Currently, investing, that is, investing your own money in any object, is quite common. Investments contribute to the growth of capital owners' own assets or an increase in the company's production volumes. Individuals spend their profits on large acquisitions, and for some, investing is their main income. Capital investments can be of different nature and depend on the period during which it is planned to receive the invested funds and profits.

Long-term investments are in most cases carried out by large companies and large investors who have significant capital. Small amounts of money are not used in this case, since there is a risk of quickly losing money at the initial stage and completely losing the investment. It is more effective to use large sums: if part of the investment is lost, there is a possibility of returning a much larger amount in the future.

What is long-term investment

The investment opportunities for investors in the modern world are almost limitless. Those who dream of living in abundance and not thinking about their daily bread have dozens of investment directions and tools to choose from.

Investments can be short-term or long-term. Investments for short periods are designed to generate relatively quick and high profits. The payback period for such deposits ranges from several months to a year.

However, experts classify such investments as high-risk. The basic rule of investing works here - the higher the potential income, the higher the probability of losing everything.

Long-term investments are investments whose payback period ranges from 1 to 5 years. Such deposits are more reliable, characterized by increased stability and minimal risks.

The main disadvantage is that, by definition, you cannot expect quick profits from long-term deposits. Therefore, there is no point in placing funds in “long-term” investments if you need money in the near future.

Example

You want to buy the car of your dreams next year, but about 30-40% of the required amount is missing. You don’t want to borrow - you are an ideological opponent of loans. A businessman I know advises investing in effective tools to get the missing part.

Short-term investments are suitable for your purposes - investments in microfinance organizations, mutual funds, PAMM accounts, and at worst - bank deposits with favorable interest rates. Long-term investments are not suitable for you - you will have to wait too long for the withdrawal of working capital.

Investments with a long payback period are less susceptible to market fluctuations. Even bank deposits are devalued due to inflation and economic crises. But shares steadily increase in value over the long term.

Not everyone can successfully work with long-term investments. This requires qualities such as prudence, patience, and the ability to control your emotions.

The same shares periodically fall in price, and investors with unstable psyches begin to urgently sell off their assets. A smart and patient investor knows that a decline in prices is a temporary phenomenon, and therefore does not succumb to general panic.

Long-term deposits are not only financial investments.

This also includes:

- investments in construction or purchase of finished real estate for the purpose of further resale or rental;

- contributions to production;

- in equipment and machinery;

- into gold;

- into your own education.

The table clearly demonstrates all the pros and cons of long-term and short-term investments:

| № | Comparison criteria | Long-term investments | Short-term investments |

| 1 | Payback period | 1-5 years | From several months to a year |

| 2 | Profitability | High | Average |

| 3 | Risks | High | Minimum |

| 4 | Entry threshold | Significant funds are needed, with the exception of investments in shares | Short |

A few words about the psychology of investing. It is difficult for an ordinary person to change his passive attitude towards his own assets. Thinking like an investor is difficult and unusual.

The brain is designed in such a way that it is attracted mainly by immediate rewards. Few people think about long-term benefits. Postponing the reward until later seems like too risky a project. You never know what could happen in a year or two to the country, money and economy.

With this approach, you will not achieve the maximum effect from financial transactions. However, it is enough to calculate the lost profits for at least the past few years to understand what income you could have had right now if you had invested your free money in stocks or other assets with a guaranteed income a couple of years ago.

A useful link on the topic of profitable investments is “Investment Management”.

Kinds

Long-term investments have a complex classification.

They are divided by types of objects:

- Securities (stocks, bonds, bills, certificates of deposit);

- Material assets (construction, real estate, production, equipment, raw materials);

- Intangible assets (personnel, education).

By stages of development of the funded project:

- Completed – full implementation, with the prospect of development (increase in price). For example, an apartment in a new building (investment) has been put into operation, but internal renovation work is still being carried out, the infrastructure of the area is being improved, the transport issue is being resolved, etc. In 3-5 years, the value will increase by at least 2-3 times and then you can sell it for maximum profit.

- Unfinished – investments occur at the project development stage. Using the same real estate as an example, this is an investment in a house at the foundation-laying phase. With each floor raised, the value of the asset increases. By the time of commissioning (on average 2-3 years), the increase in price will be 25-30%, which will be the investor’s net profit.

Long-term investments by dividend payment type:

- One-time (one-time) – provides for receipt of profit at the end of the investment period, after the sale of all assets (real estate, securities).

- Distributed (possibly lifetime). For example, leasing commissioned buildings and structures.

Investment goals also have an important impact on both the amount of future income and the timing of the investment. It is customary to distinguish between strategic and profitable. The first is reaching the level of large business (acquisition, merger of companies, development of the economy of a district, city, region). The second is increasing your own capital.

