Russian companies and businessmen are given the opportunity to use one of several types of special tax regimes, the characteristic features of which are a lower tax burden and a minimum amount of reporting. The most popular is the simplified taxation system (STS), in which at the end of the tax period a special reporting form is submitted to the Federal Tax Service - a declaration. Let's find out what this document is and how it should be compiled.

Filing a declaration under the simplified tax system in 2020

The developed declaration form for “simplified” is essentially a calculation of the tax payable to the budget, and therefore must be completed and submitted to the Federal Tax Service within the established time frame. The frequency of submitting the form is once a year, but the deadlines depend on the organizational form: companies using the simplified tax system are required to report no later than March 31 of the year following the reporting year (due to the coincidence with a holiday, the reporting deadline for 2020 is 04/01/2019 .), for individual entrepreneurs the deadline is no later than April 30.

Tax payment is made by quarterly transfer of advance payments (for 1 quarter, half a year, 9 months). These calculations are not declared, they are taken into account in the annual document drawn up, and then the final amount of tax payable is calculated based on the results of work for the year.

Read also: Insurance premiums for the simplified tax system in 2020

Declaration of individual entrepreneurs on the simplified tax system for 2020

A large number of domestic individual entrepreneurs have switched to using or are already using a simplified taxation system. This is due to the advantages that the system offers: a minimum number of taxes, a small number of reports, and simple calculations of tax amounts to be paid. The use of the mentioned system obliges individual entrepreneurs to submit reports to the simplified tax system for 2020.

In accordance with current legislation, an individual entrepreneur must submit only one declaration per year, regardless of the chosen object of taxation: either income or income minus expenses. We emphasize that despite the need to pay quarterly advance payments, the individual entrepreneur simplified taxation system declaration for 2020 is submitted once.

In cases where an entrepreneur uses the labor of employees, he must submit tax returns in form 2-NDFL and 6-NDFL for all employees to whom he paid wages and withheld income tax. An entrepreneur does not have to file a 2-NDFL declaration for himself, since he is exempt from paying personal income tax. The individual entrepreneur does not provide any other reporting except in cases where the entrepreneur must pay any special taxes, for example, excise taxes.

Deadlines for submitting individual entrepreneur reports to the simplified tax system

The deadlines for submitting reports to the simplified tax system are the same for all individual entrepreneurs, regardless of the type of activity, as well as the number of employees or the object of taxation. The Tax Code has determined the deadline for submitting reports until April 30 of the year following the reporting year. The deadline for submitting information on the average number of employees is until January 20, the deadline for filing tax returns for employee income tax is until April 1.

Coronavirus has made amendments to reporting deadlines.

On April 2, 2020, Decree of the President of the Russian Federation No. 239 “On measures to ensure the sanitary and epidemiological well-being of the population...” was published, which established non-working days from April 4 to April 30, 2020 inclusive, with wages retained for employees.

If an organization or individual entrepreneur is not subject to restrictive measures in accordance with clause 4 of the Decree, then reports must be submitted within the deadlines given above. If restrictive measures apply, then the deadline for submitting reports is postponed and established by Government Decree No. 409 dated 04/02/2020.

Read more about this in the article: New reporting deadlines in 2020 due to coronavirus

The date of submission of the Declaration to the tax authority is considered:

- the date of receipt of the declaration by the tax authority if it is submitted personally or through a representative;

- date of sending the declaration by mail with a list of attachments;

- date of dispatch via telecommunication channels, recorded in the confirmation of a specialized telecommunications operator, when transmitted via telecommunication channels.

It is allowed to fill out the declaration either typewritten or handwritten using blue or black ink, but correcting errors using correction tools is not allowed. It is possible to print out the declaration on a printer.

Taxpayers using the simplified tax system who have chosen income as the object of taxation reduce the amount of tax (advance tax payments) calculated for the tax (reporting) period by:

- the amount of insurance contributions for compulsory pension insurance;

- compulsory social insurance in case of temporary disability and in connection with maternity;

- compulsory health insurance;

- compulsory social insurance against accidents at work and occupational diseases, which were paid in a given tax period.

