What can be considered a financial investment?

In the balance sheet, financial investments include:

— securities (including bills and bonds) of other organizations, including state and municipal; — contributions to the capital of another organization; — loans issued to other organizations; — contributions from an organization bound by a simple partnership agreement; — deposit with a credit institution.

For convenience and to combine all investment movements from one organization to another, it is customary to use account 58.

Not all securities and funds are classified as financial investments. The following cannot be entered into account 58:

shares of your own company purchased from shareholders (both for resale and for cancellation);

bills issued in lieu of payment for goods, services or work;

interest-free loans;

investments in real estate and other tangible property with subsequent rental and receipt of funds;

valuables that cannot be used in the organization’s inherent activities (precious stones, jewelry, art objects, etc.). The exception will be those valuables and tangible assets that were contributed under a simple partnership agreement or as a contribution to the capital of another organization.

How to recognize assets as a financial investment of an organization

The following evidence is required for assets presented as financial investments:

documents confirming the organization’s ability to make a financial investment. This could be an agreement on a loan or deposit, a bill issued by another organization, shares and bonds or certificates for them;

the ability of this investment to produce income in the future. Income is considered interest, the difference between purchase and sale, dividends;

the ability to take responsibility for the risks that are transferred along with investments.

Shares and other securities are considered investments if they are acquired in the following ways:

payment of cost;

capital contribution;

by barter;

free of charge.

Accounting includes not only the costs of the actual amount of the asset, but also those associated with it:

payment for consulting services (if after the consultation you took advantage of the offer);

remuneration to the intermediary (for example, a lawyer or notary);

other costs that have to be paid additionally, but they are directly related to the acquisition of the asset.

We divide investments by type

There are several forms of long-term investment.

They can be classified by objects:

- Financial (investing money in any securities: stocks, bonds, futures, options, etc.);

- Real (infusion of assets into construction, production development, personnel training, etc.).

Investments are distinguished according to the stages at which the project is being developed:

- Completed (means that the project has been completed or the investment goal has been achieved). For example, you bought an apartment in a building at the construction stage. When the building is put into operation, you can already dispose of your property, that is, the construction project is completed;

- Incomplete (you have not yet realized the main purpose of the investment). The initial investment process, when you have just contributed assets, and the stage close to completion can be considered here.

Methods of long-term investment depending on payments:

- With a one-time income (that is, you bought an apartment at the construction stage, and after putting the house into operation, you sold the property at a higher price);

- With distributed profits (in this case, after completion of construction, you decide to rent out the apartment. Income will flow with the regularity described in the lease agreement between you and the resident).

There are also attachments:

- State;

- Enterprises;

- Individual.

Classification of fund injections by purpose:

- Strategic (your goal is to absorb some company. You buy up shares of the company until your package of securities gives you the right to a decisive vote in the management of this company);

- Aimed at generating income (you only want to increase your capital and do not expect to participate in the management of a joint-stock company).

Long-term and short-term financial investments

Long-term investments are aimed at stable income in the future. The contract or securities are valid for a long period, starting from one year. Payback on such investments takes longer and is subject to risks due to force majeure financial situations in the world. But with the right strategy, you can subsequently take over most of the shares of another organization.

Long-term investments may include:

shares and contributions of authorized capital of organizations;

bonds, bills, loans from third parties;

debt acquired by assignment.

Repayment for all these investments must be planned no less than one year after the agreement is executed.

Short-term investments include those investments that have a maturity of no more than a year or do not bring profit after its expiration. These assets are the easiest to realize because there is no need for calculations and forecasts for a year or more. Short-term investments are about quick gains here and now.

Short-term and long-term investments in the balance sheet must be indicated separately from each other (line 1240 and 1170, respectively).

What are the pros and cons

When considering long-term investments as an investment, many rely on their benefits.

Pros:

- They can bring high income in a few years, which will be permanent (today you invest funds, will wait for a payback for several years, and then you will be able to receive net profit without investing your own money);

- It is possible that your savings will pay off more than once (that is, during the life of the project you will be able to receive an extremely large return several times);

- Money is constantly in circulation, which means that if events develop successfully, you will not be left without income;

- They are not affected by short-term market fluctuations (you can lose some today and gain more tomorrow. This option will not work with short-term investments, which are highly dependent on market volatility).

Despite the impressive advantages, these types of investments do not attract all investors, because... there are also disadvantages.

Minuses:

- There is no way to get quick money (you invested now, and will receive your first income in a few years);

- You can lose all your funds. This happens in the case of illiterate startup management. Funds are invested in a promising project, but there is no specialist to promote it;

- Lack of liquidity (impossible to turn over funds during the investment period). You will not be able to take part of the money from the project for your own needs. Otherwise, you will have to say goodbye to the idea of long-term investing.