What are the types of long-term investments - TOP 5 main types

There are dozens of types of long-term investment. The choice of instrument depends on the volume of working capital, level of financial literacy, and personal preferences. I will consider the most popular types of investments with a long payback period.

Your task is to compare, analyze and make the right decision.

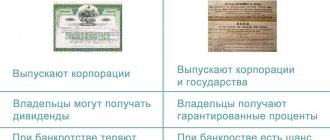

Type 1. Investments in securities

Investments in bonds, stocks and other types of securities are the most popular type of capital multiplication for investors with relatively low initial assets.

To start investing in stock exchange operations, it is enough to have 50-100 thousand free rubles. Some brokers open accounts starting from RUB 3,000. However, such an amount will not bring real profits, except to make sure that the tool works.

Shares are purchased through stock brokers: it is not recommended for beginners to buy securities directly - there is a risk of quickly losing funds by investing them in a financial pyramid or a shell company.

A brokerage account guarantees the legality of exchange transactions. In addition, individual financial consultants will work with you on the exchanges, who benefit from you making a profit and not losing it.

However, investing in securities requires a certain level of economic literacy. To begin with, it’s worth at least understanding how the exchange works and what level of income you should expect.

Read the dedicated article on this topic, “Investing in Stocks.”

Type 2. Strategic investments

Investments for people with substantial capital. The purpose of such investments is to acquire a controlling stake in a company and become its main co-owner. Projects of this kind sometimes last several years. Large corporations buy out small and medium-sized firms or promising startups and absorb them.

See “Investment in fixed capital”.

Type 3. Investments in construction and real estate

The real estate market, although not stable, is a promising investment area. People will always need housing, and businesses will always need offices, warehouses and retail space.

Acquired objects are used either for rental or for profit from subsequent resale. Investments in real estate under construction require investors to carefully study the project and make careful calculations at the preliminary stage. There are always risks of bankruptcy of the developer, dishonesty of the contractor and a sharp decline in the market.

Type 4. Investments in transport and equipment

You buy machinery, transport, high-tech production equipment, which is in stable demand. These assets are subsequently rented out, leased or sold at a higher price.

There is a risk of breakdown or significant wear and tear of equipment before the end of the lease period, as well as the risk of falling prices for equipment due to the rapid development of modern technologies.

Type 5. Direct investment in production

This includes expanding and modernizing our own production and investing in a ready-made promising business. Both options require significant capital and are available to people with high incomes.

In addition to direct benefits to the investor, real investment in production is beneficial in macroeconomic terms. Enterprises develop, new jobs appear, more goods are produced for the population, and the country’s welfare grows.

Due to the limited space of the article, I cannot talk in detail about other types of long-term investments - such as investing in gold, investing in works of art, investing in coins, investing in antiques or jewelry. Our magazine will definitely talk about these options in other thematic articles.

Attractiveness and disadvantages of long-term investing

Long-term investing is aimed at high income. If you choose the right property, the investment will pay off and can bring huge profits. By investing in long-term projects, you can pay less attention to the state of the stock market, exchange rates, resource prices, etc. In the future, the situation may change constantly. The disadvantage of long-term investing is the risk and large capital investment. All details must be calculated down to the smallest detail. When investing in the development of an organization, you need to study management features, check accounting, etc.

What are the sources of financing long-term investments - 4 main sources

Income from long-term investments is characterized by consistency and stability. You can make a profit from such investments for the rest of your life.

But to get started, you need sources of investment. Let's look at the 4 main sources of working capital.

Source 1. Own funds

These are the own assets of an enterprise or private investor.

These include:

- savings funds;

- net profits;

- payments under insurance or other partnership agreements;

- depreciation means;

- authorized capital of the company;

- specialized enterprise funds.

The so-called “retained earnings” of the company are invested in reliable and liquid instruments - construction, production, securities.

See Investment Portfolio.

Source 2. Loans and credits

If we don’t have our own funds, we borrow from someone else’s. We use long-term bank loans (including under preferential federal programs), loans from foreign funds or representatives of private capital.

Source 3. Budget funds

The state supports promising business projects and often helps budding businessmen take their first steps. Some areas, for example, investments in agriculture, are especially readily encouraged by government agencies.

Source 4. Raised funds

Another option is to use borrowed funds. This includes: equity participation in the development, share contributions of fund participants, sale of bonds and shares of the enterprise. Sometimes investors and sponsors are directly involved in a promising and commercially interesting project.

Purchase of securities

The basic principle of working with securities is based on buying at a low cost and selling at a higher cost.

The most popular among them are:

- Ordinary shares.

- Debt obligations (bonds).

- Preference shares.

Each of the three types of securities listed above has certain characteristics and is purchased for various reasons. For example, with long-term investments in shares, as mentioned above, there is an expectation of resale at a higher price.

