You have a small company, and you have won a tender to supply goods to a large corporation. There is one “but” - the contract is drawn up in such a way that you will be paid in three months at best. How to maintain working capital, pay salaries, pay for your own purchases all this time? You can try to take out a loan, but it is often easier and more profitable to resort to factoring to cover the cash gap. What is factoring, who provides this service, what is its scheme and what pitfalls there may be - we will talk in this article.

Factoring: what is it?

The most reliable way to supply goods or services is to work on prepayment. But this does not always happen, especially if it is in an area where the buyer dictates the terms of delivery. Given the high density of the corporate and public sectors in the economy, almost all small or medium-sized businesses that want to earn serious income have to deal with a similar scheme. Corporations also most often interact with each other on deferred payment terms.

Factoring (from the English factor - intermediary, sales agent) is a way to restore the working capital of a supplier by attracting third-party funds. Banks give money to the supplier, in return receiving the right to claim debt from the buyer plus a certain remuneration for providing factoring services. In fact, this is a type of trade lending with its own characteristics, which will be discussed below. The maximum deferred payment period in most cases is 180 days.

Video: What is factoring

The history of factoring dates back to antiquity, and in its modern form it was implemented in the 17th-18th centuries with the development of world trade, when the need arose for a time interval between the shipment of goods and payment.

In post-Soviet Russia, factoring developed in the early 2000s, when companies recovering from the crisis needed insurance in the form of third-party funds attracted as working capital for large transactions. However, so far only less than 1% of transactions in the commercial sector (not counting banking) are carried out using factoring. In the West, this figure in some segments reaches 15%. The reason for this difference is the high volatility of the Russian market in most product segments, as well as the cautious policy of banks, which find it easier to give a loan against collateral rather than check the solvency of the buyer of a particular product.

In legislation, a factoring transaction is called “Financing against the assignment of a monetary claim” and is regulated by Article 824 of the Civil Code of the Russian Federation.

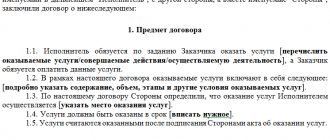

Factoring agreement

The main document regulating the activities of the factor organization is an agreement concluded in accordance with all the rules with the supplier company - a factoring agreement .

The subject of such an agreement is a monetary claim that the supplier transfers to the factor for the purpose of financing it for a certain amount of remuneration.

Relations between the parties are regulated by the Civil Code of the Russian Federation, namely the articles of Chapter 43. According to legislative norms, several requirements may be specified in the contract, but the only mandatory condition is a documented and legal right to demand the supplier fulfill a monetary obligation by the buyer.

Thus, a factoring agreement can be concluded both in relation to existing requirements and in relation to future ones.

- Existing requirements are already fulfilled obligations of the supplier or contractor, confirmed by documents - invoices, invoices, acts.

- Future claims arise when obligations to supply goods or perform work are fulfilled, and only from that moment does the factor have the right to claim monetary fulfillment of obligations.

The parties to the contract are the client (supplier) and the financial agent (factor). The contract must be concluded in simple written form, indicating the essential terms of the contract - subject, term, price of the contract, etc.

At its core, the agreement is an agreement for the assignment of the right of claim using special conditions on factoring.

Terminology

As you study this article, you will come across the following terms:

- A factor or financial agent, intermediary is an organization that handles funds. The conclusion of agreements for the assignment of rights to monetary claims is exempt from licensing. The law introduces restrictions only on the status of enterprises - it must be a legal entity conducting commercial activities (Article 825 of the Civil Code of the Russian Federation). Therefore, an intermediary can be either a credit institution (banks, microfinance organizations) or any enterprise, regardless of its organizational form or composition of founders. In Russia, most factoring operations are carried out by banks or specialized subsidiaries and branches created by them.

- Client, creditor - a seller who has released goods (performed work, services) with a deferred payment and transfers the right to claim the debt for them to the factor.

- Buyer, debtor, debtor - a company to which products (goods) were shipped or work (services) were performed with the condition of payment for them after a certain period.

- Supplier is the creditor's counterparty who supplies him with materials (goods) or performs work.

- A factoring company is a company that provides factoring services.

- A factoring agreement is a legally drawn up document that regulates the relationship between the parties to a factoring transaction, describes the rights and obligations, and liability in case of violation of obligations.