Declaration under the simplified tax system for 2020

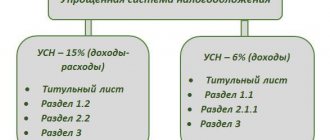

The document form was approved by order of the Federal Tax Service dated February 26, 2016 No. ММВ-7-3/99 and is still relevant. The simplified taxation system is used in two “modifications”, depending on the selected tax object:

- simplified tax system “Income” with a tax of 6% of the income received during the year on the simplified tax system;

- STS “Income minus expenses” with a tax of 15% of the difference between income and expenses.

This division is also reflected in filling out the declaration. The form is universal and contains sheets for both types of simplified taxation system, but depending on the option used, different pages are filled out:

- “Simplers” on the simplified tax system “Income” draw up the title page and sections 1.1, 2.1.1, 2.1.2 (when paying the trade fee) and 3 (if there were targeted income).

- For the simplified tax system “Income minus expenses”, sections 1.2, 2.2 and 3 are provided.

Only completed sheets should be included in the declaration, numbering them consecutively.

Section 2.2

Contains calculations for the “Income minus expenses” object.

| Line | What to include |

| 210-213 | Income for 3, 6, 9 months and a year on a cumulative basis. |

| 220-223 | Expenses for 3, 6, 9 months and a year on a cumulative basis. |

| 230 | The amount of loss for previous periods (if any) by which you will reduce the tax base this year. |

| 240-242 | The tax base for calculating advance payments, that is, the difference between income and expenses for 3, 6 and 9 months. If the difference is negative, that is, expenses were greater than income, put dashes in fields 240-242 and fill in fields 250-252. |

| 243 | Tax base for the year. The difference between income and expenses for the year and the amount of loss from line 230 (if any). If the difference is negative, put a dash and fill in line 253. |

| 250-253 | Amount of losses. Fill in these lines if income was less than expenses and there are dashes in lines 240-243. |

| 260-263 | Tax rate (generally “15.0”). |

| 270-273 | Amounts of advance payments for 3, 6 and 9 months and tax for the year. Lines 240-243 multiplied by the tax rate from lines 260-263. |

| 280 | Minimum tax. Income for the year from line 213, multiplied by 1%. |

If the declaration is zero, enter only the interest rate, and enter dashes in other numerical fields.

This is what the completed section 2.2 looks like:

Filling out a declaration according to the simplified tax system

We will briefly list all the details that need to be filled in by the “simplified” and will focus on calculating the tax and reflecting its amount in the document.

The title page contains information about the declarant. The TIN of companies contains 10 categories, individual entrepreneur – 12. The checkpoint is assigned only to legal entities, so the entrepreneur crosses out this field.

The title of the report is followed by the number of the adjustment - the primary report is “0”, the clarifying report is in numerical order, for example, the first adjusting report is numbered as “1”, the second – “2”, etc.

The period code for the declaration for the year is “34”; the same line indicates the year for which the report is being submitted. Below is the number of the Federal Tax Service Inspectorate, and on the right is encrypted its location, for example, code “120” indicates that the report is sent to the Federal Tax Service Inspectorate at the place of residence of the individual entrepreneur, and “210” - at the location of the company.

Next, indicate the name of the company or full name of the entrepreneur, the code of the main type of activity according to OKVED. If the company was reorganized, then in the following fields indicate its form before the transformation and the details of the former organization. Be sure to record the contact telephone number of the declarant, the number of sheets making up the declaration, as well as the number of sheets of documents attached to it, if any.

The lower third of the title page on the left is filled in by the declarant. It reflects information about who certifies the information specified in the declaration (“1” is the payer himself, “2” is his representative), the right part is intended for marks from the Federal Tax Service.

Having filled out the title, they proceed to the preparation of sections of the declaration, which, as we mentioned, are filled out in different ways and this depends on the form of the special regime applied.

Read also: Do I need to submit KUDIR to the tax office in 2020?