In other words, by buying Sberbank shares for 65.00 rubles and selling them for 100 rubles, you can make a profit of 35 rubles for each share purchased. Taking into account the high liquidity of this security, its sale on the stock market will not be difficult.

Preferred shares are purchased primarily to receive dividends. The difference with ordinary shares is the right of ownership; the owner of a preferred share has a 100 percent opportunity to receive dividends, while the owner of an ordinary share may be left without such payments. However, in the event of a company bankruptcy, the holders of common stock have first rights of ownership.

The relationship between risk and return in the securities investment market

When purchasing debt securities, an investor expects to receive a stable monthly or annual interest payment. By purchasing bonds with a maturity of 5 years, the investor receives successive payments averaging a few percent.

Also, it is worth noting that no matter how profitable the investment opportunity may seem, you cannot invest in one single asset. The same applies to the purchase of securities. It is important to qualitatively diversify the investment portfolio, which would correspond to an acceptable level of risk and profit.

Strategic investments are considered to be the purchase of a large number of shares. In other words, to establish complete control over the enterprise. To gain control over a company, it is enough to have 50 percent plus 1 share in the portfolio.

In most cases, the process of acquiring a controlling stake takes the investor quite a long time.

How to invest in long-term assets - step-by-step instructions

General investment rules apply to all types of investments. But long-term projects have their own characteristics.

Read and practice the algorithm developed by experts. This will increase profits and reduce risks.

Step 1. Select investment options

An obvious step, but it needs to be mentioned. The choice of options depends on the amount of capital and individual preferences. If you are a private investor with small assets, your path is to invest in securities.

Investors with substantial funds have more opportunities - they have access to investments in production, strategic investments, and the purchase of real estate.

A professional approach involves a preliminary analysis of the effectiveness of the project. First, you need to at least calculate the possible profit and correlate it with the investment period. If the result is completely satisfactory, we proceed further.

Step 2. Collect information on selected objects

It was not for nothing that the founder of the famous dynasty of millionaires, Nathan Rothschild, said: “who owns the information, owns the world.” Information in the modern world is terabytes, but the phrase does not lose its relevance. True, investors today not only need to own information, but also be able to use it effectively.

Having chosen an object, collect all information about it that has practical value. Give preference to first-hand information - look for reviews and reviews of real investors, experts, experienced investors, catch the company's clients and interrogate them with passion.

Read analytical articles, studies, useful books (for example, Kiyosaki or Warren Buffett). Take your time, the market will not run away, and you will gain valuable knowledge.

Step 3. Make a forecast and make a decision

Once you have chosen your investment options, make a preliminary forecast. At this stage, it would be helpful to have the support of a professional financial advisor.

All that remains is to make the final decision and make a contribution.

Step 4. Buy shares

Shares are taken as an example; everything said below is true for any other type of deposit. Experienced investors advise purchasing securities at the time of the maximum drop in demand for them. This way you will buy assets at the best price.

The same principle is applied by real estate investors - they invest money at a time of prolonged market stagnation. But don’t wait too long for the right moment, otherwise the lost profits will outweigh the savings.

Step 5. Monitor the market

You can't invest money and forget about it. Experts advise periodically monitoring the state of the market in order to be aware of possible changes. Minor fluctuations in the economy have little impact on long-term investments, but you need to learn to distinguish temporary fluctuations from stable trends.

Step 6. Conduct an investment audit

To estimate the current value of an investment portfolio, it is necessary to conduct an audit or accounting of investments. The purpose of such events is to control the distribution of funds. An audit is especially important if you have invested in several different instruments.

If funds allow, delegate accounting to a third-party specialist - this will reduce the likelihood of errors and serious mistakes.

If you want to know the most promising ways to invest in the Russian and CIS markets, come to the free Passive Income marathon. There you will learn how to make money work for you.

What it is

Logically speaking, long-term investments are any investments designed for the long term. While this is technically true, the definition itself is not very useful.

So, to rephrase it slightly, a long-term investment is any investment with the greatest likelihood of maximizing returns over a 10-year period (or more) compared to competing alternatives. Perhaps this will be the most accurate and succinct.

Example

Land is the simplest example of long-term investment. How it works?

For example, a manufacturer who wants to expand his factory buys 300 acres of land. He uses 100 acres for development (factory buildings, offices), and holds the rest and leases it to other businesses. Thus, land ceases to be an inert asset and begins to be quoted as a long-term investment.

Which investments are not long-term?

There are types of investments designed to safely store cash while it is not used for other purposes. Therefore, they are not considered long-term investments.

This is about:

- certificates of deposit;

- savings accounts at a bank;

- peer-to-peer lending.

The usual time frame for short-term investments is 3 to 12 months. This means that short-term bonds with a shorter maturity period also cannot be classified as long-term.

