Hello! In this article we will talk about excise taxes on alcohol.

Today you will learn:

- What is excise duty called and what types is it divided into?

- Who pays excise taxes on alcohol;

- What is the procedure for calculating and paying excise tax?

The rates for 2020 for a number of positions are brought into compliance with Law No. 301-FZ of August 3, 2018. For alcoholic products it remained at the 2020 level. We’ll talk about this, as well as the terms and procedures for payment today.

Content

- Excise tax on alcohol: the essence of the concept and why it is needed

- What is subject to excise tax

- Who pays excise taxes

- How is it different from VAT?

- Types of excise tax rates

- Excise tax rates on alcohol

- Level of increase in alcohol prices

- Calculation and payment of excise taxes

- Timing and procedure

- Goods exempt from excise duty

- The situation with other excisable products

- Labeling of alcoholic beverages

- Consequences of non-payment

- Conclusion

How to punish for counterfeiting and selling counterfeit goods

Since 2014, administrative and criminal liability for attempting to falsify the label of alcoholic products has been tightened. In accordance with Article 327.1 of the Criminal Code of the Russian Federation, there is prosecution for creating homemade signs for sale.

The production and sale of counterfeit state signs is punishable by:

- fine from 100 to 1 million rubles, the amount depends on the volume of counterfeit;

- remuneration for a period from one year to 3 years;

- community service for up to 5 years;

- imprisonment or restriction thereof for 8 years.

All capable citizens over 16 years of age will be held responsible for their actions. This applies only to individuals. The action is considered completed immediately after obviously false marks are applied to the bottles.

If an enterprise is engaged in the sale of a surrogate, then the regulatory authorities have the right to deprive it of its license and also impose an additional penalty in the amount of 200 to 300 thousand rubles. An official involved in storage or sale is subject to a fine of 10 to 15 thousand rubles. The seller will also be sanctioned - from 4 to 5 thousand rubles. The entire batch of counterfeit goods is eliminated.

It is worth remembering that if a store sells alcohol, then alcohol excise tax checks will be frequent, but what is it? To answer the question, employees of regulatory authorities visit the establishment, take any copy from the shelf and scan it.

There is a special service for control called. Any business with a sales license can access the site. It is enough to check the information on the bottle and on the screen to find out whether the sale of this product is legal.

It is important to remember these forms of liability after obtaining a trading license. It is worth contacting Cleverens to select high-quality equipment and software with which you can check the legality of a batch and optimize business processes within an establishment or in a warehouse.

Excise tax on alcohol: the essence of the concept and why it is needed

Excise tax is a duty established by the state for producers of alcoholic beverages, tobacco products and a number of other goods. But today we will dwell in more detail only on the tax for alcohol producers. This tax is called internal, operating within the borders of the state.

In addition, excise taxes in Russia are included in the price of goods, which means that the consumer pays for them. If excisable products are sold at retail, the amount of excise tax is not allocated.

So why are excise taxes needed? The answer is simple: so that the state receives profit from the manufacture of products that are popular among the population. And also, according to experts, increasing excise taxes is an effective measure in the fight against excessive alcohol consumption.

Negative sides:

- Increase in volumes of illegally imported alcohol;

- The risk of increasing sales of obviously low-quality alcoholic beverages.

Excise goods and objects of taxation

Calculation and payment of excise taxes are based on the provisions of Chapter. 22 of the Tax Code of the Russian Federation. The list of goods subject to this fee is limited and contains 15 types of products, among which are highlighted:

- ethyl alcohol and alcohol-containing products (more than 9%);

- alcohol and tobacco;

- passenger cars and motorcycles (over 150 hp);

- motor gasoline;

- diesel fuel;

- motor oils;

- straight-run gasoline, etc.

The corresponding excise duty is levied on operations for the sale of manufactured products included in the list both on a reimbursable and gratuitous basis. Sales also include the transfer of excisable products under commission agreements and the posting of goods under tolling schemes.

Transactions on:

- transfer of excisable products within the structural divisions of the organization for use in the form of raw materials for the production of excise-free products;

- sales of goods undergoing the export procedure;

- primary sale of ownerless or confiscated excisable goods;

- sale within the organization of ethyl and other types of alcohol.

Excise taxes refer to fees administered by the federal budget. Payers are recognized as persons who are manufacturers of the relevant goods. Persons engaged in wholesale and retail trade in excisable goods, but not produced by them, do not pay excise tax.

The tax period is set to a calendar month.

How is it different from VAT?

VAT, like excise tax, is an indirect tax. But there are fundamental differences between them, which we will discuss in more detail.

