Today, purchasing goods in installments is becoming increasingly popular. This is primarily due to the convenience of this type of payment, as well as its accessibility. At the moment, you can buy everything in installments, from household appliances to cars and even real estate. But what is an installment plan? How does it differ from standard bank loans? And what are its advantages?

What is the difference between an installment plan and a loan?

Unlike a regular bank loan, installment payment is issued on an interest-free basis, or the interest is much lower than on a loan. In addition, there is no service fee. Often a certain percentage (for installments) is already included in the price of the product itself.

Also, some companies approve the so-called risk percentage (most often it applies only to those customers who visit a particular store for the first time). For example, this is exactly what the Westfalika chain of shoe stores, women's bags and accessories does. Customers who came here for the first time in order to receive goods in installments can buy products for an amount of up to 18,000 rubles, which will be paid over 3-5 months. In this case, the share of the so-called insurance will be 3% of the total amount.

Unlike a loan, an installment plan is issued not by a bank, but directly by the seller (manufacturer) of the product. Accordingly, the entire procedure takes place at the retail outlet where you buy the product. An installment plan at a bank is already a loan. That is, it is the installment plan that does not imply the presence of any intermediary between the seller and the buyer. Pay attention to this fact.

Like a loan, installment plans allow the buyer to make payments in installments. However, unlike bank loans. it is issued for a short period: from 1 to 10 months. Less commonly, the period can be extended to 1-2 years. At the same time, just like a loan, installment plans may include making a down payment. Its size is 10-50% of the total cost of the selected product or service. The terms of the installment plan assume that you will pay the amount monthly in equal installments.

Among other things, the loan requires collateral. Installment plans do not require this, since in this case the goods themselves, issued in the store, automatically act as the subject of collateral.

Finally, the procedure for applying for a loan is quite lengthy and complex; it requires the borrower to have a positive credit history. You also need to provide a lot of documents. Getting an installment plan is much easier and faster.

What is installment plan

Installment payment is a service provided by stores. Using installment plans, the buyer pays a certain part of the amount as a down payment for the phone. The remaining amount is paid monthly. This type of service is very similar to a loan. But the loan is always issued at an interest rate set by the bank.

That is, if a phone costs 50,000 rubles in a store, then you can buy it in installments. To do this, the buyer makes an initial payment of 10,000 rubles, and the remaining amount of 40,000 rubles is divided into equal payments for a period set by the store. For example, for 10 months. It turns out that the buyer pays 4,000 rubles monthly.

Where can I purchase goods in installments?

It’s not enough to know what an installment plan is. It is necessary to obtain comprehensive information about where you can apply for it. In most cases, installment plans can be arranged directly at the point of sale. For example, it could be a supermarket, furniture store, car dealership, real estate agency, etc.

You can also receive installments online. For example, this is exactly what regular or new clients of the Eldorado retail chain can do.

How to calculate installments using an online calculator

It doesn't matter which card you use, they all work in the same way. Therefore, you can calculate the installment plan without any problems.

If you make just one purchase on an interest-free loan, then you won’t get confused. As an example, let’s look at the calculation of installment payments from M Video, which is a partner of many banks. Let's say you bought a washing machine worth 21,000 rubles in this store and paid with an installment card. According to the bank's conditions, in this store you can get an interest-free loan for 10 months. Accordingly, 21000/10, it turns out 2100. This is the amount of the monthly payment that must be made within 10 months.

One card can simultaneously service at least 5 or 25 installment plans. If they fit into the total amount of the provided credit line, this is normal. Having multiple active outstanding loans can really get confusing. In this case, calculating installments online using a special calculator will be relevant.

How to calculate installments:

- First, you need to fill out a card for one transaction - Purchase 1. Enter the amount of this purchase, the term of the installment plan and the interest rate. Standardly it is 0%, it increases only if the terms of repayment in installments are not met. You must also indicate the month and year of purchase.

- Click the “Add” button, a second purchase window will appear, which must be filled out in exactly the same way, making sure to indicate the month and year of purchase.

- You can create as many of these shopping cards as you like. Do as much as you actually have open loans.

- To calculate the installment plan online, after filling out the card, click the “Calculate” button, it will be located under the last card.

After clicking this button, a payment schedule will appear. Each installment plan is a separate contract with an individual schedule and payment amounts. The system automatically schedules each transaction and combines them, indicating in which month and how much the borrower must pay.

The terms of the contracts are different, so in one month you may need one payment, in the second another, and in the fourth there will be a different amount again. Calculating installments using an online calculator helps you clearly see when and how much you need to pay.

If you violate the size and frequency of payments, the bank will cancel the installment plan and set a rate. Therefore, pay close attention to the schedule.

How to apply for installments online?

A virtual installment agreement or an application for it can be completed in real time. For this purpose, as a rule, you need to log on to the official website of the retail chain and perform the following steps (their set may vary depending on the policy of the company and the credit institution):

- study the current rules for applying for installments;

- select items of goods that are covered by installment plans (usually they have special marks);

- add selected items to cart;

- choose a payment and delivery method (for example, payment by card and pickup);

- go to the “Organization in installments” tab;

- fill out the established application template indicating your full name, mobile phone number and other personal information;

- confirm your choice by pressing the appropriate key.