Who provides assistance in long-term investing - review of the TOP 3 brokerage companies

For novice private investors who decide to invest in securities, the question of choosing an intermediary determines the future of their investments. Reliable brokerage companies guarantee the safety of deposits and help beginners understand exchange instruments.

Our magazine's analysts selected three time-tested brokers. These companies use transparent customer interaction schemes and provide free consultations to each user.

1) BCS Broker

The largest national broker operating on the stock market since 1996. Has an AAA rating from the leading rating agency of Russia. The total number of clients of the company is 130,000. Every third transaction on the Moscow Exchange is made by the BCS Broker investor. In 2015, the total volume of transactions exceeded 63 billion rubles.

Provides users with access to the world's leading exchanges, professional analytics and a large selection of services to improve the efficiency of trading operations. Clients can quickly open an individual investment account and remotely purchase and sell shares, options, futures, and bonds.

2) FINAM

The company was founded in 1994 and has representative offices in 90 cities around the world. The total number of broker clients is more than 400,000 people. The number of international and domestic awards and diplomas is more than 50. FINAM offers a record 18% per annum for passive investing.

A brokerage account opens in a few minutes. It takes about the same time to withdraw money. Trading recommendations from consultants are sent to your smartphone - the transaction is completed in one click thanks to the service of direct access to exchanges. Advanced clients have the opportunity to buy shares without intermediaries.

3) Global Finance

Earn money together with the world's largest corporations - Nike, Apple, Amazon, McDonald's, Microsoft and many others. Access to 24 of the world's largest exchanges, constant financial market analytics and immediate response from consultants to changes.

Assistance in the formation of portfolio investments, professional calculations of future profits, qualified forecasts. Each client receives: an individual investment strategy, a long-term financial plan, and personal investment advice.

Efficiency calculations

Calculation of investment efficiency is based on the results of a preliminary audit using financial ratios. Using financial ratios, you can obtain the following data:

- Profitability.

- Liquidity (solvency).

- Asset turnover.

- Market sustainability.

- Financial stability.

- State of fixed assets and their reproduction.

For each type of investment project, specialized long-term investment coverage ratios are selected. True, before using the multiplier, and certainly before making a decision, it is important to determine the net value of the investment project under study in which funds will be invested, or in other words, determine the NPV.

This indicator shows the difference between cash receipts and expenses, adjusted to “today’s time.” In other words, it shows the amount of money that an investor can earn from a project after the cash flows fully recoup its initial costs.

As a rule, if the NVP indicator is greater than zero, then you can invest in the project, but if the indicator is below zero, then it is worth abandoning the investment.

NVP calculation example

The investment amount is 115,000 rubles.

- Investment income for the first year – 32 thousand rubles.

- In the second year - 41 thousand rubles.

- In the third year - 43,750 rubles.

- For the fourth year - 38,250 rubles.

The discount rate is 9.2 percent.

Let's convert future cash flows into current values:

PV1 = 32000 / (1 + 0.092) = 29304.03 rubles.

PV2 = 41000 / (1 + 0.092)2 = 34382.59 rubles.

PV3 = 43750 / (1 + 0.092)3 = 33597.75 rubles.

PV4 = 38250 / (1 + 0.092)4 = 26899.29 rubles.

Net present value = (29304.03 + 34382.59 + 33597.75 + 26899.29) – 11,5000 = 9183.66 rubles.

Result: NPV is equal to 9183.66 rubles.

Precious metals are a very profitable way to invest money. Cash investment in gold can be called a win-win option. Read more about investment instruments.

Read here where to start looking for an investor for your company.

And here https://businessmonster.ru/gde-vzyat-dengi/kredityi/kreditovanie-malogo-biznesa-s-nulya.html you will learn about whether it is worth taking out a loan for a business from scratch if you do not have start-up capital. The nuances of obtaining such a loan.

How to make money on long-term investments - 4 practical tips

It takes several years to invest to make a tangible profit. You should not immediately sell off your assets if you notice signs of unhealthy activity in the stock market. Wait for a period of stability and you will benefit. People with a cool head and a sober view of things have a stable income and good money here.

Do not make serious decisions without consulting with advisors. Do not invest in instruments based on intuition or astrological forecasts. Intuition often fails even experienced players.

Follow simple, reliable expert advice.

Tip 1. Collaborate with brokers

A novice investor is nowhere without brokers. The broker is your eyes and ears. He has full information about the progress of trading operations, knows more than you about the state of your account, and even monitors tax deductions.

Basic rules for choosing an intermediary:

- look for brokerage companies with an extremely transparent operating algorithm;

- do not chase the minimum commission;

- at the preliminary stage, ask the company’s representatives as many questions as possible so that the mechanisms for making a profit become crystal clear to you.

If for some reason you are not satisfied with the broker, withdraw your money and look for another partner.