- VAT is charged on a much larger volume of goods. It also applies to services provided by the payer. In turn, excise taxes are established only on goods;

- The next difference is that excise tax is a real burden on the entrepreneur, and when paying VAT, if you use deductions wisely, the burden can be significantly reduced;

- It is not always possible to compensate for the excise tax rate using a deduction;

- Excise taxes, unlike VAT, have a serious impact on the profitability of the company.

Excise taxes in Russia began to operate in 1991. The main elements from which the excise tax is formed are the base, object and tax rate.

Types of excise tax rates

- Specific;

- Combined;

- Ad valorem.

Specific

Presented in a fixed amount for 1 unit of goods. Most often used.

Ad valorem

It is uniform for the entire country and is set as a percentage of excisable goods. Its weakness is that each time you need to calculate the customs value of the product.

Combined

Combines specific and ad valorem rates.

Excise duty and excise stamps

Excise goods include, according to Art. 181 of the Tax Code of the Russian Federation:

- ethyl alcohol, alcohol-containing and alcoholic products;

- tobacco and tobacco products;

- cars;

- diesel fuel, gasoline, motor oils and petroleum products;

- natural gas;

- aviation kerosene;

- electronic nicotine delivery systems and liquids for them.

All these products are divided into those that are subject to marking with excise stamps, and those that are not subject to marking.

An excise stamp is a special type of stamp for paying excise duty. It is glued to goods in such a way that opening the package entails breaking the stamp. Firstly, it is a guarantee of product quality, and secondly, it allows the state to control the turnover of excisable goods, for example, alcoholic beverages and tobacco products.

To obtain excise stamps for product labeling, you must submit an application to the Central Excise Customs, which is responsible for issuing excise stamps, indicating the number of units. Excise stamps are issued in strict accordance with the quantity of products. In addition to the application, you must attach the following documents:

- confirming the transaction;

- license from the Ministry of Industry and Trade;

- confirming registration in the EGAIS system.

As a result, excise stamps will be issued in the declared quantity, along with a temporary declaration and import permit. The obligation to import goods in a certain quantity is valid for 8 months after receipt. If the goods are not imported during this time, you must submit excise stamps. The same applies to excess excise stamps if, for example, some of the products were damaged.

Note! Products must be marked before shipment of goods to customs.

As of 2020, the cost of excise stamps is:

- for alcoholic products – 1690 rub. for 1000 pcs.;

- for tobacco products – 200 rubles. for 1000 pcs.

Important! In accordance with the rules for the import of excisable goods, jewelry made of precious metals and stones is imported on a commercial scale, although these goods are not excisable.

Excise tax rates on alcohol

Next, we will consider the amount of excise taxes on alcoholic products, presenting the information in table form. And then we’ll do a little comparative analysis.

Excise taxes on alcohol in 2020:

| Product type | Tax rate 2019 | Tax rate 2018 | Tax rate 2020 (from 01.01.) |

| Ethyl. alcohol, which is sold by companies involved in the production of cosmetics. or perfume. products | 1 liter / 0 rub. | 1 liter / 0 rub. | 1 liter / 0 rub. |

| Ethyl. alcohol sold by companies that do not pay advance excise taxes | 1 liter – 107 rub. | 1 liter – 107 rub. | 1 liter – 107 rub. |

| Alcohol containing more than 9% alcohol (excluding beer and sparkling wine) | 1 liter – 523 rub. | 1 liter – 523 rub. | 1 liter – 523 rub. |

| Alcohol containing less than 9% alcohol (excluding beer and sparkling wine) | 1 liter – 418 rub. | 1 liter – 418 rub. | 1 liter – 418 rub. |

| Wine, excluding sparkling wine | 1 liter – 5 rub. | 1 liter – 5 rub. | 1 liter – 5 rub. |

| Sparkling wine | 1 liter – 36 rub. | 1 liter – 36 rub. | 1 liter – 27 rub. |

| Beer with up to 0.5% alcohol | 1 liter – 0 rub. | 1 liter – 0 rub. | 1 liter – 0 rub. |

| Beer containing from 0.5% to 8.6% alcohol | 1 liter – 21 rub. | 1 liter – 21 rub. | 1 liter – 21 rub. |

| Beer with more than 8.6% | 1 liter – 39 rub. | 1 liter – 39 rub. | 1 liter – 39 rub. |

The excise tax on alcohol brings the highest income to the state when compared with other taxes. And tax rates on vodka are much higher than on other alcohol. This is an argument in favor of reducing the production of such a drink.

Ethyl alcohol is the main source of profit from the use of excise duties. The excise duty on alcohol brings the highest income to the state when compared with other taxes. And tax rates on vodka are much higher than on other alcohol. This is an argument in favor of reducing the production of such a drink.