Declaration of an LLC on the simplified tax system for 2020

The reporting of organizations under this taxation regime is significantly reduced compared to other regimes. The tax return of an LLC using the simplified tax system for 2020 is submitted only once for the entire year, and all tax accounting consists of maintaining a book of income and expenses. Unlike the OSNO regime, organizations are exempt from paying income tax, property tax, VAT and have a number of benefits.

In order to confirm the main type of activity according to the tariffs of insurance premiums for injuries, all organizations must submit a selection of necessary documentation to their FSS department by April 15. A number of FSS branches ask that LLCs using the simplified tax system attach a letter written in free form to the application and confirmation certificate. It should reflect that the organization uses Simplified and calculates income according to the book of income and expenses. Legally, this request is not legal, but its execution eliminates unnecessary questions and simplifies communication with FSS officials.

All organizations using the simplified tax system are required to maintain accounting records. At the same time, Law No. 402-FZ and the Tax Code of the Russian Federation does not require the submission of any interim financial statements to the tax authorities; organizations are required to submit only annual financial statements to the tax authorities no later than three months after the end of the reporting year. However, due to the coronavirus epidemic, the deadlines for submitting financial statements have also changed.

What reports do organizations need to submit under the simplified tax system?

For the simplified tax system for 2020, organizations must submit the following documents:

- Tax reporting of companies:

- a tax declaration paid in connection with the application of the simplified tax system is submitted once a year before March 31 of the following year to the tax authority at the place of registration of the taxpayer in the established form on paper or in the established formats in electronic form along with documents that, in accordance with with the Code must be attached to the tax return.

- Form 2-NDFL, which must be submitted once a year before April 1

- Information on the average number of employees of the organization - must be submitted before January 20

- Quarterly reporting to the Pension Fund:

- For personalized accounting - individual information must be submitted quarterly

- Quarterly reporting to the Social Insurance Fund:

- All organizations must submit a report once a quarter in accordance with Form 4-FSS of the Russian Federation

Tax period codes

| Name | Code |

| Calendar year | 34 |

| Last tax period for reorganization (liquidation) | organization | 50 * |

| Last tax period when switching to a different taxation regime | 95 |

| Last tax period upon termination of business activity | 96 ** |

* This code is also used to indicate the last tax period upon termination of activities as an individual entrepreneur;

** This code is also used to designate the last tax period upon termination of business activities for which the taxpayer applied the simplified system.

Codes of the place of submission of the declaration to the tax authority, codes of forms of reorganization (liquidation) of the organization, codes determining the method of submitting the declaration, as well as codes of property (including funds), works, services received as part of charitable activities, targeted income, targeted financing which are required when filling out a tax return can be downloaded here .

Reporting to statistical authorities

Organizations using the simplified tax system, along with others, are required to report to statistical authorities. Most "simplistic" businesses are small or micro-enterprises. Small organizations are those that simultaneously meet the following conditions:

- the share of participation of other legal entities that are not considered small and medium-sized businesses in the authorized capital does not exceed 25%;

- the average number of employees for the previous year does not exceed 100 people;

- the volume of revenue (excluding VAT) for the previous year does not exceed 400 million rubles.

Microenterprises include organizations that:

- the share of participation of other legal entities that are not considered small and medium-sized businesses in the authorized capital does not exceed 25%;

- the average number of employees for the previous year does not exceed 15 people;

- the volume of revenue (excluding VAT) for the previous year does not exceed 60 million rubles.

It is necessary to pay attention to the following: Having received a written request from the territorial statistical bodies, the business entity is obliged to fill out and submit statistical information to them within the established time frame.

Based on the results of 2020, individual entrepreneurs will have to submit Form No. 1-IP to the territorial bodies of Rosstat. Deadline: no later than March 1, 2020.

Small enterprises are not exempt from statistical reports and submit quarterly form No. PM “Information on the main performance indicators of a small enterprise.”

It is filled out with a cumulative total for the period from the beginning of the year and submitted to the statistics department no later than the 29th day of the month following the reporting quarter.

Microenterprises submit form No. MP (micro) “Information on the main performance indicators of a microenterprise.” All micro-enterprises must report on it, except those engaged in agricultural activities. Form No. MP (micro) is annual.