Tip 2: Invest in multiple stocks

Universal advice for investors - invest in different instruments and areas.

If you buy securities, split the money between 5-10 different companies. Combine stock trading with currency trading and options investing. This reduces risks and ultimately has a positive impact on your financial potential.

Tip 3. Buy stocks when demand is lowest

Buy when everyone is selling and vice versa. This is what advanced stock market sharks do, those who have the courage to swim against the tide. Follow their example and you will be happy. And don’t be nervous about the short-term volatility of assets – only amateurs are afraid of periodic fluctuations in value.

Tip 4. Evaluate your financial capabilities sensibly

Don't start a project if you don't have free money. It is worth investing only those funds, the loss of which will not in any way affect your standard of living. First create a cash cushion, then working capital.

Watch an interesting video on the topic of publication.

What investment instruments are best to choose to create a financial cushion?

What should you consider when forming an investment portfolio? How to invest in real estate wisely? Andrei Revenko, partner and managing director of the ATON private client unit, answered these and other questions in an interview with RBC. — When and with what amount does it make sense to start playing on the stock exchange, if you set a goal to create a financial “cushion” by the time you retire?

— Until the age of 30, you don’t have to think much about retirement. During this period, people, as a rule, are still covering their immediate needs - paying off a mortgage, saving for a car, and so on. In my opinion, there is basically no minimum amount here. The best thing about long-term investing is that even a small but regularly replenished amount gives a tangible effect in the future. The main thing is not to miss the moment of choice, when important needs are covered and a certain amount of free funds remains. For example, one of my friends had already closed two mortgages and did not know where to invest the money now. Should I take another one? But the situation with real estate prices is now unclear, and the return on investment for further rental is small - about 3%.

In long-term investing, even a small but regularly replenished amount gives a tangible effect

A person understands that he can buy an even higher class car, go to more expensive resorts, and go to expensive restaurants. Today, almost all banks provide an expense control service - you can log into your personal account and look at spending categories. Everyone decides for himself whether all expenses were so necessary. The appearance of senseless expenses that you begin to regret is the first signal that it’s time to think about investing.

By the way, most often people do not talk about long-term investing that will help them in retirement, they talk about creating a financial cushion in general, for all sorts of unforeseen situations. At the same time, there are noticeably more hired employees among investors. Entrepreneurs, as a rule, prefer to invest in the development of their own business.

— Your friend closed two mortgages. But here’s another situation: a person pays off his mortgage, and he has some free money left. Can they be invested?

- I am against this approach. The total return on a conservative investment is usually approximately equal to the mortgage rate. Therefore, the only rational tactic is to send all available money to pay off the loan and pay it off as quickly as possible.

Investments can be made more profitable than the mortgage interest, but this is already a significant risk, why is this necessary? After all, until the end of payments, the apartment belongs to the bank. Therefore, in my opinion, it is better to first close the loan and then start making regular contributions for your bright future.

— You mentioned the low return on investment from renting out real estate. Does investing in real estate even make sense now?

— Large diversified portfolios should probably include real estate. But you need to understand several features. This is the most illiquid part of the portfolio: you cannot sell it in one day, you cannot sell a quarter of an apartment and transfer it to bonds, for example.

And most importantly, you need to invest in real estate where the economy is growing. It may be a separate city or even a region, but there must be growth, and you must clearly understand why it will happen. If we are in a depressed economy, it is absolutely unprofitable to invest. This applies to both residential and commercial real estate, real estate purchased for resale, and those that generate rental payments.

You need to invest in real estate where the economy is growing

It is worth keeping in mind that real estate always lags behind stock indicators by a year: first, problems begin in the stock market, then in the real estate market. And in the opposite direction the same picture: first the securities market revives, then the real estate market.

— Russians have kept a significant part of their savings in deposits for the last 15 years. Is a rate cut a reason to change your strategy?

— If we are talking about long-term investing, then there should definitely be a bank deposit in the portfolio. You do not bear any risk in this investment; you can close the deposit and withdraw the money at any time. In the worst case, you can lose interest, but there is nothing to worry about. How much money should I keep in my account? This should be the amount that will be needed in the next six months to a year. Or when it is unclear whether it will be needed at all or not.

On the other hand, a bank deposit is always a less profitable story than, say, a bond of the same bank. This happens for a number of reasons. The first is the deposit insurance system. 1.4 million rubles. the state will definitely return it to you if the bank has problems. But this is not a free service; banks transfer money to the deposit insurance agency.

The second reason is the cost of acquiring customers. This includes marketing expenses and office maintenance. When placing bonds, the bank also incurs expenses, but they are less significant. And on average - if you compare the yield of a deposit and the yield of a bond of the same bank - it turns out that bonds always give 2-3% more.