Comparing rates over several years, we see that in 2020 they remained almost at the 2020 level.

Let’s see below how this affected alcohol prices in various retail chains.

Level of increase in alcohol prices

Excise taxes on alcohol are planned to increase only from 2020. on the:

- Products containing ethyl alcohol over 9% up to 544 rubles, the excise tax is now 523 rubles.

- Products containing ethyl alcohol less than 9% up to 435 rubles, against 418 rubles, the current rate for 2020.

- Wine – the excise tax rate will be 19 rubles. per liter, now it is 18 rubles.

- Ethyl alcohol sold by companies that do not pay advance excise tax payments up to 111 rubles. per liter Now the excise tax rate is 107 rubles. per liter

How are things going with alcoholic drinks in 2020?

This year, the excise tax on alcohol will change depending on the type of alcohol production. It’s worth understanding right away that today the country’s course is towards import substitution. Therefore, the cost of excise duty increases on imported drinks. This applies not only to wine, but also to stronger options - bourbon, absinthe, scotch, and so on. The government, in addition, is still considering the option of a slower increase in the excise tax on wine from our production or even its complete abolition. Thanks to this, the authorities will be able to achieve lower prices for products of domestic producers, as well as help them reach a higher quality level.

Calculation and payment of excise taxes

In this part of our conversation, we will give an example of how excise tax is calculated, for example, at a fixed rate.

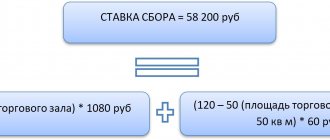

For this, the following calculation formula is used:

A = Nb * Tc, where A is the accrued amount of excise duty, Nb is the tax base (the number of goods sold), Tc is the fixed rate.

So, Company S. produced and sold 700 liters of beer, which is strong. This means that she will have to pay: 700 * 21 = 14,700 rubles.

The combined rate is calculated using the following formula:

A = Nb * Tc + O + Ac /100%, where A is the amount of excise duty, Nb is the tax base, Tc is a fixed rate, O is the amount that will be received upon the sale of Nb, Ac is the percentage rate.

The rules for exemption from excise duty have been changed

Until now, paragraph 2 of Art. 184 of the Tax Code of the Russian Federation allowed for the possibility of exemption from excise tax when selling excisable goods outside the territory of the Russian Federation only upon presentation of a bank guarantee to the tax authority or without it in the cases specified in clause 2.1 of the said article.

In 2020, exporters will be able to receive this exemption if they submit a surety agreement to secure the obligation to pay taxes. This opportunity will be given to them by the new clause 2.2 of the said article.

For tax purposes, this agreement has the following features:

- The guarantee is drawn up in accordance with the civil legislation of the Russian Federation by an agreement between the tax authority and the guarantor (a third party, not necessarily a credit institution), in a form approved by the Federal Tax Service (clause 2 of Article 74 of the Tax Code of the Russian Federation).

- The validity period of the guarantee agreement provided for the purpose of exemption from excise duty must be at least ten months from the date of expiration of the established deadline for the exporter to fulfill the obligation to pay excise duty and no more than one year from the date of conclusion of the guarantee agreement (paragraph 5, clause 2.2, article 184 Tax Code of the Russian Federation).

For your information. Operations for the issuance of sureties (guarantees) by a taxpayer who is not a bank, due to the new paragraph. 15.3 clause 3 art. 149 of the Tax Code of the Russian Federation are not subject to taxation.

The guarantor himself, on the date of submission of the application for concluding a guarantee agreement, must meet the requirements established by the provisions of the new clause 2.2 of Art. 184 Tax Code of the Russian Federation:

- be a Russian organization;

- for the last three years preceding the year of submission of the said application, pay a total of taxes (VAT, excise taxes, income tax and mineral extraction tax) in the amount of at least 10 billion rubles. (this amount does not include taxes paid in connection with the movement of goods across the border of the Russian Federation and as a tax agent);

- the amount of his obligations under existing guarantee agreements (including the guarantee agreement in relation to the taxpayer) must not exceed 20% of the value of his net assets, determined as of December 31 of the calendar year preceding the year in which the said application was submitted;

- not be in the process of reorganization or liquidation, as well as in the stage of bankruptcy, have no arrears in paying taxes, fees, penalties and fines.

So, a guarantee from other organizations (not banks) will become a full-fledged alternative to a bank guarantee to exempt the exporter from paying excise duty. Corresponding amendments were made to paragraph 3 of Art. 184 of the Tax Code of the Russian Federation, which determine the procedure for excise duty reimbursement. Let us add: the new rules apply to surety agreements that ensure the fulfillment of tax obligations, the payment of which falls due after July 1, 2020 (clause 12 of article 13 of the Law).