Small trading enterprises additionally submit a quarterly form No. PM-torg (approved by Rosstat order No. 328 dated July 19, 2011)

Individual entrepreneurs engaged in retail trade submit annual form No. 1-IP (trade) (approved by Rosstat order No. 185 dated May 12, 2010).

Annual statistical reporting for the simplified tax system for 2019 will have to include the annual balance sheet, financial results report and appendices thereto. The procedure for submitting statistical reporting sets a deadline no later than three months after the end of the reporting period, that is, until March 31, 2020 inclusive .

Declaration of the simplified tax system 2020: sample filling for the simplified tax system “Income”

Section 1.1 is divided into reporting periods (quarters), in each of them the OKTMO code is indicated (lines 010, 030, 060, 090) at the place of registration of the individual entrepreneur or location of the company. If its value remains unchanged (i.e. the address of activity does not change), only line 010 is allowed to be filled in, the rest are crossed out.

Tax amounts payable by quarter (pages 020, 040, 070, 100) are calculated indicators that are calculated according to a specific algorithm. This involves data on income received, insurance premiums paid and advance payments. Let's look at the calculation of tax and its reflection in the declaration using an example:

summed up the results of work for 2020 and issued a declaration:

| Period | Income in rub. | Insurance premiums listed in rub. | Tax amount (6%) in rub. | An advance payment in rubles was transferred. | ||||

| Amount according to KUDIR | Page in Section 2.1 | Sum | Page in Section 2.1.1 | Sum | Page in Section 2.1.1 | Sum | Page in Section 1.1 | |

| 1 sq. | 620 000 | 110 | 15 500 | 140 | 37 200 | 130 (page 110 x 6%) | 21 700 | 020 (p.130 – p.140) |

| half year | 1 330 000 | 111 | 30 600 | 141 | 79 800 | 131 (page 111 x 6%) | 27 500 | 040 (131 – 141 – 020) |

| 9 months | 1 860 000 | 112 | 45 900 | 142 | 111 600 | 132 (page 112 x 6%) | 16 500 | 070 (132 – 142 – 020 – 040) |

| year | 2 410 000 | 113 | 63 000 | 143 | 144 600 | 133 (page 113 x 6%) | 15 900 | 100 (133 – 143 – 020 – 040 – 070) |

The declaration is filled out based on the credentials. Formula for calculating tax payable:

- in the 1st quarter - the amount of tax 6% of income is reduced by the amount of insurance premiums paid during the reporting period, but not more than 50% (clause 3.1 of Article 346.21 of the Tax Code of the Russian Federation);

— for the following quarters, the calculated indicator is also reduced by the amount of the transferred tax advances.

In the sample declaration completed according to this example, the amount of additional tax paid on the listed advances in 2020 amounted to 15,900 rubles:

Section 2.1.1.

Here there will be calculations for the “Income” object.

At the top, indicate the TIN, KPP (for LLC) and the serial number of the page

| Strings | What to include |

| 102 | Taxpayer identification: “1” for individual entrepreneurs with employees and LLCs. “2” for individual entrepreneurs without employees. |

| 110-113 | Income for 3, 6, 9 months and for the year on an accrual basis. |

| 120-123 | Tax rate (generally “6.0”). |

| 130-132 | The amount of advance payments for 3, 6 and 9 months (income from lines 10-123, multiplied by the tax rate). |

| 133 | Tax for the year (income for the year multiplied by the tax rate). |

| 140-143 | Listed insurance premiums for yourself and employees (if any) for 3, 6, 9 months and a year on an accrual basis, by which you will reduce the advance payment or tax. For individual entrepreneurs without employees, the value of lines 140-143 must be less than or equal to the value of lines 130-133, even if more contributions were transferred. For example, if the advance payment was 5 thousand, and insurance premiums for the same period were 7 thousand, you can only enter 5 thousand, because the payment cannot be reduced by more than 100%. For LLCs and individual entrepreneurs with employees, the value of lines 140-143 cannot be more than 50% of the value of lines 130-133, because employers can reduce payments by no more than 50%. |

If the declaration is zero, indicate only the interest rate; put dashes in other numeric fields. Even if you paid insurance premiums, you do not need to indicate them in the zero declaration, because there is no tax to pay, which means there is nothing to reduce.