When deposits brought in more than 10% per annum, this discrepancy could be ignored, but now, when the return on deposits is 5-6% per annum, and bonds bring in 8-9%, this is already a significant difference, especially from the point of view of long-term investing.

— Is this change in scale enough for investors to become interested in bonds?

— It is very important that the state began to stimulate interest in the stock market. First of all, it equalizes deposits and investments in matters of tax efficiency. Deposits have always been more interesting not only because of the guarantees, but also because they are tax-free. Over the past few years, the state has introduced a number of measures to stimulate demand for securities - the abolition of income tax on bond coupons, a tax incentive for holding fund shares for more than three years, individual investment accounts, where an investor with long-term investment is completely exempt from paying tax or receives tax deduction on the invested amount. All this makes stock market products more competitive, and the demand for them is gradually increasing.

You can take full advantage of all the benefits from the state when you open an individual investment account (IIA). You can buy federal loan bonds (OFZ), which now give a higher yield than deposits, their coupon is not taxed, in addition, you can also save 13% on a tax deduction. Then, with a comparable level of reliability, the investor receives not 6% as in a bank, but already 11%. In this case, you can choose: either receive a tax deduction of up to 52 thousand rubles annually, or exempt your investment income from tax. For long-term investing (including savings for retirement), we recommend that our clients open an IIS account and use type B tax deduction - exemption from taxation of income on the account.

IIS is a breakthrough tool for the Russian market. However, globally the program is not new - in all developed countries there have long been special investment accounts that are tax-exempt and designed specifically for saving funds for retirement. It is worth noting that IIS has an important advantage over them - the funds can be used even before reaching retirement age. According to our statistics, half of those who invest in IIS have no previous experience in the stock market. And they are looking for conservative instruments - OFZs, bonds, bond mutual funds - with predictable returns, where an analogy can be drawn with a bank deposit.

— How do you approach the issue of long-term investments?

— I’m 33 years old—retirement age will not come soon. I'm married and have two children. At the moment my portfolio is 80% equities. First of all, these are foreign companies in the technology sector, as well as Russian blue chips. These companies are on everyone's lips. I prefer not to build a huge portfolio - I have 12 stocks, which I review periodically, but not very often. 20% of the money is in bonds, and this is the amount that I plan to spend in the next 6 months.

— In the USA in the 50s of the last century there was such an investment strategy, it is often described in the literature - regular acquisition of the same stock, reliable and capable of providing the investor with a “bright future” - Coca-Cola, General Electric. Is it worth buying the same blue chip in the 21st century?

— This approach is close to me. If there is a leading company in the market, then most often over time it strengthens its leadership and increases its market share. Take Amazon, for example. The company is engaged in online trading and excites the hearts of all investors in the world; in 2.5 years, the share price has doubled. Many analysts are already saying that there is no need to buy it, that this is the maximum. But the online trading market in the next five years, according to many forecasts, will grow 3-5 times, and Amazon will sweep away everyone in its path. Business processes are well structured, delivery works like clockwork, and a lot of new technologies are being introduced. This is an example of a leading company in which you can invest regularly.

There are, of course, negative examples, Kodak, for example. The world around has changed, but the company has not changed. The same thing is happening now with Walmart.

— That's right, how can a non-professional investor catch such moments when a company makes wrong decisions?

— If you create a portfolio yourself, you need to monitor the markets - there are no other options. A leader today does not mean a leader tomorrow.

— How important is the amount of allocated attention? Where is the golden mean between “I sit in the trading system all day long” and “I gave it to management and forgot”?

— If you trade all day long, it already becomes work. Let's not take this example into account. If a person himself is involved in the formation of a portfolio, then with a conservative option, when the portfolio mainly consists of bonds, it is enough to monitor the results once every three months. And if the portfolio is aggressive, filled with rapidly growing stocks, then at least once a month you need to pay attention to it, but, most likely, this will have to be done more often. You definitely need to keep an eye on the most unsuccessful parts of your portfolio, don’t be afraid to close them and forget about failures. It is much better to close a position at minus 10% than at minus 50%. It is completely wrong to close stocks on the principle “this stock has grown the most, I’ll close it and buy the one that has not grown yet.” In most cases, the highest-grossing stock is the best and could go up even more in the future.

If you entrust money to a professional manager, buy shares of an investment fund, for example, the “give it and forget it” option is also incorrect. It is necessary to regularly monitor the manager’s results and at least once every six months look at the investment result and compare it with the expected. You may have to diversify your investments among several professionals. Everything is important: how comfortable it is to work with the company, how much you understand where your money is invested, what strategy the manager follows.

— Are there any simple rules of diversification, understandable without explanation, that are likely to work?

— There are several fundamental things to consider. However, in any case, you need to remember that diversification is always important: the more securities you have, the safer your portfolio.