- Factoring operations are actions aimed at providing the factoring service itself. The operations are: the process of analyzing the buyer’s financial condition, his solvency, transfer of invoices, transfer of funds to the parties involved in the transaction, etc.

- Factoring services are a set of measures to ensure a factoring transaction on the part of the factor (bank or factoring company), which primarily includes ensuring the financial expenses of the seller (client) in the amount of 70% to 90% of the transaction amount, which allows the seller to conduct transactions with other companies on the terms of providing deferred payment without cash gaps.

- Factoring companies are legal entities that provide factoring services, have the necessary resources to carry out transactions and charge a commission from the seller (client) for this.

Factoring fee

The cost of factoring services is negotiated with each client individually and is fixed in the contract. A separate application indicates the interest for providing financing and the cost of processing a package of documents. For clarity, here are examples of the cost of services in different banks:

- Bank Vesta - a single commission is charged from 0.34%, a percentage is taken from the amount of the invoice.

- FC Otkrytie - total commission of 0.5%, charged from the delivery amount.

- Globex Bank - the rate under the agreement is on average 14% per annum, interest is accrued on the amount of financing.

When is factoring needed?

Entrepreneurs often try to resort to factoring, like a regular loan, in force majeure circumstances. However, this is when it is most difficult to negotiate with the bank. Under normal conditions, factoring is most popular in the following cases:

- The supplier is a small or medium-sized enterprise, the buyer is a large company with a strict deferred payment scheme for the delivered goods.

- The need for a small or medium-sized enterprise to replenish working capital. Loans to such companies are not given on the most favorable terms, so factoring often turns out to be a more logical option: the bank’s attention is drawn to the buyer rather than the seller.

- The need to provide the buyer with a deferred payment and thereby increase his loyalty.

In Russian conditions, factoring services are especially popular when a company plans to develop by cooperating with large companies on their terms. In this case, providing working capital allows you to make the most of high profits from transactions. Simply put, after receiving payment for a delivery, money is invested in development, and not in repaying debts incurred while waiting for payment.

Factoring is also relevant for companies working with chain stores. By transferring a product to a distribution network, the supplier does not wait until it is sold, but immediately manages the profit, directing it to the purchase of new goods, production development or other methods of stimulating business.

What are the stages of factoring?

Factoring operation consists of 3 main stages. It is important to determine how well the client fits the characteristics. The decision on factor servicing is made after an interview, data processing and risk analysis.

- Interview. The client asks for help and provides information about himself. In accordance with the data received, the financial agency determines whether it is profitable to work with this person. Standard questions about the scope of activity, the procedure for paying parts of the debt, and paying advances are clarified. The company also introduces its requirements.

- Data processing. If a person is suitable, then the supplier with whom he plans to work is checked. The agency already understands the level of solvency of the client and distributor, and the prospects for concluding the transaction as a whole. Now the decision on factoring services has already been established, but can be revised, for which issues are clarified and inconsistencies are corrected. This affects the effectiveness of the operation in the future.

- Risk analysis. When drawing up a contract, legal aspects are taken into account, the responsibilities of both parties are established, and actions to be taken in the event of force majeure circumstances. The documentation specifies the cost of services, as well as the required payment procedure.

When the deal comes into effect, the company monitors the quality of performance of duties on the part of the client and the importer.

Who is involved in factoring?

Factoring is a three-party transaction. The following parties are involved:

1Supplier (client, seller) is a legal entity that supplies goods or provides services on deferred payment terms.

2Buyer (debtor) is a legal entity purchasing a product or service on deferred payment terms.

3Factor – a key person in a transaction. Most often, this is a bank or a specialized company that provides the supplier with funds in the amount of up to 90% of the cost of goods supplied or services provided and receives a commission for this. After the conclusion of the contract, the right to collect receivables from the buyer passes to the factor.

Types of factoring

Factoring transactions can be divided on several grounds.

On risk sharing:

- Factoring with recourse (recourse factoring) is when the bank (factoring company) does not assume the risks of non-fulfillment of the contract by the buyer. If the latter ultimately does not pay the factor for the goods received, the transaction documents are returned to the seller, who fully compensates the bank for the money spent and then collects the debt from the buyer for the transferred goods. This type of factoring is rare, since it is unprofitable for the seller and is used only in very desperate situations.