What values are not considered financial investments?

It is worth noting that financial investments are not:

- Own shares that were purchased by a company shareholder with the purpose of their cancellation or resale.

- Bills of exchange received by the selling organization from the drawer company in the process of payment for services rendered, products provided or work performed.

- Investments in property represented in tangible form by a company. In this case, only temporary use is available for the purpose of making a profit.

- Works of art, precious metals and similar valuables that are purchased to generate income.

If the listed assets are purchased, the investor cannot accept them as a financial investment.

What it is

Logically speaking, long-term investments are any investments designed for the long term. While this is technically true, the definition itself is not very useful.

So, to rephrase it slightly, a long-term investment is any investment with the greatest likelihood of maximizing returns over a 10-year period (or more) compared to competing alternatives. Perhaps this will be the most accurate and succinct.

Example

Land is the simplest example of long-term investment. How it works?

For example, a manufacturer who wants to expand his factory buys 300 acres of land. He uses 100 acres for development (factory buildings, offices), and holds the rest and leases it to other businesses. Thus, land ceases to be an inert asset and begins to be quoted as a long-term investment.

Which investments are not long-term?

There are types of investments designed to safely store cash while it is not used for other purposes. Therefore, they are not considered long-term investments.

This is about:

- certificates of deposit;

- savings accounts at a bank;

- peer-to-peer lending.

The usual time frame for short-term investments is 3 to 12 months. This means that short-term bonds with a shorter maturity period also cannot be classified as long-term.

Kinds

Financial investments can take different types, it all depends on the investment objects. A loan from a bank is a good example of a financial investment, which, if the business is run efficiently and the borrowed funds are used for the intended purpose, can bring financial benefits to the entrepreneur. For example, an enterprise takes out a loan from a bank to upgrade current equipment, which in the future will help increase the profitability of the business. The borrower repays the loan on time and without difficulty, since his income increases significantly, and at the same time receives a large amount of profit.

Considering the types of financial investments, we can separately highlight operations on the securities market. By investing in various financial instruments, an enterprise takes part in the process of capital movement in the national economy. For example, by acting as an investor in another enterprise by purchasing shares, the organization helps optimize the activities of the issuer of these securities. However, financial investment in funds of subsidiaries can be separately considered as a separate type of the entire set of financial investments. By investing in shares of promising enterprises, the investor will receive significant financial benefits. The entrepreneur also has the opportunity to make profitable transactions with foreign exchange contracts.

Entrepreneurs are active participants in the foreign exchange market. Purchasing a currency at a rate that will increase in the future, and its further sale, can be considered a successful example of financial investment.

A less popular type of financial investment is long-term lending. Using borrowed funds over a long period involves high interest rates, and is therefore unprofitable for many enterprises.

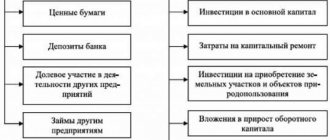

Financial investment portfolio

All financial investments made by an economic entity can be combined into a so-called investment portfolio.

Forming a portfolio of financial investments gives the entrepreneur the opportunity to systematize all capital investments by amount, duration and risks. To consider in detail the structure of an organization's investment portfolio, you need to know what forms of financial investment exist.

An enterprise can direct part of its free finances to the authorized funds of other companies. Such activities make it possible to establish close cooperation in the field of sharing resources, diversifying production and improving production infrastructure.- One of the components of the financial investment portfolio is deposits in banks and other financial institutions. Deposits may differ in terms, amount and currency.

- An important role in the formation of an investment portfolio is played by the direction of capital into stock instruments that are traded on a similar market. The undoubted advantage of such investments is that there is a huge selection of securities on the stock market.

It is worth considering that when forming a portfolio of monetary investments, an organization can enter foreign capital markets. This makes it possible to strengthen the production ties of enterprises around the world and contribute to the free movement of capital.

Tips on how to make money on long-term investments

Here are a few simple rules that will help you navigate the market and create an effective portfolio of assets for long-term investments:

- Diversify. Spread your risks by investing in different instruments and markets. For example, in mutual funds, bonds, shares and other instruments. A universal rule of money management is that no single asset should account for more than 10% of your total portfolio. For example, no more than 10% of Coca-Cola shares from the total stock portfolio.

- Do your research. Use data from different sources. Invest in companies whose products and strategies you like. There are many comparison sites and other resources online that can help you analyze and understand long-term investing. Of course, past achievements are no guarantee of future success. But I generally prefer to work with a fund or company that has been performing well for at least the last 3-5 years.

- Reinvest dividends. Most of the overall growth in a standard stock/bond portfolio comes from reinvesting dividends rather than skyrocketing stock prices. A yield of 3-5-8% may seem small, but in the long term it is very good. Choose an issuer with an impeccable dividend history and harness the power of compound interest.