Age, marital status, length of service, economic situation in the country are key factors that need to be taken into account when forming a portfolio

The first factor to consider is age. The younger you are, the higher the percentage of stocks in your portfolio. It's clear why: stocks are a cyclical story. Today they fell, and tomorrow they compensated for the fall and went up again. When the investment horizon is long, you can afford such fluctuations.

The second factor is marital status. When you are alone, you are responsible for yourself. If you have a family, the level of responsibility increases, and the likelihood of unforeseen situations when family members need financial support increases. In this case, the conservative, less volatile part should be increased.

The third factor is the duration of work in one place. This is an important question for me. Anyone who has been doing the same thing for a long time may be more likely to want to change jobs or even quit everything and go traveling. This also needs to be taken into account and the share of conservative securities – bonds – must be increased.

The fourth factor is the economic situation in the country where you live. If it is not very positive, then your job and your income are at risk. Perhaps at some point you will have to spend money from your financial safety net - that’s what it’s for. And you have everything in stocks, and they have sank greatly. Therefore, diversification, including geographic, is also important here.

— How to choose between the domestic market and the exchanges of developed countries?

— Russian assets are not the most attractive now for obvious reasons. And the US market, for example, has been a favorite for the last 10 years and brings stable income - much higher than the same dollar deposits in our banks. Therefore, of course, it is worth looking at foreign assets and choosing leaders. There is one nuance here. There are about 20 well-known good stocks, “blue chips”, on the Russian market, and their features are not so difficult to understand. In the USA, the variety is much higher, the choice is no longer so simple and obvious, so following the leaders will be beyond the power of a non-professional investor.

I would recommend investing in foreign assets through funds that have a manager who is deeply immersed in this market. The purchase of funds is also available through IIS, which will allow you to obtain an even greater return on investment.

Advantages and disadvantages

Even if there are extra funds, few are willing to part with finances for a long time. After all, the disadvantages of long-term investments:

- High risk. During this time, the enterprise will go bankrupt, the state policy will change, the government will change with all that it entails. A sad example is long-term investments in Ukraine.

- An investment portfolio is formed without knowing about the level of inflation and prices in the future. The profit will not fit in a suitcase, but there is nothing to buy with these candy wrappers - a typical situation in African republics.

- Depending on the investment object, you have to pay additionally for insurance, optimal storage conditions and security (antiques, collectible wines, gold, precious stones).

- Investments in residential and commercial real estate require funds for annual renovations.

- Investments in gold bullion when sold are often tied to the same bank where you bought it. Otherwise, additional funds will be required for an expert opinion.

But the advantages:

- Long-term investments are the best option for those who do not like speculation. Invested and received a high profit.

- When investing in commercial real estate, the investor receives (in some cases) the right to manage the enterprise, tax benefits, and enter into transactions on preferential terms with the debtor.

- Long-term investment in antiques becomes a hobby and turns an investor into a collector. This is a chance to become an expert, a celebrity in your field.

- Antique jewelry and precious stones give passion and a sense of pleasure, making life more emotionally rich. Sometimes it is so strong that the investor is unable to part with his toy.

Definition of long-term investment - what is it

Conventionally, any investment of monetary capital for a period of more than 1 year belongs to this type. Some experts believe that placement for a period of 3 years or more should be considered long-term.

The purpose of such investments is to obtain a high level of income over the long term. Moreover, depending on the chosen direction, profit can be received both on a regular basis (for example, once a quarter or year), and only upon withdrawal of funds.

Most long-term investment programs do not imply quick liquidity - if you need a sum of money, it will be difficult to quickly sell the asset . Therefore, for the long term, it is worth placing only that part of the capital that is guaranteed not to be needed during the investment period.

Based on the level of potential risk, it is impossible to unambiguously classify investments for a long period into one group or another - the probability of a total or partial loss of capital depends on the selected objects for investing funds.

It is a misconception that in order to invest for a long period of time, it is necessary to immediately deposit a large amount of capital. There are solutions that allow you to initially place a small amount, making additional contributions or purchasing additional assets in the future.

Financial and real investments

The main essence of long-term investments is their division into investment objects. Most often, the components of real investment become the subject of long-term injections of funds.

The composition of long-term investments may include investments in:

- Fixed assets of the enterprise;

- Purchase of land;

- Building;

- Purchase of equipment;

- Repair of existing equipment;

- Licenses;

- Improvement of personnel qualifications;

- Patents;

- Trademarks;

- Latest developments;

- Research works.

Most often, this form of investment is typical for enterprises or government agencies. A private investor, if he has large sums of money, can afford to purchase real estate, cars, or sponsor a company on favorable terms.

Transactions with such objects are carried out exclusively on a long-term basis. Income from this type of investment can be obtained in at least a couple of years.

Another thing is financial investments on a long-term basis: they can be placed for a period of one year and do not require bulky investments from their owner. This type of income generation is also common among individuals. The latter basically transfer savings to a qualified intermediary, who provides financial advisory services for a fee.