- Factoring without recourse - the bank assumes all risks in the transaction. Having paid the supplier under the factoring agreement, the bank itself collects the debt from the buyer in case of delay, pays legal costs, and bears other expenses.

According to the degree of buyer information:

- Open factoring is when the seller informs the buyer that the right to demand payment under a purchase and sale transaction has been transferred to the factor, and the buyer must make payment to the factoring company.

- Closed factoring – the buyer is not informed about the participation of a third party in the transaction. He pays the supplier, and he then transfers the money to the factor.

According to the tax accountability of the parties to the transaction:

- Domestic factoring – the seller, buyer and factor are tax residents of the same country.

- External (international) factoring – one of the parties to the transaction is a tax resident of another state.

Upon the occurrence of the buyer's obligation:

- Real factoring - an agreement between the seller and the factor is concluded after delivery of the goods to the buyer.

- Consensual factoring - an agreement between the seller and the factor is concluded before the delivery of goods, after the conclusion of the agreement between the seller and the buyer.

By the number of factors involved in the transaction:

- Direct factoring – one factor takes part in the transaction. This is the most common scheme.

- Mutual factoring - two factors participate in a transaction, with one acting on behalf of the second. This happens when the transaction is international - either the seller or the buyer are residents of another state. A foreign factoring company engages a local one to act on its behalf.

According to the range of services of a factoring company:

- Narrow factoring – the factor provides only basic services for one transaction: checking the buyer’s solvency, providing funds, consulting.

- Broad (conventional) factoring – the factor provides full support for the client’s receivables, including the preparation of all documents, accounting services, insurance, and extended consulting.

By type of document flow of the transaction:

- Traditional factoring is a transaction using paper documents.

- Electronic factoring (EDI factoring) – the transaction is executed using exclusively electronic document flow.

Advantages of factoring in Otkritie

The Otkritie Factoring company has not been operating for long, but it has already managed to enter the TOP 10 largest factors in the country. The rapid growth was largely due to the high-quality provision of services.

Let's consider the main advantages of factoring from Otkrytie Factoring:

- Minimum bureaucracy. To make a decision on concluding an agreement, only 2 documents are enough, and the text of the agreement itself does not contain small print or unclear conditions.

- Electronic interaction. There is no need to travel to a branch or send documents for each transaction by courier. All operations are carried out through your personal account.

- Promptness in providing financing. In most cases, money is credited to the account within 24 hours from the moment the accompanying documents are sent through your personal account.

- Individual approach. The company is ready to consider the situation of each client separately and select the appropriate solution.

How does a transaction using factoring work?

The scheme of a factoring transaction depends on many factors. The most common one looks like this:

1An agreement is concluded between the supplier and the buyer for the supply of goods on deferred payment terms.

2The seller and buyer agree to involve a third party (factoring company or bank) in the transaction.

3 An agreement is concluded between the seller and the factoring company, the delivery of invoices (if the goods have already been delivered) or invoices, as well as copies of the agreement between the seller and the buyer are transferred to it. At this stage, the factor checks the financial condition of the buyer, his solvency, financial discipline (execution of such contracts), as well as the status of the debt - delay is unacceptable. The contract must stipulate the following points:

- subject of the contract;

- rights and obligations of the parties;

- transaction financing procedure;

- amount limit;

- mechanism for transferring rights to receivables to the factor;

- cost of factor services, payment procedure;

- period of validity of the contract;

- other conditions (for example, insurance against non-payment risks).

4The factor pays up to 90% of the cost of the goods (according to invoices) if the goods are shipped, in rare cases - up to 100%.

A fee is charged at this stage. 5Payment by the buyer for the received goods. The money is transferred by the buyer to the factor's account. In closed factoring, money is transferred from the buyer to the seller, and then from the seller to the factor.

How is a factoring transaction controlled?

A bank or factoring company constantly monitors the debtor’s activities during the transaction. Both the actual fulfillment of the terms of the transaction and the buyer’s compliance with the requirements of the factor are analyzed. If the fact of withdrawal of assets is noted or signs of bankruptcy appear, the factoring agreement may be terminated, and the factor will require immediate payment of receivables.

The same applies to violation of obligations by the parties to the transaction: the factor can make claims both to the seller, with whom the bank has a direct agreement on the provision of factoring services, and to the buyer, who as a result of the transaction became the factor’s debtor.