Then, if your application for installment payment is approved by the store, the product you selected in the retail network is put aside and prepared for purchase. Once it is ready, a message will be sent to your mobile phone. Additionally, this notification may contain a reminder about the execution of the passport agreement. And at the final stage, the buyer, as a rule, arrives at the pickup point with a passport, approaches the loan specialist and, after completing the documents, goes to the cashier and receives the deferred goods.

Pitfalls when buying a phone in installments

At first, it may seem like there are no risks when buying a phone. After all, the store makes a discount that is equal to the percentage paid to the bank by the client. And in the end the amount should not change.

But very often, employees in stores, or bank employees, try to impose on the consumer additional services that he does not really need. For example, device insurance, extended warranty, and so on. In order to avoid this, it is necessary to take into account several pitfalls when purchasing a mobile device in installments.

- First, the consumer must check the delivery note. He receives it after consultation with the employees of the store where he plans to apply for the installment plan. This statement indicates the goods and services. The buyer should read it very carefully, as it may contain services that he did not ask for. After all, every seller’s job includes the responsibility to get as much money as possible from the client, and they do this by simply adding unnecessary services without the client’s knowledge. The seller draws up an agreement, which includes all services, and sends it to the bank.

- Second, insurance companies pay special bonuses to salespeople for new customers. In this regard, a person who takes an installment plan is often offered to take out a policy, and this increases the installment amount by 10%-20%. If the buyer is not satisfied with such conditions, then he should tell him about it right away. The contract will be canceled, and the procedure will take a little longer.

- Thirdly, the bank can offer the client “gifts”. As a rule, this is the protection of important papers. The key is equipped with a special key fob to which a mobile phone number is tied. If it is lost, the person who found it gives a bonus, and the owner is returned what was lost. This service is not free at all, so you should carefully study the contract.

- Fourthly, stores very often offer an extended warranty for a small fee. They motivate this by the fact that this is a very profitable offer. After all, in case of any breakdown, the store will replace the product or return the money to the buyer.

But if you carefully read the contract, you can see that the store undertakes to return only a certain percentage of the cost of the goods. Or, in the event of a serious breakdown in which the product cannot be repaired, the store will only pay a certain portion of the money.

Even if in a store the seller assured the buyer that the reason for the breakdown of the device was not at all important, then the contract may in fact establish completely different conditions. For example, for a breakdown that was caused by the user, you may need to reimburse the cost of the examination that was carried out.

Moreover, there are cases when employees in a store can tell a client that the bank will refuse an installment plan without issuing an extended type guarantee. Most often this is a blatant lie. The money for such a guarantee will be received by the store, and not by a banking organization.

What documents are needed to apply for an installment plan?

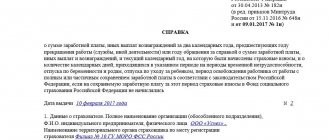

Each seller compiles a list of documents independently. Typically, installment payment provides for the execution of an agreement only with a passport. Less often, to obtain this alternative type of consumer loans, representatives of trading companies require additional documents for personal identification. For example, this could be an original driver's license, military ID, pension card or international passport. In addition, some organizations need to provide other documents:

- original certificate of family composition (issued at the place of registration);

- original certificate of employment (it indicates the name of the client’s position and the amount of wages for the last 3-6 months);

- marriage or divorce certificate.

Instructions

You can purchase your favorite product in installments in the store using the following instructions:

- The advantages of receiving installment plans for products are very obvious. Customers need to select a product, pay an agreed percentage, which is within 30% of the price. After payment, clients receive a check, with the help of which the contract is further drawn up. Based on this agreement, customers will have to deposit an agreed amount of money into the store’s cash register over a specified period of time.

- To purchase goods using installments, customers must have a passport of a Russian citizen and another document confirming the client’s identity. At the same time, buyers do not need to bring a certificate of income, as many banks require when applying for a loan. Clients do not need to confirm personal work experience. Therefore it is quite convenient. After all, you can save time and money.

- The installment agreement is drawn up in 2 copies for the buyer and seller. This agreement specifies all the conditions of the store, the amount, loan repayment terms, details and contact numbers.

- Interest for using the provided installment plan may be completely absent or very low (no more than 10%). Clients are required to deposit the required amount of funds into the account specified in the agreement within the agreed period. Buyers can also pay off the contract early, because stores do not prevent this.

- When customers pay the full amount for the goods, the contract is canceled and the buyer is given a receipt confirming full payment.

It is important to know that if customers do not comply with payment deadlines, the seller can file a claim in court to ask to return the goods or pay the resulting debt.

What types of installment plans are there?

Since you already know what an installment plan is, it makes sense to study information about its types. In total, installment plans can be divided into five types:

- interest-free;

- long-term;

- short-term;

- individual;

- with interest accrual.