Financial investments are typical for the foreign exchange and stock markets. You can use the platforms of brokerage companies for these purposes, as well as place funds in mutual fund shares. By buying shares, bonds, forwards or currencies, you thereby become a participant in investing.

We buy securities

The most common examples of long-term investments are securities on the stock market. Today you buy, for example, shares at one price, and a year later you sell at another and make a profit. Financial investment is built on this principle.

The most important rule is not to succumb to the volatile flow of the stock exchange. It is a process that affects the change in value of a security over a day or longer period.

If volatility is temporary, there is no need to worry about your own funds. If the price naturally falls, it is necessary to get rid of the unprofitable asset in time so as not to lose all your funds. It's better to replace it with another one.

When making transactions with securities, it is recommended to buy at the moment when the price of the asset has fallen to the minimum level. In this case, you can get maximum income in the future.

Strategic investing

Let's understand what is meant by investment strategy. Long-term investments are often strategic in nature. This means that an enterprise can set a specific goal for the time of infusion of funds into a large facility.

Most often, this goal does not imply generating income at the initial stage, but has a strategy for control actions in the future in relation to the investment object.

For example, a large company may set a goal to make another company its subsidiary. For these purposes, she gradually buys shares on the stock market of this company. This process takes several years. During this period, the large company does not plan to give up its goal and pours all newly available funds into the purchase of shares.

As soon as the package of securities becomes impressive and gives the right to a controlling vote at a meeting of shareholders, a large company begins the most important stage. It announces the decision to join the investment object. In the future, she receives profit from the activities of the new branch.

We invest in construction and real estate

Purchasing real estate for the purpose of generating income is common not only among large enterprises, but also among private investors. By buying an apartment in a building that only exists on paper, you can incur minimal expenses. Once the building is built, there will be two options for making a profit. This is called shared construction.

Firstly, you can sell such real estate for much more than the purchase price. Or you can rent it out. Secondly, investments will pay off over a long period, but can bring much more than just selling an apartment. Subsequently, you can find a buyer for the rental property.

The main disadvantages of long-term real estate investment:

- Possibility of losing funds if the project is not implemented due to the fault of the developer;

- Over time, real estate loses its value, and therefore you need to know when it is better to sell it;

- The building is constantly in need of repairs, and this means additional funds (especially if it is rented out);

- If the premises are empty due to the lack of clients, then the owner can only receive losses.

It is important to take into account that it is better to buy such properties during a lull in the real estate market. Then you can purchase the premises at the best price. For example, it is better to buy an apartment in the summer.

How to invest in transport, equipment and other equipment

Leasing is common today. It means long-term rental of equipment with subsequent purchase. This is a fairly convenient process that allows you to invest.

Example. You buy a car and rent it out. Once the vehicle has been paid off, you can sell it. The main thing is that the condition of the vehicle allows this to be done. This is the disadvantage of investing in large machinery, equipment, etc. Equipment wears out and requires regular repairs. In some cases, repairs will cost large sums, which exclude the advisability of further use of the investment object. If you allocate funds for repairs in a timely manner, and do not use them only for personal purposes, then you can receive a stable income.

We develop production

Investing in your own enterprise is a prerequisite for a successful business. If you allocate funds for the purchase of new equipment, repair existing equipment, and constantly improve the qualifications of staff, you can turn a small enterprise into a big business.

At first, this process will be very expensive, but in the future it will pay off handsomely. Owning your own business always requires investment, often in monetary terms. In order for a company to develop and increase turnover, it is necessary to increase productivity. This will bring good profits and allow you to occupy a certain niche in the market.

Income from gold

For the most part, passive income comes from purchasing gold bars. You buy a few grams of gold and wait for it to rise in price.

There are two significant disadvantages here:

- You will not be able to buy a bullion at a nominal price, since the selling bank makes its own markup. Consequently, the profit will be less;

- Gold is subject to a special storage system, which also costs money. You will not be able to keep the bullion at home, since even any imprint on it will reduce its value.

To prevent the investor from having contact with the precious metal, banks came up with a system of impersonal accounts. They assume that you are buying gold, but you are not purchasing bullion as such. Your gold is registered only on paper. You only deal with the money from the difference in the purchase and sale prices.

Where to get currency

The well-known Forex market does not stand aside either. You can buy currency on it and then sell it at a higher price. This process does not have many fans, since the investment process is more like roulette.

The winning percentage is quite small. This is due to high volatility, which can “eat up” your capital in seconds.

The essence of the foreign exchange market is to buy a currency pair and monitor price changes. Most often, only professionals and only those who have decent amounts of money are engaged in such activities. An ordinary investor has nothing to do here, since with small investments you can instantly go to a loss.