Also, the client and his purchasing partners are constantly re-evaluated.

Pros and cons of factoring

| Advantages | Flaws |

| Funds are provided without collateral | Relatively high cost (especially with narrow factoring) |

| Loyal requirements for the client's solvency | The need to disclose information about buyers and own transactions |

| Factoring agreement – insurance against non-payment, as well as against currency risks (if the transaction is international) | Factoring is used only in non-cash transactions |

| The factor collects the client's debt | — |

| Painless payment of income tax. With a regular deferment of payment, it may turn out that the tax will have to be paid before the money for the goods arrives. | — |

| Factoring is not a loan; it is not reflected on the seller’s balance sheet. | — |

| Additional attractiveness of the company for clients due to deferred payment. | — |

Factoring for small and medium businesses

Most banks provide factoring not only to large corporations, but also to clients from the SME segment. The following services are available for legal entities. individuals and individual entrepreneurs. The main requirement will concern only the solvency and reliability of the debtors transferred for servicing.

Suppliers who decide to use factoring receive a whole range of benefits:

- reduction of cash gaps;

- increase in sales volumes due to long deferment;

- prompt receipt of financing;

- the possibility of receiving discounts on materials, raw materials, etc. through fast payment;

- reducing the risks associated with non-payments (especially with non-recourse factoring).

How to choose a bank for factoring

You can simply call the first bank you come across or the first advertisement you see, but it is better to choose a factoring company based on the specific goals of your business. The selection algorithm could be like this:

1Determine for what purposes factoring is needed: for a one-time transaction or to service all receivables. In the first case, you can choose narrow factoring; in the second, you need a factor that provides a wide range of services and is ready to work with complex situations. Yes, it will be more expensive, but you won’t have problems with working capital.

2Choose between a bank and a factoring company. The first option is more convenient if you have significant turnover (for example, Sberbank Factoring works on transactions from 10 million rubles), and also if you plan to transfer to a factor the management of all receivables for a number of transactions. But be prepared for the fact that the bank will check you and your counterparties carefully and meticulously. Specialized factoring companies are a more convenient option for small businesses: they often provide money faster, albeit in significantly smaller amounts than banks. Tariffs in each case are set individually, so there is no point in comparing them with banks and factoring companies.

3Collect feedback on the factor. Isolate clearly custom-made ones in order to create an objective picture.

4Analyze the cost of the factor’s services, compare with the cost of the loan (if you have the opportunity to attract loan funds).

5Find out the possibility of online interaction with a factoring company - this significantly reduces the payment processing time and also eliminates the need to go to the bank.

TOP 5 banks providing factoring services

In 2020, the turnover of factoring transactions in Russia reached 2.35 trillion rubles. The majority of this amount consists of funds from state banks provided to cover the cash gaps of credit institutions being rehabilitated by the Central Bank of the Russian Federation. If we talk about the TOP 5 banks providing services to businesses, the list will look like this*:

| Bank factor | Factoring market share of manufacturing companies | Factoring market share of companies engaged in wholesale trade | Market share of factoring companies in the service sector |

| VTB Factoring | 37% | 40% | 42% |

| Sberbank Factoring | 14% | 10% | 20% |

| Promsvyazbank Group | 14% | 12% | 15% |

| Alfa Bank | 14% | 16% | 12% |

| GPB factoring (Gazprombank group) | 12% | 6% | 3% |

Here are the TOP 10 banks by volume of factoring financing in 2017*

- VTB Factoring

- Sberbank Factoring

- Alfa Bank

- GPB factoring

- Setelem Bank

- GC "National Factoring Company"

- Rosbank Factoring

- SOYUZ Bank

- Raiffeisenbank

- Promsvyazbank Group

*according to the Association of Factoring Companies for 2020

Scheme of work in Russia

Factoring services in Russia have developed relatively recently, so the field of such financing in our country is quite young. Attempts to introduce factoring operations were made back in the late 80s, but the lack of methodological developments and international experience during the Soviet era led to the fact that the essence of these services was completely distorted. Factoring has been further developed since the mid-90s; the Association of Factoring Companies was created only in 2007.

The main players include:

- Promsvyazbank and its subsidiary PSB-Factoring. The bank has been working with similar operations since 2002, the range of services is quite wide: factoring with and without recourse, domestic and international, both for export and import. Since 2008, it has been a leader in the market in terms of transaction volumes. Based on the results of 2013, it was recognized as a market leader in the segments of external factoring and services for small and medium-sized businesses.