Interest-free installments require the user to make an initial down payment in the amount of half of the total cost of the product. The rest of the funds under the installment agreement are paid by the buyer in about a month.

Long-term – this is the sale in installments of products or services for a long period (up to 1-2 years). Their alternative is short-term installment plans, issued for a period of 1 month to a year. An installment plan is considered individual, the terms of which are selected taking into account the financial condition and other characteristics of the client. Installment plan with interest – the ability to pay in installments with interest accruing on the remaining amount. In some cases, the organizers of the action may use a mixed type of installment plan (where, for example, interest-free and individual types of loans are combined).

Types of installments

Based on the proposed conditions, installment plans are divided into two types:

- From the seller, when the goods are provided with the condition of subsequent redemption in several payments. This type of installment plan is extremely rare.

- From the bank, when in fact the seller has only an indirect relation to the credit transaction. A loan agreement is signed indicating the terms of repayment of the loan taken for the purchase of a specific product.

When completing a transaction, you should pay special attention to the terms of repayment and the final amount that the client will pay for the goods.

Installment plans are provided for the purchase of expensive items ranging from several thousand rubles: appliances, equipment, furniture, expensive clothing, jewelry. Many companies that provide expensive services also practice paying for goods in installments.

What can you get in installments today?

Currently, installment plans (for a year, two or less) allow you to own anything you want. Most often, the following types of goods can be purchased in this way:

- household appliances;

- furniture;

- audio and video equipment;

- computers, tablets and laptops;

- cameras and phones;

- inverters, household generators and other electrical appliances;

- dishes;

- sports supplies (e.g. mats, exercise equipment, equipment);

- baths, saunas, jacuzzi;

- kitchen and garden equipment;

- equipment for home, cottage, office;

- clothing and accessories;

- chandeliers and curtains;

- windows and doors;

- real estate objects;

- motor transport;

- farm animals, etc.

Also, some companies provide certain services in installments (for example, installation of plastic windows).

Installment plan and loan: what's the difference?

Typically, a loan is a loan with interest. By taking out a loan, you agree to comply with the terms of the agreement, which stipulates the terms for depositing money, the interest rate and much more. Loans for the purchase of electronics are issued both at the bank and directly in the store (usually large retail chains employ credit managers from various financial organizations).

The loan itself is a rather unprofitable way to purchase a phone: you overpay by an average of 10-30 percent. Moreover, in case of delay, the buyer also undertakes to pay various penalties and fines. And if the delay was long enough, the sanctions will become even stricter - up to exceeding the original cost of the phone.

Buying in installments means no interest. Usually the seller (store) offers the purchase of goods under such conditions. In this case, the price is divided into several equal shares and is paid gradually and interest-free, one part per month. The purchased product itself serves as the deposit for the installment plan: in case of non-payment, the store can take it back.

How to get a phone in installments

Who can get an installment plan?

Don’t know what an installment plan is, but have never encountered it? Then you just need to find out who can claim it. Citizens of the Russian Federation between the ages of 23 and 70 who have registration and permanent place of residence, work, and also receive regular income can apply for an installment plan.

Sometimes sellers prefer to play it safe, and therefore citizens over the maximum age are offered - in addition to the main package of documents - to provide collateral or a guarantor.

How to get an installment plan for a phone in an online store

In the modern world, you can apply for an installment plan for your phone via the Internet without any problems. In this case, negotiations will take place by telephone.

To apply for installments online you will need:

- The consumer needs to go to the store’s website and go to the “Online Credit” section;

- Next, he fills out an application in which all personal data is indicated;

- This completed application is sent to the bank, and then you need to wait for its response;

- If the bank has approved the application, then the buyer must be contacted by the courier, with whom it is necessary to agree on the date and place of receipt of the purchase;

- At this stage, the contract is signed, the down payment is paid, and the mobile device is delivered to the client.

What does an installment agreement contain?

As we said earlier, installment plans presuppose the conclusion of an agreement (similar to a credit agreement). What items are included in this document and on what terms is it concluded?

Each installment agreement contains:

- contact information of the parties (full name of the buyer, legal name and address of the organization providing goods in installments);

- subject of the agreement and obligations of the parties;

- the price of goods provided in installments;

- cost of services (storage, packaging, etc.);

- liability of the parties;

- signatures of the parties.

You can pay in installments over the Internet, at bank cash desks, or through terminals.

Pros and cons of installment plans for the phone

This service can definitely be considered very convenient and profitable. In fact, an installment plan is a loan without interest, but very often there are cases when the bank includes interest in the cost of the goods in advance.

The table below shows the advantages and disadvantages of installment plans.

Advantages and disadvantages

No interest

The installment plan is processed very quickly

Installment plans can be arranged even if the buyer has a bad credit history

You can find an incredibly profitable offer of goods with a low price in installments

The down payment may be too high

There are cases when the price of a product is too high relative to the average market price

The repayment period is not very long

In a store, when applying for an installment plan, a large number of additional services may be imposed on the buyer (product insurance, life insurance, and so on).