This is what the completed section 2.1.1 looks like:

Declaration of the simplified tax system 2020: sample filling for the simplified tax system “Income minus expenses”

With this object, the tax base changes, therefore the tax calculation algorithm will change - costs must be taken into account, and the tax is calculated from the difference between income and expenses. The tax calculation is carried out in section 1.2, and the data necessary for it is entered in section 2.2, where, unlike section 2.1, the amounts of costs incurred are reflected on a quarterly basis.

Let's continue the example, taking the initial data on income from it, adding expenses and applying the simplified tax system 15% of the difference between income and expenses:

| Period | Income in rub. | Expenses in rub. | The tax base | Tax amount (15%) | ||||

| Amount according to KUDIR | Page Section 2.2 | Amount according to KUDIR | Page Section 2.2 | Sum (gr. 2 – gr. 4) | Page Section 2.2 | Sum (gr.6 x 15%) | Page Section 2.2 | |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| 1 sq. | 620 000 | 210 | 380 000 | 220 | 240 000 | 240 | 36 000 | 270 |

| half. | 1 330 000 | 211 | 720 000 | 221 | 610 000 | 241 | 91 500 | 271 |

| 9 months | 1 860 000 | 212 | 900 000 | 222 | 960 000 | 242 | 144 000 | 272 |

| year | 2 410 000 | 213 | 1 200 000 | 223 | 1 210 000 | 243 | 181 500 | 273 |

Based on the calculations carried out, supported by accounting data, fill out section 1.2: - page 020 = page 270 (advance payment for 1 quarter is listed);

— page 040 = page 271 – page 240 = 55,500 rub. (advance for 2 quarters);

— page 070 = page 272 – page 241 = 52,500 rub. (advance payment for Q3);

— page 100 = page 273 – page 242 = 37,500 rub.

The company must pay an additional simplified tax in the amount of 37,500 rubles. This calculation is presented in section 1.2 of the declaration:

Section 1.1

This part is completed based on the data from sections 2.1.1 and 2.1.2.

| Strings | What to include |

| 010 | OKTMO. If nothing has changed during the year, put a dash in lines 030, 060 and 090. |

| 020 | Advance payment for the first quarter. Line 130 of section 2.1.1 minus insurance premiums from line 140 of the same section and trade fee (if any) from line 160 of section 2.1.2. If the difference turns out to be negative, do not indicate it in line 020. |

| 040 | Advance payment due in 6 months. Line 131 of section 2.1.1 minus insurance premiums from line 141 of the same section, trade fee (if any) from line 161 of section 2.1.2, and the advance paid for the first quarter. If the value turns out to be negative, enter it in line 050, and put a dash in line 040. |

| 070 | Advance payment due in 9 months. Line 132 of section 2.1.1 minus insurance premiums from line 142 of the same section, trade fee (if any) from line 162 of section 2.1.2, and advances paid for the first quarter and half of the year. If the difference turns out to be negative, enter it in line 080, and put a dash in line 070. |

| 100 | Tax payable for the year. Line 133 of section 2.1.1 minus insurance premiums from line 143 of the same section, trade fee (if any) from line 163 of section 2.1.2 and advances paid for 3, 6 and 9 months. If the value turns out to be negative, it means you have an additional tax to pay, enter it in line 110, and put a dash in line 100. |

If the declaration is zero, put dashes in all numeric fields of the section.

This is what the completed section 1.1 looks like:

Start filling out from section 2.2, because... Based on it, the final data in section 2.1 is filled in.

15.png

Let us remind you that the declaration must be submitted to the Federal Tax Service even in the absence of activity and non-receipt of income (if there is no official record of termination of activity in state registers). It is not difficult to fill out a zero declaration under the simplified tax system 2020 - they draw up a title page, listing all the required details of the company and the Federal Tax Service, enter zeros in the calculation sheets (where the amounts should be indicated) and dashes in the remaining fields.

The declaration under the simplified tax system 2020 (form) can be downloaded below.