- Russian factoring company. It has been successfully operating in the financial services market since 1993 (previously operated under the name Fintek, transformed into its current form since 2008). It is one of the leaders in terms of volume and number of transactions concluded. Offers services both for suppliers (for supply chains, for production of products, for sales growth) and for buyers (for the purchase of raw materials and goods, for expanding chain retail, reverse factoring).

- VTB Factoring. A daughter of one of the largest banks in Russia. It offers services in two areas: internal factoring with recourse and factoring for suppliers with financing up to 95%. In 2014, he entered into the first contract in Russia for factoring licensing agreements with the Asteros group (software supply for 370 million rubles).

- Factoring. Specializes in express factoring for small/medium businesses. Provides corporate factoring services, including without recourse. The emphasis is on an integrated approach and information support.

- Sberbank. It has been providing services for small businesses relatively recently. The main advantage is a large branch network.

Other banks and organizations also provide services; among the leaders, Alfa Bank, Petrocommerce Bank and the National Factoring Company . Business representatives can easily select the appropriate offer for their situation.

FAQ

How does factoring differ from credit and other similar operations - for example, forfaiting and assignment?

Despite the fact that factoring is sometimes called a trade loan, the differences from a loan are significant. Let's present them in the following table:

| Options | Factoring | Credit |

| Term | From several days to six months (in rare cases up to a year) | From 3 months, most often long-term |

| Availability of collateral | No | Most often - secured by assets |

| Amount amount | Depends on the deal. With broad factoring, it depends on the sales volume. | Set in advance as part of the bank's policy. |

| Target | Financing current activities, in rare cases – increasing working capital. | Most often - for business development |

| Method of issuing funds | The entire amount minus commission, sometimes in parts. | The entire amount (except for the credit line) |

| Package of documents | Limited (agreement, invoice, invoice). An open-ended contract is possible. | A large package of documents is required. The agreement is concluded for each loan separately. |

| Debtor | Third party (buyer) | The person who took out the loan |

Forfaiting differs from factoring in that it is used only in export-import transactions. Instead of a debt expressed in cash, the seller transfers to the forfaiting bank a security (bill of exchange) received from the buyer at a certain discount. The forfaiter can present this bill for payment or sell it to third parties. The term of such a debt obligation can reach a year or more.

The difference between assignment and factoring is that in the first case the seller transfers the right to claim the debt to a third party without any additional conditions. That is, this is not the financing of any transaction, but the sale of debt. An assignment always follows the transaction, while a factoring agreement can be concluded even before the goods are shipped. A bank or other financial company must participate in a factoring transaction, and the assignee (the person purchasing the right to claim the debt) can be anyone, including an individual.

Can all businesses count on factoring services?

Banks have stop lists of companies that are not provided with factoring. There are also legal restrictions. If we put it all together, it turns out that factoring services are not provided:

- Companies with large accounts receivable (if there are several debtors who regularly delay payments for goods delivered or services provided).

- Companies producing goods with limited circulation.

- Companies with subcontractors.

- Companies that supply goods with the condition of subsequent service.

- Companies whose clients are their own branches or affiliated companies.

- Budgetary organizations.

- Companies selling goods to individuals.

How is factoring commission calculated?

It all depends on the interest the bank takes. Let's look at an example with a frequently occurring bet:

On April 1, the seller shipped goods to the buyer in the amount of 1,000,000 rubles with a payment deferment of 180 days. In the factoring agreement, the bank commission was 14% plus a document processing fee of 50 rubles.

On April 10, the bank transferred 900,000 rubles (90% of the total contract amount) to the seller.

On April 21, the buyer paid 1,000,000 rubles to the factor. The period for using money is therefore 20 days.

The commission for using factor funds will be: (900,000 * 0.14)/365 * 20 = 6904.1 rubles. We add the fee for processing documents (50 rubles), we get the total cost of bank services - 6954.1 rubles.

After the buyer transfers funds to the factor, the bank returns the remaining 100,000 - 6954.1 = 93045.9 rubles to the seller.

What is factoring and why is it needed?

In the language of economics, the term “factoring” sounds quite complicated.