- Trade against the trend. I know this advice is much easier to give than to follow. But we are not traders and we do not make money on the difference. When it comes to long-term investments, trading against the trend becomes justified. For example, her big fan is the already mentioned Warren Buffett, who from the very beginning of his career bought shares at bearish peaks; after decades they brought him hundreds of millions.

- Get rid of illiquid items. There is no guarantee that stocks will recover from a prolonged decline. It is important to be realistic about the prospects of underperforming long-term investments. Although admitting to losing a stock can be a little embarrassing and hurtful, it is better to recognize your mistakes early and sell off your losing investments to stop further losses. The famous financier Peter Lynch pays special attention to this topic, mentioning it in almost every one of his books.

However, according to the greats, the best advice is not to cling to arbitrary rules, but to consider each action on its merits.

Risks of long-term investments

Long-term investments imply high risk for the owner of capital. It is difficult to predict what the economy will be like in a few years, and therefore the forecast of investment efficiency is not easy to calculate.

There are the following main risks of this type of investment:

- The chance of losing everything at the initial stage is quite high. This may be due to ignorance of the business area or an illiterate asset management system. With small investments from a private investor, this risk increases several times;

- Long-term payback. It is possible that your invested funds will not be returned very soon, and this is fraught with additional costs for maintaining the life of the project;

- No one guarantees receipt of income at the end of the investment period. Even an experienced specialist cannot calculate the forecast 100%, and therefore the result may be unexpected and far from being in favor of the owner of the capital.

Inflation also increases the risk of long-term investments. If its pace is growing steadily, then your income will ultimately be less than planned.

An unstable situation in the country is also not the best time for long-term investments. Further uncertainty and uncertainty about the future can cause disappointment in the investment process.

Example of filling out line 1240 in the balance sheet

Example No. 2. The initial data is presented in the table below.

| No. | Index | Amounts as of December 31, 2020, t.r. |

| 1 | Debit account 58 | 650 |

The table below shows a fragment of the company's balance sheet.

| Index | Code | as of December 31, 2020 | as of December 31, 2020 | as of 12/31/2015 |

| Financial investments | 1240 | 860 | 666 | 750 |

Solution.

The cost of financial investments is determined as follows:

- as of December 31, 2020 – 666 rubles;

- as of December 31, 2020 – 860 rubles;

- as of December 31, 2020 – 650 tr.

The balance fragment will look like this.

| Index | Code | as of December 31, 2020 | as of December 31, 2020 | as of December 31, 2020 |

| Financial investments | 1240 | 650 | 860 | 666 |

Example No. 3. In 2020, I decided to withdraw a set amount of funds from circulation and put them on a bank deposit. Deposit terms: amount – 500 TR, term – 3 months.

The term under the banking agreement is 3 months, which is less than 1 year, which means an amount of 500 tr. Start LLC is reflected in the balance sheet on line 1240 in the form of short-term financial assets.

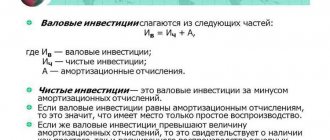

Determining the effectiveness of investments

To understand whether an investment will be profitable, you should analyze all aspects that may affect it.

Principles for justifying the effectiveness of investments include:

- Determining the minimum amount of possible income. For these purposes, it is necessary to calculate the cost of funds that can be obtained in the event of liquidation of the project itself. For example, if you invested money in shares, then you need to calculate their liquidation value. It consists of the sum of all the company's assets divided by the total number of shares. The price received is the one that will be paid to you if the joint stock company is liquidated;

- Comparison of liquidation value and actual value. Let's look again at the example of securities. Contact the stock exchange and find out the stock price at the moment. If the liquidation price is higher than the market price, then such an asset is considered undervalued. This means that the company has great potential, which means its shares can grow several times in the near future;

- Asset valuation. Using the same shares as an example, you need to find out what approximate income you can receive from them. Shares may increase in price and may also pay dividends. If the value increases and dividends are paid on time, it means the company is gaining momentum. The larger the company, the lower the value of their dividends as a percentage. Also, when investing in companies that have recently appeared on the market, expecting dividends at first is a pointless exercise. But as soon as the joint stock company's sales volume increases, you can count on additional income in the form of dividends.

Also, when managing long-term investments, it is necessary to pay attention to the following factors:

- Competition in the market;

- Speed of innovation;

- The state of the economy in the country.

The effectiveness of long-term investments cannot be accurately calculated. The approximate amount of income based on the calculations made may also not correspond to reality, since the situation in the country and new events can sharply change the direction of the asset price.

The investment structure coefficient is also important, which determines the diversification of the portfolio (if you have invested money in different types of securities, this can bring more income and save money).