Code as a general rule | Code for a consolidated group of taxpayers | Decoding | |

| 35 | 57 | 1 month | |

| 36 | 58 | 2 | months |

| 37 | 59 | 3 | |

| 38 | 60 | 4 | |

| 39 | 61 | 5 | months |

| 40 | 62 | 6 | |

| 41 | 63 | 7 | |

| 42 | 64 | 8 | |

| 43 | 65 | 9 | |

| 44 | 66 | 10 | |

| 45 | 67 | 11 | |

Organizational property tax

The tax applies to the regional level of government. The laws of the constituent entities of the Russian Federation may not provide for reporting periods. But if they exist, then they are equal to the 1st quarter, half a year and 9 months.

For the category of payers that determines the amount of mandatory payment for the cadastral value of the property, the OP are the 1st, 2nd and 3rd quarters, that is, calculations are carried out for each period separately, without a cumulative total.

At the end of the reporting periods, advance payments are made and tax estimates are submitted. For these purposes the following are provided:

| Code | Decoding | |

| 21 | 1st quarter | |

| 17 | half year (or 2nd quarter) | |

| 18 | 9 months (or 3rd quarter) | |

| 51 | 1st quarter | during the reorganization of the organization |

| 47 | half year (or 2nd quarter) | |

| 48 | 9 months (or 3rd quarter) | |

Please note that the legislator determines the EP code during reorganization. This means that upon completion of the activity, along with the last declaration, the last payment must also be provided.

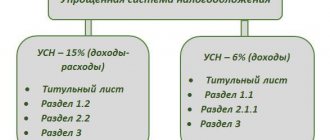

simplified tax system

The reporting periods under the simplified system are the 1st quarter, half a year and 9 months. Upon completion, advances are paid without submitting reporting documents. Therefore, only the above NP codes are defined for the simplified tax system, which are indicated when transferring funds to the budget.

Insurance premiums

Within the billing period, the 1st quarter, half a year and 9 months are considered reporting:

| Code | Decoding | |

| 21 | 1st quarter | |

| 31 | half year | |

| 33 | 9 months | |

| 51 | 1st quarter | for a reorganized (liquidated) organization |

| 52 | half year | |

| 53 | 9 months | |

Tax period code in financial statements

First of all, it should be noted that the reporting periods in tax and accounting documentation may not coincide and most often do not coincide. At the same time, both tax reporting and accounting have certain codes that undergo changes annually. Therefore, before filling out the necessary forms, it is better to double-check the available data on the codes in order to be absolutely sure that the documents are filled out correctly.

So for 2012 (accounting statements for which had to be submitted by March 30, 2013) the following codings were established:

- for the quarterly report – 21;

- for the half-year report – 31;

- for a report for nine months – 33;

- for the annual report – 34;

- for liquidation annual reporting in the event of dissolution (liquidation) of an enterprise - 90;

- for liquidation interim reporting in the event of dissolution (liquidation) of an enterprise - 94.

When filling out financial statements for 2013, the codes will need to be clarified.

Back to contents

How to indicate correctly

To eliminate possible disagreements and misunderstandings on the part of recipients of reports and mandatory payments, it is required to correctly indicate the tax period code in reporting documents, payment orders and payment receipts. The numerical designation of the NP is given simultaneously with recommendations for filling out tax returns and is indicated on the title page.

The use of numerical values is also provided for field 107 of the payment order for the correct identification of funds transferred to the budget.

Income tax

The NP for corporate income tax is recognized as a calendar year , at the end of which payers are required to submit tax returns, even if they have no income. NP code:

- 34 - in general;

- 46 – for legal entities calculating the amount of advance payment based on monthly actual profit;

- 50 – upon completion of the activities of the liquidated or reorganized organization.

a consolidated group of payers deserves special attention (Chapter 3.1 of the Tax Code of the Russian Federation). This is an association of organizations paying income tax for the purpose of calculating the mandatory payment based on the overall financial result. Calculation and payment are carried out by the responsible participant - a legal entity to which such responsibilities are assigned by the agreement. The meaning of the NP in this case:

- 16 - in general;

- 68 – when calculating actual income on a monthly basis.

Code 50 remains relevant for the group of taxpayers.

Organizational property tax

Similar to the previous paragraph, NP is considered to be a calendar year:

- 34 - in general;

- 50 – for the last year of activity.

simplified tax system

The tax period under the simplified taxation system (STS) is the year at the end of which the declaration is carried out taking into account the values:

| Code | Decoding | |

| 34 | year | |

| 50 | last NP | a reorganized (liquidated) organization or an individual entrepreneur completing its activities |

| 95 | when changing the tax regime | |

| 96 | upon completion of the activity for which the simplified tax system was used | |

UTII

The single tax on imputed income is calculated and paid quarterly. The declaration is also submitted:

| Code | Decoding | |

| 21 | 1st | quarter |

| 22 | 2nd | |

| 23 | 3rd | |

| 24 | 4th | |

| 51 | 1st | quarter for a reorganized (liquidated) organization or an individual entrepreneur terminating its activities, when the taxation regime changes, as well as the termination of activities subject to UTII |

| 54 | 2nd | |

| 55 | 3rd | |

| 56 | 4th | |

By quarter

Quarterly NP is also established for VAT. With the exception of information under production sharing agreements, period codes are established similarly to UTII.