But still, I’ll try to explain briefly and in an adapted form. Factoring can be defined as settlement with a supplier without collateral in exchange for the assignment of a monetary claim to the buyer. Difficult? Let's break it down in simple words. Factoring is well suited for companies that work on deferred payment. This is a financial service through which the seller can receive money for goods and services sold on the same day. The buyer's receivables are transferred to the factoring company.

How does it work

For example, a certain company sells water heaters. But the buyer does not receive money immediately, but after several days, weeks, months or years. The supplier is clearly not satisfied with such so-called cash gaps. After all, he is obliged to pay salaries to his employees, taxes and other deductions on time. This is where factoring comes into play.

For an agreed percentage, the factoring organization covers all cash gaps.

What is the process flow? The Teplo enterprise enters into an agreement with a factoring company. Now, after each shipment of water heaters, 90% of the money from sales is transferred to the account immediately. The remaining 10% is due after payment by the debtor or confirmation of delivery of products of appropriate quality. Only they are listed not by the buyer, but by .

When necessary

We have figured out the essence of factoring, but this raises a logical question: why resort to these services at all if you can initially set conditions for the buyer on prepayment?

And there are some nuances here. For example, there is a certain category of goods and services for which the buyer is willing to pay after testing. And only after checking that the quality meets all requirements does the money transfer.

Another reason explaining the need to defer payment is competition. By providing such a service, the seller attracts more buyers. And the requirement to pay for same-day delivery can reduce demand for a particular company's products.

Therefore, the company faces a choice: collect receivables or provoke a drop in sales. Often companies choose the first one, and resort to insurance for insurance.

Who is involved in factoring?

Typically, factoring involves three parties:

- seller – a company that supplies products with deferred payment;

- buyer – a legal entity that purchases a product or service;

- factoring company - a bank or specialized company that transfers up to 90% of the money to the buyer for the delivered products. She receives interest for her services, and after the transaction is concluded, debt collection passes to her.

Factoring or credit: which is better?

It is impossible to say unequivocally which type of transaction is better. I suggest looking at their main differences:

- Debt repayment in a factoring transaction comes from the money paid by the debtor. The borrower returns the loan to the bank;

- factoring does not require collateral, unlike a loan, which requires collateral;

- The amount of financing in factoring is not limited by strict limits; in a bank loan, on the contrary, the amount is predetermined;

- money received during a factoring transaction is spent at the discretion of the company that received it, the target loan from the bank is controlled;

- factoring financing is often permanent; in turn, repaying the debt to the bank does not mean continued cooperation.

Factoring stages

A factoring company is not ready to work with all receivables. First of all, she checks the financial condition of the debtor. All data on it is taken from the buyer and then checked for accuracy.

If the “factor” is satisfied with the results of the check, then he takes over the work with the debt in full or in part. The contract must stipulate the terms of financing, the process of transferring rights to the debt, as well as the commission of the factoring company.

How is a factoring transaction controlled?

The “factor” employees never stop analyzing the fulfillment of obligations under the contract by all parties to the transaction, and also give them repeated assessments. From time to time, assets are monitored for compliance with the requirements under the factoring agreement.

Small Business Use

In the current market conditions, it is difficult for entrepreneurs to survive only on their own funds. In addition, non-payments by buyers often ruin a business at its inception. For them, factoring acts as a kind of safety net when they need money to increase capital turnover.

Factoring calculation example

Let's assume that the product was shipped in the amount of 100,000 rubles. “Factor” transfers 90% and at the same time takes 15% per annum + commission for each invoice of 30 rubles. The debtor has a grace period of 180 days.

Let's say the products were delivered on March 1, the factoring company transferred the money, and on March 29 the debtor repaid the debt.

When the invoice is processed, the buyer will receive 90,000 rubles from the “factor,” i.e. 100,000 * 0.9, where the first value is the amount of debt, and the second is the percentage of financing.

To find out how much, we use the following scheme: (100,000 * 0.9 * 0.15)/365 * 28 = 1035.62. To the result obtained we will add a commission for processing the invoice of 30 rubles, i.e. 1035.62 + 30 = 1335.62

Ingredients of the formula:

- 100,000 – amount of debt;

- 0.9 – percentage of the debt received by the seller from the “factor”;

- 0.15 – percentage for the services of a factoring company;

- 365 – number of days in a year;

- 28 – how many days did the debtor use the money?