Insurance premiums

In 2020, the Tax Code of the Russian Federation was supplemented with Section XI on insurance premiums. Reporting on such mandatory payments began to be sent to tax inspectorates.

Contributions are characterized by the concept of a billing period of a calendar year:

- 34 - in general;

- 90 – last year of activity.

Submission of interim financial statements

In addition to annual reporting, enterprises previously submitted interim accounting reports to the tax service: for a month, a quarter, and six months. The latest edition of the Law “On Accounting” abolished this requirement, however, some organizations (for example, insurance companies) still submit interim (intra-annual) reports. It is recommended for everyone, without exception, to maintain interim accounting reports within the enterprise.

Back to contents

Code 31 in financial statements

Code 31 indicates reporting for six months, starting from the first of January of the current year. The package of documents for this period should include:

- half-year balance sheet;

- financial results report for six months;

- report on changes in the enterprise's capital for six months;

- cash flow statement for six months.

According to the new legislation, semi-annual reports are submitted to the tax service only if this is provided for by Federal laws.

If information is nevertheless submitted to the tax service, statistical reporting must be submitted before July fifteenth, 2013, a profit report must be submitted before July twenty-ninth, 2013, and personalized accounting data must be submitted before August fifteenth, 2013.

Back to contents

Code 33 in financial statements

Code 33 is used to mark reports that contain information about the enterprise for a reporting period of nine months. That is, from the first of January, for example, 2013 to the thirtieth of September 2013.

The package of reporting documents is the same as for the reporting period of six months:

- balance sheet for nine months;

- financial statement for nine months;

- statement of changes in the enterprise's capital for nine months;

- cash flow statement for nine months.

Statistical reporting must be submitted by October fifteenth, 2013, a profit report by October twenty-eighth, 2013, and personalized accounting data by November fifteenth, 2013.

Was the information interesting or useful?

Yes28

No15

Share online

Determining the correct tax period for profits

The standard tax period, as stated, is one year. It usually lasts from January 1st to December 31st. But this is a general case, to which there are always exceptions. Among them, the most common case is the organization, liquidation or creation of a company in the middle of the year.

A separate period of time is determined for organizations that were created again.

- If registration took place in December, reporting is within the day of creation - the end of the next calendar year.

- Or from the date of creation until the end of the current calendar year.

Another segment will be for a company that is being liquidated or organized.

- Or from the beginning of the year until the reorganization is completed.

- Either from the date of creation until liquidation or reorganization.

Why is reporting needed?

As mentioned above, financial statements represent a very powerful layer of information about the activities of an enterprise. An intelligent manager who regularly studies financial documentation for reporting periods and compares information will be able to foresee ways of business development, assess the profitability or, conversely, unprofitability of certain areas of production, detect increased losses where this should not be, and a thousand other little things.

That is, accounting reporting is one of the effective tools for making far-sighted management decisions. In addition, reports must be submitted to the tax service to assess the activities of the enterprise and monitor the correct payment of all taxes due.

Back to contents

How many months are there in a quarter?

This term should not be confused with another similar concept “season”. After all, it is also equal to the fourth part of the calendar year. There are as many months in a quarter as there are in a season. But, unlike a season, which denotes 3 months of one season (spring, summer, winter and autumn seasons), a quarter is three months in order, one after another, not taking into account the time of year.

The beginning of the quarter count is the new calendar year. So, for example, the first quarter of the year consists of January, February and March - two months of winter and one of spring. And the first season - winter, begins a month before the onset of the new calendar year - in December and consists of three winter months. It is worth noting that not a single quarter coincides with the season.

An interesting fact: in the old days, the Slavs counted the New Year from the first month of spring - March. If a similar time calculation were used today, the quarter of the year and the season of the year would chronologically coincide completely and, perhaps, one of these concepts would be abolished.

VAT return so-called surcharge tax

An original and necessary form regarding reporting on this tax, as well as the procedure for filling it out, which must coincide with the norms approved by order in two thousand and fourteen.

Only two-digit numbers are used for encoding. The first digit is two, and the second identifies the quarter in order of chronology and quarter number. The rules that are established exactly the opposite determine the fiscal reporting that must be submitted for each quarter. These forms must be filled out for water tax or UTII indicating the codes that are indicated in certain tables. For example, code twenty-four using quarter four.

Tax code number twenty-one is a declaration to the Unified Tax when reporting in the first three months of one year (one quarter).